Revenue Leaflet Food Drink

Diunggah oleh

ranilHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Revenue Leaflet Food Drink

Diunggah oleh

ranilHak Cipta:

Format Tersedia

April 2015

Accounting for revenue is changing

The impact on food, drink and consumer goods

companies

Have you planned for

theeffects on:

How could your business

be affected?

payments to distributors and

retailers?

Now that the IASB and FASB have published a new joint

standard on revenue recognition, the real work for the

food, drink and consumer goods (FDCG) companies is just

beginning. IFRS 15 and FASB ASC Topic606 Revenue from

Contracts with Customers were issued in May 2014, replacing

the existing IFRS and US GAAP revenue guidance, and

introducing a new revenue recognition model.

discounts, rebates and other

incentives?

contract manufacturing

arrangements?

warranties?

returns?

licences and franchises?

royalties?

transition options?

The new standard will result in significant impacts across

the FDCG sector, requiring companies to assess how their

financial reporting, information systems and processes will

be affected, and engage with their stakeholders to build up

expectations of how their key performance indicators or

business practices may change. In particular, FDCG companies

will need to review their arrangements with distributors

and retailers e.g. trade incentives, warranties, returns and

licences to assess whether the amount or the timing of

revenue recognised under the new standard will be affected.

The new standard takes effect in January 2017, although IFRS

preparers can chose to apply it earlier. While the effective date

may seem a long way off, decisions need to be made soon

namely, when and how to transition to the new standard.

An early decision will allow you to develop an efficient

implementation plan and inform your key stakeholders.

Determining the impact

Payments to

distributors

and retailers

Potential impact

Actions to consider

FDCG companies often make payments to their distributors

and retailers e.g. for product placement in the retailers store

(slotting fees), promotion events or co-branded advertising.

Under current US GAAP, such amounts generally reduce

revenue. Under current IFRS, in the absence of specific

guidance, such amounts are either recognised as a reduction of

revenue or as an expense depending on their nature.

Review arrangements involving payments

to distributors and retailers to determine if

those payments are made in exchange for

distinct goods or service or they represent a

saleincentive.

Under the new standard, an FDCG company considers whether

it receives a distinct good or service. If so, then it recognises

such payments as expenses when the distinct good or service

is consumed, if not, then it recognises such payments as a

reduction of revenue.

If an FDCG company cannot estimate the fair value of the

good or service received, then it recognises the payments as a

reduction of revenue. If the payment to the distributor or retailer

exceeds the fair value of the good or service provided, then any

excess is a reduction of revenue.

Trade incentives provided by FDCG companies take many

forms, including cash incentives, discounts and volume rebates,

free or discounted goods or services, and customer loyalty

programmes. Currently under IFRS, incentives are accounted

for as a reduction of revenue, as an expense, or as a separate

deliverable (as in the case of customer loyalty programmes)

depending on the type ofincentive.

Discounts,

rebates

and other

incentives

Develop or modify processes and adjust

systems to capture relevant information for

such arrangements.

Carefully consider the terms of arrangements

with distributors and retailers to determine

the appropriate treatment of such payments

under the new standard. For many of these

arrangements, this will require significant

judgement and appropriate internal

controls, and documentation to support

thatjudgement.

Review arrangements involving trade

incentives and determine their impact on the

transaction price.

Consider whether the allocation method that

is currently applied to account for customer

loyalty programmes remains acceptable

under the new standard.

Under the new standard, discounts, rebates, credits, price

concessions, performance bonuses and similar incentives

are treated as variable consideration. Variable consideration is

included in the transaction price at the companys best estimate

and is included in revenue to the extent it is highly probable that

there will be no significant reversal of the cumulative amount

of revenue when any pricing uncertainty is resolved. The

requirements of the new standard may change the accounting

for some FDCG companies.

The guidance on customer loyalty programmes in the new

standard is broadly similar to the current IFRS guidance.

However, the availability of the residual approach to allocate

consideration between the sales transaction and the award

credits is restricted under the new standard.

Under the current requirements, contract manufacturing

arrangements such as for the manufacture of drinks or other

consumables are generally treated as product sales and an

FDCG company recognises revenue when the manufactured

goods are delivered to the customer.

Contract

manufacturing

arrangements

Under the new standard, if an FDCG company determines that

it satisfies a performance obligation to manufacture goods

under the contract over time, then it recognises revenue over

time e.g. as the manufacturing takes place rather than

at a point in time e.g. when the product is delivered. This

could result in a significant change in recognition of revenue

from contract manufacturing arrangements under which an

FDCG company produces goods specifically for an individual

customer based on the customers specification, because such

arrangements may qualify for recognition of revenue over time.

Review contract manufacturing arrangements

and the obligations under them to assess any

potential impact.

Develop new processes and adjust systems

to capture information for arrangements in

which the performance obligation is satisfied

over time.

Warranties

Potential impact

Actions to consider

Product warranties are commonly supplied with the sale of a

product. The new standard distinguishes between two types

ofwarranty.

Review warranty arrangements to assess the

nature of the warranty provided.

If a customer can purchase the warranty separately or receives

a service over and above guaranteeing compliance with agreedupon specifications (service-type warranty), then an FDCG

company accounts for such warranty as a separate performance

obligation i.e. it allocates the transaction price to the product

and the warranty, and recognises revenue in respect of the

warranty over the warranty period rather than at the point of

sale of the product.

Assess any changes to existing billing or

financial systems that are required to be able

to separately account for warranties that

represent separate performance obligations.

If a warranty only covers the compliance of the product with

agreed-upon specifications (assurance-type warranty), then

it is accounted for as a cost accrual under relevant IFRS or

USGAAP guidance, similar to the current requirements.

Returns

Licences and

franchises

Under the current requirements, an FDCG company adjusts

revenue for expected returns. The new standards approach

of adjusting revenue for the expected level of returns and

recognising a refund liability is broadly similar to current

guidance. However, the detailed methodology for estimating

revenue may be different for some companies.

Review existing methodology to assess for

compliance with the new requirements.

Licences of intellectual property (e.g. franchise rights) are a

common practice in FDCG sector. Under the new standard, an

FDCG company first needs to determine whether to apply the

new standards specific guidance on licence revenue.

Evaluate existing arrangements involving

licences to identify whether any licences

should be accounted for separately.

Under this guidance, revenue is recognised either over

time if the licence grants the customer a right to access to

the intellectual property, or at a point in time if it grants the

customer a right to use the intellectual property. Although these

outcomes may be similar to accounting for licences under

current IFRS guidance, an FDCG company needs to review each

distinct licence to assess its nature under the new standard.

It is possible that revenue recognition may be accelerated or

deferred compared with current practice.

Review the nature of licences that represent

separate performance obligations to

determine if revenue related to them should

be recognised over time or at a point in time.

Assess any required changes to existing billing

or financial systems to be able to capture

required information.

If the new standards specific guidance on licences does not

apply, then the licence is accounted for together with the other

promised goods or services in the performanceobligation.

This is an area of future developments as the IASB and FASB are

considering amending to clarify the licence guidance.

Royalties

Under the new standard, revenue for sales- or usage-based

royalties relating to intellectual property is recognised when

the sale or usage takes place or, if later, when the performance

obligation to which the royalty has been allocated has been

partially or fully satisfied. Similar to current practice, there is

no requirement to estimate such amounts on transfer of the

licence to the customer.

Evaluate existing arrangements to identify

whether the sales- or usage-based

exemptionapplies.

Develop the processes and controls

for arrangements not covered by the

exemption and make the required estimates

andforecasts.

Other types of royalties are accounted for as variable

consideration under the new standard.

The new standard may be adopted retrospectively, by restating

comparatives and adjusting retained earnings at the beginning

of the earliest comparative period.

Transition

options

Alternatively, the new standard may be adopted as of the

application date, by adjusting retained earnings at the beginning

of the first reporting year (the cumulative effect approach).

Quantify and evaluate the effects of the

different transition options, including the

available practical expedients under the

retrospective approach.

Perform a historical analysis of key contracts.

Consider whether existing systems provide

the data required to produce comparative

information if the new standard is

appliedretrospectively.

You can find more detailed information about IFRS 15 in our publications Transition to the New Revenue Standard and Issues

In-Depth.

How we can help

KPMGs Consumer Markets practice

KPMGs Consumer Markets practice is dedicated to supporting consumer markets companies globally in understanding

industry trends and business issues. Member firms offer customised, industry-tailored services that can lead to value-added

assistance for your most pressing business requirements. Our extensive network of professionals combines in-depth industry

knowledge with extensive experience helping clients managing accounting transitions with what they entail.

For those affected by the new revenue recognition requirements, the impact will be felt far beyond accounting change. The

following are just a few examples of how our cross-functional team of experts has helped clients across various sectors

including Consumer Markets with the accounting and operational challenges.

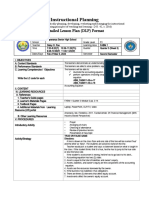

Performing an overall impact assessment to identify the key revenue streams that may be impacted by IFRS 15.

Performing a detailed accounting diagnostic to identify and prioritise the impacts on accounting policies and disclosures,

including information gaps.

Reviewing key accounting policies and accounting manuals.

Acc

and Roun

e

Sys

, Tax

it ng rting Pro tem

c

po

EM

T

Assisting in developing clear communication with stakeholders regarding the

impact of IFRS 15 on earnings.

MANAG

nd

s a ses

es

Identifying the impacts to internal management reporting, including key financial

measures and ratios.

PR

Assisting in redrafting contract documentation.

M

RA

EN

OG

Identifying and analysing key contracts under the IFRS 15 lens.

Accounting

Change

Mapping information requirements to existing sources and defining required

information that is not currently available in your existing systems.

Identifying data collection needs to meet the new disclosure requirements.

Assisting in changing systems and processes to meet the new requirements.

Providing training to finance teams.

Identifying corporate and indirect tax implications and impact on distributable reserves.

Starting now will allow you to assess the impact and design an appropriate response plan that allows time for unanticipated

complexity.

Contact us

Willy Kruh

Global Chair, Consumer Markets

T: +1 416 777 8710

E: wkruh@kpmg.ca

Jamil Khatri

Global Leader, Accounting Advisory Services

T: +91 223 090 1660

E: jkhatri@kpmg.com

Guilherme Nunes

Global Head of Audit, Food, Drink and Consumer Goods

T: +55 112 183 3104

E: grnunes@kpmg.com.br

Dan Coonan

Global Executive, Consumer Markets

T: +44 207 694 1781

E: Daniel.Coonan@kpmg.co.uk

kpmg.com/ifrs

2015 KPMG IFRG Limited, a UK company, limited by guarantee. All rights reserved.

The KPMG name, logo and cutting through complexity are registered trademarks or trademarks of KPMG International.

KPMG International Standards Group is part of KPMG IFRG Limited.

KPMG International Cooperative (KPMG International) is a Swiss entity that serves as a coordinating entity for a network of independent firms operating under the KPMG name. KPMG International

provides no audit or other client services. Such services are provided solely by member firms of KPMG International (including sublicensees and subsidiaries) in their respective geographic areas.

KPMG International and its member firms are legally distinct and separate entities. They are not and nothing contained herein shall be construed to place these entities in the relationship of parents,

subsidiaries, agents, partners, or joint venturers. No member firm has any authority (actual, apparent, implied or otherwise) to obligate or bind KPMG International or any other member firm, nor does

KPMG International have any such authority to obligate or bind KPMG International or any other member firm, in any mannerwhatsoever.

The information contained herein is of a general nature and is not intended to address the circumstances of any particular individual or entity. Although we endeavour to provide accurate and timely

information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. No one should act upon such information without

appropriate professional advice after a thorough examination of the particular situation.

Anda mungkin juga menyukai

- Type O Food List 1/4: Meat, Dairy, Fruit, and VegetablesDokumen5 halamanType O Food List 1/4: Meat, Dairy, Fruit, and VegetablesRey JohnsonBelum ada peringkat

- Meat Dairy Fruit/Fruit JuiceDokumen5 halamanMeat Dairy Fruit/Fruit JuicegomitadelimonBelum ada peringkat

- Recept WentelDokumen1 halamanRecept WentelranilBelum ada peringkat

- Us CB Evolving The Merchandising Function in Todays Battle For ShareDokumen13 halamanUs CB Evolving The Merchandising Function in Todays Battle For ShareranilBelum ada peringkat

- WUDokumen1 halamanWUranilBelum ada peringkat

- Bloodgroup ODokumen80 halamanBloodgroup OranilBelum ada peringkat

- Type O Food List 1/4: Meat, Dairy, Fruit, and VegetablesDokumen5 halamanType O Food List 1/4: Meat, Dairy, Fruit, and VegetablesRey JohnsonBelum ada peringkat

- Vegaburger - Recept - Allerhande - Albert HeijnDokumen1 halamanVegaburger - Recept - Allerhande - Albert HeijnranilBelum ada peringkat

- Estados Financieros Ilustrativos 2014Dokumen172 halamanEstados Financieros Ilustrativos 2014PwC VenezuelaBelum ada peringkat

- Consumer Currents: RetailDokumen24 halamanConsumer Currents: RetailranilBelum ada peringkat

- Insurance FlyerDokumen4 halamanInsurance FlyerranilBelum ada peringkat

- Revenue Leaflet TransportDokumen4 halamanRevenue Leaflet TransportranilBelum ada peringkat

- Prayer For WifeDokumen17 halamanPrayer For WifeDillian Daantje-van EerdenBelum ada peringkat

- TestDokumen1 halamanTestranilBelum ada peringkat

- Effective Learning With 70-20-10 WhitepaperDokumen64 halamanEffective Learning With 70-20-10 Whitepaperranil100% (1)

- Cooking With Herbs SpicesDokumen18 halamanCooking With Herbs SpicesEvelyn TyukodiBelum ada peringkat

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Time Table CS Exams December 2023Dokumen1 halamanTime Table CS Exams December 2023Himanshu UpadhyayBelum ada peringkat

- Setting The Right Price at The Right TimeDokumen5 halamanSetting The Right Price at The Right TimeTung NgoBelum ada peringkat

- DLP Fundamentals of Accounting 1 - Q3 - W3Dokumen5 halamanDLP Fundamentals of Accounting 1 - Q3 - W3Daisy PaoBelum ada peringkat

- TNB Handbook: Prepared By: COE Investor RelationsDokumen35 halamanTNB Handbook: Prepared By: COE Investor Relationsmuhd faizBelum ada peringkat

- Competitive Dynamics: Dr. Satirenjit K JohlDokumen42 halamanCompetitive Dynamics: Dr. Satirenjit K JohlrushdiBelum ada peringkat

- The Challenges and Countermeasures of Blockchain in Finance and EconomicsDokumen8 halamanThe Challenges and Countermeasures of Blockchain in Finance and EconomicsBlaahhh100% (1)

- Management Information System: (Canara Bank)Dokumen13 halamanManagement Information System: (Canara Bank)Kukki SengarBelum ada peringkat

- Solution Manual For Essentials of Corporate Finance by ParrinoDokumen21 halamanSolution Manual For Essentials of Corporate Finance by Parrinoa8651304130% (1)

- HR SopDokumen7 halamanHR SopDen PamatianBelum ada peringkat

- 11.2 Auditing Working PapersDokumen119 halaman11.2 Auditing Working PapersJohn Carlo D MedallaBelum ada peringkat

- Topic 3 Long-Term Construction Contracts ModuleDokumen20 halamanTopic 3 Long-Term Construction Contracts ModuleMaricel Ann BaccayBelum ada peringkat

- Standard ISO Response Codes PDFDokumen3 halamanStandard ISO Response Codes PDFwattylaaBelum ada peringkat

- CH 2 POP PRACTICE EXAMDokumen9 halamanCH 2 POP PRACTICE EXAMErik WeisenseeBelum ada peringkat

- AWAMI LEAGUE ELECTION MANIFESTODokumen1 halamanAWAMI LEAGUE ELECTION MANIFESTOSadik Irfan Shaikat100% (1)

- The Benefits of Free TradeDokumen30 halamanThe Benefits of Free TradeBiway RegalaBelum ada peringkat

- Senario Case StudyDokumen19 halamanSenario Case Studymaya100% (1)

- Management Discussion & Analysis highlights key developments in Indian economy, housing finance industry and company's progressDokumen136 halamanManagement Discussion & Analysis highlights key developments in Indian economy, housing finance industry and company's progressVritika JainBelum ada peringkat

- Consumer Rights and ProtectionsDokumen46 halamanConsumer Rights and ProtectionsSagar Kapoor100% (3)

- Benefit Verification LetterMichaelPunter 1Dokumen4 halamanBenefit Verification LetterMichaelPunter 1DianaCarolinaCastaneda100% (1)

- Form 26AS Annual Tax StatementDokumen4 halamanForm 26AS Annual Tax StatementAnish SamantaBelum ada peringkat

- T24 Accounting Introduction - R15Dokumen119 halamanT24 Accounting Introduction - R15Jagadeesh JBelum ada peringkat

- Southwest's Business Model and Competitive AdvantageDokumen4 halamanSouthwest's Business Model and Competitive AdvantageLina Levvenia RatanamBelum ada peringkat

- UNIT 1 - Introduction To Entepreneurship Part 1 (Compatibility Mode)Dokumen71 halamanUNIT 1 - Introduction To Entepreneurship Part 1 (Compatibility Mode)kuddlykuddles100% (1)

- Account Number Customer Id Account Currency Opening Balance Closing BalanceDokumen1 halamanAccount Number Customer Id Account Currency Opening Balance Closing Balancesamaa adelBelum ada peringkat

- RM Unit 2Dokumen18 halamanRM Unit 2VickyBelum ada peringkat

- Procurement Manager - Projects - Swiber Offshore Construction Pte LTDDokumen2 halamanProcurement Manager - Projects - Swiber Offshore Construction Pte LTDparthibanemails5779Belum ada peringkat

- Volkswagen AG PresentationDokumen29 halamanVolkswagen AG PresentationBilly DuckBelum ada peringkat

- Insead AmpDokumen23 halamanInsead AmpJasbir S RyaitBelum ada peringkat

- Multiple Choice Questions: 44 Hilton, Managerial Accounting, Seventh EditionDokumen36 halamanMultiple Choice Questions: 44 Hilton, Managerial Accounting, Seventh EditionKing MercadoBelum ada peringkat

- Job Costing QuestionsDokumen5 halamanJob Costing Questionsfaith olaBelum ada peringkat