RP582000 Newsletterpubs Integrating

Diunggah oleh

Martín GarcíaDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

RP582000 Newsletterpubs Integrating

Diunggah oleh

Martín GarcíaHak Cipta:

Format Tersedia

SPECIAL REPORT:

THE MODERN PRACTICE

By Avi Z. Kestenbaum, Christine K. Knox & Doug Kirkpatrick

Integrating Self-Management

With Estate Planning

Family business succession enters the 21st century

uccession planning is often the most complicated piece of the estate-planning puzzle. While

tax planning has specific statutory rules and

court precedents that must be followed to achieve a successful outcome, there are no official rules in succession

planning and, often, no perfect solutions. Additionally,

every family and business is unique, and we require

both psychological and business acumen to guide our

clients properly, even though most estate planners are

trained in neither. For our clients who are emotionally

torn between ensuring that their businesses continue for

as long as possible and still wanting their descendants to

play a major role in the future, the self-management

model, which has been featured in the Harvard Business

Review,1 among other publications, may offer an interesting solution. This business management structure

eliminates the traditional hierarchical system of management in favor of empowered and self-directed teams

of co-workers. Many successful companies already

implement self-management, some in bits and pieces,

and a few, in its entirety.

What Is It?

Self-management is an organizational philosophy

expressed by individuals who freely and autonomously

perform the traditional functions of management (planning, organizing, coordinating, staffing, directing and

controlling) without mechanistic hierarchy and arbi-

Left to right: Avi Z. Kestenbaum is a partner and

Christine K. Knox is an associate at Meltzer Lippe,

Goldstein and Breitstone, with offices on Long Island,

N.Y. and in New York

City. Doug Kirkpatrick

is a principal with

RedShift3 in Northern

California

FEBRUARY 2013

TRUSTS & ESTATES /

trary and unilateral authority over others.

In a strictly self-managed enterprise, there are no

bosses, no titles and no individual has unilateral power to

fire anyone else. Theres also greater cooperation among

co-workers who are devoted, committed and fiercely loyal

to each other and who are also each empowered to tackle

the decisions theyre best qualified to make.

Effective self-management relies on two foundational principles. First, co-workers shouldnt use

coercion or force against each other to make decisions. Second, co-workers should respect and uphold

the commitments theyve made to each other. These

very same principles also guide most of our current

legal system and government. When people align

their actions with these principles, the result is a more

peaceful and harmonious society. Similarly, when

individuals work in organizations that embrace these

ideals, there are fewer barriers to productivity, collaboration and lofty performances.

Organizational self-management allows co-workers full autonomy to accomplish their respective

missions, make the decisions theyre best qualified to

make, execute the tasks theyre best able to perform

and determine for themselves what education they

require. Not every individual will thrive in a self-managed organization. Those who attempt to wield power

or control tend not to succeed in this system because no

one is required to follow them. Leadership roles, while

still crucial, must be cultivated and earned. Likewise,

those who need constant direction are unlikely to prosper in a self-managed enterprise because their colleagues

wont have time to manage them. A self-managed ecosystem favors those who take initiative, communicate

well and work effectively with others.

Self-Management History

The structure of traditional hierarchical management

in the United States arose in response to the need for

wealthmanagement.com

47

SPECIAL REPORT: THE MODERN PRACTICE

ways to control the sprawling industrial organizations

of the mid-1800s. Workable systems of organizing companies with huge capital costs (railroads and steel mills)

and coordinating the efforts of thousands of employees

across a rapidly growing country required cadres of professional managers.2 This was especially true given the

vestigial communication systems of the time, because

managers could cascade decisions down the hierarchical

chain with reasonable confidence that their directives

would be obeyed.3

This predominant U.S. management structure of

the 19th century then became the default structure

of the 20th century. Later industries (cars, airlines,

telecommunications, energy, pharmaceuticals and others) depended on hierarchical structures to serve their

Whether traditional functions of

management also require certain

co-workers to manage others is

now open to serious debate, based

on the successful companies that

use self-management, in whole or

in part.

customers. The familiar pyramid-shaped organization

chart became the basic business operating system. It

was inconceivable to imagine a world without bosses

on top of the pyramid, making the big decisions. There

was also a bright line distinguishing professional managers from mere workers.

The concept of hierarchical management was developed and communicated by famous industrial economic theorists like Frederick Winslow Taylor, who once

famously declared to a congressional committee:

I can say, without the slightest hesitation, that

the science of handling pig-iron is so great that

the man who is physically able to handle pigiron and is sufficiently phlegmatic and stupid to

choose this for his occupation is rarely able to

48

TRUSTS & ESTATES /

comprehend the science of handling pig-iron.4

Regarding his system of scientific management,

Taylors appetite for management coercion was evident

when he stated:

It is only through enforced standardization of

methods, enforced adaption of the best implements and working conditions, and enforced

cooperation that this faster work can be assured.

And the duty of enforcing the adaption of standards and enforcing this cooperation rests with

management alone.5

Finally, more than a half a century later, in the 1980s,

the total quality management movement, inspired and

driven by W. Edwards Deming and others, began

to acknowledge the enormous untapped abilities of

non-managerial workers.6 Numerous initiatives were

launched to leverage this talent, including: more

employee involvement; quality circles; empowerment

programs; self-improvement plans; and knowledge

sharing. While the literature and the initiatives at last

seemed to acknowledge the importance of the nonmanagerial worker, there was still a tacit acceptance

of the need for professional managers. After all, who

would perform the work of management if not for the

professional managers?

In 1990, Chris J. Rufer, a California entrepreneur,

envisioned a new kind of company. He had already

formed a tomato processing company in the early 1980s

that was technically innovative and financially successful, yet relied on a traditional hierarchical management

structure. With some innovative ideas in mind, he created The Morning Star Packing Company (Morning Star)

in the Central Valley of California. His experience with

his prior company convinced him to launch Morning

Star with a new management philosophyself-management. Rufer queried:

If people know how to perform their jobs at a high

level, why do they need managers? And, if people

lead complex lives outside work (procuring mortgages, raising children, purchasing automobiles,

engaging in community service), why cant they

manage their own work lives as well?

While building his companys new factory in the

spring of 1990, Rufer met with his initial band of

wealthmanagement.com

FEBRUARY 2013

SPECIAL REPORT: THE MODERN PRACTICE

24 colleagues in a dusty construction trailer and distributed a document entitled Colleague Principleshis

blueprint for organizational self-management. At this

meeting, he shared his vision for a company with no

hierarchy. There would only be work and people to

perform the work. Each colleague would have a voice

and the freedom to pursue the mission. The enterprise would be agile, dynamic and resilient. It would

be unlike any other company of its size anywhere in the

world. It would be the antithesis of Taylorism. As the

first financial controller of Morning Star and part of the

original band of 24, Doug Kirkpatrick, one of the coauthors of this article, was fortuitously present for that

first self-management discussion.

After a few hours of discussion and debate, the

group agreed to adopt self-management as Morning

Stars governing mission. From that humble beginning,

Morning Star has grown to become the worlds largest

tomato processor, operating the three largest factories

in the industry. Its success, in large measure, is due to its

self-management structure. Other successful companies

like Semco S.A., W.L. Gore, Whole Foods and the Masco

Corporation also use a comprehensive self-management

system, while many other companies, such as Google,

General Electric, Proctor & Gamble, Honeywell, Xerox,

Volvo and Federal Express, implement self-management

in part.7

The Future

The traditional functions of management include planning, organizing, controlling, leading, directing, staffing,

selecting, coordinating and monitoring. Those functions

will continue to be required at the company level, even

in the self-managed model. However, whether those

functions also require certain co-workers to manage

others is now open to serious debate.

Margaret Wheatley, in her book Leadership and the

New Science, writes:

In a quantum world, everything depends on context, on the unique relationships available in the

moment.8

Since relationships are different from place to

place and moment to moment, why would we

expect that solutions developed in one context

would work the same in another?9

Her observation is remarkably prescient given the evolution of management theory and practice. Approaches

FEBRUARY 2013

TRUSTS & ESTATES /

that once worked well in an era of heavy industrialization and slow communication are unsuited to

the demands of todays world of advanced and rapidly evolving quantum technology and the required

instant communication and action. New management

paradigms are required, and self-management is a prime

candidate for a successful and innovative business model.

Self-management became a hot topic of discussion among global business leaders when the

December 2011 issue of the Harvard Business Review

featured an article by Gary Hamel entitled, First, Lets

Fire All the Managers.10 The article was an overview

of self-management as introduced by Chris Rufer and

implemented at Morning Star. In fact, one of author Avi

Kestenbaums estate-planning clients brought this article

to his attention and asked whether this concept might

work for the clients company.

Some have suggested that self-management is a

nice philosophy, but it would never work in the (fill in

the blank) industry, with (fill in the blank) number of

employees or with (fill in the blank) sales volume. We

respectfully disagree. Self-management doesnt depend

on industry, number of employees, sales volume or other

variables. It depends on core principles. Management is

still management, whether by self or others. While there

may be challenges, there are no discernable inherent

barriers to implementing and scaling self-management. For leaders interested in creating the robust,

resilient and dynamic enterprises of the future, the

self-management model should receive strong consideration.

Family Business Succession Planning

While 80 percent to 90 percent of all businesses in the

United States are family-owned, only 30 percent of these

businesses survive to the second generation, 12 percent

survive to the third generation and just 3 percent survive

to the fourth generation.11 Experts estimate that 85 percent of the problems faced by family businesses center

around the issue of succession.12 Family business succession requires careful planning for the transfer of management and ownership to a new generation in a manner

designed to meet both the financial and emotional needs

of the current owner, his family and key employees, all

while maintaining the business as a viable and ongoing

entity.13

The inherent discrepancies and contradictions

between business and family values add to the

challenges of family business succession planning.

wealthmanagement.com

49

SPECIAL REPORT: THE MODERN PRACTICE

is no longer involved, yet the family

ily business are being overly rewarded.16 The insider

siblings may want to keep the cash in the business and

only provide compensation to those who earn or deserve

it, while the outsider siblings want distributions of

cash equally or closer in range, regardless of whether

the siblings work in the family business.17 Throw into

the mix the spouses of the siblings on both sides, who

may complain and influence their husbands and wives,

and this creates even more ill will, jealousy and resentment. While some family business succession planning

uses life insurance as a source to provide financial

equality among the family members, which is helpful,

true equalization is still impossible. Before developing

a succession plan, the business owner must clarify

his primary concerns and goals. Is he more focused

on his family and not upsetting specific children? Or is

it more important that his business remain viable for as

long as possible? Furthermore, often the business owner

will want to reward key and long-term loyal employees

and to protect their security and positions as well, which

could alienate his children. Family business succession

planning is particularly difficult when the business is a

family heirloom or legacy and theres even more emotion and sensitivity involved.

members can still play a leadership

The Solution

Businesses are logical and succeed, in large part, based

on their ability to adapt to changing times, yet families

are emotional, inherently resistant to change and revere

tradition and heritage.14 Businesses reward employees

for performance, competence and achievements, whereas families accept family members unconditionally and

strive to treat everyone equally.15 The family business

owner, in his dual roles as business owner and parent,

may feel that hes faced with the proverbial choice

of deciding between a rock and a hard place when

While clearly not the panacea in every

family business succession planning

scenario, self-management can be

used to ensure that the family business

flourishes after the business owner

role, albeit one thats earned.

weighing whats best for his business and employees

versus whats best for his family members.

Family business succession planning is particularly

difficult because of the emotional and psychological

complexity of family dynamics, most notably the relationships among siblings. Sibling rivalry and jealousy

are heightened when siblings work within the family

business, especially if one sibling is reporting to another

or if one sibling is chosen for a leadership position over

another. Because the typical parent inherently wants to

treat his children equally, he may agonize over who will

lead the family business in his absence and, therefore,

put off making these succession decisions all together,

which only results in greater problems and discord

down the road.

Additionally, siblings who work in the family business may resent those siblings who dont. Similarly, those

siblings who arent working in the family business can

feel left out and that the siblings who work in the fam-

50

TRUSTS & ESTATES /

While not a panacea for every family business succession planning scenario, self-management can be used

to ensure that the family business flourishes after the

business owner is no longer involved, yet the family

members can still play a leadership role, albeit one thats

earned. The company, which has empowered its workers, can operate with less direction and control by its

owners and management. Teams will be participating

in traditional management functions with the consent,

eagerness and willingness of their co-workers and with

less interference by traditional managers and owners. Leadership roles will be earned and not given or

acquired by coercion.

Furthermore, the board of directors will still oversee the company itself, and family members can have

a place on this board. In a more complex structure,

there might be two boards, the family advisory board

and the more traditional company board. The company board supervises the normal business decisions and

the companys overall direction, and family members

whove earned it may sit on this board and participate

in these decisions. The family advisory boards membership, which is still acquired by birth, is informed of

wealthmanagement.com

FEBRUARY 2013

SPECIAL REPORT: THE MODERN PRACTICE

the companys boards decisions and, perhaps, still has a

vote on major decisions and might also be involved with

the companys charitable and social endeavors. Family

members who are young can also sit on the family board

and be educated about the company.

In terms of family members serving as employees and

receiving salaries (as opposed to ownership distributions

and dividends, which they may still receive depending

on how the ownership of the company is structured and

how distributions are made, such as with the use of family

trusts with specific distribution provisions and for trustees

to be involved), in a pure self-management structure,

these positions should probably be earned like all other

co-workers, though of course, family members might be

afforded every opportunity and consideration to work in

the company. In the self-management system, their leadership skills will be honed over time and earned because they

will have to receive the blessings and commitments of their

co-workers. They will also learn from the ground up.

Thus, by integrating self-management with estate

planning, the company will be led by the right people to

ensure its long-term success, but the family will still be

involved. Those family members who deserve a major

role will have one. Those family members who havent

earned the respect of their colleagues will have lesser

roles, but may still sit on the family advisory board (and

could still receive company distributions depending

on the ownership structure and through the use of

trusts with specific provisions regarding distributions).

However, its critical that this system be put into place

well before the business owner starts winding down,

as it will take time to restructure an existing company

and because the longer the structure is in place, the

more likely the business and family will accept its

guidelines. With a new company, its easier to implement this system from the start.

Its Time for a Change

While creative tax planning grabs most of the headlines

in the estate-planning community and is crucial for family businesses, even with top tax experts involved, most

businesses will fail to survive to second and third generations, which proves the success and failures of businesses

are only partially reliant on sound tax planning. If the

family business owner and his advisors truly want both

the business to succeed and the family to remain as harmonious as possible, more emphasis needs to be placed

on family business succession planning. Often, succession planning is ignored in the estate-planning process,

FEBRUARY 2013

TRUSTS & ESTATES /

because both the client and the planner dont know

how to properly deal with it and because there are too

many sensitive issues involved. While, this will always

be the case, planners should place more emphasis on

educating themselves and their clients regarding different types of business structures to assist with succession planning, particularly self-management.

Endnotes

1. See generally Gary Hamel, First, Lets Fire All the Managers, Harvard Business Review (December 2011) at p. 48.

2. See Alfred D. Chandler, Jr., The Railroads: Pioneers in Modern Corporate Management, 39 Bus. Hist. Rev. 16 (1965). See also Leslie W. Rue and Lloyd L.

Byars, Management: Theory and Application (1977) at p. 22.

3. Chandler, supra note 2, at pp. 22-23.

4. David Montgomery, The Fall of the House of Labor: The Workplace, the State,

and American Labor Activism 1865-1925 (1987) at p. 251.

5. Ibid. at p. 229.

6. See W. Edwards Deming, Out of the Crisis (2000) at pp. 23-24.

7. See Peter A. Maresco and Christopher C. York, Ricardo Semler: Creating Organizational Change Through Employee Empowered Leadership, www.newunionism.net/library/case%20studies/SEMCO%20-%20Employee-Powered%20

Leadership%20-%20Brazil%20-%202005.pdf. See also Alyson HuntingtonJones, A Company Run by Self-Managed Teams, Management Innovation

Exchange, www.managementexchange.com/story/new-story-10-fri-2010;

Gary Hamel, What Google, Whole Foods Do Best, CNN Money.com, http://

money.cnn.com/2007/09/26/news/companies/management_hamel.fortune/index.htm; Polly LaBarre, When Nobody (and Everybody) is the Boss,

CNN Money.com, http://management.fortune.cnn.com/2012/03/05/whennobody-and-everybody-is-the-boss/; Creationstep Inc., Work Democracy

and Self Managing Teams, http://creationstep.com/wp-content/uploads/

selfmanagement1.pdf.

8. See Margaret J. Wheatley, Leadership and the New Science: Discovering Order

in a Chaotic World (1999) at p. 173.

9. Ibid.

10. See Hamel, supra note 1.

11. See Kay B. Abramowitz, Enhancing Trust and Communication in Family Business Succession Planning (September 2011) (citing the estimate by Joseph

Astrachan, editor of Family Business Review).

12. See Bernard Kliska, Planning for Business Succession, Chicago Bar Association, April 16, 1996, at p. 1.

13. See Louis A. Mezzullo, Business Succession Planning, STO22 ALI-ABA 1131 1133

(2011). See also Edward F. Koren, Non-Tax Aspects of Family Business Succession Planning, Est. Tax & Pers. Fin. Plan. Update (March 2006).

14. See Gerald Le Van, Keeping the Family in the Business, Prob. & Prop.

(November/December 1987).

15. Ibid.

16. See Koren, supra note 13.

17. Ibid.

wealthmanagement.com

51

Anda mungkin juga menyukai

- Wiki Management: A Revolutionary New Model for a Rapidly Changing and Collaborative WorldDari EverandWiki Management: A Revolutionary New Model for a Rapidly Changing and Collaborative WorldPenilaian: 4 dari 5 bintang4/5 (4)

- Four Organizational Culture TypesDokumen4 halamanFour Organizational Culture TypesALTERINDONESIA100% (1)

- 63065Dokumen15 halaman63065spaw1108100% (1)

- in Search of Excellence - Book ReviewDokumen2 halamanin Search of Excellence - Book ReviewJoey NgBelum ada peringkat

- In Search of ExcellenceDokumen15 halamanIn Search of Excellencesuhrid02Belum ada peringkat

- DESM#11 Agile Organization ManagementDokumen44 halamanDESM#11 Agile Organization Managementz god luckBelum ada peringkat

- Orgl 4361 - Capstone II Final Proposal Research 10Dokumen12 halamanOrgl 4361 - Capstone II Final Proposal Research 10api-632483826Belum ada peringkat

- Notes On Management 5Dokumen21 halamanNotes On Management 5musbri mohamedBelum ada peringkat

- Dissertation On Good Corporate GovernanceDokumen7 halamanDissertation On Good Corporate GovernancePaperWritingServicesCanada100% (1)

- Boundaryless OrganizationDokumen26 halamanBoundaryless OrganizationVeeramachaneni Sai Ganesh100% (1)

- Chapter 3 - History, Globalization, and Values-Based LeadershipDokumen5 halamanChapter 3 - History, Globalization, and Values-Based LeadershipJUN GERONABelum ada peringkat

- Matrix Management: The InspirationDokumen4 halamanMatrix Management: The InspirationWilliam ChhunBelum ada peringkat

- The Functionally Fluent Organisation - An Update: Terry Wright - February 2016Dokumen4 halamanThe Functionally Fluent Organisation - An Update: Terry Wright - February 2016girish.nara4967Belum ada peringkat

- A Cure For The Common CorporationDokumen5 halamanA Cure For The Common CorporationAntonny WijayaBelum ada peringkat

- Adhocracy For An Agile AgeDokumen13 halamanAdhocracy For An Agile AgeVinit DawaneBelum ada peringkat

- Transformational Management, and Leadership: Final AssignmentDokumen10 halamanTransformational Management, and Leadership: Final AssignmentMaureen MainaBelum ada peringkat

- Ethics of Organizational InterventionsDokumen5 halamanEthics of Organizational InterventionsSowmiya LakshmiBelum ada peringkat

- Designing Organizations For Dynamic Capabilities: California Management Review January 2015Dokumen32 halamanDesigning Organizations For Dynamic Capabilities: California Management Review January 2015luciaBelum ada peringkat

- Organizations and Organization DesignDokumen11 halamanOrganizations and Organization DesignYaried S. AmeraBelum ada peringkat

- Module 1 The JobDokumen10 halamanModule 1 The JobCharlieBelum ada peringkat

- Corporate Governance in AfricaDokumen23 halamanCorporate Governance in AfricaIrwan Setiawan FauziBelum ada peringkat

- Problems With Matrix OrganizationsDokumen13 halamanProblems With Matrix OrganizationsDeepak Kumar Behera100% (1)

- McKinsey On Organization Agility and Organization DesignDokumen50 halamanMcKinsey On Organization Agility and Organization DesignRoxy Suwei Dotk100% (4)

- Organizational Behavior - Robbins & JudgeDokumen22 halamanOrganizational Behavior - Robbins & Judgenzl88100% (2)

- Corporate Governance Dissertation PDFDokumen9 halamanCorporate Governance Dissertation PDFBuyAPhilosophyPaperSingapore100% (1)

- WPC Vantage Point - Creating A Culture of Operational Discipline That Leads To Operational ExcellenceDokumen12 halamanWPC Vantage Point - Creating A Culture of Operational Discipline That Leads To Operational ExcellenceWilson Perumal & CompanyBelum ada peringkat

- Dissertation Corporate GovernanceDokumen4 halamanDissertation Corporate GovernanceCollegePapersToBuyCanada100% (1)

- Sparking Innovations in ManagementDokumen8 halamanSparking Innovations in ManagementADB Knowledge SolutionsBelum ada peringkat

- The Organizational Frontier: Communities of PracticeDokumen23 halamanThe Organizational Frontier: Communities of PracticeJulieth Paola Vital LópezBelum ada peringkat

- Bartlett InterviewDokumen8 halamanBartlett InterviewabhinavpaullbsimBelum ada peringkat

- Introduction To BusinessDokumen12 halamanIntroduction To BusinessEvan AdityamBelum ada peringkat

- Federalism and The Distribution of Power and AuthorityDokumen16 halamanFederalism and The Distribution of Power and AuthorityChahat Sosa MayorBelum ada peringkat

- Problems of Matrix OrganizationsDokumen21 halamanProblems of Matrix OrganizationsJoe LiBelum ada peringkat

- The Organization That Renews Itself Lasting Value From Lean ManagementDokumen7 halamanThe Organization That Renews Itself Lasting Value From Lean ManagementJonathan XueBelum ada peringkat

- The Entrepreneurial MindDokumen60 halamanThe Entrepreneurial Mindgileraz90100% (1)

- Governance Dissertation TopicsDokumen10 halamanGovernance Dissertation TopicsBestOnlinePaperWritingServiceCanada100% (1)

- Reframing OrganizationsDokumen5 halamanReframing OrganizationsFlavia Carolina Jorquera OrtuzarBelum ada peringkat

- Evolution of Management TheoryDokumen7 halamanEvolution of Management TheorySrinath RavindranBelum ada peringkat

- Constantino Mary Grace D. Report Mba522Dokumen9 halamanConstantino Mary Grace D. Report Mba522Gear Arellano IIBelum ada peringkat

- Kreitner Samplech01Dokumen20 halamanKreitner Samplech01kocak_eBelum ada peringkat

- EScholarship UC Item 6447t130Dokumen34 halamanEScholarship UC Item 6447t130aishah farahBelum ada peringkat

- 2 Leadership Entrepreneurship and Strategic Management PDFDokumen10 halaman2 Leadership Entrepreneurship and Strategic Management PDFTeodoraMariaGhitaBelum ada peringkat

- Leading From BelowDokumen8 halamanLeading From BelowMauricio Rojas GonzalezBelum ada peringkat

- Maharishi Vedic ManagementDokumen14 halamanMaharishi Vedic ManagementMeditatia Transcendentala RomaniaBelum ada peringkat

- IRLLDokumen18 halamanIRLLRoshni DarshanBelum ada peringkat

- Organisational Behaviour Term Paper TopicsDokumen4 halamanOrganisational Behaviour Term Paper Topicsc5m82v4x100% (1)

- BUS208 - Principles of ManagementDokumen7 halamanBUS208 - Principles of ManagementAnonymous PRyQ3MOBelum ada peringkat

- Module 3-MobDokumen36 halamanModule 3-MobAkshitha KulalBelum ada peringkat

- Which Are The Main Characteristics of An Empowerment CultureDokumen45 halamanWhich Are The Main Characteristics of An Empowerment CultureCristian GarciaBelum ada peringkat

- Thesis Corporate Governance PDFDokumen8 halamanThesis Corporate Governance PDFtamikabrownjackson100% (2)

- The New OrganizationDokumen21 halamanThe New Organizationarnr0011100% (3)

- Total Quality MGMTDokumen13 halamanTotal Quality MGMTVelia PutriBelum ada peringkat

- Organizational Design Project: Organization Structure of Mckinsey & CompanyDokumen6 halamanOrganizational Design Project: Organization Structure of Mckinsey & CompanySatyam SharmaBelum ada peringkat

- The Organization of The 90sDokumen10 halamanThe Organization of The 90ssaketanand2019Belum ada peringkat

- Good Corporate Governance & The Role of The DirectorsDokumen42 halamanGood Corporate Governance & The Role of The DirectorsNeha RedkarBelum ada peringkat

- AssignemntDokumen27 halamanAssignemntRandi AdithyaBelum ada peringkat

- Exam SaadDokumen4 halamanExam Saadhassan raoBelum ada peringkat

- Essay Sa IomDokumen9 halamanEssay Sa Iomjamaica MalabuyocBelum ada peringkat

- Formal and Informal OrganizationsDokumen9 halamanFormal and Informal OrganizationsMaria GrossBelum ada peringkat

- FF v3n0298 Book Review The Power of Habit PDFDokumen2 halamanFF v3n0298 Book Review The Power of Habit PDFMartín GarcíaBelum ada peringkat

- (Business Ebook) - Strategic Management and Planning PDFDokumen5 halaman(Business Ebook) - Strategic Management and Planning PDFMartín GarcíaBelum ada peringkat

- Waspmote Technical GuideDokumen140 halamanWaspmote Technical GuideMartín GarcíaBelum ada peringkat

- Habits-A Repeat Performance PDFDokumen5 halamanHabits-A Repeat Performance PDFMartín GarcíaBelum ada peringkat

- Applying The Iceberg Model To School PerformanceDokumen3 halamanApplying The Iceberg Model To School PerformanceMartín GarcíaBelum ada peringkat

- Spiral DynamicsDokumen16 halamanSpiral DynamicsMartín García100% (3)

- Supplement To Creative Forces Article Not For ProfitsDokumen5 halamanSupplement To Creative Forces Article Not For ProfitsMartín GarcíaBelum ada peringkat

- Holacracy-Whitepaper-V4.1 1 PDFDokumen10 halamanHolacracy-Whitepaper-V4.1 1 PDFMartín GarcíaBelum ada peringkat

- Open Source Ebook OpenMindedCEOs WebDokumen32 halamanOpen Source Ebook OpenMindedCEOs WebMartín GarcíaBelum ada peringkat

- Spiral Dynamics: Don Edward Beck & Christopher C. CowanDokumen1 halamanSpiral Dynamics: Don Edward Beck & Christopher C. CowanMartín García0% (2)

- Seligman Positive PsicologyDokumen15 halamanSeligman Positive PsicologyMartín GarcíaBelum ada peringkat

- Managing Polarities: An Interview With Barry Johnson, PH.DDokumen11 halamanManaging Polarities: An Interview With Barry Johnson, PH.DJoão Vitor Moreira MaiaBelum ada peringkat

- 5 Overview Soci (ENG)Dokumen5 halaman5 Overview Soci (ENG)Martín GarcíaBelum ada peringkat

- Polarity Management Executive SummaryDokumen1 halamanPolarity Management Executive SummaryMartín GarcíaBelum ada peringkat

- Barry Johnson - Polarity ManagementDokumen17 halamanBarry Johnson - Polarity ManagementMartín García100% (1)

- Innovation - Key To The Future - Kenichi OhmaeDokumen44 halamanInnovation - Key To The Future - Kenichi OhmaeMartín GarcíaBelum ada peringkat

- Tool - Single Double Triple Loop LearningDokumen2 halamanTool - Single Double Triple Loop LearningDwiAryantiBelum ada peringkat

- Operational Amplifier PDFDokumen45 halamanOperational Amplifier PDFAnonymous H6zpNuBelum ada peringkat

- Flexible Evaluation Mechanism (FEM) Understanding Culture Society and PoliticsDokumen1 halamanFlexible Evaluation Mechanism (FEM) Understanding Culture Society and Politicsgenesisgamaliel montecinoBelum ada peringkat

- The World of The GerDokumen302 halamanThe World of The GerMystic Master0% (1)

- Algebra 1 TextbookDokumen370 halamanAlgebra 1 TextbookLea Ann Smith80% (5)

- Ceg452 Test1 Marjuly2021 QuestionDokumen3 halamanCeg452 Test1 Marjuly2021 Questionahmad adliBelum ada peringkat

- ST Learning Task 10Dokumen6 halamanST Learning Task 10Jermaine DoloritoBelum ada peringkat

- Analysis of The Style and Terminology Problems in Translating Legal TextsDokumen19 halamanAnalysis of The Style and Terminology Problems in Translating Legal TextsMarvin EugenioBelum ada peringkat

- Arts 9 M1 Q3 1Dokumen15 halamanArts 9 M1 Q3 1Gina GalvezBelum ada peringkat

- A Case of Uterine Fibroid Managed by Homoeopathy.20210808065707Dokumen5 halamanA Case of Uterine Fibroid Managed by Homoeopathy.20210808065707200408203002Belum ada peringkat

- Khosravi - Professional ASP - Net 2.0 Server Control and Component Development (Wrox, 2006)Dokumen1.227 halamanKhosravi - Professional ASP - Net 2.0 Server Control and Component Development (Wrox, 2006)DerwishBelum ada peringkat

- Ejercicios de Relative ClausesDokumen1 halamanEjercicios de Relative ClausesRossyBelum ada peringkat

- Morality and Pedophilia in LolitaDokumen5 halamanMorality and Pedophilia in LolitaDiana Alexa0% (1)

- Role of Communication in BusinessDokumen3 halamanRole of Communication in Businessmadhu motkur100% (2)

- Headache PAINDokumen1 halamanHeadache PAINOmarBelum ada peringkat

- Samsung MobileDokumen80 halamanSamsung Mobiledeepkamal_jaiswalBelum ada peringkat

- Home DepotDokumen13 halamanHome DepotTyfanie PetersenBelum ada peringkat

- Applied LingDokumen11 halamanApplied Lingحسام جدوBelum ada peringkat

- Agatthiyar's Saumya Sagaram - A Quick Summary of The Ashta KarmaDokumen5 halamanAgatthiyar's Saumya Sagaram - A Quick Summary of The Ashta KarmaBujji JohnBelum ada peringkat

- Polytechnic University of The Philippines Basketball Athletes' Superstitious Rituals and Its Effects in Their Game PerformanceDokumen25 halamanPolytechnic University of The Philippines Basketball Athletes' Superstitious Rituals and Its Effects in Their Game PerformanceJewo CanterasBelum ada peringkat

- Forensic 2 Module 1-ContentDokumen12 halamanForensic 2 Module 1-ContentSheri Ann PatocBelum ada peringkat

- Afritalent Agency Seeks To Bridge Talent of The Global Diaspora With Hollywood Casting Directors and ProducersDokumen3 halamanAfritalent Agency Seeks To Bridge Talent of The Global Diaspora With Hollywood Casting Directors and ProducersPR.comBelum ada peringkat

- Analysis of Austenitic Stainless Steel by Spark Atomic Emission SpectrometryDokumen5 halamanAnalysis of Austenitic Stainless Steel by Spark Atomic Emission SpectrometryVasu RajaBelum ada peringkat

- Synonym and AntonymDokumen4 halamanSynonym and Antonymjean wongBelum ada peringkat

- Transparency IIDokumen25 halamanTransparency IIKatyanne ToppingBelum ada peringkat

- How The Tortoise Got Its ScarsDokumen3 halamanHow The Tortoise Got Its ScarsAngelenwBelum ada peringkat

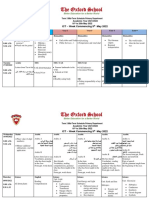

- Acadcalendar 2010-2011Dokumen2 halamanAcadcalendar 2010-2011chantel_o12100% (1)

- Term 3 Mid-Term Assessment ScheduleDokumen9 halamanTerm 3 Mid-Term Assessment ScheduleRabia MoeedBelum ada peringkat

- 5990 3285en PDFDokumen16 halaman5990 3285en PDFLutfi CiludBelum ada peringkat

- Fc406 q1 Tabilin, GizelleDokumen3 halamanFc406 q1 Tabilin, GizelleGizelle Alcantara-TabilinBelum ada peringkat