1468-2389 00145

Diunggah oleh

lucianaeuJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

1468-2389 00145

Diunggah oleh

lucianaeuHak Cipta:

Format Tersedia

176

INTERNATIONAL JOURNAL OF SELECTION AND ASSESSMENT

PROFESSIONAL FORUM

Emotional Intelligence in the Collection

of Debt

John Bachman, Steven Stein*, K. Campbell and Gill Sitarenios

Two studies are reported which compare more and less successful account officers (debt

collectors) in terms of their emotional intelligence, measured using the BarOn Emotional

Quotient Inventory. The findings support the view that higher levels of emotional

intelligence lead to enhanced job performance. Implications for selection are considered in

the conclusion.

* Address for correspondence:

Steven Stein, Multi-Health

Systems, 3770 Victoria Park

Avenue, Toronto, Ontario

M2H 3M6.

Volume 8 Number 3

In the collections business, the best strategy for

avoiding destructive encounters with customers is

to prevent them. An old martial arts adage states

that a battle avoided is a battle not lost. A new

work-place adage states that emotional intelligence yields success. A synthesis of the wisdom

distilled from these sources suggests that two

groupings of emotional competencies (Bar-On

1997; Goleman 1998) can prevent such deal

destruction. The first grouping, consisting of selfawareness (i.e., recognizing one's own feelings)

and empathy (i.e., knowing others' feelings),

permits the account officer to know which

feelings indicate the potential for an `emotional

hijack' of negotiations and the consequent

outcome of ruined deals. The other grouping,

consisting of self-control (i.e., containing disruptive emotions) and adaptability (i.e., managing

conflict flexibly), allows an account officer to

negotiate with less concern of falling victim to a

destructive emotional encounter evoked by a

customer's helpless, rude or lewd comments.

The classic hijack encountered by account

officers is `over-identification' with the customer.

When the customer appears to be helpless and

the situation hopeless, the overly empathic

account officer can blur the psychological

boundaries and identify with the customer as a

victim. This occurs when an empathic response

dissolves into a sympathetic response, leaving

the account officer in a state of `empathy distress'

(Goleman 1998). If the officer lacks the emotional

self-management skills needed to regulate or

calm this distress, then the situation can lead to

the negotiation of a more lenient deal that is less

than optimal for the collection agency (CFS in

this case). Another common emotional hijack is

`identification with the aggressor'. Here, the

account officer with little self-control again blurs

the boundaries and identifies with the belligerent,

September 2000

abusive customer. The interaction deteriorates

into a destructive shouting match and ruins any

possibility of a deal. A third kind of hijack occurs

when there is `identification with the seducer'.

Again, the vulnerable account officer may be

seduced by a sweet-talking and persuasive, sometimes overtly sexual, customer into negotiating a

deal that is best only for the customer. It was

speculated that skills associated with emotional

intelligence would enable account officers to be

more successful in their collections, in part, by

enabling them to bypass potential emotional

hijacks.

CFS conducted a `Best Practices' study of

successful account officers in order to identify the

attributes that contribute to their consistently

superior collections. A synthesis of results

obtained from that study revealed that these

attributes include (a) attitude; (b) skills; (c)

leadership; and (d) emotional intelligence. Even

though emotional intelligence has been identified

as a distinct category, the other attributes also are

undoubtedly rooted in prerequisite underlying

emotional competencies. This article presents the

findings specifically related to the investigation

of emotional intelligence as a separate attribute.

The role played by underlying emotional

competencies in the other attributes (i.e., attitude,

skills, and leadership) will be reviewed briefly in

the Summary.

It is hypothesized that working with emotional intelligence enables account officers to achieve

greater success in collections. Two studies were

conducted in order to test this hypothesis. In

Study 1, results from the administration of an

emotional intelligence measure were compared

between `best practices' (i.e., most successful) and

`less successful' account officers. In Study 2,

scores on emotional intelligence and success at

collections (defined as the average percentage of

Blackwell Publishers Ltd 2000, 108 Cowley Road, Oxford OX4 1JF, UK and

350 Main Street, Malden, MA 02148, USA.

EMOTIONAL INTELLIGENCE IN THE COLLECTION OF DEBT

cash goal attained over a specified time period)

were compared between the `best' and `less

successful' practices groups.

Method: Study 1

Participants

Participants were 36 account officers employed at

CFS who participated in the `Best Practices' study

conducted in September and October 1998. Two

groups were selected on the basis of their

performance in conducting collections negotiations. The `Best Practices' group consisted of

24 account officers who were identified as having

been consistently high producers. The `Less

Successful' group consisted of 12 account officers

who were identified as having had consistently

low production in the period that preceded

commencement of the study.

Measure

The instrument employed in this study was the

BarOn Emotional Quotient Inventory (Bar-On

1997). The Emotional Quotient Inventory (EQ-i)

is designed to measure emotional intelligence in

individuals 16 years of age and older. Emotional

intelligence pertains to the emotional, personal,

social, and survival dimensions of intelligence,

rather than the strictly cognitive skills related to

learning, memory recall, thinking, and reasoning.

An emotional intelligence score helps to predict

`success' in life. It also reflects one's current

coping skills, ability to deal with daily environmental demands, degree of `common sense', and

ultimately, overall mental health.

The EQ-i consists of 133 items that yield, in

addition to the emotional intelligence scores, validity checks in the form of positive and negative

impression scores and a response inconsistency

score. Also, the EQ-i produces scores for 5 composite factors and 15 sub-scales of emotional

intelligence. The Intrapersonal composite consists

of five sub-scales: Emotional Self-Awareness,

Assertiveness, Self-Regard, Self-Actualization,

and Independence. The Interpersonal composite

consists of three sub-scales: Empathy, Interpersonal Relationship, and Social Responsibility.

The Adaptability composite includes three subscales: Problem Solving, Reality Testing, and

Flexibility. The Stress Management scale is

comprised of two sub-scales: Stress Tolerance

and Impulse Control. The General Mood

composite includes two sub-scales: Happiness

and Optimism.

EQ-i raw scores for these composite factors

and sub-scales are converted into standard scores

that have a mean of 100 and a Standard

Deviation of 15. This is done to make comparisons within and between individuals and

Blackwell Publishers Ltd 2000

177

groups easier to comprehend. In this way,

reporting of the EQ-i results resembles that of

the traditional IQ scores.

The EQ-i sub-scales have been shown to have

very good internal consistency with average

Cronbach alpha coefficients ranging from .69

(Social Responsibility) to .86 (Self-Regard). The

overall average internal consistency coefficient of

the EQ-i is .76. Extensive research has been

conducted to assess nine types of validity:

content, face, factor, construct, convergent,

divergent, criterion-group, discriminant, and

predictive. EQ-i validity studies are reported in

the EQ-i Technical Manual (Bar-On 1997).

Overall, the EQ-i is a scientifically reliable and

valid way to assess emotional intelligence.

Procedure

The EQ-i was administered to all participants in

the `Best Practices' and `Less Successful' groups.

The reported results are the average responses of

each group.

Results

Emotional Intelligence in the `Best Practices' Account

Officers

The `Best Practices' officers, as a group, were

found to possess a level of emotional intelligence

that is significantly higher than that of the North

American population at large, as indicated by

their Total EQ score (see Table 1).1

This group's overall Intrapersonal EQ is also

significantly higher than the population average

with substantial elevations in the areas of

Independence, Emotional Self-Awareness, SelfActualization, and Assertiveness. Four of the

eight highest sub-scale scores for these account

officers are within this Intrapersonal domain.

The `Best Practices' officers also demonstrate

strength in their Interpersonal Relationship and

Social Responsibility skills, both sub-scales of the

Interpersonal EQ composite scale. Surprisingly,

their skills in the area of Empathy are not

exceptionally well developed. This group's

overall strength in the area of Adaptability is

largely due to its expertise in Reality Testing

skills.

Within the Stress Management composite, the

two sub-scales, Stress Tolerance and Impulse

Control, represent the second highest and the

lowest scores for this group profile, respectively.

The `Best Practices' officers' tolerance for stress is

very high, while concurrently, their impulse

control is not. This apparently contradictory

finding will be explored further in the Discussion

section.

Finally, the total General Mood EQ mean

score is considerably above average, with both of

Volume 8

Number 3

September 2000

178

INTERNATIONAL JOURNAL OF SELECTION AND ASSESSMENT

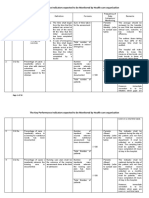

Table 1: Comparison of mean EQ-i scores between best practices and less successful account officers

EQ-i Scale

Total EQ

Intrapersonal EQ

Emotional Self-Awareness

Assertiveness

Self-Regard

Self-Actualization

Independence

Interpersonal EQ

Interpersonal Relationship

Social Responsibility

Empathy

Adaptability EQ

Problem Solving

Reality Testing

Flexibility

Stress Management EQ

Stress Tolerance

Impulse Control

General Mood EQ

Happiness

Optimism

Best Practices

Less Successful

110

112

110

109

104

110

114

108

108

109

104

108

105

109

104

105

111

98

108

106

110

102

102

101

99

101

101

104

107

107

106

106

99

94

104

99

103

106

99

97

94

101

its sub-scales, Optimism and Happiness, indicating well-developed skills in this group.

These results are summarized in Table 1.

Overall, they support the hypothesis that consistently successful account officers work with

substantially higher than average emotional

intelligence.

Emotional Intelligence in the `Less Successful'

Account Officers

The overall Total EQ mean score for the `Less

Successful' group did not prove to be

significantly different from the mean of the

population at large.2 However, this group did

demonstrate well-developed Interpersonal skills

as assessed by the Interpersonal Relationship,

Social Responsibility, and Empathy sub-scales.

This group also was found to possess a relatively

high tolerance for stress, (i.e., Stress Tolerance

sub-scale of the Stress Management composite).

Comparison of `Best Practices' Versus `Less

Successful' Groups

Overall, the `Best Practices' group demonstrated

a substantially higher level of emotional

intelligence than did the `Less Successful' group.

Within the Intrapersonal dimension, the greatest

differences were found between the two groups,

with the `Best Practices' group scoring substantially higher on the following sub-scales:

Emotional Self-Awareness, Assertiveness, SelfActualization, and Independence (see Table 1).

Volume 8 Number 3

September 2000

t-value

1.848

2.677

1.726

2.281

0.692

2.237

2.977

0.241

0.179

0.628

0.443

1.733

1.862

1.242

0.998

0.514

1.382

0.249

2.696

2.172

2.305

p-value

Significant?

0.037

0.006

0.047

0.014

0.247

0.016

0.003

0.405

0.430

0.267

0.330

0.046

0.036

0.111

0.163

0.305

0.088

0.403

0.005

0.018

0.014

Yes

Yes

Yes

Yes

No

Yes

Yes

No

No

No

No

Yes

Yes

No

No

No

No

No

Yes

Yes

Yes

In terms of Adaptability, the `Best Practices'

group performed better than did the `Less

Successful' group. The difference between groups

was most apparent in the area of ProblemSolving skills.

The mean score on General Mood was significantly different between the groups with `Best

Practices' reporting substantially higher levels on

the sub-scales of Optimism and Happiness.

Overall, the `Less Successful' account officers

scored lower than did the `Best Practices' group

on every EQ-i measure of emotional intelligence,

with the exception of Empathy and Impulse

Control (see Table 1).

Discussion: Study 1

Results of Study 1 support the hypothesis that

the `Best Practices' group possesses a higher level

of overall emotional intelligence than the `Less

Successful' group. This group's performance

suggests that it is comprised of people with

well-developed emotional intelligence who are

generally leading successful and happy lives.

The Intrapersonal emotional intelligence of the

`Best Practices' group is very well-developed and

these individuals can be described as

independent, aware of feelings, and able to

express those feelings and ideas to others with

comfort and confidence. Results suggest that

these individuals are usually willing and capable

of thinking, working, and making decisions

independently. They are likely to value their

Blackwell Publishers Ltd 2000

EMOTIONAL INTELLIGENCE IN THE COLLECTION OF DEBT

inner emotional life and are able to recognize the

origin and importance of their feelings. The high

Self-Actualization score suggests that members

of this group feel pride in their work and the

ongoing process of achieving their goals in life.

They can effectively assert themselves by

expressing their feelings, beliefs, and needs with

confidence and are able to defend their positions

in nondestructive ways.

While both `Best Practices' and `Less

Successful' groups possess significantly higher

than average Interpersonal emotional intelligence, the groups do not differ significantly in

this area. Overall, members of both groups

possess social adeptness as seen in their ability to

understand and interact with others effectively.

Of particular interest is the finding that the

`Best Practices' group failed to differ from the

population at large only in their empathic skills.

The `Less Successful' group performed

significantly better than did the population at

large on Empathy. One possible explanation for

this result is that too high an Empathy score

could lead to a sympathetic over-identification

with the customer (i.e., as the victim or the

aggressor) and hence leave the account officer

vulnerable to an emotional hijack. A lower level

of performance for the `Best Practices' group

might render them less vulnerable to such an

experience and hence, more effective at

collections. Nevertheless, the `Best Practices'

group functions within the average range of

empathic ability and most of the time, these

individuals

have

a

good

awareness,

understanding, and appreciation of the feelings

of others.

The `Best Practices' group performed very well

on the Adaptability composite scale, which

indicates that these people are skilled in their

responses to changing circumstances and situations. Their high performance on the Reality

Testing sub-scale denotes an ability to distinguish accurately between what they experience subjectively and what exists objectively.

They are able to focus and concentrate on the

immediate situation with clarity and are proactive

in their responses to it. Members of this group

possess a greater aptitude for identifying and

defining problems, as well as generating and

implementing more effective solutions to them.

Both the `Best Practices' and the `Less

Successful' groups tolerate stressful situations

and circumstances well. The lowest score

obtained by the `Best Practices' group was on

Impulse Control, a sub-scale of Stress Management. This result indicates that the group's ability

to resist or delay impulsive action is adequate,

however some individuals could have problems

overreacting or losing emotional control.

A sharp contrast is observed between the

performance of both `Best Practices' and `Less

Blackwell Publishers Ltd 2000

179

Successful' groups on the sub-scales of this Stress

Management composite. In the area of Stress

Tolerance, both groups perform significantly

better than the population at large yet in the

area of Impulse Control, neither group performs

any better. It is speculated that this contrast

between well-developed stress tolerance skills

and average, yet adequate, impulse control skills,

constitutes the dynamic seen in the best account

officers as they successfully thrive on perpetually

changing challenges while simultaneously

conveying a sense of real urgency to the

customer.

The General Mood of the `Best Practices'

group is significantly better than that of the `Less

Successful' group and suggests that they are

generally more satisfied with their lives and jobs,

enjoy the company of others, and derive pleasure

and fun from life. These account officers are able

to maintain a positive attitude in the face of

adversity and they have a hopeful outlook

regarding their futures.

Emotional Intelligence Profile of `Best Practices'

Account Officers

Overall, these results indicate that the `Best

Practices' account officers possess significantly

higher levels of overall emotional intelligence

and serve to reveal a profile of CFS' successful

account officers that consists of a unique blend of

the following competencies:

1. Assertive Independence combines an

inner-directed, self-reliant preference to work

autonomously and an ability to express

needs, thoughts, and feelings in a confident,

non-aggressive manner that results in

effective interpersonal communications.

2. Self-Actualized Problem Solving refers to

a well-developed, inner knowledge of one's

own goals and expectations in conjunction

with a finely tuned set of skills that promote

attainment and fulfillment of one's aspirations. These problem-solving skills consist

of time management, information processing,

communication, and negotiation capabilities.

3. Optimistic Happiness describes a pervasive, stable mood that prevails despite stress,

rejection, and disappointment. It protects the

individual's self-confidence and capacity to

carry-on regardless of adversity.

4. Emotional Self-Awareness and Empathy

enough empathy allows the successful

account officer to negotiate humanely with

a reduced risk of an overly sympathetic or

aggressive identification with the customer.

The officer also has highly developed skills

in emotional self-awareness and is able to

self-regulate stronger feelings or `empathy

distress'. It is speculated that this combi-

Volume 8

Number 3

September 2000

180

INTERNATIONAL JOURNAL OF SELECTION AND ASSESSMENT

nation of skills, in part, prevents the problem

of over-identification with the customer and

the subsequent blurring of boundaries that

can result in the `emotional hijack'.

An important question concerns the relevance of

the emotional intelligence findings from Study 1

to the actual collection of debt by collection

agency officers. In the collections business,

differences in emotional intelligence between

account officers become meaningful only if they

predict increased cash collections. Study 2

investigates this dynamic and the hypothesis

tested is that higher levels of emotional

intelligence in account officers will lead to

increased levels of cash goal attainment.

Method: Study 2

Participants

Participants were 34 account officers employed at

CFS who participated in the `Best Practices' Study

conducted in September and October 1998.3

Measure

A measure of cash collections, based on

information maintained in the CFS data base, is

the percentage of cash goal attained per month

by each account officer. Table 2 shows these data

averaged for the two groups of account officers

under study.

Participants completed the Bar-On Emotional

Quotient Inventory prior to engaging in this

study (see Study 1).

Procedure

In order to determine any differences in percentage of cash goal attained between the `Best

Practices' and the `Less Successful' groups over

the preceding three and six months, t-tests were

conducted. If significant differences were found

between the groups, the study would then

proceed.

Participants, for whom three full months of

collection data were available in August,

September and October 1998, were ranked and

then divided into two groups of High versus

Low Cash Collectors, each group consisting of 17

people. Next, t-tests were conducted on

emotional intelligence scores obtained by the

High and Low Cash Collectors groups. An

additional t-test analysis provided the basis for

a comparison of the High and Low collectors

groups on their percentage of cash goal

attainment.

Results

Preliminary Analysis of Percentage of Cash Goal

Attained by Group

The `Best Practices' group clearly outperformed

the `Less Successful' group in terms of cash goal

attainment for the preceding six and three

months. Results of this analysis were highly

significant statistically (see Table 2).

Comparison of High and Low Cash Collectors on

Emotional Intelligence

Analyses were conducted in order to compare

the High and Low Cash Collectors groups on

their EQ-i scores (see Table 3). Overall, the High

Cash Collectors group performed better than did

the Low Cash Collectors group on all sub-scales

with the exception of Empathy and Impulse

Control. They performed notably better on three

of the EQ-i sub-scales: Independence, SelfActualization, and Optimism. The Low

Collectors group performed significantly better

than the High Cash Collectors group on the

Interpersonal sub-scale of Empathy. This

particular finding reflects the trend seen in Study

1 where the `Less Successful' group scored higher

on the Empathy sub-scale. Again, as in Study 1,

Low Cash Collectors performed better than did

High Cash Collectors on the sub-scale Impulse

Control, however the difference was not

statistically significant.

Comparison of High and Low Cash Collectors on

Percentage of Cash Goal Attained

An additional t-test was conducted in order to

compare the High and Low Cash Collectors on

their average (corrected)4 percentage of cash goal

attained. Results of this analysis are highly

statistically significant with the High Cash

Collectors clearly outperforming the Low Cash

Collectors (see Table 4).

Table 2: Average percentage of cash goal attained over the past 6 and 3 months by the best practices and less

successful account officers

MayOctober 1998

AugustOctober 1998

Volume 8 Number 3

September 2000

Best Practices

(n = 22)

Less Successful

(n = 12)

p-values

Significant?

100%

88

47%

42

p < 0.01

p < 0.01

Yes

Yes

Blackwell Publishers Ltd 2000

EMOTIONAL INTELLIGENCE IN THE COLLECTION OF DEBT

181

Table 3: Averages of emotional intelligence profile scores for high and low cash collectors

EQ-i Scale

High cash collectors

(n = 17)

Low cash collectors

(n = 17)

p-valueb

Significant?

109

112

114

103

103

107

0.13

0.01

0.02

No

Yes

Yes

101

110

0.01

Yes

107

101

0.16

No

96

104

0.07

No

106

111

99

104

0.10

0.03

No

Yes

Intrapersonal EQ

Assertiveness

Self-Actualization

Independence

Interpersonal EQ

Empathya

Adaptability EQ

Problem Solving

Stress Management EQ

Impulse Controla

General Mood EQ

Happiness

Optimism

Notes:

a

Note the inverse relationship.

b

All p-values are based on t-tests.

Table 4: Average percentage of cash goal attained over the past 3 months by the high and low cash collectors

% Goal attainment

High collectors

(n = 17)

Low collectors

(n = 17)

p-value

163

80

< .0001

Discussion: Study 2

Results of these analyses strongly suggest that

higher levels of emotional intelligence in account

officers lead to increased cash goal attainment.

Overall, high cash collectors have particularly

well-developed skills in the areas of independence, self-actualization, and optimism. Interestingly, low cash collectors perform significantly

better in the area of empathy (an interpersonal

skill) and relatively better in the area of impulse

control (a stress management skill).

It is suggested that a good empathic skill in

combination with an adequate, or good enough

ability to control one's impulses, results in a

winning set of skills. This skill set provides the

account officer with enough understanding of the

customer's feelings and needs to build a good

rapport while maintaining the emotional

intensity needed to communicate a sense of

urgency a skill considered as being necessary in

successful collections.

Given that the two groups in Study 2 did

differ on Empathy, with the Low Cash Collectors

performing significantly better than the High

Cash Collectors, the greater success of the `Best

Practices' group can be attributed to its welldeveloped skills in other areas. Specifically, better

developed skills in the Intrapersonal area, such as

Self-Actualization and Independence, and in the

Blackwell Publishers Ltd 2000

area of General Mood, such as Optimism, appear

to contribute to the successful expression of

Empathy, and the prevention of `emotional

hijacking' or over-identification with the

customer. These skills are related to the two

groupings of emotional competencies suggested

as being essential in successful collections

officers: (a) self-awareness and empathy (skills

related to Intrapersonal and Interpersonal subscales); and (b) self-control and adaptability (skills

related to Adaptability and Stress Management

sub-scales). Results of this study strongly suggest

therefore, that well-developed emotional

intelligence plays a vital role in successful

collections.

Summary

Findings reported on the basis of these studies

strongly suggest that an overall higher level of

emotional intelligence in account officers

contributes to more successful collections. Two

groupings of emotional competencies, thought to

be essential in successful negotiations, were

outlined. Self-awareness and empathy constituted

the first grouping, while self-control and

adaptability comprised the second. Skills in these

areas were hypothesized as being essential in the

prevention of an `emotional hijack' or problem of

Volume 8

Number 3

September 2000

182

INTERNATIONAL JOURNAL OF SELECTION AND ASSESSMENT

over-identification with the customer and

subsequent failure to successfully negotiate

collection. Various components of the EQ-i

measure of emotional intelligence were tied in

with these two groupings of skills. Subsequent

analyses between groups of more and less

successful account officers demonstrated more

highly developed skills among the former group

and hence, less vulnerability to emotional

hijacking.

Other attributes that distinguished successful

account officers from those who were less

successful, were identified by the CFS `Best

Practices' study and include (a) attitude; (b) skills;

and (c) leadership. It has been suggested that

competence in each of these areas depends on

underlying emotional competencies. For example,

a success-oriented attitude could be derived from

well-developed skills in five underlying areas of

emotional

intelligence:

self-regard,

selfactualization, optimism, achievement drive, and

initiative. The latter two categories could be

measured indirectly by EQ-i sub-scales of

Assertiveness and Independence. Skills in the

areas of time management, information

processing, communications, and negotiations,

could be nourished by the underlying emotional

competencies

of

emotional

self-control,

assertiveness, independence, problem solving,

reality testing, flexibility, and empathy.

Leadership skills required by managers of

successful account officers could also find their

basis in underlying emotional competencies.

These skills include the ability to develop a

collaborative/cooperative working style with

their staff and to allow them the independence

they require. Future research in this area holds

promise.

Implications of these findings are quite

exciting for Human Resources, Training, and

Continuing Education. If higher levels of

emotional intelligence lead to enhanced job

performance among account officers, then it

may be hypothesized that emotional intelligence

Volume 8 Number 3

September 2000

plays an important role in the overall success of

individuals in the workplace. The assessment of

current levels of emotional intelligence could be

conducted using the BarOn EQ-i. This type of

assessment could fulfil a vital role especially in

the areas of personnel selection and

development. Results of such an assessment

would clearly indicate areas in which further

improvement is needed and recommendations for

developing essential `emotional' skills, whether

through individual coaching or specialized EQ

training, could be implemented.

Notes

1. All skills reported within this section, as

strengths of the Best Practices group, are

based on t-tests which achieved statistical

significance at the probability level of .05.

2. All skills reported within this section, as

strengths of the Less Successful group, are

based on t-tests which achieved statistical

significance at the probability level of .05.

3. Two Best Practices account officers began

section leader training during the August

October period and hence did not contribute

data to the analyses in Study 2.

4. Each account officer's monthly percentage of

goal attained was divided by the average

percentage of goal attained for that

individual's functional area. This ensures

comparability between account officers

working different assets.

References

Bar-On, R. (1997) Bar-On Emotional Quotient

Inventory: A Measure of Emotional Intelligence

(Technical Manual). Toronto, ON, Multi-Health

Systems Inc.

Goleman, D. (1998) Working with Emotional

Intelligence. New York, Bantam Books.

Blackwell Publishers Ltd 2000

Anda mungkin juga menyukai

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- Trends in Violence Research: An Update Through 2013: EditorialDokumen7 halamanTrends in Violence Research: An Update Through 2013: EditoriallucianaeuBelum ada peringkat

- 1 s2.0 S0742051X15300226 MainDokumen10 halaman1 s2.0 S0742051X15300226 MainlucianaeuBelum ada peringkat

- 1 s2.0 S1054139X13002115 MainDokumen8 halaman1 s2.0 S1054139X13002115 MainlucianaeuBelum ada peringkat

- Content ServerDokumen30 halamanContent ServerlucianaeuBelum ada peringkat

- Resilience Under Fire: Perspectives On The Work of Experienced, Inner City High School Teachers in The United StatesDokumen14 halamanResilience Under Fire: Perspectives On The Work of Experienced, Inner City High School Teachers in The United StateslucianaeuBelum ada peringkat

- 0020764015573848Dokumen7 halaman0020764015573848lucianaeuBelum ada peringkat

- Bul A0030010Dokumen17 halamanBul A0030010lucianaeuBelum ada peringkat

- 1 PBDokumen17 halaman1 PBlucianaeuBelum ada peringkat

- 1 PBDokumen17 halaman1 PBlucianaeuBelum ada peringkat

- X 030142004Dokumen10 halamanX 030142004lucianaeuBelum ada peringkat

- Forgetting Our Personal Past: Socially Shared Retrieval-Induced Forgetting of Autobiographical MemoriesDokumen16 halamanForgetting Our Personal Past: Socially Shared Retrieval-Induced Forgetting of Autobiographical MemorieslucianaeuBelum ada peringkat

- CCP A0031530 PDFDokumen12 halamanCCP A0031530 PDFlucianaeuBelum ada peringkat

- Apl A0035408Dokumen29 halamanApl A0035408Faizan ChBelum ada peringkat

- Xge 141 4 715Dokumen13 halamanXge 141 4 715lucianaeuBelum ada peringkat

- Council For Innovative ResearchDokumen8 halamanCouncil For Innovative ResearchlucianaeuBelum ada peringkat

- 1 s2.0 S0022096511001330 Main PDFDokumen8 halaman1 s2.0 S0022096511001330 Main PDFlucianaeuBelum ada peringkat

- Content ServerDokumen8 halamanContent ServerlucianaeuBelum ada peringkat

- 1 s2.0 S0742051X15300305 MainDokumen11 halaman1 s2.0 S0742051X15300305 MainlucianaeuBelum ada peringkat

- 1 s2.0 S0191886915003323 MainDokumen18 halaman1 s2.0 S0191886915003323 MainlucianaeuBelum ada peringkat

- 00 B 4952 CF 13 e 154 CC 4000000Dokumen13 halaman00 B 4952 CF 13 e 154 CC 4000000lucianaeuBelum ada peringkat

- Acta Psychologica: Kimberley A. Wade, Robert A. Nash, Maryanne GarryDokumen7 halamanActa Psychologica: Kimberley A. Wade, Robert A. Nash, Maryanne GarrylucianaeuBelum ada peringkat

- Acta Psychologica: Alan Scoboria, Giuliana Mazzoni, Josée L. Jarry, Daniel M. BernsteinDokumen8 halamanActa Psychologica: Alan Scoboria, Giuliana Mazzoni, Josée L. Jarry, Daniel M. BernsteinlucianaeuBelum ada peringkat

- Speculating On Everyday Life: The Cultural Economy of The QuotidianDokumen16 halamanSpeculating On Everyday Life: The Cultural Economy of The QuotidianlucianaeuBelum ada peringkat

- 1 s2.0 S0148296315003409 MainDokumen9 halaman1 s2.0 S0148296315003409 MainlucianaeuBelum ada peringkat

- Improving HW PerformanceDokumen77 halamanImproving HW Performancensg032288Belum ada peringkat

- 88875-7713 JD Debt Collection OffDokumen3 halaman88875-7713 JD Debt Collection OfflucianaeuBelum ada peringkat

- 4Dokumen3 halaman4lucianaeuBelum ada peringkat

- Adams Et Al-2000-Journal of Advanced NursingDokumen8 halamanAdams Et Al-2000-Journal of Advanced NursinglucianaeuBelum ada peringkat

- Content ServerDokumen11 halamanContent ServerlucianaeuBelum ada peringkat

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Birads PosterDokumen1 halamanBirads PosterGopalarathnam BalachandranBelum ada peringkat

- Things of Boundaries. Andrew AbbottDokumen27 halamanThings of Boundaries. Andrew AbbottDaniel SotoBelum ada peringkat

- KPI - Foruth EditionDokumen30 halamanKPI - Foruth EditionAnonymous qUra8Vr0SBelum ada peringkat

- 11 Foods That Lower Cholesterol: Foods That Make Up A Low Cholesterol Diet Can Help Reduce High LevelsDokumen3 halaman11 Foods That Lower Cholesterol: Foods That Make Up A Low Cholesterol Diet Can Help Reduce High Levelsaj dancel marcosBelum ada peringkat

- Curing Stage 4 Cancer and Terminal Liver Disease with Alpha Lipoic AcidDokumen14 halamanCuring Stage 4 Cancer and Terminal Liver Disease with Alpha Lipoic Acidguy777Belum ada peringkat

- 31congenital GlaucomasDokumen12 halaman31congenital GlaucomasShari' Si WahyuBelum ada peringkat

- Fluid Management in The Critically Ill: Jean-Louis VincentDokumen6 halamanFluid Management in The Critically Ill: Jean-Louis VincentFlorentina NadisaBelum ada peringkat

- Post MortemDokumen4 halamanPost MortemErlinda YulyBelum ada peringkat

- Kidde Fire Systems Nitrogen Engineered Systems: Design, Installation, Operation and Maintenance ManualDokumen110 halamanKidde Fire Systems Nitrogen Engineered Systems: Design, Installation, Operation and Maintenance ManualYoyon HaryonoBelum ada peringkat

- Practical Research 2 Quarter 1 Activity SheetsDokumen8 halamanPractical Research 2 Quarter 1 Activity SheetsJonnis Estillore100% (1)

- Research Paper About EpilepsyDokumen4 halamanResearch Paper About EpilepsyHazel Anne Joyce Antonio100% (1)

- IWA Publishing - Anaerobic Reactors For Sewage Treatment - Design, Construction and Operation - 2020-01-10Dokumen1 halamanIWA Publishing - Anaerobic Reactors For Sewage Treatment - Design, Construction and Operation - 2020-01-10JOHNY ALEJANDRO GARCIA SEPULVEDABelum ada peringkat

- Birth Injuries: Causes, Types and TreatmentDokumen9 halamanBirth Injuries: Causes, Types and TreatmentshailaBelum ada peringkat

- Vol3issue12018 PDFDokumen58 halamanVol3issue12018 PDFpyrockerBelum ada peringkat

- Prevention Strategies For Periodontal Disease - Chapter 16Dokumen10 halamanPrevention Strategies For Periodontal Disease - Chapter 16Daniah MBelum ada peringkat

- Complete VaccinationDokumen2 halamanComplete VaccinationNgoo NwosuBelum ada peringkat

- Effect of Ointment Base Type on Percutaneous Drug AbsorptionDokumen4 halamanEffect of Ointment Base Type on Percutaneous Drug AbsorptionINDAHBelum ada peringkat

- Pharmaceutical Microbiology Conference 2011 - SMi GroupDokumen3 halamanPharmaceutical Microbiology Conference 2011 - SMi GroupTim SandleBelum ada peringkat

- Insert - Elecsys Anti-HAV IgM.07026773500.V5.EnDokumen4 halamanInsert - Elecsys Anti-HAV IgM.07026773500.V5.EnVegha NedyaBelum ada peringkat

- Ergonomics (Uu Tien Dich)Dokumen6 halamanErgonomics (Uu Tien Dich)Phong D LeBelum ada peringkat

- Pneumonia Care PlanDokumen1 halamanPneumonia Care Plantcumurphish67% (3)

- Michael DeLong V Oklahoma Mental Health: PetitionDokumen30 halamanMichael DeLong V Oklahoma Mental Health: PetitionTony OrtegaBelum ada peringkat

- The Costly Business of DiscriminationDokumen46 halamanThe Costly Business of DiscriminationCenter for American Progress100% (1)

- Idiopathic Thrombocytopenic PurpuraDokumen3 halamanIdiopathic Thrombocytopenic Purpuraproxytia64Belum ada peringkat

- عقد خدمDokumen2 halamanعقد خدمtasheelonlineBelum ada peringkat

- Symbols On PackegingDokumen3 halamanSymbols On PackegingsakibarsBelum ada peringkat

- BDS 3rd Year Oral Pathology NotesDokumen35 halamanBDS 3rd Year Oral Pathology NotesDaniyal BasitBelum ada peringkat

- SC 2Dokumen2 halamanSC 2Ryan DelaCourt0% (3)

- Jordan Leavy Carter Criminal ComplaintDokumen10 halamanJordan Leavy Carter Criminal ComplaintFOX 11 NewsBelum ada peringkat

- Bmjopen 2017 016402Dokumen6 halamanBmjopen 2017 016402Ćatke TkećaBelum ada peringkat