Facts:: Demetrio Vs Alba

Diunggah oleh

Christian CabreraJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Facts:: Demetrio Vs Alba

Diunggah oleh

Christian CabreraHak Cipta:

Format Tersedia

Demetrio vs Alba

Facts: Petitioners are the members of the National Assembly/Batasan

Pambansa.

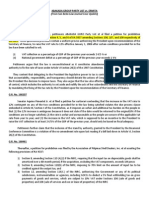

They are assailing the constitutionality of the first paragraph of Section

44 of Presidential Decree No. 1177, otherwise known as the Budget

Reform Decree of 1977. The section states that, The President shall

have the authority to transfer any fund, appropriated for the different

departments, bureaus, offices and agencies of the Executive

Department, which are included in the General Appropriations Act, to

any program, project or activity of any department, bureau, or office

included in the General Appropriations Act or approved after its

enactment.

Issue:

Whether or not the first paragraph of Section 44 of PD No.

1177 is constitutional.

Held: YES. The Constitution provides that, Sec. 16[5]. No law shall be

passed authorizing any transfer of appropriations, however, the

President, the Prime Minister, the Speaker, the Chief Justice of the

Supreme Court, and the heads of constitutional commissions may by

law be authorized to augment any item in the general appropriations

law for their respective offices from savings in other items of their

respective appropriations.

The prohibition to transfer an appropriation for one item to

another was explicit and categorical under the 1973 Constitution.

However, to afford the heads of the different branches of the

government and those of the constitutional commissions considerable

flexibility in the use of public funds and resources, the constitution

allowed the enactment of a law authorizing the transfer of funds for

the purpose of augmenting an item from savings in another item in the

appropriation of the government branch or constitutional body

concerned. The leeway granted was thus limited. The purpose and

conditions for which funds may be transferred were specified, i.e.

transfer may be allowed for the purpose of augmenting an item and

such transfer may be made only if there are savings from another item

in the appropriation of the government branch or constitutional body.

Paragraph 1 of Section 44 of P.D. No. 1177 unduly over extends

the privilege granted under said Section 16[5]. It empowers the

President to indiscriminately transfer funds from one department,

bureau, office or agency of the Executive Department to any program,

project or activity of any department, bureau or office included in the

General Appropriations Act or approved after its enactment, without

regard as to whether or not the funds to be transferred are actually

savings in the item from which the same are to be taken, or whether or

not the transfer is for the purpose of augmenting the item to which

said transfer is to be made. It does not only completely disregard the

standards set in the fundamental law, thereby amounting to an undue

delegation of legislative powers, but likewise goes beyond the tenor

thereof. Indeed, such constitutional infirmities render the provision in

question null and void.

Garcia vs. Executive Secretary

Facts: Enrique Garcia, a representative from Bataan, assails the validity

of Executive Orders Nos. 475 and 478. He argues that Executive Orders

Nos. 475 and 478 are violative of Section 24, Article VI of the 1987

Constitution which provides Sec. 24: All appropriation, revenue or

tariff bills, bills authorizing increase of the public debt, bills of local

application, and private bills shall originate exclusively in the House of

Representatives, but the Senate may propose or concur with

amendments.

He contends that since the Constitution vests the authority to

enact revenue bills in Congress, the President may not assume such

power by issuing Executive Orders Nos. 475 and 478 which are in the

nature of revenue-generating measures.

Executive Order No. 475 reduced the rate of additional duty on

all imported articles from nine percent (9%) to five percent (5%) ad

valorem, except in the cases of crude oil and other oil products which

continued to be subject to the additional duty of nine percent (9%) ad

valorem.

Executive Order No. 478 levied (in addition to the

aforementioned additional duty of nine percent (9%) ad valorem and

all other existing ad valorem duties) a special duty of P0.95 per liter or

P151.05 per barrel of imported crude oil and P1.00 per liter of imported

oil products.

Issue:Whether or not EO 475 and 478 are constitutional.

Held: YES. under Section 24, Article VI of the Constitution, the

enactment of appropriation, revenue and tariff bills, like all other bills

is, of course, within the province of the Legislative rather than the

Executive Department. It does not follow, however, that therefore

Executive Orders Nos. 475 and 478, assuming they may be

characterized as revenue measures, are prohibited to the President,

that they must be enacted instead by the Congress of the Philippines.

Section 28(2) of Article VI of the Constitution provides as follows:

(2) The Congress may, by law, authorize the President to

fix within specified limits, and subject to such limitations and

restrictions as it may impose, tariff rates, import and export quotas,

tonnage and wharfage dues, and other duties or imposts within the

framework of the national development program of the Government.

There is thus explicit constitutional permission to Congress to

authorize the President subject to such limitations and restrictions is

[Congress] may impose to fix within specific limits tariff rates . . .

and other duties or imposts . . .

ABAKADA vs Ermita

Facts: Before R.A. No. 9337 took effect, petitioners ABAKADA

GURO Party List, et al., filed a petition for prohibition on May 27, 2005.

They question the constitutionality of Sections 4, 5 and 6 of R.A. No.

9337, amending Sections 106, 107 and 108, respectively, of the

National Internal Revenue Code (NIRC). Section 4 imposes a 10% VAT

on sale of goods and properties, Section 5 imposes a 10% VAT on

importation of goods, and Section 6 imposes a 10% VAT on sale of

services and use or lease of properties. These questioned provisions

contain

a

uniform proviso authorizing

the

President,

upon

recommendation of the Secretary of Finance, to raise the VAT rate to

12%, effective January 1, 2006.

Petitioners argue that the law is unconstitutional, as it

constitutes abandonment by Congress of its exclusive authority to fix

the rate of taxes under Article VI, Section 28(2) of the 1987 Philippine

Constitution.

Issue:Whether or not there is undue delegation of legislative power

which violates Article 6 Section 28(2) of the Constitution.

Held: NO. There is no undue delegation of legislative power but only of

the discretion as to the execution of a law. This is constitutionally

permissible. Congress does not abdicate its functions or unduly

delegate power when it describes what job must be done, who must do

it, and what is the scope of his authority; in our complex economy that

is frequently the only way in which the legislative process can go

forward.

Congress did not delegate the power to tax but the mere

implementation of the law. The intent and will to increase the VAT rate

to 12% came from Congress and the task of the President is to simply

execute the legislative policy. That Congress chose to do so in such a

manner is not within the province of the Court to inquire into, its task

being to interpret the law.

Pimentel vs. Congress

Fact: Senator Aquilino Q. Pimentel, Jr. seeks a judgment declaring null

and void the continued existence of the Joint Committee of to

determine the authenticity and due execution of the certificates of

canvass and preliminarily canvass the votes cast for Presidential and

Vice-Presidential candidates in the May 10, 2004 elections following

the adjournment of Congress sine die on June 11, 2004. The petition

corollarily prays for the issuance of a writ of prohibition directing the

Joint Committee to cease and desist from conducting any further

proceedings pursuant to the Rules of the Joint Public Session of

Congress on Canvassing.

Petitioner posits that with "the adjournment sine die on June 11,

2004 by the Twelfth Congress of its last regular session, [its] term ...

terminated and expired on the said day and the said Twelfth Congress

serving the term 2001 to 2004 passed out of legal existence."

Henceforth, petitioner goes on, "all pending matters and proceedings

terminate upon the expiration of ... Congress." To advance this view, he

relies on legislative procedure, precedent or practice [as] borne [out]

by the rules of both Houses of Congress.

Petitioners claim that his arguments are buttressed by

legislative procedure, precedent or practice [as] borne [out] by the

rules of both Houses of Congress is directly contradicted by Section

42 of Rule XIV of the Rules adopted by the Senate, of which he is an

incumbent member. This section clearly provides that the

Senate shall convene in joint session during any voluntary

or compulsory recess to canvass the votes for President and VicePresident not later than thirty days after the day of the elections in

accordance with Section 4, Article VII of the Constitution.

Issue:Whether or not the Joint Committee canvassing even Congress

session has been terminated is constitutional.

Held: NO. Sec. 15. The Congress shall convene once every year on the

fourth Monday of July for its regular session, unless a different date is

fixed by law, and shall continue to be in session for such number of

days as it may determine until thirty days before the opening of its

next regular session, exclusive of Saturdays, Sundays, and legal

holidays. The President may call a special session at any time.

Contrary to petitioner's argument, the term of the present Twelfth

Congress did not terminate and expire upon the adjournment sine

die of the regular session of both Houses on June 11, 2004.

Section 15, Article VI of the Constitution cited by petitioner does

not pertain to the term of Congress, but to its regular annual legislative

sessions and the mandatory 30-day recess before the opening of its

next regular session (subject to the power of the President to call a

special session at any time).

Section 4 of Article VIII also of the Constitution clearly provides that

"[t]he term of office of the Senators shall be six years and shall

commence, unless otherwise provided by law, at noon on the thirtieth

day of June next following their election." Similarly, Section 7 of the

same Article provides that "the Members of the House of

Representatives shall be elected for a term of three years which shall

begin, unless otherwise provided by law, at noon on the thirtieth day of

June next following their election." Consequently, there being no law to

the contrary, until June 30, 2004, the present Twelfth Congress to

which the present legislators belong cannot be said to have "passed

out of legal existence."

The legislative functions of the Twelfth Congress may have come to

a close upon the final adjournment of its regular sessions on June 11,

2004, but this does not affect its non-legislative functions, such as that

of being the National Board of Canvassers. In fact, the joint public

session of both Houses of Congress convened by express directive of

Section 4, Article VII of the Constitution to canvass the votes for and to

proclaim the newly elected President and Vice-President has not, and

cannot, adjourn sine die until it has accomplished its constitutionally

mandated tasks. For only when a board of canvassers has completed

its functions is it rendered functus officio. Its membership may change,

but it retains its authority as a board until it has accomplished its

purposes.

Since the Twelfth Congress has not yet completed its non-legislative

duty to canvass the votes and proclaim the duly elected President and

Vice-President, its existence as the National Board of Canvassers, as

well as that of the Joint Committee to which it referred the preliminary

tasks of authenticating and canvassing the certificates of canvass, has

not become functus officio.

Anda mungkin juga menyukai

- Supreme Court upholds constitutionality of provisions in R.A. No. 9337 increasing VAT rateDokumen3 halamanSupreme Court upholds constitutionality of provisions in R.A. No. 9337 increasing VAT rateMikee MacalaladBelum ada peringkat

- Abakada Guro Party List V Purisima G.R. NO. 166715, AUGUST 14, 2008 FactsDokumen5 halamanAbakada Guro Party List V Purisima G.R. NO. 166715, AUGUST 14, 2008 FactsPatatas SayoteBelum ada peringkat

- Abakada Guro Party List Vs Executive SecretaryDokumen8 halamanAbakada Guro Party List Vs Executive SecretaryshelBelum ada peringkat

- Case Digests On Pork BarrelDokumen5 halamanCase Digests On Pork BarrelStephanie Dawn Sibi Gok-ongBelum ada peringkat

- Abakada Guro vs Ermita VAT caseDokumen29 halamanAbakada Guro vs Ermita VAT caseMario P. Trinidad Jr.100% (2)

- ABAKADA Guro Vs Ermita DigestDokumen2 halamanABAKADA Guro Vs Ermita DigestDarvinOliverosBelum ada peringkat

- G.R. No. 71977 February 27, 1987 Demetrio G. Demetria, vs. Hon. Manuel Alba in His Capacity As The Minister of The BUDGET, RespondentsDokumen4 halamanG.R. No. 71977 February 27, 1987 Demetrio G. Demetria, vs. Hon. Manuel Alba in His Capacity As The Minister of The BUDGET, RespondentsMaricar Corina CanayaBelum ada peringkat

- Tan Vs ComelecDokumen7 halamanTan Vs ComelecnchlrysBelum ada peringkat

- Gancayco v. GimenezDokumen5 halamanGancayco v. GimenezNathan OducadoBelum ada peringkat

- Abakada Group Party List VsDokumen7 halamanAbakada Group Party List VsHarhar HereraBelum ada peringkat

- Demetria v. Alba, 148 SCRA 208Dokumen1 halamanDemetria v. Alba, 148 SCRA 208Accentline Jay NodadoBelum ada peringkat

- Consti Sept 19Dokumen8 halamanConsti Sept 19Ynna GesiteBelum ada peringkat

- Antonio Araneta Vs Judge Rafael Dinglasan: Political Law - First Emergency Powers CasesDokumen26 halamanAntonio Araneta Vs Judge Rafael Dinglasan: Political Law - First Emergency Powers CasesGhost RiderBelum ada peringkat

- Abakada Guro Vs Ermita (Sep and Oct 2005) DigestDokumen4 halamanAbakada Guro Vs Ermita (Sep and Oct 2005) DigestLizzie GeraldinoBelum ada peringkat

- ABAKADA Guro Party List vs. Executive Secretary Ermita: Constitutionality of Sections 4, 5, and 6 of RA 9337Dokumen3 halamanABAKADA Guro Party List vs. Executive Secretary Ermita: Constitutionality of Sections 4, 5, and 6 of RA 9337Samantha ReyesBelum ada peringkat

- Princ of Taxation Taxrev Regala IncDokumen25 halamanPrinc of Taxation Taxrev Regala Incsamjuan1234Belum ada peringkat

- AbakadaDokumen7 halamanAbakadaJayzell Mae FloresBelum ada peringkat

- Article 6 Legislative Case DigestDokumen44 halamanArticle 6 Legislative Case DigestMaricon Aspiras67% (3)

- Abakada Guro Party Vs ERMITADokumen11 halamanAbakada Guro Party Vs ERMITASharon BakerBelum ada peringkat

- ABAKADA GURO PARTY LIST VS EXECUTIVE SECRETARY VAT RATE CHALLENGEDokumen3 halamanABAKADA GURO PARTY LIST VS EXECUTIVE SECRETARY VAT RATE CHALLENGEAnonymous s2jaDmP5FBelum ada peringkat

- ABAKADA GURO Partylist v. Executive Secretary (G.R. No. 168056)Dokumen3 halamanABAKADA GURO Partylist v. Executive Secretary (G.R. No. 168056)Roward100% (4)

- Abakada Guro Party List vs. Ermita (G.R. No. 168056, September 1, 2005)Dokumen4 halamanAbakada Guro Party List vs. Ermita (G.R. No. 168056, September 1, 2005)Jennilyn Gulfan YaseBelum ada peringkat

- Demetria v. AlbaDokumen3 halamanDemetria v. AlbaJPatrickOngBelum ada peringkat

- Cases On Non-Delegability of Taxing PowerDokumen5 halamanCases On Non-Delegability of Taxing PowerCharmaine Ganancial SorianoBelum ada peringkat

- Abakada Guro Vs Ermita (Sep and Oct) DigestDokumen4 halamanAbakada Guro Vs Ermita (Sep and Oct) DigestLizzie GeraldinoBelum ada peringkat

- Abakada v. ES Ermita - SiangDokumen2 halamanAbakada v. ES Ermita - SiangCJ MillenaBelum ada peringkat

- Abakada Guro Partylist v. ErmitaDokumen3 halamanAbakada Guro Partylist v. ErmitaAnton John Vincent FriasBelum ada peringkat

- ABAKADA v. ERMITA | VAT Rate Increase UpheldDokumen1 halamanABAKADA v. ERMITA | VAT Rate Increase UpheldA M I R ABelum ada peringkat

- ABAKADA Guro Party List Vs Executive Secretary ErmitaDokumen3 halamanABAKADA Guro Party List Vs Executive Secretary ErmitaAnonymous iUs2y1vNBelum ada peringkat

- Delegation of PowerDokumen7 halamanDelegation of PowerSean Carlo Rey LoriegaBelum ada peringkat

- 1 Abakada Guro Partylist v. Executive SecretaryDokumen3 halaman1 Abakada Guro Partylist v. Executive SecretaryMarvic AmazonaBelum ada peringkat

- Demetria Vs AlbaDokumen1 halamanDemetria Vs AlbaMia Claire CatapangBelum ada peringkat

- Demetria Vs Alba (Digest 1)Dokumen3 halamanDemetria Vs Alba (Digest 1)adonaiaslaronaBelum ada peringkat

- Demetria Vs AlbaDokumen2 halamanDemetria Vs AlbaLita Aguillos100% (1)

- Constitutional Law Reviewer For FinalsDokumen55 halamanConstitutional Law Reviewer For FinalsGodofredo De Leon Sabado100% (1)

- 41 and 42 Tolentino Vs Secretary of FinanceDokumen2 halaman41 and 42 Tolentino Vs Secretary of FinanceYvon Baguio100% (1)

- Abakada vs. Executive SecretaryDokumen2 halamanAbakada vs. Executive SecretaryLabajo AmyBelum ada peringkat

- Abakada Guro Party List Vs Executive SecretaryDokumen8 halamanAbakada Guro Party List Vs Executive SecretaryAndrea TiuBelum ada peringkat

- ABAKADA Guro Party List Vs Executive SecretaryDokumen3 halamanABAKADA Guro Party List Vs Executive SecretaryJulian Duba0% (1)

- ABAKADA Guro Party List Vs Executive SecretaryDokumen18 halamanABAKADA Guro Party List Vs Executive SecretaryrheaBelum ada peringkat

- FINALS. Cases - Alomia, S.Dokumen8 halamanFINALS. Cases - Alomia, S.Shaznay AlomiaBelum ada peringkat

- Philippine Constitution Association (PHILCONSA) Et Al Vs Salvador Enriquez 235 SCRA 506Dokumen7 halamanPhilippine Constitution Association (PHILCONSA) Et Al Vs Salvador Enriquez 235 SCRA 506Aubrey Mae VargasBelum ada peringkat

- ABAKADA Guro Party List vs. ErmitaDokumen9 halamanABAKADA Guro Party List vs. ErmitaGabriel LajaraBelum ada peringkat

- BAKADA Guro Party List vs. ErmitaDokumen2 halamanBAKADA Guro Party List vs. ErmitaReycy Ruth TrivinoBelum ada peringkat

- Abakada GuroDokumen3 halamanAbakada GuroJOHN ERASMUS ZAGALABelum ada peringkat

- Tariff and Customs CodeDokumen30 halamanTariff and Customs CodeJulius AnthonyBelum ada peringkat

- Case Digest For Stat ConDokumen10 halamanCase Digest For Stat Concarl fuerzasBelum ada peringkat

- Abakada-Guro-v-Ermita-G.R.-No.-168056-July-5-2005Dokumen2 halamanAbakada-Guro-v-Ermita-G.R.-No.-168056-July-5-2005Lyle BucolBelum ada peringkat

- Abakada Guro Vs ErmitaDokumen1 halamanAbakada Guro Vs Ermitaapril75Belum ada peringkat

- Philippine Judges Association, Et Al. vs. Pete PradoDokumen11 halamanPhilippine Judges Association, Et Al. vs. Pete PradoJam Macacua100% (1)

- ABAKADA Guro Party List vs. Ermita G.R. No. 168056 September 1, 2005 FactsDokumen2 halamanABAKADA Guro Party List vs. Ermita G.R. No. 168056 September 1, 2005 Factsmicky.silvosaBelum ada peringkat

- Tax Case Digest: ABAKADA Guro Party List vs ErmitaDokumen2 halamanTax Case Digest: ABAKADA Guro Party List vs ErmitaNylaBelum ada peringkat

- Gonzales V MacaraigDokumen2 halamanGonzales V MacaraigcharmdelmoBelum ada peringkat

- Abakada Guro Party List Vs Executive Secretary G.R. No. 168056 September 1, 2005 FactsDokumen1 halamanAbakada Guro Party List Vs Executive Secretary G.R. No. 168056 September 1, 2005 FactsKathleneGabrielAzasHaoBelum ada peringkat

- Consti Midterm Pex 1Dokumen4 halamanConsti Midterm Pex 1Honey Lorie PeterBelum ada peringkat

- Kapatiran NG Mga Naglilingkod Sa Pamahalaan VsDokumen5 halamanKapatiran NG Mga Naglilingkod Sa Pamahalaan VsammeBelum ada peringkat

- Supreme Court upholds constitutionality of EPIRA law's universal chargeDokumen5 halamanSupreme Court upholds constitutionality of EPIRA law's universal chargeRogelineBelum ada peringkat

- Digested CasesDokumen27 halamanDigested CasesJohnBelum ada peringkat

- Insiders Talk: Glossary of Legislative Concepts and Representative TermsDari EverandInsiders Talk: Glossary of Legislative Concepts and Representative TermsBelum ada peringkat

- The Laguna Copperplate InscriptionDokumen6 halamanThe Laguna Copperplate InscriptionLeitz Camyll Ang-AwBelum ada peringkat

- Gatepass Application Form2012Dokumen3 halamanGatepass Application Form2012Rei NalaBelum ada peringkat

- FAQs - Bar MonthDokumen4 halamanFAQs - Bar MonthChristian CabreraBelum ada peringkat

- Not ImportantDokumen20 halamanNot ImportantChristian CabreraBelum ada peringkat

- Case No 10Dokumen2 halamanCase No 10Christian CabreraBelum ada peringkat

- 047 People v. DionaldoDokumen2 halaman047 People v. DionaldoChristian CabreraBelum ada peringkat

- Carrera V PeopleDokumen3 halamanCarrera V PeopleChristian CabreraBelum ada peringkat

- Talampas guilty of homicideDokumen1 halamanTalampas guilty of homicideChristian Cabrera100% (1)

- Disini v. Secretary of JusticeDokumen16 halamanDisini v. Secretary of JusticeChristian CabreraBelum ada peringkat

- Third Division (G.R. No. 192914, January 11, 2016)Dokumen15 halamanThird Division (G.R. No. 192914, January 11, 2016)Christian CabreraBelum ada peringkat

- IX. Lawyer - S Fiduciary Obligations - CompleteDokumen30 halamanIX. Lawyer - S Fiduciary Obligations - CompleteChristian CabreraBelum ada peringkat

- PIL FinalsDokumen1 halamanPIL FinalsChristian CabreraBelum ada peringkat

- Employment in Hazardous Places - D - O - 65-04Dokumen9 halamanEmployment in Hazardous Places - D - O - 65-04JoyceMendozaBelum ada peringkat

- Criminal Law 2016-17 Case ListDokumen2 halamanCriminal Law 2016-17 Case ListChristian CabreraBelum ada peringkat

- People V ArnaizDokumen2 halamanPeople V ArnaizChristian Cabrera100% (1)

- Rule 39 Full TextDokumen177 halamanRule 39 Full TextChristian CabreraBelum ada peringkat

- Civpro Rules 17 22Dokumen14 halamanCivpro Rules 17 22Christian CabreraBelum ada peringkat

- Case Digest Batch 2Dokumen8 halamanCase Digest Batch 2Christian CabreraBelum ada peringkat

- Rule 39 Full TextDokumen177 halamanRule 39 Full TextChristian CabreraBelum ada peringkat

- Remaining DigestsDokumen1 halamanRemaining DigestsChristian CabreraBelum ada peringkat

- Case Digest Rules 1 5Dokumen21 halamanCase Digest Rules 1 5Christian CabreraBelum ada peringkat

- Civpro Rules 13-14Dokumen9 halamanCivpro Rules 13-14Christian CabreraBelum ada peringkat

- Civpro Table of Contents (Complete)Dokumen12 halamanCivpro Table of Contents (Complete)Christian CabreraBelum ada peringkat

- Doctrine:: Chico-Nazario, J.Dokumen8 halamanDoctrine:: Chico-Nazario, J.Christian CabreraBelum ada peringkat

- NM Rothschild V LepantoDokumen5 halamanNM Rothschild V LepantoChristian CabreraBelum ada peringkat

- Katon Vs Palanca 437 SCRA 565 September 7, 2004Dokumen3 halamanKaton Vs Palanca 437 SCRA 565 September 7, 2004Christian CabreraBelum ada peringkat

- G.R. No. 74833, January 21, 1991 Thomas C. Cheesman, Petitioner, vs. Intermediate Appellate Court and Estelita Padilla, RespondentsDokumen2 halamanG.R. No. 74833, January 21, 1991 Thomas C. Cheesman, Petitioner, vs. Intermediate Appellate Court and Estelita Padilla, RespondentsChristian CabreraBelum ada peringkat

- Remaining DigestsDokumen1 halamanRemaining DigestsChristian CabreraBelum ada peringkat

- NM Rothschild V LepantoDokumen5 halamanNM Rothschild V LepantoChristian CabreraBelum ada peringkat

- Infante V Aran Builders Rule 39Dokumen4 halamanInfante V Aran Builders Rule 39Christian CabreraBelum ada peringkat

- Who Should Register For GST?Dokumen9 halamanWho Should Register For GST?Gitu SinghBelum ada peringkat

- Presentation - Mid ThesisDokumen10 halamanPresentation - Mid ThesisMuhammad Murtaza AlizaiBelum ada peringkat

- Compilation of International Acts & Laws for Direct Selling IndustryDokumen132 halamanCompilation of International Acts & Laws for Direct Selling IndustryDr. Omprakash SharmaBelum ada peringkat

- Tesfaye BekeleDokumen125 halamanTesfaye BekeleAbdela AyalewBelum ada peringkat

- Hawassa University: School of Governance and Development StudiesDokumen53 halamanHawassa University: School of Governance and Development StudiesGetnet AbuBelum ada peringkat

- Magzine Forbes PDFDokumen126 halamanMagzine Forbes PDFYOGENDER KUMAR100% (2)

- HHQ Budget 2023 Corporate TaxDokumen10 halamanHHQ Budget 2023 Corporate TaxMeng Chuan NgBelum ada peringkat

- 1 Latest GSTR 9 and 9C TaxbykkDokumen73 halaman1 Latest GSTR 9 and 9C TaxbykkjitendraktBelum ada peringkat

- Hal Varian Intermediate Microeconomics SolutionsDokumen2 halamanHal Varian Intermediate Microeconomics SolutionsHammed AremuBelum ada peringkat

- Advance Payment of TaxDokumen7 halamanAdvance Payment of TaxKruti Mehta Gopi MehtaBelum ada peringkat

- Contract - DeedOfSale - Condominium UnitDokumen2 halamanContract - DeedOfSale - Condominium UnitsejinmaBelum ada peringkat

- Entreprenuership Notes 2020 by Kimuli Fred ST Henry's College Gangu PDFDokumen334 halamanEntreprenuership Notes 2020 by Kimuli Fred ST Henry's College Gangu PDFkhami PETERSON80% (5)

- Gaston v. Republic Bank G.R No. L 77194Dokumen5 halamanGaston v. Republic Bank G.R No. L 77194Rachel CayangaoBelum ada peringkat

- Exp SG SAP ICS ByDesignDokumen33 halamanExp SG SAP ICS ByDesignGopal KrishnanBelum ada peringkat

- April 2021 PAYSLIPDokumen1 halamanApril 2021 PAYSLIPPuja ParekhBelum ada peringkat

- EU4 CheatsDokumen14 halamanEU4 CheatsAngus HutchinsonBelum ada peringkat

- Pre-Membership Requirements: Quezon Public School Teachers and Employees Multipurpose CooperativeDokumen2 halamanPre-Membership Requirements: Quezon Public School Teachers and Employees Multipurpose CooperativeRoselyn San Diego PacaigueBelum ada peringkat

- Bir - Form 1903Dokumen2 halamanBir - Form 1903Jennifer Deleon86% (7)

- California LLC 1Dokumen1 halamanCalifornia LLC 1Freeman LawyerBelum ada peringkat

- Cost Control and Cost ReductionDokumen16 halamanCost Control and Cost ReductionAnu AndrewsBelum ada peringkat

- Govt Engineering College Quotation for Mixer GrinderDokumen3 halamanGovt Engineering College Quotation for Mixer GrinderVishal KesharwaniBelum ada peringkat

- HSBC Report 2012Dokumen230 halamanHSBC Report 2012Hunkar IvgenBelum ada peringkat

- "Scenarios For Mongolia: Building A Positive Future" GuidebookDokumen13 halaman"Scenarios For Mongolia: Building A Positive Future" GuidebookEconomic Policy and Competitiveness Research CenterBelum ada peringkat

- Mercantile Law and TaxationDokumen9 halamanMercantile Law and TaxationJoe SolimanBelum ada peringkat

- Parle Agro PVT Ltd-46Dokumen1 halamanParle Agro PVT Ltd-46QASWA ENGINEERING PVT LTDBelum ada peringkat

- Evolution of Philippine TaxationDokumen6 halamanEvolution of Philippine TaxationGuki Suzuki0% (1)

- Homework PieceDokumen5 halamanHomework Pieceapi-185034533Belum ada peringkat

- TAX INVOICEDokumen3 halamanTAX INVOICERohan DesaiBelum ada peringkat

- Department of Commercial Taxes - JharkhandDokumen4 halamanDepartment of Commercial Taxes - JharkhandEagle teckBelum ada peringkat

- GST MCQ MARATHON-SolvedDokumen44 halamanGST MCQ MARATHON-SolvedRudra JhaBelum ada peringkat