HKICPA QP Exam (Module A) Sep2004 Answer

Diunggah oleh

cynthia tsuiDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

HKICPA QP Exam (Module A) Sep2004 Answer

Diunggah oleh

cynthia tsuiHak Cipta:

Format Tersedia

SECTION A – CASE QUESTIONS (Total: 50 marks)

Answer 1(a)

To: Peter Chan, Director of PML

From: Accounting Manager of PML

c.c. Y. C. Lee, T. J. Cheung, Brian Cardew

Date: xxxx

I refer to your e-mail dated 18 June 2004 regarding your queries about the summary

consolidated financial statements for PML for the year ended 31 March 2004.

The explanation of the differences between the consolidated amounts and the combined

amounts are as follows:

The objective of preparing consolidated financial statements is to give a true and fair view

of the state of affairs and results of the group as if it were a single enterprise.

In order to achieve this objective, the financial statements of member companies of our

Group are combined (or added up, in simple terms) and certain adjustments are made to

the combined statements.

Because of these consolidation adjustments, in many cases the items in the consolidated

financial statements for our group will not be simply the sum of the corresponding items in

the individual financial statements of the member companies.

The principal adjustments are the elimination of PML’s investments in SML-A and SML-B

(“the subsidiaries”) of HK$600 million against PML’s interest in the equity of the two

companies at the date of acquisition (HK$650 million in total).

As a result of this elimination, the share capital and share premium of the subsidiaries

(HK$240 million) and the retained profits of the subsidiaries at the date of acquisition

(HK$410 million), or “pre-acquisition profit”, are eliminated from the consolidated balance

sheet.

The portion of the net assets of the subsidiaries attributed to the 30% equity of subsidiaries

that are not owned by PML (HK$650 million x 30% = HK$195 million) is treated as minority

interest.

The excess of the cost of the acquisition over PML's interest in the fair value of the

identifiable assets and liabilities of the subsidiaries as at the date of the exchange

transaction (HK$600 million – HK$650 million + HK$195 million = HK$145 million) was

treated as goodwill.

A number of adjustments relating to post acquisition operations of the Group have also

been made. These include:

Annual amortisation of the goodwill on a straight line basis (HK$145 million / 5 = HK$29

million).

Module A (September 2004 Session) 1

Elimination of intra-group transactions between SML-A and PML, reducing both the

consolidated revenue and consolidated cost of sales (by HK$40 million).

Elimination of intra-group transactions between SML-B and PML, reducing the amounts of

consolidated revenue (by HK$20 million), consolidated cost of sales (by HK$12 million) and

non-current assets (by HK$8 million).

Elimination of intra-group interest charges, reducing both other income and finance costs

(by HK$12 million).

Please refer to the annex for detailed reconciliation of other non-current assets and

retained earnings as at 31 March 2004.

The reasons for the presentation of diluted EPS are as follows:

Since the company’s ordinary shares are publicly traded on the Hong Kong Stock

Exchange, the company should follow the requirements of Hong Kong Accounting

Standard 33 Earnings Per Share (“HKAS 33”).

In accordance with HKAS 33, the company should calculate and present diluted EPS to

disclose the reduction in earnings per share resulting from the assumption that convertible

instruments are converted, that options or warrants are exercised, or that ordinary shares

are issued upon the satisfaction of specified conditions.

During the year, the 6% convertible debenture of HK$ 200 million and 5 million options to

the directors were in issue. The company should therefore calculate and present the

diluted EPS as a result of these potential ordinary shares.

The objective of presenting diluted earnings per share is to provide a measure of the

interest of each ordinary share of PML in the performance of the Group, giving effect to all

dilutive potential ordinary shares outstanding during the period.

The diluted EPS is calculated as follows:

For the purpose of calculating the dilution caused by the 6% convertible debenture, the

profit for the year attributable to ordinary equity holders of the company was increased by

the amount of the after-tax effect of the interest of HK$12 million (12 million x 82.5% = 9.9

million).

The number of ordinary shares was increased by the weighted average number of shares

that would be issued on the conversion of all the 6% convertible debenture into ordinary

shares of the company as at the beginning of the year ((200 million / 100) x 7 = 14 million)

For the purpose of calculating dilution caused by the options held by the directors, the

assumed proceeds from options should be regarded as having been received from the

issue of ordinary shares at the average market price of ordinary shares during the year

(5 million x HK$8 / HK$20 = 2 million).

The difference between the total number of ordinary shares to be issued and the number of

ordinary shares that would have been issued at the average market price of ordinary

shares during the period should be treated as an issue of ordinary shares for no

consideration. (5 million – 2 million = 3 million).

Module A (September 2004 Session) 2

Please refer to the annex for detailed calculation of basic and diluted EPS.

The reasons for the segment reporting requirement are as follows:

Since the shares of the company are listed on the Hong Kong Stock Exchange, the

company should follow the requirements of Hong Kong Accounting Standard 14 Segment

Reporting# (“HKAS 14”).

HKAS 14 sets out detailed requirements for the determination of a reportable segment. A

reportable segment is a business segment or a geographical segment for which segment

information is required to be disclosed in accordance with HKAS 14.

In general, a business segment or geographical segment should be identified as a

reportable segment if a majority of its revenue is earned from sales to external customers

and its revenue from sales to external customers and from transactions with other

segments is 10 per cent or more of the total revenue, external and internal, of all segments.

Since the majority of the revenue of SML-A for the year was earned from sales to external

customers (380 / 420 = 90.5%) and its revenue is more than 10% of the total revenue of all

business segments (420 / (420 + 340 + 2,000) = 15.2%), the company is required to

present segment information in its financial statements.

(Candidates may also adopt the segment results test or the segment asset test.)

The objective of segment reporting is to provide information about the different types of

products and services an enterprise produces and the different geographical areas in

which it operates so as to help users of financial statements:

(a) better understand the enterprise's past performance;

(b) better assess the enterprise's risks and returns; and

(c) make more informed judgements about the enterprise as a whole.

Please refer to the annex for detailed workings for the segment report.

I hope the above explanation has answered your queries. Please feel free to contact me

if you have further queries.

Best regards

XXX

#

SSAP26 revised by HKASs 2, 8 and 16

Module A (September 2004 Session) 3

Answer 1 (b)

HK$ million

Consolidated retained earnings:

Combined amount (220 + 240 + 580) 1,040

Pre-acquisition profit of SML-A and SML-B (200 + 210) (410)

Minority interest in profit for the year (20 + 30) x 30% (15)

Amortisation of goodwill (145/5) (29)

Elimination of unrealised profit of goods sold from PML to SML-B (8)

(20 x 40%)

Consolidated amount 578

Non-current assets:

Combined amount (350 + 280 + 1,240) 1,870

Add: Goodwill on acquisition of SML-A and SML-B 145

Less: Investments in SML-A and SML-B (600)

Accumulated amortisation of goodwill (29)

Property, plant and equipment of SML-B (8)

Consolidated amount 1,378

Answer 1 (c)

HK$ million

Basic EPS for the year ended 31 March 2004:

Profit for the year in HK$ million 81

Minority interest in profit for the year in HK$ million (15)

(20 x 30% + 30 x 30%)

Profit for the year attributed to shareholders of PML 66

Weighted average number of ordinary shares in million 60

Basic EPS in HK$ (66/60) 1.10

Diluted EPS for the year ended 31 March 2004:

EPS diluted by the options is HK$1.05 [66/(60+3)]

EPS diluted by the options and convertible debenture:

Profit for the year attributed to shareholders of PML 66

Add: Interest saved, net of tax, if the 6% convertible debenture had been

converted on 1 April 2003

($200 million x 6% x (1–17.5%)). 9.9

75.9

Weighted average number of ordinary shares in million for basic EPS 60

Add: Conversion of convertible debenture at 1 April 2003 14

(200 x 7/100)

Number of shares in million deemed to be issued zero

consideration on exercise of the options granted to the directors at

1 April 2003 (5 – 5 x 8/20) 3

77

Diluted EPS in HK$(75.9/77) 0.99

Since both the options and convertible debentures are dilutive, the diluted

EPS for the year ended 31 March 2004 should be HK$0.99.

Module A (September 2004 Session) 4

Answer 2(a)

In accordance with HKAS 27, the income and expenses of operations of SML-A would be

included in the consolidated income statement of the Group until the date of disposal,

which is the date on which the company ceases to have control of SML-A.

The company would cease to have control of SML-A when the company loses the power to

govern SML-A’s financial and operating policies so as to obtain benefit from its activities.

The date on which the consideration is received will be an important indication of the date

on which SML-A is disposed of, although it will not be conclusive evidence of the date of

the cessation of control.

Where SML-A is disposed of, the difference between the proceeds from disposal and its

carrying amount as of the date of disposal will be recognised in the consolidated income

statement as the gain or loss on the disposal of the subsidiary.

Since SML-A is a separate major line of business that can be distinguished operationally

and for financial reporting purpose, its disposal pursuant to a single plan would constitute a

discontinuing operation under HKAS 35 (SSAP33 revised by HKASs 1, 8 and 10). The

Group is therefore required to comply with the disclosure requirements set out in HKAS 35.

Answer 2(b)

Gain or loss on disposal of SML-A $ million $ million

Proceeds from the disposal of the subsidiary 400

Fair value of net assets of SML-A acquired 252

(160 + 200) x 70%

Goodwill on acquisition (145 x 60%) 87

Cost of acquisition of SML-A 339

Post acquisition profit attributable to shareholders of PML (20 14

x 70%)

Amortisation of goodwill (87/5) (17.4)

Net asset of SML-A as at 31 March 2004 attributable to shareholders 335.6*

of PML

Profit for the six months ended 30 September 2004 7

attributable to shareholders of PML (20 x 6/12 x 70%)

Amortisation of goodwill (87/5/2) (8.7)

Net asset of SML-A as at 30 September 2004 attributable to 333.9**

shareholders of PML

Gain on disposal of SML-A 66.1

Module A (September 2004 Session) 5

* Alternatively $ million

Equity of SML-A as at 31 March 2004 380

Minority interest in equity of SML-A (380 x 30%) (114)

Balance of amortised goodwill (87 – 87/5) 69.6

Net asset of SML-A as at 31 March 2004 attributable to shareholders

of PML 335.6

** Alternatively $ million

Net assets of SML-A at 31 March 2004 380

Post acquisition Profit for the six month ended

30 September 2004 10

390

Less minority interest (117)

Share of net assets of SML-A 273

Unamortised goodwill (87 – 87/5 x 1.5) 60.9

333.9

* * * END OF SECTION A * * *

(ANSWERS)

Module A (September 2004 Session) 6

SECTION B - ESSAY / SHORT QUESTIONS (Total: 50 marks)

Answer 3

Legal considerations

A director has legal duties and responsibilities under common law and statues. They

include:

Fiduciary duties - for examples, a director must act honestly and in good faith for the benefit

of the company. In particular, directors must act in good faith in what they believe to be

the best interests of the company.

Duty to exercise skill and care - A director must exercise reasonable care and skill in the

performance of his duties. If employed as having particular skills, for example as a

certified public accountant, a director should display the skill or ability expected from a

person of that profession.

Statutory duty - The Hong Kong Companies Ordinance imposes a number of duties on

directors, such as the preparation of annual accounts to give a true and fair view.

All directors should be aware of their legal responsibilities at all times, including selecting

accounting policies for the company.

Ethical considerations

As a certified public accountant, he or she also has duties to comply with the Statements of

Professional Ethics of the Hong Kong Institute of Certified Public Accountants.

The Fundamental Principles of Professional Ethics are:

A certified public accountant should always have regard to any factors that might reflect

adversely upon his/her integrity and objectivity in relation to his/her professional assignment

or occupation.

A certified public accountant should carry out his/her professional work with a proper regard

for the technical and professional standards expected of a certified public accountant and

should not undertake professional work that he/she is not competent to perform.

A certified public accountant should conduct him/herself with courtesy and consideration

towards all with whom he/she comes into contact in the course of his/her professional work.

In circumstances not provided for by the ethical guidelines, a certified public accountant

should conduct him/herself in a manner consistent with the good reputation of the

profession and the HKICPA.

All directors should be aware of their ethical responsibilities at all times, including selecting

accounting policies for the company, if they are certified public accountants.

Module A (September 2004 Session) 7

Professional considerations

There is a presumption in HKAS 1 that the appropriate application of Hong Kong Financial

Reporting Standards (“HKFRSs”), with additional disclosure where necessary, results in

financial statements that give a true and fair view in virtually all circumstances. Therefore,

a director should ensure that financial statements of the company comply with all the

relevant HKFRSs.

In particular, the directors should refer to HKAS 8 Accounting policies, Changes in

Accounting Estimates and Errors when selecting accounting policies for the company.

HKAS 8 requires that when a HKFRS specifically applies to a transaction, event or

condition, the accounting policy applied to that item should be determined by applying the

HKFRS and considering any relevant Implementation Guidance issued by the HKICPA for

the HKFRS.

In the absence of a HKFRS that specifically applies to a transaction, event or condition, the

director should use his/her judgement in developing and applying an accounting policy that

results in information that is relevant to the economic decision-making needs of users and

is reliable.

Answer 4

Revenue recognition

HKAS 18 (SSAP 18 revised by HKAS 39) sets out revenue recognition criteria for

transactions including sale of goods and rendering of services.

Revenue from sale of goods should be recognised when all of the following criteria have

been satisfied:

• The enterprise has transferred to the buyer the significant risks and rewards of

ownership of the goods;

• The enterprise retains neither continuing managerial involvement to the degree

usually associated with ownership nor effective control over the goods sold;

• The amount of revenue can be measured reliably;

• It is probable that the economic benefits associated with the transaction will flow to

the enterprise; and

• The costs incurred or to be incurred in respect of the transaction can be measured

reliably.

When the outcome of a transaction involving the rendering of services can be estimated

reliably, revenue associated with the transaction should be recognised by reference to the

stage of completion of the transaction at the balance sheet date.

Module A (September 2004 Session) 8

The outcome of a transaction can be estimated reliably when all the following conditions

are satisfied:

• the amount of revenue can be measured reliably;

• it is probable that the economic benefits associated with the transaction will flow to

the enterprise;

• the stage of completion of the transaction at the balance sheet date can be measured

reliably; and

• the costs incurred for the transaction and the costs to complete the transaction can be

measured reliably.

In a situation where sales and services are bundled into one contract, revenue recognition

criteria should be applied to the separately identifiable components of each single

transaction in order to reflect the substance of the transaction.

In this case, the contract has two separately identifiable components - sale of equipment

and provision of services.

Sale of equipment

The revenue from sale of equipment should be recognised in the financial statements for

the year ended 31 December 2003 because all conditions for recognition of revenue from

sale of goods are met.

1. The customer acknowledged receipt on the delivery note after Oriental Network

Limited delivered and installed the equipment during the year ended

31 December 2003. Oriental Network Limited had completely transferred to its

customer the significant risks and rewards of ownership of the equipment.

2. Oriental Network Limited did not retain any control over the network equipment as the

customer subsequently integrated the network equipment into its management

information systems.

3. The fair value of the equipment sold can be estimated from the contract value based

on the historical information.

4. All costs for sale of equipment, including installation costs, were incurred during the

year ended 31 December 2003.

Module A (September 2004 Session) 9

Provision of development services

Revenue from provision of services can also be recognised during the year ended 31

December 2003 because-

1. The fair value of the services can be estimated based on past experience.

2. The stage of completion at 31 December 2003 can be determined reliably.

3. Costs incurred at the year ended 31 December 2003 and total project costs can be

estimated.

4. The customer can enjoy the economic benefits the system generated when it was

completed on 30 June 2004.

As historical information indicated workload and relevant costs of the services were evenly

spread over the development period and 50% of the work was completed as at 31

December 2003, half of the service revenue together with half of the total estimated project

cost should be recognised in the profit and loss account for the year ended 31 December

2003.

Answer 5(a)

General conditions for recognition of government grants

HKAS 20 (SSAP 35 revised by HKAS 8) defines government grants as assistance by

government in the form of transfers of resources to an entity in return for past or future

compliance with certain conditions relating to the operating activities of the entity.

HKAS 20 requires that government grants, including non-monetary grants at fair value,

should not be recognised until there is reasonable assurance that the enterprise will

comply with the conditions attaching to them, and that the grants will be received.

HKAS 20 states that receipt of a grant does not of itself provide conclusive evidence that

the conditions attaching to the grant have been or will be fulfilled.

In this case, there are at least four dates on which the grant may be recognised initially in

the Thomas Group’s financial statements. They are (1) when JML made the application to

the Bureau; (2) when JML purchased the machinery from the Mainland China

manufacturers; (3) when JML received the grant; (4) 1 January 2006 when the 5 year

period lapses.

It is obvious the grant should not be initially recognised when JML made the application

since none of the conditions required by HKAS 20 had been satisfied.

Upon JML’s purchase of the machinery, no formal reply had been received from the

Bureau, so there was no reassurance that JML would receive the grant. Therefore, the

grant should not be initially recognised at that moment.

When JML received the grant from the Bureau, all the conditions set out by HKAS 20 had

been satisfied. Therefore, the grant should be recognised initially at 31 December 2003.

It is not appropriate to defer recognition of the grant to 1 January 2006, unless the Thomas

Group planned to shut down the plant before that date, or had other possibilities that the

conditions attaching to the grant would not be satisfied until that date.

Module A (September 2004 Session) 10

Answer 5(b)

Measurement subsequent to initial recognition

HKAS 20 requires that an entity should recognise government grants as income over the

periods necessary to match them with the related costs which they are intended to

compensate, on a systematic basis. They should not be credited directly to shareholders'

interests.

HKAS 20 requires that government grants related to depreciable assets should be

recognised as income over the periods and in the proportions in which depreciation on

those assets is charged.

HKAS 20 states grants are sometimes received as part of a package of financial or fiscal

aids to which a number of conditions are attached. In such cases, care is needed in

identifying the conditions giving rise to costs and expenses which determine the periods

over which the grant will be earned. It may be appropriate to allocate part of a grant on

one basis and part on another.

Presentation of grant related to assets

In this case, the government grant is related to an asset and should be presented in the

balance sheet either by (i) setting up the grant as deferred income or (ii) by deducting the

grant in arriving at the carrying amount of the asset.

When the grant is set up as deferred income, it is recognised as income on a systematic

and rational basis over the useful life of the asset.

When the grant is deducted against the carrying amount of the asset, it is recognised as

income over the life of a depreciable asset by way of a reduced depreciation charge.

Answer 5(c)

Carrying amounts of the government grant

As at and for the year ended 31 December 2002: -

The government grant should not be recognised as there was no reasonable assurance

that it would be received because the application had not been approved by the Bureau.

The carrying amount would be zero under both methods of presentation.

As at and for the year ended 31 December 2003: -

Since there was reasonable assurance that the Thomas Group would comply with all

conditions attaching to the grant which was received on 31 December 2003, the

government grant of Rmb5,000,000 can be recognised as deferred income. Therefore,

the carrying amount would be Rmb5,000,000. Alternatively, the entire amount can be

deducted against the carrying amount of the machinery acquired. Therefore, the carrying

amount would be zero.

Module A (September 2004 Session) 11

As at and for the year ended 31 December 2004: -

If the grant is set up as deferred income, Rmb555,555 (Rmb5,000,000/9) of the grant

should be recognised as income in the consolidated profit and loss account to reduce the

annual depreciation charge of the machinery. The remaining useful life of the machinery

is 9 years as at 31 December 2003. The carrying value of the deferred income should be

Rmb4,444,445 as at 31 December 2004.

If the entire amount had been deducted in 2003 against the carrying amount of the

machinery acquired, the carrying amount would be zero.

Carrying amounts of the machinery

As at and for the year ended 31 December 2002: -

The machinery should be stated at cost less accumulated depreciation of Rmb6,000,000

(Rmb6,000,000 – Rmb0) under both methods of presentation.

As at and for the year ended 31 December 2003: -

The machinery should be stated at cost less accumulated depreciation of Rmb5,400,000

(Rmb6,000,000 – Rmb600,000)) if the grant is recognised as deferred income or

Rmb400,000 (Rmb5,400,000 – Rmb5,000,000) if the grant is deducted against the carrying

amount of the machinery.

As at and for the year ended 31 December 2004: -

The machinery should be stated at cost less accumulated depreciation of Rmb4,800,000

(Rmb6,000,000 – (2 x Rmb600,000)) if the grant is recognised as deferred income or

Rmb355,556 (Rmb400,000 – (Rmb400,000/9)) if the grant is deducted against the carrying

amount of the machinery. The remaining useful life of the machinery is 9 years as at 31

December 2003.

Answer 6

Short term benefits

The basic salary and annual paid leave to which Mr. Edward Chan is entitled are examples

of short term benefits, which are employee benefits that fall due wholly within twelve

months after the end of a period in which the employees render the related service.

HKAS 19 (SSAP 34 revised by HKAS 8) requires that when an employee has rendered

service to a reporting entity during an accounting period, the entity should recognise the

undiscounted amount of short-term employee benefits expected to be paid in exchange for

that service as an expense, unless another Standard or Interpretation requires or permits

the inclusion of the benefits in the cost of an asset.

In particular, HKAS 19 requires an enterprise to recognise untaken annual leaves

(accumulating compensated absences) as a liability and an expense when the employees

render service that increases their entitlement to future compensated absences.

Module A (September 2004 Session) 12

An enterprise should measure the expected cost of accumulating compensated absences

as the additional amount that the enterprise expects to pay as a result of the unused

entitlement that has accumulated at the balance sheet date.

Total salary payable to Mr. Edward Chan for the year ended 31 December 2004 of

HK$480,000 (HK$40,000 x 12) should be recognised as an expense in Golden Dragon

Limited’s financial statements for the year ended 31 December 2004.

The 5 days annual paid leave carried forward from 2003 should have already been

recognised as an expense in the financial statements for the year ended

31 December 2003 in accordance with HKAS 19.

If the 10 days entitlement for 2004 is vesting, total compensation payable to Mr. Edward

Chan for the year ended 31 December 2004 of HK$18,462 [HK$480,000 x 10/(52x5), or

other reasonable method of computation] should be recognised as an expense in Golden

Dragon Limited’s financial statements for the year ended 31 December 2004.

Post employment benefits – defined contribution plan

The Mandatory Provident Fund (“MPF”) to which Mr. Edward Chan is entitled is a form of

post-employment benefit plan, or a defined contribution plan to be exact, under which an

entity pays fixed contributions into a separate entity, normally a retirement fund, and will

have no legal or constructive obligation to pay further contributions if the fund does not hold

sufficient assets to pay all employee benefits relating to employee service in the current

and prior periods.

According to HKAS 19, when an employee has rendered service to an entity during a

period, the entity should recognise the contribution payable to a defined contribution plan in

exchange for that service as an expense, unless another Standard or Interpretation

requires or permits the inclusion of the contribution in the cost of an asset.

Total MPF contributions payable by Golden Dragon Limited for the year ended 31

December 2004 of HK$12,000 (HK$1,000 x 12) should be recognised as an expense in

Golden Dragon Limited’s financial statements for the year ended 31 December 2004.

Termination benefits

Termination benefits are employee benefits payable as a result of either an entity's decision

to terminate an employee's employment before the normal retirement date, or an

employee's decision to accept voluntary redundancy in exchange for those benefits.

An entity should recognise termination benefits as a liability and an expense when and only

when the entity is demonstrably committed to either terminate the employment of an

employee before their normal retirement date; or provide termination benefits as a result of

an offer made in order to encourage voluntary redundancy.

Module A (September 2004 Session) 13

Long Service Payment

Under the Hong Kong Employment Ordinance, an employer should make a long service

payment (“LSP”) to an employee or his/her relatives if the employee has been employed

for not less than 5 years and the employee is dismissed and the employer is not liable to

pay a severance payment.

Since Mr. Chan will have worked for Golden Dragon Limited for 6 years at 31 December

2004 when dismissed by Golden Dragon Limited (and he is unlikely to be entitled to any

severance payment), Mr. Chan is entitled to LSP.

The long service payment payable in these circumstances is a termination benefit under

HKAS 19 since it is payable as a result of Golden Dragon Limited's decision to terminate

Mr. Edward Chan's employment before his normal retirement date (which is presumably 65

years under the Hong Kong Employment Ordinance).

Because Mr. Edward Chan’s actual monthly salary of HK$40,000 exceeded the cap as

stipulated by the Hong Kong Employment Ordinance, the cap of HK$22,500 should be

used for LSP computation.

Under the Hong Kong Employment Ordinance, If the employee is also entitled to

occupational retirement scheme benefits, mandatory provident fund scheme benefits or

gratuities based on length of service, the amount of long service payment may be reduced

by benefits arising from these retirement scheme.

The amount of long service payment is to be reduced by the total amount of all of the

gratuities and benefits that relate to the employee’s years of service.

The accumulated MPF contributions made by Golden Dragon Limited can therefore be

utilised to reduce the LSP liability.

Total LSP payable by Golden Dragon Limited on termination of Mr. Edward Chan of

HK$41,000 (6x (HK$22,500 x 2/3) – HK$49,000) should be recognised as an expense in

Golden Dragon’s financial statements for the year ended 31 December 2004.

For the purpose of these suggested solutions, earlier adoptions of all Hong Kong Accounting

Standards in issue as at 28 June 2004 are assumed.

* * * END OF EXAMINATION PAPER * * *

(ANSWERS)

Module A (September 2004 Session) 14

Anda mungkin juga menyukai

- HKICPA QP Exam (Module A) Feb2008 Question PaperDokumen8 halamanHKICPA QP Exam (Module A) Feb2008 Question Papercynthia tsuiBelum ada peringkat

- HKICPA QP Exam (Module A) Sep2006 Question PaperDokumen7 halamanHKICPA QP Exam (Module A) Sep2006 Question Papercynthia tsuiBelum ada peringkat

- HKICPA QP Exam (Module A) Sep2004 Question PaperDokumen7 halamanHKICPA QP Exam (Module A) Sep2004 Question Papercynthia tsuiBelum ada peringkat

- HKICPA QP Exam (Module A) Feb2006 AnswerDokumen12 halamanHKICPA QP Exam (Module A) Feb2006 Answercynthia tsuiBelum ada peringkat

- HKICPA QP Exam (Module A) May2007 AnswerDokumen13 halamanHKICPA QP Exam (Module A) May2007 Answercynthia tsuiBelum ada peringkat

- HKICPA QP Exam (Module A) May2007 Question PaperDokumen7 halamanHKICPA QP Exam (Module A) May2007 Question Papercynthia tsuiBelum ada peringkat

- HKICPA QP Exam (Module A) May2005 AnswerDokumen12 halamanHKICPA QP Exam (Module A) May2005 Answercynthia tsuiBelum ada peringkat

- HKICPA QP Exam (Module A) May2005 Question PaperDokumen6 halamanHKICPA QP Exam (Module A) May2005 Question Papercynthia tsuiBelum ada peringkat

- HKICPA QP Exam (Module A) Feb2008 AnswerDokumen10 halamanHKICPA QP Exam (Module A) Feb2008 Answercynthia tsui100% (1)

- 기출 기관IPS 2015Dokumen11 halaman기출 기관IPS 2015soej1004Belum ada peringkat

- Earl CaseDokumen5 halamanEarl CaseKamen KamenBelum ada peringkat

- 道德、经济、数量、组合、固收、衍生Dokumen170 halaman道德、经济、数量、组合、固收、衍生Ariel MengBelum ada peringkat

- CFA Level III Mock Exam 4 June, 2018 Revision 1Dokumen47 halamanCFA Level III Mock Exam 4 June, 2018 Revision 1Munkhbaatar SanjaasurenBelum ada peringkat

- 2014 Mock Exam - AM - QuestionDokumen30 halaman2014 Mock Exam - AM - Question12jdBelum ada peringkat

- SFM New Sums Added in Study Material by CA Mayank KothariDokumen112 halamanSFM New Sums Added in Study Material by CA Mayank KothariSBelum ada peringkat

- Sample Midterm For Risk Management (MGFD30)Dokumen21 halamanSample Midterm For Risk Management (MGFD30)somebodyBelum ada peringkat

- Cfa L1 Topicwise Questions - Solutions Book FinalDokumen216 halamanCfa L1 Topicwise Questions - Solutions Book Final848 Anirudh ChaudheriBelum ada peringkat

- CFA Level III Mock Exam 2 June, 2018 Revision 1Dokumen33 halamanCFA Level III Mock Exam 2 June, 2018 Revision 1Munkhbaatar SanjaasurenBelum ada peringkat

- Ed - 16wchap07sln For 30 Jan 2018Dokumen7 halamanEd - 16wchap07sln For 30 Jan 2018MarinaBelum ada peringkat

- 2CEXAM Mock Question Licensing Examination Paper 8Dokumen9 halaman2CEXAM Mock Question Licensing Examination Paper 8Tsz Ngong KoBelum ada peringkat

- V2 Exam 2 PM PDFDokumen30 halamanV2 Exam 2 PM PDFMaharishi VaidyaBelum ada peringkat

- FinQuiz - Item-Set Questions, Study Session 2, Reading 4 PDFDokumen30 halamanFinQuiz - Item-Set Questions, Study Session 2, Reading 4 PDFAriyaBelum ada peringkat

- P4 Answer Bank PDFDokumen47 halamanP4 Answer Bank PDFyared haftuBelum ada peringkat

- Usgaap, Igaap & IfrsDokumen7 halamanUsgaap, Igaap & IfrsdhangarsachinBelum ada peringkat

- AFR - Question BankDokumen31 halamanAFR - Question BankDownloder UwambajimanaBelum ada peringkat

- 2016 CFA Level III ErrataDokumen1 halaman2016 CFA Level III ErrataimvavBelum ada peringkat

- Jun18l1equ-C03 QaDokumen7 halamanJun18l1equ-C03 Qarafav10Belum ada peringkat

- BFF3351 S1 2020 FinalDokumen11 halamanBFF3351 S1 2020 Finalsardar hussainBelum ada peringkat

- Aubrey YachtsDokumen6 halamanAubrey YachtsKamen Kamen0% (1)

- Corporate and Business Law (Global) : Tuesday 4 December 2007Dokumen4 halamanCorporate and Business Law (Global) : Tuesday 4 December 2007api-19836745Belum ada peringkat

- CFA Level III Mock Exam 2 - Questions (AM)Dokumen39 halamanCFA Level III Mock Exam 2 - Questions (AM)Munkhbaatar SanjaasurenBelum ada peringkat

- CFA III-Performance Evaluation关键词清单Dokumen9 halamanCFA III-Performance Evaluation关键词清单Thanh NguyenBelum ada peringkat

- Source of Control Premium Data and What It Doesn't Tell UsDokumen5 halamanSource of Control Premium Data and What It Doesn't Tell UsNatalia CadavidBelum ada peringkat

- Bloomberg L.P., (2012), FWCV Forward Analysis Matching Output. Bloomberg L.P PDFDokumen11 halamanBloomberg L.P., (2012), FWCV Forward Analysis Matching Output. Bloomberg L.P PDFAbdurahman JumaBelum ada peringkat

- Section A - QuestionsDokumen27 halamanSection A - Questionsnek_akhtar87250% (1)

- f7 Mock QuestionDokumen20 halamanf7 Mock Questionnoor ul anumBelum ada peringkat

- CFA Level III Mock Exam 2 June, 2018 Revision 1Dokumen55 halamanCFA Level III Mock Exam 2 June, 2018 Revision 1Munkhbaatar SanjaasurenBelum ada peringkat

- CA FINAL AFM ADVANCED FINANCIAL MANAGEMENT Pawan Sir Volume 02Dokumen403 halamanCA FINAL AFM ADVANCED FINANCIAL MANAGEMENT Pawan Sir Volume 02neerajsakotwalBelum ada peringkat

- CFA Level 2 - 2020 Curriculum Changes (300hours) PDFDokumen1 halamanCFA Level 2 - 2020 Curriculum Changes (300hours) PDFJOAOBelum ada peringkat

- IIIrd Sem 2012 All Questionpapers in This Word FileDokumen16 halamanIIIrd Sem 2012 All Questionpapers in This Word FileAkhil RupaniBelum ada peringkat

- CHAPTER 4 - AssociatesDokumen11 halamanCHAPTER 4 - AssociatesSheikh Mass JahBelum ada peringkat

- SA 701 MCQsDokumen2 halamanSA 701 MCQspreethesh kumarBelum ada peringkat

- Reading 31 Slides - Private Company ValuationDokumen57 halamanReading 31 Slides - Private Company ValuationtamannaakterBelum ada peringkat

- Registered Prep Provider of CFA InstituteDokumen18 halamanRegistered Prep Provider of CFA InstituteSergiu CrisanBelum ada peringkat

- R27 CFA Level 3Dokumen10 halamanR27 CFA Level 3Ashna0188Belum ada peringkat

- Aicpa 040212far SimDokumen118 halamanAicpa 040212far SimHanabusa Kawaii IdouBelum ada peringkat

- Financial AuditDokumen3 halamanFinancial AuditgalaxystarBelum ada peringkat

- Ca - Final: ForexDokumen25 halamanCa - Final: ForexVANDANA GOYAL100% (1)

- ACCA Strategic Business Reporting (SBR) Achievement Ladder Step 7 Questions and AnswersDokumen24 halamanACCA Strategic Business Reporting (SBR) Achievement Ladder Step 7 Questions and AnswersAdam M100% (1)

- Financial Statements 2, ModuleDokumen4 halamanFinancial Statements 2, ModuleSUHARTO USMANBelum ada peringkat

- Past Papers CADokumen176 halamanPast Papers CAinnocent moonoBelum ada peringkat

- 2023 CFA LIII MockExamA-PMDokumen23 halaman2023 CFA LIII MockExamA-PMHugo VALERIO100% (1)

- Academy Course NotesDokumen208 halamanAcademy Course NotesPhebin PhilipBelum ada peringkat

- 2014 Mock Exam - AM - AnswersDokumen25 halaman2014 Mock Exam - AM - Answers12jdBelum ada peringkat

- Final Exam Questions Portfolio ManagementDokumen4 halamanFinal Exam Questions Portfolio ManagementThảo Như Trần NgọcBelum ada peringkat

- Financial Statement Analysis ExamDokumen21 halamanFinancial Statement Analysis ExamKheang Sophal100% (2)

- ppb-M3Dokumen23 halamanppb-M3Asad MuhammadBelum ada peringkat

- P2Dokumen11 halamanP2AbdulHameedAdamBelum ada peringkat

- Fins3625 Week 4 Lecture SlidesDokumen24 halamanFins3625 Week 4 Lecture SlidesjoannamanngoBelum ada peringkat

- 3-6int 2004 Dec ADokumen12 halaman3-6int 2004 Dec AsyedtahaaliBelum ada peringkat

- HKICPA QP Exam (Module A) Sep2008 AnswerDokumen12 halamanHKICPA QP Exam (Module A) Sep2008 Answercynthia tsuiBelum ada peringkat

- HKICPA QP Exam (Module A) Sep2006 AnswerDokumen15 halamanHKICPA QP Exam (Module A) Sep2006 Answercynthia tsui100% (2)

- HKICPA QP Exam (Module A) May2005 AnswerDokumen12 halamanHKICPA QP Exam (Module A) May2005 Answercynthia tsuiBelum ada peringkat

- HKICPA QP Exam (Module A) Feb2008 AnswerDokumen10 halamanHKICPA QP Exam (Module A) Feb2008 Answercynthia tsui100% (1)

- HKICPA QP Exam (Module A) Sep2008 Question PaperDokumen9 halamanHKICPA QP Exam (Module A) Sep2008 Question Papercynthia tsui67% (3)

- HKICPA QP Exam (Module A) Feb2006 Question PaperDokumen7 halamanHKICPA QP Exam (Module A) Feb2006 Question Papercynthia tsuiBelum ada peringkat

- HKICPA QP Exam (Module A) May2007 Question PaperDokumen7 halamanHKICPA QP Exam (Module A) May2007 Question Papercynthia tsuiBelum ada peringkat

- HKICPA QP Exam (Module A) May2005 Question PaperDokumen6 halamanHKICPA QP Exam (Module A) May2005 Question Papercynthia tsuiBelum ada peringkat

- Tristar Case Sol.Dokumen4 halamanTristar Case Sol.Niketa JaiswalBelum ada peringkat

- TP1-W2-S3-R0 Sri Annisa KatariDokumen3 halamanTP1-W2-S3-R0 Sri Annisa Katarisri annisa katariBelum ada peringkat

- Corporation LiquidationDokumen1 halamanCorporation LiquidationMelisa DomingoBelum ada peringkat

- JP Morgan Valuation Training MaterialsDokumen49 halamanJP Morgan Valuation Training MaterialsAdam Wueger92% (26)

- Fabm 2 Notes (Multi-Step Aproach)Dokumen2 halamanFabm 2 Notes (Multi-Step Aproach)Mia Abegail ChuaBelum ada peringkat

- Accounting Chapter 3Dokumen14 halamanAccounting Chapter 3Huy Nguyễn NgọcBelum ada peringkat

- Question SheetDokumen2 halamanQuestion SheetHarsh DubeBelum ada peringkat

- FM Butler Grup 2Dokumen10 halamanFM Butler Grup 2Anna Dewi Wijayanto100% (1)

- Financial Analysis, Planning and Forecasting Theory and ApplicationDokumen102 halamanFinancial Analysis, Planning and Forecasting Theory and ApplicationJose MartinezBelum ada peringkat

- I) Increase in Utilities Expense J) Decrease in LandDokumen3 halamanI) Increase in Utilities Expense J) Decrease in LandRosendo Bisnar Jr.Belum ada peringkat

- Computer ConceptsDokumen10 halamanComputer Conceptshamza tariqBelum ada peringkat

- A F I R: Ccounts ROM Ncomplete EcordsDokumen69 halamanA F I R: Ccounts ROM Ncomplete EcordsYash GoklaniBelum ada peringkat

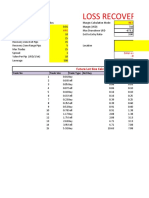

- Loss Recovery Trader CalculatorDokumen31 halamanLoss Recovery Trader CalculatorMuhammad Rizki Amin100% (1)

- Work 2 Joshi ClassDokumen6 halamanWork 2 Joshi ClassSatyajeet RananavareBelum ada peringkat

- Aishwarya Precision Works GECLSDokumen7 halamanAishwarya Precision Works GECLSchandan bhatiBelum ada peringkat

- Marriott Corporation The Cost of CapitalDokumen18 halamanMarriott Corporation The Cost of CapitalshagsBelum ada peringkat

- Problem.1. "If We Can Get That New Robot To Combine With Our Other Automated Equipment, We Wil Have Manager For Diller ProductsDokumen6 halamanProblem.1. "If We Can Get That New Robot To Combine With Our Other Automated Equipment, We Wil Have Manager For Diller ProductsMd. Shahriar Kabir RishatBelum ada peringkat

- Capital Budgeting TechniquesDokumen11 halamanCapital Budgeting TechniquesDip KunduBelum ada peringkat

- ACCOUNTANCY Collectable Marks Question PapersDokumen58 halamanACCOUNTANCY Collectable Marks Question PaperszanabunityBelum ada peringkat

- Revival Investments & Financial Solutions v1Dokumen13 halamanRevival Investments & Financial Solutions v1robitrevivalBelum ada peringkat

- Finm 547 Ca2Dokumen7 halamanFinm 547 Ca2Surya Pratap Singh RathoreBelum ada peringkat

- Security Analysis AND Portfolio Management: Mba Iii Semester PristDokumen15 halamanSecurity Analysis AND Portfolio Management: Mba Iii Semester PristSingh CharuBelum ada peringkat

- AC-MGT102 Reviewer (Quiz)Dokumen10 halamanAC-MGT102 Reviewer (Quiz)ABM-5 Lance Angelo SuganobBelum ada peringkat

- Handout in Corporation LawDokumen62 halamanHandout in Corporation LawGabx Tapas100% (1)

- CH 09Dokumen13 halamanCH 09Sami KhanBelum ada peringkat

- RD020 Process QuestionnaireDokumen371 halamanRD020 Process QuestionnaireIndumathi KumarBelum ada peringkat

- AccountingDokumen8 halamanAccountingLaurio, Genebabe TagubarasBelum ada peringkat

- Form No. Mgt-9 Extract of Annual Return: Annexure-VIIDokumen10 halamanForm No. Mgt-9 Extract of Annual Return: Annexure-VIIAbhishekBelum ada peringkat

- Part 7 Fundamentals of Accountanct 1Dokumen30 halamanPart 7 Fundamentals of Accountanct 1mang tomasBelum ada peringkat

- ITC Report and Accounts 2023 184Dokumen1 halamanITC Report and Accounts 2023 184Nishith RanjanBelum ada peringkat