Il 1040

Diunggah oleh

Darius SamahJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Il 1040

Diunggah oleh

Darius SamahHak Cipta:

Format Tersedia

Use your mouse or Tab key to move through the fields.

Use your mouse or space bar to enable check boxes.

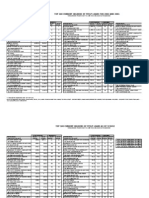

Illinois Department of Revenue

2014 Form IL-1040

Individual Income Tax Return

or for fiscal year ending

Over 80% of taxpayers file electronically. It is easy and you will get your refund faster. Visit tax.illinois.gov.

Do not write above this line.

Step 1: Personal Information

A Social Security numbers in the order they appear on your federal return

Your Social Security number

B Personal information

Your first name and initial

Your last name

Spouses first name and initial

Spouses last name

Mailing address (See instructions if foreign address)

Apartment number

Spouses Social Security number

City

State

ZIP or Postal Code

Foreign Nation, if not United States (do not abbreviate)

C Filing status (see instructions)

Single or head of household

Married filing jointly

Married filing separately

Widowed

D Check if you or your spouse are a military veteran and want your name and address shared with the Illinois

Department of Veterans Affairs.

You

Spouse

Step 2:

Staple W-2 and 1099 forms here

1

Income

2

3

4

(Whole dollars only)

Federal adjusted gross income from your U.S. 1040, Line 37; U.S. 1040A, Line 21; or

U.S. 1040EZ, Line 4

Federally tax-exempt interest and dividend income from your U.S. 1040 or 1040A, Line 8b;

or U.S. 1040EZ

Other additions. Attach Schedule M.

Total income. Add Lines 1 through 3.

1 .00

2 .00

3 .00

4 .00

Step 3:

5

Base

6

Income

7

Social Security benefits and certain retirement plan income

received if included in Line 1. Attach Page 1 of federal return.

5

Illinois Income Tax overpayment included in U.S. 1040, Line 10 6

Other subtractions. Attach Schedule M. 7

Check if Line 7 includes any amount from Schedule 1299-C.

8 Add Lines 5, 6, and 7. This is the total of your subtractions.

9 Illinois base income. Subtract Line 8 from Line 4.

Step 4:

10 a

Exemptions

b

c

d

.00

.00

.00

8 .00

9 .00

Number of exemptions from your federal return

x $2,125 a .00

If someone can claim you as a dependent, see instructions.

x $2,125 b .00

Check if 65 or older:

You +

Spouse =

x $1,000 c .00

Check if legally blind:

You +

Spouse =

x $1,000 d

.00

Exemption allowance. Add Lines a through d.

10 .00

Step 5:

Staple your check and IL-1040-V

11 Residents: Net income. Subtract Line 10 from Line 9. Skip Line 12.

11 .00

Net

12 Nonresidents and part-year residents:

Check the box that applies to you during 2014

Nonresident

Part-year resident, and

Income

enter the Illinois base income from Schedule NR. Attach Schedule NR. 12

.00

6:

Step

13 Residents: Multiply Line 11 by 5% (.05). Cannot be less than zero.

Nonresidents and part-year residents: Enter the tax from Schedule NR. 13 .00

Tax

14 Recapture of investment tax credits. Attach Schedule 4255.

14 .00

15 Income tax. Add Lines 13 and 14. Cannot be less than zero.

15 .00

Step 7:

16 Income tax paid to another state while an Illinois resident.

Attach Schedule CR.

16

Tax After

Non17 Property tax and K-12 education expense credit amount from

Schedule ICR. Attach Schedule ICR.

17

refundable

18

Credit amount from Schedule 1299-C. Attach Schedule 1299-C.

18

Credits

19 Add Lines 16, 17, and 18. This is the total of your credits. Cannot

exceed the tax amount on Line 15.

20 Tax after nonrefundable credits. Subtract Line 19 from Line 15.

IL-1040 front (R-12/14)

This form is authorized as outlined under the Illinois Income Tax Act. Disclosure of

this information is required. Failure to provide information could result in a penalty.

.00

.00

.00

*460001110*

19 .00

20 .00

21 Tax after nonrefundable credits from Page 1, Line 20

21

.00

22 Household employment tax. See instructions.

22

23 Use tax on internet, mail order, or other out-of-state purchases from

Other

Taxes

UT Worksheet or UT Table in the instructions. Do not leave blank.

23

24 Compassionate Use of Medical Cannabis Pilot Program Act Surcharge 24

25 Total Tax. Add Lines 21, 22, 23, and 24.

.00

Step

8:

Step

9:

Payments

26 Illinois Income Tax withheld. Attach all W-2 and 1099 forms.

27 Estimated payments from Forms IL-1040-ES and IL-505-I,

and

Refundable

28

Credit

29

30

Step

10:

Result

.00

.00

25 .00

26

.00

including any overpayment applied from a prior year return

27

Pass-through entity tax payments. Attach Schedule K-1-P or K-1-T. 28

Earned Income Credit from Schedule ICR. Attach Schedule ICR.

29

Total payments and refundable credit. Add Lines 26 through 29.

.00

.00

.00

30 .00

31 Overpayment. If Line 30 is greater than Line 25, subtract Line 25 from Line 30.

32 Underpayment. If Line 25 is greater than Line 30, subtract Line 30 from Line 25.

31 .00

32 .00

Step 11:

33 Late-payment penalty for underpayment of estimated tax

33

a

Check if at least two-thirds of your federal gross income is from farming.

Underpayment

of

Estimated

Tax

b

Check if you or your spouse are 65 or older and permanently

.00

Penalty

and

living in a nursing home.

Donations

c Check if your income was not received evenly during the year and

you annualized your income on Form IL-2210. Attach Form IL-2210.

d Check if you were not required to file an Illinois Individual Income Tax

return in the previous tax year.

34 Voluntary charitable donations. Attach Schedule G.

34

35 Total penalty and donations. Add Lines 33 and 34.

.00

35 .00

Step

12:

36 If you have an overpayment on Line 31 and this amount is greater than

Line 35, subtract Line 35 from Line 31. This is your remaining overpayment.

36 .00

Refund or

Amount

You

37 Amount from Line 36 you want refunded to you. Check one box on Line 38. See instructions. 37 .00

Owe

38 I choose to receive my refund by

direct deposit - Complete the information below if you check this box.

Routing number

Account number

Checking or

Savings

Illinois Individual Income Tax refund debit card

paper check

39

40

Amount to be applied to estimated tax. Subtract Line 37 from Line 36. See instructions.

If you have an underpayment on Line 32, add Lines 32 and 35. or

If you have an overpayment on Line 31 and this amount is less than Line 35,

subtract Line 31 from Line 35. This is the amount you owe. See instructions.

39 .00

40 .00

13:

Under penalties of perjury, I state that I have examined this return, and, to the best of my knowledge, it is true, correct, and

Step

complete.

Sign and

Date

Your signature

Date

Daytime phone number

Your spouses signature

Date

Paid preparers signature

Date

Preparers phone number

Preparers FEIN, SSN, or PTIN

Third

Party

Check, and complete the designees name and phone number below, to allow another person to discuss this return

Designee

and any previous return that affects the liability reported on this return with the Illinois Department of Revenue.

Designees name (please print)

Designees phone number

Form

1099-G

If you are unable to obtain your Form 1099-G from our website, you may check the box to receive a paper 1099-G form

Information

next year. We will mail you a 1099-G form if you meet the criteria requiring us to issue one to you.

If no payment enclosed, mail to:

ILLINOIS DEPARTMENT OF REVENUE

SPRINGFIELD IL 62719-0001

DR

AP

IL-1040 back (R-12/14)

Reset

If payment enclosed, mail to:

ILLINOIS DEPARTMENT OF REVENUE

SPRINGFIELD IL 62726-0001

RR

DC

IR

*460002110*

Anda mungkin juga menyukai

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Slideshare 140429172514 Phpapp01Dokumen17 halamanSlideshare 140429172514 Phpapp01Darius SamahBelum ada peringkat

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- Summary Software Test Execution Report TemplateDokumen8 halamanSummary Software Test Execution Report TemplateDarius SamahBelum ada peringkat

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (890)

- Kronos F AqsDokumen5 halamanKronos F AqsDarius SamahBelum ada peringkat

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Business Model Canvas PosterDokumen1 halamanBusiness Model Canvas Posterosterwalder75% (4)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- 11&12.corning Incorporated Reinventing New Business PDFDokumen34 halaman11&12.corning Incorporated Reinventing New Business PDFNishanth Ashok100% (2)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- Sno Tester Name Name of The Test Case Document Test Cycle Hardware/Software RecordingDokumen8 halamanSno Tester Name Name of The Test Case Document Test Cycle Hardware/Software RecordingDarius SamahBelum ada peringkat

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Adminstudio MicrosoftsecuritypatchDokumen10 halamanAdminstudio MicrosoftsecuritypatchDarius SamahBelum ada peringkat

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- 2014 Schedule NR: Nonresident and Part-Year Resident Computation of Illinois TaxDokumen2 halaman2014 Schedule NR: Nonresident and Part-Year Resident Computation of Illinois TaxDarius SamahBelum ada peringkat

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- VCU DataClassificationStandard FinalDokumen11 halamanVCU DataClassificationStandard FinalDarius SamahBelum ada peringkat

- BII WG4 Test Case Template, Version 0.7Dokumen12 halamanBII WG4 Test Case Template, Version 0.7Darius SamahBelum ada peringkat

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- The Cathedral and The BazaarDokumen1 halamanThe Cathedral and The BazaarDarius SamahBelum ada peringkat

- New Economy Technology Scholarship (NETS) Program Graduate/Undergraduate Study Deferment Request For Work ObligationDokumen2 halamanNew Economy Technology Scholarship (NETS) Program Graduate/Undergraduate Study Deferment Request For Work ObligationDarius SamahBelum ada peringkat

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Eplc Test Reports TemplateDokumen13 halamanEplc Test Reports Templatethuyvan024Belum ada peringkat

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Test Result ReportingDokumen12 halamanTest Result ReportingDarius SamahBelum ada peringkat

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- The Cathedral and The BazaarDokumen1 halamanThe Cathedral and The BazaarDarius SamahBelum ada peringkat

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Introduction To IRC - PyLadiesDokumen12 halamanIntroduction To IRC - PyLadiesDarius SamahBelum ada peringkat

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Boston College Security PolicyDokumen8 halamanBoston College Security PolicyKevin MartinBelum ada peringkat

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- Examples Annual Work GoalsDokumen7 halamanExamples Annual Work GoalsDarius SamahBelum ada peringkat

- Boston College Security PolicyDokumen8 halamanBoston College Security PolicyKevin MartinBelum ada peringkat

- CSQA Certification ProposalDokumen2 halamanCSQA Certification ProposalDarius SamahBelum ada peringkat

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Casq 01Dokumen4 halamanCasq 01Amit RathiBelum ada peringkat

- Introduction To Security PoliciesDokumen10 halamanIntroduction To Security PoliciesMarubadi Rudra Shylesh KumarBelum ada peringkat

- IT Security StdsDokumen17 halamanIT Security StdsDarius SamahBelum ada peringkat

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Brussels Unveils Sweeping Plan To Cut EU's Carbon Footprint: Ringing Hollow Questions of Trust French ConnectionDokumen20 halamanBrussels Unveils Sweeping Plan To Cut EU's Carbon Footprint: Ringing Hollow Questions of Trust French ConnectionHoangBelum ada peringkat

- Top 100 Contractors Report Fiscal Year 2010Dokumen156 halamanTop 100 Contractors Report Fiscal Year 2010Ansh ShuklaBelum ada peringkat

- RP 2013 30Dokumen4 halamanRP 2013 30forbesadmin100% (2)

- Certain Government Payments: Copy B For RecipientDokumen2 halamanCertain Government Payments: Copy B For RecipientDylan Bizier-Conley100% (1)

- IRS Form W2Dokumen2 halamanIRS Form W2nurulamin00023Belum ada peringkat

- Employees Vs Ind ContractorDokumen5 halamanEmployees Vs Ind ContractorGetto VocabBelum ada peringkat

- Overdue Surveys States 16months CASPER 02-19-2023Dokumen2 halamanOverdue Surveys States 16months CASPER 02-19-2023Michael Scott DavidsonBelum ada peringkat

- Church Pay Stubs QuarterlyDokumen6 halamanChurch Pay Stubs Quarterlydae ChoBelum ada peringkat

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Tax Guide For Small BusinessDokumen54 halamanTax Guide For Small BusinessRaja PKBelum ada peringkat

- Alaska: Articles of IncorporationDokumen2 halamanAlaska: Articles of IncorporationFinally Home RescueBelum ada peringkat

- 10000016619Dokumen160 halaman10000016619Chapter 11 Dockets100% (1)

- CamScanner 07-07-20Dokumen31 halamanCamScanner 07-07-20Annie Scarlett Hernandez Esquivel67% (6)

- IRA Deadlines Are ApproachingDokumen1 halamanIRA Deadlines Are ApproachingDoug PotashBelum ada peringkat

- Description: Tags: Top 100 Current Holders Cor Vers1Dokumen4 halamanDescription: Tags: Top 100 Current Holders Cor Vers1anon-20972Belum ada peringkat

- Request For Taxpayer Identification Number and CertificationDokumen1 halamanRequest For Taxpayer Identification Number and CertificationIsmail; HossainBelum ada peringkat

- SF-181 Ethnicity and Race Identification Standard Form 181Dokumen26 halamanSF-181 Ethnicity and Race Identification Standard Form 181Sistar Makkah94% (16)

- Net Pay $2,269.21 Pay DetailsDokumen1 halamanNet Pay $2,269.21 Pay DetailsSimonBelum ada peringkat

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Customer Address ListDokumen45 halamanCustomer Address ListNayan Moni KalitaBelum ada peringkat

- Iliteracy Breeds Economic IncompetenciesDokumen7 halamanIliteracy Breeds Economic IncompetenciesabdulBelum ada peringkat

- w-4 IN PDFDokumen2 halamanw-4 IN PDFAnonymous rPkHXogyBelum ada peringkat

- 2019 TaxreturnDokumen6 halaman2019 TaxreturnMARC ANDREWS WOLFFBelum ada peringkat

- (Circular E), Employer's Tax Guide: Future DevelopmentsDokumen49 halaman(Circular E), Employer's Tax Guide: Future DevelopmentsJoel PanganibanBelum ada peringkat

- Sspusadv PDFDokumen1 halamanSspusadv PDFKIMBelum ada peringkat

- Top 10 Direct Selling PDFDokumen2 halamanTop 10 Direct Selling PDFFabio Fish S100% (2)

- CO Real Estate Agents Contact ListDokumen240 halamanCO Real Estate Agents Contact ListReymondo BundocBelum ada peringkat

- Factiva 20160512 1904Dokumen155 halamanFactiva 20160512 1904Chong An OngBelum ada peringkat

- Net Profit From Business: Schedule C-Ez (Form 1040) 09ADokumen2 halamanNet Profit From Business: Schedule C-Ez (Form 1040) 09AtinpenaBelum ada peringkat

- Membership List: Russell 3000® IndexDokumen33 halamanMembership List: Russell 3000® IndexFuboBelum ada peringkat

- True The Vote v. IRS Consent Order - Jan 21, 2018Dokumen14 halamanTrue The Vote v. IRS Consent Order - Jan 21, 2018Catherine Engelbrecht100% (1)

- F 1040 SeDokumen2 halamanF 1040 SepdizypdizyBelum ada peringkat

- The Courage to Be Free: Florida's Blueprint for America's RevivalDari EverandThe Courage to Be Free: Florida's Blueprint for America's RevivalBelum ada peringkat

- The Smear: How Shady Political Operatives and Fake News Control What You See, What You Think, and How You VoteDari EverandThe Smear: How Shady Political Operatives and Fake News Control What You See, What You Think, and How You VotePenilaian: 4.5 dari 5 bintang4.5/5 (16)

- The Russia Hoax: The Illicit Scheme to Clear Hillary Clinton and Frame Donald TrumpDari EverandThe Russia Hoax: The Illicit Scheme to Clear Hillary Clinton and Frame Donald TrumpPenilaian: 4.5 dari 5 bintang4.5/5 (11)

- To Make Men Free: A History of the Republican PartyDari EverandTo Make Men Free: A History of the Republican PartyPenilaian: 4.5 dari 5 bintang4.5/5 (20)

- Making a Difference: Stories of Vision and Courage from America's LeadersDari EverandMaking a Difference: Stories of Vision and Courage from America's LeadersPenilaian: 3 dari 5 bintang3/5 (2)