IT Policies, Procedures and Standards v1

Diunggah oleh

Jimmy UkoboDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

IT Policies, Procedures and Standards v1

Diunggah oleh

Jimmy UkoboHak Cipta:

Format Tersedia

Subject:

IT Policies, Procedures & Standards

August 5, 2015

Table of Contents

Document Titles

Document Ref.

No.

Internet Security Policy

PPS-DB-001

Technology Support-Virtual Private Network

PPS-DB-002

E-mail Security Policy

PPS-DB-003

Business Application Support-Back up

Policy

PPS-DB-004

10

Technology Support-Network Operating

System Maintenance

PPS-DB-005

Technology Support -Documents Rights

Management

PPS-DB-006

Business Application Support-Database

Policy

PPS-DB-007

10

Business Information System-System

Development Life Cycle

PPS-DB-008

10

IT Change Management Procedures

PPS-DB-009

11

IT Services Document Managment

Procedures

PPS-DB-010

Uninterruptible Power Supply (UPS) Usage

Policy

PPS-DB-011

Software: Acceptable Use Policy

PPS-DB-012

Acceptable Use of Diamond Bank Systems

Policy

PPS-DB-013

Data Center Policy and Procedures

PPS-DB-014

Information Security Policies

PPS-DB-015

Information Security Framework

ISF-DB-016

Business Continuity Planning

PPS-DB-017

75

Diamond Bank

No. of

Pages

Business Process

Assurance

Page 1 of 176

Subject:

IT Policies, Procedures & Standards

Subject

PPS No.

August 5, 2015

Internet Security Policy

Effective

Date

PPS-DB-001

Review Date

REVISION:

SUBJECT:

SERIAL #. 240-07

COMPLETE__X___

TECHNOLOGY

SUPPORT-

PAGE #24 of 55

PARTIAL_______

AREA CORRECTED:

INTERNET

POLICY

SECURITY

ISSUED DATE:

VARIOUS

OCTOBER

2003

SUPERSEDES/REPLACE

S:

FORM NUMBER: 240-007

N/A

06,

EFFECTIVE DATE:

OCTOBER

2003

06,

I. AFFECTS:

All staff of Diamond Bank.

II. PURPOSE

The purposes of the Policy statements are:

To enlighten DB staff on the inherent risk involved in surfing

web pages on the internet.

To define access level to Internet resources amongst all

Diamond Bank Limited employees.

To define security standards for all equipment connected to

Diamond Bank Limited Internet Services

Diamond Bank

Business Process

Assurance

Page 2 of 176

Subject:

IT Policies, Procedures & Standards

August 5, 2015

To provide operational guidelines for usage of Internet

Services

III. INTRODUCTION

The Internet is a worldwide collection of computer networks

connecting

academic,

governmental,

commercial,

and

organizational sites. It provides access to communication

services and information resources to millions of users around

the globe. Internet services include direct communication (email, chat), online conferencing (Usenet News, e-mail discussion

lists), distributed information resources (World Wide Web,

Gopher), remote login and file transfer (telnet, ftp), and many

other valuable tools and resources. In view of the wide use of

the internet and the attendant risks, the policies and procedures

in the succeeding sections shall guide the use of the internet in

the Bank.

The internet security policies apply to all DB employees, the

Banks vendors who use the internet with DB computing or

networking resources as well as those who represent

themselves as being connected in one way or another with DB.

IV. POLICIES

1)

All DB staff shall have access to the internet between

6:00p.m and 8:00p.m on all working week days only. However,

unlimited access shall be granted to all Divisional Heads and

Executive Committee members. Other employees with proven

legitimate business needs may be granted similar access,

subject to resource availability and the joint approval of the

Divisional Head and the Head, Information Technology Group.

2)

All non-text files (databases, software object code,

spreadsheets, formatted word processing package files, etc.)

downloaded from non-DB sources via the Internet must be

screened with virus detection software prior to it being used.

Downloaded software shall be tested on a standalone server

before deployment.

3)

Automatic updating of software or information whereby

any vendor or third party is granted access to remotely

administer any database or application codes on DB computers

otherwise known as "push Internet technology is prohibited.

Diamond Bank

Business Process

Assurance

Page 3 of 176

Subject:

IT Policies, Procedures & Standards

August 5, 2015

4)

DB software, documentation, and all other types of

internal information must not be sold or otherwise transferred

to any non-DB party for any purposes.

5)

Firewalls have been established to routinely prevent users

from accessing certain non-business and offensive web sites. All

employees who discover they have connected or linked to sites

that contain sexually explicit, racist, violent or other potentially

offensive material must immediately disconnect from such sites.

As a guiding rule, users must not go to any site that they would

not walk into physically and lay their business cards on the

table.

6)

To avoid libel, defamation of character, and other legal

issues, all Internet messages intended to harass, annoy, or alarm

another person are prohibited.

7)

All users must realise that communications on the internet

are not automatically protected from viewing by 3 rd parties;

hence caution is prescribed during internet usage.

8)

The Bank is committed to respecting user privacy.

However, for regulatory requirement, auditing, security, and

investigating activities, the Administrator or a designated

Inspectorate Division staff, as approved by Executive Committee

member reserves the right to examine electronic mail messages,

files on personal computers, web browser cache files, web

browser bookmarks, logs of web sites visited, and other

information stored on or passing through DB computers.

9)

DB employees in receipt of information about system

vulnerabilities must not personally redistribute such which

most times come in form of hoax chain letters requesting that

the receiving party send the message to other people -, rather

they should be forwarded to ITG Helpdesk where an appropriate

action shall be taken.

To prevent unauthorised access, users must not save

passwords in their web browsers or electronic mail clients (i.e

automatic log-on), rather such passwords must be provided each

time a browser or electronic mail is invoked. It should be noted

that where this is violated, anyone with physical access to the

workstations would be able to access the internet with their

identities as well as read and send e-mails.

10)

Diamond Bank

Business Process

Assurance

Page 4 of 176

Subject:

IT Policies, Procedures & Standards

August 5, 2015

All new internet web pages dealing with the Banks

business, and or modification to the authorised DB web pages

by the Administrator or any other designated employee, must

pass through the change management process. Such changes

must be approved by the Divisional Head, e-Business &

Consumer Product, Heads ITG, ICU and the Divisional or Group

Head of the change originating Unit if different from the above.

11)

The internet user must notify ITG Helpdesk once it is

believed that sensitive DB information is lost, or suspected of

being lost or disclosed to unauthorised parties. In addition,

unauthorised use of DB system, lost or stolen or disclosed

passwords or other system access control mechanism, unusual

system behaviour such as missing files, frequent system

crashes, misrouted messages must be immediately reported to

ITG Helpdesk. The specifics of such security problems should

not be discussed widely but should instead be shared on a needto-know basis.

12)

All users must exercise caution in the use of Internetsupplied information for business decision-making purposes.

Some amount of internet information may be outdated,

unreliable and inaccurate, and in some instances even

deliberately misleading. Users are advised to verify the

information by consulting other sources.

13)

Only designated spokesperson(s) of the Bank are allowed

to disclose their affiliation with the Bank over the internet.

Where non-designated staffs choose to do so however, they must

ensure that whatever opinions expressed are clearly shown to

be their personal opinions.

14)

All staff, contractors or 3rd party employees given

permission to use the DB internet are required to comply fully

with the policies contained here-in. Violation of any part of these

policies will result in disciplinary action up to and including

termination of employment (in the case of staff) and review of

relationships (in the case of 3rd parties).

15)

V. ROLES AND RESPONSIBILITIES

Information Technology Group

ITG shall be responsible for the following functions:

Diamond Bank

Business Process

Assurance

Page 5 of 176

Subject:

IT Policies, Procedures & Standards

August 5, 2015

a. Provide technical guidance on internet use and security to

all DB staff.

b. Provide administrative support and technical guidance to

management on matters related to Internet Security.

c. System administrator shall routinely log web sites visited,

files downloaded, time spent on the internet and such

related information.

d. Internet Administrator shall install a protective shield

(capable of scanning all traffic between the Banks

network and the internet) at the proxy server to scan all

web page, e-mails and attachments into the Bank network.

e. Internet Administrator shall install Verisign 128 bit secure

socket layer on the web server to secure the web.

f. Internet Administrator shall investigate all reported cases

of usage problems such as loss of sensitive DB

information,

disclosure

to

unauthorised

parties,

unauthorised use of DB system, lost or stolen or disclosed

passwords or other system access control mechanism,

missing files, frequent system crashes, misrouted

messages etc

g. Internet Administrator shall administer these policies,

hence questions about the policies may be directed to the

Administrator

Diamond Bank

Business Process

Assurance

Page 6 of 176

Subject:

IT Policies, Procedures & Standards

August 5, 2015

Subject

Technology SupportVirtual Private Network

Effective

Date

PPS No.

PPS-DB-002

Review Date

REVISION:

SUBJECT:

COMPLETE__X___

TECHNOLOGY

SUPPORT-

PARTIAL_______

AREA CORRECTED:

VIRTUAL

NETWORK

SERIAL #. 24008

PRIVATE

ISSUED DATE:

VARIOUS

SUPERSEDES/REPLACE

S:

N/A

PAGE #28 of 55

OCTOBER

2007

FORM NUMBER: 240-008

04,

EFFECTIVE

DATE:

OCTOBER

2007

04,

I. AFFECTS:

All staff

II. PURPOSE

This document provides a set of guidelines for Remote Access

Virtual Private Network (VPN) connections to the Diamond bank

trusted corporate network.

III. INTRODUCTION

The rapid transformation in Information Technology and

Telecommunication

has

broken

the

barrier

between

geographically dispersed locations by typically leveraging on the

public internet to securely extend the computing capabilities of

a business home network and allow users share information

privately between remote locations, or between a remote

Diamond Bank

Business Process

Assurance

Page 7 of 176

Subject:

IT Policies, Procedures & Standards

August 5, 2015

location and the business home network. In order to tap into

this revolution, Diamond Bank is providing remote access

Virtual Private Network (VPN) service to allow authorized users

of this service conducted their official duties from anywhere in

the world.

The VPN is a channel that provides secure information transport

by authenticating users, and an encrypted data connection

access to the banks trusted network. It is worthy of note that

VPN does not by itself provide Internet connectivity. Users are

responsible for providing their own Internet service in order to

use the VPN service. The policies detailed in this document shall

serve as standard guideline in the implementation of the

service.

IV. SCOPE

This policy applies to all employees, contractors, consultants,

temporaries, and other workers including all personnel affiliated

with third parties utilizing VPN access to the banks network.

This Policy applies to implementations of all VPN that are

directed through any type VPN Concentrator.

V. OVERVIEW

The VPN allows users at remote locations to access services and

applications available only on the Diamond bank network. By

accessing the banks network through VPN, the user bypasses

security measures designed to protect the network from viruses,

hackers and other threats on the Internet. Therefore, users who

require a VPN must accept the responsibility of assuring that

the computer they will use is secure.

Approved employees of the bank as well as authorized third

parties (including but not limited to contractors/vendors,

consultants, associate staff, temporaries, and other workers

including all personnel affiliated with third parties etc.) may

utilize the benefits of VPNs, which are a "user managed"

service. This means that the user is responsible for selecting an

Internet Service Provider (ISP), coordinating installation,

installing any required software, and paying associated fees.

Further details may be found in the Remote Access Policy.

Diamond Bank

Business Process

Assurance

Page 8 of 176

Subject:

IT Policies, Procedures & Standards

August 5, 2015

VI. POLICIES

1. AGMs and above shall have automatic access to the VPN

service. All other staff whose job functions require such access

(except staff of IT Services), shall require their Divisional Head

approval. In addition, the approval of the Head, Customer

Services and Technology shall be required to maintain staff

profile in the system.

2. Staff of IT Services that require remote access connection to

exercise his/her duties shall be granted access to VPN service

upon the singular approval of the Head, IT Services.

3. VPN gateways will be set up and managed by IT services

4. .It is the responsibility of the users with VPN privileges to

ensure that unauthorized persons are not allowed access to DB

plc network.

5. VPN use shall be controlled using either a one-time password

authentication such as a token device or a public/private key

system with a strong passphrase.

6. When actively connected to the corporate network, VPNs will

force all traffic to and from the PC over the VPN tunnel: all

other traffic will be dropped.

7. Dual (split) tunnelling is NOT permitted; only one network

connection per user is allowed.

8. All computers connected to the banks internal networks via

VPN or any other technology must use the most up-to-date antivirus software that is of the banks standard; this includes

personal computers.

9. VPN users shall be automatically disconnected from DB plc's

network after ten minutes of inactivity or a total connection time

of 8 hours per user in one session. The user must then logon

again to reconnect to the network. Pings or other artificial

network processes are not to be used to keep the connection

open.

10.

Only VPN client software that is approved by and/or

distributed by the Head, IT services shall be used to connect to

the banks VPN concentrators.

Diamond Bank

Business Process

Assurance

Page 9 of 176

Subject:

IT Policies, Procedures & Standards

August 5, 2015

11.

Approved users laptops will be configured with the VPN

client software by designated personnel at IT services.

12.

Users of computers that are not owned by the bank must

have their equipment configured by IT services personnel to

comply with the bank's VPN and Network policies.

13.

Use of the VPN signifies your acceptance of and

compliance with all other related policies of the bank.

14.

By using VPN technology with personal equipment, users

must understand that their machines are a de facto extension of

the bank's network, and as such are subject to the same rules

and regulations that apply to the bank-owned equipment, i.e.,

their machines must be configured to comply with the banks

Information Security as well as other IT Policies.

15.

Theft or loss of any computer with a VPN client configured

on it must be reported immediately to the IT Services via

Service Desk.

16.

The VPN may be used only for official, bank related work.

You must disconnect the VPN before attempting any non-bank

related activities from your computer.

ENFORCEMENT

17.

Any user found to have violated this policy may be subject

to loss of privileges or services, including but not necessarily

limited to loss of VPN services.

Subject

PPS No.

E-mail Security Policy

Effective

Date

PPS-DB-003

Review Date

REVISION:

Diamond Bank

SUBJECT:

SERIAL #. 240-06

Business Process

Assurance

Page 10 of 176

Subject:

IT Policies, Procedures & Standards

COMPLETE__X___

PARTIAL_______

AREA CORRECTED:

August 5, 2015

PAGE #18 of 19

TECHNOLOGY

SUPPORTE-MAIL

POLICY

SECURITY

ISSUED DATE:

VARIOUS

OCTOBER

2003

SUPERSEDES/REPLACE

S:

FORM NUMBER: 240-006

N/A

06,

EFFECTIVE DATE:

OCTOBER

2003

06,

I. AFFECTS:

All staff of Diamond Bank

II. PURPOSE

The purposes of the Policy statements are:

i. To provide specific instructions on the ways to secure

electronic mail resident on personal computers and

servers.

ii. To ensure that staff trust the integrity of mails

iii. To ensure that disruptions of e-mail and other services and

activities are minimized and;

iv. To inform users of e-mail services on how concepts of

privacy and security policy apply to e-mail

III. INTRODUCTION

The E-Mail (electronic mail) is simply put, the transmission of

computer-based messages over telecommunication technology.

This can be by communication within DB network or with others

outside DB network.

The e-mail security policies apply to all DB employees and in

some instances the Banks vendors who use e-mail located on

Diamond Bank

Business Process

Assurance

Page 11 of 176

Subject:

IT Policies, Procedures & Standards

August 5, 2015

personal computers and servers under the jurisdiction and or

ownership of DB.

IV. POLICIES

a) All DB staff shall be created on the Banks network and by

extension will have an e-mail account. However, the ability to

use e-mail for communication with parties outside DB

network shall be restricted to staffs on the grade of Assistant

Manager (AM) and above. Employees below the AM grade

but with proven legitimate business needs for such access

may be so created, subject to the joint approval of the staffs

Divisional Head and Head ITG.

b) Outward bound e-mails through DB network generally must

be used only for business activities. Users are prohibited

from using Diamond Bank Limited e-mail for private business

activities, or amusement/entertainment purposes. However,

where personal use of the e-mail is to be made, the user must

ensure that:

i. It does not consume more than a trivial amount of

resources.

ii.

It does not interfere with his/her

productivity.

iii.

It does not pre-empt any business

activity.

c) Users are responsible and are liable for all messages sent

from their e-mail accounts. E-mail accounts are to be used

only by the authorized owner of the account name. Account

owners shall be held responsible for all activities performed

through their account.

d) Users privileges on e-mail communication systems shall be

assigned to grant only the capabilities necessary to perform a

job. Privilege to send mail, emergencies, regular system

maintenance notices, and broadcast facilities to groups like

All Diamond Bank Limited staff; Divisional Heads; Exec

Diamond Bank

Business Process

Assurance

Page 12 of 176

Subject:

IT Policies, Procedures & Standards

August 5, 2015

Office; ALCO; etc. shall be restricted

Administrator and Divisional Heads.

to

the

System

e) E-mail accounts put to improper use, or not used for sixty

consecutive days will be disabled, while disengaged Staffs email accounts -upon notification from the Human Capital

Management- will be deleted.

f) Users must employ only authorized DB electronic mail

software (diamondbank.com) for official or business

communications. Therefore the use of personal electronic

mail accounts (such as Hotmail; Yahoo; MSN etc.) with an

Internet Service Provider (ISP) or any other third party for

any DB business messages is prohibited.

g) The Bank is committed to respecting user privacy. However,

for regulatory requirement, auditing, security, and

investigating activities, the Administrator or a designated

Inspectorate staff, as approved by Executive Committee

member(s) reserves the right to monitor the use and content

of electronic mail messages. Users are therefore expected to

structure their electronic mail in recognition of this.

h) All users must realise that electronic mails may be

forwarded, intercepted, printed and stored by others

(intended or unintended); hence caution is prescribed during

usage. Similarly, users must note that where information is

intended for specific individuals, it may be inappropriate for

general consumption; therefore messages being forwarded

must be done with utmost care. In addition, all DB sensitive

information must not be forwarded to any party outside DB

without the prior approval of an EXCO member.

i) All e-mail with attachment files should be scanned with an

authorized virus detection software package before opening

and or execution. Unexpected attachments received from

third parties should be viewed with suspicion, even if the

Diamond Bank

Business Process

Assurance

Page 13 of 176

Subject:

IT Policies, Procedures & Standards

August 5, 2015

third party is known and trusted. Users must also ensure that

the virus checker on their PC is functional and up to date.

j) Users must not use obscenities or derogatory remarks in

electronic mail messages discussing employees, customers,

competitors, or others. E-mail system must not be used for

the exercise of the workers' right to free speech, open forum

to discuss DB organizational changes or business policy

matters. Likewise, sexual, ethnic, religious and racial

harassment is strictly prohibited. Any staff who receives

offensive unsolicited material from outside sources must not

forward or redistribute it to either internal or external

parties (unless it is to Human Capital management in order

to assist with the investigation of a complaint). As a matter of

standard business practice, all DB electronic mail

communication must be consistent with conventional

standards of ethical conduct

k) The user must notify ITG Helpdesk once it is believed that

sensitive DB information is lost, or suspected of being lost or

disclosed to unauthorised parties. In addition, unauthorised

use of DB information system, lost or stolen or disclosed

passwords or other system access control mechanism,

unusual system behaviour such as missing files, frequent

system crashes, misrouted messages must be immediately

reported to ITG Helpdesk. The specifics of such security

problems should not be discussed widely but should instead

be shared on a need-to-know basis.

l) Users are prohibited from "mail bombing" to other users

(that is, sending a large number of messages in order to

overload a server or user's electronic mailbox) in retaliation

for any perceived wrong. Unsolicited electronic mail (socalled "Spam") from a particular organisation or e-mail

address or user should be reported to the ITG Helpdesk

immediately for appropriate action.

m) While DB encourages the business use of electronic

communications (voice mail, e-mail, and fax) as a productivity

enhancement tool, e-mail and all messages generated on or

Diamond Bank

Business Process

Assurance

Page 14 of 176

Subject:

IT Policies, Procedures & Standards

August 5, 2015

handled by electronic mail systems, including back-up copies,

are considered to be the property of Diamond Bank Limited,

and are not the property of users of the electronic mail

services.

n) All external contracts or Official documents formed through

electronic mail offer and acceptance messages (fax,

electronic document Imaging and electronic mail etc.) shall

not be binding on DB until such documents have been

formalized, confirmed and signed via paper documents within

two weeks of acceptance. In addition, staff must not employ

scanned versions of hand-rendered signatures to give the

impression that an electronic mail message or other

electronic communications were signed by the sender. This is

to prevent identity theft and other types of fraud.

o) Users must not transmit copyrighted materials without the

permission of an EXCO member.

p) Due to capacity limitations at the mail server, users are

required to create personal folders on their PCs. These

personal folders are to be archived on a monthly basis.

q) All staff, contractors or 3rd party employees given permission

to use the DB e-mail are required to comply fully with the

policies contained here-in. Violation of any part of these

policies will result in disciplinary action up to and including

termination of employment (in the case of staff) and review of

relationships (in the case of 3rd parties).

V.

ROLES AND RESPONSIBILITIES

1.

Information Technology Group

ITG shall be responsible for the following functions:

Diamond Bank

Business Process

Assurance

Page 15 of 176

Subject:

IT Policies, Procedures & Standards

August 5, 2015

i.

ITG shall provide technical guidance on e-mail

security to all DB staff.

ii.

ITG shall also provide administrative support and

technical guidance to management on matters

related to e-mail.

iii.

E-mail administrator shall assign unique user

names to staff to access the e-mail system. The

format for e-mail address shall be the first name

initial and surname; where the e-mail address is

not unique, the middle name initial and surname

shall be used. Job titles shall not be displayed

along with user name.

iv.

Anti-virus

administrator

shall

send

out

information whenever there is an anti-virus

update in line with the DB anti-virus policy

administered by ITG.

v.

E-mail administrator shall investigate all reported

cases of usage problems such as loss of sensitive

DB information, disclosure to unauthorised

parties, unauthorised use of DB system, lost or

stolen or disclosed passwords or other system

access control mechanism, missing files, frequent

system crashes, misrouted messages etc

vi.

The e-mail administrator shall ensure that the

following message is inserted at the foot of all

outbound external e-mails:

The Information contained and transmitted by

this e-mail is proprietary to Diamond Bank

Limited and/or its Customer and is intended for

use only by the individual or entity to which it is

addressed, and may contain information that is

privileged, confidential or exempt from a

disclosure under applicable law. If this is a

forwarded message, the content of this e-mail

may not have been sent with the authority of the

Bank. Diamond Bank Limited shall not be liable

Diamond Bank

Business Process

Assurance

Page 16 of 176

Subject:

IT Policies, Procedures & Standards

August 5, 2015

for any mails sent without due authorisation or

through unauthorised access. If you are not the

intended recipient, an agent of the intended

recipient or a person responsible for delivering

the information to the named recipient, you are

notified that any use, distribution, transmission,

printing, copying or dissemination of this

information in any way or in any manner is

strictly prohibited.

If you have received this communication in error,

please delete this mail and notify us immediately

at info@diamondbank.com

vii.

E-mail Administrator is responsible for the

administration of this

Policy, therefore questions about this policy may

be directed to the e-mail Administrator

2.

DB supervisors shall ensure that employees under their

supervision implement e-mail security measures as

defined in this document.

3.

Corporate Affairs Unit shall be responsible for managing

Info@diamondbank.com e-mail account.

4.

Human Capital Management shall notify ITG of any

change in employees status.

Diamond Bank

Business Process

Assurance

Page 17 of 176

Subject:

IT Policies, Procedures & Standards

Subject

Business Application

Support-Back up Policy

Effective

Date

PPS No.

PPS-DB-004

Review Date

REVISION:

August 5, 2015

SUBJECT:

SERIAL #000 000/01

COMPLETE_____

PARTIAL_______

AREA CORRECTED:

N/A

SUPERCEDES/REPLACES:

BUSINESS APPLICATION PAGE #1 of 11

SUPPORT

BACKUP POLICY

FORM NUMBER:

N/A

ISSUED DATE:

31 AUGUST

2009

REVISION

DATE:

31 AUGUST

2009

I. AFFECTS

All staff on Diamond Bank Plc and its subsidiaries.

II. PURPOSE

To establish guidelines for the backup of IT Services infrastructure

throughout the Bank.

III. INTRODUCTION

The aim of this back-up policy is to ensure that all IT Services infrastructures

acting as hosts to mission-critical applications (i.e. with zero downtime) such as

Flexcube, ATM, DBPool, Diamondonline etc and others alike have up-to-date and

adequate backups to mitigate disasters or recover historical information. These

infrastructures include Operating systems, applications, databases, system

configurations and any other file documents. The main objective of the back-up

procedure is to ensure that files and directories can be recovered in case of

corruption or system failure.

IV. POLICIES

Diamond Bank

Business Process

Assurance

Page 18 of 176

Subject:

1.

2.

3.

4.

5.

6.

IT Policies, Procedures & Standards

August 5, 2015

Only authorized IT Services staff shall be allowed to

backup critical applications.

Any changes to the database or file shall necessitate a

backup of the change by the Database Administrator or the

Application Administrator.

Full system backup of all application and database servers

shall be performed once every quarter by the Database

Administrator or Application Administrator to ensure the bank

has a reference point for recovery when necessary.

Each Application Administrator shall maintain a logbook

for logging all application backups under their custody and these

shall be kept with the librarian.

No backup tape shall be re-used more than 30 times in its

life span

Duplicate copies of all End of Day (EOD) and off-cycle

backups shall be moved to the off-site storage location by the

software librarian the next working day following the backup

date.

V. GENERAL PROCEDURES

1.

Backup Type:

This refers to the target data to be backed-up and a combination

of backup types which may be needed to quickly recover the

system and the operation. The following types of backups shall

be carried out:

Full System Backup: The full system backup makes a copy of

the system files, including the systems software, utilities,

applications software and data. Since this process takes quite

a lot of time to conclude, the operation shall be performed

quarterly or when a major change is made on the system. .

The backup tapes shall then be tested by the application administrator

for readability after each back up.

File System Backup: These are file systems backup.

End of Day Backup: This refers to backup of data, data tables

and files of a database taken at the end of each day. The

backup contains both historic and new data for each day.

Database Backup: This involves using Microsoft SQL or

Oracle backup commands to backup the respective

databases. Database objects are exported to files in an Oracle

database, while Microsoft SQL utilizes the backup scripts in

the application. This may be daily or monthly depending on

the criticality of the application and the frequency of change.

Diamond Bank

Business Process

Assurance

Page 19 of 176

Subject:

2.

IT Policies, Procedures & Standards

August 5, 2015

File/Directory Backup: This refers to the backup of

Application and User-Created Files and/or Directories. They

include Image files, Application files, Reports, etc.

Archive logs: These are proprietary Oracle archive log files

backups

Snapshots: A Snapshot or Business copy as the name implies

is a process where an image of the Oracle database is taken

at preset intervals or manually initiated.

Swap: There shall be a rotation of all critical Servers and

their backups on a weekly basis and according to a schedule

to be approved by the Ag. Div Head, IT Services. The format

of this schedule would be as highlighted in the attached

appendix.

Clone: This refers to process of making copies of an existing

missioncritical application whenever there is a major change

on that system, into a compressed image file that is

restorable.

RMAN: Oracle Recovery Manager (RMAN), a command-line

and Enterprise Manager-based tool, is the Oracle-preferred

method for efficiently backing up and recovering your Oracle

database.

Backup Frequency:

This refers to the number of times the backup will be taken

which will be determined by the frequency of change to the

data, the criticality of the data and the need for retrieval of the

data.

Any changes to the database or file must necessitate a backup of

the change by the Database Administrator or the Application

Administrator as the case may be.

If the changes are application specific then Backups shall be

taken as frequently as the changes, by the Application

Administrator.

Full System Backup of all application and database servers shall

be taken once every quarter by the DBA or Application

Administrator to ensure the bank has a reference point for

recovery when necessary.

All critical servers shall be configured in a load balancing

architecture and the Application Administrator shall ensure that

all servers involved in the load balancing configuration are

always in sync at all times for business continuity.

Please refer to the attached schedule for backup frequency of IT

Infrastructure. This will be updated from time to time.

Diamond Bank

Business Process

Assurance

Page 20 of 176

Subject:

3.

IT Policies, Procedures & Standards

August 5, 2015

Back-up Media Labeling:

The acceptable backup media to be used in the bank include:

Ultrium Tapes, CD-ROM, DDS/DAT Tapes, DLT Tapes, USB drive

and hard drives.

The Backup media should be identified as follows for DDS/DAT

Tapes, DLT Tapes, and CD-ROMs:

BACKUP TITLE

BACKUP TYPE

BACKUP DATE

BACKUP SET

BACKUP SEQUENCE

BAR CODE

a. Where DDS, DAT or DLT are used, the DBA or Application Administrator

shall label the tape using the format below

1. BACKUP TITLE (e.g. FCAT_DB, ECPIX, SWIFT, etc).

2. BACKUP TYPE:

FULL SYSTEM BACKUP abbreviated to FSBK

APPLICATION BACKUP abbreviated to ABK

DATABASE BACKUP abbreviated to DBBK

3. BACKUP DATE: DD/MM/YY

4. BACKUP SET ( SET1 for On-site and SET 2 for Off-site)

5. BACKUP SEQUENCE is either 1 of X; 2 of X (where X is the total

number of tapes used)

b. Where Snapshot or RMAN backups are taken using the Data Protector,

the System Administrator shall append the bar code label to the Ultrium

Tape media before loading the Tape library, which can also to generate

catalogue. This shall be scanned by the System and a log of the contents

saved.

4.

Backup Logs:

Each Application Administrator shall maintain a logbook for logging all

application backups under their custody and these shall be kept with the

librarian. Any backup taken must be registered in the appropriate backup

logbook by the Application Administrator or his designate and submitted to the

librarian same day.

These logbooks shall be kept in the transit safe in IT

Services and shall be reviewed by the Librarian daily. The Librarian shall

prepare an exception report of any missing application backup and this shall

be reviewed by the Strategic and Security Controls personnel before notifying

the affected unit.

The log must capture the following details:

Backup Title

Backup Type

Backup Date

Backup Administrator

Signature

Backup checked/verified by

Remark

Diamond Bank

Business Process

Assurance

Page 21 of 176

Subject:

IT Policies, Procedures & Standards

August 5, 2015

The System Administrator shall generate the backup logs for all Snapshot and

RMAN backups taken on the Data Protector Cell Manager. This will be

reviewed and filed by the Librarian daily.

5.

On-site back-up media storage

The on-site storage location is at the Head Office. The fireproof data safe

located in IT Services office and on the ground floor of the head office, hosts all

backup media and access to it via a manual key lock.

Two sets of backup must be taken as a matter of policy except where a formal

waiver is granted by the Group Head/Ag. Div Head, IT Services in unavoidable

circumstances. A set of the back up media must be received into the library at

the agreed time set out in the schedule attached. The librarian shall ensure

that all Tape movements in and out of the on-site storage are properly logged

in the on-site/offsite tape movement log.

Access to the main on-site safe is via a manual lock key. One of the keys shall

be kept by the librarian while copies shall be kept in a designated location in

line with the banks disaster recovery plan. Only the software librarian or his

backup will have access to this safe unless otherwise authorized by Ag. Div Ag.

Div Head, IT Services.

6.

Transit Media Storage

EOD (including off-cycle) backup tapes and logbooks shall be kept in the

transit fire-proof data safe located in the IT Services main office. This transit

safe shall be under the custody of the Librarian but shall be accessible to any

staff of IT Services for storing and logging any backup taken. These tapes shall

be evacuated daily to either the on-site /off-site storage areas by the librarian.

7.

Application Software CDs

The Librarian shall keep the original copies of all Application CDs in the

secondary on-site safe while duplicates shall be retained at the primary on-site

safe. A CD request logbook shall be maintained by the librarian for logging any

request for such media by IT Services Staff. Only duplicates of the Application

CDs shall be available for borrowing, the originals would be permanently kept

in the secondary on-site safe.

The CD request logbook must capture the following details:

8.

Date Borrowed

Description

Quantity

Borrower

Unit/Department

Signature

Date Returned

Librarians Remark

Borrowers Sign-off

Librarians Sign-off

Requests for Media

Staff requesting for blank CDs, Tapes, etc. shall obtain due

approval from their supervisor and forward to the Librarian for

action. The librarian shall escalate this request to the Head BAS

Diamond Bank

Business Process

Assurance

Page 22 of 176

Subject:

IT Policies, Procedures & Standards

August 5, 2015

or his designate for approval before processing. The Head of BAS

approves request and the staff receive the media not later than an

hour after approval is granted.

The librarian shall on a weekly basis review the re-order level and request for

CDs from Admin Services where necessary.

9.

Off-site back up media storage

Duplicate copies of all EOD and off-cycle backups shall be moved to the off-site

storage location by the software librarian the next working day following the

backup date. Details of these tapes shall be logged in the on-site/offsite tape

movement register by the librarian and kept in the fireproof data safe at the

off-site location. Similarly, the librarian shall retrieve all expired tapes from the

off-site safe for re-use. The backup media shall be transported to the off-site

location in a secure, unmarked and environmentally sound box or bag. The

pool car attached to IT Services shall be used for this purpose. As much as is

practicable the media must not be carried using public transport, however, in

some exceptional circumstances, Ag. Div Head, IT Services could approve the

use of other forms of transportation. Access to the safe is via a manual lock

key. One of the keys is locked up in the on-site safe while copies of it shall be

kept in a designated location in line with the banks disaster recovery plan.

Only the software librarian or his backup will have access to this safe unless

otherwise authorized by Ag. Div Head, IT Services.

10. Backup Tape Retention Period:

To be determined by the frequency of reference or possible need for archived

data. (See attached schedule for the applicable recycle frequency)

No tape should be re-used more than 30 times.

11. Mock Restoration / Server Swap

Mock restoration shall be performed of the backed up data on periodic

intervals. This will ensure that the data backed up is in a readable format in

the media. All servers with a dedicated backup machine will have the tape

restored on the backup machine immediately the backup is taken. At this point

the backup tape is tested. However, the backup server, which must always be

in sync with the live server, will be tested on live situation on a quarterly basis

for one week. In case of servers that do not have a dedicated backup machine,

the verify backup must be checked to enable the tape drive verify what has

been written on the tape. A readability test shall be performed by opening at

least one file upon completion of backup. Where a tape is unreadable, the

backup will be re-performed. The test restoration should be logged in the

backup logbook.

VI. ROLES AND RESPONSIBILITIES

Diamond Bank

Business Process

Assurance

Page 23 of 176

Subject:

i.

ii.

IT Policies, Procedures & Standards

August 5, 2015

The Backup Administrators shall ensure that all backups relating to their job

functions are duly completed in line with the backup plan.

The Librarian shall perform daily review of backup register to ensure

completeness and accuracy of backup.

iii.

The librarian shall perform daily review of backup tapes stored onsite and

off-site (i.e. Daily backup tapes) to ensure appropriate labelling and

completeness of contents.

iv.

The librarian shall ensure that all tape movements in and out of the onsite/off-site media storage are properly logged in the on-site/off-site tape

movement log.

v.

The Policy, Standard Governance personnel shall perform monthly review of

the backup register and system generated backup logs to verify consistent

performance of backup, and sign-off on the register to evidence review.

vi.

The Policy, Standard Governance personnel in conjunction with the System

Administrator(s) shall perform backup restoration test based on the

restoration plan.

vii.

The Policy, Standard Governance personnel shall perform monthly review of

the on-site/off-site tape movement register for propriety.

Diamond Bank

Business Process

Assurance

Page 24 of 176

Subject:

Business Continuity Planning Policy

August 5, 2015

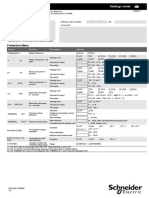

APPENDIX A- BACKUP PLAN

TYPE OF

BACKUP

PPLICATION

NTERNET BANKING

PPLICATION (FCAT_APP)

NTERNET BANKING

ATABASE (FCAT_DB)

NTERNET BANKING WEB

ERVER (FCAT_WEB)

C/TELE-BANKING

C/TELE-BANKING SERVER

MOBILE BANKING SERVER

MOBILE BANKING

WESTERN UNION SERVER

WESTERN UNION

TM

ARDWORLD

PAY

LEXCUBE DATABASE

LEXCUBE DATABASE

ARCHIVELOG)

WIFT

CPIX SERVER

D SERVER

CEED

IXED ASSET / INVENTORY

YIMAGE

ERVICE DESK

CALLOVER

FASS APPLICATION

RADETRACKER

TGS

ERVER-016

P UNIX SERVER

CHANGESVR01 (EXCHANGE

ERVER)

CHANGESVR02 (EXCHANGE

ERVER)

CHANGESVR03 (EXCHANGE

ERVER)

IAM21 (PRIMARY DOMAIN

Diamond Bank

BACKUP TITLE

FREQUENCY

RETENTIO

N

Full System

Snapshot /

RMAN

FCAT_APP

Bi-Monthly

Yearly

FCAT_DB

Daily

Bi-Monthly

Full System

Database

Full System

Full System

Database

Full System

Database

Database

Database

Database

Snapshot /

RMAN

FCAT_WEB

PCTEL_DB

PCTEL_APP

SMSBNK_APP

SMSBNK_DB

WU_APP

WU_DB

ATM

CARDSOFT

CARDPRO

Bi-Monthly

Weekly

Bi-Monthly

Bi-Monthly

Weekly

Quarterly

Weekly

Daily

Daily

Daily

Yearly

Quarterly

Yearly

Yearly

Quarterly

Yearly

Quarterly

Weekly

Monthly

Monthly

FCR / FCC

FCR_ARCH/FCC_ARCH/FCAT_A

RCH

SWIFT

Daily

Bi-Monthly

Daily

Daily

Bi-Annual

Weekly

ECPIX

Daily

Monthly

Archive log

Database

Full

System/Data

base

Full

System/Data

base

Database

Full

System/Data

base

Full System

Database

Full System

Database

Database

Database

Database

File System

RESPO

IT Ope

IT Ope

IT Ope

IT

IT

IT

IT

IT

IT

IT

IT

IT

IT

Ope

Ope

Ope

Ope

Ope

Ope

Ope

Ope

Ope

Ope

IT Ope

IT Ope

IT Ope

IT Ope

KD

XCEED

Daily

Daily

Monthly

Monthly

FIXED_ASSET

ZYIMAGE

SDESK

ECALL

EFASS

TRADETRACK

RTGS

BR016_DB

DIAM X

Weekly

Weekly

Daily

Daily

Daily/Weekly

Daily

Weekly

Daily

Weekly

Monthly

Monthly

Weekly

Monthly

Monthly

Monthly

Monthly

Monthly

2 Weeks

Full Online

XCHANGESVR01

Daily

Quarterly

Full Online

XCHANGESVR02

Daily

Monthly

Full Online

System State

XCHANGESVR02

DC

Daily

Quarterly

Monthly

Quarterly

Business Process

Assurance

Page 25 of 176

IT Ope

IT Ope

IT

IT

IT

IT

IT

IT

IT

IT

IT

Ope

Ope

Ope

Ope

Ope

Ope

Ope

Ope

Ope

IT Ope

IT Ope

IT Ope

Subject:

Business Continuity Planning Policy

August 5, 2015

ONTROLLER)

System

State/Databa

se

System

State/Databa

se

PO

HAREPOINT PORTAL

ISCO ROUTERS AND

WITCHES

IT Ope

EPO

Quarterly

Quarterly

IT Ope

SHAREPOINT

Daily

Weekly

Application

CISCO

Monthly

Yearly

Database

Database

Database

Database

Database

Database

Database

Database

Database

DBPOOL

DBSERVICEDESK

MSME

DBAPPRAISE

DB CALL CARD

CP ONLINE

DB VISA

VPAY CARD PRO

DBPOOL

Weekly

Weekly

Weekly

Weekly

Weekly

Weekly

Weekly

Weekly

Weekly

Monthly

Monthly

Monthly

Monthly

Monthly

Monthly

Monthly

Monthly

Monthly

IT Ope

BPOOL

BSERVICEDESK

MSME

BAPPRAISE

B CALL CARD

P ONLINE

B VISA

PAY CARD PRO

B TOD

Tech

Tech

Tech

Tech

Tech

Tech

Tech

Tech

Tech

S

S

S

S

S

S

S

S

S

RESTORATION SCHEDULE

PPLICATION

NTERNET BANKING

PPLICATION

FCAT_APP)

NTERNET BANKING

ATABASE (FCAT_DB)

NTERNET BANKING

WEB SERVER

FCAT_WEB)

C/TELE-BANKING

C/TELE-BANKING

ERVER

MOBILE BANKING

ERVER

MOBILE BANKING

WESTERN UNION

ERVER

WESTERN UNION

TYPE OF

BACKUP

Full System

Snapshot /

RMAN

BACKUP TITLE

FREQUENC

Y

RETENTION

RESPONS

FCAT_APP

Bi-Monthly

Yearly

FCAT_DB

Daily

Bi-Monthly

IT Operatio

IT Operatio

IT Operatio

Full System

Database

FCAT_WEB

PCTEL_DB

Bi-Monthly

Weekly

Yearly

Quarterly

Full System

PCTEL_APP

Bi-Monthly

Yearly

Full System

Database

SMSBNK_APP

SMSBNK_DB

Bi-Monthly

Weekly

Yearly

Quarterly

Full System

Database

WU_APP

WU_DB

Quarterly

Weekly

Yearly

Quarterly

Diamond Bank

Business Process

Assurance

Page 26 of 176

IT Operatio

IT Operatio

IT Operatio

IT Operatio

IT Operatio

IT Operatio

Subject:

TM

ARDWORLD

PAY

LEXCUBE DATABASE

LEXCUBE DATABASE

ARCHIVELOG)

WIFT

CPIX SERVER

D SERVER

CEED

IXED ASSET /

NVENTORY

YIMAGE

ERVICE DESK

CALLOVER

FASS APPLICATION

RADETRACKER

TGS

ERVER-016

P UNIX SERVER

CHANGESVR01

EXCHANGE SERVER)

CHANGESVR02

EXCHANGE SERVER)

CHANGESVR03

EXCHANGE SERVER)

IAM21 (PRIMARY

OMAIN CONTROLLER)

PO

HAREPOINT PORTAL

ISCO ROUTERS AND

WITCHES

BPOOL

BSERVICEDESK

MSME

BAPPRAISE

B CALL CARD

P ONLINE

B VISA

Business Continuity Planning Policy

Database

Database

Database

Snapshot /

RMAN

Archive log

Database

Full

System/Data

base

Full

System/Data

base

Database

Full

System/Data

base

Full System

Database

Full System

Database

Database

Database

Database

File System

August 5, 2015

ATM

CARDSOFT

CARDPRO

Daily

Daily

Daily

Weekly

Monthly

Monthly

FCR / FCC

FCR_ARCH/FCC_ARCH/FCAT_A

RCH

SWIFT

Daily

Bi-Monthly

Daily

Daily

Bi-Annual

Weekly

ECPIX

Daily

Monthly

Operatio

Operatio

Operatio

Operatio

IT Operatio

IT Operatio

IT Operatio

IT Operatio

KD

XCEED

Daily

Daily

Monthly

Monthly

FIXED_ASSET

ZYIMAGE

SDESK

ECALL

EFASS

TRADETRACK

RTGS

BR016_DB

DIAM X

Weekly

Weekly

Daily

Daily

Daily/Weekly

Daily

Weekly

Daily

Weekly

Monthly

Monthly

Weekly

Monthly

Monthly

Monthly

Monthly

Monthly

2 Weeks

Full Online

XCHANGESVR01

Daily

Quarterly

Full Online

XCHANGESVR02

Daily

Monthly

Full Online

XCHANGESVR02

Daily

Monthly

System State

System

State/Databa

se

System

State/Databa

se

DC

Quarterly

Quarterly

SHAREPOINT

Daily

Weekly

Application

CISCO

Monthly

Yearly

Database

Database

Database

Database

Database

Database

Database

DBPOOL

DBSERVICEDESK

MSME

DBAPPRAISE

DB CALL CARD

CP ONLINE

DB VISA

Weekly

Weekly

Weekly

Weekly

Weekly

Weekly

Weekly

Monthly

Monthly

Monthly

Monthly

Monthly

Monthly

Monthly

Diamond Bank

IT

IT

IT

IT

IT Operatio

IT Operatio

IT

IT

IT

IT

IT

IT

IT

IT

IT

Operatio

Operatio

Operatio

Operatio

Operatio

Operatio

Operatio

Operatio

Operatio

IT Operatio

IT Operatio

IT Operatio

IT Operatio

EPO

Quarterly

Quarterly

IT Operatio

Business Process

Assurance

Page 27 of 176

IT Operatio

Tech

Tech

Tech

Tech

Tech

Tech

Tech

Solut

Solut

Solut

Solut

Solut

Solut

Solut

Subject:

PAY CARD PRO

B TOD

Business Continuity Planning Policy

Database

Database

VPAY CARD PRO

DBPOOL

August 5, 2015

Weekly

Weekly

Monthly

Monthly

Sign-Of

Name & Signature____________________________

Head, Information Technology Operations

Date _____________________

Name & Signature____________________________

Head, Business and Technology Solutions

Date _____________________

Name & Signature____________________________

Ag. Head, System Engineering

Date _____________________

Name & Signature____________________________ Date _____________________

Head, Groupwide Information Technology Services

Name & Signature____________________________ Date _____________________

Executive Director, Customer Services and Technology.

Diamond Bank

Business Process

Assurance

Page 28 of 176

Tech Solut

Tech Solut

Subject:

Subject

PPS No.

Business Continuity Planning Policy

August 5, 2015

Technology SupportNetwork Operating

System Maintenance

Effective

Date

PPS-DB-005

Review Date

REVISION:

SUBJECT:

COMPLETE__X___

TECHNOLOGY

SUPPORT-

PARTIAL_______

AREA CORRECTED:

SERIAL #. 24005

PAGE #15 of 17

NETWORK OPERATING

SYSTEMS

ISSUED DATE:

MAINTENANCE

VARIOUS

SUPERSEDES/REPLACE

S:

N/A

Diamond Bank

OCTOBER

2005

FORM NUMBER: 240-005

31,

EFFECTIVE

DATE:

OCTOBER

2005

31,

Business Process

Assurance

Page 29 of 176

Subject:

Business Continuity Planning Policy

August 5, 2015

I. AFFECTS

All staff.

II. INTRODUCTION

This section deals with the policies for purchasing, maintaining, tracking and

ensuring physical security of hardware.

Technical Support unit staf are advised to consult the units desk manual for

other technical details relating to the final details of steps involved in

performing the specific functions described in this document.

III. OBJECTIVE

i. To define procedures for tracking and maintaining physical inventory and

movement of hardware assets

ii. To define the procedures that will ensure physical security for hardware

iii. To define procedures for administering Internet access

iv. To define procedures for backup and restore operations.

IV. DESKTOP COMPLIANCE POLICY

i. The desktop PC provided to each user will have a set of standard software

installed. Users will be required to submit a written request or mail

approval to the Head, Operations & Technology for any additional software

installation on their systems.

ii. A mail and domain id will also be created when a person joins the

organisation via an approval mail from his/her Supervisor. The domain ids

will be in the form: first name initial+ last name. Mail ids will normally be of

the form first name initial. Last name @ diamondbank.com. The individual

will retain these mail ids until he/she leaves the bank.

iii. Domain ids get locked after a preset number of wrong tries for security

reasons. Guest logins will be disabled on all PCs to prevent any anonymous

access. In cases where specific software demands Local Admin Rights, the

same will have to be approved and authorised by the Head, Operations &

Technology

iv. Users will be advised to protect important files with a password. Password

protection will be the first level of security for any file. The Diamond Bank

security implementations will be based on existing Information Security

guidelines. Current implementations at Diamond Bank include policy

guidelines for NT servers and NT workstations. The implementation of

Diamond Bank

Business Process

Assurance

Page 30 of 176

Subject:

Business Continuity Planning Policy

August 5, 2015

security policy for NT workstations has been limited to certain identified

individuals within the IT Services based on their roles and job functions.

Some workstations have been excluded from this list due to the specific

nature of their users work, which requires them to have local administrator

rights to their own workstations.

v. Users will be educated through various means about the implications of

using unlicensed software. Additionally, they will be discouraged from

storing games, pornographic material, unauthorised wallpapers and screen

savers. Organisation-wide screen saver parameters have been set for all

users. Users will have to shutdown and power off their systems before they

leave at the end of the day.

V. ASSET MANAGEMENT

Asset Management is the process of tracking and maintaining a physical

inventory of hardware assets procured by IT Services. These assets will

include the desktops, laptops and spares used within the organisational

premises. IT Services will maintain an inventory of these assets. A physical

verification of these assets will be performed on a quarterly basis. Spares,

which will be maintained in storage areas, are also included in the final

inventory list. These will be used in ensuring quick turnaround in the event

of failure.

1. PURCHASE OF HARDWARE

1. Equipment are usually bought in bulk

2. Forward estimate of the number of equipment and equipment specification

to admin (in line with budgetary constraints)

3. Admin sends quotes for specifications to the vendors. Extra budgetary

approvals have to be sought for equipment replacements as they were not

catered for in the budget

4. Vendor supplies equipments (this is usually delivered at the Marina store)

5. Confirm that equipment supplied by vendor is in line with specifications

sent to Admin

6. Assigned TS staff sign off on delivery form.

2. ALLOCATION OF HARDWARE

This process follows after the hardware has been purchase following the

process described in the purchase of hardware above.

1.

2.

3.

4.

5.

6.

Allocate hardware to the user

Assign asset code to the new PC

Inform user of the availability of hardware by e-mail

Fill the equipment movement form

Hardware is moved to the user department/location

User confirms receipt of equipment by mail or an acknowledgement letter.

Diamond Bank

Business Process

Assurance

Page 31 of 176

Subject:

Business Continuity Planning Policy

August 5, 2015

In the case of reallocation,

1.

2.

3.

4.

Unit head request for reallocation of hardware via email

Head TS approves request

Assigned TS staff performs reallocation of hardware

TS staff updates the asset register with activity performed.

3. OPERATING SYSTEMS MAINTENANCE

Hardware systems such as the printer, laptops, computers etc have to be in

good working condition and thus, it is necessary for proper maintenance to be

carried out on these systems.

A. FAULT RESOLUTION PROCEDURE

Failed systems are usually sent to the head office by the user/user department.

For offices outside Lagos, the failed systems are usually moved to the Regional

Offices in these locations.

1. User logs fault via email, phone call or the help desk (users are usually

encouraged to use the help desk)

2. TS staff tries to diagnose the nature of problem

3. If it can be resolved immediately via email, phone or help desk, TS staff

resolves fault.

4. On the other hand, if the system has to be moved to the TS unit, TS staff

informs user of the need to send the system to TS

5. User/designate logs faulty system at the reception using the equipment

movement form

6. Receive system from the user/designate

7. Allocate stop gaps to user if available

8. If a stop gap is not available, re-route the affected department to a

department or unit nearer to it ( for printers, fax machines and

photocopiers)

9. For equipment under warranty, send to the vendor for necessary repairs

10. If the faults are minor, resolve faults

11. Send mail to inform user, system has been repaired

12. User fills equipment movement form

13. Handover system to user.

On the other hand, if there is a need to use parts, in addition to processes 1 8

above;

1. Inform Head TSU of the need to request for parts

2. Head TSU approves request for parts

3. Send mail with part details to admin requesting for parts

Diamond Bank

Business Process

Assurance

Page 32 of 176

Subject:

Business Continuity Planning Policy

August 5, 2015

4. Sign off on vendor delivery note

5. Head TS appends delivery note

6. Receive parts from Admin

7. Resolve faults

8. Send mail to inform user that the system has been repaired

9. User fills equipment movement form

10. Hand over system to user.

Diamond Bank

Business Process

Assurance

Page 33 of 176

Subject:

Business Continuity Planning Policy

August 5, 2015

Subject

Technology Support

-Documents Rights

Management

Effective

Date

PPS No.

PPS-DB-006

Review Date

REVISION:

SUBJECT:

SERIAL #. 240-011

COMPLETE__X___

TECHNOLOGY

SUPPORT-

PAGE #48 of 55

PARTIAL_______

AREA CORRECTED:

DOCUMENTS RIGHTS

MANAGEMENT

VARIOUS

SUPERSEDES/REPLACE

S:

ISSUED DATE:

21 OCTOBER 2008

FORM NUMBER: 240-011

EFFECTIVE DATE:

21 OCTOBER 2008

N/A

I. AFFECTS:

All staff.

II. PURPOSE

To define guidelines for protecting the Banks valuable and classified

information from unauthorized usage and circulation.

III. INTRODUCTION

The need to protect the Banks information assets from abuse and mishandling resulted in the implementation of E-mail and Internet Security

Policies in 2003. However with growing concerns about information

theft, the need to devise better information security management cannot

be over-emphasized.

To address this need, Management has approved the introduction of

Microsoft Windows Rights Management Services (RMS) to help

Diamond Bank

Business Process

Assurance

Page 34 of 176

Subject:

Business Continuity Planning Policy

August 5, 2015

safeguard digital information from unauthorised use- both online and

offline as well as inside and outside of the banks network. RMS enabled

applications protects information by assigning usage rights and

conditions which remain with the information irrespective of where it is

distributed. Windows Right Management addresses the Banks security

needs with respect to information misuse and wrong dissemination. .

The policies and procedures detailed in this manual define the roles and

responsibilities of key stakeholders. The policy shall be read in

conjunction with existing policies on Email and Internet Security.

IV. POLICIES AND PROCEDURES

1. Sensitive digital information shall be right-protected using Microsoft

Windows Rights Management Services (RMS). Technology Support

Group (TSG) shall be responsible for implementing RMS enabled

application bankwide.

2. All emails containing classified and confidential information must be

right-protected by the sender before dissemination to staff. Such mails

shall NOT be distributed or forwarded to external email addresses or

persons outside the banks network domain.

3. Information distributed through the Administrator profile or any of

the designated mailing groups (e.g. Business Process Assurance,

ALCO, Credit Admin etc) must be secured using the Rights

Management Services (RMS). Access to such mails must be limited to

read only while other features such as printing, copying, saving,

forwarding etc shall be deactivated.

4. Proprietary information such as project related documents,

confidential reports, policy documents, new product papers, budget

documents, product programs, approved credit forms etc included as

an attachment to any mail must be protected and access restricted to

only authorised users. Recipients of these mails shall have a read

only access to the attachment unless other permission is granted by

the originator.

5. All sensitive documents on the intranet and public folder (soon to be

migrated to share point) must be protected from unauthorised access

and distribution by user unit. Only users granted read only access

shall be able to view information on these documents.

Diamond Bank

Business Process

Assurance

Page 35 of 176

Subject:

Business Continuity Planning Policy

August 5, 2015

6. Confidential and sensitive information on official laptops and other

work tools such as Blackberry must be right protected by assigned

users. Full restriction must be imposed on any document saved on

such work tools.

7. The procedure for applying protection on documents and emails shall

apply as highlighted in the user manual (refer to appendix section).

This shall be the sole responsibility of the staff producing the

documents.

V. BENEFITS OF IMPLEMENTING RMS

1.

2.

3.

4.

5.

RMS helps protect information through consistent adherence to

the set RMS policy

Restricts ability to print, save, copy or forward, secured office

documents and emails - within or outside the banks network.

Ability to selectively grant different permissions to different group

of users.

Helps to safeguard proprietary information within the bank as well

as documents that are distributed to authorised entities.

Ease of implementation i.e RMS is designed to minimize the effort

required to implement rights management.

Diamond Bank

Business Process

Assurance

Page 36 of 176

Subject:

Business Continuity Planning Policy

August 5, 2015

VI. ROLES AND RESPONSIBILITIES

1.

Technology Support Group

TSG shall be responsible for:

i.

Managing the RMS environment through centralised

administration..

ii.

Providing technical support to all users of the RMS enabled

applications.

iii.

Send awareness mail on fortnight basis to all staff sensitizing

them on the need to right protect their documents.

2.

Corporate Audit

System Audit staff shall be responsible for:

i.

Performing sample checks on mails forwarded from

Administrator and other mailing groups to ensure compliance with

the policy.

ii.

Investigating any cases of violation of this policy by staff of the

Bank.

3.

All Staff

Staff of the bank shall be responsible for:

i.

Ensuring that all documents containing vital information are

right protected as appropriate.

Diamond Bank

Business Process

Assurance

Page 37 of 176

Subject:

Business Continuity Planning Policy

August 5, 2015

Appendix

Using Rights Management to create a Protected Document

To assign RM permissions to a document created in an Office program, click

File | Permission. As shown in figure A, the default is Unrestricted Access.

FIGURE A

If you want to allow a user to view the document, but you dont want him/her

to be able to distribute it to others, select Do Not Distribute from the menu.

This will display the Permission dialog box that is shown in Figure B.

Diamond Bank

Business Process

Assurance

Page 38 of 176

Subject:

Business Continuity Planning Policy

August 5, 2015

FIGURE B

As you can see, you can enter users email addresses or select them from the

Address Book. If you want the users to be able to read the document but do

nothing to it, enter them in the Read text box. If you want them to be able to

edit the document, but want to keep them from copying or printing it, enter

them in the Change text box.

You can set permissions more granularly, or cause the users access to the

document to expire completely on a specified date, by clicking the More

Options button. This will display the dialog box shown in Figure C.

Diamond Bank

Business Process

Assurance

Page 39 of 176

Subject:

Business Continuity Planning Policy

August 5, 2015

FIGURE C

Remember that any users who are assigned rights with IRM will need to have

certificates from an RM server. To open the document, they might have to

install the client update software if this is the first time theyve opened an RM

protected document. If they dont already have Passport accounts, theyll need

to create them. Finally, theyll have to download RM certificates.

To assign RM permissions to an email in outlook.

Click on New mail message, on the new mail message, click on file, and then

click on permissions. You can now select do not forward to prevent your mails

from being forward to another recipient.

Diamond Bank

Business Process

Assurance

Page 40 of 176

Subject:

Business Continuity Planning Policy

Diamond Bank

August 5, 2015

Business Process

Assurance

Page 41 of 176

Subject:

Business Continuity Planning Policy

August 5, 2015

Subject

Business Application

Support-Database Policy

Effective

Date

PPS No.

PPS-DB-007

Review Date

REVISION:

SUBJECT:

COMPLETE__X___

BUSINESS

APPLICATION SUPPORT PAGE #31 of 129

DATABASE POLICY

PARTIAL_______

SERIAL #. 270-06

AREA CORRECTED:

ISSUED DATE:

VARIOUS

14

2005

SUPERSEDES/REPLA

CES:

FORM NUMBER: 270-006

N/A

SEPTEMBER

EFFECTIVE DATE:

14

2005

SEPTEMBER

VII. AFFECTS

All staff on DB Network (i.e. Diamond Bank Plc and its subsidiaries)

Database(s)

VIII. PURPOSE

This policy document aims at:

1. Providing specific instructions on the roles and responsibilities of the

Database Administrator(s) in DB Network Databases

2. Ensuring that the integrity of the Database(s) is/are maintained

3. Ensuring that only authorized users/applications are granted access to the

database

4. Ensuring that data are safeguarded from corruption and unauthorized

access.

5. Defining database procedures for continuity of business and disaster

recovery

6. Ensuring database availability at all times

Diamond Bank

Business Process

Assurance

Page 42 of 176

Subject:

Business Continuity Planning Policy

August 5, 2015

IX. INTRODUCTION

A database, simply put, is an organized collection of information or data. It is

a store of data that describes entities and the relationships between the

entities.. A database management system (e.g. Oracle, MSSQL) on the other

hand, is the software mechanism for managing the data.

Databases can be classified into the following types viz;

Analytic Databases

Operational Databases

Hierarchical Databases

Network Databases

Relational Databases

Client/Server Databases

In a relational database management system (e.g. Oracle, MSSQL), data is

stored in a tabular form and identified by rows and columns.