Rmo15 03anxa6

Diunggah oleh

alfx2160 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

40 tayangan1 halamanEstate

Judul Asli

rmo15_03anxa6

Hak Cipta

© © All Rights Reserved

Format Tersedia

PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniEstate

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

40 tayangan1 halamanRmo15 03anxa6

Diunggah oleh

alfx216Estate

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 1

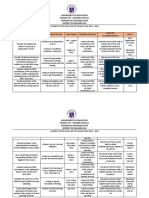

CHECKLIST OF DOCUMENTARY REQUIREMENTS (CDR)

ESTATE TAX

IMPORTANT:

"Annex A-6"

1. Processing of transaction commence only upon submission of COMPLETE DOCUMENTS.

2. In all instances wherein xerox or photocopies are submitted, the original must be presented for authentication.

MANDATORY REQUIREMENTS (Taxable/Exempt)

TIN of ESTATE

Photocopy of the Death Certificate, subject to presentation of the original

Any of the following: a) Affidavit of Self Adjudication; b) Deed of Extra-Judicial Settlement of the Estate, if the estate had

been settled extrajudicially; c) Court order if settled judicially; d) Sworn Declaration of all properties of the Estate

Official Receipt/Deposit Slip and duly validated return as proof of payment

For Real Properties, if any

Certified true copy of the latest Tax Declaration issued by the Local Assessor's Office for land and improvement relevant to the

date of taxable transaction (date of death)

Owner's Copy for presentation purposes only together with the photocopy thereof for authentication or Certifified True Copy of Transfer

Certificate of Tittle (TCT), condominium Cetificate of Title (CCT), Original Certificate of Title (OCT)

Sworn Declaration of No Improvement by at least one (1) of the transferees or Certificate of No Improvement issued by the Assessor's Office, if

applicable

For Personal Properties, if any

Certificate of Deposit/Investment/Indebtedness owned by the decedent and the surviving spouse duly signed by the Bank Manager

Certificate of Registration of Motor Vehicle together with official receipt/cost of acquisition for the purpose of applying the

20% annual depreciation rate

Proof of valuation of shares of stocks at the time of death:

a. For listed stocks - certification of the price index from the Philippine Stock Exchange/latest FMV published in newspapers

b. For unlisted stocks - latest audited financial statements of the issuing corporation with computation of the book value per share

Such Other requirements as may be required by law/rulings/regulations/other issuances

Notice of Death, if applicable

Statement duly certified by a CPA containing the itemized assets, deductions, and the amount of the tax due or still due,

if applicable

NAME OF TAXPAYER

ONETT OFFICER

DATE ISSUED

DATE RECEIVED

HEAD ONETT TEAM

Telephone No: ____________________

Instruction: Prepare in duplicate and ascertain that CDR is signed by Head ONETT Team before release to taxpayer

Distribution:

Original

Duplicate

Attach to Docket

Taxpayer's Copy

CHECKLIST OF DOCUMENTARY REQUIREMENTS (CDR)

ESTATE TAX

IMPORTANT:

"Annex A-6"

1. Processing of transaction commence only upon submission of COMPLETE DOCUMENTS.

2. In all instances wherein xerox or photocopies are submitted, the original must be presented for authentication.

MANDATORY REQUIREMENTS (Taxable/Exempt)

TIN of ESTATE

Photocopy of the Death Certificate, subject to presentation of the original

Any of the following: a) Affidavit of Self Adjudication; b) Deed of Extra-Judicial Settlement of the Estate, if the estate had

been settled extrajudicially; c) Court order if settled judicially; d) Sworn Declaration of all properties of the Estate

Official Receipt/Deposit Slip and duly validated return as proof of payment

For Real Properties, if any

Certified true copy of the latest Tax Declaration issued by the Local Assessor's Office for land and improvement relevant to the

date of taxable transaction (date of death)

Owner's Copy for presentation purposes only together with the photocopy thereof for authentication or Certifified True Copy of Transfer

Certificate of Tittle (TCT), condominium Cetificate of Title (CCT), Original Certificate of Title (OCT)

Sworn Declaration of No Improvement by at least one (1) of the transferees or Certificate of No Improvement issued by the Assessor's Office, if

applicable

For Personal Properties, if any

Certificate of Deposit/Investment/Indebtedness owned by the decedent and the surviving spouse duly signed by the Bank Manager

Certificate of Registration of Motor Vehicle together with official receipt/cost of acquisition for the purpose of applying the

20% annual depreciation rate

Proof of valuation of shares of stocks at the time of death:

a. For listed stocks - certification of the price index from the Philippine Stock Exchange/latest FMV published in newspapers

b. For unlisted stocks - latest audited financial statements of the issuing corporation with computation of the book value per share

Such Other requirements as may be required by law/rulings/regulations/other issuances

Notice of Death, if applicable

Statement duly certified by a CPA containing the itemized assets, deductions, and the amount of the tax due or still due,

if applicable

NAME OF TAXPAYER

ONETT OFFICER

DATE ISSUED

DATE RECEIVED

HEAD ONETT TEAM

Telephone No: ____________________

Instruction: Prepare in duplicate and ascertain that CDR is signed by Head ONETT Team before release to taxpayer

Distribution:

Original

Duplicate

Attach to Docket

Taxpayer's Copy

Anda mungkin juga menyukai

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- Libel CaseDokumen31 halamanLibel Casealfx21650% (2)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Pleading PublicianaDokumen2 halamanPleading Publicianaalfx21683% (6)

- Pleading PublicianaDokumen2 halamanPleading Publicianaalfx21683% (6)

- Separation PayDokumen3 halamanSeparation PayMalen Roque Saludes100% (1)

- Letter of IntentDokumen1 halamanLetter of Intentalfx216100% (3)

- Gardner Denver PZ-11revF3Dokumen66 halamanGardner Denver PZ-11revF3Luciano GarridoBelum ada peringkat

- Condition Monitoring of Steam Turbines by Performance AnalysisDokumen25 halamanCondition Monitoring of Steam Turbines by Performance Analysisabuhurairaqazi100% (1)

- Bir Psic CodesDokumen12 halamanBir Psic Codesalfx2160% (1)

- Jefferson M MarquezDokumen8 halamanJefferson M Marquezalfx216Belum ada peringkat

- Petition For Annulment of JudgmentDokumen177 halamanPetition For Annulment of Judgmentalfx21667% (3)

- Application For Accreditation For Donee Institution StatusDokumen2 halamanApplication For Accreditation For Donee Institution Statusalfx216Belum ada peringkat

- Hotel ManagementDokumen34 halamanHotel ManagementGurlagan Sher GillBelum ada peringkat

- Consti Midterm Exam SummaryDokumen9 halamanConsti Midterm Exam Summaryalfx216Belum ada peringkat

- Affidavit of Modus OperandiDokumen1 halamanAffidavit of Modus Operandialfx216Belum ada peringkat

- What Is Retrofit in Solution Manager 7.2Dokumen17 halamanWhat Is Retrofit in Solution Manager 7.2PILLINAGARAJUBelum ada peringkat

- Qualifying Conditions Before ApplicationDokumen1 halamanQualifying Conditions Before Applicationalfx216Belum ada peringkat

- Certificate To File Action FormatDokumen1 halamanCertificate To File Action Formatalfx216Belum ada peringkat

- Steps & Requirements - UpdatedDokumen4 halamanSteps & Requirements - Updatedalfx216Belum ada peringkat

- Policy On Conflict of InterestDokumen1 halamanPolicy On Conflict of Interestalfx216Belum ada peringkat

- OIC Director: Oic Dir Felipe G. DeriDokumen1 halamanOIC Director: Oic Dir Felipe G. Derialfx216Belum ada peringkat

- PALS Bar Ops Pilipinas Must Read Cases TAXATION 2015Dokumen52 halamanPALS Bar Ops Pilipinas Must Read Cases TAXATION 2015manol_salaBelum ada peringkat

- ChristmasDokumen1 halamanChristmasalfx216Belum ada peringkat

- 2009-SEC Form ExA-001-Initia External AuditorlDokumen3 halaman2009-SEC Form ExA-001-Initia External Auditorlalfx216Belum ada peringkat

- Galtierra Transfer of Shares Checklist of BIR Requirements Party Involved StatusDokumen1 halamanGaltierra Transfer of Shares Checklist of BIR Requirements Party Involved Statusalfx216Belum ada peringkat

- Resignation LetterDokumen2 halamanResignation Letteralfx216Belum ada peringkat

- Professional BackgroundDokumen1 halamanProfessional Backgroundalfx216Belum ada peringkat

- Supreme Court: Public Information OfficeDokumen7 halamanSupreme Court: Public Information Officealfx216Belum ada peringkat

- LOA Business Card DesignDokumen1 halamanLOA Business Card Designalfx216Belum ada peringkat

- RH Law DecisionDokumen72 halamanRH Law Decisionalfx216Belum ada peringkat

- Mat Boundary Spring Generator With KX Ky KZ KMX KMy KMZDokumen3 halamanMat Boundary Spring Generator With KX Ky KZ KMX KMy KMZcesar rodriguezBelum ada peringkat

- Heavy LiftDokumen4 halamanHeavy Liftmaersk01Belum ada peringkat

- Action Plan Lis 2021-2022Dokumen3 halamanAction Plan Lis 2021-2022Vervie BingalogBelum ada peringkat

- Computer First Term Q1 Fill in The Blanks by Choosing The Correct Options (10x1 10)Dokumen5 halamanComputer First Term Q1 Fill in The Blanks by Choosing The Correct Options (10x1 10)Tanya HemnaniBelum ada peringkat

- Reflections On Free MarketDokumen394 halamanReflections On Free MarketGRK MurtyBelum ada peringkat

- Sophia Program For Sustainable FuturesDokumen128 halamanSophia Program For Sustainable FuturesfraspaBelum ada peringkat

- Channel Tables1Dokumen17 halamanChannel Tables1erajayagrawalBelum ada peringkat

- Ingles Avanzado 1 Trabajo FinalDokumen4 halamanIngles Avanzado 1 Trabajo FinalFrancis GarciaBelum ada peringkat

- Doas - MotorcycleDokumen2 halamanDoas - MotorcycleNaojBelum ada peringkat

- Working Capital ManagementDokumen39 halamanWorking Capital ManagementRebelliousRascalBelum ada peringkat

- (X-09485) XYLENE RECTIFIED Extra Pure (Mix Isomers)Dokumen9 halaman(X-09485) XYLENE RECTIFIED Extra Pure (Mix Isomers)Bharath KumarBelum ada peringkat

- Ss 7 Unit 2 and 3 French and British in North AmericaDokumen147 halamanSs 7 Unit 2 and 3 French and British in North Americaapi-530453982Belum ada peringkat

- Guide For Overseas Applicants IRELAND PDFDokumen29 halamanGuide For Overseas Applicants IRELAND PDFJasonLeeBelum ada peringkat

- PVAI VPO - Membership FormDokumen8 halamanPVAI VPO - Membership FormRajeevSangamBelum ada peringkat

- Gabby Resume1Dokumen3 halamanGabby Resume1Kidradj GeronBelum ada peringkat

- Transparency Documentation EN 2019Dokumen23 halamanTransparency Documentation EN 2019shani ChahalBelum ada peringkat

- Google App EngineDokumen5 halamanGoogle App EngineDinesh MudirajBelum ada peringkat

- LMU-2100™ Gprs/Cdmahspa Series: Insurance Tracking Unit With Leading TechnologiesDokumen2 halamanLMU-2100™ Gprs/Cdmahspa Series: Insurance Tracking Unit With Leading TechnologiesRobert MateoBelum ada peringkat

- Ishares Core S&P/TSX Capped Composite Index Etf: Key FactsDokumen2 halamanIshares Core S&P/TSX Capped Composite Index Etf: Key FactsChrisBelum ada peringkat

- Aisladores 34.5 KV Marca Gamma PDFDokumen8 halamanAisladores 34.5 KV Marca Gamma PDFRicardo MotiñoBelum ada peringkat

- Droplet Precautions PatientsDokumen1 halamanDroplet Precautions PatientsMaga42Belum ada peringkat

- Aitt Feb 2017 TH Sem IIIDokumen6 halamanAitt Feb 2017 TH Sem IIIMadhu KumarBelum ada peringkat

- IEC Blank ProformaDokumen10 halamanIEC Blank ProformaVanshika JainBelum ada peringkat

- Sterling B2B Integrator - Installing and Uninstalling Standards - V5.2Dokumen20 halamanSterling B2B Integrator - Installing and Uninstalling Standards - V5.2Willy GaoBelum ada peringkat

- Dissertation On Indian Constitutional LawDokumen6 halamanDissertation On Indian Constitutional LawCustomPaperWritingAnnArbor100% (1)