Nonprofit Insider - May 2015

Diunggah oleh

UHYColumbiaMDHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Nonprofit Insider - May 2015

Diunggah oleh

UHYColumbiaMDHak Cipta:

Format Tersedia

May 2015 Vol. 6 No.

UHY LLP

Mid-Atlantic

Nonprofit Insider

U H Y L LP p r ovi de s sol utio ns to no np r of it firms

i n acc ou nt in g, tax and co nsult in g.

Mobile Workforce:

Do You Know Where Your Employees Are?

by Tracey Powell, Senior Manager

any organizations are

expanding

their

multi-state

and

international footprint. This expansion often includes

hiring or deploying

a mobile workforce. These employees

could potentially travel across state

lines several days a week to visit external clients or internal colleagues

from other offices, to attend meetings and conferences, and, otherwise,

to transact business. Many of these

organizations are unaware of the

complexities of each states personal

income tax rules and withholding and

reporting requirements.

When a nonresident employee performs services or works on behalf of

the organization in another state, the

employer could be required to withhold and remit state income taxes on

the wages earned in the nonresident

state, the state where the organization is not based or where the employee is not a resident. Withholding on wages of nonresidents is

required of an out-of-state employer

if the employer transacts business in

the state. Operating or engaging in

business by an employee on behalf of

the employer in a state, even though

these activities are not sufficient to

create an income/franchise tax busi-

ness filing requirement for the employer, would likely be considered

transacting business for income tax

withholding purposes.

Lack of State Nonresident

Withholding Uniformity

Every state has its own laws regarding state income tax withholding for

nonresident employees. While some

states provide for either a day or dollar de minimis threshold, the majority

the next level of service

of states require employers to withhold from the very first day or dollar

earned in the state. This lack of uniformity requires employers who deploy a mobile workforce to comprehend and apply a patchwork of state

rules.

Several states have entered into reciprocal agreements exempting employers in neighboring states from

withholding taxes of its employees

earning income in a neighboring

state. For instance, Maryland has entered into reciprocal agreements

with three border statesPennsylvania, Virginia, West Virginiaand

with the District of Columbia. These

agreements provide that Maryland

businesses sending employees into

the border state are not required to

withhold the other states income tax

on the compensation paid there, and

vice versa.

Compliance Burden for

the Employer

Given this lack of uniformity, its not

surprising that employers do not alcontinued on page 2

For more information,

please contact Matt Duvall

at mduvall@uhy-us.com

8601 Robert Fulton Drive l Suite 210 l Columbia, MD 21046 l 410-423-4800 l Fax 410-381-5538 l www.uhy-us.com

the next level of service

Mobile Workforce

continued from page 1

ways know or follow these state rules.

Many employers fail to understand

their obligation to withhold the other

states income tax from the employees income earned outside their

home state. The lack of uniformity

creates complexity for employers that

want to be compliant.

Accurately tracking employees time

and wages in other states means having to adjust timekeeping systems

and payroll systems. Employers must

be able to flag when an employee is

working in another state. Another

complication is how to handle

salaried employees who are not paid

hourly wages and do not have to

track time at all. Thus, tracking of

these employees is generally a manual process. This data could be further

skewed if the traveling employee

does not remit, or excludes, a certain

days worth of information, whether

they intended to or not.

Telecommuting can also present significant issues for withholding. Typically the default is for employers to

withhold income tax for the state in

which the employee performs services. However, an employee may

telecommute from State A but report

to State B. In most instances, the employer will have to withhold from

State A because that is where the services are performed.

Employers that are required to

deduct and withhold state income

tax from wages of nonresident employees could be liable for the payment of the associated tax whether

or not it is collected from the employees. In addition, substantial in-

terest and penalties can accrue for

not complying with state(s) nonresident withholding requirements.

Compliance Burden for the

Employee

Employees must determine if their activity in a nonresident state is subject

to tax even if their employer withheld

payroll taxes for the state. Thus, employees often file multiple state individual income tax returns to either

pay additional taxes or claim a refund

on income incorrectly withheld.

Employers

must

be

able to flag when an

employee is working in

another state.

Spending several hours to complete

and file a few or numerous nonresident state tax returns resulting in aggregate a few hundred dollars in state

income tax is something an employee

wants to avoid and is not high on

their list after traveling and working

possibly a 10+ hour day. Most so-called

road warriors do not file the nonresident returns nor do they have income

tax withheld in these states.

What if one employer does withhold

from the employees paycheck for the

nonresident state(s) and another employer in the same industry does not

do this for their mobile employees?

All else being equal, the employee

could consider working for the other

employer to avoid dealing with the

nonresident state income tax return

compliance.

Need a Uniform Standard

With a new 114th Congress, The Mobile Workforce State Income Tax Simplification Act, which has been proposed several times in Congress, most

recently in November 2013, is expected to be reintroduced in 2015. A

state is entitled to tax income earned

within its borders. The act would limit

state and local government authority

to tax income of nonresident employees working within their borders on

temporary assignments by providing a

30-day bright-line rule before a state

can impose tax on the employee or

withholding obligations on the employer. This would apply uniformly to

all 50 states.

Such laws will certainly ease the employers compliance issues of withholding income taxes from traveling

employees. While this simplifies things

for employers, they still have the burden to prove time and wages of employees working in multiple states.

Conclusion

As states have different withholding

rules, employers must be cognizant of

where their employees are earning

income and properly withhold taxes

when income is earned outside the

employees home state, as well as

what exemptions are available.

Additionally, an employees physical

presence, depending on the extent

and frequency, will likely create

other state tax obligations for the

employer, such as sales tax collection

obligations or corporate income/

franchise tax liability.

Our firm provides the information in this newsletter as tax information and general business or economic information or analysis for educational purposes, and none of the information contained herein is intended to serve as a

solicitation of any service or product. This information does not constitute the provision of legal advice, tax advice, accounting services, investment advice, or professional consulting of any kind. The information provided herein

should not be used as a substitute for consultation with professional tax, accounting, legal,or other competent advisors. Before making any decision or taking any action, you should consult a professional advisor who has been

provided with all pertinent facts relevant to your particular situation. Tax articles in this newsletter are not intended to be used, and cannot be used by any taxpayer, for the purpose of avoiding accuracy-related penalties that may

be imposed on the taxpayer. The information is provided "as is," with no assurance or guarantee of completeness, accuracy, or timeliness of the information, and without warranty of any kind, express or implied, including but not

limited to warranties of performance, merchantability, and fitness for a particular purpose.

UHY Advisors, Inc. provides tax and business consulting services through wholly owned subsidiary entities that operate under the name of UHY Advisors. UHY Advisors, Inc. and its subsidiary entities are not licensed CPA firms.

UHY LLP is a licensed independent CPA firm that performs attest services in an alternative practice structure with UHY Advisors, Inc. and its subsidiary entities. UHY Advisors, Inc. and UHY LLP are U.S. members of Urbach Hacker

Young International Limited, a UK company, and form part of the international UHY network of legally independent accounting and consulting firms. UHY is the brand name for the UHY international network. Any services

described herein are provided by UHY Advisors and/or UHY LLP (as the case may be) and not by UHY or any other member firm of UHY. Neither UHY nor any member of UHY has any liability for services provided by other members.

Anda mungkin juga menyukai

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5795)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1091)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- Estrogen Dominance-The Silent Epidemic by DR Michael LamDokumen39 halamanEstrogen Dominance-The Silent Epidemic by DR Michael Lamsmtdrkd75% (4)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- UHY Not-for-Profit Newsletter - August 2013Dokumen2 halamanUHY Not-for-Profit Newsletter - August 2013UHYColumbiaMDBelum ada peringkat

- Nonprofit Insider: Plan Sponsors, Are You Ready For The New Regulations?Dokumen2 halamanNonprofit Insider: Plan Sponsors, Are You Ready For The New Regulations?UHYColumbiaMDBelum ada peringkat

- Nonprofit Insider: What Is Your Form 990 Telling The IRS?Dokumen2 halamanNonprofit Insider: What Is Your Form 990 Telling The IRS?UHYColumbiaMDBelum ada peringkat

- UHY Not-For-Profit Newsletter - August 2012Dokumen2 halamanUHY Not-For-Profit Newsletter - August 2012UHYColumbiaMDBelum ada peringkat

- Insider: Plan Sponsors, Are You Ready For The New Regulations?Dokumen2 halamanInsider: Plan Sponsors, Are You Ready For The New Regulations?UHYColumbiaMDBelum ada peringkat

- UHY Government Contractor Newsletter - September 2011Dokumen2 halamanUHY Government Contractor Newsletter - September 2011UHYColumbiaMDBelum ada peringkat

- UHY Government Contractor Newsletter - November 2011Dokumen2 halamanUHY Government Contractor Newsletter - November 2011UHYColumbiaMD100% (1)

- UHY Not-For-Profit Newsletter - March 2012Dokumen2 halamanUHY Not-For-Profit Newsletter - March 2012UHYColumbiaMDBelum ada peringkat

- UHY Not-for-Profit Newsletter - November 2011Dokumen2 halamanUHY Not-for-Profit Newsletter - November 2011UHYColumbiaMDBelum ada peringkat

- UHY Not-for-Profit Newsletter - August 2011Dokumen2 halamanUHY Not-for-Profit Newsletter - August 2011UHYColumbiaMDBelum ada peringkat

- UHY Government Contractor Newsletter - January 2011Dokumen2 halamanUHY Government Contractor Newsletter - January 2011UHYColumbiaMDBelum ada peringkat

- UHY Government Contractor Newsletter - February 2011Dokumen2 halamanUHY Government Contractor Newsletter - February 2011UHYColumbiaMDBelum ada peringkat

- UHY Not-for-Profit Newsletter - March 2011Dokumen2 halamanUHY Not-for-Profit Newsletter - March 2011UHYColumbiaMDBelum ada peringkat

- UHY Financial Managment Newsletter - February 2011Dokumen2 halamanUHY Financial Managment Newsletter - February 2011UHYColumbiaMDBelum ada peringkat

- UHY Construction Newsletter - February 2011Dokumen2 halamanUHY Construction Newsletter - February 2011UHYColumbiaMDBelum ada peringkat

- UHY Not-for-Profit Newsletter - December 2010Dokumen2 halamanUHY Not-for-Profit Newsletter - December 2010UHYColumbiaMDBelum ada peringkat

- ProAct ISCDokumen120 halamanProAct ISCjhon vergaraBelum ada peringkat

- Market Pulse Q4 Report - Nielsen Viet Nam: Prepared by Nielsen Vietnam February 2017Dokumen8 halamanMarket Pulse Q4 Report - Nielsen Viet Nam: Prepared by Nielsen Vietnam February 2017K57.CTTT BUI NGUYEN HUONG LYBelum ada peringkat

- Policy Schedule Personal Accident Insurance Policy: (Plan 5)Dokumen2 halamanPolicy Schedule Personal Accident Insurance Policy: (Plan 5)Rana BiswasBelum ada peringkat

- 1 PolarographyDokumen20 halaman1 PolarographyRiya Das100% (1)

- Dual Laminate Piping HandbookDokumen46 halamanDual Laminate Piping HandbookA.Subin DasBelum ada peringkat

- Ergo 1 - Workshop 3Dokumen3 halamanErgo 1 - Workshop 3Mugar GeillaBelum ada peringkat

- Cisco - Level 45Dokumen1 halamanCisco - Level 45vithash shanBelum ada peringkat

- Electronic Price List June 2022Dokumen55 halamanElectronic Price List June 2022MOGES ABERABelum ada peringkat

- The Coca-Cola Company - Wikipedia, The Free EncyclopediaDokumen11 halamanThe Coca-Cola Company - Wikipedia, The Free EncyclopediaAbhishek ThakurBelum ada peringkat

- Presentasi Evaluasi Manajemen Risiko - YLYDokumen16 halamanPresentasi Evaluasi Manajemen Risiko - YLYOPERASIONALBelum ada peringkat

- Food Safety PosterDokumen1 halamanFood Safety PosterMP CariappaBelum ada peringkat

- Chemical Analysis and Mechancial Test Certificate: Yield Strength Tensile Strength ElongationDokumen1 halamanChemical Analysis and Mechancial Test Certificate: Yield Strength Tensile Strength ElongationDigna Bettin CuelloBelum ada peringkat

- Om Deutz 1013 PDFDokumen104 halamanOm Deutz 1013 PDFEbrahim Sabouri100% (1)

- Wire Rope Inspection ProgramDokumen2 halamanWire Rope Inspection Programسيد جابر البعاجBelum ada peringkat

- Nature and Nurture - How They Play A Role in Serial Killers and THDokumen40 halamanNature and Nurture - How They Play A Role in Serial Killers and THJ.A.B.ABelum ada peringkat

- Chemistry DemosDokumen170 halamanChemistry DemosStacey BensonBelum ada peringkat

- UBKV Ranking Proforma With Annexures 2018 PDFDokumen53 halamanUBKV Ranking Proforma With Annexures 2018 PDFSubinay Saha RoyBelum ada peringkat

- Distilled Witch Hazel AVF-SP DWH0003 - June13 - 0Dokumen1 halamanDistilled Witch Hazel AVF-SP DWH0003 - June13 - 0RnD Roi SuryaBelum ada peringkat

- Top 6 Beginner Work Out MistakesDokumen4 halamanTop 6 Beginner Work Out MistakesMARYAM GULBelum ada peringkat

- Demolition/Removal Permit Application Form: Planning, Property and Development DepartmentDokumen3 halamanDemolition/Removal Permit Application Form: Planning, Property and Development DepartmentAl7amdlellahBelum ada peringkat

- T W H O Q L (Whoqol) - Bref: Skrócona Wersja Ankiety Oceniającej Jakość ŻyciaDokumen6 halamanT W H O Q L (Whoqol) - Bref: Skrócona Wersja Ankiety Oceniającej Jakość ŻyciaPiotrBelum ada peringkat

- OBESITY - Cayce Health DatabaseDokumen4 halamanOBESITY - Cayce Health Databasewcwjr55Belum ada peringkat

- CAT Test Series - 2014Dokumen2 halamanCAT Test Series - 2014dimevsnBelum ada peringkat

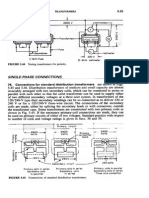

- Transformers ConnectionsDokumen6 halamanTransformers Connectionsgeorgel1980Belum ada peringkat

- The Development of Attachment in Separated and Divorced FamiliesDokumen33 halamanThe Development of Attachment in Separated and Divorced FamiliesInigo BorromeoBelum ada peringkat

- Full Carrino Plaza Brochure and Application (General)Dokumen8 halamanFull Carrino Plaza Brochure and Application (General)tanis581Belum ada peringkat

- Immobilization of E. Coli Expressing Bacillus Pumilus CynD in Three Organic Polymer MatricesDokumen23 halamanImmobilization of E. Coli Expressing Bacillus Pumilus CynD in Three Organic Polymer MatricesLUIS CARLOS ROMERO ZAPATABelum ada peringkat

- ReferensiDokumen4 halamanReferensiyusri polimengoBelum ada peringkat

- Upper Limb OrthosesDokumen29 halamanUpper Limb OrthosesMaryam KhalidBelum ada peringkat