Gitmanjoeh 238702 Im08

Diunggah oleh

trevorsum123Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Gitmanjoeh 238702 Im08

Diunggah oleh

trevorsum123Hak Cipta:

Format Tersedia

Chapter8StockValuation143

Chapter8

StockValuation

.1

Outline

Learning Goals

I.

Valuation:ObtainingaStandardofPerformance

A) ValuingaCompanyandItsFuture

1. ForecastedSalesandProfits

2. ForecastedDividendsandPrices

a. GettingaHandleontheP/ERatio

b. ARelativePrice/EarningsMultiple

c. EstimatingEarningsPerShare

d. PullingItAllTogether

B) DevelopinganEstimateofFutureBehavior

C) TheValuationProcess

1. RequiredRateofReturn

ConceptsinReview

II.

StockValuationModels

A) TheDividendValuationModel

1. ZeroGrowth

2. ConstantGrowth

a. ApplyingtheConstantGrowthDVM

144Gitman/JoehnkFundamentalsofInvesting,NinthEdition

3. VariableGrowth

a. ApplyingtheVariableGrowthDividendValuationModel

4. DefiningtheExpectedGrowthRate

B) SomeAlternativestotheDVM

1. DividendsandEarningsApproach

2. FindingtheValueofNonDividendPayingStocks

3. DeterminingExpectedReturn

4. ThePrice/Earnings(P/E)Approach

C) OtherPriceRelativeProcedures

1. APricetoCashFlow(P/CF)Procedure

2. PricetoSales(P/S)andPricetoBookValue(P/BV)Ratios

ConceptsinReview

Chapter8StockValuation145

Summary

PuttingYourInvestmentKnowHowtotheTest

DiscussionQuestions

Problems

CaseProblems

8.1 ChrisLooksforaWaytoInvestHisNewFoundWealth

8.2 AnAnalysisofaHighFlyingStock

ExcelwithSpreadsheets

TradingOnlinewithOTIS

.2

Key Concepts

1.

Theroleacompanysfutureprospectsplaysinthestockvaluationprocessandaframeworkfor

developingsuchforecasts.

2.

Developingaforecastofastocksexpectedcashflow,startingwithcorporatesalesandearningsand

thenmovingtoexpecteddividendsandshareprices.

3.

Theconceptofintrinsicvalueasastandardofperformance,anditsuseinjudgingtheinvestment

suitabilityofashareofcommonstock.

4.

Valuationofastockusingzerogrowth,constantgrowth,andvariablegrowthdividendvaluation

models.

5.

Otherstockvaluationmodels:DividendandEarningsandIRRapproaches.

6.

Pricerelativemeasures,includingprice/earnings,price/cashflow,price/sales,andprice/bookvalue.

7.

Understandingthatdifferentvaluationmodelsworkindifferentinstancesdependingonthepayment

ofdividendsandearningspersistence.

.3

Overview

Thetopicsofstockvaluationandsecurityanalysisarefurtherconsideredinthischapter.Itisbasicallya

continuationofthediscussionintheprecedingchapter.Alsoaddressedaresomemajorchangestaking

placeinthemarket,astheyaffectthevaluationprocess.

1.

Afteranalyzingacompanysperformancetodate,theinvestorprojectsthecompanysfuture

performance.Basicperformanceprojectionsarerelatedtothesalesandprofitsofthecompany,

subjecttovariouseconomicandindustryprojections.Next,estimatesoffuturedividendsandstock

pricesareobtained.Usingtheexampleinthetext,theinstructorshouldstresstheusefulnessand

limitationsofhistoricalgrowthratesinobtainingestimatesofthefuture.

146Gitman/JoehnkFundamentalsofInvesting,NinthEdition

2.

TheP/Eratioisthenextensivelydiscussed,includingtherelationshipbetweenacompanysP/E

ratiosandthemarketsP/E.Thisratioisshowntobeafunctionofthegrowthofthefirm,therisk

associatedwiththatgrowth,andP/Eratiosinthemarketplace.

3.

Nextcomesthediscussionofvarioustypesofstockvaluationmodels.Firstpresentedisthedividend

valuationmodelasatheoreticallysoundapproachtoapplytocommonstocks.Themodelrequiresa

forecastofthenextreturn,whichisafunctionofriskandalternativereturns.Inthisregard,the

CAPMisreintroducedatthispointtoshowhowCAPMcanbeusedtoestablishtherequiredrateof

return.Threetypesofdividendvaluationmodelsareintroduced:zerogrowth,constantgrowth,and

variablegrowthmodels.

4.

ThedividendsandearningsapproachandtheP/Eapproacharethenshownasalternativestothe

dividendvaluationapproach.Thismodelisbasedonthepresentvalueofthestocksfuturecashflow,

fromdividendandcapitalgains,overafiniteholdingperiod;itcorrectssomeofthepractical

shortcomingsofthedividendvaluationmodel.Theinstructorshouldworkoutseveralvaluation

examples,includingthedividendvaluationapproach,HPR,thepresentvalueofastock,andyield.

5.

Inaddition,theinvestmentdecisionprocessisthoroughlydiscussed.Astockshouldbeconsidereda

viableinvestmentcandidatewhenintrinsicvalueresultsinarateofreturnthatmeetsorexceedsthe

investors(riskadjusted)desiredrateofreturn.

.4

Answers to Concepts in Review

1.

Thepurposeofstockvaluationistoobtainastandardofperformancethatcanbeusedtojudgethe

investmentmeritsofashareofstock.Astocksintrinsicvalueissuchastandard;itprovidesan

indicationofthefutureriskandreturnperformanceofasecurity.

2.

Expectedearningsareindeedimportantindeterminingastocksinvestmentsuitability.Inmakingan

investmentdecision,theinvestormustdecideifastockisundervaluedorovervaluedbycomparing

thecurrentmarketpriceoftheissuetoitsintrinsicvalue.Andtheintrinsicvalueofastockdepends

onaninvestorsexpectationsaboutitsfuturecashflowsanditsrisk.Toestimatefuturecashflows,

onehastoforecastthefutureearningsofthatcompany.Thisisdonebymultiplyingforecastedsales

bytheforecastednetprofitmargin.Expectedfuturereturns(fromdividendsandcapitalgains)

dependontheseforecastedearnings,aswellasforecasteddividendpayoutratios,thenumberof

sharesoutstanding,andfutureprice/earningsratios.

3.

BoththegrowthprospectsofacompanyandtheamountofdebtitusescanaffecttheP/Eratio.As

thegrowthrateincreases,ahigherP/Eratiocanbeexpected.Likewise,asthedebtleveldecreases,

thefinancialriskinherentinthefirmdecreases,andtheP/Eratiocanbeexpectedtoincrease.Other

factorsthataffecttheP/Eratioaregeneralmarketpsychology(higherP/Eratiosaccompany

optimisticmarkets)andthelevelofdividends(ahigherP/Eratiocanbeexpectedwithhigher

dividends,solongasthefirmisalsoabletomaintainarespectablerateofgrowthinearnings).

4.

ThemarketmultipleistheaverageP/Eratioofstocksinthemarketplace.Itprovidesinsightintothe

generalstateofthemarketanditgivestheinvestorinformationonhowaggressivelythemarketis

pricingstocks.Usingthemarketmultipleasabenchmark,astocksP/Eperformancecanbe

evaluatedrelativetothemarket.TherelativeP/Eofastockisnotthemarketmultiple.Therelative

P/EisfoundbydividingastocksP/EbythemarketsP/E.

Chapter8StockValuation147

5.

Ifthecomputedrateofreturnequalsorexceedstheyieldtheinvestorfeelsiswarranted,basedonthe

stocksriskbehavior,orifthejustifiedpriceisequaltoorgreaterthanthecurrentmarketprice,the

stockunderconsiderationshouldbeconsideredaworthwhileinvestmentcandidate.Therequiredrate

ofreturnprovidesastandardsothataninvestorcandetermineiftheexpectedreturnonastockis

satisfactoryornot.Therequiredrateofreturnispositivelyrelatedtotheunderlyingriskinvolvedin

aninvestment.Thehighertherisk,thehigherthereturntheinvestorwouldexpecttheinvestmentto

generate.Theinvestorwhopicksastockwhosereturnislessthantherequiredrateofreturnhas

reallyinvestedinastockwhichisovervaluedatthecurrenttime.Thisisbecausethestockisnot

yieldingreturnscommensuratewiththeriskexposure.Sincethemarketwilllearnofsuch

overvaluationintime,marketforceswillbiddownthepriceofsuchasecurity.Theinvestorwill

incurcapitallosseswhenthestockpricedropsbelowthepurchaseprice.

6.

Ingeneral,thevalueofanyassetisthepresentvalueofallfuturecashflowbenefitsreceived.For

commonstock,thecashflowisdividendsreceivedeachyearplusthefuturesalepriceofthestock.If

anyfuturepricecanbedescribedintermsofsubsequentdividends,thenthecurrentpricecanbe

viewedasthepresentvalueofdividendsreceivedoveraninfinitetimehorizon.Thebasicdividend

valuationmodelreducestheneedtoestimateallfuturedividendsindividuallybysayingthatthe

valueofashareofstockisafunctionofdividendsthataregrowingataspecifiedrateovertime.In

thisway,eachfuturedividendcanbeexpressedasafunctionofthecurrentdividendandaspecified

rateofgrowthindividends.Thediscountrateappliedtothesefuturecashflowsisthedesiredrateof

returnoftheinvestorrelativetotheriskofthestockandtheotherreturnsavailable.

TheDVMcanbeusedtovalueastockwhichpaysaconstantdividend;anongrowingstockwhich

paysadividendthatisgrowingataconstantrateovertime;andastockwhichpaysadividendthat

growsatvariableratesovertime.

TheCAPMfitsintothevariablegrowthDVMthroughitseffectonk,therequiredrateofreturn.The

greaterthesystematicriskofaparticularinvestment,thegreatershouldbeitsrequiredrateof

return,ascomputedusingtheCAPMand,therefore,thelowerthevalueobtainedthroughthe

variablegrowthDVM.Moregenerally,theCAPMfitsintoallthreeofthedividendvaluationmodels

andhasthesameeffectdescribedabove.

7.

Thedifferencebetweenthevariablegrowthdividendvaluationmodelandthedividendsand

earningsapproachisinthedeterminationofthefuturesellingpriceofthestock.Thevariablegrowth

dividendvaluationmodelusesthefuturedividendstoderivethepriceofthestockwhilethe

dividendsandearningsmodelemploysprojectedEPSandP/Emultiplestoderivethestockprice.

Thedividendsandearningsmodelispreferabletothevariablegrowthmodelbecauseitismore

flexibleandeasiertounderstandandapply.ThismodelonlyrequirestheestimationofaP/Emultiple

inonefutureperiodasopposedtoestimatingthedividendgrowthrateoveraninfiniteperiodoftime.

8.

Expectedreturnonastockcanbefoundbyusingthe(presentvaluebased)internalrateofreturn

(IRR).Theexpectedrateofreturnonastockwouldbethediscountratethatequatesthefuturestream

ofbenefitsfromthestock(i.e.,thefutureannualdividendsandfuturepriceofthestock)toitscurrent

marketvalue.Inordertoacceptastockasaninvestmentvehicle,itsexpectedreturn(IRR)mustat

leastequalitsrequiredrateofreturn(e.g.usingCAPM).Iftheexpectedreturnonastockishigher

thanitsrequiredrateofreturn,thenitiscertainlyagoodbuy.

148Gitman/JoehnkFundamentalsofInvesting,NinthEdition

9.

TheP/Eapproachisasimpler,moreintuitiveapproachtovaluingastock.GivenanestimatedEPS

figure,decideonaP/Eratiothatisappropriateforthestock,multiplytheEPSbytheP/Eto

determinethestockprice,thencomparethispricetothestockscurrentprice.TheP/Eapproach

differsfromthevariablegrowthdividendmodelinthattheP/EapproachestimatesEPSanddevelops

anappropriateP/Eforthefirm.Thevariablegrowthdividendmodelonlyusesfuturedividendsand

estimatedgrowthratestodeterminethestockprice.

Thepricetocashflow(P/CF)measurehasbeenpopularwithinvestorsbecausecashflowisfeltto

provideamoreaccuratepictureofacompanysearningpower.InamannersimilartoP/Eratio

valuation,cashflowismultipliedbyaP/CFratio.Inadditiontoeaseofuse,therelativelylowlevel

oftheP/CFratio(whencomparedtotheP/Eratio),isviewedasastrength.Theobstacletousingthe

P/CFmethodisthevaryingcashflowmeasures,includingcashflowfromoperations,freecashflow,

andEBITDA.

10. Pricetosales(P/S)andpricetobookvalue(P/BV)ratiosarealternativepricerelativemeasures.

Theyareusefulforvaluingfirmsthatareneworhavevolatileearningsstreams,wheretheP/E

multipleapproachhaslittlevalue.Unprofitablefirmsstillhavesales.Bothareusedinasimilar

fashiontoestimatefuturevalues,bymultiplyingestimatedsalesorbookvaluebytherelevantratio.

Generallyspeaking,investorspreferlowP/SandP/BVratios,withdesiredP/Sratiosoflessthan2.0

andP/BVratiosoflessthan7.0.However,ifacompanyhasahighprofitmargin,itislikelytohave

highP/SandP/BVratios,also.Animportantdifferenceliesinthefactthatsalesariseinthecurrent

period,whilebookvalueisbasedontheissuanceofstockandretentionofearningssincethefirm

wentpublic.

.5

Suggested Answers to Investing in Action Questions

Ive Got a Secret: Whisper Forecasts (p. 334)

(a) Whatarewhisperforecastsandhowcaninvestorsusethem?

(b) Howaccuratearewhisperforecasts?

Answers:

(a) Whisperforecastsareunofficialearningsestimatesthatcirculateamongtradersandinvestors.They

arerumorsratherthanofficialanalystsestimates.WhispernumbersareavailableontheInternet.

Investorsshouldusewhisperforecastsonlyincombinationwithothersecuritiesanalysisand

techniques.

(b) Somestudiesshowwhisperforecaststendedtobemoreaccuratethananalystsestimates.Duringthe

20002002downturn,whispernumbersprovedtobelessaccuratethananalystsforecasts.

.6

Suggested Answers to Ethics in Investing Questions

Stock Analysts: Dont Always Believe the Hype (p. 344)

Shouldanalystsbeforbiddenfromowningthestocktheycover?

Answers:

Chapter8StockValuation149

Althoughthereisnofederalregulationforbiddingtheanalystsfromowningthestockfromcompanies

theycover,manybrokeragehouseshaveadoptedthispolicytoavoidconflictofinterestbetweenanalyst

buyandsellrecommendationsandtheirpersonaltradinginstocks.Therulesrecentlyimplementedbythe

SECrequiremoredisclosurebyfirmsandanalystsregardingstockrecommendationsandtheirholdings,

imposeblackoutperiodsonanalystspersonaltradingofstockstheycover(30daybeforeand5daysafter

theannouncement),andforbidsthepracticeoftyinganalystscompensationtotheamountofinvestment

bankingbusinesstheirfirmreceives.

Perhapsabetterpolicywouldbe(withinthelimitsimposedbytheSEC)toallowtheanalyststotrade

accordingtotheirownrecommendationsandrequirethemtodisclosethisinformationtothegeneral

public.Tofurtherdiminishthepossibilityofconflictofinterestanalystsshouldalsobebannedfrom

coveringcompanieswithwhomtheirbrokeragehousedoesinvestmentbanking.

.7

Suggested Answers to Discussion Questions

1.

Answerswillvarybystudent.

2.

(a) 1. Thevalueofagrowthstockthatpayslittleornothingindividendscouldbefoundusinga

dividendsandearnings(D&E)approach.Thedividendportionbeingminimal.

2. TheS&P500wouldbestbevaluedwithaconstantgrowthmodel,sinceabnormallygood

performancebysomecompaniescouldoffsetpoorperformanceofothers.

3. Arelativelynewcompanywhichhasabriefhistoryofearningswouldbestbevaluedusinga

price/salesratio.Sinceitisrelativelynew,thereprobablyhasnotbeenmuchofabuildupin

bookvaluethroughearningsretention.

4. Alargematurecompanyisprobablypayingadividend,howeverthatdividendmightvary

withfirmspecificevents.Hence,avariablegrowthDVMisappropriate.

5. Preferredstockhasafixeddividendpayment,makingthezerogrowthDVMappropriate.

6. Afirmwithalargeamountofdepreciationandamortizationshouldusethepricetocash

flow(P/CF)ratio,becausethismeasureaddsdepreciationandamortizationtoearningsinthe

estimationprocess.

(b) Answersvarybystudent.However,thedividendsandearnings(D&E)valuationmodel

incorporatesbothoftheseinputs.Thepricetosales(P/S)ratioisappropriateforsmallfirmsand

thosewitherraticearnings.Finally,thevariablegrowthDVMcanhandleincreasingand

decliningdividends.

(c) Again,answerswillvarybystudent.However,theinstructormaywanttopointoutthat

dividendsaretheonlycashflowbacktotheshareholder.Hence,adividendvaluationmodelis

appropriate.Sincethevariablegrowthmodelhandlesalltypesofdividendgrowthrate(negative,

zero,andpositive)itmaywellbethebest.Ifdividendsarecurrentlyhardtoestimate,onemay

havetousethedividendsandearnings(D&E)approach.

3.

Alldecisionsaremadeinlightoffutureconsequences.Shareholderinvestmentdecisionsarebased

uponthefuturecashinflowsarisingfromtheirinvestment.Newfirmspecificevents(i.e.,anticipated

patentapproval,facilitycompletion),newindustryrelatedevents(i.e.,anticipatedcompetition,

potentialofstrikes)andchangesinmacroeconomicconditions(i.e.,inflation,disposableincome)will

impactfuturesales,profitsandtheabilitytopaydividends.

Theintrinsicvalueofastockisaninversefunctionoftherequiredrateofreturn.Thehigherthe

requiredrateofreturn,thelessashareholderiswillingtopayforanygivencashflowstream.For

instance,theintrinsicvalueofa$1.00constantdividendpayment,whentherequiredrateofreturnis

eightpercentis$12.50.Iftherequiredrateofreturnrisestotenpercent,theintrinsicvaluedrops

to$10.

150Gitman/JoehnkFundamentalsofInvesting,NinthEdition

.8

1.

Solutions to Problems

(a) Estimatednetearnings EstimatedsalesExpectednetprofitmargin

$75,000,0000.05

$3,750,000

Chapter8StockValuation151

(b) First,wemustfindestimatedEPS:

EstimatedNetEarnings

ExpectedSharesOutstanding

$3, 750, 000

EstimatedEPS

$1.50

2,500, 000

EstimatedEPS

EstimateddividendspershareEstimatedEPSExpectedpayoutratio

$1.500.5$0.75

(c) ExpectedpriceEstimatedEPSExpectedP/Eratio

$1.5024.5$36.75

(d) ExpectedHoldingPeriodReturn:

Futuredividend

Futuresaleprice

Currentstock

receipts

ofstock

price

HPR

Currentstockprice

$0.75 $36.75 $25.00

HPR

$25.00

50%

2.

GrowthRate:EndingSales/BeginningSalesFVIFX%,3years

$83,650,000/$55,000,0001.521

FVIF1.521at15%in3yearrow

Salesin2003$83,650,0001.15$96,197,500

NetProfitMarginin2003:8%

NetProfitin20040.08$96,197,500$7,695,800

3.

EPSROEBookValuepershare

BookValuepershare$500/100$5.00

EPS0.15$5$0.75

4.

DividendpershareEPSPayoutratio

EPSROEBookValuepershare

BookValuepershare$500/100$5.00

EPS0.15$5$0.75

Dividend$0.750.3333$0.25

5.

GrowthrateROERetentionRate

Retentionrate1Payoutratio

PayoutRatio$0.20/$2.0000.10

RetentionRate10.100.90or90%

Growthrate0.150.900.135or13.5%

152Gitman/JoehnkFundamentalsofInvesting,NinthEdition

6.

Totaldebt$75M/0.10$750,000,000

GrowthROERetentionRate.RetentionRate1.Growth15%.

Withaconstantequitymultiplier,debtandequitywilleachincreaseby15%,sonewdebt

$750,000,0001.15$862,500,000.

Interestrate0.10(0.250.10)0.075.

InterestExpense0.075$862,500,000$64,687,500

7.

(a) Theintrinsicworth(orjustifiedprice)isequaltothepresentvalueofexpecteddividendsand

futurepricediscountedattherequiredrateofreturn(10percenthere).

Intrinsicvalue PV(dividends) PV(futureprice)

Intrinsicvalue $5(0.909)* $5(0.826)* ($75 $5)(0.751)*

=$68.76

*Presentvalueinterestfactorsfor10%and1,2,3years,respectively.

(b) Expectedreturncanalsobecalculatedusingthepresentvaluebasedinternalrateofreturn

(IRR):

($5 PVIFIYR ) ($5 PVIF2YRS ) ($5 PVIF3YRS )

($75 PVIF3YRS ) $50

Therateofreturnwhichdiscountsfuturecashflowssuchthattheirsumequalsthecurrentstock

priceis23%.Hencetheexpectedreturnofthestockis23%.

Nomatterhowyoulookatit,Education,Inc.shouldbeviewedasaviableinvestmentcandidate.

Ithasajustifiedprice($68.76)thatfarexceedsthestockscurrentprice($50),suggestingthat

thestockisundervalued(solongasCharlenesexpectationsareright),anditsyield(23%)is

faraboveCharlenesrequiredrateofreturn

(10%).

8.

TheintrinsicvalueofAmalgamatedAircraftParts,Inc.canbecalculatedusingthedividend

valuationmodel:

Valuepershare

$1.50

$1.50

$16.67

0.16 0.07 0.09

where16%isthedesiredrateofreturnand7%isthedividendgrowthrate.

9.

IntrinsicvalueAnnualDividend/RequiredRateofReturn$2/0.12$16.67

Eddyshouldnotbuythestock,asitisoverpricedbasedonhisvaluation.

10. ValueNextYearsDividends/(RequiredRateofReturnConstantRateofDividendGrowth)

GrowthRateindividends12%($2.12/$2.001.255;FVIF12%,2periods1.254)

Value(1.12x$2.51)/(0.140.12)$2.81/0.02$140.56

Chapter8StockValuation153

11. (a) ValueofStock4.32xPVIF15%,1yr.+4.67PVIF15%,2yrs.

+(5.04+77.75)xPVIF15%,3yrs.

4.32(0.870)+4.67(0.756)+82.79(0.658)

$61.76

(b) Expectedreturncanalsobecalculatedusingthepresentvaluebasedinternalrateofreturn

(IRR):

($4.32PVIF1YR)+($4.67PVIF2YRS)+($5.04

PVIF3YRS)

+($77.75PVIF3YRS)$61.76

Therateofreturnwhichdiscountsfuturecashflowssuchthattheirsumequalsthecurrentstock

priceis15%.Thisisalsotherequiredrateofreturnusedinparta.Hence,theanswertothe

followingitemhasbeenverified.

(c) Usingthedividendvaluationmodel:

Valueofstock

$4.00(1.08) $4.32

$61.71

15 0.08

0.07

where15%isthedesiredrateofreturnand8%isthedividendgrowthrate.

(d) Thedividendinyear4willbe$5.04(1.08)$5.44.

Thepriceinyear3willbe

$5.44

$77.71

0.15 0.08

Lookingattheinformationgivenintheproblem,theabovevalueisveryclosetothe$77.75

givenasthepriceofthestockinyear3.(Thedifferencecanprobablybeattributedtorounding

errors.)Sincethecashflowmodelissimplyanextensionofthedividendvaluationapproach,

whentheunderlyingassumptionsaboutgrowthratesandrequiredratesofreturnarethesame(as

theyarehere),thetwomodelswillgivethesameresults.

12. Tofindtheexpectedreturnonthissecurity,weneedtofindtheexpectedfuturepriceofthestock:

FuturepriceofthestockFutureEPSExpectedP/Emultiple

$7.00x18$126.00

Expectedreturncanbecalculatedusingthepresentvaluebasedinternalrateofreturn(IRR):

($2.50PVIF1YR)+($2.50PVIF2YRS)+($2.50PVIF3YRS)

+

($126PVIF3YRS)$70

Therateofreturnwhichdiscountsfuturecashflowssuchthattheirsumequalsthecurrentstockprice

is24.63%.ThisistheexpectedrateofreturnonWestCoastElectronics.

154Gitman/JoehnkFundamentalsofInvesting,NinthEdition

RequiredReturn

Riskfreerate+[Stocksbeta(MarketreturnRiskfreerate)]

7+[1.15(14.07.0)]

7+[1.157]

7+8.05

15.05;use15%

Chapter8StockValuation155

Usingthepresentvaluemodel,thisstockcouldcarryapriceof:

StockPrice(Value)PV(dividends)+PV(futurepriceofthestock)

($2.50)(0.870)*+($2.50)(0.756)*

+(2.50+$126.00)(0.658)*

$88.62

*15%presentvalueinterestfactors

Yes,thestocklookslikeitwouldmakeagoodinvestment.Ithasajustifiedpricethatsaboveits

currentmarketprice,anditsexpectedreturnexceedstherequiredrateofreturn.

13. Onemayevaluatethissituationusingjustifiedprice(intrinsicvalue).Inthiscasewecanignore

dividends;assuch,wecanfindthepresentvalueofthefuturepriceofthestock,usingadiscountrate

of10percent:

IntrinsicvaluePresentvalueofthefuturepriceofthestock

$100(0.751)*

$75.10

*Interestfactorfor10%,3years

Sincethisisslightlygreaterthanthecurrentmarketpriceof$75,itisasatisfactoryinvestmentit

earnstherequired10percentrateofreturn.

Theexpectedreturncanbecomputedusingthebasicpresentvalueequationandthepresentvalue

interestfactortables:

PresentvalueFuturevaluePVIF

$75$100PVIF

SolvingtheequationforPVIF:

PVIF$75/$100.750

Wecannowlookinapresentvalueinterestfactortable(suchastheoneinAppendixA,

TableA.3)fora3yearinterestfactorequal(orclose)to0.750.(ThetimehorizonforMs.Bs

investmentis3years).Lookingacrossthe3yearrowoffactors,wefindafactorof0.751underthe

10%column;thus,thisinvestmentpromisesareturnofjustover10%.

14. (a)

ProjectedAnnualDividends

Year

0

1

2

3

4

5

6

Dividends

$3.00

3.30(g10%)

3.63(g10%)

3.99(g10%)

4.39(g10%)

4.83(g10%)

5.12(g6%)

Estimatedannualgrowthrateforyear6andbeyond:6%

156Gitman/JoehnkFundamentalsofInvesting,NinthEdition

Step1:Presentvalueofdividendsusingarequiredrateofreturnof12%:]

Year

1

2

3

4

5

Dividend

s

3.30

3.63

3.99

4.39

4.83

PVIF,

12%

0.893

0.797

0.712

0.636

0.567

Total

Present

Value

$2.95

2.89

2.84

2.79

2

.74

$14.21

Step2:Priceofstockattheendofyear5:

P5

D6

$5.12

$5.12

$85.33

k g 0.12 0.06 0.06

Step3:Presentvalueofthestockprice:

PV $85.33 PVIF12%,5yrs.

$85.33 0.567

$48.38

Step4:

ValueofSLL&Gstock $14.21(Step1)+$48.38(Step3)

$62.59

Therefore,$62.59isathemaximumpriceyoushouldbewillingtopayforthisstock.

(b) Sinceg0foryear6andbeyond,dividendsforyear6willbethesameasthedividendforyear

5;i.e.,$4.83.Wejustneedtoredosteps2and3tofindtheintrinsicvalueofthestock:

Step2:Priceofstockattheendofyear5:

P5

D6

$4.83

$4.83

$40.25

k g 0.12 0 0.12

Step3:Presentvalueofthestockprice:

PV(P5 ) $40.25 PVIF12%,5yrs.

$40.25 0.567

$22.82

Sincethepresentvalueofthefirstfiveyearsofdividendsisthesameasin(a),above,the

intrinsicvalueofthestockis:

Intrinsicvalue$14.21+$22.82$37.03

(c) Theintrinsicvalueofthestockin(a)ismuchhigherthanthatcomputedin(b).In(a),dividends

aregrowingat6%peryearbeyondyear5,whilein(b),thedividendsdonotgrowafteryear5.

Thedividendvaluationmodelisverysensitivetothegrowthrateindividends;thehigherthe

rateofgrowthindividends,thehighertheintrinsicvalueofthestock.

Chapter8StockValuation157

15. (a) ValuationusingtheDVM:

Intrinsicvalue

D (1 g)

D1

0

kg

kg

BuggiesAreUs:

Intrinsicvalue

$2.25(1+0)

$22.50

0.10 0.06

SteadyFreddie,Inc.:

Intrinsicvalue

$2.25(1+.06) $2.385

$59.63

0.10 0.06

0.04

GangBusterGroup:

Step1:Presentvalueofdividendsusingarequiredrateofreturnof10%:

Year

1

2

3

4

Dividends

$2.53

2.85

3.20

3.60

PVIF,10%

PresentValue

0.909

$2.30

0.826

2.35

0.751

2.40

0.683

2

.46

Total

$9.51

Step2:Priceofstockattheendofyear4:

D5

D4 (1 g)

kg

kg

$3.60(1 0.06) $3.82

$95.50

0.10 0.06

0.04

P4

Step3:Presentvalueofthestockprice:

PV $95.50 PVIF10%,4yrs.

$95.50 0.683

$65.23

Step4:Valueofstock$9.51(Step1)+$65.23(Step3)$74.74

(b) TheintrinsicvalueofGangBustersis$74.74,comparedto$59.63forSteadyFreddieand$22.50

forBuggiesAreUs.Thedifferenceinthevaluesiscausedbythedifferenceindividendgrowth

rates.TheBuggiesAreUsdividendsdonotgrow,resultinginaverylowintrinsicvalueforits

stock.ThedividendsofSteadyFreddie,inc.,growataconstantrateof6%forever,whereas

GangBustersdividendsgrowatapproximately12%forthefirst4yearsand6%fromyear5into

thefuture.ThishighergrowthindividendsintheearlieryearscausesGangBusterGrouptobe

worthmuchmorethanSteadyFreddie.

158Gitman/JoehnkFundamentalsofInvesting,NinthEdition

16. Tocomputethejustifiedprice,oneneedsexpecteddividendsandtheexpectedfutureprice.Expected

annualdividendsaregivenat$2pershare.Theexpectedpriceisestimatedbymultiplyingthe

expected$5inearningspersharebytheexpectedpriceearningsratioof14:

Expectedpriceinyearfive21$5$105

Thejustifiedpriceequalsthepresentvalueofthedividendsandfuturepricediscountedatthe

requiredrateofreturn,12percent:

Justifiedprice

($2)(0.893)* ($2)(0.797)* ($2)(0.712)* ($2)(0.636)* ($2 $105)(0.567)*

$66.75

*Presentvalueinterestfactorsfor12%

17. Tosolvethisproblem,firstcomputefuturesales,profits,dividends,andshareprice.

FutureSales:

Year1:$250million1.20$300million

Year2:$300million1.10$330million

FutureProfits:

Year1:$300million.08$24million

Year2:$330million.08$26.4million

FutureEPS:

Year1:$24million/15million $1.60

Year2:$26.4million/15million $1.76

FutureDividends:

Year1:$1.60.50$0.80

Year2:$1.76.50$0.88

FutureSharePrice:

Year1:$1.6015$24.00

Year2:$1.7615$26.40

Nowwecanfindthestocksintrinsicvalue,approximateyield,andHPRs.

(a) Intrinsicvalue/justifiedprice:

Intrinsicvalue presentvalueoffuturedividendsandshareprice

($0.80 0.833) ($0.88 0.694) ($26.40 0.694)

$19.60

(b) CalculatetheIRR:

($0.80PVIF1)+($0.88PVIF2)+($26.40PVIF2)$15.00

IRR37.50%

Chapter8StockValuation159

(c) Holdingperiodreturns:

$0.80 $24.00 $15.00

65.3%

$15.00

$0.88 $26.40 $24.00

HPR(Year2)

13.7%

$24.00

HPR(Year1)

18. (i)

CAPM:

Requiredrateofreturnriskfreerate+stocksbetamarketreturnriskfreerate

6%+[1.80(11%6%)]

6%+9%15%

(ii) Valuethestockusingthevariablegrowthdividendmodel:

D1D0(1+g)$3(1.12)$3.36

D2D1(1+g)$3.36(1.12)$3.76

D3D2(1+g)$3.76(1.12)$4.21

D4D3(1+g)$4.21(1.12)$4.72

Valueofstock(D1PVIF1)+(D2PVIF2)+(D3PVIF3)+(D4PVIF4)+PVIF4

D4 (1 g)

kg

($3.36PVIF15%,1)+($3.76PVIF15%,2)+($4.21PVIF15%,3)

$4.72(1.09)

+($4.72PVIF15%,4)+PVIF4

0.15 0.09

2.92+2.84+2.77+2.70+(0.57285.7549.05)

$60.28

19. (i)

Findthegrowthrateindividends:

g ROE thefirm'sretentionrate,rr

rr 1 dividendpayoutratio

g 0.20 (1 0.4)

g 0.12or12%

(ii)

Usetheconstantgrowthratedividendmodel:

D4 (1 g)

Valueofthestockinfouryears

kg

$3.00(1.12)

0.15 0.12

$112.00

(iii) Valueofstocktoday:

$112.00PVIF15%,4Presentvalue

$112.000.572$64.06

160Gitman/JoehnkFundamentalsofInvesting,NinthEdition

20. Inordertovaluethiscompany,youfirstneedtodeterminethefirmsROE,thenthegrowthratein

dividends,andfinallythedividendpayment.

(i)

ROE

NetIncome

$3,750,000

0.15or15%

TotalEquityValue $25,000,000

(ii)

growthrateROErr

0.15(10.40)

0.09or9%

(iii) dividendEPSpaymentratio

$5.00.040

$2.00

Valueofthestock

D0 (1 g) $2.00(1.09)

$72.67

kg

0.12 0.09

21. (a) UsingtheP/Eapproach:

stockprice EPS P/Eratio( MarketP/E RelativeP/E)

$4.00 (18.5 1.25)

$4.00(23.125)

$92.50

(b) (11087.50)/87.5025.7%

22. UsingtheP/Eapproachtovaluethestock:

Valueofthestock EPS P/E

1.25(2.75) 30

$103.125

23. Themostlogicalapproachbasedonthedatapresentedistovaluethestockbasedonamultipleof

sales.Marketvaluesarefairlyconsistentat10%ofsales,soagoodestimatewouldbe$1.00per

share.If,however,Newcoisexpectedtogrowmuchfasterthanitscompetitors,thenthepriceshould

beadjustedupwardforthegrowth.

24.

Amazing.com

ReallyCooking.com

Fixtures&AppliancesOnline

4.5

4.1

3.8

12.4/34.13averagepricetosalesratio

Giventrailingsalesof$40millionandsharesoutstandingof10million

$40million/10million$4.00sales/share

Tofindthevalueofashare,multiplythesalespersharebytheaveragepricetosalesratio

$4.004.13$16.52

Chapter8StockValuation161

.9

Solutions to Case Problems

Case 8.1Chris Looks For a Way to Invest His New Found Wealth

Thiscaseallowsthestudenttoestimatethefuturepriceandapproximateyieldofastock.Withthis

information,thestudentmustanalyzetheriskandrecommendwhetherornotthestockisagood

investment.

(a) 1.

Sales

Netprofitmargin(20%)

Netprofit

DividedbyNumberofshares

Earningspershare($)

($inmillions)

Year

1

2

3

$22.5

$35.0

$50.0

0.20

0.20

0.20

$4.5

$7.0

$10.0

(2.5million)

$1.80

$2.80

$4.00

162Gitman/JoehnkFundamentalsofInvesting,NinthEdition

2. Estimatedprice(year3)estimatedP/EestimatedEPS

40$4.00$160.00

3. Expectedreturncanalsobecalculatedusingthepresentvaluebasedinternalrateofreturn(IRR):

($160P VIF3YR ) $70.00

PVIF3YR 70.000 /160

0.437

Therateofreturnwhichdiscountsfuturepricesuchthatitequalsthecurrentstockpriceis32%.

4. Chrisfacesaconsiderableamountofbothintrinsicandmarketrisk.Chrismustconsiderthe

possibilitythatthefirmwillnotreachexpectedsalesgoals,and/orthatthenetprofitmargins

maydecline.Ifthemarketfalls,P/Eratiosfallaswell;iftheP/Eisonly15timesearningsin

threeyearsforexample,thestockwillsellfor$60.00,andtheyieldwillbe:

(60 PVIF3YR ) $70.00

PVIF3YR 70.000 / 60

1.167

Therateofreturnwhichdiscountsfuturepricesuchthatitequalsthecurrentstockpriceis

negative.Thepricedeclines.

5. BecauseChrisexpectsthestocktoyield32percent,heshoulddecidewhetherthisreturnisat

leastequaltohisdesiredrateofreturn.Thedesiredrateofreturn,ofcourse,isanestimatehe

mustmakeafterstudyingtheriskcharacteristicsofthestock.Ifhisdesiredrateofreturnisless

thanorequalto32percent,Chrisshouldconsiderthestocktobeaworthwhileinvestment

candidate.

(b) 1. Chrishasadoptedaspeculativeinvestmentstrategy,anditmaynotmeethisinvestmentneeds.

Hehasnoneedforcurrentincome,buthedoesneedastoreofvalueandcapitalappreciation.

Thespeculativeprogramheisfollowing,ifcorrectlymanaged,mayenablehimtohititbig.

However,thisstrategy,beinghighlyrisky,mayalsoleavehimwithlittletoshowforhis

successfulyears.Thespeculativestrategyisusuallyfollowedbyveryactiveinvestors,andChris

isnotlikelytohavetimetomanagehisportfolioonadailybasis(evenwithahighlyregarded

BeverlyHillsbrokertohelp).

2. Onemightsuggestheputalargepartofhisearningsintomoreconservative(butstill

appealing)growthstocks,andmovetowardalongtermgrowthstrategy,whilekeepingasmaller

portionofhisportfolioinspeculativeissues.ThiswouldallowChristomeethisneedswhilestill

providingthepotentialofthebigscorefromspeculativeissues.Thischangelowershisrisk,

andalthoughChrisearnsenoughtoacceptsomerisks,itisprobablybettersuitedtothetimeand

talentChriscandevotetohisinvestments.

3. Yes,therearemanyforeignstocksandnationfundsthatoffersubstantialgrowthopportunities

andhence,thepotentialforcapitalappreciation.WiththeavailabilityofADRsformanypopular

foreignstocks,tradingforeignsecuritiesisaseasyastradingU.S.stocks.Also,byinvestingin

foreignstock,Chriscanachieveahigherlevelofdiversificationandtherebyreducetheriskof

hisportfolio.

Case 8.2An Analysis of a High-Flying Stock

Chapter8StockValuation163

Thiscaseenablesthestudenttogeneratefutureearningsandpershareperformance;inaddition,the

studentisaskedtousetheforecastsinestablishinganintrinsicvalueforthestock,andinmakingan

investmentdecision.Finally,thestudentisgivensomerecentpriceinformationandaskedtodosome

charting,andconsidertheroleoftechnicalanalysisintheinvestmentdecision.

(a) Averagegrowthrate:

Years

00to01

01to02

02to03

03to04

GrowthRate

(12.510.0)/10.00.250

(16.212.5)/12.50.296

(22.016.2)/16.20.358

(28.522.0)/22.00.296

0.25 0.296 0.358 0.296

30%

4

Note:Withmoreadvancedstudents,thecompoundannualratemaybeintroducedhereasamore

precisemeasure.Herethetwoareequivalent,butwhentheannualratesdiffergreatly,thearithmetic

averagemayyieldlargeerrors.

Compoundgrowthrate:

Arithmeticaverage

28.510.0(FVIF),givenn4years.

NowsolveforFVIF:

2.85FVIF

Lookingacrossthe4yearrow,weseethatFVIF2.85fori30%

1. Usingagrowthrateof30%,wehave:

Salesnextyear(2005) 2004sales(1+30%growthrate)

$28.5million1.30

$37.05million

Salesin2006

2005sales(1+30%)

$37million1.30

$48.1million

164Gitman/JoehnkFundamentalsofInvesting,NinthEdition

2. Earningsin2005

Earningsin2006

EPS:2005

EPS:2006

3. P/Eratiofor2006

SharePrice,2006

SalesProfitmargin

$37,000,0000.12

$4,440,000

SalesProfitmargin

$48,100,0000.12

$5,772,000

$4,440,000

$0.89

5,000,000

$5,772,000

$1.15

5,000,000

50(givenintheproblem).

502006EPS50$1.15

$57.50pershare

(b) 1. Justifiedprice Presentvalueofdividendsandfutureprice

Therefore,justifiedprice(0.050.800)*+(0.050.640)*

+(57.500.640)*

$36.87

*Presentvalueinterestfactorsfor25%.

2. Sincethemarketpriceofthestock($32.50)iswellbelowthisjustifiedprice,Wiltshouldconsider

thestockaworthwhileinvestmentcandidate.Clearly,hewillbeearningmorethanhis25percent

desiredrateofreturn.

.10 Outside Project

Chapter 8Trying Your Hand at Technical Analysis

Generally,technicalanalystsbelievethatbystudyingpastmarketprices,itispossibletoforecastfuture

prices,atleastintheshortrun.Peoplewhoareprofessionaltradersalsospeakofasensetheyacquireof

commonstocktradingpatternsforparticularcompanies.Thesepatternsmaybetheresultofmany

influences:thetypeofinvestorswhotradethestock;theparticularactionofthestocksspecialist;whether

thecompanyiscyclical,growthoriented,defensive,orincomeoriented;thecurrentcourseofthemarket;

andothervariables.Thisprojectwillhelpyouacquirethissenseofthemarketforcommonstocks.

Thisprojectrequiresyoutoprepareabarchartofthedailyhigh,low,andclosingpricesfortwostocks.

Youwillneedsomegraphpaper(thefinerthelines,thebetter).Youwanttoputatleasttwoorthree

monthsofdataononepage.Inpractice,themoreconsecutivedataononepage,theeasieritistointerpret

theprices.Next,obtainsomehistoricalandcurrentpricedata.OneobviousplacetolookisTheWall

StreetJournal;buthopefully,yourlibrarywillhavetheStandard&PoorsDailyStockPriceRecord.

ThesebookscontaindailystockpricesforanentirequarterforcompaniestradedontheNYSE,AMEX,

andOTC.Obtaintherequiredinformation(dailyhigh,low,andclosingprices)foraperiodof3to

6months;confineyourdatagatheringtothemostrecenttimeperiod.

Chapter8StockValuation165

Onceyouvecollectedthedata,makethegraph.Thenobserveandstudythepricetrendsandpatternsyou

justgraphed.Notehowvolatiledailypricesare.Lookforsimilaritiesinthepatternsorforunusualprice

changes.Ifyouwanttoexpandtheproject,plottheDowJonesIndustrialAverage(usejustthedaily

closingfigures)duringtheperiodandnotehowthestockpricechangesarecorrelatedwiththeDJIA.

Thereisalotofinformationonapricechart.Remember,somepeopleseethisinformationasvery

valuableandsomebelievemarketsaresoefficientthatwhatyouhavegraphedisoflittleornovalue.

Whatisyouropinion?

Anda mungkin juga menyukai

- Madura FMI9e IM Ch14Dokumen15 halamanMadura FMI9e IM Ch14Stanley HoBelum ada peringkat

- Oil, Gas & Mining QuestionsDokumen34 halamanOil, Gas & Mining QuestionsoussemBelum ada peringkat

- This Question Has Been Answered: Find Study ResourcesDokumen3 halamanThis Question Has Been Answered: Find Study ResourcesChau NguyenBelum ada peringkat

- AC2101 S2 20132014 Seminar 1Dokumen33 halamanAC2101 S2 20132014 Seminar 1David KohBelum ada peringkat

- BFC5935 - Tutorial 10 SolutionsDokumen8 halamanBFC5935 - Tutorial 10 SolutionsAlex YisnBelum ada peringkat

- IF Problems Arbitrage OpportunityDokumen11 halamanIF Problems Arbitrage OpportunityChintakunta PreethiBelum ada peringkat

- Chap 026sddDokumen33 halamanChap 026sddsatishiitrBelum ada peringkat

- Dawn Bolton-Smith (2001) - On Trading Systems (5 P.)Dokumen5 halamanDawn Bolton-Smith (2001) - On Trading Systems (5 P.)FrankBelum ada peringkat

- Ebook PDF Corporate Finance A Focused Approach 6th Edition PDFDokumen29 halamanEbook PDF Corporate Finance A Focused Approach 6th Edition PDFjennifer.browne345100% (38)

- Gitmanjoeh 238702 Im13Dokumen25 halamanGitmanjoeh 238702 Im13trevorsum123Belum ada peringkat

- Forecasting of Financial StatementsDokumen9 halamanForecasting of Financial StatementssamaanBelum ada peringkat

- Chapter 4 - Simple InterestDokumen18 halamanChapter 4 - Simple InterestKPRobin0% (1)

- Lecture Notes2231 SCMDokumen57 halamanLecture Notes2231 SCMhappynandaBelum ada peringkat

- Chapter 3.1 Mechanics of Futures MarketsDokumen17 halamanChapter 3.1 Mechanics of Futures MarketslelouchBelum ada peringkat

- Analyzing Common Stocks: OutlineDokumen30 halamanAnalyzing Common Stocks: OutlineHazel Anne MarianoBelum ada peringkat

- FM Textbook Solutions Chapter 8 Second EditionDokumen11 halamanFM Textbook Solutions Chapter 8 Second EditionlibredescargaBelum ada peringkat

- Bond and Stock ValuationDokumen44 halamanBond and Stock Valuationali khanBelum ada peringkat

- Chapter 3.2 Futures HedgingDokumen19 halamanChapter 3.2 Futures HedginglelouchBelum ada peringkat

- A Case Study On Business Mathematics - Assignment PointDokumen2 halamanA Case Study On Business Mathematics - Assignment PointJunior PyareBelum ada peringkat

- Practice For Chapter 5 SolutionsDokumen6 halamanPractice For Chapter 5 SolutionsAndrew WhitfieldBelum ada peringkat

- Lecture 2 Behavioural Finance and AnomaliesDokumen15 halamanLecture 2 Behavioural Finance and AnomaliesQamarulArifin100% (1)

- KLCI Futures Contracts AnalysisDokumen63 halamanKLCI Futures Contracts AnalysisSidharth ChoudharyBelum ada peringkat

- Eiteman PPT CH01Dokumen37 halamanEiteman PPT CH01Divya BansalBelum ada peringkat

- SMJC 3123 Project Finance QuestionsDokumen2 halamanSMJC 3123 Project Finance QuestionsJuandeLaBelum ada peringkat

- Based On Session 5 - Responsibility Accounting & Transfer PricingDokumen5 halamanBased On Session 5 - Responsibility Accounting & Transfer PricingMERINABelum ada peringkat

- Working Capital Practice SetDokumen12 halamanWorking Capital Practice SetRyan Malanum AbrioBelum ada peringkat

- Question Bank SAPMDokumen7 halamanQuestion Bank SAPMN Rakesh92% (12)

- Gitmanjoeh 238702 Im05Dokumen25 halamanGitmanjoeh 238702 Im05sara24391Belum ada peringkat

- Past Exam Questions - InvestmentDokumen14 halamanPast Exam Questions - InvestmentTalia simonBelum ada peringkat

- FOREX EXERCISE QUESTIONSDokumen4 halamanFOREX EXERCISE QUESTIONShoholalahoopBelum ada peringkat

- Challenges in Forecasting Exchange Rates by Multinational Corporations Ms 12may2016Dokumen22 halamanChallenges in Forecasting Exchange Rates by Multinational Corporations Ms 12may2016dr Milorad Stamenovic100% (3)

- e 51 F 8 F 8 B 4 A 32 Ea 4Dokumen159 halamane 51 F 8 F 8 B 4 A 32 Ea 4Shawn Kou100% (5)

- 1.2 Doc-20180120-Wa0002Dokumen23 halaman1.2 Doc-20180120-Wa0002Prachet KulkarniBelum ada peringkat

- Lecture Notes (Financial Economics)Dokumen136 halamanLecture Notes (Financial Economics)americus_smile7474100% (2)

- Derivatives Individual AssignmentDokumen24 halamanDerivatives Individual AssignmentCarine TeeBelum ada peringkat

- Organised Securities MarketsDokumen4 halamanOrganised Securities MarketsNipun Sachdeva50% (2)

- Calculating Cost of Capital and WACCDokumen21 halamanCalculating Cost of Capital and WACCMardi UmarBelum ada peringkat

- Bond Valuation: Bond Analysis: Returns & Systematic RiskDokumen50 halamanBond Valuation: Bond Analysis: Returns & Systematic RiskSamad KhanBelum ada peringkat

- FINA0804 Assignment 4 PDFDokumen2 halamanFINA0804 Assignment 4 PDFHarry KwongBelum ada peringkat

- International Financial ManagementDokumen23 halamanInternational Financial Managementsureshmooha100% (1)

- CHAPTER 9 The Cost of CapitalDokumen37 halamanCHAPTER 9 The Cost of CapitalAhsanBelum ada peringkat

- CH 06Dokumen73 halamanCH 06Sarang AdgokarBelum ada peringkat

- Investment ManagementDokumen38 halamanInvestment ManagementPranjit BhuyanBelum ada peringkat

- Mid Term Report FingameDokumen6 halamanMid Term Report FingameShine NagpalBelum ada peringkat

- SFM Theory BookDokumen33 halamanSFM Theory BookvishnuvermaBelum ada peringkat

- Week 2 Tutorial QuestionsDokumen4 halamanWeek 2 Tutorial QuestionsWOP INVESTBelum ada peringkat

- Tutorial 2 AnswersDokumen6 halamanTutorial 2 AnswersBee LBelum ada peringkat

- Lecture 4 Index Models 4.1 Markowitz Portfolio Selection ModelDokumen34 halamanLecture 4 Index Models 4.1 Markowitz Portfolio Selection ModelL SBelum ada peringkat

- Chapter 9: The Capital Asset Pricing ModelDokumen6 halamanChapter 9: The Capital Asset Pricing ModelJohn FrandoligBelum ada peringkat

- PPP and exchange ratesDokumen16 halamanPPP and exchange ratesNovrika DaniBelum ada peringkat

- FX Risk Management Transaction Exposure: Slide 1Dokumen55 halamanFX Risk Management Transaction Exposure: Slide 1prakashputtuBelum ada peringkat

- Diploma in Corporate Finance SyllabusDokumen18 halamanDiploma in Corporate Finance Syllabuscima2k15Belum ada peringkat

- Stock ExchangeDokumen8 halamanStock ExchangeNayan kakiBelum ada peringkat

- Corporate Finance Chapter 9Dokumen31 halamanCorporate Finance Chapter 9dia0% (2)

- Introduction To Financial ManagemntDokumen29 halamanIntroduction To Financial ManagemntibsBelum ada peringkat

- Corporate Finance: Laurence Booth - W. Sean Cleary Chapter 7 - Equity ValuationDokumen64 halamanCorporate Finance: Laurence Booth - W. Sean Cleary Chapter 7 - Equity ValuationShailesh RathodBelum ada peringkat

- International & Transnational StrategiesDokumen28 halamanInternational & Transnational Strategieskirthika sekar100% (5)

- RWJ Chapter 1 Introduction To Corporate FinanceDokumen21 halamanRWJ Chapter 1 Introduction To Corporate FinanceAshekin Mahadi100% (1)

- Building Your Financial Future: A Practical Guide For Young AdultsDari EverandBuilding Your Financial Future: A Practical Guide For Young AdultsBelum ada peringkat

- Cloud Family PAMM IB PlanDokumen4 halamanCloud Family PAMM IB Plantrevorsum123Belum ada peringkat

- Cloud Summer Marketing Plan Eng 3.1Dokumen6 halamanCloud Summer Marketing Plan Eng 3.1Dino TTBelum ada peringkat

- AlphaX IntroductionDokumen10 halamanAlphaX IntroductionDino TTBelum ada peringkat

- Cloud Summer Presentation Eng v3.1Dokumen20 halamanCloud Summer Presentation Eng v3.1Dino TTBelum ada peringkat

- 8.2a Secure USB To Export Your ETHDokumen2 halaman8.2a Secure USB To Export Your ETHtrevorsum123Belum ada peringkat

- 8.2f Don't Travel With Your Crypto WalletDokumen1 halaman8.2f Don't Travel With Your Crypto Wallettrevorsum123Belum ada peringkat

- 8.2o Why Would I Want To Move My Coins Away From An ExchangeDokumen1 halaman8.2o Why Would I Want To Move My Coins Away From An Exchangetrevorsum123Belum ada peringkat

- 8.2h Dilute RiskDokumen1 halaman8.2h Dilute Risktrevorsum123Belum ada peringkat

- 8.2d Update - Ignore ThisDokumen1 halaman8.2d Update - Ignore Thistrevorsum123Belum ada peringkat

- Hi, Upgrade Your Account Liftetime - HTTPS://WWW - Wsodownloads.in/ Lifetime Membership Cost Only $25 USD Exclusive VIP Download AreaDokumen1 halamanHi, Upgrade Your Account Liftetime - HTTPS://WWW - Wsodownloads.in/ Lifetime Membership Cost Only $25 USD Exclusive VIP Download Areatrevorsum123Belum ada peringkat

- 8.2i Another Security ToolDokumen1 halaman8.2i Another Security Tooltrevorsum123Belum ada peringkat

- Must ReadDokumen1 halamanMust Readtrevorsum123Belum ada peringkat

- 8.2j Where To Get A Bitcoin WalletDokumen1 halaman8.2j Where To Get A Bitcoin Wallettrevorsum123Belum ada peringkat

- 1.10a 2020 UPDATEDokumen1 halaman1.10a 2020 UPDATEtrevorsum123Belum ada peringkat

- 8.2g Where Can I Find Other WalletsDokumen1 halaman8.2g Where Can I Find Other Walletstrevorsum123Belum ada peringkat

- 1.i0b Passive Income - Up To 12% Returns! Better Than Real Estate As No Nightmare TennantsDokumen1 halaman1.i0b Passive Income - Up To 12% Returns! Better Than Real Estate As No Nightmare Tennantstrevorsum123Belum ada peringkat

- Excel Training - Level 1Dokumen95 halamanExcel Training - Level 1Cristiano Aparecido da SilvaBelum ada peringkat

- 8.2n What Coins Do The Hard Wallets SupportDokumen2 halaman8.2n What Coins Do The Hard Wallets Supporttrevorsum123Belum ada peringkat

- Hi, Upgrade Your Account Liftetime - HTTPS://WWW - Wsodownloads.in/ Lifetime Membership Cost Only $25 USD Exclusive VIP Download AreaDokumen1 halamanHi, Upgrade Your Account Liftetime - HTTPS://WWW - Wsodownloads.in/ Lifetime Membership Cost Only $25 USD Exclusive VIP Download Areatrevorsum123Belum ada peringkat

- Must ReadDokumen1 halamanMust Readtrevorsum123Belum ada peringkat

- Hi, Upgrade Your Account Liftetime - HTTPS://WWW - Wsodownloads.in/ Lifetime Membership Cost Only $25 USD Exclusive VIP Download AreaDokumen1 halamanHi, Upgrade Your Account Liftetime - HTTPS://WWW - Wsodownloads.in/ Lifetime Membership Cost Only $25 USD Exclusive VIP Download Areatrevorsum123Belum ada peringkat

- The Art of Tehnical AnalisisDokumen87 halamanThe Art of Tehnical AnalisisBursa ValutaraBelum ada peringkat

- Academic Essay WritingDokumen26 halamanAcademic Essay WritingFahad Areeb100% (1)

- 1.05 Got QuestionsDokumen1 halaman1.05 Got Questionstrevorsum123Belum ada peringkat

- 1.03 Welcome To The $100 A Day Investment CourseDokumen1 halaman1.03 Welcome To The $100 A Day Investment Coursetrevorsum123Belum ada peringkat

- Must ReadDokumen1 halamanMust Readtrevorsum123Belum ada peringkat

- 1.04 Why Investing in Cryptocurrencies Could Make You A MillionaireDokumen1 halaman1.04 Why Investing in Cryptocurrencies Could Make You A Millionairetrevorsum123Belum ada peringkat

- Policy and Procedures For Regular Procurement Rev - 4 April 2015 - 0 PDFDokumen186 halamanPolicy and Procedures For Regular Procurement Rev - 4 April 2015 - 0 PDFtrevorsum123Belum ada peringkat

- Getting Started With Excel: ComprehensiveDokumen10 halamanGetting Started With Excel: Comprehensivetrevorsum123Belum ada peringkat

- 1 Ahmad 2 Ahmad 3 Ahmad 4 Ahmad 5 Ahmad: 8) Fill HandleDokumen35 halaman1 Ahmad 2 Ahmad 3 Ahmad 4 Ahmad 5 Ahmad: 8) Fill Handletrevorsum123Belum ada peringkat

- Harvey Norman AnalysisDokumen5 halamanHarvey Norman AnalysisSarah BunoBelum ada peringkat

- Insolvency and Bankruptcy Board of IndiaDokumen7 halamanInsolvency and Bankruptcy Board of Indiamathi DBelum ada peringkat

- EstateDokumen6 halamanEstateJAYAR MENDZBelum ada peringkat

- Valuation For Mergers Buyouts and RestructuringDokumen17 halamanValuation For Mergers Buyouts and RestructuringCAclubindiaBelum ada peringkat

- Indian Accounting Standards (One Pager)Dokumen29 halamanIndian Accounting Standards (One Pager)sridhartks100% (1)

- Inventory recognition and measurementDokumen33 halamanInventory recognition and measurementAJHDALDKJA0% (1)

- JLL Asia Pacific Capital Tracker 4q23Dokumen35 halamanJLL Asia Pacific Capital Tracker 4q23zhaoyynBelum ada peringkat

- Mdu - 1ST Sem.Dokumen24 halamanMdu - 1ST Sem.laurybabeBelum ada peringkat

- Alternative Investments Structures and Outlook 2021Dokumen13 halamanAlternative Investments Structures and Outlook 2021jayRBelum ada peringkat

- EVA Financial Management at Godrej Consumer Products LTDDokumen28 halamanEVA Financial Management at Godrej Consumer Products LTDRahul SaraogiBelum ada peringkat

- Intelligent Investing ChecklistDokumen136 halamanIntelligent Investing Checklistamaresh gautamBelum ada peringkat

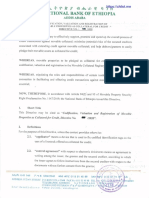

- 186 2020 Codification Valuation and Registration of Movable Properties As Collateral For Credit DirectiveDokumen22 halaman186 2020 Codification Valuation and Registration of Movable Properties As Collateral For Credit DirectiveAfework AtnafsegedBelum ada peringkat

- SSGA Global Market Outlook Media ReleaseDokumen4 halamanSSGA Global Market Outlook Media Releasekaren_cooper412Belum ada peringkat

- Valuation of Fixed Income Securities Aims and ObjectivesDokumen20 halamanValuation of Fixed Income Securities Aims and ObjectivesAyalew Taye100% (1)

- 50 AAPL Buyside PitchbookDokumen22 halaman50 AAPL Buyside PitchbookZefi KtsiBelum ada peringkat

- Whitman Ch03Dokumen50 halamanWhitman Ch03Mah ElBelum ada peringkat

- 2017 ACG Cup Round 1Dokumen13 halaman2017 ACG Cup Round 1DhivyaRajprasad0% (2)

- Professional Practice: B.Arch. V YearDokumen12 halamanProfessional Practice: B.Arch. V YearMohammad AnasBelum ada peringkat

- Environmental Economics in 40 CharactersDokumen23 halamanEnvironmental Economics in 40 Characterschongzhenkhai8966Belum ada peringkat

- HBS Case Report Analysis of Newbridge's Investment in Shenzhen Development BankDokumen11 halamanHBS Case Report Analysis of Newbridge's Investment in Shenzhen Development BankAmandaTranBelum ada peringkat

- Investment AnalysisDokumen49 halamanInvestment AnalysisNabasundar RoutBelum ada peringkat

- ACC 291 Including FinalDokumen124 halamanACC 291 Including Finalmingluoismyname_8495Belum ada peringkat

- SBR Notes by Ali Amir 20-21Dokumen68 halamanSBR Notes by Ali Amir 20-21Mensur Ćuprija100% (1)

- Course Manual MBA (Financial Management) 2022 - 2024Dokumen38 halamanCourse Manual MBA (Financial Management) 2022 - 2024Mayur ChandanBelum ada peringkat

- IIML AMP Financial Services CapitalMarkets BrochureDokumen15 halamanIIML AMP Financial Services CapitalMarkets BrochureAshishBelum ada peringkat

- Other Concepts and Valuation Techniques 05.19.23Dokumen3 halamanOther Concepts and Valuation Techniques 05.19.23Ivan Jay E. EsminoBelum ada peringkat

- Interview With Oyinkan Adewale, Executive Director - Chief Financial Officer, Oceanic Bank International PLC On Q2 2010 ResultsDokumen9 halamanInterview With Oyinkan Adewale, Executive Director - Chief Financial Officer, Oceanic Bank International PLC On Q2 2010 ResultsOceanic Bank International PLCBelum ada peringkat