Accounting Manual

Diunggah oleh

narasi64Deskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Accounting Manual

Diunggah oleh

narasi64Hak Cipta:

Format Tersedia

Accounting ManualDisbursements: Advance Payments

UC Accounting Manual

VI. Accounts Payable Operations

D-371-11 (TL 39, 11/01/83)

*****************************************************************

DISBURSEMENTS: ADVANCE PAYMENTS

I. INTRODUCTION

A. SCOPE

This chapter sets forth the University guidelines for

advance payments on procurements, and is intended

primarily as a practical guide for the disbursing

sections of the accounting offices.

B. LISTING OF ADVANCE PAYMENTS

Advance payments to which the procedures described in

Section II.B. below may be applied according to the

magnitude of the amounts involved included, but are not

limited to, those listed below which are the most

common types of advance payments. If, however, the

procedures outlined in Section II.B. (transaction may

be treated as in Section I.C. below), are not applied,

it will be advisable that supporting documentation be

required in order to assure that there is appropriate

evidence of receipt of goods or services paid for.

1) Foreign orders of low value--under $500 (those in

excess of this amount should be procured through a

commercial letter of credit. (See Accounting

Manual Chapter C-555-42, Commercial Letters of

Credit.)

2) Government and Library of Congress publications

purchased from U.S. Superintendent of Documents the

cost of which warrants special treatment in the

judgment of the accounting officer. [In some cases

campus departments which are volume users have

established prepayment draw-accounts against which

they place orders.]

3) Items manufactured to order or to meet special

tolerances (require purchase order)--advance

payment may be made based on the terms of the

purchase order.

4) Library materials--advanced payment may be made

when required by dealer or publisher.

5) Payment for collection of specimen, etc., in the

field.

6) Payment [partial or full] to individuals for

caterers for food and beverage service for official

functions such as commencement exercises,

administrative meetings, and student-faculty

programs.

7) Research expeditions--charters for boats and

reservations for other transportation and for

expenses.

8) Special order items for trade and professional

publications.

9) Subjects in research where a large number of people

are paid small amounts. Check for entire amount is

paid to investigator or experiment controller.

**

10)

Vendors who offer substantial prepayment

discounts.

11)

Vendors who require prepayment if order is less

than a certain minimum amount.

12)

When a purchase order requires a unique product

or service and the vendor is the only

distributor or source, advance payment may be

made if approved by the campus material manager.

13)

Travel advances.

14)

Removal or moving advances.

C. LOW EXPENDITURE OUTLAY

Because of the low expenditure outlay per transaction

in relation to the costs of accounting for each

transaction, the following types of advance payments

are ordinarily excluded from the policy contained in

this chapter. However, where in the opinion of the

accounting officer and/or the campus materiel manager

the expenditure outlay per transaction is considered to

be material, the procedures described in Section II.B.

below may be applied.

1) Subscriptions.

2) Honoraria--sometimes requested in advance of

lecture or program.

3) Memberships dues.

4) Performing artists--where contract requires payment

before performance begins.

5) Seminars and colloquia registration fees.

6) Other like transactions where in the judgement of

the accounting officer and/or campus materiel

manager the costs of accounting (as described in

Section II.B. below) and/or handling are

excessively high in com- parison to the expenditure

outlay for the transaction.

II. POLICY AND PROCEDURES

A. POLICY

1. Avoidance of Advance Payments

Advance payments or prepayments are to be avoided

whenever possible for three primary reasons:

a) It is prudent business practice (The University

Terms and Conditions of Purchase provides (Article

VI.), "Seller shall be paid, upon submission of

acceptable invoices, for materials and supplies

delivered and accepted or services performed and

accepted.") not to pay for goods or services until

they have been received in good order or rendered

satisfactorily;

b) The certifications on forms U FIN 161 (State Claim

for Reimbursement) and U FIN 162 (No Warrant State

Claim) prescribe that the signer, under penalty of

perjury, certify that goods and/or services

mentioned in the claim have in part been received

or rendered in accordance with the contract

(Purchase Order, etc.) and law; and

c) The loss of interest on funds used to make advance

payments, especially if delivery of materials or

performance of services ordered is to take place at

some distant future date.

NOTE: Ordinarily, University [current] funds are

invested by the Treasurer of The Regents in shortterm notes, etc. Monies drawn from these funds and

used to make advance payments therefore lose

interest they would have otherwise earned.

2. Approval Authority

Where advance payments are required (unavoidable),

approval authority for advance payments will be

effected as follows:

a. Purchase Orders

Where purchase orders are prepared, advance

payments requested by vendors and accepted

(approved) by the campus materiel manager (or

the campus librarian) are to be entered on the

purchase order as one of the terms of the

purchase. It may be requested that the vendors

send invoices directly to the ordering

departments.

b. Direct Charges

When an advance payment is required for a direct

charge transaction, the individual processing

the direct charge must obtain the approval of

the Vice Chancellor--Business and Finance/

Administration or his/her designee. Such

approval will be effected by an appropriate

approval signature on Form U FIN 5 (Check

Request).

c. Low-Value Procurements

Advance payments are not authorized under the

Low-Value Purchase Authorization Program unless

approved by the campus materiel manager.

B. PROCEDURES

1. Accounting for Cash Advances

a. Account Recordation

An appropriate cash advance account (for

example, account number 112XXX, Receivable-Other) is to be charged. The fund block or

purchase order block may be used to project the

date the invoice is expected to be received

(this date control procedure will enable the

disbursement section of the accounting office to

follow-up on each cash advance). When the

advance payment is recorded in the receivable

account, a lien may be placed against the

expense or other account to which the charge

eventually will be made.

b. Invoice Processing

The invoice is double-tagged with a credit to

the receivable account and a debit to the

expense or other account; the lien, if any, is

concurrently removed from the account previously

charged.

III.

RESPONSIBILITIES

A. CAMPUS MATERIEL MANAGERS, ETC.

Campus materiel managers (or campus librarians) are

responsible for the preparation and processing of

purchase orders where they are required.

B. CAMPUS ACCOUNTING OFFICERS

Accounting officers are responsible for processing

Forms UFIN 5 initiated by campus departments, for

issuing checks, and for processing invoices for

payment.

IV. REFERENCES

Accounting Manual Chapters:

D-371-16

D-371-23

D-371-28

D-371-35

D-371-36

Disbursements:

Disbursements:

Disbursements:

Disbursements:

Disbursements:

Approvals Required.

Discount Terminology.

Freight.

Honorarium Payments.

Invoice Processing.

Business and Finance Bulletins:

BUS-43

A-53

Materiel Management.

Official Documentation Required in Support of

University Financial Transactions.

_________________________________

Historical note: Original Accounting Manual Chapter first

Published 07/01/80; analyst--Quint Doroquez.

Back to Accounting Manual Table of Contents

Anda mungkin juga menyukai

- Procedures No 3511 Customer Billing and CollectionsDokumen6 halamanProcedures No 3511 Customer Billing and Collectionsakondolenin74Belum ada peringkat

- Rocedures: These Policies and Procedures May Be Revised, Subject To Board ApprovalDokumen23 halamanRocedures: These Policies and Procedures May Be Revised, Subject To Board ApprovalpateljayaminBelum ada peringkat

- Prodcure ManualDokumen23 halamanProdcure ManualpateljayaminBelum ada peringkat

- Policies ManualDokumen23 halamanPolicies Manualpateljayamin100% (1)

- PenaDokumen2 halamanPenaClaude PeñaBelum ada peringkat

- Change 2A 12/01Dokumen56 halamanChange 2A 12/01Tee R TaylorBelum ada peringkat

- PaymentsDokumen22 halamanPaymentsFifi AdiBelum ada peringkat

- Chapter 5 Accounting For Disbursements and Related TransactionsDokumen2 halamanChapter 5 Accounting For Disbursements and Related TransactionsJaps100% (1)

- Accounts Receivable PolicyDokumen6 halamanAccounts Receivable PolicyJS100% (1)

- Guidelines Stock Audit - Drawing PowerDokumen4 halamanGuidelines Stock Audit - Drawing PowerHimanshu Aggarwal50% (4)

- Chapter 10 - Solution ManualDokumen27 halamanChapter 10 - Solution Manualjuan100% (1)

- Announcement From Systems - Circulars Issued by - Released Thru Systems (For December)Dokumen18 halamanAnnouncement From Systems - Circulars Issued by - Released Thru Systems (For December)Andy EdonoBelum ada peringkat

- IT Audit 4ed SM Ch10Dokumen45 halamanIT Audit 4ed SM Ch10randomlungs121223Belum ada peringkat

- Fundamentals of Acct - I, Lecture Note - Chapter 5-1Dokumen13 halamanFundamentals of Acct - I, Lecture Note - Chapter 5-1Kiya GeremewBelum ada peringkat

- Chap010 SMDokumen24 halamanChap010 SMTaylor NataleBelum ada peringkat

- Gve Policies and Guidelines On Cash AdvancesDokumen3 halamanGve Policies and Guidelines On Cash Advancesmarvinceledio100% (3)

- Internal Audit ManualDokumen11 halamanInternal Audit ManualAnudeep ReddyBelum ada peringkat

- Auditing The Expenditure CycleDokumen56 halamanAuditing The Expenditure CycleJohn Lexter Macalber100% (1)

- Petty CashDokumen11 halamanPetty CashCecibloom Shara Hiludo-CabreraBelum ada peringkat

- Accounts PayableDokumen4 halamanAccounts PayablemaheshBelum ada peringkat

- Chapter 5 Accounting For Disbursements and Related TransactionsDokumen8 halamanChapter 5 Accounting For Disbursements and Related TransactionsLeonard CanamoBelum ada peringkat

- Section 13: Fund Accounting Accounting Entries: Accounts ReceivableDokumen5 halamanSection 13: Fund Accounting Accounting Entries: Accounts ReceivablethisisghostactualBelum ada peringkat

- About This ProcedureDokumen8 halamanAbout This ProcedurenguyenkieumyBelum ada peringkat

- 10 Auditing The Expenditure CycleDokumen9 halaman10 Auditing The Expenditure CycleJude AlbaniaBelum ada peringkat

- Basic Features of The New Government Accounting SystemDokumen4 halamanBasic Features of The New Government Accounting SystemabbiecdefgBelum ada peringkat

- Revenue PDFDokumen265 halamanRevenue PDFvb_krishnaBelum ada peringkat

- Chapter 5Dokumen5 halamanChapter 5Itsme ColladoBelum ada peringkat

- How Do Different Levels of Control Risk in The RevDokumen3 halamanHow Do Different Levels of Control Risk in The RevHenry L BanaagBelum ada peringkat

- SOP AccountsDokumen6 halamanSOP Accountsnkadam737Belum ada peringkat

- Guide On Revenue AuditDokumen5 halamanGuide On Revenue AuditRahul PathakBelum ada peringkat

- Cash ProgramDokumen13 halamanCash Programapi-3828505Belum ada peringkat

- ACCTG16A FinalExamDokumen5 halamanACCTG16A FinalExamJeane BongalanBelum ada peringkat

- Acquisition and Payment Cycle Final AnswerDokumen2 halamanAcquisition and Payment Cycle Final AnswerPrincess MarceloBelum ada peringkat

- Government AccountingDokumen17 halamanGovernment AccountingJaniña Natividad100% (1)

- CIT V InsilcoDokumen13 halamanCIT V InsilcoRavi SrinivasanBelum ada peringkat

- COA PresentationDokumen155 halamanCOA PresentationRonnie Balleras Pagal100% (1)

- FM LaDokumen115 halamanFM LaSamBelum ada peringkat

- Chapter 20 - Answer PDFDokumen10 halamanChapter 20 - Answer PDFjhienellBelum ada peringkat

- Accounts of Banking CompaniesDokumen24 halamanAccounts of Banking CompaniesrachealllBelum ada peringkat

- Solution Manual For Financial Accounting Fundamentals 5Th Edition by Wild Isbn 0078025753 9780078025754 Full Chapter PDFDokumen36 halamanSolution Manual For Financial Accounting Fundamentals 5Th Edition by Wild Isbn 0078025753 9780078025754 Full Chapter PDFcarmen.hall969100% (11)

- CH 3.0-CONDUCT THE CASH EXAMINATIONDokumen22 halamanCH 3.0-CONDUCT THE CASH EXAMINATIONBon Carlo Medina MelocotonBelum ada peringkat

- Manual of Standing Orders (Accounts & Entitlements) Volume-IDokumen85 halamanManual of Standing Orders (Accounts & Entitlements) Volume-IAtul SushantBelum ada peringkat

- D. Prepare and Periodically Update Lists of Authorized CustomersDokumen3 halamanD. Prepare and Periodically Update Lists of Authorized Customersjojijoon.miralBelum ada peringkat

- COA Presentation - RRSADokumen155 halamanCOA Presentation - RRSAKristina Dacayo-Garcia100% (1)

- A Project Report: Mukand Lal National College, YAMUNA NAGAR-135001Dokumen64 halamanA Project Report: Mukand Lal National College, YAMUNA NAGAR-135001Sudhir KakarBelum ada peringkat

- Unit 6 Audit of LiabilitiesDokumen6 halamanUnit 6 Audit of Liabilitiessolomon adamuBelum ada peringkat

- CHAPTER 4.lecture Note-Apr 2023Dokumen16 halamanCHAPTER 4.lecture Note-Apr 2023Eyuel SintayehuBelum ada peringkat

- CH 5 Accounting For Disbursements and Related TransactionsDokumen3 halamanCH 5 Accounting For Disbursements and Related TransactionsGem Baguinon100% (1)

- Advances To EmployeesDokumen22 halamanAdvances To EmployeesDebarati BoseBelum ada peringkat

- Ngas Module Government AccountingDokumen11 halamanNgas Module Government AccountingAnn Kristine Trinidad50% (2)

- Standard Operating Procedure SOP For AccDokumen7 halamanStandard Operating Procedure SOP For AccOsman ZaheerBelum ada peringkat

- 1 SOP Petty Cash ManagementDokumen27 halaman1 SOP Petty Cash ManagementMuhammad Julianto FardanBelum ada peringkat

- Solution Manual For Financial Accounting Fundamentals 4Th Edition by Wild Isbn 0078025591 9780078025594 Full Chapter PDFDokumen36 halamanSolution Manual For Financial Accounting Fundamentals 4Th Edition by Wild Isbn 0078025591 9780078025594 Full Chapter PDFcarmen.hall969100% (12)

- 414 Petty Cash Policy 5.9.13Dokumen3 halaman414 Petty Cash Policy 5.9.13অরণ্য আহমেদBelum ada peringkat

- Textbook of Urgent Care Management: Chapter 13, Financial ManagementDari EverandTextbook of Urgent Care Management: Chapter 13, Financial ManagementBelum ada peringkat

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeDari Everand1040 Exam Prep Module III: Items Excluded from Gross IncomePenilaian: 1 dari 5 bintang1/5 (1)

- Bookkeeping And Accountancy Made Simple: For Owner Managed Businesses, Students And Young EntrepreneursDari EverandBookkeeping And Accountancy Made Simple: For Owner Managed Businesses, Students And Young EntrepreneursBelum ada peringkat

- The Entrepreneur’S Dictionary of Business and Financial TermsDari EverandThe Entrepreneur’S Dictionary of Business and Financial TermsBelum ada peringkat

- Purchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsDari EverandPurchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsPenilaian: 5 dari 5 bintang5/5 (1)

- Cloud Banks of NectarDokumen3 halamanCloud Banks of Nectarfreetax108Belum ada peringkat

- Nishkama KarmaDokumen4 halamanNishkama Karmaanon-388274100% (1)

- Saranagathi Enewsletter April 2019 PDFDokumen10 halamanSaranagathi Enewsletter April 2019 PDFnarasi64Belum ada peringkat

- KRI (Key Risk Indicators) ToolkitDokumen19 halamanKRI (Key Risk Indicators) ToolkitAleksey Savkin100% (4)

- Meditation Mouni Sadhu Concentration A Guide To Mental MasteryfixedDokumen48 halamanMeditation Mouni Sadhu Concentration A Guide To Mental Masteryfixedsantsetesh100% (1)

- Pradeep Apte The SelfDokumen19 halamanPradeep Apte The SelfmbasaferBelum ada peringkat

- D and ADokumen73 halamanD and Anarasi64Belum ada peringkat

- SOP Trade In1Dokumen15 halamanSOP Trade In1narasi64Belum ada peringkat

- There Is OnlyDokumen7 halamanThere Is OnlyChander VenkataramanBelum ada peringkat

- Nist 8 April 2013Dokumen7 halamanNist 8 April 2013narasi64Belum ada peringkat

- Capital Budgeting: Cyrk Assets Cyrk Assets Chapter 8 1/18/2001 03:58:00 PMDokumen5 halamanCapital Budgeting: Cyrk Assets Cyrk Assets Chapter 8 1/18/2001 03:58:00 PMnarasi64Belum ada peringkat

- Fixed Asset VeificationDokumen12 halamanFixed Asset Veificationnarasi64Belum ada peringkat

- Pingali Surya Sundaram, Sri Krishna Bhikshu - Sri Ramana Leela (A Biography of Bhagavan Sri Ramana Maharshi)Dokumen325 halamanPingali Surya Sundaram, Sri Krishna Bhikshu - Sri Ramana Leela (A Biography of Bhagavan Sri Ramana Maharshi)Francesca Gee100% (1)

- IDSP SC Act SlidesDokumen31 halamanIDSP SC Act Slidesnarasi64Belum ada peringkat

- Mapping Cgeit and CobitDokumen55 halamanMapping Cgeit and CobitLaura IntanBelum ada peringkat

- 12v1 Database BackupDokumen6 halaman12v1 Database Backupnarasi64Belum ada peringkat

- Aeid 9111Dokumen10 halamanAeid 9111narasi64Belum ada peringkat

- Whistleblower StrategiesDokumen22 halamanWhistleblower StrategiesMustapha MugisaBelum ada peringkat

- 12v1 Key Issues ChallengesDokumen4 halaman12v1 Key Issues Challengesnarasi64Belum ada peringkat

- 20 Critical Controls For Cyber Defense QADokumen5 halaman20 Critical Controls For Cyber Defense QAnarasi64Belum ada peringkat

- Risk Assessment TemplateDokumen5 halamanRisk Assessment TemplateAnonymous iI88LtBelum ada peringkat

- Sample Mat WRKPLNDokumen5 halamanSample Mat WRKPLNnarasi64Belum ada peringkat

- FCPA GuideDokumen130 halamanFCPA GuideSrivatsa KrishnaBelum ada peringkat

- Helpsource: Ganapathi Subramaniam, Cisa, Cism, Has RecentlyDokumen1 halamanHelpsource: Ganapathi Subramaniam, Cisa, Cism, Has Recentlynarasi64Belum ada peringkat

- Segregation of Duties - SoDDokumen7 halamanSegregation of Duties - SoDJulio Turchan OleaBelum ada peringkat

- Mapping Cgeit and CobitDokumen57 halamanMapping Cgeit and Cobitnarasi64Belum ada peringkat

- Assets Chapter2 EnteringDokumen24 halamanAssets Chapter2 Enteringnarasi64Belum ada peringkat

- The Rirdc Fraud Control Allegation Reporting Template and GuidelinesDokumen3 halamanThe Rirdc Fraud Control Allegation Reporting Template and Guidelinesnarasi64Belum ada peringkat

- Risk Plan ExcelDokumen14 halamanRisk Plan ExcelJanaka WempathiBelum ada peringkat

- Risk Management Plan Template 1.2Dokumen9 halamanRisk Management Plan Template 1.2Janaka WempathiBelum ada peringkat

- Medical Devices RegulationsDokumen59 halamanMedical Devices RegulationsPablo CzBelum ada peringkat

- Mentorship ICT at A GlanceDokumen5 halamanMentorship ICT at A GlanceTeachers Without Borders0% (1)

- Spine Beam - SCHEME 4Dokumen28 halamanSpine Beam - SCHEME 4Edi ObrayanBelum ada peringkat

- Qualifi Level 6 Diploma in Occupational Health and Safety Management Specification October 2019Dokumen23 halamanQualifi Level 6 Diploma in Occupational Health and Safety Management Specification October 2019Saqlain Siddiquie100% (1)

- Reading TPO 49 Used June 17 To 20 10am To 12pm Small Group Tutoring1Dokumen27 halamanReading TPO 49 Used June 17 To 20 10am To 12pm Small Group Tutoring1shehla khanBelum ada peringkat

- EMI-EMC - SHORT Q and ADokumen5 halamanEMI-EMC - SHORT Q and AVENKAT PATILBelum ada peringkat

- Woodward GCP30 Configuration 37278 - BDokumen174 halamanWoodward GCP30 Configuration 37278 - BDave Potter100% (1)

- Strength and Microscale Properties of Bamboo FiberDokumen14 halamanStrength and Microscale Properties of Bamboo FiberDm EerzaBelum ada peringkat

- Pet Care in VietnamFull Market ReportDokumen51 halamanPet Care in VietnamFull Market ReportTrâm Bảo100% (1)

- Sem 4 - Minor 2Dokumen6 halamanSem 4 - Minor 2Shashank Mani TripathiBelum ada peringkat

- Harga H2H Pula-Paket Data - Saldo EWallet v31012022Dokumen10 halamanHarga H2H Pula-Paket Data - Saldo EWallet v31012022lala cemiBelum ada peringkat

- Rules On Evidence PDFDokumen35 halamanRules On Evidence PDFEuodia HodeshBelum ada peringkat

- Self-Instructional Manual (SIM) For Self-Directed Learning (SDL)Dokumen28 halamanSelf-Instructional Manual (SIM) For Self-Directed Learning (SDL)Monique Dianne Dela VegaBelum ada peringkat

- Analysis of Brand Activation and Digital Media On The Existence of Local Product Based On Korean Fashion (Case Study On Online Clothing Byeol - Thebrand)Dokumen11 halamanAnalysis of Brand Activation and Digital Media On The Existence of Local Product Based On Korean Fashion (Case Study On Online Clothing Byeol - Thebrand)AJHSSR JournalBelum ada peringkat

- Mcqs in Wills and SuccessionDokumen14 halamanMcqs in Wills and Successionjudy andrade100% (1)

- Questionnaire: ON Measures For Employee Welfare in HCL InfosystemsDokumen3 halamanQuestionnaire: ON Measures For Employee Welfare in HCL Infosystemsseelam manoj sai kumarBelum ada peringkat

- Tekla Structures ToturialsDokumen35 halamanTekla Structures ToturialsvfmgBelum ada peringkat

- 3.1 Radiation in Class Exercises IIDokumen2 halaman3.1 Radiation in Class Exercises IIPabloBelum ada peringkat

- Learner Guide HDB Resale Procedure and Financial Plan - V2Dokumen0 halamanLearner Guide HDB Resale Procedure and Financial Plan - V2wangks1980Belum ada peringkat

- On Applied EthicsDokumen34 halamanOn Applied Ethicsamanpatel78667% (3)

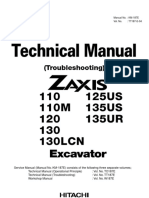

- Technical Manual: 110 125US 110M 135US 120 135UR 130 130LCNDokumen31 halamanTechnical Manual: 110 125US 110M 135US 120 135UR 130 130LCNKevin QuerubinBelum ada peringkat

- ILRF Soccer Ball ReportDokumen40 halamanILRF Soccer Ball ReportgabalauiBelum ada peringkat

- Seminar Report of Automatic Street Light: Presented byDokumen14 halamanSeminar Report of Automatic Street Light: Presented byTeri Maa Ki100% (2)

- CEC Proposed Additional Canopy at Guard House (RFA-2021!09!134) (Signed 23sep21)Dokumen3 halamanCEC Proposed Additional Canopy at Guard House (RFA-2021!09!134) (Signed 23sep21)MichaelBelum ada peringkat

- Qa-St User and Service ManualDokumen46 halamanQa-St User and Service ManualNelson Hurtado LopezBelum ada peringkat

- DPC SEMESTER X B Project ListDokumen2 halamanDPC SEMESTER X B Project ListVaibhav SharmaBelum ada peringkat

- Drug Study TemplateDokumen2 halamanDrug Study TemplateKistlerzane CABALLEROBelum ada peringkat

- I5386-Bulk SigmaDokumen1 halamanI5386-Bulk SigmaCleaver BrightBelum ada peringkat

- Typical World Coordinates Are: Pos X-Axis Right Pos Y-Axis Back Pos Z-Axis UpDokumen2 halamanTypical World Coordinates Are: Pos X-Axis Right Pos Y-Axis Back Pos Z-Axis UpSabrinadeFeraBelum ada peringkat

- Common OPCRF Contents For 2021 2022 FINALE 2Dokumen21 halamanCommon OPCRF Contents For 2021 2022 FINALE 2JENNIFER FONTANILLA100% (30)