ACE PROPERTY AND CASUALTY INSURANCE COMPANY v. LIBERTY SURPLUS INSURANCE CORPORATION Et Al Complaint

Diunggah oleh

ACELitigationWatchDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

ACE PROPERTY AND CASUALTY INSURANCE COMPANY v. LIBERTY SURPLUS INSURANCE CORPORATION Et Al Complaint

Diunggah oleh

ACELitigationWatchHak Cipta:

Format Tersedia

Case 1:15-cv-00949-WBH Document 1 Filed 04/01/15 Page 1 of 18

UNITED STATES DISTRICT COURT

FOR THE NORTHERN DISTRICT OF GEORGIA

ACE PROPERTY AND CASUALTY

INSURANCE COMPANY,

)

)

)

Plaintiff, )

)

v.

) No. ______________

)

LIBERTY SURPLUS INSURANCE

)

CORPORATION; AXIS SURPLUS

)

INSURANCE COMPANY; FIRST

)

SPECIALTY INSURANCE

)

CORPORATION; AMERICAN

)

GUARANTEE & LIABILITY

)

COMPANY; ASLAN COMMONS, LLC; )

WSE, LLC; and STEPHEN D. WELLS.

)

Defendants. )

)

)

COMPLAINT FOR DECLARATORY JUDGMENT

Plaintiff, ACE PROPERTY AND CASUALTY COMPANY, by its attorneys,

LEWIS BRISBOIS BISGAARD & SMITH, LLP, files this Complaint for Declaratory

Judgment against the above-captioned Defendants and in support thereof, states as

follows:

I. NATURE OF ACTION

1.

This is an insurance coverage action seeking declaratory relief pursuant

to 28 U.S.C. 2201 and 2202. ACE Property and Casualty Company seeks that this

4836-3712-6946.1

Case 1:15-cv-00949-WBH Document 1 Filed 04/01/15 Page 2 of 18

Court declare that the primary insurers had the obligation to defend and indemnify the

insureds with respect to the underlying action and pay the premium to secure a bond

to stay the execution of judgment for any appeal of the underlying action. A further

declaration is sought finding that attorneys fees awarded as a part of the underlying

verdict do not constitute covered damages as described fully herein.

II. PARTIES

2.

ACE Property and Casualty Company (ACE), a member company of

ACE Group of Insurance Companies, is a Pennsylvania corporation with its principal

place of business in Philadelphia, Pennsylvania and is authorized to write liability

insurance policies in Georgia.

3.

Liberty Surplus Insurance Corporation (Liberty) is a New Hampshire

corporation with its principal place of business in Boston, Massachusetts and is

authorized to write liability insurance policies in Georgia.

4.

Axis Surplus Insurance Company (Axis) is a Maryland company with

its principal place of business in Glenview, Illinois and is authorized to write liability

insurance policies in Georgia.

5.

First Specialty Insurance Corporation (First Specialty) is a Missouri

company with its principal place of business in Overland Park, Kansas and is

authorized to write liability insurance policies in Georgia.

4836-3712-6946.1

Case 1:15-cv-00949-WBH Document 1 Filed 04/01/15 Page 3 of 18

6.

American Guarantee & Liability Company (American Guarantee) is a

New York company with its principal places of business in New York, New York and

Schaumburg, Illinois and is authorized to write liability insurance policies in Georgia.

7.

Aslan Commons, LLC (Aslan) is a Delaware limited liability company

with its principal place of business in Irvine, California and is authorized to transact

business in Georgia. Aslan is a nominal party from whom no relief is sought.

8.

WSE, LLC (WSE) is a Georgia limited liability company with its

principal place of business in Atlanta, Georgia and is authorized to transact business in

Georgia. WSE is a nominal party from whom no relief is sought.

9.

Stephen D. Wells (Wells) is an individual who, on information and

belief, resides in Sandy Springs, Fulton County, Georgia. Wells is named herein as a

nominal party from whom no relief is sought.

III. JURISDICTION AND VENUE

10.

This declaratory judgment action is brought pursuant to 28 U.S.C.

2201 and 2202 and Rule 57 of the Federal Rules of Civil Procedure.

11.

An actual justiciable controversy exists between ACE and the named

defendants within the meaning of 28 U.S.C. 2201 regarding the priority of insurance

coverage provided to Aslan and WSE under the respective insurance policies at issue

4836-3712-6946.1

Case 1:15-cv-00949-WBH Document 1 Filed 04/01/15 Page 4 of 18

in this action for the underlying judgment entered in favor of Wells and against Aslan

and WSE.

12.

This Court has diversity jurisdiction pursuant to 28 U.S.C. 1332(a)(1),

because the amount in controversy exceeds the sum of $75,000, exclusive of interest

and costs, and the suit is between citizens of different states. In particular, there is

complete diversity of citizenship between ACE and the named defendants.

13.

Venue is proper in this Court pursuant to 28 U.S.C. 1391(a)(1), because

the subject insurance policies issued covered a risk located in the Northern District of

Georgia, where the underlying events giving rise to this action also occurred.

IV. FACTS COMMON TO ALL COUNTS

The Wells Action and Verdict

14.

On May 29, 2010, Stephen D. Wells suffered injuries from an explosion

at his apartment located in a complex owned by Aslan and managed by WSE.

15.

Wells filed a tort action against Aslan and WSE seeking damages from

his injuries in the suit captioned Wells v. Aslan Commons, et al., which is pending in

the State Court of Fulton County, Georgia under number 12EV014738F. A copy of

the operative complaint filed in the Wells action is attached hereto as Ex. A.

16.

The Wells action proceeded to trial and on January 15, 2015, a Fulton

County, Georgia jury returned a general, non-apportioned verdict against Aslan and

4836-3712-6946.1

Case 1:15-cv-00949-WBH Document 1 Filed 04/01/15 Page 5 of 18

WSE in the amount of $73M in damages, including $17.9M in compensatory, $47.9M

in punitive and $7.16M in attorneys fees under O.C.G.A. 13-6-11. The punitive

damage award was reduced to the statutory cap of $250,000.

17.

On information and belief, Aslan and WSE intend to appeal the verdict.

18.

Aslan and WSE had in place a Management Agreement, which among

other things, provides that each party procure insurance for the other party. A true and

correct copy of the Management Agreement is attached hereto as Ex. B.

The Primary Insurance Policies

19.

Axis and First Specialty each issued a primary policy to WSE as a

Named Insured, and Liberty issued a primary policy to Aslan Realty Group, LLC as a

Named Insured. (These three insurers are collectively referred to as the Primary

Carriers herein).

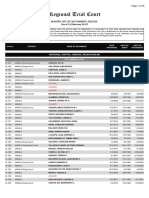

Insurer

Liberty

Surplus Ins.

Corp.

(Liberty)

Axis Surplus

Ins. Co.

(Axis)

First

Specialty Ins.

Corp. (First

Specialty)

4836-3712-6946.1

Number/Type

Period

Limits

Insureds

DGLSF209149100 4/1/2010- $1M/occ Aslan Realty Group,

Primary CGL

11

$2M/agg LLC as named insured

ECP751725-10

Primary CGL

4/1/2010- $1M/occ WSE, LLC as named

11

$2M/agg insured

IRG98362

Primary CGL

4/1/2010- $1M/occ WSE, LLC as named

11

$2M/agg insured

Case 1:15-cv-00949-WBH Document 1 Filed 04/01/15 Page 6 of 18

20.

The Axis and First Specialty primary insurance policies issued to WSE

provide additional insured coverage to Aslan.

21. The Liberty primary insurance policy issued to Aslan Realty Group, LLC

provides additional insured coverage to WSE.

22.

Liberty assumed and controlled the defense of both Aslan and its

property manager, WSE, which is a defined insured under its policy, in the Wells

action from the outset of the claim. A true and correct copy of the Liberty Policy is

attached hereto as Ex. C.

23.

The Axis primary policy issued to WSE, includes a defense obligation

and further includes an additional insured endorsement. The additional insured

endorsement operates for the benefit of Aslan per the parties Management Agreement

providing that:

It is further agreed that such insurance as is afforded by this policy for

the benefit of the above [Aslan] shall be primary insurance as respects to

any claim, loss or liability arising out of [WSEs] operations and any

other insurance maintained by [Aslans] shall be excess and noncontributory with the insurance provided hereunder.

A true and correct copy of the Axis Policy is attached hereto as Ex. D.

24.

On December 16, 2014, Axis denied a defense obligation in the Wells

action, claiming that it was not a primary insurer.

4836-3712-6946.1

Case 1:15-cv-00949-WBH Document 1 Filed 04/01/15 Page 7 of 18

25.

The First Specialty primary policy issued to WSE, includes a defense

obligation, and further includes two endorsements for the benefit of Aslan per the

parties Management Agreement providing that:

With respect to the Third Party shown below, the insurance provided by

this policy shall be primary and non-contributing insurance. Any and all

other valid and collectible insurance available to such Third Party in

respect of work performed by you under written contractual agreements

with said Third Party for a loss covered by this policy, shall in no

instance be considered as primary, co-insurance, or contributing

insurance. Rather, any such other insurance shall be considered excess

over and above the insurance provided by this policy. (First Specialty

Policy, Primary and Non-Contributing Insurance (Third-Party),

Endorsement Serial No. FSIC-33513 (01/03)).

***

Name of Person or Organization: Any person or organization for

whom you are performing operations when you and such person or

organization have agreed in writing in a contract or agreement that such

person or organization be added as an additional insured on your policy.

(First Specialty Policy, Additional Insured-Owner, Lessors or

Contractors (Form B) Endorsement No. CG 2010 11 85).

A true and correct copy of the First Specialty Policy is attached hereto as Ex. E.

The Excess Insurance Policies

26.

The ACE Excess Policy was issued to Aslan Realty Group LLC and the

American Guarantee Excess Policy was issued to WSE, LLC as follows:

Insurer

Number/Type Period

Limits

Insureds

ACE Property M00418463

4/1/2010- $10M/occ Aslan Realty Group, LLC

and Casualty 001

11

$10M/agg as named insured and

4836-3712-6946.1

Case 1:15-cv-00949-WBH Document 1 Filed 04/01/15 Page 8 of 18

Ins. Co.

(ACE)

American

Guarantee &

Liability Ins.

Co.

(Zurich)

27.

Excess CGL

follows form of

over Liberty

underlying policy as to

primary policy

other insureds

AUC

4/1/2010- $20M/occ WSE, LLC as named

930410207

11

$20M/agg insured and follows form

Excess CGL

of underlying policy as to

over Axis

other insureds

primary policy

The ACE Excess Policy includes as an insured [a]ny person or

organization, if insured under underlying insurance, provided that coverage provided

by this policy for any such insured will be no broader than coverage provided by

underlying insurance.

28. The ACE Excess Policy defines Underlying Insurance to include that

listed on the Schedule of Underlying Insurance, which lists the Liberty Policy. A

true and correct copy of the ACE Policy is attached hereto as Ex. F.

29.

The ACE Excess Policy imposes no defense obligation and provides

indemnity only after exhaustion of the underlying insurance as follows:

I.

INSURING AGREEMENT

A.

4836-3712-6946.1

We will pay on behalf of the insured those sums in excess

of the retained limit that the insured becomes legally

obligated to pay as damages because of bodily injury,

property damage or personal and advertising injury to

which this insurance applies.

Case 1:15-cv-00949-WBH Document 1 Filed 04/01/15 Page 9 of 18

30.

The ACE Excess Policy defines Retained limit, pertinent to this action

as the total applicable limits of underlying insurance and any applicable limit of

other insurance providing coverage to the insured.

31.

The ACE Excess Policys Other Insurance clause provides:

If valid and collectible other insurance applies to damages that are also

covered by this policy, this policy will apply excess of the other

insurance and will not contribute with such other insurance. This

provision will not apply if the other insurance is written to be excess of

this policy.

32.

The ACE Excess Policy defines other insurance as a policy of

insurance providing coverage for damages covered in whole by this policy. Other

insurance does not include underlying insurance, the amount shown in the

Declarations as the Self-Insured Retention or any policy of insurance specifically

purchased to be excess of this policy and providing coverage that this policy also

provides.

33.

The American Guarantee Policy follows the form of the Axis Policy but

also contains its own provisions. A true and correct copy of the American Guarantee

Policy is attached hereto as Ex. G.

34.

The American Guarantee Policy has a separate Other Insurance clause,

which provides, as follows:

If other insurance applies to damages that are also covered by this policy,

this policy will apply excess of other insurance. Nothing herein will be

4836-3712-6946.1

Case 1:15-cv-00949-WBH Document 1 Filed 04/01/15 Page 10 of 18

construed to make this policy subject to the terms, conditions and

limitations of such other insurance. However, this provision will not

apply if the other insurance is written to be excess of this policy.

35.

The American Guarantee Policy defines other insurance, in pertinent

part, as a policy of insurance providing coverage that this policy also provides. Other

insurance includes any type of self-insurance or other mechanisms by which an

insured arranges for funding of legal liabilities.

V. CAUSES OF ACTION

COUNT ONE

Priority of Coverage

36.

Paragraphs 1-35 set forth supra are hereby incorporated by reference.

37.

As a primary carrier, Liberty accepted its defense obligation and provided

a joint defense to Aslan and WSE in the Wells action. At all relevant times, Liberty

controlled the defense.

38.

The remaining Primary Carriers, Axis and First Liberty, did not

participate in the defense of Aslan and/or WSE in the Wells action.

39.

On December 16, 2014, Axis denied a defense obligation in the Wells

action, claiming that although its policy was written as primary coverage, it was

excess to ACE, a true excess carrier.

4836-3712-6946.1

10

Case 1:15-cv-00949-WBH Document 1 Filed 04/01/15 Page 11 of 18

40.

Pursuant to the terms and conditions of the Primary Carriers policies,

their respective defense obligation is only exhausted upon the payment of the per

occurrence liability limits on a settlement or judgment.

41.

The Primary Carriers have not made any payments in connection with the

judgment entered in the Wells action notwithstanding Plaintiffs counsels pretrial

demand of $5M, $2M of which he sought from Liberty and Axis. See Ex. H,

Plaintiffs Motion for Pre-Judgment Interest and Exhibits Thereto.

42.

Libertys tender of its limits to ACE immediately before trial does not

exhaust its recognized and continuing defense obligation.

43.

Following the verdict, the Primary Carriers have failed to meet their

ongoing defense obligations in paying for the premium to secure the bond for appeal,

which they are obligated to do.

44.

The provisions of the ACE Excess Policy, quoted above, demonstrates

that it is a true excess insurer, which, as a matter of law, makes it excess over all

primary policies, including the primary policies issued by the Primary Carriers

regardless of the other insurance clauses contained in the primary policies.

45.

The priority of coverage for the Wells action is exhaustion of all primary

coverage before the ACE Excess Policy, a true excess policy, and the American

Guarantee Excess Policy, also a true excess policy, are triggered.

4836-3712-6946.1

11

Case 1:15-cv-00949-WBH Document 1 Filed 04/01/15 Page 12 of 18

46.

Following the exhaustion of the Primary Carriers coverage, that the true

excess insurers ACE and American Guarantee share the remaining indemnity

obligations.

47.

The indemnity obligations of the true excess insurers, ACE and American

Guarantee, will be shared equally, as the other insurance clauses contained in those

policies are mutually repugnant in that they contain the same excess language, thereby

canceling each other out.

48.

The insurers had notice of this priority of coverage as early as March 19,

2013 when Plaintiffs made a $5M demand seeking $1M each from Liberty and Axis

and $3M jointly from ACE and Zurich. See Exs. B and H Attached Thereto.

49.

Despite notice prior to the underlying verdict, ACE has no knowledge

that Axis or Zurich took any action.

WHEREFORE, ACE respectfully requests this Court enter a judgment

determining and declaring the rights, duties and obligations of ACE under the ACE

Excess Policy, award costs, and grant such further and supplemental relief as it deems

necessary and proper, including the following:

A.

That the Management Agreement entered into between Aslan and WSE

was a valid and effective agreement on the date of Wells incident;

B.

That the Liberty, Axis and First Specialty Policies provide primary

coverage to WSE and Aslan for the Wells Action;

4836-3712-6946.1

12

Case 1:15-cv-00949-WBH Document 1 Filed 04/01/15 Page 13 of 18

C.

That the defense obligation provided by the Liberty, Axis and First

Specialty Policies has not been exhausted as the per occurrence liability

limits on each of these policies remain unpaid;

D.

That the ACE Excess Policy is an excess policy over the primary policies

issued by Liberty, Axis and First Specialty;

E.

That the ACE Excess Policy has no duty to pay any sums on behalf of

WSE and/or Aslan until all primary per occurrence limits of liability

coverage is exhausted by the payment of settlement or judgment;

F.

That upon exhaustion of the Primary Carriers liability limits that the

ACE Excess Policy and the American Guarantee Excess Policy pay in

equal shares for the entry of settlement or judgment up to the exhaustion

of their respective liability limits; and

G.

Any further determinations, declarations and relief as the Court deems

proper and necessary.

COUNT TWO

Payment of Premium for Appeal Bond

50.

Paragraphs 1-49 set forth supra are hereby incorporated by reference.

51.

The Liberty, Axis and First Specialty Policies each include coverage for

the payment of appeal bonds as follows:

SUPPLEMENTARY PAYMENTS COVERAGES

1.

We will pay, with respect to any claim we investigate or settle, or

any suit against an insured we defend: ***

c.

The cost of bonds to release attachments, but only for bond

amounts within the applicable limits of insurance. We do

not have to furnish these bonds.

(Exs. B, C, D).

4836-3712-6946.1

13

Case 1:15-cv-00949-WBH Document 1 Filed 04/01/15 Page 14 of 18

52.

Liberty defended the Wells action.

53.

As part of the ongoing defense obligation, the Primary Carriers each are

legally obligated to pay for the premium to secure the appeal bond for the Wells

action.

54.

The ACE Excess Policy covers payments associated with a bond only

where it assumes the defense per the following language:

DEFENSE AND SUPPLEMENTARY PAYMENTS

***

D.

If we assume the defense of any suit against the insured, we

will pay in addition to the applicable Limit of insurance:

***

3.

The cost of bonds to release attachments, but only for bond

amounts within the applicable Limit of Insurance. We do

not have to furnish these bonds.

4.

The cost of appeal bonds required by law to appeal any suit

we defend but only for bond amounts within the application

Limit of insurance. We do not have to apply for or furnish

such bond.

(Ex. E, Form XS-20835 (08/06), pgs. 3-4).

55.

At no time did ACE assume the defense of Aslan and/or WSE in the

Wells action.

56.

Absent its assumption of the defense in the Wells action, ACE has no

duty to pay for the premium to secure the appeal bond.

4836-3712-6946.1

14

Case 1:15-cv-00949-WBH Document 1 Filed 04/01/15 Page 15 of 18

WHEREFORE, ACE respectfully requests this Court enter a judgment

determining and declaring the rights, duties and obligations of ACE under the ACE

Excess Policy, award costs, and grant such further and supplemental relief as it deems

necessary and proper, including the following:

A.

That the Liberty, Axis and First Specialty Policies, as Primary Carriers,

are obligated to pay all premiums and any other costs associated with

securing a bond to stay the Wells judgment on appeal;

B.

That ACE did not assume the defense of the Wells action, thereby

eliminating any obligation to pay the premium or costs associated with

an appeal bond; and

C.

Any further determinations, declarations and relief as the Court deems

proper and necessary.

COUNT THREE

Attorneys Fees Awarded Not Covered Under ACE Excess Policy

57.

Paragraphs 1-56 set forth supra are hereby incorporated by reference.

58.

The jury awarded $7,160,000 to Wells in attorneys fees under O.C.G.A.

13-6-11, which provides that:

The expenses of litigation generally shall not be allowed as a part of the

damages; but where the plaintiff has specially pleaded and has made

prayer therefor and where the defendant has acted in bad faith, has been

stubbornly litigious, or has caused the plaintiff unnecessary trouble and

expense, the jury may allow them.

59.

The O.C.G.A. 13-6-11 award resulted because of the defense provided,

which at all times was controlled and provided by Liberty.

4836-3712-6946.1

15

Case 1:15-cv-00949-WBH Document 1 Filed 04/01/15 Page 16 of 18

60.

ACE did not control the defense and any award of attorneys fees pursuant

to O.C.G.A. 13-6-11 should be attributed to the Primary Carriers that assigned

defense counsel and controlled the defense.

61.

In the alternative, the ACE Excess Policy insuring agreement provides

I.

INSURING AGREEMENT

that:

A.

62.

We will pay on behalf of the insured those sums in excess

of the retained limit that the insured becomes legally

obligated to pay as damages because of bodily injury,

property damage or personal and advertising injury

to which this insurance applies.(emphasis added).

The attorneys fees awarded in the Wells action are not damages

because of of any bodily injury or property damage that Wells suffered.

63.

The ACE Excess Policy also provides as follows:

DEFENSE AND SUPPLEMENTARY PAYMENTS

***

D.

If we assume the defense of any suit against the insured, we

will pay in addition to the applicable Limit of insurance:

***

6.

All costs taxed against the insured in the suit.

(Ex., E, Form XS-20835 (08/06), pgs. 3-4).

64.

The attorneys fees awarded in the Wells action under O.C.G.A. 13-6-11

are not taxable costs contemplated for coverage under the ACE Excess Policy.

4836-3712-6946.1

16

Case 1:15-cv-00949-WBH Document 1 Filed 04/01/15 Page 17 of 18

65.

ACE did not assume the defense in the Wells action, so it has no

obligation to pay for taxable costs.

WHEREFORE, ACE respectfully requests this Court enter a judgment

determining and declaring the rights, duties and obligations of ACE under the ACE

Excess Policy, award costs, and grant such further and supplemental relief as it deems

necessary and proper, including the following:

A.

That the attorneys fees awarded in the Wells action under O.C.G.A.

13-6-11 are should be covered by the Primary Carriers, which appointed

defense counsel and controlled the defense at all times;

B.

That the attorneys fees awarded in the Wells action under O.C.G.A.

13-6-11 are not covered damages under the ACE Excess Policy;

C.

That the attorneys fees awarded in the Wells action under O.C.G.A.

13-6-11 are not covered taxable costs under the ACE Excess Policy;

D.

That ACE has no obligation to pay the attorneys fees awarded the Wells

action under the ACE Excess Policy;

E.

Any further determinations, declarations and relief as the Court deems

proper and necessary.

Respectfully submitted,

4836-3712-6946.1

17

Case 1:15-cv-00949-WBH Document 1 Filed 04/01/15 Page 18 of 18

This 1st Day of April 2015.

LEWIS BRISBOIS BISGAARD & SMITH

LLP

________________________________

P. MICHAEL FREED

Georgia Bar No. 061128

Counsel for ACE Property and Casualty

Insurance Company

1180 Peachtree Street, N.E.

Suite 2900

Atlanta, Georgia 30309

404-348-8585 (t)

404-467-8845 (f)

michael.freed@lewisbrisbois.com

4836-3712-6946.1

Anda mungkin juga menyukai

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Writ of MandamusDokumen2 halamanWrit of MandamusMalikBey100% (3)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- Appendix A - Bid FormDokumen3 halamanAppendix A - Bid FormUmair AfrimaBelum ada peringkat

- Texas Homeowners Rights Under ForeclosureDokumen9 halamanTexas Homeowners Rights Under Foreclosurelascl500Belum ada peringkat

- The Law and The LawyerDokumen130 halamanThe Law and The LawyerAshu Garg67% (12)

- The Public Liability Insurance Act, 1991Dokumen8 halamanThe Public Liability Insurance Act, 1991Karsin ManochaBelum ada peringkat

- Roca V CIRDokumen2 halamanRoca V CIRJemima Rachel CruzBelum ada peringkat

- Valmonte Vs CADokumen4 halamanValmonte Vs CAchappy_leigh118100% (1)

- Civil Law) Agency) Memory Aid) Made 2002) by Ateneo) 14 PagesDokumen14 halamanCivil Law) Agency) Memory Aid) Made 2002) by Ateneo) 14 PagesbubblingbrookBelum ada peringkat

- Bidhan Biswas PDFDokumen11 halamanBidhan Biswas PDFBidhan BiswasBelum ada peringkat

- The CenSEI Report (Vol. 2, No. 13, April 2-8, 2012)Dokumen45 halamanThe CenSEI Report (Vol. 2, No. 13, April 2-8, 2012)John Carlo Gil Sadian100% (1)

- ASIAN ALCOHOL V NLRCDokumen3 halamanASIAN ALCOHOL V NLRCAyleen RamosBelum ada peringkat

- CENTURION REAL ESTATE PARTNERS, LLC Et Al v. ARCH INSURANCE COMPANY DocketDokumen4 halamanCENTURION REAL ESTATE PARTNERS, LLC Et Al v. ARCH INSURANCE COMPANY DocketACELitigationWatchBelum ada peringkat

- MINNS v. INDEMNITY INSURANCE COMPANY OF NORTH AMERICA Et Al DocketDokumen2 halamanMINNS v. INDEMNITY INSURANCE COMPANY OF NORTH AMERICA Et Al DocketACELitigationWatchBelum ada peringkat

- MANGUAL-MORALES v. COMBINED INSURANCE COMPANY OF AMERICA Et Al DocketDokumen2 halamanMANGUAL-MORALES v. COMBINED INSURANCE COMPANY OF AMERICA Et Al DocketACELitigationWatchBelum ada peringkat

- MINNS v. INDEMNITY INSURANCE COMPANY OF NORTH AMERICA Et Al DocketDokumen2 halamanMINNS v. INDEMNITY INSURANCE COMPANY OF NORTH AMERICA Et Al DocketACELitigationWatchBelum ada peringkat

- MANGUAL-MORALES v. COMBINED INSURANCE COMPANY OF AMERICA Et Al ComplaintDokumen10 halamanMANGUAL-MORALES v. COMBINED INSURANCE COMPANY OF AMERICA Et Al ComplaintACELitigationWatchBelum ada peringkat

- MINNS v. INDEMNITY INSURANCE COMPANY OF NORTH AMERICA Et Al ComplaintDokumen6 halamanMINNS v. INDEMNITY INSURANCE COMPANY OF NORTH AMERICA Et Al ComplaintACELitigationWatchBelum ada peringkat

- CENTURION REAL ESTATE PARTNERS, LLC Et Al v. ARCH INSURANCE COMPANY ComplaintDokumen53 halamanCENTURION REAL ESTATE PARTNERS, LLC Et Al v. ARCH INSURANCE COMPANY ComplaintACELitigationWatchBelum ada peringkat

- WESTCHESTER FIRE INSURANCE COMPANY Et Al v. LALO DRYWALL, INC. Et Al ComplaintDokumen20 halamanWESTCHESTER FIRE INSURANCE COMPANY Et Al v. LALO DRYWALL, INC. Et Al ComplaintACELitigationWatchBelum ada peringkat

- STEWART v. TARGET CORPORATION OF MINNESOTA Et Al DocketDokumen2 halamanSTEWART v. TARGET CORPORATION OF MINNESOTA Et Al DocketACELitigationWatchBelum ada peringkat

- GUNTHERT Et Al VS ACE AMERICAN INSURANCE COMPANY Et Al DocketDokumen5 halamanGUNTHERT Et Al VS ACE AMERICAN INSURANCE COMPANY Et Al DocketACELitigationWatchBelum ada peringkat

- WESTCHESTER FIRE INSURANCE COMPANY Et Al v. LALO DRYWALL, INC. Et Al DocketDokumen4 halamanWESTCHESTER FIRE INSURANCE COMPANY Et Al v. LALO DRYWALL, INC. Et Al DocketACELitigationWatchBelum ada peringkat

- GUNTHERT Et Al VS ACE AMERICAN INSURANCE COMPANY Et Al ComplaintDokumen33 halamanGUNTHERT Et Al VS ACE AMERICAN INSURANCE COMPANY Et Al ComplaintACELitigationWatchBelum ada peringkat

- STEWART v. TARGET CORPORATION OF MINNESOTA Et Al ComplaintDokumen10 halamanSTEWART v. TARGET CORPORATION OF MINNESOTA Et Al ComplaintACELitigationWatchBelum ada peringkat

- DEICHMANN v. ACE AMERICAN INSURANCE COMPANY Et Al DocketDokumen4 halamanDEICHMANN v. ACE AMERICAN INSURANCE COMPANY Et Al DocketACELitigationWatchBelum ada peringkat

- GERRA v. BANKERS STANDARD INSURANCE COMPANY ComplaintDokumen4 halamanGERRA v. BANKERS STANDARD INSURANCE COMPANY ComplaintACELitigationWatchBelum ada peringkat

- DEICHMANN v. ACE AMERICAN INSURANCE COMPANY Et Al ComplaintDokumen26 halamanDEICHMANN v. ACE AMERICAN INSURANCE COMPANY Et Al ComplaintACELitigationWatchBelum ada peringkat

- OLEN PROPERTIES CORP. Et Al v. ACE AMERICAN INSURANCE COMPANY Et Al ComplaintDokumen20 halamanOLEN PROPERTIES CORP. Et Al v. ACE AMERICAN INSURANCE COMPANY Et Al ComplaintACELitigationWatchBelum ada peringkat

- OLEN PROPERTIES CORP. Et Al v. ACE AMERICAN INSURANCE COMPANY Et Al DocketDokumen3 halamanOLEN PROPERTIES CORP. Et Al v. ACE AMERICAN INSURANCE COMPANY Et Al DocketACELitigationWatchBelum ada peringkat

- SANBORN Et Al v. CENTURY INDEMNITY COMPANY DocketDokumen3 halamanSANBORN Et Al v. CENTURY INDEMNITY COMPANY DocketACELitigationWatchBelum ada peringkat

- SIMPSON Et Al v. NRG ENERGY, INC. Et Al DocketDokumen3 halamanSIMPSON Et Al v. NRG ENERGY, INC. Et Al DocketACELitigationWatchBelum ada peringkat

- CERNER CORPORATION v. COLUMBIA CASUALTY COMPANY Et Al ComplaintDokumen9 halamanCERNER CORPORATION v. COLUMBIA CASUALTY COMPANY Et Al ComplaintACELitigationWatchBelum ada peringkat

- Livas Et Al v. ACE American Insurance Company Et Al DocketDokumen3 halamanLivas Et Al v. ACE American Insurance Company Et Al DocketACELitigationWatchBelum ada peringkat

- CERNER CORPORATION v. COLUMBIA CASUALTY COMPANY Et Al DocketDokumen2 halamanCERNER CORPORATION v. COLUMBIA CASUALTY COMPANY Et Al DocketACELitigationWatchBelum ada peringkat

- SANBORN Et Al v. CENTURY INDEMNITY COMPANY ComplaintDokumen8 halamanSANBORN Et Al v. CENTURY INDEMNITY COMPANY ComplaintACELitigationWatchBelum ada peringkat

- INDEMNITY INSURANCE COMPANY OF NORTH AMERICA Et Al ComplaintDokumen5 halamanINDEMNITY INSURANCE COMPANY OF NORTH AMERICA Et Al ComplaintACELitigationWatchBelum ada peringkat

- ESURANCE INSURANCE COMPANY v. WESTCHESTER FIRE INSURANCE COMPANY ComplaintDokumen4 halamanESURANCE INSURANCE COMPANY v. WESTCHESTER FIRE INSURANCE COMPANY ComplaintACELitigationWatchBelum ada peringkat

- INDEMNITY INSURANCE COMPANY OF NORTH AMERICA v. EXPEDITORS INTERNATIONAL OF WASHINGTON, INC Et Al DocketDokumen3 halamanINDEMNITY INSURANCE COMPANY OF NORTH AMERICA v. EXPEDITORS INTERNATIONAL OF WASHINGTON, INC Et Al DocketACELitigationWatchBelum ada peringkat

- INDEMNITY INSURANCE COMPANY OF NORTH AMERICA v. EXPEDITORS INTERNATIONAL OF WASHINGTON, INC Et Al ComplaintDokumen7 halamanINDEMNITY INSURANCE COMPANY OF NORTH AMERICA v. EXPEDITORS INTERNATIONAL OF WASHINGTON, INC Et Al ComplaintACELitigationWatchBelum ada peringkat

- INDEMNITY INSURANCE COMPANY OF NORTH AMERICA Et Al DocketDokumen4 halamanINDEMNITY INSURANCE COMPANY OF NORTH AMERICA Et Al DocketACELitigationWatchBelum ada peringkat

- ESURANCE INSURANCE COMPANY v. WESTCHESTER FIRE INSURANCE COMPANY DocketDokumen2 halamanESURANCE INSURANCE COMPANY v. WESTCHESTER FIRE INSURANCE COMPANY DocketACELitigationWatchBelum ada peringkat

- Manalo vs. Court of AppealsDokumen4 halamanManalo vs. Court of AppealsaudreyracelaBelum ada peringkat

- Apple Transparency Report Requests 2019 H1 enDokumen21 halamanApple Transparency Report Requests 2019 H1 enJack PurcherBelum ada peringkat

- Democracy PPT NewDokumen11 halamanDemocracy PPT Newlalit13patilBelum ada peringkat

- Trust Deed of JMN/PVCHR: LatestDokumen10 halamanTrust Deed of JMN/PVCHR: LatestPeoples' Vigilance Committee on Human rightsBelum ada peringkat

- Affidavit of LossDokumen3 halamanAffidavit of LosschacharancharanBelum ada peringkat

- Weimar Republic - Birth & Three Phases Overview (1919-1933)Dokumen8 halamanWeimar Republic - Birth & Three Phases Overview (1919-1933)api-19773192Belum ada peringkat

- CaseDokumen61 halamanCaseTani AngubBelum ada peringkat

- United States v. Joseph S. Benevides, 985 F.2d 629, 1st Cir. (1993)Dokumen8 halamanUnited States v. Joseph S. Benevides, 985 F.2d 629, 1st Cir. (1993)Scribd Government DocsBelum ada peringkat

- Mishel Escaño - EH 407Dokumen2 halamanMishel Escaño - EH 407Ace Asyong AlveroBelum ada peringkat

- David L. PolkDokumen7 halamanDavid L. PolkTexas WatchdogBelum ada peringkat

- Moot AfspaDokumen4 halamanMoot Afspaichchhit srivastavaBelum ada peringkat

- RTC JudgesDokumen35 halamanRTC JudgesMichael John Duavit Congress OfficeBelum ada peringkat

- Criminal Cases Penned by Justice Perlas Bernabe, by Judge CampanillaDokumen16 halamanCriminal Cases Penned by Justice Perlas Bernabe, by Judge Campanilladhine77100% (2)

- Aboitiz Shipping Corporation v. CA (569 SCRA 294) - FULL TEXTDokumen16 halamanAboitiz Shipping Corporation v. CA (569 SCRA 294) - FULL TEXTAdrian Joseph TanBelum ada peringkat

- DM - 2023 Celebration of NCMDokumen2 halamanDM - 2023 Celebration of NCMJoanna Marie MenorBelum ada peringkat

- Mission Visa Rules and RegulationsDokumen2 halamanMission Visa Rules and RegulationsLuu Quang HoaBelum ada peringkat

- Parkin 8e TIF Ch00Dokumen3 halamanParkin 8e TIF Ch00josephBelum ada peringkat

- Salary Sheet FormatDokumen83 halamanSalary Sheet FormatKartikesh MishraBelum ada peringkat

- R V Robb (1991) 93 CRDokumen2 halamanR V Robb (1991) 93 CRJeree Jerry AzreeBelum ada peringkat