Consumer Behaviour Towards Smartphones

Diunggah oleh

Ankur KalaniHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Consumer Behaviour Towards Smartphones

Diunggah oleh

Ankur KalaniHak Cipta:

Format Tersedia

Consumer Behaviour towards Smartphones

Introduction

1

Apple

EY COMPETITORS

Strong competitor in the prosumer customer segment 15% of current smart

phone market share

Advantages: Brand awareness and variety of application downloads

Disadvantages: Price point and limited to AT&T GSM network

Blackberry

Low cost OS with open development

Advantages: Scalable and flexible functions on a variety of smart phones

Disadvantages: Low adoption and low number of available apps (both are rapidly

increasing).

Blackberry and Apple are the two major smart phone manufacturers of the world,

and both has a huge number of fan following and users. Though it is a matter of

personal choice and preference, as to what to choose. In this study we are going to

analyse customer preferences and characteristics in order to better define customer

segments, determine which customers to focus marketing efforts on, and what

features are most important to those customers.

Globally, RIM holds 15% of the smart phone market share.

Although this is a rather substantial portion of the available market, RIM faces

threats from close smart phone competitors and is constantly rivalling to stay on

top. Smart phone competitors consist of: High Tech Computer (HTC), Apple,

Nokia, Googles Android, Samsung and Palm. Apples smart phone net sales for

the fiscal year end September 2009 was $11.8 billion. In 2010, research shows that

Apple smart phones seized 13.3% of the global market share as their 3GB iphone

is growing in popularity selling for $199 with a service contract (Data monitor,

2009; Toronto Star, 2009). Additionally, the iPhone

Consumer Behaviour towards Smartphones

provides a competitive advantage, as the device is able to run upwards of 85,000

2

applications providing higher utility for customers.

HTC:

HTC Corp, (TAIEX: 2498) produces powerful handsets that continually push the

boundaries of innovation to provide true mobile freedom.

Founded in 1997 by Cher Wang, Chairwoman, HT Cho, Director of the Board &

Chairman of HTC Foundation, and Peter Chou, President and CEO, HTC made its

name as the company behind many of the most popular operator-branded devices

on the market. It has established unique partnerships with key mobile brands,

including the leading five operators in Europe, the top four in the US, and many

fast-growing Asian operators. It has also brought products to market with industry

leading OEM partners and, since June 2006, under its own HTC brand.

HTC is one of the fastest-growing companies in the mobile sector and has achieved

remarkable recognition over the past couple of years. Business Week ranked HTC

as the second best performing technology company in Asia in 2007 as well as

giving the company the number 3 spot in its Global listing in 2006.

Since launching its own brand 18 months ago the company has introduced dozens

of HTC-branded products around the world.

Products & Innovation

HTC is known for its innovation. It is constantly broadening the range of devices it

offers introducing devices to support specific applications and new form factors

that meet the increasingly diverse needs of its customers and partners.

HTC's product portfolio offers easy-to-use solutions that embrace the full range of

mobile multimedia resources, wireless anytime and Internet on the go.

First Microsoft Windows 5.0 Smartphone (2006)

First Tri-band UMTS PDA First intuitive touch screen to allow finger tip

navigation (June 2007)

In early 2006, HTC launched a powerful new device with a groundbreaking form

factor: the HTC Advantage. The HTC Advantage is the worlds most powerful

office, boasting a 5" screen and full detachable QWERTY keyboard. This was

Consumer Behaviour towards Smartphones

followed in early 2007 with the introduction of the HTC Shift. Equipped with

3

Windows Vista this device includes a brilliant 7-inch widescreen touch display and

a 40 gigabyte hard drive.

HTC launched the HTC Touch in June 2007 as the result of extensive R&D and

the conviction that fingertip control would enable more intuitive navigation. The

groundbreaking HTC Touch is equipped with TouchFLO so that consumers

just sweep their finger across the screen to get access to the most commonly used

content, contacts and features in a simple finger flick.

HTC aims to continually develop smart new devices that empower users on the go,

providing more freedom in the way they live their lives.

SAMSUNG:

From its inception as a small export business in Taegu, Korea, Samsung has grown

to become one of the world's leading electronics companies, specializing in digital

appliances and media, semiconductors, memory, and system integration. Today

Samsung's innovative and top quality products and processes are world recognized.

This timeline captures the major milestones in Samsung's history, showing how the

company expanded its product lines and reach, grew its revenue and market share,

and has followed its mission of making life better for consumers around the world.

The digital age has brought revolutionary change and opportunity to global

business, and Samsung has responded with advanced techno-logies, competitive

products, and constant innovation.

At Samsung, we see every challenge as an opportunity and believe we are perfectly

positioned as one of the world's recognized leaders in the digital technology

industry.

Our commitment to being the world's best has won us the No.1 global market share

for 13 of our products, including semiconductors, TFT-LCDs, monitors and

CDMA mobile phones. Looking forward, we're making historic advances in

research and development of our overall semiconductor line, including flash

memory and non-memory, custom semiconductors, DRAM and SRAM, as well as

producing best-in-class LCDs, mobile phones, digital appliances, and more.

Consumer Behaviour towards Smartphones

OBJECTIVE

4

To study consumer motivation for buying a smart phone.

To analyze the consumer preference for brands of smart phone.

To determine whether there is a significant difference between

preferences for features of smart phones on the basis of gender.

To identify the most effective medium for advertisement of smart

phone.

Hypothesis

Hypothesis-1:

Ho: There is no difference between preferences for features of smart phones on the

basis of gender.

H1: There is a difference between preferences for features of smart phones on the

basis of gender.

Consumer Behaviour towards Smartphones

5

Research Methodology

Research Design:

It is the plan, structure of investigation conceived so as to obtain answer to

research question. It is the specification of methods and procedures for acquiring

the information needed.

It is concerned with:

Overall operational pattern

Framework of the project

Stipulates what information is needed

The first step that undertakes in the report was the selection of research. The

research design, which was adopted for the study was descriptive in nature.

The two types of research are as follows:

Exploratory research: It is to generate new ideas.

Descriptive research: They are well structured. It can be complex, a high

degree of scientific skill on the part of the demanding a high degree of scientific

skill on the part of the researcher. It can be taken in certain circumstances. When

the researcher is interested in knowing the characteristics of certain groups such as,

gender, profession, a descriptive study may be necessary.

Consumer Behaviour towards Smartphones

In this I did descriptive research also because I want to know the consumer buying

6

behaviour and preferences towards smart phone.

Primary Data

The descriptive nature of research necessitated collection of primary data from

smart phone users through survey. Personal Interview method will be used and

interview would be conducted through structure questionnaire.

RESEARCH INSTRUMENTS

We prepared a structured questionnaire to collect the data and it consisted of

Multiple-choice questions, direct questions.

SURVEY LIMITATIONS

Time Constraint - Sampling was not a perfect representation, could have been

larger.

Survey Length - Questions, wouldve liked more to capture more

critical data but there were concerns about the impact on participation.

Consumer Behaviour towards Smartphones

7

DATA

INTERPRETATION

AND

ANALYSIS

Consumer Behaviour towards Smartphones

1) Age?

Age Group

15-20

21-26

27-32

32 and above

Total

Responses

4

22

0

1

27

In %

14.81

81.48

0

3.70

100.00

Age

32 and above

27-32

Responses

21-26

15-20

0

10

15

20

25

Interpretation:

81.48% of respondents were in the age group of 21-26 years

Consumer Behaviour towards Smartphones

2) Gender

Gender

Male

Female

Total

Responses

19

8

27

In %

70.37

29.63

100.00

Responses

8

Male

Female

19

Interpretation:

70.37% of respondents were male.

Consumer Behaviour towards Smartphones

3) Most Preferred Brand

10

Brand

Samsung

Apple

HTC

Micromax

Nokia

Total

Responses

17

9

4

4

2

36

In %

62.96

33.33

14.81

14.81

7.41%

Preferred Brand

Nokia

Micromax

Responses

HTC

Apple

Samsung

0

10

12

14

16

18

Interpretation:

Maximum respondents preferred Samsung followed by Apple and HTC

stands third .

Consumer Behaviour towards Smartphones

11

4) Average Household Income?

Income Range

0-1 Lac

1-2 Lac

2-3 Lac

3-4 Lac

4-5 Lac

More than 5 Lac

Respondents

0

2

5

2

3

15

In %

0

7.41

18.52

7.41

11.11

55.56

Average Household Income

More than 5 Lac

4-5 Lac

Respodents

3-4 Lac

2-3 Lac

1-2 Lac

0-1 Lac

0

10 12 14 16

Interpretation:

For 55.56% of respondents surveyed average household income is more than

5 Lakhs.

Consumer Behaviour towards Smartphones

12

5) How much are you ready to pay for a smart phone?

Price Range

5,000-15,000

15,000-25,000

25,000-35,000

35,000-45,000

More than 45,000

Total

Respodents

12

5

6

3

1

27

In %

44.44

18.52

22.22

11.11

3.70

100.00

Price ready to pay for a SmartPhone

More than 45,000

35,000-45,000

Respodents

25,000-35,000

15,000-25,000

5,000-15,000

0

10

12

Consumer Behaviour towards Smartphones

13

Respodents

5,000-15,000

15,000-25,000

12

6

5

25,000-35,000

35,000-45,000

More than 45,000

Interpretation:

From the responses received we can infer that most of the respondents

(60%) are willing to spend upto Rs. 25,000 for a smart phone.

Consumer Behaviour towards Smartphones

6) Rank the following on the basis of your preference for a new Smartphone?

(1 - Most Important, 7 - Least important)

14

Criteria

OS

Camera

Screen Size

Price

Brand

Warranty

EMI Options

Average Ranking

2.11

2.67

2.81

8.78

2.11

3.48

5.85

Average Ranking

EMI Options

Warranty

Brand

Average Ranking

Price

Screen Size

Camera

OS

0

9 10

Interpretation:

For most of the respondents surveyed their major preference is for EMI

options available for the Smartphones, followed by Warranty.

Consumer Behaviour towards Smartphones

15

7) How frequently do you change your Smartphone?

Answer Choices

< 6 Months

6 months to 1 yr

1 to 2 yr

> 2 yr

Responses

5

4

11

15

In %

11.11

7.41

33.33

48.15

Responses

> 2 yr

1 to 2 yr

Responses

6 months to 1 yr

< 6 Months

0

5 10 15 20 25 30 35 40 45 50

Interpretation:

For 48.15% of respondents surveyed, they would prefer to change their

Smartphones after 2 years.

Consumer Behaviour towards Smartphones

16

Consumer Behaviour towards Smartphones

8) For what purpose you use your Smartphone the most?

17

Answer Choices

Stay Connected

Research & news

Navigate

Keep Entertained

Manage & Plan

Responses

25

11

10

11

9

In %

92.59

40.74

37.04

40.74

33.33

Responses

Manage & Plan

Keep Entertained

Responses

Navigate

Research & news

Stay Connected

0

20

40

60

80

100

Interpretation:

For 92.59% of respondents surveyed, they use their Smartphone mostly to

Stay Connected....

Consumer Behaviour towards Smartphones

18

9) Whom do you ask before buying a Smartphone?

Answer Choices

Family

Friends

Online Research

TV Shows reviews

Sales Person

Responses

2

9

22

0

2

In %

3.70

29.63

62.96

0

3.70

Responses

Sales Person

TV Shows reviews

Responses

Online Research

Friends

Family

0

10 20

30 40

50 60

70

Interpretation:

For 62.96% of respondents surveyed, they would seek review from online

Research before buying a Smartphone.

Consumer Behaviour towards Smartphones

10)

19

Do you prefer to buy Smartphone Online?

Answer Choices

Yes

No

Responses

12

25

In %

25.93

74.07

Responses

Yes

No

Interpretation:

For 74.07% of respondents surveyed, they would not buy the Smartphone

Online and would prefer to buy Offline.

Consumer Behaviour towards Smartphones

CONCLUSION:

20

Most preferred brand in smart phone market is Samsung followed by Apple

and HTC.

The main reason for smart phone purchase is its features and to stay

connected.

Online buying is least preferred option for buying smart phones.

There is no difference between preferences for features of smart phones on

the basis of gender.

Anda mungkin juga menyukai

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5784)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- T Codes For PPDokumen79 halamanT Codes For PPAshwin WaghamshiBelum ada peringkat

- HALEEB FOODS' RISE AND FALL IN PAKISTAN'S DAIRY MARKETDokumen7 halamanHALEEB FOODS' RISE AND FALL IN PAKISTAN'S DAIRY MARKETAsif Javaid100% (2)

- MilmaDokumen28 halamanMilmaaks16_201467% (3)

- Test EnglezaDokumen8 halamanTest EnglezaGeorgyana ValentynaBelum ada peringkat

- Consumer Behavior: Name of The Author John C. Mowen / Michael MinorDokumen12 halamanConsumer Behavior: Name of The Author John C. Mowen / Michael MinorLariz Valles DiucoBelum ada peringkat

- Assignment 2-Fatema Obaid-201101371Dokumen17 halamanAssignment 2-Fatema Obaid-201101371api-287929423Belum ada peringkat

- What's The Market Feasibility Process For Waterpark ResortsDokumen7 halamanWhat's The Market Feasibility Process For Waterpark ResortsBarbie GomezBelum ada peringkat

- Products, Services, and Brands: Building Customer ValueDokumen27 halamanProducts, Services, and Brands: Building Customer ValueSANAD MEHYARBelum ada peringkat

- Services RetailingDokumen31 halamanServices RetailingPinkBelum ada peringkat

- Arvind MillsDokumen4 halamanArvind MillsYardenKalinto0% (1)

- Submitted To: Submitted By: Mrs. Sumeet Kaur Srishti Pahwa Professor-G.G.D.S.D College, Sem. Chandigarh Roll No-1515021Dokumen7 halamanSubmitted To: Submitted By: Mrs. Sumeet Kaur Srishti Pahwa Professor-G.G.D.S.D College, Sem. Chandigarh Roll No-1515021radhika marwahBelum ada peringkat

- CHAP 5, Lesson 1 New Product StrategyDokumen2 halamanCHAP 5, Lesson 1 New Product Strategyfelize padllaBelum ada peringkat

- QTC Cert Module 2 CPQDokumen41 halamanQTC Cert Module 2 CPQjalaj01Belum ada peringkat

- Legal English Writing MemosDokumen5 halamanLegal English Writing MemosDominic Sowa100% (1)

- ANKIT Final DissertationDokumen44 halamanANKIT Final DissertationSamuel DavisBelum ada peringkat

- Notes Managerial EconomicsDokumen7 halamanNotes Managerial EconomicsarhijaziBelum ada peringkat

- ExamplesDokumen5 halamanExamplesAstraea KimBelum ada peringkat

- In Road Bistro & Café Profile AssessmentDokumen36 halamanIn Road Bistro & Café Profile Assessment2ND MobileLegendBelum ada peringkat

- Smart Meters in VictoriaDokumen23 halamanSmart Meters in VictoriaJoAnne LoquellanoBelum ada peringkat

- Chapter Twelve: Communicating Customer Value: Advertising, Sales Promotion, and Public RelationsDokumen38 halamanChapter Twelve: Communicating Customer Value: Advertising, Sales Promotion, and Public RelationsGangadhar MamadapurBelum ada peringkat

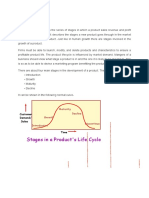

- Product Life CycleDokumen9 halamanProduct Life Cycleceevit100% (1)

- Final Project On MaggiDokumen29 halamanFinal Project On Maggikhansamir515967% (15)

- Advertising Effectivness RaymondDokumen53 halamanAdvertising Effectivness RaymondpRiNcE DuDhAtRa0% (3)

- Vedika Nigania SIPDokumen56 halamanVedika Nigania SIPRaj ShikharBelum ada peringkat

- The Fashion CycleDokumen16 halamanThe Fashion Cycle5.subhash.k100% (9)

- Merchandising Planning ProcessDokumen13 halamanMerchandising Planning ProcessAkhsh Kriti100% (1)

- Department of Labor: 2007 02 08 07 FLSADokumen3 halamanDepartment of Labor: 2007 02 08 07 FLSAUSA_DepartmentOfLaborBelum ada peringkat

- Ambush Marketing attitudes surveyDokumen4 halamanAmbush Marketing attitudes surveyLaksh Bhatnagar0% (1)

- Ibm Group AssignmentDokumen7 halamanIbm Group AssignmentBee Kee0% (1)

- 80 20 PrincipleDokumen5 halaman80 20 Principlerahmad kurniawanBelum ada peringkat