933nbs 1

Diunggah oleh

Nuwan SeneviratneJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

933nbs 1

Diunggah oleh

Nuwan SeneviratneHak Cipta:

Format Tersedia

Criteria Adopted in Registering Companies to carry on Finance Business

Basic Requirement

Public companies registered under the Companies Act No. 17 of 1982 and having a

specified minimum amount of capital, are considered for registration as finance companies.

The Finance Companies Act has stipulated Rs. 5 million as the minimum issued and paid up

capital. However, the Monetary Board, taking into consideration the fall in value of money

and expansion in business activities, has decided that the issued and paid up capital of a

company commencing finance business should at least have Rs. 200 million.

A. Criteria for Registration

A public company which meets the minimum capital requirement specified above is

registered, if the Monetary Board, on the information made available to it, is satisfied that

its registration would not be detrimental to the interests of its depositors and other

creditors.

For consideration of registration as a finance company, the following documents and

information are required :

- A copy of the Manual of Operations

- A certified copy of the Auditors confidential letter to the board of directors at the

completion of their audit for the last financial year.

- Memorandum & Articles of Association *

- Certificate of Incorporation *

- Latest forms 13, 36, 48 and 63 *

* (Each has to be certified by the Registrar of Companies)

Projections of deposits, lending and profit and loss for the first 03 years.

Feasibility Report on establishing the company.

Organization Chart

Confirmation from the Auditors on the availability of capital

A declaration from the Board of Directors of the company that the company has met

all regulatory and statutory requirements.

Tax clearance certificate.

Experience and qualifications of the members of the Board of Directors and the senior

management of the proposed company.

In addition, if an existing company acts as the promoter of the proposed finance

company, the following information and documents should also be forwarded together

with the application:

- Memorandum and Articles of Association of the promoting company.

- Resolution passed by the Board of Directors to form a new company with an issued

and paid up share capital of not less than Rs. 200 million for the purpose of carrying on

finance business.

- Qualifications and experience of the members of the Board of Directors of the

promoting company.

- 10 major shareholders of the promoting company.

- Audited annual accounts of the promoting company for the last 3 years.

- List of companies in the promoters group together with details of major business

activities of each company and each companys relationship to the promoting

company.

- Whether there are any loss making companies in the group.

Further information will be requested if necessary.

B. Licensing

After registering as a finance company the Monetary Board issues a licence to such

company to carry on finance business.

Anda mungkin juga menyukai

- A Mathematical Modeling Approach To Create A Living Index .....Dokumen12 halamanA Mathematical Modeling Approach To Create A Living Index .....Nuwan SeneviratneBelum ada peringkat

- PM 1001-Calculus I Tutorial - 02Dokumen2 halamanPM 1001-Calculus I Tutorial - 02Nuwan SeneviratneBelum ada peringkat

- InTech-Fuzzy Modeling of Geospatial PatteDokumen23 halamanInTech-Fuzzy Modeling of Geospatial PatteNuwan SeneviratneBelum ada peringkat

- A Mathematical Model To Select The Best Location For A New Commercial Bank BranchDokumen1 halamanA Mathematical Model To Select The Best Location For A New Commercial Bank BranchNuwan SeneviratneBelum ada peringkat

- Tutorial 4 CalDokumen2 halamanTutorial 4 CalNuwan SeneviratneBelum ada peringkat

- SS 05 03 22 PDFDokumen7 halamanSS 05 03 22 PDFNuwan SeneviratneBelum ada peringkat

- SAT Math II PDFDokumen334 halamanSAT Math II PDFSri KondabattulaBelum ada peringkat

- FM3004 Numerical Methods for Finance Practical AssessmentDokumen2 halamanFM3004 Numerical Methods for Finance Practical AssessmentNuwan SeneviratneBelum ada peringkat

- Edexcel IGCSE Biology AnswersDokumen36 halamanEdexcel IGCSE Biology AnswersSumiya Sultan70% (47)

- Analog TransmissionDokumen14 halamanAnalog TransmissionNuwan SeneviratneBelum ada peringkat

- FM-3004-Numerical Methods For Finance Practical AssessmentDokumen1 halamanFM-3004-Numerical Methods For Finance Practical AssessmentNuwan SeneviratneBelum ada peringkat

- Fuzzy AhpDokumen27 halamanFuzzy AhpNuwan SeneviratneBelum ada peringkat

- 2005 Larsen Lecture Notes - Fundamentals of Fuzzy Sets and Fuzzy Logic PDFDokumen8 halaman2005 Larsen Lecture Notes - Fundamentals of Fuzzy Sets and Fuzzy Logic PDFgetmak99Belum ada peringkat

- MatlabDokumen1 halamanMatlabNuwan SeneviratneBelum ada peringkat

- Anlouge TransmissionDokumen14 halamanAnlouge TransmissionNuwan SeneviratneBelum ada peringkat

- A~v = λ~v λ~v − A~v = ~0 − A) ~v = ~0Dokumen11 halamanA~v = λ~v λ~v − A~v = ~0 − A) ~v = ~0coolsome42Belum ada peringkat

- InTech-Fuzzy Modeling of Geospatial PatteDokumen23 halamanInTech-Fuzzy Modeling of Geospatial PatteNuwan SeneviratneBelum ada peringkat

- Formulation and Implementation of RecruitmentDokumen20 halamanFormulation and Implementation of RecruitmentNuwan Seneviratne100% (2)

- Curriculum VitaeDokumen3 halamanCurriculum VitaeNuwan SeneviratneBelum ada peringkat

- Motivation in Company1Dokumen29 halamanMotivation in Company1Nuwan SeneviratneBelum ada peringkat

- Numerical MethodsDokumen28 halamanNumerical MethodsadnanBelum ada peringkat

- ANOVA for Simple Linear Regression AnalysisDokumen2 halamanANOVA for Simple Linear Regression AnalysisNuwan SeneviratneBelum ada peringkat

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5782)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (72)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Worship: We Invite You To With UsDokumen4 halamanWorship: We Invite You To With UsUnited Church of Christ in the PhilippinesBelum ada peringkat

- Unit 1 AssignmentDokumen4 halamanUnit 1 Assignmentapi-277507981Belum ada peringkat

- INDUS WATERS TREATY KEY TO PAK-INDIA WATER SHARINGDokumen21 halamanINDUS WATERS TREATY KEY TO PAK-INDIA WATER SHARINGAzhar AhmadBelum ada peringkat

- Technical Occurrence Report: European Aviation Safety AgencyDokumen3 halamanTechnical Occurrence Report: European Aviation Safety AgencyNihar BBelum ada peringkat

- Testamentary Petition For Succession Certificate ProjectDokumen30 halamanTestamentary Petition For Succession Certificate ProjectVikramaditya MuralidharanBelum ada peringkat

- Idlc MT 1079Dokumen1 halamanIdlc MT 1079saadman672Belum ada peringkat

- Philippine Air Force - PAF OrganizationDokumen40 halamanPhilippine Air Force - PAF Organizationjb2ookworm78% (9)

- Step by Step Guide For Students To Enter The Exam.: Mcta: Rvi Academy MandalayDokumen7 halamanStep by Step Guide For Students To Enter The Exam.: Mcta: Rvi Academy MandalaySteve AvanBelum ada peringkat

- GT Essays makkarIELTSDokumen233 halamanGT Essays makkarIELTSa “aamir” Siddiqui100% (1)

- Examination of ConscienceDokumen2 halamanExamination of ConscienceBrian2589Belum ada peringkat

- 2020-07-01consumer Reports - July 2020 (USA)Dokumen81 halaman2020-07-01consumer Reports - July 2020 (USA)enock-readersBelum ada peringkat

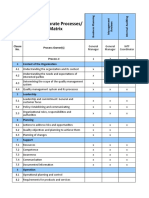

- IATF 16949 Corporate Processes/ Clause Matrix: Process Owner(s) Process # Context of The Organization Clause NoDokumen6 halamanIATF 16949 Corporate Processes/ Clause Matrix: Process Owner(s) Process # Context of The Organization Clause NoshekarBelum ada peringkat

- Chapter 5 Cross Culture Communication and NegotiationDokumen19 halamanChapter 5 Cross Culture Communication and NegotiationAMAL WAHYU FATIHAH BINTI ABDUL RAHMAN BB20110906Belum ada peringkat

- Central Bank of India P.O. Exam., 2010: Computer KnowledgeDokumen36 halamanCentral Bank of India P.O. Exam., 2010: Computer KnowledgeArif KhanBelum ada peringkat

- U. P. State Sugar Corporation v. Sumac International LimitedDokumen6 halamanU. P. State Sugar Corporation v. Sumac International LimitedMihika100% (1)

- 18 Macawadib v. PNP DirectorateDokumen2 halaman18 Macawadib v. PNP DirectorateJames Ryan AlbaBelum ada peringkat

- ARC (File Format)Dokumen5 halamanARC (File Format)Rakesh InaniBelum ada peringkat

- Final Quiz - Cybersecurity EssentialsDokumen32 halamanFinal Quiz - Cybersecurity EssentialsNetaji Gandi50% (26)

- Rameshwar Vs State of Rajasthan AIR 1952 SC 54Dokumen9 halamanRameshwar Vs State of Rajasthan AIR 1952 SC 54Richard SebestianBelum ada peringkat

- Presentation On Wild ChildDokumen30 halamanPresentation On Wild ChildjosieameliaBelum ada peringkat

- Nephrotic Syndrome Nutrition Therapy: Recommended FoodsDokumen8 halamanNephrotic Syndrome Nutrition Therapy: Recommended FoodssivasankarisukumarBelum ada peringkat

- Impact of E-Recruitment Using Social Networking Sites On Labour MarketDokumen8 halamanImpact of E-Recruitment Using Social Networking Sites On Labour MarketChirag GargBelum ada peringkat

- Coach ListDokumen295 halamanCoach ListMustafa Şahin AYDINBelum ada peringkat

- Hapner: St. Henry Native Named A MonsignorDokumen12 halamanHapner: St. Henry Native Named A MonsignormcchronicleBelum ada peringkat

- Agustin Garcia Resume 2018 UpdatedDokumen1 halamanAgustin Garcia Resume 2018 Updatedapi-419712490Belum ada peringkat

- Creativity Required To Retain Top Teachers: Turning Point' For SyriaDokumen31 halamanCreativity Required To Retain Top Teachers: Turning Point' For SyriaSan Mateo Daily JournalBelum ada peringkat

- MATERIAL # 9 - (Code of Ethics) Code of EthicsDokumen6 halamanMATERIAL # 9 - (Code of Ethics) Code of EthicsGlessey Mae Baito LuvidicaBelum ada peringkat

- Trade Union Act 1926Dokumen14 halamanTrade Union Act 1926Jyoti DaveBelum ada peringkat

- Who Is A Ship Chandler?: Origin and Importance of Ship Chandelling ServicesDokumen3 halamanWho Is A Ship Chandler?: Origin and Importance of Ship Chandelling ServicesPaul Abonita0% (1)