Bir Forms PDF

Diunggah oleh

garyDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Bir Forms PDF

Diunggah oleh

garyHak Cipta:

Format Tersedia

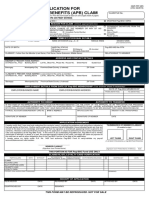

For BIR

Use Only

BCS/

Item

Annual Income Tax Return

Republika ng Pilipinas

Kagawaran ng Pananalapi

Kawanihan ng Rentas

Internas

1 For the Year

(MM/20YY)

4 Alphanumeric Tax Code (ATC)

170106/13ENCSP1

BIR Form No.

For Self-Employed Individuals, Estates and Trusts

1701

Enter all required information in CAPITAL LETTERS using BLACK ink. Mark applicable

boxes with an X. Two copies MUST be filed with the BIR and one held by the Tax Filer.

June 2013 (ENCS)

Page 1

2 Amended

Return?

/20

Yes

No

II 011 Compensation Income

3 Short Period Return?

Yes

II 012 Business Income / Income from Profession

No

II 013 Mixed Income

Part I Background Information on TAXPAYER/FILER

5 Taxpayer Identification Number (TIN)

1 8 3 2 2 0 - 0 0 0 0 6 RDO Code 0 77

2 9 9 7 Tax Filer Type

Single Proprietor

Professional

Estate

Trust

8 Tax Filers Name (Last Name, First Name, Middle Name for Individual) / ESTATE of (First Name, Middle Name, Last Name) / TRUST FAO:(First Name, Middle Name, Last Name)

MAYOGA, ANA LIZA CARMONA

9 Trade Name

10 Registered Address (Indicate complete registered address)

P urok Santo, Brgy. Mandalagan, Bacolod City

11 Date of Birth (MM/DD/YYYY)

2 /

1 /

12 Email Address

7 1

13 Contact Number

14 Civil Status

3 1

Single

15 If Married, indicate whether spouse has income

With Income

17 Main Line of

Business

co

m mo n

c a r r

[Sec. 34 (A-J), NIRC]

21 Method of Accounting

Cash

22 Income Exempt from Income Tax?

Accrual

Yes

No

If Yes, fill up also Mandatory Attachments PER ACTIVITY (Part X).

24 Claiming Additional Exemptions?

26

27

28

29

30

31

Yes

With No Income

e r

Itemized Deduction

20 Method of Deduction

x Married

Legally Separated

16 Filing Status

Widow/er

Joint Filing

18 PSIC

Separate Filing

19 PSOC

Optional Standard Deduction (OSD) 40% of Gross Sales/

Receipts/Revenues/Fees [Sec. 34(L), NIRC, as amended by R.A. 9504]

Others (Specify)

23 Income subject to Special/Preferential Rate?

Yes

No

If Yes, fill up also Mandatory Attachments PER ACTIVITY (Part X)

No

25 If YES, enter number of Qualified Dependent Children

(Enter information about Children on Part VIIA of Page 4)

Part II Total Tax Payable

Total Income Tax Due (Overpayment) for Tax Filer and Spouse (Sum of Items 72A & 72B)

Less: Total Tax Credits / Payments (Sum of Items 76A & 76B)

Net Tax Payable (Overpayment) (Item 26 Less Item 27)

(Do NOT enter Centavos)

Less: Portion of Tax Payable Allowed for 2nd Installment to be paid on or before July 15 (Not More Than 50% of

Item 26)

Total Tax Payable (Item 28 Less Item 29)

Add: Total Penalties( From Item 84)

32 TOTAL AMOUNT PAYABLE Upon Filing (Overpayment) (Sum of Items 30 & 31)

If Overpayment, mark one box only (Once the choice is made, the same is irrevocable)

To be refunded

To be issued a Tax Credit Certificate (TCC)

To be carried over as a tax credit for next year/quarter

I declare under the penalties of perjury, that this annual return has been made in good faith, verified by me, and to the best of my knowledge and belief, is true and correct, pursuant to the

provisions of the National Internal Revenue Code, as amended, and the regulations issued under authority thereof. (If Authorized Representative, attach authorization letter and indicate TIN)

33 Number of pages filed

Signature over printed name of Tax Filer

34 Community Tax Certificate

(CTC) No./Govt. Issued ID

Signature over printed name of Authorized Representative

35 Date of Issue

(MM/DD/YYYY)

36 Place of Issue

Part III - Details of

Payment

38 Cash/Bank Debit Memo

39 Check

37 Amount, if CTC

Drawee Bank/

Agency

Number

Date (MM/DD/YYYY)

/

/

/

/

Amount

40 Others (Specify below)

Machine Validation / Revenue Official Receipt Details (if not filed with an Authorized Agent Bank)

Stamp of Receiving Office/AAB and Date of Receipt

(ROs Signature/Bank Tellers Initial)

Annual Income Tax Return

BIR Form No.

For Self-Employed Individuals, Estates and Trusts

Subject to REGULAR Income Tax Only

1701

June 2013 (ENCS)

Page 2

170106/13ENCSP2

Tax Filers Last Name

TIN

0

Part IV Computation of Income Tax- REGULAR RATE

41 Gross Compensation Income (From Schedule1 Item 5A1 / 5B1 )

A) Taxpayer/Filer

B) Spouse

42 Less: Non-Taxable / Exempt Compensation

43 Gross Taxable Compensation Income (Item 41 Less Item 42)

Less: Deductions

44 Premium on Health and/or Hospitalization Insurance (Not to Exceed P 2,400 / year)

45 Personal Exemption/Exemption for Estate and Trust

46 Additional Exemption

47 Total Deductions (Sum of Items 44 to 46)

48 Net Taxable Compensation Income (Item 43 Less Item 47)

OR

49 Excess of Deductions (Item 47 Less Item 43)

50 Net Sales/Revenues/Receipt/Fees (From Schedule 2 Item 5A / 5B)

51 Add: Other Taxable Income from Operations not Subject to Final Tax

(From Schedule 3 Item 3A / 3B)

52 Total Sales/Revenues/Receipts/Fees (Sum of Items 50 & 51)

53 Less: Cost of Sales/Services

(Not allowed for Tax Filer who opted for OSD)

(From Schedule 4 Item 27A / 27B)

54 Gross Income from Business/Profession (Item 52 Less Item 53)

55 Add: Non-Operating Income (From Schedule 5 Item 6A / 6B)

56 Total Gross Income (Sum of Items 54 & 55)

Less: Allowable Deductions

57 Ordinary Allowable Itemized Deductions (From Schedule 6 Item 40A / 40B)

58 Special Allowable Itemized Deductions (From Schedule 7 Item 5A/5B)

59 Allowance for Net Operating Loss Carry Over (NOLCO)

(From Schedule 8A1 Item 8D / Schedule 8B1 Item 8D)

60 Total Allowable Itemized Deductions (Sum of Items 57 to 59)

OR

61 Optional Standard Deductions (OSD) (40% of Item 52-Total Sales/Receipts/Revenues/Fees)

(NOTE: If all income is subject ONLY to Regular Income Tax Regime)

62 Taxable Income from Business/Profession(Item 56 Less Item 60 OR 61)

63 Add: Net Taxable Compensation Income(From Item 48A/48B)

64 Net Taxable Income (Sum of Items 62 & 63)

65 Less: Excess Deductions, if any (From Item 49) OR the Total

Deductions, if there is no compensation income (From Item 47)

66 TOTAL TAXABLE INCOME (Item 64 Less Item 65)

67 TAX DUE-REGULAR [Refer to Tax Table (Graduated Income Tax Rates) below]

Tax Table

If Taxable Income is:

Tax Due is:

Not over P 10,000

5%

Over P 10,000

but not over P 30,000

Over P 30,000

but not over P 70,000

Over P 70,000

but not over P 140,000

P 500 + 10% of the

excess over P 10,000

P 2,500 + 15% of the

excess over P 30,000

P 8,500 + 20% of the

excess over P 70,000

If Taxable Income is:

Tax Due is:

Over P 140,000

but not over P 250,000

Over P 250,000

but not over P 500,000

P 22,500 + 25% of the excess over

P 140,000

P 50,000 + 30% of the excess over

P 250,000

P 125,000 + 32% of the excess over

P 500,000

Over P 500,000

Annual Income Tax Return

For Self-Employed Individuals, Estates and Trusts

Subject to REGULAR Income Tax Only

Page 3

BIR Form No.

1701

June 2013 (ENCS)

170106/13ENCSP3

Tax Filers Last Name

TIN

0

0

Part V - Summary of Income Tax Due

A) Taxpayer/Filer

Description

B) Spouse

68 Regular Rate - Income Tax Due (From Item 67A/67B)

69 Special Rate - Income Tax Due (From Part IX Item 18B/18F)

70 Less: Share of Other Government Agency, if remitted directly

71 Net Special Income Tax Due

(Share of National Govt.) (Item 69 Less Item 70)

72 TOTAL INCOME TAX DUE (Overpayment)

(Sum of Items 68 &71)

(To Item 26)

Less: Tax Credits/Payments

73 Regular (From Schedule 9 Item 10A/10B)

74 Special (From Part IX Item 19B/19F)

75 Exempt (From Part IX Item 19C/19G)

76 Total Tax Credit/Payments (Sum of Items 73 to 75)

(To Item 27)

77 Net Tax Payable/(Overpayment) (Item72 Less Item 76)

78 NET TAX PAYABLE (OVERPAYMENT) FOR TAX FILER and SPOUSE (Sum of Items 77A & 77B)

79 Less: Portion of Tax Payable Allowed for 2nd Installment to be paid on or before July 15

(To Item 29)

(Not More Than 50% of the Sum of Items 72A & 72B)

80 NET AMOUNT OF TAX PAYABLE (OVERPAYMENT) (Item 78 Less Item 79)

Add: Penalties

81 Surcharge

82 Interest

83 Compromise

84 Total Penalties (Sum of Items 81 to 83)

(To Item 31)

85 TOTAL AMOUNT PAYABLE UPON FILING (OVERPAYMENT) (Sum of Items 80 & 84)

(To Item 32)

Part VI - Tax Relief Availment

Description

A) Taxpayer/Filer

86 Regular Income Tax Otherwise Due

(Sum of Items 66 & 58 X applicable Tax Rate per Tax Table )

87 Less: Tax Due Regular (From Item 67)

88 Tax Relief Availment Before Special Tax Credits (Items 86 Less Item 87)

89 Add: Special Tax Credits(From Schedule 9 Item 8A/8B)

90 Regular Tax Relief Availment (Sum of Items 88 & 89)

91 Special Tax Relief Availment( From Part IX Item 21B/21F)

92 Exempt Tax Relief Availment (From Part IX Item 21C/21G)

93 Total Tax Relief Availment (Sum of Items 90, 91 & 92)

94 Total Tax Relief Availment of Tax Filer & Spouse (Sum of Items 93A & 93B)

B) Spouse

Annual Income Tax Return

BIR Form No.

1701

For Self-Employed Individuals, Estates and Trusts

Subject to REGULAR Income Tax Only

June 2013 (ENCS)

Page 4

170106/13ENCSP4

Tax Filers Last Name

TIN

0

Part VII - Other Relevant Information - SPOUSE

95 Spouses TIN

96 RDO Code

97 Spouses Name (Last Name, First Name and Middle Initial)

98 Trade Name

99 Date of Birth(MM/DD/YYYY)

/

/

100 Email Address

101 Contact Number

102 PSIC

103 PSOC

104 Line of Business

105 Method of Deduction

106 Method of Accounting

Cash

107 Income Exempt from Income Tax?

Itemized Deductions

Optional Standard Deduction (OSD) 40% of Gross

[Sec. 34 (A-J), NIRC]

Sales/Receipts/Revenues/Fees [Sec. 34(L), NIRC, as amended by R.A. 9504]

Others

(Specify)

Accrual

Yes

108 Income subject to Special/Preferential Rate?

No

If Yes, fill up also Mandatory Attachments PER ACTIVITY (Part X) .

109 Alphanumeric Tax Code (ATC)

II 011 Compensation Income

110 Claiming Additional Exemptions?

Yes

No

Yes

No

If Yes, fill up also Mandatory Attachments PER ACTIVITY (Part X)

II 012 Business Income/Income from Profession

II 013 Mixed Income

111 If YES, enter number of Qualified Dependent Children

(Enter information about Children on Part VIIA)

Part VIIA - Qualified Dependent Children (If wife is claiming for additional exemption, please attach waiver of the husband)

Last Name

Date of Birth

(MM / DD / YYYY)

First Name and Middle Initial

Mark if Mentally/

Physically

Incapacitated

Part VIIB - Current Address (Accomplish if current address is different from registered address)

Unit/Room Number/Floor

Building Name

Lot Number Block Number Phase Number House Number

Street Name

Subdivision/Village

Barangay

Municipality/City

Province

Zip Code

Part VIII - Information - External Auditor/Accredited Tax Agent

112 Name of External Auditor/Accredited Tax Agent

113 TIN

114 Name of Signing Partner (If External Auditor is a Partnership)

Just when I think

that I cant love

you anymore115 TIN

than 117

I do,Issue

I do.Date (MM/DD/YYYY)

116 BIR Accreditation No.

118 Expiry Date (MM/DD/YYYY)

Anda mungkin juga menyukai

- 1701 Bir FormDokumen12 halaman1701 Bir Formbertlaxina0% (1)

- BLCTE - MOCK EXAM II With Answer Key PDFDokumen20 halamanBLCTE - MOCK EXAM II With Answer Key PDFVladimir Marquez78% (18)

- Bir Form 1701Dokumen12 halamanBir Form 1701miles1280Belum ada peringkat

- Sana MabagoDokumen1 halamanSana MabagojoystambaBelum ada peringkat

- Capital Gains Tax ReturnDokumen6 halamanCapital Gains Tax ReturnSuzette BalucanagBelum ada peringkat

- Tax Update RR 18-2012Dokumen32 halamanTax Update RR 18-2012johamarz6245Belum ada peringkat

- 1701qjuly2008 (ENCS)Dokumen6 halaman1701qjuly2008 (ENCS)alvie_budBelum ada peringkat

- 2550 MDokumen2 halaman2550 MJose Venturina Villacorta100% (3)

- Philippines New Annual Income Tax Return Form 01 IAF JUNE 2013Dokumen12 halamanPhilippines New Annual Income Tax Return Form 01 IAF JUNE 2013Danilla Navarro VelasquezBelum ada peringkat

- Opentext Extended Ecm For Sap Successfactors Ce - HR ProcessesDokumen69 halamanOpentext Extended Ecm For Sap Successfactors Ce - HR ProcessesflasancaBelum ada peringkat

- 82255BIR Form 1701Dokumen12 halaman82255BIR Form 1701Leowell John G. RapaconBelum ada peringkat

- New Income Tax Return BIR Form 1700 - November 2011 RevisedDokumen4 halamanNew Income Tax Return BIR Form 1700 - November 2011 RevisedBusinessTips.Ph100% (2)

- BIR Form 1701QDokumen2 halamanBIR Form 1701QfileksBelum ada peringkat

- Annual Income Tax Return: I I 0 1 1 I I 0 1 2 I I 0 1 1 I I 0 1 2 I I 0 1 3Dokumen9 halamanAnnual Income Tax Return: I I 0 1 1 I I 0 1 2 I I 0 1 1 I I 0 1 2 I I 0 1 3albertBelum ada peringkat

- 1702 July 08Dokumen7 halaman1702 July 08Jchelle Lustre DeligeroBelum ada peringkat

- Payment Form: Kawanihan NG Rentas InternasDokumen3 halamanPayment Form: Kawanihan NG Rentas InternasglydelBelum ada peringkat

- Gadiano 2316Dokumen2 halamanGadiano 2316Jypy Torrejos100% (1)

- 267731702final PDFDokumen5 halaman267731702final PDFelmarcomonal100% (1)

- 62983rmo 5-2012Dokumen14 halaman62983rmo 5-2012Mark Dennis JovenBelum ada peringkat

- Bir 2013Dokumen1 halamanBir 2013karlycoreBelum ada peringkat

- Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDokumen2 halamanKawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldGjianne PeñaredondoBelum ada peringkat

- Annual Income Tax Return: (DonotentercentavosDokumen2 halamanAnnual Income Tax Return: (DonotentercentavosKuhramaBelum ada peringkat

- Bir Form Percentage TaxDokumen3 halamanBir Form Percentage TaxEc MendozaBelum ada peringkat

- FTP FTP - Bir.gov - PH Webadmin Forms 2551mDokumen1 halamanFTP FTP - Bir.gov - PH Webadmin Forms 2551mPeter John M. LainezBelum ada peringkat

- BIR Ruling No. 453-2018 Interest Income On Individual Loans Obtained From Banks That Are Not Securitized, Assigned or Participated OutDokumen4 halamanBIR Ruling No. 453-2018 Interest Income On Individual Loans Obtained From Banks That Are Not Securitized, Assigned or Participated Outliz kawiBelum ada peringkat

- Old Form 0605 PDFDokumen2 halamanOld Form 0605 PDFeugene badere50% (2)

- Handling BIR Tax Examination For COOPS EVR PDFDokumen133 halamanHandling BIR Tax Examination For COOPS EVR PDFGracel Joy Galeno100% (1)

- 1701a - Page 2Dokumen1 halaman1701a - Page 2Sygee BotantanBelum ada peringkat

- SSS R-5 Employer Payment ReturnDokumen2 halamanSSS R-5 Employer Payment ReturnJimzon Kristian JimenezBelum ada peringkat

- Mastering BIR Year-End Compliance Requirements.: AIT Webinar, January 22, 2022 By: Dante R. TorresDokumen66 halamanMastering BIR Year-End Compliance Requirements.: AIT Webinar, January 22, 2022 By: Dante R. TorresClarine Kyla Bautista100% (1)

- 2316 JAKEDokumen1 halaman2316 JAKEJM HernandezBelum ada peringkat

- Euv 1ST 2011 1701QDokumen6 halamanEuv 1ST 2011 1701QAdrian Raymnd EspirituBelum ada peringkat

- Annual Income Tax Return: I I 0 1 1 I I 0 1 2 I I 0 1 1 I I 0 1 1 I I 0 1 2 I I 0 1 3Dokumen5 halamanAnnual Income Tax Return: I I 0 1 1 I I 0 1 2 I I 0 1 1 I I 0 1 1 I I 0 1 2 I I 0 1 3Jhanrich MatalaBelum ada peringkat

- Guidelines and Instruction For BIR Form No 1702 RTDokumen2 halamanGuidelines and Instruction For BIR Form No 1702 RTRahrahrahn100% (2)

- BIR Form 2316 UndertakingDokumen1 halamanBIR Form 2316 UndertakingJan Paolo CruzBelum ada peringkat

- New Income Tax Return BIR Form 1702 - November 2011 RevisedDokumen6 halamanNew Income Tax Return BIR Form 1702 - November 2011 RevisedBusinessTips.Ph100% (4)

- 1701A Annual Income Tax ReturnDokumen1 halaman1701A Annual Income Tax ReturnmoemoechanBelum ada peringkat

- Bir Ruling 044-10Dokumen4 halamanBir Ruling 044-10Jason CertezaBelum ada peringkat

- 2550Q FOrmDokumen1 halaman2550Q FOrmxdmhundz999Belum ada peringkat

- Return For Provisional Tax PaymentDokumen2 halamanReturn For Provisional Tax PaymentByron KanengoniBelum ada peringkat

- Cta 2D CV 09224 M 2019feb12 AssDokumen17 halamanCta 2D CV 09224 M 2019feb12 AssMelan YapBelum ada peringkat

- NBR Tin Certificate 180261996183 PDFDokumen1 halamanNBR Tin Certificate 180261996183 PDFNewaz KabirBelum ada peringkat

- Annual Income Tax ReturnDokumen6 halamanAnnual Income Tax ReturnZweetzzy PenafloridaBelum ada peringkat

- 2-4 Audited Financial StatementsDokumen9 halaman2-4 Audited Financial StatementsJustine Joyce GabiaBelum ada peringkat

- Stamped Received Bir - Google Search PDFDokumen1 halamanStamped Received Bir - Google Search PDFJasper AlonBelum ada peringkat

- Withholding Taxes 2Dokumen20 halamanWithholding Taxes 2hildaBelum ada peringkat

- Practice Test - Financial ManagementDokumen6 halamanPractice Test - Financial Managementelongoria278100% (1)

- 1601e Form PDFDokumen3 halaman1601e Form PDFLee GhaiaBelum ada peringkat

- Pagong BagalDokumen1 halamanPagong Bagaljuliet_emelinotmaestroBelum ada peringkat

- Notes To Financial StatementsDokumen9 halamanNotes To Financial StatementsCheryl FuentesBelum ada peringkat

- PFF285 ApplicationProvidentBenefitsClaim V03Dokumen2 halamanPFF285 ApplicationProvidentBenefitsClaim V03Carlo Beltran Valerio0% (2)

- Annex A - 1701A Jan 2018 - RMC 17-2019Dokumen2 halamanAnnex A - 1701A Jan 2018 - RMC 17-2019Joe75% (4)

- Documentary Stamp TaxDokumen7 halamanDocumentary Stamp TaxJenny KimmeyBelum ada peringkat

- BIR Form 1701-Jan-2018-Encs.-FinalDokumen6 halamanBIR Form 1701-Jan-2018-Encs.-FinalJosent Marie FranciscoBelum ada peringkat

- Valencia FBT Chapter 6 5th EditionDokumen8 halamanValencia FBT Chapter 6 5th EditionJacob AcostaBelum ada peringkat

- BAC103A-02a Income Tax For IndividualsDokumen8 halamanBAC103A-02a Income Tax For IndividualsNovelyn Duyogan100% (1)

- 1601EDokumen7 halaman1601EEnrique Membrere SupsupBelum ada peringkat

- RMC 124-2020Dokumen19 halamanRMC 124-2020Glenn Sabanal GarciaBelum ada peringkat

- ITF 12C Income Tax Self Assessment ReturnDokumen4 halamanITF 12C Income Tax Self Assessment ReturnTavongasheMaddTMagwati100% (1)

- BIR FormsDokumen30 halamanBIR FormsRoma Sabrina GenoguinBelum ada peringkat

- 82202BIR Form 1702-MXDokumen9 halaman82202BIR Form 1702-MXJp AlvarezBelum ada peringkat

- 82202BIR Form 1702-MXDokumen9 halaman82202BIR Form 1702-MXRen A EleponioBelum ada peringkat

- Warehouse Receipt Law ReviewerDokumen6 halamanWarehouse Receipt Law ReviewerElaine Villafuerte Achay100% (6)

- Catu Vs Atty. RellosaDokumen5 halamanCatu Vs Atty. RellosaUnknown userBelum ada peringkat

- Suggested Solution Far 660 Final Exam December 2019Dokumen6 halamanSuggested Solution Far 660 Final Exam December 2019Nur ShahiraBelum ada peringkat

- Pra05 TMP-301966624 PR002Dokumen3 halamanPra05 TMP-301966624 PR002Pilusa AguirreBelum ada peringkat

- Owner's Manual & Safety InstructionsDokumen4 halamanOwner's Manual & Safety InstructionsDaniel CastroBelum ada peringkat

- Midf FormDokumen3 halamanMidf FormRijal Abd ShukorBelum ada peringkat

- Nuclear Tests Case - Australia v. France New Zealand v. FranceDokumen8 halamanNuclear Tests Case - Australia v. France New Zealand v. FranceBalindoa JomBelum ada peringkat

- Downloads - Azure Data Services - Módulo 2Dokumen11 halamanDownloads - Azure Data Services - Módulo 2hzumarragaBelum ada peringkat

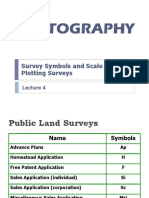

- GE 103 Lecture 4Dokumen13 halamanGE 103 Lecture 4aljonBelum ada peringkat

- Comparative Financial Statement - Day4Dokumen28 halamanComparative Financial Statement - Day4Rahul BindrooBelum ada peringkat

- Chinese OCW Conversational Chinese WorkbookDokumen283 halamanChinese OCW Conversational Chinese Workbookhnikol3945Belum ada peringkat

- GOAL Inc v. CA, GR No. 118822Dokumen3 halamanGOAL Inc v. CA, GR No. 118822Nikki Rose Laraga AgeroBelum ada peringkat

- Board of Commissioners V Dela RosaDokumen4 halamanBoard of Commissioners V Dela RosaAnonymous AUdGvY100% (2)

- Petitioner FinalDokumen20 halamanPetitioner FinalAdv AAkanksha ChopraBelum ada peringkat

- Declaration of Ruth Stoner Muzzin 2-08-17Dokumen75 halamanDeclaration of Ruth Stoner Muzzin 2-08-17L. A. PatersonBelum ada peringkat

- Mas 2 Departmental ExamzDokumen8 halamanMas 2 Departmental ExamzjediiikBelum ada peringkat

- 101, Shubham Residency, Padmanagar PH ., Hyderabad GSTIN:36AAFCV7646D1Z5 GSTIN/UIN: 36AAFCV7646D1Z5 State Name:, Code: Contact: 9502691234,9930135041Dokumen8 halaman101, Shubham Residency, Padmanagar PH ., Hyderabad GSTIN:36AAFCV7646D1Z5 GSTIN/UIN: 36AAFCV7646D1Z5 State Name:, Code: Contact: 9502691234,9930135041mrcopy xeroxBelum ada peringkat

- 10 FixedAsset 21 FixedAsset InitSettingsDokumen32 halaman10 FixedAsset 21 FixedAsset InitSettingsCrazy TechBelum ada peringkat

- Google Hacking CardingDokumen114 halamanGoogle Hacking CardingrizkibeleraBelum ada peringkat

- Friday Foreclosure List For Pierce County, Washington Including Tacoma, Gig Harbor, Puyallup, Bank Owned Homes For SaleDokumen11 halamanFriday Foreclosure List For Pierce County, Washington Including Tacoma, Gig Harbor, Puyallup, Bank Owned Homes For SaleTom TuttleBelum ada peringkat

- SAN JUAN ES. Moncada North Plantilla 1Dokumen1 halamanSAN JUAN ES. Moncada North Plantilla 1Jasmine Faye Gamotea - CabayaBelum ada peringkat

- MS - 1064 PT 7 2001 TilesDokumen16 halamanMS - 1064 PT 7 2001 TilesLee SienBelum ada peringkat

- What Is A Citizen CharterDokumen6 halamanWhat Is A Citizen CharterGanesh ShindeBelum ada peringkat

- Sample of Notarial WillDokumen3 halamanSample of Notarial WillJF Dan100% (1)

- The Contemporary Global GovernanceDokumen12 halamanThe Contemporary Global GovernanceSherilyn Picarra100% (1)

- POCSODokumen12 halamanPOCSOPragya RaniBelum ada peringkat

- Ratio AnalysisDokumen36 halamanRatio AnalysisHARVENDRA9022 SINGHBelum ada peringkat

- 1788-10 Series 310 Negative Pressure Glove Box ManualDokumen10 halaman1788-10 Series 310 Negative Pressure Glove Box Manualzivkovic brankoBelum ada peringkat