PBCOM: Q1 Statement of Condition

Diunggah oleh

BusinessWorldJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

PBCOM: Q1 Statement of Condition

Diunggah oleh

BusinessWorldHak Cipta:

Format Tersedia

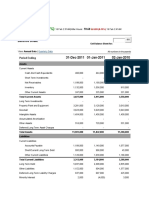

ASSETS

BALANCE SHEET

(Head Office and Branches)

As of March 31, 2015

As of December 31, 2014

ASSETS

BALANCE SHEET

(Parent Bank and Financial Subsidiaries)

As of March 31, 2015

As of December 31, 2014

Cash and Cash Items

Due from Bangko Sentral ng Pilipinas

Due from Other Banks

Financial Assets Designated at Fair Value through Profit or Loss

Available-for-Sale Financial Assets - Net

Held-to-Maturity Financial Assets - Net

Unquoted Debt Securities Classified as Loans - Net

Loans and Receivables - Net

Interbank Loans Receivable

Loans and Receivables - Others

General Loan Loss Provision

Other Financial Assets

Equity Investment in Subsidiaries, Associates and Joint Ventures - Net

Bank Premises, Furniture, Fixture & Equipment - Net

Real and Other Properties Acquired - Net

Other Assets - Net

846,686,007.05

15,221,708,719.28

1,831,799,325.27

1,153,568,294.27

42,974,932.50

14,713,339,614.37

5,044,332,476.73

26,502,088,464.56

50,000,000.00

26,710,135,376.41

258,046,911.85

325,835,249.86

758,292,228.98

1,969,537,845.96

316,292,035.00

6,438,834,383.27

1,157,746,050.92

12,507,925,895.46

1,918,808,508.55

684,985,876.64

42,974,932.50

13,700,428,402.71

5,267,276,169.46

26,522,957,632.56

289,440,000.00

26,623,330,102.01

389,812,469.45

495,097,661.40

752,590,866.12

2,024,095,302.04

423,925,967.55

6,587,007,202.89

Cash and Cash Items

P

Due from Bangko Sentral ng Pilipinas

Due from Other Banks

Financial Assets Designated at Fair Value through Profit or Loss

Available-for-Sale Financial Assets - Net

Held-to-Maturity Financial Assets - Net

Unquoted Debt Securities Classified as Loans - Net

Loans and Receivables - Net

Interbank Loans Receivable

Loans and Receivables - Others

General Loan Loss Provision

Other Financial Assets

Equity Investment in Subsidiaries, Associates and Joint Ventures - Net

Bank Premises, Furniture, Fixture & Equipment - Net

Real and Other Properties Acquired - Net

Other Assets - Net

875,039,544.47 P

15,273,063,338.43

2,028,388,994.67

1,153,568,294.27

42,974,932.50

14,727,893,284.29

5,044,332,476.73

27,746,054,536.66

28,013,699,683.29

267,645,146.63

345,911,754.87

24,949,158.20

2,095,651,595.15

530,690,843.48

6,756,162,220.50

1,185,900,847.69

12,567,472,328.83

2,406,369,065.19

684,985,876.64

42,974,932.50

13,724,048,223.11

5,267,276,169.46

27,779,889,737.32

289,440,000.00

27,889,860,441.55

399,410,704.23

515,912,305.59

25,121,325.03

2,153,399,974.71

545,626,872.71

6,926,845,590.74

TOTAL ASSETS

75,165,289,577.10

72,085,820,468.80

TOTAL ASSETS

76,644,680,974.22 P

73,825,823,249.52

LIABILITIES

LIABILITIES

Deposit Liabilities

Bills Payable:

Interbank Loans Payable

Other Deposit Substitutes

Due to Bangko Sentral ng Pilipinas

Other Financial Liabilities

Other Liabilities

61,265,829,815.19

3,522,585,312.98

3,522,585,312.98

5,253,861.12

331,720,670.28

2,025,135,322.42

57,762,270,095.92

3,421,651,512.16

313,040,000.00

3,108,611,512.16

358,530,777.97

2,313,745,237.73

Deposit Liabilities

Bills Payable:

Interbank Loans Payable

Other Deposit Substitutes

Due to Bangko Sentral ng Pilipinas

Other Financial Liabilities

Other Liabilities

62,502,027,038.22 P

3,623,229,874.78

3,623,229,874.78

5,253,861.12

362,248,715.35

2,183,719,967.79

59,362,176,650.73

3,428,694,581.30

313,040,000.00

3,115,654,581.30

378,877,283.52

2,448,431,208.69

TOTAL LIABILITIES

67,150,524,981.99

63,856,197,623.78

TOTAL LIABILITIES

68,676,479,457.26 P

65,618,179,724.24

10,095,412,736.76

1,779,784,587.51

-3,645,574,479.25

Capital Stock

Other Capital Accounts

Retained Earnings

Minority Interest in Subsidiaries

10,095,412,736.76

1,610,616,898.52

-3,733,057,344.37

-4,770,773.94

10,095,412,736.76

1,756,057,699.58

-3,644,241,265.38

414,354.32

STOCKHOLDERS EQUITY

STOCKHOLDERS EQUITY

Capital Stock

Other Capital Accounts

Retained Earnings

10,095,412,736.76

1,611,523,246.97

-3,692,171,388.62

TOTAL STOCKHOLDERS EQUITY

8,014,764,595.11

TOTAL LIABILITIES AND STOCKHOLDERS EQUITY

8,229,622,845.02

75,165,289,577.10

72,085,820,468.80

Financial Standby Letters of Credit

Commercial Letters of Credit

Trade Related Guarantees

Spot Foreign Exchange Contracts

Trust Department Accounts

Trust and Other Fiduciary Accounts

Agency Accounts

Others

1,704,770,656.68

365,847,573.69

654,651,825.63

1,127,236,330.50

6,067,002,272.22

1,621,114,950.45

4,445,887,321.77

120,446,778.58

1,123,767,068.98

661,153,180.12

596,144,674.63

134,160,000.00

5,930,414,262.73

1,402,989,840.42

4,527,424,422.31

125,797,556.08

TOTAL CONTINGENT ACCOUNTS

10,039,955,437.30

CONTINGENT ACCOUNTS

8,571,436,742.54

ADDITIONAL INFORMATION

Gross total loan portfolio (TLP)

Specific allowance for credit losses on the TLP

Non-Performing Loans (NPLs)

a. Gross NPLs

b. Ratio of gross NPLs to gross TLP (%)

c. Net NPLs

d. Ratio of Net NPLs to gross TLP (%)

Classified Loans & Other Risk Assets, gross of allowance for credit losses

DOSRI Loans and receivables, gross allowance of credit losses

Ratio of DOSRI loans and receivables, gross of allowance for

credit losses, to gross TLP (%)

Gross non-performing DOSRI loans and receivables

Ratio of gross non-performing DOSRI loans and receivables to TLP (%)

Percent Compliance with Magna Carta (%)

a. 8% for Micro and Small Enterprises

b. 2% for Medium Enterprises

Return on Equity (ROE) (%)

Capital Adequacy Ratio (CAR) on Solo Basis, as prescribed under

existing regulations

a. Total CAR (%)

b. Tier 1 CAR (%)

c. Common Tier 1 Ratio (%) 1/

1/ Common Equity Tier 1 is only applicable to all Universal and

Commercial Banks and their subsidiary banks.

28,009,232,510.50

1,249,097,134.09

28,027,449,272.39

1,114,679,170.38

1,745,888,751.18

6.23%

496,791,617.09

1.77%

31,102,717.11

26,357,816.93

0.09%

1,586,752,249.52

5.66%

472,073,079.14

1.68%

32,437,945.23

26,373,135.98

0.09%

111,209.91

0.00%

219,120.15

0.00%

3.92%

9.44%

0.64%

4.16%

9.94%

3.89%

14.60%

10.99%

10.99%

16.03%

12.00%

12.00%

TOTAL STOCKHOLDERS EQUITY

(SGD.) ARLENE M. DATU

Controller, SVP

(SGD.) HENRY Y. UY

Acting President

SUBSCRIBED AND SWORN to before me this 27th day of April 2015 at City of Makati, affiants exhibiting their SSS no.

0356633451 and TIN No. 122824523 , respectively.

(SGD.) ATTY. GERVACIO B. ORTIZ JR.

NOTARY PUBLIC City of Makati until December 31, 2016

IBP no. 656155 - Lifetime Member

MCLE Compliance No. III-0014282

Appointment no. M-199 -(2015-2016)

Doc. No. 245

PTR no. 4748512 Jan. 5, 2015

Page No. 50

Makati City Roll no. 40091

Book No. XXIII

101 Urban Ave., Campos Rueda Bldg. Brgy. Pio del Pilar, Makati City

Series of 2015.

8,207,643,525.28

76,644,680,974.22 P

73,825,823,249.52

Financial Standby Letters of Credit

Commercial Letters of Credit

Trade Related Guarantees

Spot Foreign Exchange Contracts

Trust Department Accounts

Trust and Other Fiduciary Accounts

Agency Accounts

Others

1,704,770,656.68 P

365,847,573.69

654,651,825.63

1,127,236,330.50

6,067,002,272.22

1,621,114,950.45

4,445,887,321.77

120,446,778.58

1,123,767,068.98

661,153,180.12

596,144,674.63

134,160,000.00

5,930,414,262.73

1,402,989,840.42

4,527,424,422.31

125,797,556.08

TOTAL CONTINGENT ACCOUNTS

10,039,955,437.30 P

8,571,436,742.54

CONTINGENT ACCOUNTS

ADDITIONAL INFORMATION

1. List of Financial Allied Subsidiaries (excluding Subsidiary Insurance Companies)

1. Rural Bank of Nagcarlan, Inc.

2. Banco Dipolog, Inc. Rural Bank

2. List of Subsidiary Insurance Companies

1. PBCom Insurance Services Agency, Inc.

3. Capital Adequacy Ratio (CAR) on Consolidated Basis, as prescribed under existing regulations

a. Total CAR (%)

14.57%

b. Tier 1 CAR (%)

11.08%

c. Common Tier 1 Ratio (%) 1/

11.08%

1/ Common Equity Tier 1 is only applicable to all Universal and Commercial Banks and their subsidiary banks.

15.91%

12.02%

12.02%

REPUBLIC OF THE PHILIPPINES)

City of Makati

)S.S.

We, Arlene M. Datu and Henry Y. Uy, of the above-mentioned bank do solemnly swear that all matters set forth in the above

balance sheet are true and correct to the best of our knowledge and belief.

(SGD.) ARLENE M. DATU

Controller, SVP

(SGD.) HENRY Y. UY

Acting President

SUBSCRIBED AND SWORN to before me this 27th day of April 2015 at City of Makati, affiants exhibiting their SSS no.

0356633451 and TIN No. 122824523, respectively.

REPUBLIC OF THE PHILIPPINES)

City of Makati

)S.S.

We, Arlene M. Datu and Henry Y. Uy, of the above-mentioned bank do solemnly swear that all matters set forth in the above

balance sheet are true and correct to the best of our knowledge and belief.

7,968,201,516.97

TOTAL LIABILITIES AND STOCKHOLDERS EQUITY

Doc. No. 244

Page No. 50

Book No. XXIII

Series of 2015.

(SGD.) ATTY. GERVACIO B. ORTIZ JR.

NOTARY PUBLIC City of Makati until December 31, 2016

IBP no. 656155 - Lifetime Member

MCLE Compliance No. III-0014282

Appointment no. M-199 -(2015-2016)

PTR no. 4748512 Jan. 5, 2015

Makati City Roll no. 40091

101 Urban Ave., Campos Rueda Bldg. Brgy. Pio del Pilar,

Makati City

Anda mungkin juga menyukai

- Review your PLDT bill details onlineDokumen4 halamanReview your PLDT bill details onlinetsung gokoBelum ada peringkat

- CDB ReportDokumen9 halamanCDB ReportBruce FerreiraBelum ada peringkat

- Devaksha Rampersadh Ftnqngi2 ArchivedDokumen2 halamanDevaksha Rampersadh Ftnqngi2 ArchiveddevaksharamharakhBelum ada peringkat

- eStatementFile 20230112102731Dokumen3 halamaneStatementFile 20230112102731wai ling tsangBelum ada peringkat

- Sterling Bank PLC Abridged Financial Statement For The Year Ended September 30, 2008Dokumen1 halamanSterling Bank PLC Abridged Financial Statement For The Year Ended September 30, 2008Sterling Bank PLCBelum ada peringkat

- SOFTTECH ENGINEERS LIMITED statement analysisDokumen5 halamanSOFTTECH ENGINEERS LIMITED statement analysisHimanshu ChavanBelum ada peringkat

- Ap 6050003562019Dokumen1 halamanAp 6050003562019Vijayraj SriramBelum ada peringkat

- DBS Singapore Bank Statement PDFDokumen13 halamanDBS Singapore Bank Statement PDFMuhammad OwaisBelum ada peringkat

- CASA Statement 1606148149984Dokumen2 halamanCASA Statement 1606148149984akundonlot filemBelum ada peringkat

- Uribapplicationform 39694878 PDFDokumen3 halamanUribapplicationform 39694878 PDFsheelkumar belekarBelum ada peringkat

- Noa-Iit Ob2620220516204800b91Dokumen2 halamanNoa-Iit Ob2620220516204800b91Tha OoBelum ada peringkat

- Documents of Munyai KutelaniDokumen1 halamanDocuments of Munyai KutelaniKutelani MunyaiBelum ada peringkat

- 9f71ccd9 Acfa 4d7d 85f1 Eda40ddd6c3a ListDokumen4 halaman9f71ccd9 Acfa 4d7d 85f1 Eda40ddd6c3a ListAllan Ramirez RadilloBelum ada peringkat

- Í Qdo - È Hayco Loveâfaithâââââ P Çrâ'54Eî Ms. Love Faith Pasetes HaycoDokumen5 halamanÍ Qdo - È Hayco Loveâfaithâââââ P Çrâ'54Eî Ms. Love Faith Pasetes HaycoLove Faith HopeBelum ada peringkat

- Statement Letter12302019153646 2 PDFDokumen1 halamanStatement Letter12302019153646 2 PDFTracy deebBelum ada peringkat

- HDFC Regalia UnlockedDokumen4 halamanHDFC Regalia UnlockedMayank RaghuwanshiBelum ada peringkat

- Stetment 10Dokumen4 halamanStetment 10varaprasadBelum ada peringkat

- Ooccmkn01 PDFDokumen1 halamanOoccmkn01 PDFnnuuyy 22Belum ada peringkat

- United Bank For Africa (Ghana) Limited Summary Financial Statements For The Year Ended 31 December 2020Dokumen2 halamanUnited Bank For Africa (Ghana) Limited Summary Financial Statements For The Year Ended 31 December 2020Fuaad DodooBelum ada peringkat

- LT Bill Dec16Dokumen2 halamanLT Bill Dec16nahkbceBelum ada peringkat

- Payment Slip: Summary of Charges / Payments Current Bill AnalysisDokumen4 halamanPayment Slip: Summary of Charges / Payments Current Bill AnalysisAizuddinBelum ada peringkat

- Sample Credit Card Statement FiqDokumen1 halamanSample Credit Card Statement FiqAditya KulkarniBelum ada peringkat

- Portfolio 74246 OnDate 5-5-2022Dokumen1 halamanPortfolio 74246 OnDate 5-5-2022Shahid MahmudBelum ada peringkat

- HSBCDokumen2 halamanHSBCВлад АнгелBelum ada peringkat

- HDFC Bank Credit Cards GSTIN: 33AAACH2702H2Z6 HSN Code - 9971Dokumen2 halamanHDFC Bank Credit Cards GSTIN: 33AAACH2702H2Z6 HSN Code - 9971golu84Belum ada peringkat

- Gerrymdayanan : Prk3Crossingsalimbalan Baungon 8707bukidnonDokumen4 halamanGerrymdayanan : Prk3Crossingsalimbalan Baungon 8707bukidnonTommyjames ElfiroBelum ada peringkat

- Principal June StatementDokumen10 halamanPrincipal June Statementsusu ultra menBelum ada peringkat

- Ref - No. 2203166-16309213-4: Prashant KaushikDokumen4 halamanRef - No. 2203166-16309213-4: Prashant KaushikVicky GunaBelum ada peringkat

- Josephinecrey : Zone1Baculud Iguig 3504cagayanDokumen4 halamanJosephinecrey : Zone1Baculud Iguig 3504cagayanJerome ReyBelum ada peringkat

- State Bank of IndiaDokumen1 halamanState Bank of IndiaAnjusha NairBelum ada peringkat

- Payslip November 2023Dokumen1 halamanPayslip November 2023Wiz ChillzBelum ada peringkat

- NSB Online Banking: Transaction DetailsDokumen1 halamanNSB Online Banking: Transaction DetailsNethum DiasBelum ada peringkat

- Invoice: Plot No - 320, Flat No - 3A, Amrita Plaza, Near Durga Mandap, Satya Nagar.Dokumen1 halamanInvoice: Plot No - 320, Flat No - 3A, Amrita Plaza, Near Durga Mandap, Satya Nagar.Sourav NandaBelum ada peringkat

- Muhammad Azhar Tariq S/O Manzoor Ahmad H No 29 ST No 13 Eden Palace HomeDokumen1 halamanMuhammad Azhar Tariq S/O Manzoor Ahmad H No 29 ST No 13 Eden Palace HomeJavaid AshrafBelum ada peringkat

- Bank Reconciliation Statement 0007Dokumen16 halamanBank Reconciliation Statement 0007Hussein Abdou HassanBelum ada peringkat

- TransNum Nov 18 223225Dokumen1 halamanTransNum Nov 18 223225alpha_numericBelum ada peringkat

- Cards Fees & Charges PDFDokumen1 halamanCards Fees & Charges PDFSudipto BoseBelum ada peringkat

- Bank Statement: If You Have Any Questions About Your Statement, Please Call Us at 021-520046Dokumen1 halamanBank Statement: If You Have Any Questions About Your Statement, Please Call Us at 021-520046Tri Adi NugrohoBelum ada peringkat

- Fastag E-Statement: Customer Details Bank DetailsDokumen2 halamanFastag E-Statement: Customer Details Bank DetailsKunjemy EmyBelum ada peringkat

- Your Basic Banking Plan Account Summary: Here's What Happened in Your Account This Statement PeriodDokumen2 halamanYour Basic Banking Plan Account Summary: Here's What Happened in Your Account This Statement PeriodMichael FissehaBelum ada peringkat

- Titas Gas & Electricity Bill Payment June 2023Dokumen4 halamanTitas Gas & Electricity Bill Payment June 2023YousufBelum ada peringkat

- Í+ (JÇ) È Agura Noelitoââââââââ Â ÇC '55&Î Mr. Noelito Agura: Welcome To The Wonderful World of GlobeDokumen5 halamanÍ+ (JÇ) È Agura Noelitoââââââââ Â ÇC '55&Î Mr. Noelito Agura: Welcome To The Wonderful World of GlobenoelitoBelum ada peringkat

- Model Bank StatementDokumen2 halamanModel Bank StatementhanhBelum ada peringkat

- Loan Account Detail As On 15/07/2021: Issue Date: 15/07/2021 Page 1 of 12Dokumen12 halamanLoan Account Detail As On 15/07/2021: Issue Date: 15/07/2021 Page 1 of 12Omprakash KatreBelum ada peringkat

- Converge SOA SummaryDokumen1 halamanConverge SOA SummaryJayson IbardalozaBelum ada peringkat

- Bill Oct 16Dokumen1 halamanBill Oct 16deeBelum ada peringkat

- Account StatementDokumen3 halamanAccount StatementRonald MyersBelum ada peringkat

- Pay SlipDokumen1 halamanPay Slipraj Kumar Thapa chhetriBelum ada peringkat

- 18 Apr 2020 - (Free) ..cg11NTQKdgU - FXpwFhZhdQVyA3wCGXwCdhwEBxp-CHEOcw0DfBkIdgdzBQR1dgh2B3MDBn11DnECcgwHcQDokumen1 halaman18 Apr 2020 - (Free) ..cg11NTQKdgU - FXpwFhZhdQVyA3wCGXwCdhwEBxp-CHEOcw0DfBkIdgdzBQR1dgh2B3MDBn11DnECcgwHcQLovemore Mutyambizi MuchenjeBelum ada peringkat

- Jyoti Gautam's 6-year term deposit statementDokumen1 halamanJyoti Gautam's 6-year term deposit statementRajendra GautamBelum ada peringkat

- Date Transaction Description Amount (In RS.)Dokumen1 halamanDate Transaction Description Amount (In RS.)shashi singhBelum ada peringkat

- Bank StatementDokumen3 halamanBank StatementSigei LeonardBelum ada peringkat

- JEEVES Invoice PDFDokumen1 halamanJEEVES Invoice PDFBijay BeheraBelum ada peringkat

- SILASDokumen1 halamanSILASKaronyo JBelum ada peringkat

- Trustee Zach Mottl's Water BillsDokumen6 halamanTrustee Zach Mottl's Water BillsDavid GiulianiBelum ada peringkat

- Operative Accounts Deposit Accounts Loan Accounts All AccountsDokumen2 halamanOperative Accounts Deposit Accounts Loan Accounts All AccountsGamer JiBelum ada peringkat

- View your account statement onlineDokumen1 halamanView your account statement onlineossamamhelmyBelum ada peringkat

- Account Statement 230628 065759Dokumen6 halamanAccount Statement 230628 065759Lesiba NeozaBelum ada peringkat

- BDO Unibank: H1 Statement of ConditionDokumen1 halamanBDO Unibank: H1 Statement of ConditionBusinessWorldBelum ada peringkat

- UBL Financial Statement AnalysisDokumen17 halamanUBL Financial Statement AnalysisJamal GillBelum ada peringkat

- Nation at A Glance - (12/18/18)Dokumen1 halamanNation at A Glance - (12/18/18)BusinessWorldBelum ada peringkat

- Nation at A Glance - (11/16/18)Dokumen1 halamanNation at A Glance - (11/16/18)BusinessWorldBelum ada peringkat

- Nation at A Glance - (12/21/18)Dokumen1 halamanNation at A Glance - (12/21/18)BusinessWorldBelum ada peringkat

- Nation at A Glance - (12/20/18)Dokumen1 halamanNation at A Glance - (12/20/18)BusinessWorldBelum ada peringkat

- Nation at A Glance - (11/14/18)Dokumen1 halamanNation at A Glance - (11/14/18)BusinessWorldBelum ada peringkat

- Nation at A Glance - (11/27/18)Dokumen1 halamanNation at A Glance - (11/27/18)BusinessWorldBelum ada peringkat

- Nation at A Glance - (12/06/18)Dokumen1 halamanNation at A Glance - (12/06/18)BusinessWorldBelum ada peringkat

- Nation at A Glance - (12/11/18)Dokumen1 halamanNation at A Glance - (12/11/18)BusinessWorldBelum ada peringkat

- Nation at A Glance - (12/07/18)Dokumen1 halamanNation at A Glance - (12/07/18)BusinessWorldBelum ada peringkat

- Nation at A Glance - (11/23/18)Dokumen1 halamanNation at A Glance - (11/23/18)BusinessWorldBelum ada peringkat

- Nation at A Glance - (11/30/18)Dokumen1 halamanNation at A Glance - (11/30/18)BusinessWorldBelum ada peringkat

- Nation at A Glance - (11/13/18)Dokumen1 halamanNation at A Glance - (11/13/18)BusinessWorldBelum ada peringkat

- Nation at A Glance - (12/04/18)Dokumen1 halamanNation at A Glance - (12/04/18)BusinessWorldBelum ada peringkat

- Nation at A Glance - (11/29/18)Dokumen1 halamanNation at A Glance - (11/29/18)BusinessWorldBelum ada peringkat

- Nation at A Glance - (11/22/18)Dokumen1 halamanNation at A Glance - (11/22/18)BusinessWorldBelum ada peringkat

- Nation at A Glance - (11/21/18)Dokumen1 halamanNation at A Glance - (11/21/18)BusinessWorldBelum ada peringkat

- Nation at A Glance - (11/06/18)Dokumen1 halamanNation at A Glance - (11/06/18)BusinessWorldBelum ada peringkat

- Nation at A Glance - (11/20/18)Dokumen1 halamanNation at A Glance - (11/20/18)BusinessWorldBelum ada peringkat

- Nation at A Glance - (10/26/18)Dokumen1 halamanNation at A Glance - (10/26/18)BusinessWorldBelum ada peringkat

- Nation at A Glance - (10/30/18)Dokumen1 halamanNation at A Glance - (10/30/18)BusinessWorldBelum ada peringkat

- Nation at A Glance - (11/08/18)Dokumen1 halamanNation at A Glance - (11/08/18)BusinessWorldBelum ada peringkat

- Nation at A Glance - (11/09/18)Dokumen1 halamanNation at A Glance - (11/09/18)BusinessWorldBelum ada peringkat

- Nation at A Glance - (11/07/18)Dokumen1 halamanNation at A Glance - (11/07/18)BusinessWorldBelum ada peringkat

- Nation at A Glance - (10/25/18)Dokumen1 halamanNation at A Glance - (10/25/18)BusinessWorldBelum ada peringkat

- Nation at A Glance - (10/23/18)Dokumen1 halamanNation at A Glance - (10/23/18)BusinessWorldBelum ada peringkat

- Nation at A Glance - (10/24/18)Dokumen1 halamanNation at A Glance - (10/24/18)BusinessWorldBelum ada peringkat

- Nation at A Glance - (10/22/18)Dokumen1 halamanNation at A Glance - (10/22/18)BusinessWorldBelum ada peringkat

- Nation at A Glance - (10/17/18)Dokumen1 halamanNation at A Glance - (10/17/18)BusinessWorldBelum ada peringkat

- Nation at A Glance - (10/18/18)Dokumen1 halamanNation at A Glance - (10/18/18)BusinessWorldBelum ada peringkat

- Nation at A Glance - (10/16/18)Dokumen1 halamanNation at A Glance - (10/16/18)BusinessWorldBelum ada peringkat

- WCM Toyota STDokumen18 halamanWCM Toyota STferoz khanBelum ada peringkat

- LK INDOFARMA 2018 - CompressedDokumen89 halamanLK INDOFARMA 2018 - CompressedDika DaniswaraBelum ada peringkat

- RATIO Analysis in Life Insurance CorporationDokumen61 halamanRATIO Analysis in Life Insurance Corporationsreeja kandula789Belum ada peringkat

- BSc Business Finance Exam QuestionsDokumen9 halamanBSc Business Finance Exam QuestionsRukshani RefaiBelum ada peringkat

- Audit Exam 3 Part 3 Flashcards - QuizletDokumen15 halamanAudit Exam 3 Part 3 Flashcards - QuizletLilliane EstrellaBelum ada peringkat

- 12 Problem: 10: Corporate Valuation and Financial PlanningDokumen141 halaman12 Problem: 10: Corporate Valuation and Financial PlanningMarium RazaBelum ada peringkat

- Raymond Balance Sheet Trend AnalysisDokumen635 halamanRaymond Balance Sheet Trend AnalysisShashank PatelBelum ada peringkat

- Exercise 1: Tugas 12 Oktober 2020Dokumen2 halamanExercise 1: Tugas 12 Oktober 2020melvina siregarBelum ada peringkat

- Senior Accounting Manager Finance in ST Louis MO Resume Kelly Whitelock SmithDokumen2 halamanSenior Accounting Manager Finance in ST Louis MO Resume Kelly Whitelock SmithKelly Whitelock SmithBelum ada peringkat

- MEFA - IV and V UnitsDokumen30 halamanMEFA - IV and V UnitsMOHAMMAD AZEEMABelum ada peringkat

- Practice Set 5 Financial Statements of Sole ProprietorshipsDokumen3 halamanPractice Set 5 Financial Statements of Sole ProprietorshipsBritney PetersBelum ada peringkat

- Kellogg Company Balance SheetDokumen5 halamanKellogg Company Balance SheetGoutham BindigaBelum ada peringkat

- Depreciation 181008092040Dokumen23 halamanDepreciation 181008092040kidest mesfinBelum ada peringkat

- Tutorial 2 - A202 QuestionDokumen6 halamanTutorial 2 - A202 QuestionFuchoin ReikoBelum ada peringkat

- Adoc - Pub - 1 Daftar Ifrs Dan Sak Berbasis IfrsDokumen17 halamanAdoc - Pub - 1 Daftar Ifrs Dan Sak Berbasis IfrsFarhan SyadidannBelum ada peringkat

- Dewan Cement Industry Ratio Analysis PresentationDokumen15 halamanDewan Cement Industry Ratio Analysis PresentationMuhammad Usama Mahmood0% (1)

- SGVFS015182 : Manila Electric Company and Subsidiaries Consolidated Statements of Financial PositionDokumen8 halamanSGVFS015182 : Manila Electric Company and Subsidiaries Consolidated Statements of Financial Positionjosie belazaBelum ada peringkat

- Financial Accounting Errors & CorrectionsDokumen5 halamanFinancial Accounting Errors & CorrectionsHarvey Dienne QuiambaoBelum ada peringkat

- Financial Reporting and Statements ExplainedDokumen26 halamanFinancial Reporting and Statements ExplainedVictor VandekerckhoveBelum ada peringkat

- Chapter 18. Tool Kit For Lease Financing: LeasingDokumen7 halamanChapter 18. Tool Kit For Lease Financing: LeasingHerlambang PrayogaBelum ada peringkat

- PDF Financial Analysis, Ratios and InterpretationDokumen7 halamanPDF Financial Analysis, Ratios and InterpretationAaliyah AndreaBelum ada peringkat

- ACT #4 - Jewel Ann C. Penaranda - ACT213Dokumen20 halamanACT #4 - Jewel Ann C. Penaranda - ACT213JEWELL ANN PENARANDA100% (1)

- Bba 402 PDFDokumen2 halamanBba 402 PDFarmaanBelum ada peringkat

- Financial Performance Analysis of Bangladesh Commerce Bank LtdDokumen10 halamanFinancial Performance Analysis of Bangladesh Commerce Bank Ltdcric6688100% (1)

- Godrej Agrovet Ratio Analysis 17-18Dokumen16 halamanGodrej Agrovet Ratio Analysis 17-18arpitBelum ada peringkat

- ALKA - Annual Report 2019Dokumen173 halamanALKA - Annual Report 2019Sri Zahara Dewi SBelum ada peringkat

- Financial Statement AnalysisDokumen34 halamanFinancial Statement AnalysisanshumanBelum ada peringkat

- (AMALEAKS - BLOGSPOT.COM) FABM 2nd SemDokumen68 halaman(AMALEAKS - BLOGSPOT.COM) FABM 2nd SemJurome Luise Fernando50% (4)

- MEDINA - Homework 1 No. 14Dokumen7 halamanMEDINA - Homework 1 No. 14Von Andrei MedinaBelum ada peringkat

- Ashish Bhattad: Contact: +91 7066105779Dokumen2 halamanAshish Bhattad: Contact: +91 7066105779parth sarthyBelum ada peringkat