Ch09 - Statistical Sampling For Testing Control Procedures

Diunggah oleh

rain06021992Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Ch09 - Statistical Sampling For Testing Control Procedures

Diunggah oleh

rain06021992Hak Cipta:

Format Tersedia

Chapter 9 Statistical Sampling for Testing Control Procedures 142

Statistical Sampling for Testing Control

Procedures

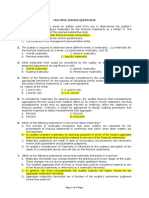

MULTIPLE CHOICE

1.

Auditors who prefer statistical sampling to non-statistical

sampling may do so because statistical sampling helps the

auditor

a.

Measure the sufficiency of the evidential matter

obtained.

b.

Eliminate subjectivity in the evaluation of sampling

results.

c.

Reduce the level of tolerable error to a relatively low

amount.

d.

Minimize the failure to detect a material misstatement

due to non-sampling risk.

ANSWER:

2.

If all other factors in a sampling plan are held constant,

changing the measure of tolerable error to a smaller value

would cause the sample size to be:

a.

Smaller.

b.

Larger.

c.

Unchanged.

d.

Indeterminate.

ANSWER:

3.

Which of the following sampling plans would be designed to

estimate a numerical measurement of a population, such as a

dollar value?

a.

Numerical sampling.

b.

Discovery sampling.

c.

Sampling for attributes.

d.

Sampling for variables.

ANSWER:

4.

Based on a random sample, it is estimated that four percent,

plus or minus two percent, of a firm's invoices contain

errors. The plus or minus two percent is known as the

estimate's:

a.

Precision.

b.

Accuracy.

143

Chapter 9 Statistical Sampling for Testing Control Procedures

c.

d.

5.

Confidence level.

Standard error.

ANSWER: A

In order to quantify the risk that sample evidence leads to

erroneous conclusions about the sampled population

a.

Each item in the sampled population must have an equal

chance of being selected.

b.

Each item in the sampled population must have a chance

of being selected proportional to its book value.

c.

Each item in the sampled population must have an equal

or known probability of being selected.

d.

The precise number of items in the population must be

known.

ANSWER:

6.

Which of the following statements is not true regarding

audit risk assessment?

a.

The auditor studies the business and industry and

applies analytical procedures as a basis for assessing

inherent risk.

b.

When control risk and inherent risk are high, the

auditor increases detection risk to maintain overall

audit risk at the desired level.

c.

The auditor studies and evaluates internal control

policies and procedures for assessing control risk.

d.

The auditor designs substantive audit procedures to

reduce detection risk to an acceptable level.

ANSWER:

7.

Which of the following factors does an auditor generally

need to consider in planning a particular audit sample

for a

control test?

a.

Number of items in the population.

b.

Total dollar amount of the items to be sampled.

c.

Estimated standard deviation of the population.

d.

Tolerable error.

ANSWER:

8.

Random numbers can be used to select a sample only when each

item in the population:

a.

Can be assigned to a specific stratum.

b.

Is independent of outside influence.

c.

Can be identified with a unique number.

Chapter 9 Statistical Sampling for Testing Control Procedures

d.

Is expected to be within plus or minus three standard

deviations of the population mean.

ANSWER:

9.

An auditor samples cash disbursement records for significant

errors of $5 or more. Upon finding one such error, these

records are scheduled for a complete review. This

conclusion is most likely based on a

a.

Cluster sample.

b.

Discovery sample.

c.

Systematic sample.

d.

Stratified sample.

ANSWER:

12.

An advantage of statistical over non-statistical sampling is

that statistical sampling:

a.

Enables auditors to objectively measure the reliability

of their sample results.

b.

Permits use of a smaller sample size than would be

necessary with non-statistical sampling.

c.

Is compatible with a wider variety of sample selection

methods than is non-statistical sampling.

d.

Allows auditors to inject their subjective judgment in

determining sample size and selection process in order

to audit items of greatest value and highest risk.

ANSWER:

11.

The tolerable occurrence rate for a control test is

generally

a.

Lower than the expected occurrence rate in the related

accounting records.

b.

Higher than the expected occurrence rate in the related

accounting records.

c.

Identical to the expected occurrence rate in the

related accounting records.

d.

Unrelated to the expected occurrence rate in the

related accounting records.

ANSWER:

10.

144

Of the following statements, which one best differentiates

statistical sampling from nonstatistical sampling?

145

Chapter 9 Statistical Sampling for Testing Control Procedures

a.

b.

c.

d.

Statistical sampling is a mathematical approach to

inference, whereas nonstatistical sampling is a more

subjective approach.

Nonstatistical sampling has greater applicability to

large populations than does statistical sampling.

Nonstatistical sampling is more subjective, but

produces greater consistency in the application of

audit judgment.

Nonstatistical sampling has greater applicability to

populations that lend themselves to random selection.

ANSWER:

13.

In examining cash disbursements, an auditor plans to choose

a sample using systematic selection with a random start.

The primary advantage of such a systematic selection is that

population items

a.

Which include errors will not be overlooked when the

auditor exercises compatible reciprocal

options.

b.

May occur in a systematic pattern, thus making the

sample more representative.

c.

May occur more than once in a sample.

d.

Do not have to be prenumbered in order for the auditor

to use the technique.

ANSWER:

14.

When planning an attribute sampling application, the

difference between the expected occurrence rate and the

tolerable occurrence rate is the planned

a.

Precision.

b.

Reliability.

c.

Dispersion.

d.

Skewness.

ANSWER:

15.

If certain forms are not consecutively numbered

a.

Selection of a random sample probably is not possible.

b.

Systematic sampling may be appropriate.

c.

Stratified sampling should be used.

d.

Random number tables cannot be used.

ANSWER:

Chapter 9 Statistical Sampling for Testing Control Procedures

16.

In an attribute sampling application, holding other factors

constant, sample size will increase as which of the

following becomes smaller?

a.

Reliability level.

b.

Population.

c.

Planned precision.

d.

Expected rate of occurrence.

ANSWER:

17.

Which of the following is an element of sampling risk?

a.

Choosing an audit procedure that is inconsistent with

the audit objective.

b.

Choosing a sample size that is too small to achieve the

sampling objective.

c.

Failing to detect an error on a document that has been

inspected by the auditor.

d.

Failing to perform audit procedures that are required

by the sampling plan.

ANSWER:

20.

Attribute sampling, as applied to control testing, can

assist the auditor in several ways. Which of the following

tasks is not enhanced by sampling?

a.

Determining the number of documents to examine in

testing for a specific attribute.

b.

Selecting the documents to be tested.

c.

Examining the documents.

d.

Evaluating the sample results.

ANSWER:

19.

Which of the following sampling methods is most useful to

auditors when testing for internal control effectiveness?

a.

Stratified random sampling.

b.

Attribute sampling.

c.

Variables sampling.

d.

Unrestricted random sampling with replacement.

ANSWER:

18.

146

Which of the following would not be an attribute of interest

to an auditor performing control tests?

a.

Do selling prices agree with published price lists?

b.

Do purchased parts meet established quality standards?

c.

Are proper labor rates being used to compute payroll?

147

Chapter 9 Statistical Sampling for Testing Control Procedures

d.

Are account distributions (debits and credits) correct?

ANSWER:

21.

The precision limit for control testing necessary to

justify lowering the assessed control risk level

depends

primarily on which of the following?

a.

The cause of the errors.

b.

The materiality of the attribute(s) to be tested.

c.

The amount of any substantive errors.

d.

The limit used in audits of similar clients.

ANSWER:

22.

Which of the following statements concerning sample size is

true?

a.

An increase in the tolerable occurrence rate, other

factors remaining unchanged, increases sample size.

b.

The higher the expected occurrence rate, other factors

remaining unchanged, the larger will be the sample

size.

c.

The more critical the attribute being tested, the

higher will be the tolerable occurrence rate set by the

auditor, and the larger will be the sample size.

d.

The lower the acceptable risk of underassessment of

control risk, the smaller will be the sample size.

ANSWER:

23.

In the examination of the financial statements of Delta

Company, the auditor determines that in performing a

test of

internal control effectiveness, the rate of error in

the

sample does not support the auditor's preconceived

notion of

a tolerable occurrence rate when, in fact, the

actual error

rate in the population does meet the auditor's

notion of

effectiveness. This situation illustrates

the risk of

a.

Underassessment of control risk.

b.

Overassessment of control risk.

c.

Incorrect rejection.

d.

Incorrect acceptance.

ANSWER:

24.

If all other factors in a sampling plan are held constant,

changing the risk of underassessment from five percent to

Chapter 9 Statistical Sampling for Testing Control Procedures

148

three percent would cause the sample size to be:

a.

Smaller.

b.

Larger.

c.

Unchanged.

d.

Indeterminate.

ANSWER:

25.

An auditor performs a test to determine whether all

merchandise for which the client was billed was

received.

The population for this test consists of all

a.

Merchandise received.

b.

Vendors' invoices.

c.

Canceled checks.

d.

Receiving reports.

ANSWER:

26.

Although mathematically based, statistical sampling does not

replace audit judgment. In utilizing statistical sampling

techniques, the auditor must apply judgment in all but which

of the following tasks?

a.

Selecting a tolerable rate of error.

b.

Determining an acceptable risk of underassessing

control risk.

c.

Calculating the actual error rate.

d.

Assessing the materiality of control weaknesses.

ANSWER:

27.

To determine sample size in an attribute sampling

application, what must be specified?

a.

Population mean, expected error rate, precision.

b.

Precision, reliability, standard deviation.

c.

Precision, reliability, expected occurrence rate.

d.

Population mean, standard deviation, precision.

ANSWER:

28.

Which of the following statements regarding statistical

sampling in auditing is true?

a.

Inasmuch as audits are test-based, generally accepted

auditing standards require the use of statistical

sampling methods whenever the auditor decides to

examine only part of a population.

b.

Although statistical sampling may be applied to control

testing, it is required for substantive testing

149

Chapter 9 Statistical Sampling for Testing Control Procedures

c.

d.

purposes.

Sampling methods are used by auditors in both control

testing and substantive testing.

Statistical sampling methods are more appropriate for

control testing when the auditor elects to reprocess

transactions, than when controls are tested by means of

document examination.

ANSWER:

29.

The application of statistical sampling techniques is least

related to which of the following generally accepted

auditing standards?

a.

The work is to be adequately planned and assistants, if

any, are to be properly supervised.

b.

In all matters relating to the assignment, an independence in mental attitude is to be maintained by the

auditor or auditors.

c.

A sufficient understanding of the internal control

system is to be obtained to plan the audit and to

determine the nature, timing, and extent of tests

to be

performed.

d.

Sufficient competent evidential matter is to be

obtained through inspection, observation, inquiries,

and confirmations to afford a reasonable basis for

an

opinion regarding the financial statements

under

examination.

ANSWER:

30.

The major weakness of nonstatistical (judgmental) sampling

is it

a.

Usually requires larger sample sizes than statistical

sampling.

b.

Does not allow sampling risk to be objectively

measured.

c.

Frequently results in samples that are not

representative of the population.

d.

Gives less accurate point estimates of parameters than

statistical sampling.

ANSWER:

31.

An auditor is testing credit authorization procedures by

examining sales invoices for credit approval by the credit

department. The procedures will be considered to be working

adequately if 96% of all sales invoices either indicate

Chapter 9 Statistical Sampling for Testing Control Procedures

random

of the

a.

b.

c.

d.

150

approval or are cash sales. The auditor selects a

sample of 100 invoices. In this situation, which

following outcomes illustrates underassessment?

The auditor finds five deviations and concludes that

procedures work inadequately. The actual population

deviation rate is 2%.

The auditor finds no deviations and concludes that

procedures work adequately. The true population

deviation rate is 5%.

The auditor finds no deviations and concludes that the

procedures work adequately. The true population

deviation rate is 2%.

The auditor finds five deviations and concludes that

procedures work inadequately. The true population

deviation rate is 6%.

ANSWER:

32.

If an auditor, planning to use statistical sampling, is

concerned with the number of a client's sales invoices

that

contain mathematical errors, the auditor would most

likely

utilize

a.

Random sampling with replacement.

b.

Sampling for attributes.

c.

Sampling for variables.

d.

Stratified random sampling.

ANSWER:

33.

An advantage of using statistical over non-statistical

sampling methods in tests of controls is that the

statistical methods

a.

Afford greater assurance than a non-statistical sample

of equal size.

b.

Provide an objective basis for quantitatively

evaluating sample risks.

c.

Can more easily convert the sample into a dual-purpose

test useful for substantive testing.

d.

Eliminate the need to use judgment in determining

appropriate sample sizes.

ANSWER:

34.

Several risks are inherent in the evaluation of audit

evidence which has been obtained through the use of

statistical sampling. Which of the following

151

Chapter 9 Statistical Sampling for Testing Control Procedures

risks is an

example of the risk of underassessment of control

risk?

a.

Failure to properly define the population to be

sampled.

b.

Failure to draw a random sample from the population.

c.

Failure to accept the statistical hypothesis that

internal control is unreliable when, in fact, it is.

d.

Failure to accept the statistical hypothesis that a

book value is not materially misstated when the true

book value is not materially misstated.

ANSWER:

35.

As a result of tests of controls, an auditor underassessed

control risk and decreased substantive testing. This

underassessment occurred because the true occurrence rate in

the population was

a.

Less than the risk of underassessment in the auditor's

sample.

b.

Less than the occurrence rate in the auditor's sample.

c.

More than the risk of underassessment in the auditor's

sample.

d.

More than the occurrence rate in the auditor's sample.

ANSWER:

36.

If all other factors specified in an attribute sampling plan

remain constant, changing the specified precision from 6% to

10%, and changing the specified reliability from 97% to 93%

would cause the required sample size to

a.

Increase.

b.

Remain the same.

c.

Decrease.

d.

Change by 4%.

ANSWER:

37.

Which of the following factors is generally not considered

in determining the sample size for a test of controls?

a.

Population size.

b.

Tolerable rate.

c.

Risk of underassessment.

d.

Expected population occurrence rate.

ANSWER:

Chapter 9 Statistical Sampling for Testing Control Procedures

152

38.

The expected population occurrence rate of client billing

errors is 3%. The auditor has established a tolerable

rate

of 5%. In the review of client invoices the auditor

should

use

a.

Stratified sampling.

b.

Variable sampling.

c.

Discovery sampling.

d.

Attribute sampling.

ANSWER:

39.

An auditor desired to test credit approval on 10,000 sales

invoices processed during the year. The auditor designed a

statistical sample that would provide a 1% risk of assessing

control risk too low (99% confidence) that not more than 7%

of the sales invoices lacked approval. The auditor estimated

from previous experience that about 2 1/2% of the sales

invoices lacked approval. A sample of 200 invoices was

examined and 7 of them were lacking approval. The

auditor

then determined the upper occurrence limit to be

8%. In the

evaluation of this sample, the auditor decided to

increase

the level of the preliminary assessment of control

risk

because the

a.

Tolerable rate (7%) was less than the achieved upper

occurrence limit (8%).

b.

Expected occurrence rate (7%) was more than the

percentage of errors in the sample (3 1/2%).

c.

Achieved upper occurrence limit (8%) was more than the

percentage of errors in the sample (3 1/2%).

d.

Expected occurrence rate (2 1/2%) was less than the

tolerable rate (7%).

ANSWER:

40.

To evaluate the sample results for an attributes sampling

application, a measure of precision is required. Which of

the following statements is true regarding precision?

a.

Precision is subtracted from the tolerable rate of

error to determine the acceptability of sample

results.

b.

Precision is added to the tolerable rate

of error to

determine the acceptability of sample

results.

c.

Precision is subtracted from the

sample occurrence rate

and the result is compared to the

tolerable rate of

error.

d.

Precision is added to the sample occurrence rate and

the result is compared to the tolerable rate of error.

153

Chapter 9 Statistical Sampling for Testing Control Procedures

ANSWER:

41.

An auditor who uses statistical sampling for attributes in

testing internal controls should increase the assessed level

of control risk when the

a.

Sample occurrence rate is less than the expected

occurrence rate used in planning the sample.

b.

Tolerable rate less the allowance for sampling risk

exceeds the sample occurrence rate.

c.

Sample occurrence rate plus the allowance for sampling

risk exceeds the tolerable rate.

d.

Sample occurrence rate plus the allowance for sampling

risk equals the tolerable rate.

ANSWER:

42.

Which of the following statements is correct concerning

statistical sampling for control testing?

a.

The population size has little or no effect on

determining sample size except for very small

populations.

b.

The expected population occurrence rate has little or

no effect on determining sample size except for

very

small populations.

c.

As the population size doubles, the sample size also

should double.

d.

For a given tolerable rate, a larger sample size should

be selected as the expected population deviation rate

decreases.

ANSWER:

43.

An auditor wishes to determine if the error rate on travel

reimbursement claims is within the five-percent tolerance

level set by management. What sampling plan should the

auditor use?

a.

Variables sampling.

b.

Attribute sampling.

c.

Judgment sampling.

d.

PPS sampling.

ANSWER:

44.

The auditor samples cash disbursements for minor errors of

$5 or less. The parameter to be estimated is the error

rate, which might be as high as 10%. The auditor is

most

likely to use

Chapter 9 Statistical Sampling for Testing Control Procedures

a.

b.

c.

d.

Block sampling.

Variables sampling.

Attributes sampling.

Discovery sampling.

ANSWER:

45.

154

An important difference between a statistical sample and a

non-statistical (judgmental) sample is that with a

statistical sample:

a.

No judgment is required, everything is by formula.

b.

A smaller sample size can be used.

c.

More accurate results are obtained.

d.

Population estimates with measurable reliability can be

made.

ANSWER:

COMPLETION:

47.

Statistical sampling for attributes is most applicable in

situations where a visible

in the form

of

exists.

ANSWER:

48.

As contrasted with statistical sampling, nonstatistical

sampling is a more

approach to inference.

ANSWER:

49.

whereas

ANSWER:

50.

AUDIT TRAIL, DOCUMENTATION

SUBJECTIVE

estimates the frequency of events,

is an estimate of amount.

ATTRIBUTE SAMPLING, VARIABLES SAMPLING

The

is the anticipated

error rate, whereas the

is

the maximum rate of error acceptable to the auditor, while

still warranting a lowering of assessed control risk below

the maximum level.

ANSWER:

EXPECTED OCCURRENCE RATE, TOLERABLE OCCURRENCE RATE

155

51.

Chapter 9 Statistical Sampling for Testing Control Procedures

The

size.

the precision range, the larger the sample

ANSWER:

52.

The more critical an attribute to those control policies and

procedures relevant to an audit, the

the tolerable

occurrence rate.

ANSWER:

53.

`

BETA

PROBABILITY

When documents are not prenumbered, an acceptable

alternative to the use of random number tables or computergenerated numbers is

.

ANSWER:

56.

____________

Random selection requires that items to be included in the

sample must be drawn on a

basis.

ANSWER:

55.

LOWER

Another term for "risk of underassessment" is

risk.

ANSWER:

54.

NARROWER

SYSTEMATIC SAMPLING

Under conditions of

detection risk, a minimal

quantity of audit evidence is needed.

ANSWER:

HIGH

MATCHING:

57.

Indicate by letter the term matching the definition given.

A.

B.

C.

D.

E.

F.

G.

H.

I.

J.

K.

Attribute sampling

Alpha risk

Discovery sampling

Beta risk

Expected occurrence rate

Precision

Discovery sampling

Sampling risk

Systematic sampling

Tolerable occurrence rate

Upper occurrence limit

Chapter 9 Statistical Sampling for Testing Control Procedures

L.

156

Variables sampling

____1.

An estimate of frequency of events.

____2.

An orderly approach to locating a particular event.

____3.

The anticipated error rate.

____4.

Risk of underassessment.

____5.

Maximum rate of error acceptable to the auditor.

____6.

Risk that the auditors conclusions about a population

will be incorrect.

____7.

A random selection method that involves choosing every

nth item in the population until the requisite sample

size has been reached.

____8.

The calculated maximum error rate based on the results of

sampling.

____9.

Risk of overassessment.

____10. Range within the true answer most likely falls.

SOLUTION:

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

A

C

E

D

J

H

I

K

B

F

PROBLEM/ESSAY:

58.

Margaret Hopkins, CPA, wishes to test the effectiveness of

internal controls over the customer billing function of

Jacks Wholesale Hardware, an audit client. Hopkins has

identified the following attributes to be tested. For each

attribute, indicate the appropriate sampling unit and

carefully define what constitutes an error.

157

Chapter 9 Statistical Sampling for Testing Control Procedures

1.

2.

3.

4.

5.

6.

7.

8.

9.

Does the customer order agree with the invoice as to

type and quantity of goods?

Does the shipping order agree with the invoice as to

type and quantity of goods?

Has customer credit been approved?

Does the invoice amount cause the customer to exceed

the prepared credit limit?

Have goods been billed but not shipped?

Have goods been shipped but not billed?

Do invoiced prices agree with official price lists?

Do credit and discount terms appearing on face of

customer invoice accord with company policy?

Are proper accounts debited and credited?

SOLUTION:

1.

SAMPLING UNIT: Sales invoice

ERROR:

Lack of agreement between invoice and order

as to:

Type of goods

Quantity of goods

Price of goods

Credit and discount terms

2.

SAMPLING UNIT: Sales invoice

ERROR:

Lack of agreement between invoice and

shipping order as to:

Type of goods

Quantity of goods

3.

SAMPLING UNIT: Sales invoice

ERROR:

Lack of evidence of credit approval on face

of invoice

4.

SAMPLING UNIT: Sales invoice

ERROR:

Invoice amount plus previous customer

balance exceeds prepared credit limit

5.

SAMPLING UNIT: Sales invoice

ERROR:

Shipping order and/or bill of lading not

attached to customer invoice

6.

SAMPLING UNIT: Bill of lading

ERROR:

Matching invoice not located

7.

SAMPLING UNIT: Sales invoice

Chapter 9 Statistical Sampling for Testing Control Procedures

ERROR:

158

Price not in agreement with master price list

and no evidence of proper approval of

billed price

8.

SAMPLING UNIT: Sales invoice

ERROR:

Credit and/or discount terms at variance with

company policy, and no evidence of proper

approval of quoted credit and discount

terms.

9.

SAMPLING UNIT: Sales invoice

ERROR:

Incorrect debits or credits appearing on face

of invoice and not corrected before posting

accounts.

59.

Sampling can assist the auditor in various ways during the

examination of documentary evidence for tests of

internal

controls. Using a vouchering and vendor billing application

as an example, assume that you are interested in evaluating

internal controls relative to ordering goods, receiving

goods, and processing vendor invoices. Discuss how

attribute sampling might assist you in the following

phases

of your tests of controls:

a.

Determining the number of vouchers to test;

b.

Selecting the vouchers for testing;

c.

Evaluating the results of the voucher test;

d.

Assessing audit risk associated with the

expenditure cycle.

SOLUTION:

a. In determining the number of vouchers to test, the

auditor will need to set a tolerable occurrence rate and an

acceptable risk of underassessment. These parameters,

along with an estimated occurrence rate may then be used as

inputs to determining sample size.

b. If vouchers are prenumbered, the auditor can elect to use

a random selection approach to selecting vouchers test

for predefined attributes.

c. Having examined the sample for the attributes of

interest, the auditor can calculate the observed error

rate and the upper occurrence limit.

d. The upper occurrence limit can be compared with the

tolerable occurrence rate to support raising or lowering

the assessed level of control risk.

159

Chapter 9 Statistical Sampling for Testing Control Procedures

60.

George Jones, CPA, wishes to test payroll controls for

Hopkins Manufacturing, an audit client. He has identified

the following attributes of interest for testing purposes:

1.

Correctness of pay rates and hours used in

preparing the payroll summary;

2.

Genuineness of listed employees;

3.

Correctness of gross pay, withholdings, and net

pay;

4.

Correctness of debits and credits.

A pilot test of forty payroll transactions revealed the

following errors: One transaction revealed an

incorrect

pay rate; two transactions resulted in incorrect

calculations of either gross pay or withholdings; and two

transactions resulted in erroneous debits or credits. All

listed employees were found to be working for the company

during the pay period being tested. Jones believes that

four or more errors for each of the four attributes is

significant.

Required:

a.

Based on the pilot sample, calculate the expected

occurrence rate and the tolerable occurrence rate for

each attribute.

b.

In determining sample size, Jones can select an

expected occurrence rate ranging from the low for

attribute number 2 to the high for attributes 3 and 4.

What impact will a low rate relative to a high rate

have on the calculated sample size?

c.

What other factors must Jones consider before

determining the sample size?

c.

Assuming that a sample of 100 payroll summary entries

produced the following calculated upper occurrence

limits, what impact will these limits have on

Jones substantive audit program?

Attribute

Attribute

Attribute

Attribute

1:

2:

3:

4:

7.0%

4.0%

12.0%

6.0%

SOLUTION:

a.

The tolerable occurrence rate is 10% (4/40) for each

Chapter 9 Statistical Sampling for Testing Control Procedures

b.

c.

d.

160

of the attributes. The expected occurrence rates are:

Attribute No. 1: 2.5%

Attribute No. 2: 0.0%

Attribute No. 3: 5.0%

Attribute No. 4: 5.0%

The higher the expected occurrence rate, the larger

will be the sample size.

Jones must determine the acceptable risk of

underassessing control risk.

Only attribute 3 produces an unacceptable upper

occurrence limit, exceeding the tolerable rate of 10%.

Given incorrect calculation of gross pay, withholdings,

and net pay, Jones should plan to focus more heavily

on inventory costing, inasmuch as inventory includes

both direct and indirect labor components. He should

also concentrate on payroll cost included in general

and administrative expense, as well as on accrued

payroll and payroll taxes payable at year end.

Incorrect calculation of gross pay and withholdings

will also impact the calculation of employers payroll

tax expense. Therefore, Jones must plan to audit these

accounts more intensively than under conditions of

strong internal control.

Anda mungkin juga menyukai

- Quiz On Audit SamplingDokumen5 halamanQuiz On Audit SamplingTrisha Mae AlburoBelum ada peringkat

- Quizzer 8Dokumen6 halamanQuizzer 8CriscelBelum ada peringkat

- Audit Sampling: Quiz 2Dokumen8 halamanAudit Sampling: Quiz 2weqweqwBelum ada peringkat

- Audit - Mock Board Examination - Sy2019-20Dokumen15 halamanAudit - Mock Board Examination - Sy2019-20Mark Domingo MendozaBelum ada peringkat

- Senior Internal Auditor Promotion Exam ReviewDokumen8 halamanSenior Internal Auditor Promotion Exam Reviewwondimeneh AsratBelum ada peringkat

- Pre Engagement MCQsDokumen5 halamanPre Engagement MCQskeiBelum ada peringkat

- MSU-CBA Internal Auditing ModuleDokumen7 halamanMSU-CBA Internal Auditing ModuleNoroBelum ada peringkat

- Audit of Liabilities ProceduresDokumen9 halamanAudit of Liabilities Procedureskara albueraBelum ada peringkat

- Chapter 2 The Risk of FraudDokumen49 halamanChapter 2 The Risk of FraudcessbrightBelum ada peringkat

- TBCH01Dokumen6 halamanTBCH01Arnyl ReyesBelum ada peringkat

- Answer: Difficulty: Objective: Terms To Learn: Capital BudgetingDokumen7 halamanAnswer: Difficulty: Objective: Terms To Learn: Capital BudgetingMaha HamdyBelum ada peringkat

- Classification of Assurance EngagementDokumen3 halamanClassification of Assurance EngagementJennybabe PetaBelum ada peringkat

- Auditing The Finance and Accounting FunctionsDokumen19 halamanAuditing The Finance and Accounting FunctionsMark Angelo BustosBelum ada peringkat

- First PreboardDokumen5 halamanFirst PreboardRodmae VersonBelum ada peringkat

- Audit EvidenceDokumen10 halamanAudit EvidenceJane Layug CabacunganBelum ada peringkat

- OpAudCh03 CBET 01 501E Toralde, Ma - Kristine E.Dokumen5 halamanOpAudCh03 CBET 01 501E Toralde, Ma - Kristine E.Kristine Esplana ToraldeBelum ada peringkat

- Fraud Error NoclarDokumen17 halamanFraud Error NoclarChixNaBitterBelum ada peringkat

- Quiz Production CycleDokumen2 halamanQuiz Production CycleAira Jaimee GonzalesBelum ada peringkat

- Chapter 5Dokumen22 halamanChapter 5Jenny Lelis100% (1)

- Auditor's primary responsibility and assurance servicesDokumen14 halamanAuditor's primary responsibility and assurance servicesTricia Mae FernandezBelum ada peringkat

- Unit Iv Assessment Part Ii Internal Control A Tool in Managing RiskDokumen3 halamanUnit Iv Assessment Part Ii Internal Control A Tool in Managing RiskLaiven Ryle100% (1)

- Audit Risk and MaterialityDokumen5 halamanAudit Risk and Materialitycharmsonin12Belum ada peringkat

- Course Book 2018-2019Dokumen40 halamanCourse Book 2018-2019AdrianaBelum ada peringkat

- Quiz On Auditing For 1 To 2Dokumen10 halamanQuiz On Auditing For 1 To 2Vanjo MuñozBelum ada peringkat

- Audit Planning AnswersDokumen3 halamanAudit Planning AnswersKathlene BalicoBelum ada peringkat

- Audit Planning, Client Understanding, Risk AssessmentDokumen44 halamanAudit Planning, Client Understanding, Risk Assessmentjamie_xiBelum ada peringkat

- Audit Reports and Financial StatementsDokumen7 halamanAudit Reports and Financial StatementsMa. Hazel Donita Diaz100% (1)

- CPA Review School Philippines Audit Final ExamDokumen17 halamanCPA Review School Philippines Audit Final ExamJane DizonBelum ada peringkat

- 02 Code of EthicsDokumen10 halaman02 Code of EthicsMhmd HabboshBelum ada peringkat

- Which of The Following Is An Example of Fraudulent Financial Reporting?Dokumen2 halamanWhich of The Following Is An Example of Fraudulent Financial Reporting?accounts 3 lifeBelum ada peringkat

- Chapter 2Dokumen3 halamanChapter 2Carlo SolanoBelum ada peringkat

- Chapter 8—General Ledger, Financial Reporting, and Management Reporting SystemsDokumen8 halamanChapter 8—General Ledger, Financial Reporting, and Management Reporting SystemsIsla PageBelum ada peringkat

- Psa 610 Using The Work of Internal Auditors: RequirementsDokumen2 halamanPsa 610 Using The Work of Internal Auditors: RequirementsJJ LongnoBelum ada peringkat

- Barcode MGDokumen16 halamanBarcode MGarjunachu81100% (1)

- Fundamentals of Assurance Services - Docx'Dokumen8 halamanFundamentals of Assurance Services - Docx'jhell dela cruzBelum ada peringkat

- Auditing A Risk Based-Approach To Conducting A Quality Audit 10th Edition Johnstone Test Bank 1Dokumen30 halamanAuditing A Risk Based-Approach To Conducting A Quality Audit 10th Edition Johnstone Test Bank 1patriciaBelum ada peringkat

- Lecture 7-Exercise PDFDokumen2 halamanLecture 7-Exercise PDFakii ram100% (1)

- Evaluation of Prospective Client FormDokumen2 halamanEvaluation of Prospective Client FormDyanne Yssabelle DisturaBelum ada peringkat

- Audit Liabilities Completeness ProceduresDokumen3 halamanAudit Liabilities Completeness ProceduresJobby Jaranilla100% (1)

- Auditing the Procurement Process and Accounts Payable CycleDokumen7 halamanAuditing the Procurement Process and Accounts Payable CyclecykenBelum ada peringkat

- AP.3401 Audit of InventoriesDokumen8 halamanAP.3401 Audit of InventoriesMonica GarciaBelum ada peringkat

- Auditing Theory 3rd ExaminationDokumen12 halamanAuditing Theory 3rd ExaminationKathleenBelum ada peringkat

- Applied Auditing Quiz #1 (Diagnostic Exam)Dokumen15 halamanApplied Auditing Quiz #1 (Diagnostic Exam)xjammerBelum ada peringkat

- Aud Plan 123Dokumen7 halamanAud Plan 123Mary GarciaBelum ada peringkat

- Pre EngagementDokumen3 halamanPre EngagementJanica BerbaBelum ada peringkat

- Quiz BeeDokumen15 halamanQuiz BeeRudolf Christian Oliveras UgmaBelum ada peringkat

- Internal Auditing Quiz 2Dokumen3 halamanInternal Auditing Quiz 2richarddiagmelBelum ada peringkat

- (Roncal) at Midterms 2Dokumen5 halaman(Roncal) at Midterms 2Lorie RoncalBelum ada peringkat

- PSA 505: External Confirmation: Patricia Jerimae Bensorto/ Arlene Joy Garcia/ Marle Angel PanorilDokumen25 halamanPSA 505: External Confirmation: Patricia Jerimae Bensorto/ Arlene Joy Garcia/ Marle Angel PanorilARLENE GARCIABelum ada peringkat

- CW6 - MaterialityDokumen3 halamanCW6 - MaterialityBeybi JayBelum ada peringkat

- Auditing Multiple ChoicesDokumen8 halamanAuditing Multiple ChoicesyzaBelum ada peringkat

- Auditing and Assurance Principles Final Exam Set ADokumen11 halamanAuditing and Assurance Principles Final Exam Set APotato CommissionerBelum ada peringkat

- Auditing AssignmentDokumen17 halamanAuditing Assignmentihsan278Belum ada peringkat

- T.B - CH10Dokumen17 halamanT.B - CH10MohammadYaqoobBelum ada peringkat

- Final Exam: Fall 1997 This Exam Is Worth 30% and You Have 2 HoursDokumen84 halamanFinal Exam: Fall 1997 This Exam Is Worth 30% and You Have 2 HoursJatin PanchiBelum ada peringkat

- Audit of InventoriesDokumen2 halamanAudit of InventoriesWawex DavisBelum ada peringkat

- Auditing Theory - 1Dokumen9 halamanAuditing Theory - 1Kageyama HinataBelum ada peringkat

- ch11 Doc PDF - 2 PDFDokumen39 halamanch11 Doc PDF - 2 PDFRenzo RamosBelum ada peringkat

- Ch09 - Statistical Sampling For Testing Control ProceduresDokumen18 halamanCh09 - Statistical Sampling For Testing Control ProceduresSamit TandukarBelum ada peringkat

- Statistical Sampling For Testing Control Procedures Multiple ChoiceDokumen7 halamanStatistical Sampling For Testing Control Procedures Multiple ChoiceAnonymous N9dx4ATEghBelum ada peringkat

- FDA License 1Dokumen1 halamanFDA License 1rain06021992Belum ada peringkat

- FDA License 1Dokumen1 halamanFDA License 1rain06021992Belum ada peringkat

- PDF Delgado Notes On Civil Procedure Rule 6 21 As Amended DDDokumen60 halamanPDF Delgado Notes On Civil Procedure Rule 6 21 As Amended DDrain06021992Belum ada peringkat

- II. Trade and Investment Policy Regime (1) O: Brazil WT/TPR/S/212Dokumen13 halamanII. Trade and Investment Policy Regime (1) O: Brazil WT/TPR/S/212rain06021992Belum ada peringkat

- Module 1b SJ Mainstreaming Framewok Part 1Dokumen49 halamanModule 1b SJ Mainstreaming Framewok Part 1rain06021992Belum ada peringkat

- I. A. Background: IEE Checklist For PLTU Projects of 30Dokumen38 halamanI. A. Background: IEE Checklist For PLTU Projects of 30rain06021992Belum ada peringkat

- Philippine Economic Zone AuthorityDokumen26 halamanPhilippine Economic Zone Authorityrain06021992Belum ada peringkat

- FDA License 1Dokumen1 halamanFDA License 1rain06021992Belum ada peringkat

- Iii. Trade Policies and Practices by Measure (1) I: The Philippines WT/TPR/S/149Dokumen40 halamanIii. Trade Policies and Practices by Measure (1) I: The Philippines WT/TPR/S/149rain06021992Belum ada peringkat

- Rules 64 65 DigestsDokumen25 halamanRules 64 65 Digestsrain06021992Belum ada peringkat

- PH Econ UpdateDokumen68 halamanPH Econ Updaterain06021992Belum ada peringkat

- Module 3 Mainstreaming Framework Jan29 2014 LRDokumen78 halamanModule 3 Mainstreaming Framework Jan29 2014 LRrain06021992Belum ada peringkat

- TerminalDokumen38 halamanTerminalrain06021992Belum ada peringkat

- Philippines Economic OutlookDokumen9 halamanPhilippines Economic Outlookrain06021992Belum ada peringkat

- Definition of Product Groups Used in Part A.2: Agricultural Products (Ag)Dokumen3 halamanDefinition of Product Groups Used in Part A.2: Agricultural Products (Ag)rain06021992Belum ada peringkat

- Technical Bulletin 2013-01 - List of Protected Areas Under NIPAS PDFDokumen24 halamanTechnical Bulletin 2013-01 - List of Protected Areas Under NIPAS PDFLiezl Bohol100% (1)

- LLR (LPart I)Dokumen12 halamanLLR (LPart I)rain06021992Belum ada peringkat

- Module 1a Tibig VA May27Dokumen86 halamanModule 1a Tibig VA May27rain06021992Belum ada peringkat

- UP PLANO 2017 ENP BOARD EXAM MOCK EXAM COACHING SESSIONSDokumen25 halamanUP PLANO 2017 ENP BOARD EXAM MOCK EXAM COACHING SESSIONSCedric Recato DyBelum ada peringkat

- Ra - 7718 - PPPDokumen8 halamanRa - 7718 - PPPMaykaDSBelum ada peringkat

- Iclte-b.6-Blgfpresentation NDSC BC 2017Dokumen19 halamanIclte-b.6-Blgfpresentation NDSC BC 2017rain06021992Belum ada peringkat

- Local Budget Process GuideDokumen22 halamanLocal Budget Process GuideNash A. Dugasan100% (3)

- Humanitarian Law and Human Rights Law - The Politics of DistinctioDokumen110 halamanHumanitarian Law and Human Rights Law - The Politics of Distinctiorain06021992Belum ada peringkat

- Local Budget Process GuideDokumen22 halamanLocal Budget Process GuideNash A. Dugasan100% (3)

- Site & Area Planning (Full)Dokumen167 halamanSite & Area Planning (Full)rain06021992Belum ada peringkat

- Projected Population Population in Single-Year: Table 1 Table 2Dokumen2 halamanProjected Population Population in Single-Year: Table 1 Table 2rain06021992Belum ada peringkat

- World Trade Organization: CriticismDokumen44 halamanWorld Trade Organization: Criticismrain06021992Belum ada peringkat

- WEF VisionManagingNaturalDisaster Proposal 2011Dokumen127 halamanWEF VisionManagingNaturalDisaster Proposal 2011rain06021992Belum ada peringkat

- Singco NotesDokumen85 halamanSingco Notesrain06021992Belum ada peringkat

- Initial Environmental Examination (Iee) Checklist For Small Water Impounding ProjectDokumen17 halamanInitial Environmental Examination (Iee) Checklist For Small Water Impounding Projectrain06021992Belum ada peringkat

- Englishvi4thgrading 150612020842 Lva1 App6892Dokumen44 halamanEnglishvi4thgrading 150612020842 Lva1 App6892xylaxander100% (1)

- Infinity Optional Mathematics Book 9 Final For CTP 2077Dokumen352 halamanInfinity Optional Mathematics Book 9 Final For CTP 2077Aakriti PoudelBelum ada peringkat

- Programa WaporDokumen22 halamanPrograma WaporMarcelo Astorga VelosoBelum ada peringkat

- International Law Doctrines DefinedDokumen3 halamanInternational Law Doctrines DefinedJames PagdangananBelum ada peringkat

- Theories of Outdoor & Adventure EducationDokumen8 halamanTheories of Outdoor & Adventure EducationMohd Zaidi Abd LatifBelum ada peringkat

- Chem MagicDokumen2 halamanChem MagicMark John DumaslanBelum ada peringkat

- CEFP 25th Anniversary CelebrationDokumen1 halamanCEFP 25th Anniversary CelebrationJoHn REnzBelum ada peringkat

- Release 2: May 2001 J. Ronald EastmanDokumen16 halamanRelease 2: May 2001 J. Ronald EastmanbrayanalarconBelum ada peringkat

- Portal Dosimetry 11, Rev. 1.2 - Annotated - Flattened-2Dokumen523 halamanPortal Dosimetry 11, Rev. 1.2 - Annotated - Flattened-2yumeki100% (1)

- What Is A Carchive Object: Visual C++ MaterialDokumen21 halamanWhat Is A Carchive Object: Visual C++ MaterialrajeshmanamBelum ada peringkat

- Unfamiliar Text - Violence ComprehensionDokumen1 halamanUnfamiliar Text - Violence ComprehensionjazminecoxofficialBelum ada peringkat

- Thomson Reuters Performance SystemDokumen1 halamanThomson Reuters Performance SystemJYOTIKA WASANBelum ada peringkat

- Technical Analysis Around The WorldDokumen30 halamanTechnical Analysis Around The Worldshorttermblog100% (1)

- Marikina Polytechnic College FS student classroom observationDokumen2 halamanMarikina Polytechnic College FS student classroom observationCindy GeronaBelum ada peringkat

- 01 Full WorkbookDokumen67 halaman01 Full WorkbookalezozovBelum ada peringkat

- CFX Fsi 14.5 l4 - Two - Way - Setup 46Dokumen46 halamanCFX Fsi 14.5 l4 - Two - Way - Setup 46Moh SenBelum ada peringkat

- Assignment 6Dokumen6 halamanAssignment 6Suresh ThallapelliBelum ada peringkat

- Speech Community Essay DraftDokumen3 halamanSpeech Community Essay Draftapi-242066660Belum ada peringkat

- Geosoft - Exploring With Data - Target4Dokumen7 halamanGeosoft - Exploring With Data - Target4kataukongBelum ada peringkat

- RPMS Part 2Dokumen4 halamanRPMS Part 2Rei Diaz ApallaBelum ada peringkat

- Module 2Dokumen9 halamanModule 2Uday Prakash SahuBelum ada peringkat

- Building and Using Web Services JDeveloperDokumen27 halamanBuilding and Using Web Services JDeveloperVivita ContrerasBelum ada peringkat

- Davit Serving and Maintenance ManualDokumen13 halamanDavit Serving and Maintenance ManualIvan Maltsev100% (2)

- Chapter 18 Theoretical Bases For Promoting Family HealthDokumen43 halamanChapter 18 Theoretical Bases For Promoting Family Healthbaashe100% (2)

- Buddhist Foundation of EconomicsDokumen21 halamanBuddhist Foundation of Economicsbyangchubsems100% (1)

- Semiotic Analysis On The Dark Knight Movie PostersDokumen11 halamanSemiotic Analysis On The Dark Knight Movie PostersBaitul Ulum67% (3)

- Physics and Maths Tutor Edexcel GCE Core Mathematics C1 Sequences and Series Exam PaperDokumen16 halamanPhysics and Maths Tutor Edexcel GCE Core Mathematics C1 Sequences and Series Exam Paperkhalil rehmanBelum ada peringkat

- Linux Lab 02 Command LineDokumen1 halamanLinux Lab 02 Command Linesmile4ever54Belum ada peringkat

- D72896GC40 - Oracle Solaris 11 System Administration - AGDokumen200 halamanD72896GC40 - Oracle Solaris 11 System Administration - AGMounir Ben Mohamed100% (2)

- SP 3 D Upgrade GuideDokumen37 halamanSP 3 D Upgrade GuideIndra RosadiBelum ada peringkat