PM Report Complete

Diunggah oleh

Mohsin RahimJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

PM Report Complete

Diunggah oleh

Mohsin RahimHak Cipta:

Format Tersedia

Performance Management Report on Bank Alfalah & Askari Bank

C:\mohsin laptop\d drive\Downlaods

PERFORMANCE MANAGEMENT REPORT

ON BANK ALFALAH & ASKARI BANK

SUBMITTED TO

MR. JAHANGIR ALI

GROUP MEMBERS:

MARIYA MAHER ------------------- ( 1235202)

SHAHBANO NASRULLAH -------------------(1235239)

MOHSIN RAHIM ------------------- ( 1235253)

MARYAM ZAHEER ------------------- ( 1235251)

SUBMITTED ON: 12TH APRIL, 2014

Performance Management Report on Bank Alfalah & Askari Bank

Table of Contents

Performance Management System:.............................................................................................................2

Askari Bank............................................................................................................................................3

Introduction:................................................................................................................................................3

HR Department:.......................................................................................................................................3

Organizational Structure:....................................................................................................................4

Performance Planning:................................................................................................................................9

Performance Monitoring:.......................................................................................................................10

Performance Evaluation:....................................................................................................................10

Introduction...............................................................................................................................................12

Human Resource Department of BAL...................................................................................................12

Organizational Structure...................................................................................................................14

Grade Structure..........................................................................................................................................14

Salary Ranges & Allowances for Officers and Executives....................................................................16

Forced distribution Ranking Method.........................................................................................................18

Evaluation..............................................................................................................................................18

Promotion Policy of Bank Alfalah Ltd...............................................................................................19

Recommendations.....................................................................................................................................19

Bank Alfalah..........................................................................................................................................19

Askari Bank...........................................................................................................................................20

Performance Management System:

Page | 1

Performance Management Report on Bank Alfalah & Askari Bank

Performance management is a holistic approach to optimizing human capital, which enables an

organization to implement short, and long-term results by building culture, engagement,

capability, and capacity through integrated talent acquisition, development, and deployment

processes that are aligned with the business goals. It is an ongoing, continuous process of

communicating and clarifying job responsibilities, priorities and performance expectations in

order to ensure mutual understanding between supervisor and employee. It involves clarifying

the job duties, defining performance standards, and documenting, evaluating and discussing

performance with each employee.

Askari Bank

Introduction:

Askari Bank Limited Formerly known as Askari Commercial Bank Limited. Askari Bank LTD

was incorporated in Pakistan on October 9, 1999 as a Public Limited Company and listed on the

Page | 2

Performance Management Report on Bank Alfalah & Askari Bank

Karachi, Lahore, and Islamabad stocks exchanges. The registered office of the Bank is located at

AWT Plaza, The Mall Rawalpindi. The Bank has 200 branches (2007: 150 branches); 199 in

Pakistan and Azad Jammu and Kashmir, including 18 Islamic Banking Branches, 11 subbranches and a wholesale bank branch in the Kingdom of Bahrain.

Bank is playing a leading role in the Banking sector with broad product lines & customer need

based services. Bank is operating with 200 branches in conventional banking as well as Islamic

banking moods of financing. Bank is leading the way to the most modern and dynamic banking

in the country.

The Vision: To be the bank of first choice in the region

The mission: To be the leading private sector Bank in Pakistan with an international presence,

delivering quality services through innovative technology and effective human source

management, in a modern and progressive organizational culture of meritocracy, maintaining

high ethical and professional standards, while providing enhance value to all our stakeholders

and contributing to society.

HR Department:

This section includes a summary of the HRM practices followed in ACBL and a detailed study of

Training and Development. The most important Division at the Head Office is responsible for

human resource management, including planning, recruitment, staffing, training & development,

compensation, performance management,

employee relation and evaluation.

The

division

also handles matters relating to administration that proves an integrative linkage (34) between

HRD and Administration.

Organizational Structure:

Page | 3

Performance Management Report on Bank Alfalah & Askari Bank

Compensation: Askari Bank places itself amongst the better paymasters within the industry

and continuously endeavors to improve the level of job satisfaction of its employees through

learning, development and making Askari Bank the best place to work.

Job Evaluation: Askari Bank shall assign a grade level to each job with relevance to the value

contributed by the role towards the achievement of organizational goals. The salary of

experienced employees may vary due to qualification, experience, past appraisals and nature of

skills. Minimum salary in different grades of fresh /non experienced staff shall be determined by

the President and CE on the basis of qualification, grading of the university and average salary

levels in the banking industry.

Salary Structure: Gross salary of an employee shall comprise of three (3) components, Basic

Salary, House Rent Allowance and Utility Allowance. In addition to the above, the employees

will be reimbursed Medical Allowance and Fuel/Conveyance Allowance as per entitlement, with

a monthly salary. Net Salary of an employee will be arrived at by deducting provident fund

Page | 4

Performance Management Report on Bank Alfalah & Askari Bank

contribution, income tax, loans installments, EOBI contribution and any other statutory

deductions from Gross salary.

Basic Salary

i. Basic salary of an employee shall be determined by the competent appointment approving

authority.

ii. On promotion to a higher grade, salary shall be fixed by giving an appropriate increase in the

basic salary, as approved by the competent authority.

iii. The annual increment will be on the basis of %age of the basic salary which will vary as per

performance rating of the employee and as approved by the competent authority.

iv. An increment cannot be claimed as a matter of right, but it depends on the discretion of the

Competent Authority. The Competent Authority may allow additional incremental on the basis of

performance.

v. As working guidelines, the HRD shall prepare minimum basic pay to be offered to a fresh

employee in a specific grade on the basis of qualification and the institution from where they

have been obtained. While for experienced candidates, pay can be fixed in any grade to

commensurate his/her experience and keeping in view previously drawn salary/market pay, as

approved by the competent authority. The guideline specifying minimum pay etc.; will be

finalized with the approval of HR Sub-Committee.

Other Allowances:

Reimbursement of Residential Telephone Expenses: The monthly telephone expenses for

residential phones shall be reimbursed on the production of telephone bills as per following

entitlement.

Grades

SEVP

EVP

SVP

VP

AVP

Monthly Limit

Rs.6, 000/Rs.3, 000/Rs.2, 000/Rs.1,000/Rs.860/-

House Rent Allowance: An employee shall be entitled to receive from the Bank a house rent

allowance @ 45% of the Basic salary.

Page | 5

Performance Management Report on Bank Alfalah & Askari Bank

Utilities Allowance: The utilities allowance for monthly gas, electricity and water charges

(Residential) etc. shall be admissible to all employees @ 10% of Basic Salary.

Medical Reimbursement: Reimbursement of Medical expenses shall be made in cash each

month with the payroll equivalent to 10% of the Basic Salary.

Fuel Reimbursement: Expenses incurred on fuel expenses shall be reimbursed along with a

monthly salary as per the premium fuel price during the month. Fuel expenses shall be

reimbursed subject to following monthly limits:

Sr. No.

1

2

3

4

5

6

7

8

9

10

Grade

SEVP

EVP

SVP

VP

AVP

MG

AMG

OG-I

OG-II

OG-III

Fuel in liters

650

500

400

350

150

120

100

80

70

60

Average rate of petrol during the month shall be applicable for reimbursement of fuel expense.

Special Allowance: An employee may be allowed a special allowance as may be determined by

the competent authority from time to time.

Additional House Rent on Transfer/ Relocation Allowance: An employee shall be entitled to an

additional house rent allowance/ relocation allowance as determined by the competent authority

on a case to case basis upon his transfer/posting from one city to another city subsequent to a

decision of the management, for operational and other reasons, made in the best interest of the

bank, provided that the transfer/posting is not effected on the request of the employee or on

grounds of discipline, and subject to following maximum limits:

SEVP

SVP/EVP

AVP/VP

Officers

Others

Married

Rs.60, 000/Rs.40, 000/Rs.25,000/Rs.15, 000/RS.8, 000/-

Unmarried

Rs.40,000/Rs.25,000/Rs.15,000/Rs.10,000/Rs.5, 000/-

Page | 6

Performance Management Report on Bank Alfalah & Askari Bank

Furniture, Fixture & Electrical Appliances for Executives

Entitlement: All executives shall be allowed to purchase furniture, fixtures and electrical

appliances for their residence as per following entitlement:

Grade

Senior Executive Vice President

Executive Vice President

Senior Vice President

Vice President

Assistant Vice President

Entitlement

Rs.280,000/Rs.230, 000/Rs.185, 000/Rs.140, 000/Rs.100, 000/-

Cash Handling Allowance:

All staff working full time in the cash department in the branches and handling cash shall be

paid cash handling allowance equivalent to Rs. 3,000/- per month.

Fixed Bonus

This type of bonus shall be rewarded equal to X number of Basic salary to all the regular

employees of the bank. Basis for Contractual staff shall be 50% of that of regular staff. The staff

who joins the bank during the year receive bonus as follows;

Those who join during 1st quarter shall be paid 100%

Those who join during 2nd quarter shall be paid 75%

Those who join during 3rd quarter shall be paid 50%

Those who join during 4th quarter shall be paid 25%

The fixed bonus shall be paid to an employee who retires from the service of the Bank during the

year on a prorated basis. This shall also be paid to the employee deceased during the year on a

prorated basis.

Variable Performance Bonus: In addition to regular compensation benefits to employees,

Askari bank provide for a Performance based Bonus. This policy is designed to fairly reward top

performers with variable bonuses to attract, retain, and appropriately reward talent making

Askari bank the employer of first choice in the marketplace.

This bonus is awarded to regular employees only and is determined on the basis of individual

performance during a year as determined through his/her performance evaluation. Star

performers shall also be identified during the performance appraisal exercise.

Page | 7

Performance Management Report on Bank Alfalah & Askari Bank

The performance bonus shall be linked to individuals performance rating. The grid for award

of performance bonus shall be approved by the competent authority each year and shall be

awarded after the finalization of performance evaluation exercise. Staff members who are rated

D & E shall not be considered for bonus while staff members rated C may be considered

depending upon the size of the bonus pool available for distribution.

Loyalty Awards:

On completion of 10 years of Service 50% of Basic Salary

On completion of 15 years of Service 75% of Basic Salary

On completion of 20 years of Service 100% of Basic Salary & 10 gram gold coins.

Performance management System:

This policy will allow Askari Bank to propose and agree upon development / improvement

initiatives and to reward staff members in line with their performance outcomes.

All Employees are required to go through the formal process of performance planning,

monitoring and evaluation according to the terms of this policy. It may be noted that the

evaluation part of the performance management process is carried out once at the end of each

financial year. In certain cases, the Bank may also carry out a mid-term performance review as

required. Two important points regarding performance management that need to be kept in view

at all times are:

a. Performance management is a continuous process and the yearly exercise of completing the

template is only a formal document and an agreement to this effect. In light of the same Line

Managers are required to continuously monitor performance and provide feedback and coaching

throughout the year instead of waiting for the year end.

b. Performance management is not a confidential or one-time personal assessment report of an

Employee by a Line Manager. Rather, it is a two-way exercise in which the Employee must

understand and also agree with his or her performance assessment ratings and performance

improvement objectives.

The Askari Bank Performance Management System is divided into three (3) main areas namely:

1. Performance Planning

2. Performance Monitoring

Page | 8

Performance Management Report on Bank Alfalah & Askari Bank

3. Performance Evaluation

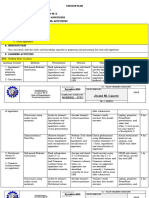

Performance Planning:

Performance Planning involves following the conventions of a comprehensive PMS policy and

defining measures of performance through the incumbents job description, specific goals set for

the year, and behavioral capabilities needed for the job. During this stage, the line manager must

communicate the performance standards and weightings for the role using key accountabilities

and behaviors. This should result in a discussion with the jobholder jointly agreeing upon on

actions to meet role expectations. For the performance planning process, the following

documents are included as part of this report:

1. Defining JDDs A detailed write up defining Job Description Documents and explaining the

sections of their related JDD Template.

2. Job Description Document A form / template designed to capture all necessaryelements of

a unique role. HRD will provide all JDDs for each unique role in Askari Bank as agreed upon in

the new organizational structure.

3. Goal Setting Form A form designed to set goals that are based upon key accountabilities as

mentioned in the job descriptions for the ensuring evaluation period.

4. About Job Families A detailed write up on the job family concept and its application to

performance evaluation system.

5. Job Family Matrix A classification of Askari Bank Departments into job families and

details of both basic and advanced attributes associated with each job family.

Performance Monitoring: Performance monitoring involves monitoring performance of the

incumbent based on the above measurements throughout the year. This process involves

identifying performance gaps and taking remedial action through regular feedback and coaching

provided on a relatively informal basis. In certain cases, a mid-year performance review can be

conducted (after a 6 month period) using a shortened PMS form as mentioned below

Mid-Year Performance Review Template A form / template designed to document and

evaluate performance of Employees at the middle of the year. This template is generally used in

select cases for Employees who are placed on a performance watch list.

Page | 9

Performance Management Report on Bank Alfalah & Askari Bank

Performance Evaluation: Performance evaluation involves completing the PMS template

according to the PMS policy in which managers formally assess performance based on objective

grounds and provide relevant feedback and recognition to deserving candidates. Through this

assessment, improvement opportunities are discussed and agreed upon by the incumbent and

his / her supervisor. To complete the performance evaluation process, we have designed and

enclosed the following documents for Askari Bank:

Performance Management Policy

A formal write-up on Askari Banks performance management policy entailing both the theory

behind evaluation and details explaining sections of the correlating performance evaluation

templates usage.

Full-Year Performance Evaluation Template A form / template designed to evaluate

performance of Askari Bank employees between OG-III and SEVP grade levels. This template is

linked to the performance management system proposed by HRD in bringing about the major

change in the way reward and promotion is perceived. A separate Performance Evaluation

Template for Clerical/Non-Clerical staff is also developed.

Promotional Policy:

The criterion for promotion in the Bank is based on the following factors:

Performance Appraisal: The performance of each employee is established, based on the Annual

Performance Review. These reports contain a comprehensive list of character traits and the

performance evaluation against already set objectives business development and training targets.

Besides awarding Performance Rating to each employee, the Reporting Officer shall record his

opinion with regard to general profile, present performance as well as give specific

recommendations on suitability for future promotion or employment in a particular

vacancy/assignment besides ascertaining the ultimate potential of the Appraise.

While awarding marks for the Performance Rating, the Appraise shall be compared with other

employees of the same category at the entire bank level and not the branch level. This is essential

from the point of view of maintaining uniformity of efficiency at the bank level. Similarly, the

Page | 10

Performance Management Report on Bank Alfalah & Askari Bank

recommendations should also be in conformity with the marks awarded e.g. cases of promotion

should fall amongst A or a high B.

Other promotion criteria are: Educational Qualifications, Professional Qualifications,

Experience, Minimum Qualifying Service for Promotion, Marketing Achievements, Availability

of positions, Special Provisions, Accelerated promotions, Qualification improvement, Promotion

Approving Authorities.

Page | 11

Performance Management Report on Bank Alfalah & Askari Bank

Bank Alfalah

Introduction

Bank Alfalah Limited (BAL) was first established on June 21, 1992, under the Companies

Ordinance 1984, as a Public Limited Company. However, its operations began on November 1,

1997 in Pakistan. Since then, the bank has adapted and implemented various policies that have

helped it to strengthen its position and presence amongst various countries such as Pakistan,

Bangladesh, Bahrain and Afghanistan (www.bankalfalah.com).

Backed by the Abu Dhabi Group, the bank boasts of diverse board of management and driven

with the aim of growing continuously focuses its operations in commercial banking and has a

diverse portfolio of goods and services to offer to its clients. Bank Alfalah Limited currently has

over four hundred and six branches across a hundred and fifty-eight cities including seven

international branches and a offshore unit in Bahrain. The Bank added twenty new branches in

2011 alone. In Karachi, their head office is located at B.A.Building at I.I.Chundrigar Road.

Some of the associated companies of the Bank includes other industry bigwigs such as Warid

Telecom (Pvt.) Limited, Alfalah Securities, Alfalah Insurance Company Limited and Alfalah

Investment Management Limited.

The Vision of the Bank states it to become a premier organization at both local and international

level to provide all possible financial services under one roof.

The Banks Mission instates it to develop and deliver customer-oriented services that attain the

bank both profitability and market, while also garnering customer value and loyalty.

Human Resource Department of BAL

At Bank Alfalah Limited the human Resource motto is described as We are Struggling for

People. Like any other organization, HR department of Bank Alfalah acts as a vital organ to the

organization, it is also important to mention that the HR department at BAL acts as a strategic

partner to the bank, in fulfilling all its workforce related needs and functions. As this department

is specifically focused to carry out the following key functions of the organization

Conducting job analyses (determining the nature of each employees job)

Planning employee needs and recruiting job candidates

Selecting job candidates

Orienting and training new employees

Page | 12

Performance Management Report on Bank Alfalah & Askari Bank

Managing wages and salaries (compensating employees)

Providing incentives and benefits

Appraising performance

Communicating (interviewing, counseling, disciplining)

Training and developing managers and executives

Building employee commitment

Other Key Departments

Bank Alfalah Limited has various departments/divisions, a complete list of these includes

Strategic Planning & Global Marketing

Corporate Banking & Home Finance

IT Division

Credit Monitoring System

Credit Division

Systems & Operations

Legal Affairs Division

HR Division

Business Development Business

Finance Division

International Operations

Islamic Banking

Audit & Inspection Division

Cards Division

Administration

Page | 13

Performance Management Report on Bank Alfalah & Askari Bank

Organizational Structure

The organizational structure of Bank Alfalah Limited is as follows:

Compensation System of Bank Alfalah System

Grade Structure

Bank Alfalahs salary ranges provide a structure to which basic rates of pay is linked to various

positions. All the employees placed in these ranges are based on seniority level, current

responsibilities, and market value of these jobs. The constituents of a pay range are minimum

pay, maximum pay and a midpoint. Freshly appointed employees are given the midpoint salary,

which is usually considered as the market rate for the job in question. This salary usually falls in

the 60th to 65th percentile. As the employees become more experienced, their salaries are moved

above the midpoint, thus defining their level of seniority.

Page | 14

Performance Management Report on Bank Alfalah & Askari Bank

However, the decision of assigning the salary of any employee remains with the authorized

managers, which can be set at any point of the predefined salary range for the relative grade.

BAL salary ranges start with Range I (entry-level position) end with Range IX [Group Head/

General Manager level position]. These ranges reflect an individuals position, responsibilities,

size of the operation (Branch / Dept.) and scope of assignment. Based on these considerations,

various positions fall into BAL Salary ranges as follows:

Job Positions

Grades

Group Head/ General Manager

IX

Head of Division/ DGM/ Regional Manager/ Regional Heads/

VII - VIII

Product Heads

Senior Managers at HO and Group Offices/ AGM

VIII

Area Managers/ Zonal Managers

VI - VII

Branch Managers according to size of the branch

Team Leaders according to size of portfolio

Head of Department of Large Size Branch (Credit/ Trade

Finance/Operations Manager etc.)

National Sales Managers

Head of Large Department at Head Office Division

Head of Credits/Foreign Trade/Operations Dept. of Medium size

Branch

V VII

IV - V

Relationship Managers at SME

Dept Heads at HO with more than 5 years relevant experience

Head of Dept at Small size branch

Branch Sales Officer or Branch Sales Supervisor

Senior Officer at HO Divisions with more than 5 years of III - IV

relevant experience

Secretaries of Group Heads & GM

Credit Officer or Trade Finance Officer

CD In-Charge or Chief Cashier of Large size branch

Officers with more than 3 years of relevant experience ( Officers

III

at Head Office, Officers of Consumer Finance, Mortgages, SME,

Rural Finance, Leasing, General Banking, Operations, Cash, CD

In-Charge, IT, Accounts, Customer Service/ Relationship Officer

etc.)

Page | 15

Performance Management Report on Bank Alfalah & Askari Bank

Secretary with 5 years or more relevant experience

MTO (Post Graduates or foreign qualified)

Fresh Officers Post Graduates or 4 years BBA/BS etc

Officers who are Graduates with less than 3 years of relevant

experience (Officers at HO, Officers of Consumer Finance,

Mortgages, SME, Rural Finance, Leasing, General Banking,

II

Operations, Cash, CD In-Charge, IT, Accounts, Customer Service

Officer etc.)

Entry level position / Fresh Graduates / Cash/Operations Officer I

Salary Ranges & Allowances for Officers and Executives

Since the exact salary of each grade has not been shared by the bank for confidentiality issues,

apart from the starting basic salary of Grade I personnel, we have assumed the minimum and

maximum salaries for each grade. The organizational structure followed by Bank Alfalah is

narrow banded so the overlap and range limits have been applied accordingly (Range= 1.1;

Overlap= 0.4). The allowances are also assumed to the nearest possible percentages and amounts

for each.

(All Amounts in PKR)

House

Basic

Utility

Conveya

Allowanc

Drivers

Salary

Allowance nce

Furniture Telephone Cellphone

Grade

e

Allowanc

Ranges

(%

ofAllowanc

Allowance Allowance Allowance

(%

of

e

(Min-Max)

Basic)

e

Basic)

I

II

III

IV

V

2000042000

28000-

40%

10%

40%

10%

40%

10%

40%

10%

40%

10%

58800

3920082320

54880115248

76832-

3100

4650

6200

7750

17000

9300

17000

Page | 16

Performance Management Report on Bank Alfalah & Askari Bank

161347

VI

VII

VIII

IX

107565-

40%

10%

40%

10%

40%

10%

40%

10%

225886

150591316241

210827442737

295158619831

17000

45000

31000

20000

15000

50000

42000

30000

20000

55000

50000

40000

25000

Note: The formula used for basic salary calculation by Bank Alfalah is

Basic salary = 0.607 * Gross Salary

Performance Appraisal System

Through performance appraisal, organizations assess each of its employees in a systematic

manner. Where an employee performance is being measured against several factors including;

job knowledge, quantity and quality of output, loyalty, leadership abilities, cooperation, decisionmaking abilities etc. Performance appraisal is highly important for all the organizations because

it helps them to take decisions regarding; promotions, bonuses and incentives, employee training

and determining the future workforce needs of the organization.

Bank Alfalah Ltd. also uses performance appraisal system in order to enhance the efficiency of

employees. This system composes of setting targets or objectives in the beginning of the year, the

progress of which is then determined by the respective supervising officer on half-yearly basis.

Using the standard tools of performance evaluation such as appraisal forms, performance

assessment is conducted. This helps the HR manager of the bank in gauging the work standards

and employee performance, providing feedback and to eliminate performance deficiencies.

Appraisal Approach Adopted by Bank Alfalah Ltd

Page | 17

Performance Management Report on Bank Alfalah & Askari Bank

Forced distribution Ranking Method

Bank Alfalah uses the bell curve or forced distribution method to appraise their employees.A

forced

distribution

method

requires

rater

to

compare

performance

of

employees

and place a certain percentage of employees at various performance levels. It assumes performan

ce level in a group of employees will be distributed according to a bell-shaped or normal curve.

Their criteria are base on the performance of quantity of output, quality of output, timeliness of

output, presence at work and cooperativeness.

There is no favoritism and discrimination at any level in the performance appraisal system. BAL

uses 20-60-20 distribution the top 20 percent is rewarded for best performance, the middle 60%

employees are rated as average and the bottom 20% are trained for improvement.

Thus, this method of appraisal is regarded as important by many HR managers and is commonly

used by many organizations for rewarding the top performers and setting the specific deadlines

for the improvement of poor performers. However, this system has some drawbacks as well. For

example, the system promotes individual performance over teamwork and often leads to

dissatisfaction between average and poor performers.

Evaluation

Besides, following forced ranking distribution method, BAL has also developed their own

performance management process, which is performed biannually in the months of June and

December. This approach is named as evaluation approach in which manager conducts thirty

minutes interview with his subordinate to discuss about the projects and the goals that have been

assigned to them and then rates the employee according to appraisal form established at the start

of the year. Employees are aware of these evaluation criteria at the start of the year so that they

can improve performance according to criteria set by the bank.

This performance management process differentiates the employees as following three categories

Partially performing: if an employee does not achieve his goals in given period, he would

be rated as partial performing employee.

Performing: if an employee completes his work in the given time he would be rated as a

performing employee.

Excellent: if an employee is doing the work designated to him as well as showing

concern for other projects, he would be rated as an excelling performer.

Page | 18

Performance Management Report on Bank Alfalah & Askari Bank

After this, evaluation process is carried out where the employees who lie among the performing

and excellent rank are given bonuses and only excellent employees are given performance

bonuses as for their good performance. These are given to appreciate employees and to motivate

partially performing and performing employees. After the completion of evaluation process

manager discusses or provides feedback to the employees.

Promotion Policy of Bank Alfalah Ltd

Promotion to higher grades depends upon operational needs based on current assignment of the

incumbent. The other important reason for promoting employees is to reward the high

performing individuals, as and if the organization is itself growing, as the growing organization

as BAL. The process of promoting employees the chosen employees is finally determined

through an interview process conducted by the respective departments head and the HR

representative illustrated as below.

For promotion to

1st Interview

2nd Interview

3rd Interview

Ranges II, III, IV, V BM / Dept. Head

AM/ RM/ Div. Head/ GM/ GH Ranges VI and above BM / Dept. Head

AM/ RM/ Div. Head/ GM/ GH Panel

GM HR, Co-Chairman Executive Committees / CEO duly approve all promotion

Recommendations

Bank Alfalah

The current compensation and performance management structure is quite good but definitely,

there is a room for improvement, which helps BAL in reducing its employee turnover rate and

increase employee loyalty and dedication towards the achievement of organizational goals.

Therefore, there are some recommendations defined below for BAL:

Since BAL has different job families, so the organization should adopt such pay structure

which is based on different job families that can define a varied salary pattern of the

organization in the market.

Secondly, in order to minimize the tall hierarchal structure of the organization and bridge

the distance between the employees and employers BAL should adopt broadband grade

structure.

The performance appraisal system of BAL is based on two methods forced distribution

method and evaluation method both these methods are good enough to evaluate the

Page | 19

Performance Management Report on Bank Alfalah & Askari Bank

performance of its employees but the constant feedback from the supervisors has been

observed to be absent to the employees regarding their performance. This feedback is

important as it helps the employees in improving their performance which in turn

enhance the organizations performance.

Bank Alfalah doesnt have any goal setting policy for their performance evaluation

system, like Askari Bank, who has developed and communicated clear policies about

their performance structure and evaluation systems.

Therefore, in order to retain the qualified, talented, competent and motivated staff in the

organization to operate their business activities effectively, a good recommendation to

BAL is to timely modify its compensation and performance appraisal system as per the

changing market trends.

Askari Bank

Comparatively, Askari Bank has a proper outlined and structured PMS then Bank Alfalah.

However, some key recommendations for improvement are listed as follows:

The bank places great importance on performance monitoring phase in its annual

evaluations. The parameters outlined by the management for this phase includes the

employees having to discuss and set their own goals or targets for the upcoming year with

their line managers and update and get them signed from them on the goal setting form.

Although, the goals and targets can vary afterwards, for which they need to fill in/update

their old or new forms and get it signed in by their line managers again. This is a tedious

process and should be altered or be upgraded from paper to automated filing.

The PMS of the bank places great emphasis to evaluate performance based on the targets

achieved by an employee. A significant lack of emphasis made on evaluating the

behavioral traits has been observed. Thus, it is recommended that the management

incorporates or considers the behavioral aspect of the employee during their performance

appraisal and evaluation.

Page | 20

Anda mungkin juga menyukai

- Banking Operations. ManualDokumen162 halamanBanking Operations. Manualjaisundriyal100% (4)

- The Organization and The HR DepartmentDokumen3 halamanThe Organization and The HR DepartmentShaniaGrazianneAlbiaReyes0% (3)

- Session-Plan - TM1-Jerald M. CaneteDokumen6 halamanSession-Plan - TM1-Jerald M. CaneteJerald Cañete100% (2)

- NBP HR Report-FinalDokumen58 halamanNBP HR Report-FinalMaqbool Jehangir100% (1)

- Compensation and BenifitsDokumen162 halamanCompensation and BenifitsAnonymous WnrRCpBelum ada peringkat

- Compensation and BenefitsDokumen161 halamanCompensation and BenefitskulsoomalamBelum ada peringkat

- Business Continuity PlanDokumen1 halamanBusiness Continuity PlanasshhwiniBelum ada peringkat

- Compensation Practices at NBPDokumen9 halamanCompensation Practices at NBPBen TenisonBelum ada peringkat

- Personnel Administration Goals, Objectives and PrinciplesDokumen16 halamanPersonnel Administration Goals, Objectives and PrinciplesRameshwari Wadghule100% (7)

- Business Ethics: "Workplace Diversity"Dokumen5 halamanBusiness Ethics: "Workplace Diversity"Sneha SinhaBelum ada peringkat

- Performance Appraisal: Eneral Bjectives of Erformance PpraisalDokumen4 halamanPerformance Appraisal: Eneral Bjectives of Erformance PpraisalAIMAN SAMI 18389Belum ada peringkat

- Interbank Clearing Process and Funds Transfer MechanismsDokumen15 halamanInterbank Clearing Process and Funds Transfer Mechanismsmurad_yousfani@hotmail.comBelum ada peringkat

- EMPLOYEE COMPENSATION & BENEFITS GUIDEDokumen9 halamanEMPLOYEE COMPENSATION & BENEFITS GUIDEjaydee_atc5814100% (1)

- Soneri Bank Compensation PolicyDokumen20 halamanSoneri Bank Compensation PolicySapii MandhanBelum ada peringkat

- Al-Arafah Islami Bank Limited: An OverviewDokumen17 halamanAl-Arafah Islami Bank Limited: An OverviewRubel50Belum ada peringkat

- The Basic Pay Followed by The CompanyDokumen2 halamanThe Basic Pay Followed by The CompanySuny ChowdhuryBelum ada peringkat

- Performance & Reward Decisions 2023Dokumen3 halamanPerformance & Reward Decisions 2023qamarranumBelum ada peringkat

- Management Trainee ProgramDokumen2 halamanManagement Trainee ProgramAfaq AhmadBelum ada peringkat

- CRM PPT PSB FinalDokumen17 halamanCRM PPT PSB Final24nikiBelum ada peringkat

- Bank Alfalah Internship Report SummaryDokumen25 halamanBank Alfalah Internship Report SummarySikandar GujjarBelum ada peringkat

- Compensation Meezan WordDokumen9 halamanCompensation Meezan WordUsman Aziz0% (1)

- Recruitment and Selection Process For 1st Level Officer in Bank AlfalahDokumen28 halamanRecruitment and Selection Process For 1st Level Officer in Bank AlfalahArslan Nawaz100% (1)

- Bank Asia HRM 410Dokumen20 halamanBank Asia HRM 410Mona RahamanBelum ada peringkat

- Sound Personnel PoliciesDokumen14 halamanSound Personnel PoliciesgianneismBelum ada peringkat

- Dhanlaxmi Bank Compensation StudyDokumen4 halamanDhanlaxmi Bank Compensation StudyShubhangi AsthanaBelum ada peringkat

- Internship ReportDokumen85 halamanInternship ReportHassan IkhlaqBelum ada peringkat

- Project On Analysis of Financial Performance (KNSB LTD)Dokumen73 halamanProject On Analysis of Financial Performance (KNSB LTD)Ronit Singh100% (2)

- Promotion Study Material For BankDokumen271 halamanPromotion Study Material For BankJack Meena100% (1)

- MCB Bank Internship Report SummaryDokumen50 halamanMCB Bank Internship Report Summaryrizwan_hameed786Belum ada peringkat

- Assignment On Profit Planning in BanksDokumen10 halamanAssignment On Profit Planning in BanksMichael MaysBelum ada peringkat

- Compensation and BenifitsDokumen155 halamanCompensation and BenifitskulsoomalamBelum ada peringkat

- Term Paper On Credit Operations of Bank in Bangladesh Course Title: Bank Fund Management Course Code: FIN-435Dokumen33 halamanTerm Paper On Credit Operations of Bank in Bangladesh Course Title: Bank Fund Management Course Code: FIN-435Tuhin KhalekuzzamanBelum ada peringkat

- SwotDokumen10 halamanSwotmubasharnauman22Belum ada peringkat

- HR Practices at Askari BankDokumen12 halamanHR Practices at Askari BankSyed Osama AliBelum ada peringkat

- Human Resource ManagementDokumen11 halamanHuman Resource ManagementShakeeb AhmedBelum ada peringkat

- Monthly BeePedia September 2020Dokumen118 halamanMonthly BeePedia September 2020RISHABH JAINBelum ada peringkat

- Sanaul - CECM 4th - Assignment 1Dokumen6 halamanSanaul - CECM 4th - Assignment 1Sanaul Faisal100% (1)

- Internship Report MCB Bank 1Dokumen67 halamanInternship Report MCB Bank 1abdul rehmanBelum ada peringkat

- Balance Sheet Analysis Quick BookletDokumen16 halamanBalance Sheet Analysis Quick BookletSwatiRanjanBelum ada peringkat

- Literature Review of Standard Chartered BankDokumen7 halamanLiterature Review of Standard Chartered Bankafdtsdece100% (1)

- Internship Report On Nib Bank: Provided by Nishat Academy IslamabadDokumen16 halamanInternship Report On Nib Bank: Provided by Nishat Academy Islamabadk_starsunBelum ada peringkat

- Human Resource Management Process in The OrganizationDokumen19 halamanHuman Resource Management Process in The OrganizationabubakarsahilBelum ada peringkat

- Credit Officer Mwanza 2015Dokumen3 halamanCredit Officer Mwanza 2015Rashid BumarwaBelum ada peringkat

- Understanding The Credit Department of A BankDokumen6 halamanUnderstanding The Credit Department of A Bankzubair07077371Belum ada peringkat

- MIS For RawishDokumen13 halamanMIS For RawishUrs FaddiBelum ada peringkat

- Advert - Relationship Officers-Directorate of Retail Banking - 12 Positions - February 2014Dokumen4 halamanAdvert - Relationship Officers-Directorate of Retail Banking - 12 Positions - February 2014Rashid BumarwaBelum ada peringkat

- Grace Report CompensationDokumen13 halamanGrace Report CompensationDarkindi GreceyBelum ada peringkat

- Audit Officer ExternalDokumen1 halamanAudit Officer ExternalFrankline AnastasiaBelum ada peringkat

- HBL Pakistan benefits circularDokumen4 halamanHBL Pakistan benefits circularZahid IftikharBelum ada peringkat

- A Project Report On The Surat PeopleDokumen131 halamanA Project Report On The Surat PeopleHimanshu MistryBelum ada peringkat

- Cover Page for Academic Tasks - Course Code, Title, Instructor, Student DetailsDokumen11 halamanCover Page for Academic Tasks - Course Code, Title, Instructor, Student DetailsSaV ReeNaBelum ada peringkat

- Credit Rating SchemeDokumen12 halamanCredit Rating SchemeAnil KumarBelum ada peringkat

- This Report Is To Analysis Credit Risk Management of Eastern Bank LimitedDokumen30 halamanThis Report Is To Analysis Credit Risk Management of Eastern Bank Limitedশফিকুল ইসলাম লিপুBelum ada peringkat

- DCB BankDokumen13 halamanDCB BankRajvi ShahBelum ada peringkat

- Value Added Statement: Letter of UndertakingDokumen54 halamanValue Added Statement: Letter of UndertakingAsif NazirBelum ada peringkat

- HRM CompensationDokumen46 halamanHRM CompensationShassotto Chatterjee100% (2)

- Non Performing AssetsDokumen12 halamanNon Performing AssetsVikram SinghBelum ada peringkat

- A Dynamic Professional With More Than 13 Years of Rich and Extensive Experience inDokumen4 halamanA Dynamic Professional With More Than 13 Years of Rich and Extensive Experience insaieswar4uBelum ada peringkat

- FDSLKJFDokumen9 halamanFDSLKJFumairu28Belum ada peringkat

- Regulation & Financial Market: Prudential Regulations For Small & Medium Enterprises Financing Fall 2021 IBA - KarachiDokumen25 halamanRegulation & Financial Market: Prudential Regulations For Small & Medium Enterprises Financing Fall 2021 IBA - KarachialiBelum ada peringkat

- Md. Munzurul Haq Sayem: Dutch-Bangla Bank LimitedDokumen4 halamanMd. Munzurul Haq Sayem: Dutch-Bangla Bank LimitedZiad HafizBelum ada peringkat

- MD Sarwar Jahan 1410294 Internship CaseDokumen11 halamanMD Sarwar Jahan 1410294 Internship CaseSarwar ShakilBelum ada peringkat

- Proposal Thesis, Debit Card and Credit Card PromotionsDokumen6 halamanProposal Thesis, Debit Card and Credit Card PromotionsMohsin Rahim100% (2)

- Cover LetterDokumen1 halamanCover LetterMohsin RahimBelum ada peringkat

- Assi 2Dokumen16 halamanAssi 2Mohsin RahimBelum ada peringkat

- Engro ReportDokumen5 halamanEngro ReportMohsin RahimBelum ada peringkat

- Internship Report of Adamjee InsuranceDokumen20 halamanInternship Report of Adamjee InsuranceMohsin Rahim100% (4)

- Compensation Management Report On EFU Life InsuranceDokumen13 halamanCompensation Management Report On EFU Life InsuranceMohsin Rahim0% (1)

- Operations Management at Mehmood Textile MillsDokumen11 halamanOperations Management at Mehmood Textile MillsMohsin Rahim100% (1)

- Compensation ManagementDokumen14 halamanCompensation ManagementMohsin RahimBelum ada peringkat

- Pasta Restaurant Marketing PlanDokumen14 halamanPasta Restaurant Marketing PlanMohsin RahimBelum ada peringkat

- ConclusionDokumen1 halamanConclusionMohsin RahimBelum ada peringkat

- HR Anlytics ProjectDokumen77 halamanHR Anlytics ProjectBramhini KunchalaBelum ada peringkat

- SGS Pakistan Final Report-1Dokumen29 halamanSGS Pakistan Final Report-1Fahad NadeemBelum ada peringkat

- Organizational Development of The City Bank - CompressedDokumen44 halamanOrganizational Development of The City Bank - CompressedSalman Bin AnwarBelum ada peringkat

- Public Managers Need to Understand Policy-Making for Effective ManagementDokumen14 halamanPublic Managers Need to Understand Policy-Making for Effective Management자기여보Belum ada peringkat

- HR Compliance ChecklistDokumen4 halamanHR Compliance Checklistlloyd814100% (1)

- EMI Profile - 1Dokumen19 halamanEMI Profile - 1HaileTakeleBelum ada peringkat

- Contemporary Issues in HR Management/ Essay / PaperDokumen20 halamanContemporary Issues in HR Management/ Essay / PaperAssignmentLab.comBelum ada peringkat

- Teaching Support Untuk Managemen HRDokumen102 halamanTeaching Support Untuk Managemen HRFernando FmchpBelum ada peringkat

- Human Resource Management: Chapter 2: The Analysis and Design of WorkDokumen5 halamanHuman Resource Management: Chapter 2: The Analysis and Design of WorkEricka Razon ContanteBelum ada peringkat

- A Guide For Local Chief Executives On Public Personnel AdminDokumen50 halamanA Guide For Local Chief Executives On Public Personnel AdminJong King88% (8)

- Assessment 1 Instructions - HR Challenge - Engagement Study ..Dokumen3 halamanAssessment 1 Instructions - HR Challenge - Engagement Study ..Brian MachariaBelum ada peringkat

- Puboff-Fernandez Vs Sto TomasDokumen14 halamanPuboff-Fernandez Vs Sto TomasSuiBelum ada peringkat

- Official Notification - PGCIL RecruitmentDokumen10 halamanOfficial Notification - PGCIL RecruitmentSupriya SantreBelum ada peringkat

- Marketing Management Department Unilab Sales Management Procedure (Sales Management Procedure)Dokumen36 halamanMarketing Management Department Unilab Sales Management Procedure (Sales Management Procedure)Jan AcostaBelum ada peringkat

- Assignment 1 Outline SuggestedDokumen4 halamanAssignment 1 Outline SuggestedThùy TrangBelum ada peringkat

- Taru INTERNDokumen32 halamanTaru INTERNMdrehan AhmedBelum ada peringkat

- Case StudyDokumen2 halamanCase StudyMelvin RicanaBelum ada peringkat

- Report on Organizational Development at ZONG PakistanDokumen25 halamanReport on Organizational Development at ZONG PakistanCucu ChaudaryBelum ada peringkat

- Chapter 2 - Aligning HR With StrategyDokumen31 halamanChapter 2 - Aligning HR With StrategyBrunaBelum ada peringkat

- Batch Element Entry Via Web ADI HRMSDokumen22 halamanBatch Element Entry Via Web ADI HRMSPraveen Ks100% (1)

- Question: What Is Human Resource Management? AnswerDokumen10 halamanQuestion: What Is Human Resource Management? AnswerAileen TacbalanBelum ada peringkat

- 403 HRMDokumen231 halaman403 HRMNaman LadhaBelum ada peringkat

- HRM Problems, Approaches, and Challenges at GrameenphoneDokumen19 halamanHRM Problems, Approaches, and Challenges at Grameenphonenaimul_bariBelum ada peringkat

- Turnover IntentionDokumen217 halamanTurnover IntentionBushraa JabbooBelum ada peringkat

- BBA 2nd Semester Course DetailsDokumen14 halamanBBA 2nd Semester Course DetailsKunal SharmaBelum ada peringkat

- B.B.A Sem ViDokumen9 halamanB.B.A Sem Visaurabh burrewarBelum ada peringkat