Global Inves

Diunggah oleh

blueraincapitalDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Global Inves

Diunggah oleh

blueraincapitalHak Cipta:

Format Tersedia

EQUITY

9 April 2015

Extract from a report

Global Investment Banks

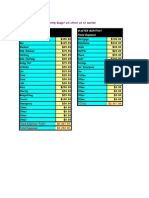

Global IBs: Positive quarter for trading but lack of capital is the key issue

Q1 should be a decent quarter JPM will kick off the global investment banks Q1

earnings season on 14 April. Q1 15 equity and FICC trading revenues in investment banking

Stock selection

are widely anticipated to be healthy (consensus = up mid-high single-digit percentage points

Preferred

yoy), while advisory revenues should be stable. However, weak underwriting revenues, a low

interest rate environment, weak mortgage revenues (US), catch-up litigation expenses (EU)

Bank of America

Barclays

JP Morgan

UBS

would be key offsets. Importantly, we continue to see lack of adequate capital as a key

structural concern, exacerbated by continuing regulatory burdens (e.g. trading book review).

Least preferred

Credit Suisse

Deutsche Bank

Goldman Sachs

See here for our detailed report. Robust trading revenues in Q1 15 are therefore likely to be a

passing phase in a general downtrend. We reiterate our preference for business models that

are more diversified, well capitalised and have manageable regulation/litigation risks.

We are buyers of BAC, BARC, JPM and UBS. BAC has sold-off 13% YTD (vs down 3% for

BKX), and is particularly compelling given our forecast 16e ROTNAV of 11% vs P/16e TNAV

of 0.9x. BARC and UBS are attractive self-help restructuring stories in our view;

management should be able to improve ROTNAVs to drive a re-rating of P/TNAVs. JPM is

well placed to benefit from an improvement in the global macroeconomic environment, and

looks attractively valued on forward ROTNAV in our view.

We are sellers of CS, DBK and GS. CS, DBK and GS have weak capital adequacy in various

guises. We see capital deficits of CHF6.5bn at CS and 5bn at DBK to reach minimum

leverage ratio requirements. At GS, the CCAR/stress test has severely reduced buyback

capacity and therefore future EPS accretion (see here) We are also sellers of WFC given

slowing earnings growth and expensive valuation (click here for detailed report).

We update our EPS for several stocks. Please see page 4-6 for details. There are only

very modest changes to our EPS forecasts. There are no changes to our target prices or

recommendations.

Key recommendations

Company

07/04/15

Pricing

Curr

Reco

Target

Price

P/TVNAV ROTNAV

12m

12m

fcast div

TSR

15e

Bank of America

15.46

USD

Buy

19.0

0.20

24%

0.95

Citigroup

51.52

USD

Hold

55.0

0.16

7%

0.83

Barclays

258

P/E

Comments

ratio

10.0% 10.9 Cleaner turnaround in profitability, RoTE to rise to to11% in FY15

9.1% 10.0 EM growth risks and lower US exposure

GBp

Buy

320.0

8.00

27%

0.85

10.4% 8.4 Non-core run-off will move group towards cores 12% RoTE

Credit Suisse

26.85

CHF

Sell

15.5

0.35

-41%

1.26

12.6% 10.5 Weak CET1 leverage ratio points to equity deficit. RMBS fines a concern

Deutsche Bank

33.15

EUR

Sell

23.0

0.75

-28%

0.83

8.3% 10.1 Weak leverage ratio points to equity raise. Litigation for MBS mis-selling

Goldman Sachs

192.39

USD

Sell

149.0

2.50

-21%

1.17

10.2% 11.6 Expensive. mRWA inflation concerns. Capital return policy under pressure

JP Morgan

60.85

USD

Buy

69.0

1.72

16%

1.27

12.6% 10.6 Capital optimisation and expense savings are key areas of focus.

Morgan Stanley

35.94

USD

Hold

37.0

0.55

5%

1.13

9.1% 13.0 Attractive WM strategy. Rally leaves little value in the stock though

UBS

18.75

CHF

Buy

23.0

0.50

25%

1.55

16.3% 10.0 Great WM business. Litigation & leverage concerns should alleviate

Wells Fargo

54.02

USD

Sell

51.0

1.55

-3%

1.93

15.7% 13.2 Slowing earnings growth/quality, rising credit costs, expensive valuation

Equity analyst

Murali Gopal

(91) 80 2803 7319

Equity analyst

Andrew Lim

(44) 20 7676 6014

Equity analyst

Anubhav Srivastava

(91) 888 416 8685

Specialist sales

James Lloyd

(44) 20 7762 5426

murali.gopal@sgcib.com

andrew.lim@sgcib.com

anubhav.srivastava@sgcib.com

james.d.lloyd@sgcib.com

Societe Generale (SG) does and seeks to do business with companies covered in its research reports. As a result, investors should be aware

that SG may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in

making their investment decision. PLEASE SEE APPENDIX AT THE END OF THIS REPORT FOR THE ANALYST(S)

CERTIFICATION(S), IMPORTANT DISCLOSURES AND DISCLAIMERS AND THE STATUS OF NON-US RESEARCH ANALYSTS.

This document is being provided for the exclusive use of TONY TANAKA (JI-ASIA GROUP)

Global Investment Banks

9 April 2015

This document is being provided for the exclusive use of TONY TANAKA (JI-ASIA GROUP)

Global Investment Banks

Contents

Key SG bank sub-sector calls ............................................................................................... 4

Q1 15 earnings calendar ....................................................................................................... 5

Earnings estimates fine tuned; target price and rating remain unchanged ............................. 5

SG estimates versus consensus (Q1 15) ............................................................................... 6

Key recommendations .......................................................................................................... 8

Global IBs set for revenue boost from trading................................................................... 11

US banks: net interest revenues should be weak ................................................................ 16

Asset management: Strong flows in the US; markets up sharply in Europe ......................... 18

Global IBs: Structural issues still at play .............................................................................. 19

Leverage ratios: Key differentiator among UBS, CSG and DBK ........................................... 19

US Banks: 2015 CCAR cloud clears but increased G-SIB surcharges ahead ...................... 20

Litigation monitor ................................................................................................................ 22

Stock performance in Q1 15 European IBs prevail ........................................................... 23

Company section ................................................................................................................ 25

Bank of America Buy........................................................................................................ 25

Barclays -- Buy ................................................................................................................... 27

Citigroup Hold .................................................................................................................. 29

Credit Suisse Sell ............................................................................................................. 31

Deutsche Bank Sell .......................................................................................................... 33

Goldman Sachs Sell ......................................................................................................... 35

JP Morgan Buy ................................................................................................................ 37

Morgan Stanley Hold ........................................................................................................ 39

UBS Buy .......................................................................................................................... 41

Wells Fargo Sell ................................................................................................................ 43

9 April 2015

This document is being provided for the exclusive use of TONY TANAKA (JI-ASIA GROUP)

Global Investment Banks

Key SG bank sub-sector calls

Key SG bank sub-sector calls

2015 OUTLOOK

Benelux &

Germany

KEY CALLS

BUY

SELL

ING, CBK

ACA

BARC,

LLOY

BOI

- Funding costs and restructuring to drive EPS upgrades

- Sound credit quality and capital

- Funding costs and restructuring to drive EPS upgrades

France

PREFERRED

- Sound credit quality and capital

- An increasing focus on capital return

UK:

Domestic

- Further deposit repricing likely, accelerated by eventual rate rises

- Election (May) too tight to call, could bring volatility

US:

Universal

- Return to healthy earnings growth, and greater consistency

- Revenue growth outlook positive; pick-up in loan growth and higher ST

rates

JPM,

BAC

WFC

- Higher AUM driven by rising markets and net new money

Wealth Mgmt

UBS

Akbank, Yapi

Kredi

Bank Pekao

SA

ISP,

UBI

POP,

Caixabank

BKT

HSBC

BARC

CSGN, DBK,

GS

- Wealth management benefits from operating leverage and rising rates

- Poland: Low interest rates put pressure on NIM. Russia: Visibility very

low.

- Turkey: steady recovery. Other CEE: waiting for loan demand to

recover.

NEUTRAL

CEE

- ISP safer and cheaper way to play peripheral banks

Italy

- UBI best small play in Italy. Huge discount to Spanish domestic

Spain:

Domestic

- Valuations discount blue sky scenario in some names

- Revenue expectations starting to improve from a low base, US rate

rises would help

UK:

Asian

LEAST

PREFERRED

- Domestic conditions improving

- Continued restructuring to offset rising cost of being international

Investment

Banks

- Trading weakness on rising US rates and volatility spikes

- Regulation and litigation a struggle: leverage, MBS/CDO mis-selling

- Earnings healthy in Norway and corporate Sweden

Nordics

DNB

- Risk of volume slowdown and limited cost extraction opportunities

Nordea

- Diversified earnings stream

Spain: Large

- Potential earnings downgrade due to EM exposure

Source: SG Cross Asset Research/Equity

9 April 2015

This document is being provided for the exclusive use of TONY TANAKA (JI-ASIA GROUP)

BBVA

Global Investment Banks

Q1 15 earnings calendar

Tuesday 14 April

Wednesday 15 April

Thursday 16 April

JPM

BAC

Citi

GS

MS

Call: 8:30 am (EST)

Call: 8.30 am (EST)

Call: 11.00 am (EST)

Call: 9:30am EST

Call: 8:30am EST

(866) 541-2724 (US/Can)

877-200-4456 (US)

(866) 516-9582 (US/Can)

888-281-7154 (US)

877-895-9527 (US)

(866) 786-8836 (US/Can)

785.424.1732 (Intl)

(973) 409-9210 (Int)

706-679-5627 (Intl)

706-679-2291 (Intl)

(706) 634-7246 (Intl)

Conference ID: 79795

Conference ID: 90108772

Tuesday 21 April

Wednesday 29 April

CS

BARC

WFC

Monday 20 April

Passcode: 19351679

Tuesday 5 May

DBK

UBS

Call: 10 am EST

866-872-5161 (US/Can)

706-643-1962 (Intl))

Source: Company site, SG Cross Asset Research/Equity

Earnings estimates fine tuned; target price and

rating remain unchanged

Q1 15

FY15

FY16

Target price

Rating

New

Old

New

Old

New

Old

New

Old

Old

New

JPM $

1.40

1.35

5.72

5.74

6.48

6.50

69.00

69.00

Buy

Buy

BAC $

0.30

0.31

1.42

1.44

1.67

1.68

19.00

19.00

Buy

Buy

29.85

29.85

36.31

36.31

320.00

320.00

Buy

Buy

5.18

5.23

5.52

5.55

55.00

55.00

Hold

Hold

Sell

BARC (GBP)

Citi $

1.38

1.35

Wells $

1.00

0.99

4.12

4.12

4.53

4.53

51.00

51.00

Sell

GS $

4.10

4.47

16.50

16.10

17.57

16.90

149.00

149.00

Sell

Sell

MS $

0.77

0.78

2.77

2.78

3.17

2.95

37.00

37.00

Hold

Hold

CSG (CHF)

0.67

0.66

2.51

2.44

2.49

2.43

15.50

15.50

Sell

Sell

DBK (EUR)

1.11

1.14

3.22

3.28

3.51

3.63

23.00

23.00

Sell

Sell

UBS (CHF)

0.41

0.40

1.86

1.82

2.07

2.00

23.00

23.00

Buy

Buy

Source: SG Cross Asset Research/Equity

9 April 2015

This document is being provided for the exclusive use of TONY TANAKA (JI-ASIA GROUP)

Global Investment Banks

SG estimates versus consensus (Q1 15)

SG estimates versus consensus (Q1 15)

BAC

SG est.

Per share items

JPM

Cons. SG est.

Citi

Cons. SG est.

WFC

Cons. SG est.

GS

Cons. SG est.

MS

Cons. SG est.

UBS

Cons. SG est.

CS

Cons. SG est.

DB

Cons. SG est.

Cons.

CHF

CHF

CHF

CHF

EUR

EUR

EPS

0.30

0.30

1.40

1.39

1.38

1.39

1.00

0.98

4.10

4.09

0.77

0.77

0.41

0.35

0.67

0.70

1.11

0.98

Dividends per share

0.05

0.05

0.40

0.41

0.01

0.02

0.35

0.35

0.60

0.61

0.10

0.11

0.13

0.00

0.00

Book value per share

22.1

21.6

58.4

58.2

67.6

67.3

32.2

32.8

165.3

165.7

35.2

33.9

13.4

26.8

50.1

Tangible BVPS

15.1

14.7

45.3

45.2

58.3

58.1

27.2

27.2

156.0

155.8

30.4

29.1

11.6

21.2

39.3

3,757

P&L statement ($m)

Net interest income

925

611

1,749

1,990

Non-interest income

12,045 11,442 14,039 13,053

9,252

7,688 10,129 10,009

8,422

8,397

5,594

3,974

Revenue

21,297 21,362 25,013 24,379 19,835 19,903 21,129 21,238

9,347

Loan loss provision

9,902 10,974 11,145 11,870 11,914 11,000 11,215

782

Non-interest expense

701

1,036

931

7,965

2,220

1,929

622

9,083

9,008

9,304

585

7,343

7,734

83

15,295 15,266 14,876 14,963 11,435 11,568 12,136 12,523

6,394

6,655

5,963

4,866

6,535

28

6,253

8,623

8,797

396

4,534

6,660

Pre-tax profit

5,220

5,383

9,101

8,176

6,180

6,396

8,371

8,043

2,953

2,905

2,353

2,409

1,090

882

1,402

1,379

1,567

1,386

Net income

3,416

3,487

5,244

5,371

4,316

4,268

5,609

5,163

1,884

1,857

1,523

1,551

1,560

661

1,090

1,229

1,571

1,338

NIM %

2.08

2.24

2.08

2.13

2.83

2.94

2.96

3.02

0.46

NA

0.00

NA

1.12

1.51

3.00

ROTE %

8.89

8.06

12.69

12.27

9.92

9.56

15.55

14.37

10.82

10.51

10.40

10.56

14.88

12.61

11.68

ROA %

0.64

0.69

0.90

0.87

0.93

0.94

1.32

1.26

0.88

0.87

0.73

0.78

0.28

Efficiency ratio %

71.1

70.6

59.5

60.8

57.7

57.6

57.4

58.9

68.4

NA

73.9

NA

85.2

Ratios

0.44

76.0

0.25

77.2

Source: SG Cross Asset Research/Equity, SNL Factset and Bloomberg estimates for consensus

SG estimates versus consensus (2015)

BAC

JPM

Citi

WFC

GS

MS

UBS

CS

DB

BARC

SGe

Cons.

SGe

Cons.

SGe

Cons.

SGe

Cons.

SGe

Cons.

SGe

Cons.

SGe

Cons.

SGe

Cons.

SGe

Cons.

SGe

CHF

CHF

CHF

CHF

EUR

EUR

EPS

1.42

1.40

5.72

5.77

5.18

5.34

4.12

4.16

16.50

17.28

2.77

2.89

1.86

1.22

2.51

2.20

3.22

3.18

29.85

25.00

DPS

0.20

0.24

1.72

1.71

0.16

0.24

1.55

1.47

2.50

2.46

0.55

0.55

0.50

0.77

0.35

0.89

0.75

1.93

10.00

8.60

BVPS

23.3

22.6

61.1

61.3

71.3

72.2

33.0

34.4

176.0

174.9

36.3

36.5

13.9

13.4

26.4

50.1

346.2

343.4

TBVPS

16.3

15.6

47.8

48.1

62.0

62.7

28.0

28.8

167.1

164.2

31.7

31.7

12.0

20.9

39.3

300.0

Per share items

Cons.

P&L statement

NII

39,550 40,853

46,094 44,223 49,416 48,675 45,034 46,269

3,850

2,559

6,758

7,692

14,865

12,736

Non-interest inc.

45,717 45,377

55,161 53,808 28,922 29,291 41,631 41,316 29,888

32,853

22,018

15,363

17,282

13,627

Revenue

85,267 86,661 101,255 98,739 78,338 78,044 86,665 87,597 33,738 34,384 35,412 36,342 28,776 28,726

Impairment

3,333

3,397

4,409

4,178

9,041

8,190

2,752

2,686

26,362 25,850

272

106

1,525

2,088

24,954

20,892

27,980

17,637

Non-interest exp.

56,782 58,305

59,683 59,463 46,080 45,543 49,827 50,451 22,213

Pre-tax profit

25,152 24,597

37,164 34,024 23,217 24,722 34,086 34,227 11,526 12,250

8,565

9,235

3,822

4,573

2,057

4,727

2,642

4,642

6,696

6,512

Net income

15,754 15,950

21,341 21,928 16,166 16,268 22,846 21,927

7,868

5,420

5,758

7,078

4,587

4,321

4,434

4,447

4,693

4,555

4,047

7,268

26,847

23,055 24,645 32,147 32,717

Ratios

NIM %

2.19

2.24

2.13

2.11

2.92

2.90

3.00

3.01

0.48

NA

0.00

NA

1.10

1.55

2.97

2.97

ROTE %

9.96

8.98

12.61

12.00

9.11

8.51

15.73

14.43

10.22

10.53

9.13

9.12

16.3

12.58

8.27

10.45

ROA %

0.73

0.78

0.90

0.87

0.87

0.88

1.25

1.30

0.84

0.91

0.62

0.73

0.37

Efficiency ratio %

65.9

66.9

58.9

60.6

58.8

58.7

57.5

57.5

65.8

NA

75.8

NA

86.7

0.47

0.11

90.6

0.00

0.11

87.0

Source: SG Cross Asset Research/Equity, SNL Factset and Bloomberg estimates for consensus.

9 April 2015

This document is being provided for the exclusive use of TONY TANAKA (JI-ASIA GROUP)

0.39

82.0

66.9

0.33

Global Investment Banks

SG estimates versus consensus (2016)

JPM

Citi

WFC

SGe

Cons.

BAC

SGe

Cons.

SGe Cons.

SGe Cons.

EPS

1.67

1.64

6.48

6.45

5.52

5.86

DPS

0.26

0.33

1.85

1.85

0.30

BVPS

25.0

24.1

65.3

65.5

76.7

TBVPS

17.9

17.0

51.9

52.1

67.1

NII

43,099 43,360

Non-interest inc.

48,389 47,874

Revenue

91,488 91,390 108,942 104,411 82,445 81,170 92,484 93,346 34,480 35,969 37,196 39,177 31,028 30,169

Per share items

GS

MS

UBS

CS

SGe

Cons.

SGe Cons.

SGe Cons.

SGe Cons.

SGe

Cons.

DB

SGe

BARC

CHF

CHF

CHF

CHF

EUR

EUR

4.53

4.54

17.57

18.45

3.17

3.27

2.07

1.56

2.49

2.67

3.51

3.83

36.31

29.60

0.72

1.70

1.57

2.70

2.73

0.70

0.70

1.80

1.15

0.50

1.31

0.80

1.11

13.00

11.30

77.8

34.3

36.8

188.7

189.5

38.1

39.2

13.9

13.9

28.6

52.3

364.8

353.9

68.6

29.2

31.2

180.5

178.5

33.6

34.4

12.0

23.0

41.5

322.0

50,249

47,186 52,186 51,298 48,381 50,034

4,548

2,757

6,611

7,960

14,843

13,699

58,693

56,514 30,259 29,638 44,103 43,244 29,932

34,440

24,417

15,897

17,400

13,751

Cons.

P&L statement

Impairment

4,461

5,293 10,158

9,523

3,859

4,094

28

23,857 25,382 32,243 33,338

Non-interest exp.

58,006 58,043

62,222

60,484 46,645 45,789 52,079 52,157 22,668

Pre-tax profit

29,021 28,466

41,525

37,594 25,642 26,025 36,547 36,789 11,812 12,920

9,527 10,400

7,324

6,697

6,007

6,482

6,205

7,499

8,972

8,117

Net income

18,262 18,191

23,837

24,099 16,715 17,144 24,520 23,515

8,308

6,093

6,511

7,887

5,845

4,288

4,933

4,953

5,627

6,003

4,863

7,460

23,704

1,468

26,522

5,196

27,669

101

27,450

4,774

17,749

2,197

24,570

16,340

Ratios

NIM %

2.28

2.32

2.22

2.20

3.00

2.96

3.16

3.10

0.55

NA

0.00

NA

1.12

1.64

3.00

3.19

ROTE %

10.72

9.60

13.16

12.37

8.90

8.54

16.49

14.54

10.03

10.33

9.80

9.51

18.1

12.21

8.89

11.96

ROA %

0.81

0.88

0.97

0.94

0.87

0.91

1.28

1.32

0.84

0.94

0.65

0.78

0.74

Efficiency ratio %

62.7

62.9

57.1

57.8

56.6

56.9

56.3

55.7

65.7

NA

74.4

NA

76.4

0.68

0.53

74.4

0.00

0.25

76.2

Source: SG Cross Asset Research/Equity, SNL Factset and Bloomberg estimates for consensus.

9 April 2015

This document is being provided for the exclusive use of TONY TANAKA (JI-ASIA GROUP)

0.51

74.0

59.5

0.41

Global Investment Banks

Key recommendations

Global Investment Banks and US Universal Banks Buy recommendations

SG View

Bank of America

Analyst: Murali Gopal

Ticker: BAC US

Buy

Target price: $19

SG View Q1 earnings expectations

A much cleaner turnaround in profitability is

expected, and we forecast RoTE to rise to

to11% in FY16.

In the near term: cost savings, asset

management, primary markets business and a

pick-up in loan growth should support

earnings growth.

Over the medium term: as short-term interest

rates rise, the banks market-leading deposit

franchise should support NII growth.

JP Morgan

Analyst: Murali Gopal

Ticker: BAC US

Buy

Target price: $69

BUY

Barclays

Analyst: James Invine

Ticker: BARC LN

Buy

Target price: GBP 320

UBS

Analyst: Andrew Lim

Ticker: UBSG VX

Buy

Target price: CHF23.00

The bank is in our view best placed to benefit

from a robust macroeconomic recovery. Most

asset-sensitive among the largest banks

although larger non-core deposits, which

should run-off.

Could accelerate exit from its large non-core

loan book (c. 19% of total) as asset valuations

continue to improve.

Faced with a steep increase in GSIB buffer

(4.5% vs 2.5%), capital optimisation and

expense savings are key areas of focus.

However, GSIB buffer likely to restrict any

meaningful upside to current payout nearterm.

Strong self-help deleveraging story as NonCore shrinks (2014 alone saw leverage

exposure fall from ~480bn to 277bn)

Core businesses generate 12% RoTE thanks

to high return UK, Africa, cards; IB a drag but

FICC now only 12% of group revenues

I-Bank headwinds of litigation and

restructuring should recede, but a double-digit

RoTE looks difficult without further balance

sheet restructuring

Litigation risks remain high for FX fines and

perhaps also US CDO mis-selling (fourth

largest player in 2006/7); we forecast a further

4bn provisions 2015-17e.

Undervalued versus 2015e ROTNAV of 16%

and 2016e of 18%. Significant excess capital

as RWA and leverage exposure reduces, even

with new leverage ratio rules.

Unrecognised DTA of CHF23bn can be utilised

via the P&L, therefore supporting equity and

CET1 growth. Potential for DTA recognition to

increase due to extension of profit recognition

period.

We see payout ratio of 75% in 2015 and at

least 100% for 2016-18.

Litigation risk is high, but alleviating as FX

fines comes through lower than expected.

RMBS fines should be relatively small (we

estimate CHF2bn in 2015). UBS was a small

CDO player in 2006/7.

New leverage ratio rules in 2015 are an

uncertain overhang risk.

NII should be under pressure as the ten-year

yields were down 23bp qoq. However, the

combination of improving asset inflows, FICC

trading and cost savings should support

earnings growth.

Key positive would be an improvement in the

loan growth as the bank has been re-positioning

its balance sheet and also seems to be losing

market share.

Another positive would be any commentary on

the outlook for credit costs the current outlook

is for costs to rise substantially. FX-related

litigation expense is possible.

Lastly, operating RWAs are set to rise although

should be manageable as the bank just last

month received approval for its capital plan.

FICC trading should be solid and up high-single

digit rate despite the sale of the 'physical

commodities' business.

Loan growth should also be solid although noncore book continues to be significant.

Expect non-core spending to pick up as the

bank begins implementing its business

simplification and business/product exits plans

with an expected cost savings of $4.8bn over

time.

We expect Non-Core leverage exposure to print

250bn (Dec 2014:277bn), benefiting from the

Spanish sale in January (14bn).

In the retail/commercial businesses we expect

reasonable volume growth, while Africa's

reported numbers should benefit from the first

quarter of ZAR/GBP stability for several years.

We expect FICC revenues to be about flat:

positive backdrop but restructuring disruption

began towards the end of Q1 14; we may see

further hints of balance sheet reduction to be

announced H2 15

Strong equity markets should have benefited

AUM and wealth margin.

Expect DTA recognition to continue to boost

earnings.

Greater clarity on FX fines likely to result in

reduced COE.

Excess capital expected to build despite

tougher Swiss leverage ratio requirements.

Source: SG Cross Asset Research/Equity

9 April 2015

This document is being provided for the exclusive use of TONY TANAKA (JI-ASIA GROUP)

Global Investment Banks

Global Investment Banks Sell recommendations

SG View

Credit Suisse

Analyst: Andrew Lim

Ticker: CSGN VX

Sell

Target price: CHF15.50

Deutsche Bank

Analyst: Andrew Lim

Ticker: DBK GY

SELL

Sell

Target price: EUR23.00

Goldman Sachs

Analyst: Andrew Lim

Ticker: GS US

Sell

Target price: $149

Wells Fargo

Analyst: Murali Gopal

Ticker: WFC US

Sell

Target price: $51

SG View Q1 earnings expectations

Weak CET1 leverage ratio of 2.5%. Likely

increase in minimum requirements under new

Swiss legislation points to need for equity raise.

We estimate c.CHF6.5bn if CET1 leverage ratio

increases to 3.5% (currently 2.4%).

I-Bank is much more exposed to Emerging

Markets versus peers (c. 11% of I-Bank net profit

on our estimates). Credit and Securitised Product

revenues likely under pressure when US interest

rates increase.

Uncertainty from new Swiss leverage rules, but

these may be less onerous than expected.

We expect CSG benefitted lesser than peers from a

pickup in trading revenues given relatively smaller

presence in macro products. Also, flow credit and

securitised products appear to have weakened again

in Q1 15, areas where CSG has greater exposure.

New Swiss leverage rules have been pushed to yearend. However, the new CEO may bring forward a

dilutive equity raise to improve the weak CET1

leverage ratio, which will impact ROE.

RMBS litigation provisions are significantly underestimated by consensus.

We are more negative than consensus on

FX and rates volatility should be a positive for

earnings forecasts due to weaker revenue growth

revenues in the short term but weak leverage ratio

and cost management.

will drive further business contraction in the longer

A weak leverage ratio (SGe 3.6% at end-2015)

term.

points to another equity raise of c.EUR5bn to

Consensus has under-estimated provisions for US

reach 4.0%.

RMBS issues in our view, exacerbated by the

Fines for RMBS/CDO mis-selling might be

strengthening in the US/ exchange rate.

significantly more than expected. We factor in

Any strategic announcement regarding

EUR3bn for 2015. Likely fines for OFAC (we factor

divestment/restructuring has already been priced-in

in EUR1.5bn) is another overhang risk, although

in our view and will likely disappoint high

risk from FX fines looks to be low.

expectations.

Meaningful exposure to Emerging Markets in Ibank versus peers

GS is an expensive stock, trading at 1.2x TNAV

Trading revenues is relatively large proportion of total

for a 2015e ROTNAV of only 10.4%. We see

revenues, and along with the primary markets

headwinds for FICC trading revenues

business is likely to contribute to a good quarter.

(commodities revenues under regulatory pressure)

However, faced with regulatory constraints, the

and Investment & Lending revenues, (which

earnings contribution from investment and lending

should suffer pressure from implementation of the

business should steadily decline.

Volcker rule).

We also expect greater clarity on the buyback

We believe GS' current aggressive capital return

potential post-CCAR, which is likely to be

strategy needs to be reined in, which will reduce

significantly lower (than last year), and we believe

EPS accretion.

market expectations.

Significant market RWA inflation risk from the

Trading Book review.

With the near-term outlook challenging, we

Expect EPS growth to turn negative (yoy) for the first

expect profitability to decline in FY15.

time in several years. With loan growth (commercial)

Slowing earnings growth, deterioration in the

already being solid, a pick-up in consumer growth

quality of earnings, loan growth largely limited to

(jumbo mortgages) will be important in the absence

low-yielding assets, continuing NIM pressure, loss

of a pickup in NIM near-term.

absorbing capital issuance, and rising loan loss

NCOs were at historically low levels (35bp) in Q4

provision costs are some of the headwinds.

we expect it to have bottomed. Loan-loss provisions

Valuation multiples have continued to expand,

should rise should the consumer (cards) loan growth

and at current levels we see little potential for

improve.

further re-rating of the stock.

Expense ratio has remained stubborn, and any

decline would be positive.

Faced with revenue pressure, we expect investment

income and some reserve releases to support

earnings.

Source: SG Cross Asset Research/Equity

9 April 2015

This document is being provided for the exclusive use of TONY TANAKA (JI-ASIA GROUP)

Global Investment Banks

Global Investment Banks Hold recommendations

SG View

Citi

Analyst: Murali Gopal

Ticker: C US

Hold

Target price: $55

HOLD

Morgan Stanley

Analyst: Andrew Lim

Ticker: MS US

Hold

Target price: $37

SG View Q1 earnings expectations

2015 capital plan was approved but EM growth

Expect a noisy quarter as various consumer nonrisks and lower US exposure should keep RoTE

core consumer businesses are included under

subdued.

'Citi Holdings'.

Ongoing repositioning should result in substantial

Key positive would be a pick-up in consumer

expense savings but fall through to the bottom-line

spending translating in to higher card balances.

is expected to be only a small proportion.

Unlike, its peers, we expect FICC trading

Unlikely to reach Citicorps efficiency target (midrevenues to be weak, in part we believe related

50%) in FY15.

to the losses around Swiss franc volatility.

Expect sharp rise in GSIB surcharge (3.5% vs 2% Details on the ongoing divestment plans and cost

currently).

savings will be important.

Expect litigation expenses to fall substantially

and closer to a more normalised level.

Impressive re-orientation of the group towards

Asset (and wealth) management likely had a

wealth management with the purchase of the

good quarter with positive flows, and strong

Smith Barney JV. Has achieved increase in WM

European equity markets.

margins as free deposits have been deployed into Continued deployment of deposits should remain

higher yielding assets and as greater penetration of

a positive.

the WM client base is achieved (particularly with

Any additional target for FICC RWA reduction

respect to securities-backed lending).

would be a positive but unlikely, in our view.

Attractive capital build as CET1 and leverage ratios

increase. Potential further release if low return FIC

operations are restructured.

mRWA inflation risk from the trading book review

could limit capital return. MS still has significant

RWA tied up in the low return FIC business.

Hold recommendation reflects full valuation for

turnaround efforts.

Source: SG Cross Asset Research/Equity

9 April 2015

10

This document is being provided for the exclusive use of TONY TANAKA (JI-ASIA GROUP)

Global Investment Banks

Global IBs set for revenue boost from trading

Over the past several quarters, FICC trading (and latterly equities trading) has been adversely

impacted by the lack of volatility. This seems to have changed with reasonable levels of

volatility across several asset classes. We expect trading revenues to have been robust, up

mid-to-high single-digit percentage points yoy and macro, within that (rates and currency) to

have been particularly strong.

However, flow credit and securitised products look to have been weaker yoy for the second

quarter in a row. ECM and DCM revenues also look like they will be softer yoy by high

single/low double-digit percentage points. We believe ECM has suffered from a change in

product mix, with weaker high-margin IPO business offsetting the strength seen in the lowermargin equity issuance business. In DCM, investment grade spreads have tightened even

further, more than offsetting decent volumes.

Overall, business models continue to be re-sized. US banks seemed to be gaining market

share for a while but that seems to be easing. While the US banks are well capitalised, capital

requirements are moving higher (driven by G-SIB and CCAR regulations). Picking up market

share is no longer a priority. Instead, capital optimisation and RoE are more important.

MOVE Index (treasury market volatility)

Currency Volatility Index

12

125

11

10

100

9

8

75

7

6

50

5

25

Mar 12

Sep 12

Mar 13

Sep 13

Mar 14

Sep 14

Mar 15

4

Mar 12

Sep 12

Mar 13

Sep 13

Mar 14

Sep 14

Mar 15

Source: Bloomberg and SG Cross Asset Research/Equity

Commodity Volatility Index

Credit spreads (bp)

160

20

140

120

16

100

80

60

12

40

20

4

Mar 12

Mar 13

Sep 13

Mar 14

Sep 14

ITRX EUROPE (EUR)

ITRX ASIAXJ (USD)

Mar 15

ITRX EUR SNR (EUR)

Source: Bloomberg and SG Cross Asset Research/Equity

9 April 2015

Apr-15

Jan-15

Oct-14

Jul-14

Jan-14

Sep 12

Apr-14

11

This document is being provided for the exclusive use of TONY TANAKA (JI-ASIA GROUP)

Global Investment Banks

US Bond markets (average daily trading volume), $bn

US: Stock market volume (daily average), millions of shares

6,000

900

800

5,000

700

Agency

600

4,000

Corporate

500

ABS

400

Non-Agency (MBS)

300

Agency MBS

200

Treasury

100

Municipal

DirectEdge

BATS**

3,000

NASDAQ

2,000

AMEX/ARCA*

NYSE

1,000

0

Q1 14

Q2 14

Q3 14

Q4 14

Q1 15

(Jan-Feb)

Q1 14

Q2 14

Q3 14

Q4 14

Q1 15 (JanFeb)

Source: SIFMA and SG Cross Asset Research/Equity

VIX Index (S&P 500 equity market volatility)

European market volatility (VDAX Index)

32

24

22

28

20

24

18

20

16

16

14

12

12

10

Mar 12

Sep 12

Mar 13

Sep 13

Mar 14

Sep 14

8

Mar 12

Mar 15

Sep 12

Mar 13

Sep 13

Mar 14

Sep 14

Mar 15

Source: Bloomberg and SG Cross Asset Research/Equity

Cash equities Xetra

6.0

ADV traded (bn)

Cash equities Euronext

% change (RHS)

60%

9.0

ADV traded (bn)

Cash equities LSE

% change (RHS)

60%

6.0

8.0

ADV traded (bn)

% change (RHS)

60%

5.0

40%

4.0

7.0

40%

6.0

5.0

40%

4.0

5.0

3.0

20%

20%

4.0

2.0

3.0

0%

0%

1.0

1.0

-20%

20%

2.0

0%

2.0

1.0

0.0

3.0

0.0

-20%

0.0

Source: Xetra, Euronext, LSE and SG Cross Asset

Research/Equity,

9 April 2015

12

This document is being provided for the exclusive use of TONY TANAKA (JI-ASIA GROUP)

-20%

Global Investment Banks

Xetra Derivatives

Euronext Derivatives

ADNoC (m)

% change (RHS)

12.0

11.0

10.0

9.0

8.0

7.0

6.0

5.0

4.0

3.0

2.0

1.0

0.0

ADNoC (m)

% change (RHS)

0.8

40%

40%

0.7

0.6

20%

20%

0.5

0.4

0%

0.3

0%

0.2

-20%

0.1

-40%

Feb-15

Dec-14

Oct-14

Aug-14

Jun-14

Apr-14

Feb-14

Dec-13

Oct-13

Aug-13

Apr-13

Jun-13

-20%

Feb-13

0.0

Source: Xetra, Euronext, LSE, and SG Cross Asset Research/Equity

Who is best placed as volatility rises?

On the back of favourable volatility across several asset classes, FICC trading revenues

should see a pick-up. Within FICC, we expect macro products (FX and rates) to have

performed strongly, more than offsetting an expected slowdown in flow credit and structured

products. We expect JPM to report a strong quarter, unlike Citi. Also, DBKs large FX trading

platform is a positive. Meanwhile, CSG and BAC have large credit businesses, which are likely

to have been weak.

GS and DBK have the largest FICC trading revenues (as a proportion of total group revenues).

Also, year-on-year growth trends will be impacted by each banks growth in the same quarter

in the previous year. On that basis, the US IBs seem better placed (see charts on next page).

FICC trading revenues as a proportion of total group revenues

25%

20%

15%

10%

5%

0%

GS

DBK

CSG

Citi

JPM

MS

KN

BAR

BAC

CASA

Source: SG Cross Asset Research/Equity

9 April 2015

13

This document is being provided for the exclusive use of TONY TANAKA (JI-ASIA GROUP)

BNPP

UBS

Global Investment Banks

FICC trading revenue in Q4 14 (yoy growth) was weak, particularly for the US IBs

30.0%

20.0%

10.0%

0.0%

GS

BAC

JPM

BAR

Citi

MS

UBS

DBK

SG

BNPP

Natixis

CASA

CSG

BNPP

UBS

CASA

Natixis

-10.0%

-20.0%

-30.0%

-40.0%

Source: SG Cross Asset Research/Equity

FICC trading revenue in Q4 14 (qoq growth) US IBs are well placed to experience a rebound

20.0%

10.0%

0.0%

GS

MS

CSG

BAC

Citi

JPM

SG

DBK

BAR

-10.0%

-20.0%

-30.0%

-40.0%

-50.0%

Source: SG Cross Asset Research/Equity

9 April 2015

14

This document is being provided for the exclusive use of TONY TANAKA (JI-ASIA GROUP)

Global Investment Banks

Primary markets...mixed quarter ahead

Equity underwriting should be weak as IPO volumes have slumped. We also expect debt

underwriting to have been somewhat weak. However, advisory revenues likely held up well.

Global M&A Announced transactions (Q1 15), $bn

M&A advisor ranking (Q1 15), $m

1,800

A dv is e r

700

1,600

JP M o rgan

174,063

56

600

1,400

Go ldman Sachs

162,657

85

1,200

M o rgan Stanley

135,712

65

Lazard Ltd

126,078

45

B ank o f A merica M errill Lynch

112,492

51

HSB C

100,588

19

Centerview P artners LLC

99,916

11

Deutsche B ank

76,161

36

800

Volume (LHS)

Deal Count (RHS)

500

1,000

400

800

300

600

200

400

100

200

0

1Q09

2Q09

3Q09

4Q09

1Q10

2Q10

3Q10

4Q10

1Q11

2Q11

3Q11

4Q11

1Q12

2Q12

3Q12

4Q12

1Q13

2Q13

3Q13

4Q13

1Q14

2Q14

3Q14

4Q14

1Q15

T o t a l D e a l V a lue

R a nk

D e a l C o unt

Credit Suisse

72,704

30

So merley

70,586

10

17

Source: Bloomberg and SG Cross Asset Research/Equity

Q1 15 global equity underwriting volume, $bn (follow-on

offerings likely were strong but IPOs down)

U.S.

350

Global equity underwriter ranking (Q1 15)

E quit ie s

Unde rwrit e r

Rest of the world

300

250

A m o unt

R a nk

Is s ue s

Go ldman Sachs

20,858

76

UB S

16,603

61

M o rgan Stanley

16,080

94

JP M o rgan

15,756

98

B ank o f A merica M errill Lynch

14,864

81

Deutsche B ank

11,303

55

Citi

10,465

69

Credit Suisse

10,203

58

200

150

100

50

1Q08

2Q08

3Q08

4Q08

1Q09

2Q09

3Q09

4Q09

1Q10

2Q10

3Q10

4Q10

1Q11

2Q11

3Q11

4Q11

1Q12

2Q12

3Q12

4Q12

1Q13

2Q13

3Q13

4Q13

1Q14

2Q14

3Q14

4Q14

1Q15

B arclays

9,324

49

RB C Capital M arkets

4,340

10

44

Source: Bloomberg and SG Cross Asset Research/Equity

Corporate and international bonds underwriting volume ($bn)

Bond underwriter ranking (Q1 15), $m

3,000

Global Corporate bonds

International Bonds

C o rpo ra t e bo nds Unde

A m orwrit

unt e r

Int e rna t io na l bo nds Unde A

rwrit

m oeunt

r

2,500

2,000

1,500

1,000

500

1Q15

4Q14

3Q14

2Q14

1Q14

4Q13

3Q13

2Q13

1Q13

4Q12

3Q12

2Q12

1Q12

JP M o rgan

83,023

B arclays

84,000

B ank o f A merica M errill Lynch

66,216

JP M o rgan

83,996

Citi

65,504

Citi

74,957

Deutsche B ank

59,601

Deutsche B ank

72,563

M o rgan Stanley

57,458

HSB C

B arclays

57,185

Go ldman Sachs

54,685

Go ldman Sachs

51,271

B ank o f A merica M errill Lynch

53,679

HSB C

49,157

M o rgan Stanley

49,826

Credit Suisse

45,326

Credit Suisse

45,741

Wells Fargo

32,908

B NP P aribas

43,988

Source: Bloomberg and SG Cross Asset Research/Equity

9 April 2015

15

This document is being provided for the exclusive use of TONY TANAKA (JI-ASIA GROUP)

71,118

Global Investment Banks

US banks: net interest revenues should be weak

US loan growth: Home mortgages (overall) show some revival

Europe loan growth: ECB survey shows recovery

14%

60

12%

40

10%

20

8%

0

%

6%

-20

4%

-40

2%

-60

0%

Total loans

C&I

Home mortgages

Demand

Jan-15

Jan-14

Jan-13

Jan-12

Jan-11

Jan-10

Jan-09

Credit cards

-4%

Jan-08

CRE

-80

Jan-07

Q1 15 (JanFeb)

Jan-06

Q4 14

Jan-05

Q3 14

Jan-04

-2%

Q2 14

Jan-03

Q1 14

Supply

Source: Federal Reserve, ECB, and SG Cross Asset Research/Equity

US Banks: Loan growth (reported)

Q2 14

US Banks: Non-core loans proportion of total

Q3 14

Q4 14

21.7%

5.3%

4.0%

18.3%

4.0%

3.7%

3.0%

13.9%

2.6%

2.0%

JPM

11.3%

BAC

Citi

-0.6%

7.0%

5.4%

4.0%

Wells

9.8%

-1.0%

-3.1%

JPM

BAC

Citi

WFC

-4.6%-5.0%

Q4 13

Q4 14

Source: SG Cross Asset Research/Equity

Although loan growth appears decent (see above), the low interest rate environment is likely to

have kept NII subdued. Also, Q1 is seasonally weak given two less days for interest accrual

during the quarter. In the case of BAC, we further expect greater headwind from the

amortisation of bond premium. The ten-year treasury yield ended 23bp lower compared with

the end of Q4, although the decline was slower than it was in Q4 14 when the yield was 35bp

lower.

The outlook for spread revenues should pick up as loan growth remains healthy, although only

gradually as growth is largely been confined to some of the lower yielding categories, i.e. C&I

and CRE. While auto loans have been very positive, consumer loan growth in general has

remained challenging, particularly credit cards. The trend in credit card balances would be a

key indicator to note in Q1.

Also, with treasury yields heading lower during the quarter, opportunity for re-investments

within the securities portfolio was limited.

9 April 2015

16

This document is being provided for the exclusive use of TONY TANAKA (JI-ASIA GROUP)

Global Investment Banks

US 10-year Treasury yield has fallen further

%

3.2

Fed funds rate (SG economist forecast)...we see limited upside

to FY15 NIM

Fed f unds rate

Average rate

1Q15: 1.97%

4Q14: 2.28%

3Q14: 2.50%

2Q14: 2.62%

1Q14: 2.77%

3.0

2.8

%

6.0

Libor 3m (USD)

SG Eco team av g. est. (Fed rate)

5.0

2.6

4.0

2.4

3.0

2.2

2.0

2.0

1.0

1.8

2017e

2016e

2014

2015e

2013

2012

2011

2010

2009

2008

2007

2006

2005

2004

2003

2001

Jan-15

Feb-15

Mar-15

Nov -14

Dec-14

Sep-14

Oct-14

Aug-14

Jun-14

Jul-14

Apr-14

May -14

Jan-14

Feb-14

Mar-14

Nov -13

Dec-13

Sep-13

Oct-13

Aug-13

Jun-13

Jul-13

2002

0.0

1.6

Source: SG Cross Asset Research/Equity

Mortgage banking revenues Purchase index picked up in January but has given up some of

the gains. Outlook is positive as we move into a seasonally strong quarter.

Mar-12

May-12

Jul-12

Sep-12

Nov-12

Jan-13

Mar-13

May-13

Jul-13

Sep-13

Nov-13

Jan-14

Mar-14

May-14

Jul-14

Sep-14

Nov-14

Jan-15

Mar-15

-15

Mar-15

Jan-15

Nov-14

Jul-14

Mar-15

Jan-15

Nov-14

Sep-14

Jul-14

May-14

Jan-14

Mar-14

Nov-13

Jul-13

Sep-13

Mar-13

0

May-13

,0

-10

Sep-14

50

1,000

-5

May-14

100

2,000

Jan-14

150

3,000

10

Mar-14

4,000

15

Nov-13

200

Jul-13

5,000

Mortgage applications weekly change

(%)

20

4.8

4.6

4.4

4.2

4.0

3.8

3.6

3.4

3.2

3.0

Sep-13

250

Mar-13

Refinancing Index SA

Purchase Index SA (rhs)

6,000

Mortgage 30-year fixed rate % (national

average)

May-13

The refinancing and purchase indexes

remain weak

Source: SG Cross Asset Research/Equity

9 April 2015

17

This document is being provided for the exclusive use of TONY TANAKA (JI-ASIA GROUP)

Global Investment Banks

Asset management: Strong flows in the US;

markets up sharply in Europe

Asset management Inflows have picked up in the US, and were strong in Europe in Q1 15.

Also, equity markets spiked in Europe in Q1 15, which should have helped CS and UBS in

particular.

Mutual fund flows picked up in the US: Outflows were reversed in domestic US equity funds

after three consecutive quarters of outflows. Also, inflows to non-US products were strong,

registering $22bn (as of 18 March). While inflows into fixed income funds were strong,

doubling to $32bn in Q2 14, they turned anaemic in Q2 and Q3 with $3-$4bn outflows.

However, in Q1 15, the inflows picked up to $33bn. As a result, total long-term inflows of

$71bn were the strongest since Q1 14 (as of 18 March). While flows were solid in the US, the

market performance was lacklustre.

US: Asset management (industry growth), long-term mutual

fund flows picked-up

Domestic/US equity

Non-US equity

Total Bond

Total Hy brid

Europe: Flows were strong to start the quarter

70

90

60

75

50

60

40

45

30

30

20

15

10

-15

-10

-30

Jan

'14

-45

-60

1Q13

2Q13

3Q13

4Q13

1Q14

2Q14

3Q14

4Q14

Feb Mar Apr May Jun

'14 '14 '14 '14 '14

Equity

1Q15

Jul

'14

Bond

Aug

'14

Sep

'14

Oct Nov Dec

'14 '14 '14

Balanced

Source: ICI, EFAMA and SG Cross Asset Research/Equity

Asset and wealth management revenues as a proportion of total (FY14)

70%

61%

60%

53%

50%

40%

40%

30%

20%

20%

16%

15%

15%

11%

10%

0%

UBS

MS

CS

BAC

GS

Wells

DB

Source: SG Cross Asset Research/Equity

9 April 2015

18

This document is being provided for the exclusive use of TONY TANAKA (JI-ASIA GROUP)

JPM

Jan

'15

Global Investment Banks

Global IBs: Structural issues still at play

Leverage ratios: Key differentiator among UBS, CSG and DBK

The CET1 leverage ratio is a significant (but not the only) differentiator between CSG and UBS.

With a much lower starting position at CSG, together with higher litigation risk, we see CSG

having an equity deficit against a likely minimum CET1 leverage ratio of 3.5% of c.CHF7bn.

This projection incorporates a significant 50% reduction in CSGs cash DPS to CHF0.35 for

2015e, equivalent to a yield of only 2%.

For UBS, on the other hand, we see its CET1 leverage ratio already in excess of a 3.5%

minimum requirement at end-2015, enabling it to pay out 75% of its earnings for 2015e. For

2016 and beyond, continued deleveraging and the absence of large litigation fines should

allow it to pay out 100% of its earnings and achieve yields in excess of 12% for 2016e

onwards.

DBKs leverage ratio (FL) is only 3.5% with additional headwinds related to: 1) a prudential

valuation hit to capital of 1.5-2.0bn; 2) likely leverage exposure inflation from further US dollar

appreciation; and 3) significant litigation charges we forecast an equity deficit of 5bn.

UBS: Leverage ratio glide path

6.0%

5.0%

Credit Suisse: Leverage ratio glide path

6.0%

Likely new minimum

CET1 leverage ratio

4.0%

3.0%

3.0%

2.0%

2.0%

1.0%

1.0%

0.0%

0.0%

FY2014e

4.5%

Likely new minimum

CET1 leverage ratio

4.0%

5.0%

4.0%

FY2013

Deutsche: Leverage ratio glide path

FY2015e

FY2016e

FY2017e

FY2018e

3.5%

3.0%

2.5%

2.0%

1.5%

1.0%

0.5%

0.0%

FY2013

FY2014e

FY2015e

FY2016e

FY2017e

FY2018e

FY2012

FY2013

FY2014e

FY2015e

FY2016e

CET1 capital (FL)

T1 low trigger hy brids

CET1 capital (FL)

T1 low trigger hy brids

CET1 capital (FL)

Low trigger hy brids

T1 high trigger hy brids

Min. CET1 lev erage ratio

T1 high trigger hy brids

Min. B3 lev erage ratio

High trigger hy brids

Min. B3 lev erage ratio

Source: SG Cross Asset Research/Equity

UBS: Expected DPS and payout ratio

Credit Suisse: Expected DPS and payout ratio

0.60

2.00

50.0%

0.50

1.50

40.0%

0.40

30.0%

0.30

20.0%

0.20

10.0%

0.10

0.0%

0.00

1.00

0.50

DPS (R/H)

FY 2018e

FY 2017e

FY 2016e

FY 2015e

FY 2014e

FY 2013

0.00

Pay -out ratio (L/H)

DPS (R/H)

Pay -out ratio (L/H)

Source: SG Cross Asset Research/Equity

9 April 2015

19

This document is being provided for the exclusive use of TONY TANAKA (JI-ASIA GROUP)

FY 2018e

60.0%

FY 2017e

0.70

2.50

FY 2016e

0.80

70.0%

FY 2015e

80.0%

FY 2014e

DPF (CHF)

3.00

FY 2013

110%

100%

90%

80%

70%

60%

50%

40%

30%

20%

10%

0%

Global Investment Banks

US Banks: 2015 CCAR cloud clears but increased G-SIB

surcharges ahead

CCAR was positive for Citi and MS. For GS, we believe management has scaled back its

buyback programme significantly. GSs buybacks were $5.5bn in FY14, which we now think

could be below $1bn for 2015.

CCAR results for individual banks

Dividend/share

Quarterly

Buybacks $mil

Comments

BAC

13 CCAR

14 CCAR

15 CCAR

0.01

0.05

0.05

5,000 Approved

Initially approved; buyback disallowed subsequently.

4,000 Conditional approval. Scaled back initial ask.

JPM

13 CCAR

14 CCAR

15 CCAR

0.38

0.40

0.44

6,000 Conditional approval

6,500 Approved

6,400 Approved. Scaled back initial ask.

Citi

13 CCAR

14 CCAR

15 CCAR

0.01

0.05

0.05

1,200 Approved

6,400 Denied

7,800 Approved

WFC

13 CCAR

14 CCAR

15 CCAR

0.3

0.35

0.375

Inc. vs FY12 of $3.9bn Approved

Inc. vs FY13 Approved

continue strong repurch. activity Approved

GS

13 CCAR

Potential increase (was $0.55/quarter)

14 CCAR

details not disclosed

15 CCAR

0.65 (0.60 in prior year)

MS

13 CCAR

14 CCAR

15 CCAR

Approved, incl. acq. of balance 35% in JV

0.10 (from $0.05)

0.15

Amt. not disclosed Conditional approval

Amt. not disclosed Approved. Scaled back initial ask.

Amt. not disclosed Approved. Scaled back initial ask (we believe substantially).

Approved

1,000 Approved

3,100 Approved. Scaled back initial ask.

Santander Holdings USA Inc.

14 CCAR

15 CCAR

Objection based on qualitative concerns

Objection based on qualitative concerns

HSBC North America Holdings Inc.

14 CCAR

15 CCAR

Objection based on qualitative concerns

Approved

Deutsche Bank Trust Corpn.

15 CCAR

Objection based on qualitative concerns

Source: SG Cross Asset Research/Equity

9 April 2015

20

This document is being provided for the exclusive use of TONY TANAKA (JI-ASIA GROUP)

Global Investment Banks

G-SIB surcharge inflation ahead (SGe of new and old surcharges below)

1.

2.

3.

4.

5.

Category

Size

Interconnectedness

STWF

Complexity

Cross-jurisdictional activity

Total Score

US score multiplier

US G-SIB score

G-SIB buffer SGe

G-SIB buffer (current)

Surcharge bands

Score range

230 329

330 429

430 529

530 629

630 729

730 829

830 929

930 1029

1030 1129

WFC

43

38

25

53

10

JPM

78.21

86.91

69.00

173.13

66.82

Citi

63.42

84.72

69.30

101.20

77.11

BAC

59.06

53.89

71.23

97.10

30.48

GS

33.25

41.60

109.56

93.31

32.40

MS

28.10

55.20

146.26

98.22

40.96

168

2x

336

474

2x

948

396

2x

791

312

2x

624

310

2x

620

369

2x

737

2.00%

4.5%-5%

4.0%

3.00%

3.0%

3.5%

1.0%

2.5%

2.0%

1.5%

1.5%

1.5%

Surcharge

1.5%

2.0%

2.5%

3.0%

3.5%

4.0%

4.5%

5.0%

5.5%

Source: Basel Committee on Banking Supervision, US Federal Reserve and SG Cross Asset Research/Equity

9 April 2015

21

This document is being provided for the exclusive use of TONY TANAKA (JI-ASIA GROUP)

Global Investment Banks

Litigation monitor

Litigation monitor: Banks exposure to litigation risks

RED - Penalties/settlements which could yet be paid in future.

Civil settlements are not included.

BANK

LIBOR

(US & UK)

EURIBOR

(and similar)

CASA

Yet to settle

Yet to settle

BNPP

Yet to settle

725m fine by

EU for

EURIBOR and

yen LIBOR

manipulation

DBK

Banks not in the table are deemed to have LOW litigation risk.

REGULATORY PENALTIES ALREADY INCURRED and COULD YET BE PAID IN FUTURE

PPI misInterest rate

US trade

US tax

FHFA

US MBS/CDO mis- Dark pools

Other

2

selling

hedging

sanctions

evasion

selling

products

Small player in FX market

650m likely

settlement?

(Bloomberg)

c.9th largest player in FX

$8.9bn with one

market

year ban on $

clearing

Top 2 player in FX market.

Likely

$1.9bn

Likely exposure. 3rd 4th largest Gold and silver

Risk could be low given

exposure.

settlement in largest player in US

US dark

trading (main

benign reaction from FCA

Dec 2013

MBS & CDO markets

pool

player). DoJ suit

and US regulators. No

in 2006/7

for tax evasion.

fines incurred yet

Possible fee

rebate for

German loans

FX trading

CS

Yet to settle,

Yet to settle,

Small player in FX market

mgmt claims no mgmt claims no

material

material

exposure

exposure

UBS

$1.5bn (o/w

$500m for DoJ,

$700m for

CFTC, $259m

for UK, $64m

for FINMA)

2.5bn fine

avoided due to

whistleblower

status

Top 4 player in FX market.

CHF1.8bn litigation

provision in 3Q14, mainly

for FX? $290m for CFTC,

$371m for UK, $139m for

FINMA (total $800m thus

far). DoJ outstanding. Not

under remit of DFS

BARC

$451m, o/w

690m fine

$160m for DoJ, avoided due to

$200m for

whistleblower

CFTC, $91m for

status

UK

Top 4 player in FX market.

0.5bn 3Q14 FX provision,

followed by 0.75bn in

4Q14. No settlement yet.

Litigation

risk profile

Medium

Medium

High

$536m

$2.6bn

$0.9bn

settlement

Mar 2014

$10bn lawsuit from Crossfinder

NY Attorney General. is largest

4th largest US MBS

US dark

player in 2006/7 (14th

pool

in CDOs)

High

$780m.

Potential

use of

bearer

bonds

could result

in further

fines.

$0.9bn

settlement

July 2013

Likely exposure. 8th 2nd largest

largest CDO and 12th US dark

largest MBS player in

pool

2007

French tax

evasion issue.

1.1bn bond

posted. Will

likely take many

years to resolve

High

$0.3bn in Aug

2010

$0.28bn

Gold trading

(main player)

High

$375m

Recent

revelations

of very poor

compliance

in Swiss

private

bank; tax

authorities

were

-

$550m

Likely exposure. 4th

Sued by

largest US CDO

NY

player in 2006/7. 17th attorneyin US MBS

general. LX

is third

largest

Possible exposure

-

Gold & silver

trading. Up to

$600m for

savings rates in

Brazil.

$1.9bn for money

laundering

Medium

Low

$350m

Low

High

Taken total 1.34bn provision

5.22bn

taken, of which

provision, of 211m remains

which

1059m

remains

c.5th largest player in FX Taken total 682m provisions

market. $378m 3Q14 FX

2,578m

taken, of which

provision. $275m for

provisions, of 200m remains

CFTC, $336m for UK (total which 624m

$611m thus far); HSBC

remains

carries $550m relating to

future settlements

HSBC

Yet to settle

Yet to settle

STAN

Small player in FX market

LLOY

$370m

RBS

$612m (o/w

$150m for DoJ,

$325m for

CFTC, $137m

for UK)

391m

BAC

Yet to settle

Yet to settle

c.7th largest player in FX

market. Took $400m FX

charge in 3Q14. $250m

fine from OCC thus far.

DoJ and DFS outstanding

$6.3bn total

settlement

March 2014

$16.65bn

5th largest

US dark

pool

High

CITI

Yet to settle

70m

Top 4 player in FX market.

$600m 3Q14 FX provision.

$310m for CFTC, $350m

for OCC, $358m for UK

(Total: $1.018bn thus far).

DoJ and DFS outstanding

$0.3bn

settlement

May 2013

$7bn

Small US

dark pool

High

JPM

Yet to settle

$200m

c.6th largest player in FX

market. c.$500m 3Q14 FX

provision. $310m for

CFTC, $350m for OCC,

$353m for UK (total

$1.013bn thus far). DoJ

and DFS outstanding

$4bn

settlement

Oct 2013

$9bn

10th

largest US

dark pool

Hiring of

'Princelings'

under

investigation.

High

GS

Yet to settle

Yet to settle

$1.2bn

Potential exposure

Medium

Yet to settle

$1.25bn

$2.6bn

6th largest

US dark

8th largest

US dark

Yet to settle

c.10th largest player in FX

market

Small player in FX market

MS

Medium

Taken total 680m provisions

12,025m

taken, of which

provisions of 109m remains

which

c.8th largest player in FX Taken total 1.4bn provisions

market. 400m 3Q14 FX

3,750m

taken, of which

provision to pay for CFTC provisions, of 424m remains

($290m) and UK ($344m) which 799m

settlements; a further

remains

320m provided in Q4

$667m and

$320m top-up

for insufficient

implementation

of compliance

recommendatio

ns

Yet to settle; Speculation of c.3bn

2bn held as

fine, mainly for DoJ

provision

(Times) with no

against

provisions made.

regulatory

Already paid $150m

investigations to SEC in Nov 2013.

and litigation

Top 5 player in US

(ex FX/LIBOR)

MBS market

Source: SG Cross Asset Research/Equity. 1. Ranking data from Euromoney FX Surveys 2. Ranking data from https://ats.finra.org/TradingParticipants

9 April 2015

22

This document is being provided for the exclusive use of TONY TANAKA (JI-ASIA GROUP)

Global Investment Banks

Stock performance in Q1 15 European IBs prevail

Performance of stock indices in Q1 15

Indices

Q1 14

Q2 14

Q3 14

Q4 14

Q1 15

S&P 500

1.3%

4.7%

0.6%

4.4%

0.4%

Nasdaq

0.5%

5.0%

1.9%

5.4%

3.5%

Euro Stoxx 50

1.7%

2.1%

-0.1%

-2.5%

17.5%

FTSE 100

-2.2%

2.2%

-1.8%

-0.9%

3.2%

Bovespa

-2.1%

5.5%

1.8%

-7.6%

2.3%

Nikkei

-9.0%

2.3%

6.7%

7.9%

10.1%

Hang Seng

-5.0%

4.7%

-1.1%

2.9%

5.5%

1.2%

-16.6%

41.0%

17.7%

-20.4%

2.73%

2.53%

2.52%

2.17%

1.94%

VIX

US Treasury 10-year

Source: Bloomberg and SG Cross Asset Research/Equity

US equities/bank stocks impacted by interest rate and growth

outlook; also by the strong dollar

30%

EU IBs: Stellar performance on optimism driven by ECBs QE

measures and improving macroeconomic growth outlook

40%

2014

25%

1Q15

2014

1Q15

30%

20%

20%

15%

10%

10%

5%

0%

0%

-5%

JPM

GS

MS

BAC

Citi

WFC

KBW Bk

Index

UBS

S&P 500

CSG

DBK

SX7P Index

Euro Stoxx 600

FTSE 100

-10%

-10%

-20%

-15%

-20%

-30%

Source: Bloomberg and SG Cross Asset Research/Equity

US banks valuationStrong relationship to profitability

2.5

MTB

R = 0.8818

Consensus FY15 Price / Tangible book

European banks valuationSomewhat less correlated

BBT

1.8

WFC

1.6

KEY

1.2

MS

RF

1.0

0.8

0.6

8.0%

COF

PNC

1.4

STI

FITB

GS

JPM

BAC

Citi

10.0%

12.0%

Consensus FY15 ROTE

14.0%

Consensus FY15 Price / Tangible book

2.0

Non-eurozone

CEE

R = 0.1358

R = 0.7989

US

R = 0.9019

2.0

WFC

1.5

JPM

BAC

MS

GS

1.0

Citi

0.5

0.0

2.0%

16.0%

Eurozone

R = 0.716

4.0%

6.0%

8.0% 10.0% 12.0%

Consensus FY15 ROTE

14.0%

Source: Datastream and SG Cross Asset Research/Equity

9 April 2015

23

This document is being provided for the exclusive use of TONY TANAKA (JI-ASIA GROUP)

16.0%

18.0%

Global Investment Banks

Long-term valuation: Six-bank US index trades at wider than

historical discount to the S&P 500 Index

Long-term valuation: Four-bank Euro IBs index trades at a

wider than historical discount to the Stoxx 50

18

18

16

16

14

14

S&P500

Stoxx Euro

50

12

10

Apr-15

Oct-14

Jan-15

Jul-14

Apr-14

Oct-13

Jan-14

Jul-13

Apr-13

Jan-13

Euro IB

index

Apr-12

Apr-15

Oct-14

Jan-15

Jul-14

Apr-14

Oct-13

Jan-14

Jul-12

Jul-13

Apr-13

Jan-13

Oct-12

Apr-12

Jul-12

6-banks

index

10

Oct-12

12

US and Euro indexes are SG calculated. Six banks index include JPM, BAC, C, GS, MS and WFC.

Four banks EU IBs index include UBS, CSG, DBK, BARC Source: Datastream and SG Cross Asset

Research/Equity

Short-term valuation: Six-bank US index vs Euro IBs index

18

12

16

11

Euro IB

index

US and Euro indexes are SG calculated. Six banks index include JPM, BAC, C, GS, MS and WFC.

Four banks EU index include UBS, CSG, DBK, BARC Source: Datastream and SG Cross Asset

Research/Equity

9 April 2015

24

This document is being provided for the exclusive use of TONY TANAKA (JI-ASIA GROUP)

Apr-15

Feb-15

Dec-14

Oct-14

Aug-14

Apr-14

Jun-14

Apr-13

Apr-15

Dec-14

Aug-14

Apr-14

Dec-13

Apr-13

Aug-13

Dec-12

Aug-12

Apr-12

Dec-11

Apr-11

Aug-11

Dec-10

Apr-10

Aug-10

Euro IB

index

Feb-14

6-banks

index

Oct-13

10

10

Dec-13

6-banks

index

12

Jun-13

14

Aug-13

Long-term valuation: Six-bank US index vs Euro IBs index

Global Investment Banks

Company section

We provide valuation methodology, summary earnings forecasts and risks for each of the

banks discussed in this report.

Bank of America Buy

Valuation ($)

Forward

Multiple

Multiple

Valuation

Probability

estimate

3-year avg.

assigned

per share

assigned

16.23

0.8x

1.20x

19.5

25%

1.42

9.7x

11.0x

15.6

25%

DCF valuation

19.2

25%

Sum-of-parts

20.2

25%

Tang. BV/share

Forward EPS (NTM)

Weighted valuation/TP

Value/share

5

19

Source: SG Cross Asset Research/Equity

Valuation methodology

Our fair value for Bank of America of $19.0 is derived using a probability-weighted

methodology that includes a DCF, trading multiples (tangible book and earnings), and sum-ofthe-parts.

Risks to our target price

FICC trading revenues could remain low for longer. The bank could continue to lose loanmarket share. Investigations related to rogue trading in the LIBOR and currency markets could

result in larger fines than expected. Weakness in CCAR process and RWA inflation could be

significant.

9 April 2015

25

This document is being provided for the exclusive use of TONY TANAKA (JI-ASIA GROUP)

Global Investment Banks

Summary financials

Bank of America financials ($m)

FY 2014

Q1 15e

Q2 15e

Q3 15e

Q4 15e

FY 2015e

FY 2016e

Income statement

Net interest income

39,952

9,252

9,721

10,117

10,460

39,550

43,099

Non-interest income

44,535

12,045

11,538

11,190

10,944

45,717

48,389

Revenue

85,356

21,518

21,491

21,548

21,654

86,211

92,517

2,275

782

811

850

890

3,333

4,461

75,117

15,295

13,993

13,779

13,715

56,782

58,006

Pre-tax income

7,964

5,441

6,687

6,919