Advanced Accounting 23

Diunggah oleh

2Ng0Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Advanced Accounting 23

Diunggah oleh

2Ng0Hak Cipta:

Format Tersedia

Chapter 02 - Consolidation of Financial Information

Chapter02

ConsolidationofFinancialInformation

MultipleChoiceQuestions

1.Atthedateofanacquisitionwhichisnotabargainpurchase,theacquisitionmethod

A.Consolidatesthesubsidiary'sassetsatfairvalueandtheliabilitiesatbookvalue

B.Consolidatesallsubsidiaryassetsandliabilitiesatbookvalue

C.Consolidatesallsubsidiaryassetsandliabilitiesatfairvalue

D.Consolidatescurrentassetsandliabilitiesatbookvalue,longtermassetsandliabilitiesat

fairvalue

E.Consolidatesthesubsidiary'sassetsatbookvalueandtheliabilitiesatfairvalue

Difficulty:Easy

2.Inapurchaseoracquisitionwherecontrolisachieved,howwouldthelandaccountsofthe

parentandthelandaccountsofthesubsidiarybecombined?

A.EntryA

B.EntryB

C.EntryC

D.EntryD

E.EntryE

Difficulty:Medium

2-1

Chapter 02 - Consolidation of Financial Information

3.LisaCo.paidcashforallofthevotingcommonstockofVictoriaCorp.Victoriawill

continuetoexistasaseparatecorporation.EntriesfortheconsolidationofLisaandVictoria

wouldberecordedin

A.Aworksheet

B.Lisa'sgeneraljournal

C.Victoria'sgeneraljournal

D.Victoria'ssecretconsolidationjournal

E.Thegeneraljournalsofbothcompanies

Difficulty:Easy

4.Usingthepurchasemethod,goodwillisgenerallydefinedas:

A.Costoftheinvestmentlessthesubsidiary'sbookvalueatthebeginningoftheyear

B.Costoftheinvestmentlessthesubsidiary'sbookvalueattheacquisitiondate

C.Costoftheinvestmentlessthesubsidiary'sFairValueatthebeginningoftheyear

D.Costoftheinvestmentlessthesubsidiary'sFairValueatacquisitiondate

E.Isnolongerallowedunderfederallaw

Difficulty:Medium

2-2

Chapter 02 - Consolidation of Financial Information

5.Directcombinationcostsandstockissuancecostsareoftenincurredintheprocessof

makingacontrollinginvestmentinanothercompany.Howshouldthosecostsbeaccounted

forinaPurchasetransaction?

A.EntryA

B.EntryB

C.EntryC

D.EntryD

E.EntryE

Difficulty:Medium

2-3

Chapter 02 - Consolidation of Financial Information

6.Directcombinationcostsandstockissuancecostsareoftenincurredintheprocessof

makingacontrollinginvestmentinanothercompany.Howshouldthosecostsbeaccounted

forinanAcquisitiontransaction?

A.EntryA

B.EntryB

C.EntryC

D.EntryD

E.EntryE

Difficulty:Medium

7.Whatistheprimaryaccountingdifferencebetweenaccountingforwhenthesubsidiaryis

dissolvedandwhenthesubsidiaryretainsitsincorporation?

A.Ifthesubsidiaryisdissolved,itwillnotbeoperatedasaseparatedivision

B.Ifthesubsidiaryisdissolved,assetsandliabilitiesareconsolidatedattheirbookvalues

C.Ifthesubsidiaryretainsitsincorporation,therewillbenogoodwillassociatedwiththe

acquisition

D.Ifthesubsidiaryretainsitsincorporation,assetsandliabilitiesareconsolidatedattheir

bookvalues

E.Ifthesubsidiaryretainsitsincorporation,theconsolidationisnotformallyrecordedinthe

accountingrecordsoftheacquiringcompany

Difficulty:Medium

2-4

Chapter 02 - Consolidation of Financial Information

8.AccordingtoSFASNo.141,thepoolingofinterestmethodforbusinesscombinations

A.Ispreferredtothepurchasemethod

B.Isallowedforallnewacquisitions

C.IsnolongerallowedforbusinesscombinationsafterJune30,2001

D.IsnolongerallowedforbusinesscombinationsafterDecember31,2001

E.IsonlyallowedforlargecorporatemergerslikeExxonandMobil

Difficulty:Easy

2-5

Chapter 02 - Consolidation of Financial Information

9.Inapoolingofinterests,

A.Revenuesandexpensesareconsolidatedfortheentirefiscalyear,evenifthecombination

occurredlateintheyear

B.Goodwillmayberecognized

C.Consolidationisaccomplishedusingthefairvaluesofbothcompanies

D.Thetransactionsmayinvolvetheexchangeofpreferredstockordebtsecuritiesaswellas

commonstock

E.Thetransactionisproperlyregardedasanacquisitionofonecompanybyanother

Difficulty:Easy

10.Acompanyisnotrequiredtoconsolidateasubsidiaryinwhichitholdsmorethan50%of

thevotingstockwhen

A.Thesubsidiaryislocatedinaforeigncountry

B.Thesubsidiaryinquestionisafinancesubsidiary

C.Thecompanyholdsmorethan50%butlessthan60%ofthesubsidiary'svotingstock

D.Thecompanyholdslessthan75%ofthesubsidiary'svotingstock

E.Thesubsidiaryisinbankruptcy

Difficulty:Medium

11.Whichoneofthefollowingisacharacteristicofabusinesscombinationthatshouldbe

accountedforasanacquisition?

A.Thecombinationmustinvolvetheexchangeofequitysecuritiesonly

B.Thetransactionestablishesanacquisitionfairvaluebasisforthecompanybeingacquired

C.Thetwocompaniesmaybeaboutthesamesizeanditisdifficulttodeterminetheacquired

companyandtheacquiringcompany

D.Thetransactionmaybeconsideredtobetheunitingoftheownershipinterestsofthe

companiesinvolved

E.Theacquiredsubsidiarymustbesmallerinsizethantheacquiringparent

Difficulty:Easy

2-6

Chapter 02 - Consolidation of Financial Information

12.Whichoneofthefollowingisacharacteristicofabusinesscombinationthatshouldbe

accountedforasapurchase?

A.Thecombinationmustinvolvetheexchangeofequitysecuritiesonly

B.Thetransactionclearlyestablishesanacquisitionpriceforthecompanybeingacquired

C.Thetwocompaniesmaybeaboutthesamesizeanditisdifficulttodeterminetheacquired

companyandtheacquiringcompany

D.Thetransactionmaybeconsideredtobetheunitingoftheownershipinterestsofthe

companiesinvolved

E.Theacquiredsubsidiarymustbesmallerinsizethantheacquiringparent

Difficulty:Easy

13.Astatutorymergerisa(n)

A.Businesscombinationinwhichonlyoneofthetwocompaniescontinuestoexistasalegal

corporation

B.Businesscombinationinwhichbothcompaniescontinuestoexist

C.Acquisitionofacompetitor

D.Acquisitionofasupplieroracustomer

E.Legalproposaltoacquireoutstandingsharesofthetarget'sstock

Difficulty:Medium

2-7

Chapter 02 - Consolidation of Financial Information

14.Howarestockissuancecostsanddirectcombinationcoststreatedinabusiness

combinationwhichisaccountedforasanacquisitionwhenthesubsidiarywillretainits

incorporation?

A.Stockissuancecostsareapartoftheacquisitioncostsandthedirectcombinationcostsare

expensed

B.Directcombinationcostsareapartoftheacquisitioncostsandthestockissuancecostsare

areductiontoadditionalpaidincapital

C.Directcombinationcostsareexpensedandstockissuancecostsareareductionto

additionalpaidincapital

D.Botharetreatedaspartoftheacquisitionprice

E.Botharetreatedasareductiontoadditionalpaidincapital

Difficulty:Medium

2-8

Chapter 02 - Consolidation of Financial Information

BullenInc.assumed100%controloverVickerInc.onJanuary1,20X1.Thebookvalueand

fairvalueofVicker'saccountsonthatdate(priortocreatingthecombination)follow,along

withthebookvalueofBullen'saccounts:

15.AssumethatBullenissued12,000sharesofcommonstockwitha$5parvalueanda$47

fairvaluetoobtainallofVicker'soutstandingstock.Inthistransaction(whichisnota

poolingofinterests),howmuchgoodwillshouldberecognized?

A.$144,000

B.$104,000

C.$64,000

D.$60,000

E.$0

Difficulty:Medium

2-9

Chapter 02 - Consolidation of Financial Information

16.AssumethatBullenissued12,000sharesofcommonstockwitha$5parvalueanda$42

fairvalueforalloftheoutstandingstockofVicker.WhatistheconsolidatedLandasaresult

ofthistransaction(whichisnotapoolingofinterests)?

A.$460,000

B.$510,000

C.$500,000

D.$520,000

E.$490,000

Difficulty:Medium

2-10

Chapter 02 - Consolidation of Financial Information

17.AssumethatBullenissued12,000sharesofcommonstockwitha$5parvalueanda$42

fairvalueforalloftheoutstandingsharesofVicker.WhatwillbetheconsolidatedAdditional

PaidInCapitalandRetainedEarnings(January1,20X1balances)asaresultofthis

transaction(whichisnotapoolingofinterests)?

A.$20,000and$160,000

B.$20,000and$260,000

C.$380,000and$160,000

D.$464,000and$160,000

E.$380,000and$260,000

Difficulty:Hard

18.AssumethatBullenissuedpreferredstockwithaparvalueof$240,000andafairvalueof

$500,000foralloftheoutstandingsharesofVickerinabusinesscombination(whichisnota

poolingofinterests).WhatwillbethebalanceintheconsolidatedInventoryandLand

accounts?

A.$440,000,$496,000

B.$440,000,$520,000

C.$425,000,$505,000

D.$402,000,$520,000

E.$427,000,$510,000

Difficulty:Hard

2-11

Chapter 02 - Consolidation of Financial Information

19.AssumethatBullenpaidatotalof$480,000incashforallofthesharesofVicker.In

addition,Bullenpaid$35,000toagroupofattorneysfortheirworkinarrangingthe

combinationtobeaccountedforasapurchase.Whatwillbethebalanceinconsolidated

goodwill?

A.$0

B.$20,000

C.$35,000

D.$55,000

Difficulty:Medium

2-12

Chapter 02 - Consolidation of Financial Information

20.AssumethatBullenpaidatotalof$480,000incashforallofthesharesofVicker.In

addition,Bullenpaid$35,000toagroupofattorneysfortheirworkinarrangingthe

combinationtobeaccountedforasanacquisition.Whatwillbethebalanceinconsolidated

goodwill?

A.$0

B.$20,000

C.$35,000

D.$55,000

Difficulty:Medium

Priortobeingunitedinabusinesscombination,BotkinsInc.andVolkersonCorp.hadthe

followingstockholders'equityfigures:

Botkinsissued56,000newsharesofitscommonstockvaluedat$3.25pershareforallofthe

outstandingstockofVolkerson.

21.AssumethatBotkinsacquiredVolkersonasapurchasecombination.Immediately

afterwards,whatareconsolidatedAdditionalPaidInCapitalandRetainedEarnings,

respectively?

A.$133,000

and$360,000

B.$236,000and$360,000

C.$130,000and$360,000

D.$236,000and$490,000

E.$133,000and$490,000

Difficulty:Medium

2-13

Chapter 02 - Consolidation of Financial Information

22.AssumethatBotkinsandVolkersonwerebeingjoinedinapoolingofinterestsandthis

occurredonJanuary1,2000,usingthesamevaluesgiven.Immediatelyafterwards,whatis

consolidatedAdditionalPaidInCapital?

A.$138,000

B.$266,000

C.$130,000

D.$236,000

E.$133,000

Difficulty:Hard

23.ChapelHillCompanyhadcommonstockof$350,000andretainedearningsof$490,000.

BlueTownInc.hadcommonstockof$700,000andretainedearningsof$980,000.On

January1,2009,BlueTownissued34,000sharesofcommonstockwitha$12parvalueand

a$35fairvalueforallofChapelHillCompany'soutstandingcommonstock.This

combinationwasaccountedforasanacquisition.Immediatelyafterthecombination,what

wastheconsolidatednetassets?

A.$2,520,000

B.$1,190,000

C.$1,680,000

D.$2,870,000

E.$2,030,000

Difficulty:Medium

24.Whichofthefollowingisanotareasonforabusinesscombinationtotakeplace?

A.Costsavingsthrougheliminationofduplicatefacilities

B.Quickentryfornewandexistingproductsintodomesticandforeignmarkets

C.Diversificationofbusinessrisk

D.Verticalintegration

E.Costsynergiesthroughouttheorganizations

Difficulty:Easy

2-14

Chapter 02 - Consolidation of Financial Information

25.Whichofthefollowingstatementsistrueregardingastatutorymerger?

A.Theoriginalcompaniesdissolvewhileremainingasseparatedivisionsofanewlycreated

company

B.Bothcompaniesremaininexistenceaslegalcorporationswithonecorporationnowa

subsidiaryoftheacquiringcompany

C.Theacquiredcompanydissolvesasaseparatecorporationandbecomesadivisionofthe

acquiringcompany

D.Theacquiringcompanyacquiresthestockoftheacquiredcompanyasaninvestment

E.Astatutorymergerisnolongeralegaloption

Difficulty:Medium

26.Whichofthefollowingstatementsistrueregardingastatutoryconsolidation?

A.Theoriginalcompaniesdissolvewhileremainingasseparatedivisionsofanewlycreated

company

B.Bothcompaniesremaininexistenceaslegalcorporationswithonecorporationnowa

subsidiaryoftheacquiringcompany

C.Theacquiredcompanydissolvesasaseparatecorporationandbecomesadivisionofthe

acquiringcompany

D.Theacquiringcompanyacquiresthestockoftheacquiredcompanyasaninvestment

E.Astatutoryconsolidationisnolongeralegaloption

Difficulty:Medium

2-15

Chapter 02 - Consolidation of Financial Information

27.Inatransactionaccountedforusingthepurchasemethodwherecostexceedsbookvalue,

whichstatementistruefortheacquiringcompanywithregardtoitsinvestment?

A.Netassetsoftheacquiredcompanyarerevaluedtotheirfairvaluesandanyexcessofcost

overfairvalueisallocatedtogoodwill

B.Netassetsoftheacquiredcompanyaremaintainedatbookvalueandanyexcessofcost

overbookvalueisallocatedtogoodwill

C.Assetsarerevaluedtotheirfairvalues.Liabilitiesaremaintainedatbookvalues.Any

excessisallocatedtogoodwill

D.Longtermassetsarerevaluedtotheirfairvalues.Anyexcessisallocatedtogoodwill

Difficulty:Medium

2-16

Chapter 02 - Consolidation of Financial Information

28.Inatransactionaccountedforusingthepurchasemethodwherecostislessthanfair

value,whichstatementistrue?

A.Negativegoodwillisrecorded

B.Adeferredcreditisrecorded

C.Longtermassetsoftheacquiredcompanyarereducedinproportiontotheirfairvalues.

Anyexcessisrecordedasadeferredcredit

D.Longtermassetsoftheacquiredcompanyarereducedinproportiontotheirfairvalues.

Anyexcessisrecordedasanextraordinarygain

E.Longtermassetsandliabilitiesoftheacquiredcompanyarereducedinproportiontotheir

fairvalues.Anyexcessisrecordedasanextraordinarygain

Difficulty:Hard

29.Whichofthefollowingstatementsistrueregardingthepoolingofinterestsmethodof

accountingforabusinesscombination?

A.Netassetsoftheacquiredcompanyarereportedattheirbookvalues

B.Netassetsoftheacquiredcompanyarereportedattheirfairvalues

C.Anygoodwillassociatedwiththeacquisitionhasanindefinitelife

D.Subsequentamountsofcostinexcessoffairvalueofnetassetsareamortizedovertheir

usefullives

E.Indirectcostsreduceadditionalpaidincapital

Difficulty:Medium

2-17

Chapter 02 - Consolidation of Financial Information

30.Whichofthefollowingstatementsistrue?

A.PoolingofinterestsisacceptableprovidedthetwelvecriteriarequiredbytheAPBaremet

B.PoolingofinterestsisnolongeracceptablefornewcombinationsasstatedinSFASNo.

141,"BusinessCombinations"

C.Companiesthatusedpoolingofinterestsmethodinthepastmustmakearetrospective

accountingchangeinaccountingprinciple

D.Companiesthatusedpoolingofinterestsmethodinthepastmustmakeacumulativeeffect

accountingchangeinaccountingprinciple

E.Companiesthatusedpoolingofinterestsinthepastmustmakeaprospectivechangein

accountingprinciple

Difficulty:Easy

2-18

Chapter 02 - Consolidation of Financial Information

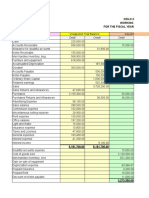

ThefinancialstatementsforGoodwin,Inc.andCorrCompanyfortheyearendedDecember

31,20X1,priortoGoodwin'sbusinesscombinationtransactionregardingCorr,follow(in

thousands):

OnDecember31,20X1,Goodwinissued$600indebtand30sharesofits$10parvalue

commonstocktotheownersofCorrtopurchasealloftheoutstandingsharesofthat

company.Goodwinshareshadafairvalueof$40pershare.

Goodwinpaid$25toabrokerforarrangingthetransaction.Goodwinpaid$35instock

issuancecosts.Corr'sequipmentwasactuallyworth$1,400butitsbuildingswereonlyvalued

at$560.

2-19

Chapter 02 - Consolidation of Financial Information

31.Ifthecombinationisaccountedforasapurchase,atwhatamountistheinvestment

recordedonGoodwin'sbooks?

A.$1,540

B.$1,800

C.$1,860

D.$1,825

E.$1,625

Difficulty:Medium

2-20

Chapter 02 - Consolidation of Financial Information

32.Ifthecombinationisaccountedforasanacquisition,atwhatamountistheinvestment

recordedonGoodwin'sbooks?

A.$1,540

B.$1,800

C.$1,860

D.$1,825

E.$1,625

Difficulty:Medium

33.Computetheconsolidatedrevenuesfor20X1.

A.$2,700

B.$720

C.$920

D.$3,300

E.$1,540

Difficulty:Easy

34.Assumingthecombinationisaccountedforasapurchase,computetheconsolidated

expensesfor20X1.

A.$1,980

B.$2,380

C.$2,040

D.$2,015

E.$2,005

Difficulty:Easy

2-21

Chapter 02 - Consolidation of Financial Information

35.Assumingthecombinationisaccountedforasanacquisition,computetheconsolidated

expensesfor20X1.

A.$1,980

B.$2,380

C.$2,040

D.$2,015

E.$2,005

Difficulty:Easy

36.ComputetheconsolidatedcashaccountatDecember31,20X1.

A.$460

B.$425

C.$400

D.$435

E.$240

Difficulty:Medium

37.Computetheconsolidatedbuildings(net)accountatDecember31,20X1.

A.$2,700

B.$3,370

C.$3,300

D.$3,260

E.$3,340

Difficulty:Medium

2-22

Chapter 02 - Consolidation of Financial Information

38.Computetheconsolidatedequipment(net)accountatDecember31,20X1.

A.$2,100

B.$3,500

C.$3,300

D.$3,000

E.$3,200

Difficulty:Medium

2-23

Chapter 02 - Consolidation of Financial Information

39.Assumingthecombinationisaccountedforasapurchase,computetheconsolidated

goodwillaccountatDecember31,20X1.

A.$0

B.$100

C.$125

D.$160

E.$45

Difficulty:Medium

40.Assumingthecombinationisaccountedforasanacquisition,computetheconsolidated

goodwillaccountatDecember31,20X1.

A.$0

B.$100

C.$125

D.$160

E.$45

Difficulty:Medium

41.ComputetheconsolidatedcommonstockaccountatDecember31,20X1.

A.$1,080

B.$1,480

C.$1,380

D.$2,280

E.$2,680

Difficulty:Medium

2-24

Chapter 02 - Consolidation of Financial Information

42.ComputetheconsolidatedadditionalpaidincapitalatDecember31,20X1.

A.$810

B.$1,350

C.$1,675

D.$1,910

E.$1,875

Difficulty:Medium

2-25

Chapter 02 - Consolidation of Financial Information

43.Assumingthecombinationisaccountedforasapurchase,computetheconsolidated

retainedearningsatDecember31,20X1.

A.$2,850

B.$3,450

C.$2,400

D.$2,800

E.$2,810

Difficulty:Medium

44.Assumingthecombinationisaccountedforasanacquisition,computetheconsolidated

retainedearningsatDecember31,20X1.

A.$2,800

B.$2,825

C.$2,850

D.$3,425

E.$3,450

Difficulty:Medium

2-26

Chapter 02 - Consolidation of Financial Information

OnJanuary1,20X1,theMoodycompanyenteredintoatransactionfor100%ofthe

outstandingcommonstockofOsorioCompany.Toacquiretheseshares,Moodyissued$400

inlongtermliabilitiesand40sharesofcommonstockhavingaparvalueof$1persharebut

afairvalueof$10pershare.Moodypaid$20tolawyers,accountantsandbrokersfor

assistanceinbringingaboutthispurchase.Another$15waspaidinconnectionwithstock

issuancecosts.Priortothesetransactions,thebalancesheetsforthetwocompanieswereas

follows:

Note:Parenthesesindicateacreditbalance.

InMoody'sappraisalofOsorio,threeassetsweredeemedtobeundervaluedonthe

subsidiary'sbooks:Inventoryby$10,Landby$40andBuildingsby$60.

45.Ifthetransactionisaccountedforasapurchase,whatamountwasrecordedasthe

investmentinOsorio?

A.$930

B.$820

C.$800

D.$835

E.$815

Difficulty:Medium

2-27

Chapter 02 - Consolidation of Financial Information

46.Ifthetransactionisaccountedforasanacquisition,whatamountwasrecordedasthe

investmentinOsorio?

A.$930

B.$820

C.$800

D.$835

E.$815

Difficulty:Medium

47.Computetheamountofconsolidatedinventoriesatdateofcombination.

A.$1,080

B.$1,350

C.$1,360

D.$1,370

E.$290

Difficulty:Medium

48.Computetheamountofconsolidatedbuildings(net)atdateofcombination.

A.$1,700

B.$1,760

C.$1,655

D.$1,550

E.$1,660

Difficulty:Hard

2-28

Chapter 02 - Consolidation of Financial Information

49.Computetheamountofconsolidatedlandatdateofcombination.

A.$1,000

B.$816

C.$940

D.$916

E.$920

Difficulty:Hard

2-29

Chapter 02 - Consolidation of Financial Information

50.Computetheamountofconsolidatedequipmentatdateofcombination.

A.$580

B.$480

C.$559

D.$570

E.$560

Difficulty:Hard

51.Computetheamountofconsolidatedcommonstockatdateofacquisition.

A.$370

B.$570

C.$610

D.$330

E.$530

Difficulty:Medium

52.Computetheamountofconsolidatedadditionalpaidincapitalatdateofcombination.

A.$1,080

B.$1,420

C.$1,065

D.$1,425

E.$1,440

Difficulty:Hard

2-30

Chapter 02 - Consolidation of Financial Information

53.Computetheamountofconsolidatedcashafterrecordingthetransaction.

A.$220

B.$185

C.$200

D.$205

E.$215

Difficulty:Medium

2-31

Chapter 02 - Consolidation of Financial Information

CarneshasthefollowingaccountbalancesasofMay1,2000beforeapoolingofinterests

transactiontakesplace.

ThefairvalueofCarnes'LandandBuildingsare$650,000and$550,000,respectively.On

May1,2000,RileyCompanyissues30,000sharesofits$10parvalue($25fairvalue)

commonstockinexchangeforallofthesharesofCarnes'commonstock.

54.OnMay1,2000,whatvalueisassignedtotheinvestmentaccount?

A.$300,000

B.$750,000

C.$800,000

D.$1,100,000

E.$1,300,000

Difficulty:Medium

55.Atthedateofpooling,byhowmuchdoesRiley'sretainedearningsincreaseordecrease?

A.$200,000increase

B.$200,000decrease

C.$700,000increase

D.$300,000increase

E.$300,000decrease

Difficulty:Medium

2-32

Chapter 02 - Consolidation of Financial Information

56.AssumeRileyissues70,000sharesinsteadof30,000atdateofacquisition.Riley

currentlyhas$40,000ofadditionalpaidincapitalonitsbooks.ByhowmuchwillRiley's

retainedearningsincreaseordecreaseasaresultofthecombination?

A.$40,000increase

B.$200,000increase

C.$140,000increase

D.$160,000increase

E.$40,000decrease

Difficulty:Hard

57.AssumeRileyissues70,000sharesinsteadof30,000atdateofpooling.AssumeRileyhas

noadditionalpaidincapitalonitsbooks.ByhowmuchwillRiley'sretainedearnings

increaseordecreaseasaresultofthecombination?

A.$100,000increase

B.$200,000increase

C.$100,000decrease

D.$200,000decrease

E.Nochange

Difficulty:Hard

2-33

Chapter 02 - Consolidation of Financial Information

ThefinancialbalancesfortheAtwoodCompanyandtheFranzCompanyasofDecember31,

20X1,arepresentedbelow.AlsoincludedarethefairvaluesforFranzCompany'snetassets.

Note:Parenthesisindicateacreditbalance

AssumeabusinesscombinationtookplaceatDecember31,20X1.Atwoodissued50shares

ofitscommonstockwithafairvalueof$35pershareforalloftheoutstandingcommon

sharesofFranz.Stockissuancecostsof$15(inthousands)anddirectcostsof$10(in

thousands)werepaid.

58.AssumingAtwoodaccountsforthecombinationasapurchase,computetheinvestmentto

berecordedatdateofacquisition.

A.$1,760

B.$1,750

C.$1,775

D.$1,765

E.$1,120

Difficulty:Medium

2-34

Chapter 02 - Consolidation of Financial Information

59.AssumingAtwoodaccountsforthecombinationasanacquisition,computethe

investmenttoberecordedatdateofacquisition.

A.$1,760

B.$1,750

C.$1,775

D.$1,765

E.$1,120

Difficulty:Medium

60.Computeconsolidatedinventoryatthedateofthebusinesscombination.

A.$1,650

B.$1,810

C.$1,230

D.$580

E.$1,830

Difficulty:Medium

61.Computeconsolidatedlandatthedateofthebusinesscombination.

A.$2,060

B.$1,800

C.$260

D.$2,050

E.$2,070

Difficulty:Medium

2-35

Chapter 02 - Consolidation of Financial Information

62.Computeconsolidatedbuildings(net)atthedateofthebusinesscombination.

A.$2,450

B.$2,340

C.$1,800

D.$650

E.$1,690

Difficulty:Medium

2-36

Chapter 02 - Consolidation of Financial Information

63.AssumingAtwoodaccountsforthecombinationasapurchase,computeconsolidated

goodwillatthedateofthecombination.

A.$360

B.$450

C.$460

D.$440

E.$475

Difficulty:Medium

64.AssumingAtwoodaccountsforthecombinationasanacquisition,computeconsolidated

goodwillatthedateofthecombination.

A.$360

B.$450

C.$460

D.$440

E.$475

Difficulty:Medium

65.Computeconsolidatedequipment(net)atthedateofthecombination.

A.$400

B.$660

C.$1,060

D.$1,040

E.$1,050

Difficulty:Medium

2-37

Chapter 02 - Consolidation of Financial Information

66.Assumingthecombinationisaccountedforasapurchase,computeconsolidatedretained

earningsatthedateofthecombination.

A.$1,170

B.$1,650

C.$1,290

D.$1,810

E.$3,870

Difficulty:Medium

67.Assumingthecombinationisaccountedforasanacquisition,computeconsolidated

retainedearningsatthedateofthecombination.

A.$1,160

B.$1,170

C.$1,280

D.$1,290

E.$1,640

Difficulty:Medium

68.Computeconsolidatedrevenuesatthedateofthecombination.

A.$3,540

B.$2,880

C.$1,170

D.$1,650

E.$4,050

Difficulty:Medium

2-38

Chapter 02 - Consolidation of Financial Information

69.Assumingthecombinationisaccountedforasapurchase,computeconsolidatedexpenses

atthedateofthecombination.

A.$2,760

B.$3,380

C.$2,770

D.$2,735

E.$2,785

Difficulty:Medium

70.Assumingthecombinationisaccountedforasanacquisition,computeconsolidated

expensesatthedateofthecombination.

A.$2,760

B.$2,770

C.$2,785

D.$3,380

E.$3,390

Difficulty:Medium

2-39

Chapter 02 - Consolidation of Financial Information

PresentedbelowarethefinancialbalancesfortheAtwoodCompanyandtheFranzCompany

asofDecember31,2009,immediatelybeforeAtwoodacquiredFranz.Alsoincludedarethe

fairvaluesforFranzCompany'snetassetsatthatdate.

Note:Parenthesisindicateacreditbalance

AssumeabusinesscombinationtookplaceatDecember31,2009.Atwoodissued50shares

ofitscommonstockwithafairvalueof$35pershareforalloftheoutstandingcommon

sharesofFranz.Stockissuancecostsof$15(inthousands)anddirectcostsof$10(in

thousands)werepaid.AtwoodisapplyingtheacquisitionmethodinaccountingforFranz.

TosettleadifferenceofopinionregardingFranz'sfairvalue,Atwoodpromisestopayan

additional$5.2(inthousands)totheformerownersifFranz'searningsexceedacertainsum

duringthenextyear.Giventheprobabilityoftherequiredcontingencypaymentandutilizing

a4%discountrate,theexpectedpresentvalueofthecontingencyis$5(inthousands).

2-40

Chapter 02 - Consolidation of Financial Information

71.Computetheinvestmentcostatdateofacquisition.

A.$1,760

B.$1,755

C.$1,750

D.$1,765

E.$1,120

Difficulty:Medium

72.Computeconsolidatedinventoryatdateofacquisition.

A.$1,650

B.$1,810

C.$1,230

D.$580

E.$1,830

Difficulty:Medium

73.Computeconsolidatedlandatdateofacquisition.

A.$2,060

B.$1,800

C.$260

D.$2,050

E.$2,070

Difficulty:Medium

2-41

Chapter 02 - Consolidation of Financial Information

74.Computeconsolidatedbuildings(net)atdateofacquisition.

A.$2,450

B.$2,340

C.$1,800

D.$650

E.$1,690

Difficulty:Medium

2-42

Chapter 02 - Consolidation of Financial Information

75.Computeconsolidatedgoodwillatdateofacquisition.

A.$455

B.$460

C.$450

D.$440

E.$465

Difficulty:Medium

76.Computeconsolidatedequipmentatdateofacquisition.

A.$400

B.$660

C.$1,060

D.$1,040

E.$1,050

Difficulty:Medium

77.Computeconsolidatedretainedearningsasaresultofthisacquisition.

A.$1,160

B.$1,170

C.$1,265

D.$1,280

E.$1,650

Difficulty:Hard

2-43

Chapter 02 - Consolidation of Financial Information

78.Computeconsolidatedrevenuesatdateofacquisition.

A.$3,540

B.$2,880

C.$1,170

D.$1,650

E.$4,050

Difficulty:Medium

2-44

Chapter 02 - Consolidation of Financial Information

79.Computeconsolidatedexpensesatdateofacquisition.

A.$2,760

B.$3,380

C.$2,770

D.$2,735

E.$2,785

Difficulty:Medium

80.Computetheconsolidatedcashuponcompletionoftheacquisition.

A.$870

B.$1,110

C.$1,080

D.$1,085

E.$635

Difficulty:Medium

2-45

Chapter 02 - Consolidation of Financial Information

Flynnacquires100percentoftheoutstandingvotingsharesofMacekCompanyonJanuary

1,20X1.Toobtaintheseshares,Flynnpays$400(inthousands)andissues10,000sharesof

$20parvaluecommonstockonthisdate.Flynn'sstockhadafairvalueof$36pershareon

thatdate.Flynnalsopays$15(inthousands)toalocalinvestmentfirmforarrangingthe

transaction.Anadditional$10(inthousands)waspaidbyFlynninstockissuancecosts.

ThebookvaluesforbothFlynnandMacekasofJanuary1,20X1follow.Thefairvalueof

eachofFlynnandMacekaccountsisalsoincluded.Inaddition,Macekholdsafully

amortizedtrademarkthatstillretainsa$40(inthousands)value.Thefiguresbelowarein

thousands.Anyrelatedquestionalsoisinthousands.

2-46

Chapter 02 - Consolidation of Financial Information

81.Assumingthecombinationisaccountedforasapurchase,whatamountwillbereported

forgoodwill?

A.$35

B.$5

C.$110

D.$70

E.$150

Difficulty:Hard

82.Assumingthecombinationisaccountedforasanacquisition,whatamountwillbe

reportedforgoodwill?

A.$55

B.$65

C.$70

D.$135

E.$175

Difficulty:Hard

83.Whatamountwillbereportedforconsolidatedreceivables?

A.$660

B.$640

C.$500

D.$460

E.$480

Difficulty:Medium

2-47

Chapter 02 - Consolidation of Financial Information

84.Whatamountwillbereportedforconsolidatedinventory?

A.$960

B.$920

C.$700

D.$620

E.$660

Difficulty:Medium

2-48

Chapter 02 - Consolidation of Financial Information

85.Whatamountwillbereportedforconsolidatedbuildings(net)?

A.$1,420

B.$1,260

C.$1,140

D.$1,480

E.$1,200

Difficulty:Medium

86.Whatamountwillbereportedforconsolidatedequipment(net)?

A.$385

B.$335

C.$435

D.$460

E.$360

Difficulty:Medium

87.Whatamountwillbereportedforconsolidatedlongtermliabilities?

A.$1,480

B.$1,440

C.$1,180

D.$1,100

E.$1,520

Difficulty:Medium

2-49

Chapter 02 - Consolidation of Financial Information

88.Whatamountwillbereportedforconsolidatedcommonstock?

A.$1,200

B.$1,280

C.$1,400

D.$1,480

E.$1,390

Difficulty:Medium

2-50

Chapter 02 - Consolidation of Financial Information

89.Assumingthecombinationisaccountedforasapurchase,whatamountwillbereported

forconsolidatedretainedearnings?

A.$1,830

B.$1,350

C.$1,080

D.$1,560

E.$1,535

Difficulty:Medium

90.Assumingthecombinationisaccountedforasanacquisition,whatamountwillbe

reportedforconsolidatedretainedearnings?

A.$1,065

B.$1,080

C.$1,525

D.$1,535

E.$1,560

Difficulty:Medium

91.Whatamountwillbereportedforconsolidatedadditionalpaidincapital?

A.$165

B.$150

C.$160

D.$175

E.$145

Difficulty:Hard

2-51

Chapter 02 - Consolidation of Financial Information

92.Whatamountwillbereportedforconsolidatedcashafterthepurchasetransaction?

A.$900

B.$875

C.$955

D.$980

E.$555

Difficulty:Medium

2-52

Chapter 02 - Consolidation of Financial Information

Chapter3

ConsolidationsSubsequenttotheDateofAcquisition

MultipleChoiceQuestions

1.Whichoneofthefollowingaccountswouldnotappearintheconsolidatedfinancial

statementsattheendofthefirstfiscalperiodofthecombination?

A.Goodwill.

B.Equipment.

C.InvestmentinSubsidiary.

D.CommonStock.

E.AdditionalPaidInCapital.

2.Whichofthefollowinginternalrecordkeepingmethodscanaparentchoosetoaccount

forasubsidiaryacquiredinabusinesscombination?

A.initialvalueorbookvalue.

B.initialvalue,lowerofcostormarketvalue,orequity.

C.initialvalue,equity,orpartialequity.

D.initialvalue,equity,orbookvalue.

E.initialvalue,lowerofcostormarketvalue,orpartialequity.

3.Whichoneofthefollowingvariesbetweentheequity,initialvalue,andpartialequity

methodsofaccountingforaninvestment?

A.theamountofconsolidatednetincome.

B.totalassetsontheconsolidatedbalancesheet.

C.totalliabilitiesontheconsolidatedbalancesheet.

D.thebalanceintheinvestmentaccountontheparent'sbooks.

E.theamountofconsolidatedcostofgoodssold.

4.Underthepartialequitymethod,theparentrecognizesincomewhen

A.dividendsarereceivedfromtheinvestee.

B.dividendsaredeclaredbytheinvestee.

C.therelatedexpensehasbeenincurred.

D.therelatedcontractissignedbythesubsidiary.

E.itisearnedbythesubsidiary.

5.Pushdownaccountingisconcernedwiththe

A.impactofthepurchaseonthesubsidiary'sfinancialstatements.

B.recognitionofgoodwillbytheparent.

C.correctconsolidationofthefinancialstatements.

D.impactofthepurchaseontheseparatefinancialstatementsoftheparent.

E.recognitionofdividendsreceivedfromthesubsidiary.

2-53

Chapter 02 - Consolidation of Financial Information

6.RacerCorp.acquiredallofthecommonstockofTangiersCo.in2011.Tangiers

maintaineditsincorporation.WhichofRacer'saccountbalanceswouldvarybetweenthe

equitymethodandtheinitialvaluemethod?

A.Goodwill,InvestmentinTangiersCo.,andRetainedEarnings.

B.Expenses,InvestmentinTangiersCo.,andEquityinSubsidiaryEarnings.

C.InvestmentinTangiersCo.,EquityinSubsidiaryEarnings,andRetainedEarnings.

D.CommonStock,Goodwill,andInvestmentinTangiersCo.

E.Expenses,Goodwill,andInvestmentinTangiersCo.

7.Howdoesthepartialequitymethoddifferfromtheequitymethod?

A.Inthetotalassetsreportedontheconsolidatedbalancesheet.

B.Inthetreatmentofdividends.

C.Inthetotalliabilitiesreportedontheconsolidatedbalancesheet.

D.Underthepartialequitymethod,subsidiaryincomedoesnotincreasethebalanceinthe

parent'sinvestmentaccount.

E.Underthepartialequitymethod,thebalanceintheinvestmentaccountisnot

decreasedbyamortizationonallocationsmadeintheacquisitionofthesubsidiary.

8.JansenInc.acquiredalloftheoutstandingcommonstockofMerriamCo.onJanuary1,

2012,for$257,000.Annualamortizationof$19,000resultedfromthisacquisition.Jansen

reportednetincomeof$70,000in2012and$50,000in2013andpaid$22,000individends

eachyear.Merriamreportednetincomeof$40,000in2012and$47,000in2013andpaid

$10,000individendseachyear.WhatistheInvestmentinMerriamCo.balanceonJansen's

booksasofDecember31,2013,iftheequitymethodhasbeenapplied?

A.$286,000.

B.$295,000.

C.$276,000.

D.$344,000.

E.$324,000.

9.VelwayCorp.acquiredJokerInc.onJanuary1,2012.Theparentpaidmorethanthefair

valueofthesubsidiary'snetassets.Onthatdate,Velwayhadequipmentwithabookvalueof

$500,000andafairvalueof$640,000.Jokerhadequipmentwithabookvalueof$400,000

andafairvalueof$470,000.Jokerdecidedtousepushdownaccounting.Immediatelyafter

theacquisition,whatEquipmentamountwouldappearonJoker'sseparatebalancesheetand

onVelway'sconsolidatedbalancesheet,respectively?

A.$400,000and$900,000

B.$400,000and$970,000

C.$470,000and$900,000

D.$470,000and$970,000

E.$470,000and$1,040,000

10.ParrettCorp.acquiredonehundredpercentofJonesInc.onJanuary1,2011,atapricein

2-54

Chapter 02 - Consolidation of Financial Information

excessofthesubsidiary'sfairvalue.Onthatdate,Parrett'sequipment(tenyearlife)hada

bookvalueof$360,000butafairvalueof$480,000.Joneshadequipment(tenyearlife)with

abookvalueof$240,000andafairvalueof$350,000.Parrettusedthepartialequitymethod

torecorditsinvestmentinJones.OnDecember31,2013,Parretthadequipmentwithabook

valueof$250,000andafairvalueof$400,000.Joneshadequipmentwithabookvalueof

$170,000andafairvalueof$320,000.WhatistheconsolidatedbalancefortheEquipment

accountasofDecember31,2013?

A.$387,000.

B.$497,000.

C.$508,000.

D.$537,000.

E.$570,000.

11.OnJanuary1,2012,CaleCorp.paid$1,020,000toacquireKaltopCo.Kaltopmaintained

separateincorporation.Caleusedtheequitymethodtoaccountfortheinvestment.The

followinginformationisavailableforKaltop'sassets,liabilities,andstockholders'equity

accountsonJanuary1,2012:

Kaltopearnednetincomefor2012of$126,000andpaiddividendsof$48,000duringthe

year.

The2012totalamortizationofallocationsiscalculatedtobe

A.$4,000.

B.$6,400.

C.$(2,400).

D.$(1,000).

E.$3,800.

12.OnJanuary1,2012,CaleCorp.paid$1,020,000toacquireKaltopCo.Kaltopmaintained

separateincorporation.Caleusedtheequitymethodtoaccountfortheinvestment.The

followinginformationisavailableforKaltop'sassets,liabilities,andstockholders'equity

accountsonJanuary1,2012:

Kaltopearnednetincomefor2012of$126,000andpaiddividendsof$48,000duringthe

year.

InCale'saccountingrecords,whatamountwouldappearonDecember31,2012forequityin

subsidiaryearnings?

A.$77,000.

B.$79,000.

C.$125,000.

D.$127,000.

E.$81,800.

13.OnJanuary1,2012,CaleCorp.paid$1,020,000toacquireKaltopCo.Kaltopmaintained

separateincorporation.Caleusedtheequitymethodtoaccountfortheinvestment.The

followinginformationisavailableforKaltop'sassets,liabilities,andstockholders'equity

accountsonJanuary1,2012:

2-55

Chapter 02 - Consolidation of Financial Information

Kaltopearnednetincomefor2012of$126,000andpaiddividendsof$48,000duringthe

year.

WhatisthebalanceinCale'sinvestmentinsubsidiaryaccountattheendof2012?

A.$1,099,000.

B.$1,020,000.

C.$1,096,200.

D.$1,098,000.

E.$1,144,400.

14.OnJanuary1,2012,CaleCorp.paid$1,020,000toacquireKaltopCo.Kaltopmaintained

separateincorporation.Caleusedtheequitymethodtoaccountfortheinvestment.The

followinginformationisavailableforKaltop'sassets,liabilities,andstockholders'equity

accountsonJanuary1,2012:

Kaltopearnednetincomefor2012of$126,000andpaiddividendsof$48,000duringthe

year.

Attheendof2012,theconsolidationentrytoeliminateCale'saccrualofKaltop'searnings

wouldincludeacredittoInvestmentinKaltopCo.for

A.$124,400.

B.$126,000.

C.$127,000.

D.$76,400.

E.$0.

15.OnJanuary1,2012,CaleCorp.paid$1,020,000toacquireKaltopCo.Kaltopmaintained

separateincorporation.Caleusedtheequitymethodtoaccountfortheinvestment.The

followinginformationisavailableforKaltop'sassets,liabilities,andstockholders'equity

accountsonJanuary1,2012:

Kaltopearnednetincomefor2012of$126,000andpaiddividendsof$48,000duringthe

year.

IfCaleCorp.hadnetincomeof$444,000in2012,exclusiveoftheinvestment,whatisthe

amountofconsolidatednetincome?

A.$569,000.

B.$570,000.

C.$571,000.

D.$566,400.

E.$444,000.

16.OnJanuary1,2012,FranelCo.acquiredallofthecommonstockofHurlemCorp.For

2012,Hurlemearnednetincomeof$360,000andpaiddividendsof$190,000.Amortization

ofthepatentallocationthatwasincludedintheacquisitionwas$6,000.

HowmuchdifferencewouldtherehavebeeninFranel'sincomewithregardtotheeffectof

theinvestment,betweenusingtheequitymethodorusingtheinitialvaluemethodofinternal

recordkeeping?

A.$190,000.

2-56

Chapter 02 - Consolidation of Financial Information

B.$360,000.

C.$164,000.

D.$354,000.

E.$150,000.

17.OnJanuary1,2012,FranelCo.acquiredallofthecommonstockofHurlemCorp.For

2012,Hurlemearnednetincomeof$360,000andpaiddividendsof$190,000.Amortization

ofthepatentallocationthatwasincludedintheacquisitionwas$6,000.

HowmuchdifferencewouldtherehavebeeninFranel'sincomewithregardtotheeffectof

theinvestment,betweenusingtheequitymethodorusingthepartialequitymethodofinternal

recordkeeping?

A.$170,000.

B.$354,000.

C.$164,000.

D.$6,000.

E.$174,000.

18.CashenCo.paid$2,400,000toacquireallofthecommonstockofJanexCorp.on

January1,2012.Janex'sreportedearningsfor2012totaled$432,000,anditpaid$120,000in

dividendsduringtheyear.Theamortizationofallocationsrelatedtotheinvestmentwas

$24,000.Cashen'snetincome,notincludingtheinvestment,was$3,180,000,anditpaid

dividendsof$900,000.

Ontheconsolidatedfinancialstatementsfor2012,whatamountshouldhavebeenshownfor

EquityinSubsidiaryEarnings?

A.$432,000.

B.$0

C.$408,000.

D.$120,000.

E.$288,000

.

19.CashenCo.paid$2,400,000toacquireallofthecommonstockofJanexCorp.on

January1,2012.Janex'sreportedearningsfor2012totaled$432,000,anditpaid$120,000in

dividendsduringtheyear.Theamortizationofallocationsrelatedtotheinvestmentwas

$24,000.Cashen'snetincome,notincludingtheinvestment,was$3,180,000,anditpaid

dividendsof$900,000.

Ontheconsolidatedfinancialstatementsfor2012,whatamountshouldhavebeenshownfor

consolidateddividends?

A.$900,000.

B.$1,020,000.

C.$876,000.

D.$996,000.

E.$948,000.

20.CashenCo.paid$2,400,000toacquireallofthecommonstockofJanexCorp.on

2-57

Chapter 02 - Consolidation of Financial Information

January1,2012.Janex'sreportedearningsfor2012totaled$432,000,anditpaid$120,000in

dividendsduringtheyear.Theamortizationofallocationsrelatedtotheinvestmentwas

$24,000.Cashen'snetincome,notincludingtheinvestment,was$3,180,000,anditpaid

dividendsof$900,000.

Whatistheamountofconsolidatednetincomefortheyear2012?

A.$3,180,000.

B.$3,612,000.

C.$3,300,000.

D.$3,588,000.

E.$3,420,000.

21.JansInc.acquiredalloftheoutsta

ndingcommonstockofTyskCorp.onJanuary1,2011,for$372,000.Equipmentwithaten

yearlifewasundervaluedonTysk'sfinancialrecordsby$46,000.Tyskalsoownedan

unrecordedcustomerlistwithanassessedfairvalueof$67,000andanestimatedremaining

lifeoffiveyears.

Tyskearnedreportednetincomeof$180,000in2011and$216,000in2012.Dividendsof

$70,000werepaidineachofthesetwoyears.SelectedaccountbalancesasofDecember31,

2013,forthetwocompaniesfollow.

Ifthepartialequitymethodhadbeenapplied,whatwas2013consolidatednetincome?

A.$840,000.

B.$768,400.

C.$822,000.

D.$240,000.

E.$600,000.

22.JansInc.acquiredalloftheoutstandingcommonstockofTyskCorp.onJanuary1,2011,

for$372,000.EquipmentwithatenyearlifewasundervaluedonTysk'sfinancialrecordsby

$46,000.Tyskalsoownedanunrecordedcustomerlistwithanassessedfairvalueof$67,000

andanestimatedremaininglifeoffiveyears.

Tyskearnedreportednetincomeof$180,000in2011and$216,000in2012.Dividendsof

$70,000werepaidineachofthesetwoyears.SelectedaccountbalancesasofDecember31,

2013,forthetwocompaniesfollow.

Iftheequitymethodhadbeenapplied,whatwouldbetheInvestmentinTyskCorp.account

balancewithintherecordsofJansattheendof2013?

A.$612,100.

B.$744,000.

C.$774,150.

D.$372,000.

E.$844,150.

23.RedCo.acquired100%ofGreen,Inc.onJanuary1,2012.Onthatdate,Greenhad

inventorywithabookvalueof$42,000andafairvalueof$52,000.Thisinventoryhadnot

yetbeensoldatDecember31,2012.Also,onthedateofacquisition,Greenhadabuilding

2-58

Chapter 02 - Consolidation of Financial Information

withabookvalueof$200,000andafairvalueof$390,000.Greenhadequipmentwitha

bookvalueof$350,000andafairvalueof$280,000.Thebuildinghada10yearremaining

usefullifeandtheequipmenthada5yearremainingusefullife.Howmuchtotalexpensewill

beintheconsolidatedfinancialstatementsfortheyearendedDecember31,2012relatedto

theacquisitionallocationsofGreen?

A.$43,000.

B.$33,000.

C.$5,000.

D.$15,000.

E.0.

24.Allofthefollowingareacceptablemethodstoaccountforamajorityownedinvestment

insubsidiaryexcept

A.Theequitymethod.

B.Theinitialvaluemethod.

C.Thepartialequitymethod.

D.Thefairvaluemethod.

E.Bookvaluemethod.

25.Undertheequitymethodofaccountingforaninvestment,

A.Theinvestmentaccountremainsatinitialvalue.

B.Dividendsreceivedarerecordedasrevenue.

C.Goodwillisamortizedover20years.

D.Incomereportedbythesubsidiaryincreasestheinvestmentaccount.

E.Dividendsreceivedincreasetheinvestmentaccount.

26.Underthepartialequitymethodofaccountingforaninvestment,

A.Theinvestmentaccountremainsatinitialvalue.

B.Dividendsreceivedarerecordedasrevenue.

C.Theallocationsforexcessfairvalueallocationsoverbookvalueofnetassetsatdateof

acquisitionareappliedovertheirusefullivestoreducetheinvestmentaccount.

D.Amortizationoftheexcessoffairvalueallocationsoverbookvalueisignoredin

regardtotheinvestmentaccount.

E.Dividendsreceivedincreasetheinvestmentaccount.

27.Undertheinitialvaluemethod,whenaccountingforaninvestmentinasubsidiary,

A.Dividendsreceivedbythesubsidiarydecreasetheinvestmentaccount.

B.Theinvestmentaccountisadjustedtofairvalueatyearend.

C.Incomereportedbythesubsidiaryincreasestheinvestmentaccount.

D.Theinvestmentaccountremainsatinitialvalue.

E.Dividendsreceivedareignored.

28.AccordingtoGAAPregardingamortizationofgoodwillandotherintangibleassets,

whichofthefollowingstatementsistrue?

A.Goodwillrecognizedinconsolidationmustbeamortizedover20years.

2-59

Chapter 02 - Consolidation of Financial Information

B.Goodwillrecognizedinconsolidationmustbeexpensedintheperiodofacquisition.

C.Goodwillrecognizedinconsolidationwillnotbeamortizedbutsubjecttoanannual

testforimpairment.

D.Goodwillrecognizedinconsolidationcanneverbewrittenoff.

E.Goodwillrecognizedinconsolidationmustbeamortizedover40years.

29.Whenacompanyappliestheinitialmethodinaccountingforitsinvestmentina

subsidiaryandthesubsidiaryreportsincomeinexcessofdividendspaid,whatentrywouldbe

madeforaconsolidationworksheet?

A.Aabove

B.Babove

C.Cabove

D.Dabove

E.Eabove

30.Whenacompanyappliestheinitialvaluemethodinaccountingforitsinvestmentina

subsidiaryandthesubsidiaryreportsincomelessthandividendspaid,whatentrywouldbe

madeforaconsolidationworksheet?

A.Aabove

B.Babove

C.Cabove

D.Dabove

E.Eabove

31.Whenacompanyappliesthepartialequitymethodinaccountingforitsinvestmentina

subsidiaryandthesubsidiary'sequipmenthasafairvaluegreaterthanitsbookvalue,what

consolidationworksheetentryismadeinayearsubsequenttotheinitialacquisitionofthe

subsidiary?

A.Aabove

B.Babove

C.Cabove

D.Dabove

E.Eabove

32.Whenacompanyappliesthepartialequitymethodinaccountingforitsinvestmentina

subsidiaryandinitialvalue,bookvalues,andfairvaluesofnetassetsacquiredareallequal,

whatconsolidationworksheetentrywouldbemade?

A.Aabove

B.Babove

C.Cabove

D.Dabove

E.Eabove

33.Whenconsolidatingasubsidiaryundertheequitymethod,whichofthefollowing

statementsistrue?

A.Goodwillisneverrecognized.

B.Goodwillrequiredisamortizedover20years.

C.Goodwillmayberecordedontheparentcompany'sbooks.

2-60

Chapter 02 - Consolidation of Financial Information

D.Thevalueofanygoodwillshouldbetestedannuallyforimpairmentinvalue.

E.Goodwillshouldbeexpensedintheyearofacquisition.

34.Whenconsolidatingasubsidiaryundertheequitymethod,whichofthefollowing

statementsistruewithregardtothesubsidiarysubsequenttotheyearofacquisition?

A.Allnetassetsarerevaluedtofairvalueandmustbeamortizedovertheirusefullives.

B.Onlynetassetsthathadexcessfairvalueoverbookvaluewhenacquiredbytheparent

mustbeamortizedovertheirusefullives.

C.Alldepreciablenetassetsarerevaluedtofairvalueatdateofacquisitionandmust

beamortizedovertheirusefullives.

D.Onlydepreciablenetassetsthathaveexcessfairvalueoverbookvaluemustbeamortized

overtheirusefullives.

E.Onlyassetsthathaveexcessfairvalueoverbookvaluemustbeamortizedovertheir

usefullives.

35.Whichofthefollowingstatementsisfalseregardingpushdownaccounting?

A.Pushdownaccountingsimplifiestheconsolidationprocess.

B.Fewerworksheetentriesarenecessarywhenpushdownaccountingisapplied.

C.Pushdownaccountingprovidesbetterinformationforinternalevaluation.

D.Pushdownaccountingmustbeappliedforallbusinesscombinationsundera

poolingofinterests.

E.Pushdownproponentsarguethatachangeinownershipcreatesanewbasisfor

subsidiaryassetsandliabilities.

36.Whichofthefollowingisfalseregardingcontingentconsiderationinbusiness

combinations?

A.Contingentconsiderationpayableincashisreportedunderliabilities.

B.Contingentconsiderationpayableinstocksharesisreportedunderstockholders'equity.

C.Contingentconsiderationisrecordedbecauseofitssubstantialprobabilityof

eventualpayment.

D.Thecontingentconsiderationfairvalueisrecognizedaspartoftheacquisitionregardless

ofwhethereventualpaymentisbasedonfutureperformanceofthetargetfirmorfuturestock

priceoftheacquirer.

E.Contingentconsiderationisreflectedintheacquirer'sbalancesheetatthepresentvalueof

thepotentialexpectedfuturepayment.

37.Factorsthatshouldbeconsideredindeterminingtheusefullifeofanintangibleasset

include

A.Legal,regulatory,orcontractualprovisions.

B.Theresidualvalueoftheasset.

C.Theentity'sexpecteduseoftheintangibleasset.

D.Theeffectsofobsolescence,competition,andtechnologicalchange.

E.Allofthesechoicesareusedindeterminingtheusefullifeofanintangibleasset.

2-61

Chapter 02 - Consolidation of Financial Information

38.Consolidatednetincomeusingtheequitymethodforanacquisitioncombinationis

computedasfollows:

A.Parentcompany'sincomefromitsownoperationsplustheequityfromsubsidiary's

incomerecordedbytheparent.

B.Parent'sreportednetincome.

C.Combinedrevenueslesscombinedexpenseslessequityinsubsidiary'sincomeless

amortizationoffairvalueallocationsinexcessofbookvalue.

D.Parent'srevenueslessexpensesforitsownoperationsplustheequityfrom

subsidiary'sincomerecordedbyparent.

E.Allofthese.

39.PerryCompanyacquires100%ofthestockofHurleyCorporationonJanuary1,2012,

for$3,800cash.AsofthatdateHurleyhasthefollowingtrialbalance;

Anyexcessofconsiderationtransferredoverfairvalueofnetassetsacquiredisconsidered

goodwillwithanindefinitelife.FIFOinventoryvaluationmethodisused.

ComputetheconsiderationtransferredinexcessofbookvalueacquiredatJanuary1,2012.

A.$150.

B.$700.

C.$2,200.

D.$550.

E.$2,900.

40.PerryCompanyacquires100%ofthestockofHurleyCorporationonJanuary1,2012,

for$3,800cash.AsofthatdateHurleyhasthefollowingtrialbalance;

Anyexcessofconsiderationtransferredoverfairvalueofnetassetsacquiredisconsidered

goodwillwithanindefinitelife.FIFOinventoryvaluationmethodisused.

Computegoodwill,ifany,atJanuary1,2012.

A.$150.

B.$250.

C.$700.

D.$1,200.

E.$550.

41.PerryCompanyacquires100%ofthestockofHurleyCorporationonJanuary1,2012,

for$3,800cash.AsofthatdateHurleyhasthefollowingtrialbalance;

Anyexcessofconsiderationtransferredoverfairvalueofnetassetsacquiredisconsidered

goodwillwithanindefinitelife.FIFOinventoryvaluationmethodisused.

ComputetheamountofHurley'sinventorythatwouldbereportedinaJanuary1,2012,

consolidatedbalancesheet.

A.$800.

B.$100.

C.$900.

D.$150.

E.$0.

2-62

Chapter 02 - Consolidation of Financial Information

42.PerryCompanyacquires100%ofthestockofHurleyCorporationonJanuary1,2012,

for$3,800cash.AsofthatdateHurleyhasthefollowingtrialbalance;

Anyexcessofconsiderationtransferredoverfairvalueofnetassetsacquiredisconsidered

goodwillwithanindefinitelife.FIFOinventoryvaluationmethodisused.

ComputetheamountofHurley'sbuildingsthatwouldbereportedinaDecember31,2012,

consolidatedbalancesheet.

A.$1,560.

B.$1,260.

C.$1,440.

D.$1,160.

E.$1,140.

43.PerryCompanyacquires100%ofthestockofHurleyCorporationonJanuary1,2012,

for$3,800cash.AsofthatdateHurleyhasthefollowingtrialbalance;

Anyexcessofconsiderationtransferredoverfairvalueofnetassetsacquiredisconsidered

goodwillwithanindefinitelife.FIFOinventoryvaluationmethodisused.

ComputetheamountofHurley'sequipmentthatwouldbereportedinaDecember31,2012,

consolidatedbalancesheet.

A.$1,000.

B.$1,250.

C.$875.

D.$1,125.

E.$750.

44.PerryCompanyacquires100%ofthestockofHurleyCorporationonJanuary1,2012,

for$3,800cash.AsofthatdateHurleyhasthefollowingtrialbalance;

Anyexcessofconsiderationtransferredoverfairvalueofnetassetsacquiredisconsidered

goodwillwithanindefinitelife.FIFOinventoryvaluationmethodisused.

Computetheamountoftotalexpensesreportedinanincomestatementfortheyearended

December31,2012,inordertorecognizeacquisitiondateallocationsoffairvalueandbook

valuedifferences,

A.$140.

B.$190.

C.$260.

D.$285.

E.$310.

45.PerryCompanyacquires100%ofthestockofHurleyCorporationonJanuary1,2012,

for$3,800cash.AsofthatdateHurleyhasthefollowingtrialbalance;

Anyexcessofconsiderationtransferredoverfairvalueofnetassetsacquiredisconsidered

goodwillwithanindefinitelife.FIFOinventoryvaluationmethodisused.

ComputetheamountofHurley'slongtermliabilitiesthatwouldbereportedinaDecember

31,2012,consolidatedbalancesheet.

A.$1,800.

B.$1,700.

C.$1,725.

D.$1,675.

2-63

Chapter 02 - Consolidation of Financial Information

E.$3,500.

46.PerryCompanyacquires100%ofthestockofHurleyCorporationonJanuary1,2012,

for$3,800cash.AsofthatdateHurleyhasthefollowingtrialbalance;

Anyexcessofconsiderationtransferredoverfairvalueofnetassetsacquiredisconsidered

goodwillwithanindefinitelife.FIFOinventoryvaluationmethodisused.

ComputetheamountofHurley'sbuildingsthatwouldbereportedinaDecember31,2013,

consolidatedbalancesheet.

A.$1,620.

B.$1,380.

C.$1,320.

D.$1,080.

E.$1,500.

47.PerryCompanyacquires100%ofthestockofHurleyCorporationonJanuary1,2012,

for$3,800cash.AsofthatdateHurleyhasthefollowingtrialbalance;

Anyexcessofconsiderationtransferredoverfairvalueofnetassetsacquiredisconsidered

goodwillwithanindefinitelife.FIFOinventoryvaluationmethodisused.

ComputetheamountofHurley'sequipmentthatwouldbereportedinaDecember31,2013,

consolidatedbalancesheet.

A.$0.

B.$1,000.

C.$1,250.

D.$1,125.

E.$1,200.

48.PerryCompanyacquires100%ofthestockofHurleyCorporationonJanuary1,2012,

for$3,800cash.AsofthatdateHurleyhasthefollowingtrialbalance;

Anyexcessofconsiderationtransferredoverfairvalueofnetassetsacquiredisconsidered

goodwillwithanindefinitelife.FIFOinventoryvaluationmethodisused.

ComputetheamountofHurley'slandthatwouldbereportedinaDecember31,2013,

consolidatedbalancesheet.

A.$900.

B.$1,300.

C.$400.

D.$1,450.

E.$2,200.

49.PerryCompanyacquires100%ofthestockofHurleyCorporationonJanuary1,2012,

for$3,800cash.AsofthatdateHurleyhasthefollowingtrialbalance;

Anyexcessofconsiderationtransferredoverfairvalueofnetassetsacquiredisconsidered

goodwillwithanindefinitelife.FIFOinventoryvaluationmethodisused.

ComputetheamountofHurley'slongtermliabilitiesthatwouldbereportedinaDecember

31,2013,consolidatedbalancesheet.

A.$1,700.

B.$1,800.

2-64

Chapter 02 - Consolidation of Financial Information

C.$1,650.

D.$1,750.

E.$3,500.

50.KayeCompanyacquired100%ofFioreCompanyonJanuary1,2013.Kayepaid$1,000

excessconsiderationoverbookvaluewhichisbeingamortizedat$20peryear.Fiorereported

netincomeof$400in2013andpaiddividendsof$100.

Assumetheequitymethodisapplied.HowmuchwillKaye'sincomeincreaseordecreaseasa

resultofFiore'soperations?

A.$400increase.

B.$300increase.

C.$380increase.

D.$280increase.

E.$480increase.

51.KayeCompanyacquired100%ofFioreCompanyonJanuary1,2013.Kayepaid$1,000

excessconsiderationoverbookvaluewhichisbeingamortizedat$20peryear.Fiorereported

netincomeof$400in2013andpaiddividendsof$100.

Assumethepartialequitymethodisapplied.HowmuchwillKaye'sincomeincreaseor

decreaseasaresultofFiore'soperations?

A.$400increase.

B.$300increase.

C.$380increase.

D.$280increase.

E.$480increase.

52.KayeCompanyacquired100%ofFioreCompanyonJanuary1,2013.Kayepaid$1,000

excessconsiderationoverbookvaluewhichisbeingamortizedat$20peryear.Fiorereported

netincomeof$400in2013andpaiddividendsof$100.

Assumetheinitialvaluemethodisapplied.HowmuchwillKaye'sincomeincreaseor

decreaseasaresultofFiore'soperations?

A.$400increase.

B.$300increase.

C.$380increase.

D.$100increase.

E.$210increase.

53.KayeCompanyacquired100%ofFioreCompanyonJanuary1,2013.Kayepaid$1,000

excessconsiderationoverbookvaluewhichisbeingamortizedat$20peryear.Fiorereported

netincomeof$400in2013andpaiddividendsof$100.

Assumethepartialequitymethodisused.Intheyearsfollowingacquisition,whatadditional

worksheetentrymustbemadeforconsolidationpurposesthatisnotrequiredfortheequity

method?

A.EntryA.

B.EntryB.

C.EntryC.

D.EntryD.

E.EntryE.

2-65

Chapter 02 - Consolidation of Financial Information

54.KayeCompanyacquired100%ofFioreCompanyonJanuary1,2013.Kayepaid$1,000

excessconsiderationoverbookvaluewhichisbeingamortizedat$20peryear.Fiorereported

netincomeof$400in2013andpaiddividendsof$100.

Assumetheinitialvaluemethodisused.Intheyearsubsequenttoacquisition,whatadditional

worksheetentrymustbemadeforconsolidationpurposesthatisnotrequiredfortheequity

method?

A.EntryA.

B.EntryB.

C.EntryC.

D.EntryD.

E.EntryE.

55.HoytCorporationagreedtothefollowingtermsinordertoacquirethenetassetsof

BrownCompanyonJanuary1,2013:

(1.)Toissue400sharesofcommonstock($10par)withafairvalueof$45pershare.

(2.)ToassumeBrown'sliabilitieswhichhaveafairvalueof$1,500.

Onthedateofacquisition,theconsiderationtransferredforHoyt'sacquisitionofBrown

wouldbe

A.$18,000.

B.$16,500.

C.$20,000.

D.$18,500.

E.$19,500.

56.FollowingareselectedaccountsforGreenCorporationandVegaCompanyasof

December31,2015.SeveralofGreen'saccountshavebeenomitted.

Greenacquired100%ofVegaonJanuary1,2011,byissuing10,500sharesofits$10par

valuecommonstockwithafairvalueof$95pershare.OnJanuary1,2011,Vega'slandwas

undervaluedby$40,000,itsbuildingswereovervaluedby$30,000,andequipmentwas

undervaluedby$80,000.Thebuildingshavea20yearlifeandtheequipmenthasa10year

life.$50,000wasattributedtoanunrecordedtrademarkwitha16yearremaininglife.There

wasnogoodwillassociatedwiththisinvestment.

ComputethebookvalueofVegaatJanuary1,2011.

A.$997,500.

B.$857,500.

C.$1,200,000.

D.$1,600,000.

E.$827,500.

57.FollowingareselectedaccountsforGreenCorporationandVegaCompanyasof

December31,2015.SeveralofGreen'saccountshavebeenomitted.

Greenacquired100%ofVegaonJanuary1,2011,byissuing10,500sharesofits$10par

valuecommonstockwithafairvalueof$95pershare.OnJanuary1,2011,Vega'slandwas

undervaluedby$40,000,itsbuildingswereovervaluedby$30,000,andequipmentwas

2-66

Chapter 02 - Consolidation of Financial Information

undervaluedby$80,000.Thebuildingshavea20yearlifeandtheequipmenthasa10year

life.$50,000wasattributedtoanunrecordedtrademarkwitha16yearremaininglife.There

wasnogoodwillassociatedwiththisinvestment.

ComputetheDecember31,2015,consolidatedrevenues.

A.$1,400,000.

B.$800,000.

C.$500,000.

D.$1,590,375.

E.$1,390,375.

58.FollowingareselectedaccountsforGreenCorporationandVegaCompanyasof

December31,2015.SeveralofGreen'saccountshavebeenomitted.

Greenacquired100%ofVegaonJanuary1,2011,byissuing10,500sharesofits$10par

valuecommonstockwithafairvalueof$95pershare.OnJanuary1,2011,Vega'slandwas

undervaluedby$40,000,itsbuildingswereovervaluedby$30,000,andequipmentwas

undervaluedby$80,000.Thebuildingshavea20yearlifeandtheequipmenthasa10year

life.$50,000wasattributedtoanunrecordedtrademarkwitha16yearremaininglife.There

wasnogoodwillassociatedwiththisinvestment.

ComputetheDecember31,2015,consolidatedtotalexpenses.

A.$620,000.

B.$280,000.

C.$900,000.

D.$909,625.

E.$299,625.

59.FollowingareselectedaccountsforGreenCorporationandVegaCompanyasof

December31,2015.SeveralofGreen'saccountshavebeenomitted.

Greenacquired100%ofVegaonJanuary1,2011,byissuing10,500sharesofits$10par

valuecommonstockwithafairvalueof$95pershare.OnJanuary1,2011,Vega'slandwas

undervaluedby$40,000,itsbuildingswereovervaluedby$30,000,andequipmentwas

undervaluedby$80,000.Thebuildingshavea20yearlifeandtheequipmenthasa10year

life.$50,000wasattributedtoanunrecordedtrademarkwitha16yearremaininglife.There

wasnogoodwillassociatedwiththisinvestment.

ComputetheDecember31,2015,consolidatedbuildings.

A.$1,037,500.

B.$1,007,500.

C.$1,000,000.

D.$1,022,500.

E.$1,012,500.

60.FollowingareselectedaccountsforGreenCorporationandVegaCompanyasof

December31,2015.SeveralofGreen'saccountshavebeenomitted.

Greenacquired100%ofVegaonJanuary1,2011,byissuing10,500sharesofits$10par

valuecommonstockwithafairvalueof$95pershare.OnJanuary1,2011,Vega'slandwas

undervaluedby$40,000,itsbuildingswereovervaluedby$30,000,andequipmentwas

undervaluedby$80,000.Thebuildingshavea20yearlifeandtheequipmenthasa10year

2-67

Chapter 02 - Consolidation of Financial Information

life.$50,000wasattributedtoanunrecordedtrademarkwitha16yearremaininglife.There

wasnogoodwillassociatedwiththisinvestment.

ComputetheDecember31,2015,consolidatedequipment.

A.$800,000.

B.$808,000.

C.$840,000.

D.$760,000.

E.$848,000.

61.FollowingareselectedaccountsforGreenCorporationandVegaCompanyasof

December31,2015.SeveralofGreen'saccountshavebeenomitted.

Greenacquired100%ofVegaonJanuary1,2011,byissuing10,500sharesofits$10par

valuecommonstockwithafairvalueof$95pershare.OnJanuary1,2011,Vega'slandwas

undervaluedby$40,000,itsbuildingswereovervaluedby$30,000,andequipmentwas

undervaluedby$80,000.Thebuildingshavea20yearlifeandtheequipmenthasa10year

life.$50,000wasattributedtoanunrecordedtrademarkwitha16yearremaininglife.There

wasnogoodwillassociatedwiththisinvestment.

ComputetheDecember31,2015,consolidatedland.

A.$220,000.

B.$180,000.

C.$670,000.

D.$630,000.

E.$450,000.

62.FollowingareselectedaccountsforGreenCorporationandVegaCompanyasof

December31,2015.SeveralofGreen'saccountshavebeenomitted.

Greenacquired100%ofVegaonJanuary1,2011,byissuing10,500sharesofits$10par

valuecommonstockwithafairvalueof$95pershare.OnJanuary1,2011,Vega'slandwas

undervaluedby$40,000,itsbuildingswereovervaluedby$30,000,andequipmentwas

undervaluedby$80,000.Thebuildingshavea20yearlifeandtheequipmenthasa10year

life.$50,000wasattributedtoanunrecordedtrademarkwitha16yearremaininglife.There

wasnogoodwillassociatedwiththisinvestment.

ComputetheDecember31,2015,consolidatedtrademark.

A.$50,000.

B.$46,875.

C.$0.

D.$34,375.

E.$37,500.

63.FollowingareselectedaccountsforGreenCorporationandVegaCompanyasof

December31,2015.SeveralofGreen'saccountshavebeenomitted.

Greenacquired100%ofVegaonJanuary1,2011,byissuing10,500sharesofits$10par

valuecommonstockwithafairvalueof$95pershare.OnJanuary1,2011,Vega'slandwas

undervaluedby$40,000,itsbuildingswereovervaluedby$30,000,andequipmentwas

undervaluedby$80,000.Thebuildingshavea20yearlifeandtheequipmenthasa10year

life.$50,000wasattributedtoanunrecordedtrademarkwitha16yearremaininglife.There

2-68

Chapter 02 - Consolidation of Financial Information

wasnogoodwillassociatedwiththisinvestment.

ComputetheDecember31,2015,consolidatedcommonstock.

A.$450,000.

B.$530,000.

C.$555,000.

D.$635,000.

E.$525,000.

64.FollowingareselectedaccountsforGreenCorporationandVegaCompanyasof

December31,2015.SeveralofGreen'saccountshavebeenomitted.

Greenacquired100%ofVegaonJanuary1,2011,byissuing10,500sharesofits$10par

valuecommonstockwithafairvalueof$95pershare.OnJanuary1,2011,Vega'slandwas

undervaluedby$40,000,itsbuildingswereovervaluedby$30,000,andequipmentwas

undervaluedby$80,000.Thebuildingshavea20yearlifeandtheequipmenthasa10year

life.$50,000wasattributedtoanunrecordedtrademarkwitha16yearremaininglife.There

wasnogoodwillassociatedwiththisinvestment.

ComputetheDecember31,2015,consolidatedadditionalpaidincapital.

A.$210,000.

B.$75,000.

C.$1,102,500.

D.$942,500.

E.$525,000.

65.FollowingareselectedaccountsforGreenCorporationandVegaCompanyasof

December31,2015.SeveralofGreen'saccountshavebeenomitted.

Greenacquired100%ofVegaonJanuary1,2011,byissuing10,500sharesofits$10par

valuecommonstockwithafairvalueof$95pershare.OnJanuary1,2011,Vega'slandwas

undervaluedby$40,000,itsbuildingswereovervaluedby$30,000,andequipmentwas

undervaluedby$80,000.Thebuildingshavea20yearlifeandtheequipmenthasa10year

life.$50,000wasattributedtoanunrecordedtrademarkwitha16yearremaininglife.There

wasnogoodwillassociatedwiththisinvestment.

ComputetheDecember31,2015consolidatedretainedearnings.

A.$1,645,375.

B.$1,350,000.

C.$1,565,375.

D.$1,840,375.

E.$1,265,375.

66.FollowingareselectedaccountsforGreenCorporationandVegaCompanyasof

December31,2015.SeveralofGreen'saccountshavebeenomitted.

Greenacquired100%ofVegaonJanuary1,2011,byissuing10,500sharesofits$10par

valuecommonstockwithafairvalueof$95pershare.OnJanuary1,2011,Vega'slandwas

undervaluedby$40,000,itsbuildingswereovervaluedby$30,000,andequipmentwas

undervaluedby$80,000.Thebuildingshavea20yearlifeandtheequipmenthasa10year

life.$50,000wasattributedtoanunrecordedtrademarkwitha16yearremaininglife.There

2-69

Chapter 02 - Consolidation of Financial Information

wasnogoodwillassociatedwiththisinvestment.

ComputetheequityinVega'sincometobeincludedinGreen'sconsolidatedincome

statementfor2015.

A.$500,000.

B.$300,000.

C.$190,375.

D.$200,000.

E.$290,375.

67.Onecompanyacquiresanothercompanyinacombinationaccountedforasan

acquisition.Theacquiringcompanydecidestoapplytheinitialvaluemethodinaccounting

forthecombination.Whatisonereasontheacquiringcompanymighthavemadethis

decision?

A.ItistheonlymethodallowedbytheSEC.

B.Itisrelativelyeasytoapply.

C.Itistheonlyinternalreportingmethodallowedbygenerallyacceptedaccounting

principles.

D.Operatingresultsontheparent'sfinancialrecordsreflectconsolidatedtotals.

E.Whentheinitialmethodisused,noworksheetentriesarerequiredintheconsolidation

process.

68.Onecompanyacquiresanothercompanyinacombinationaccountedforasan

acquisition.Theacquiringcompanydecidestoapplytheequitymethodinaccountingforthe

combination.Whatisonereasontheacquiringcompanymighthavemadethisdecision?

A.ItistheonlymethodallowedbytheSEC.

B.Itisrelativelyeasytoapply.

C.Itistheonlyinternalreportingmethodallowedbygenerallyacceptedaccounting

principles.

D.Operatingresultsontheparent'sfinancialrecordsreflectconsolidatedtotals.

E.Whentheequitymethodisused,noworksheetentriesarerequiredintheconsolidation

process.

69.Whenisagoodwillimpairmentlossrecognized?

A.Annuallyonasystematicandrationalbasis.

B.Never.

C.Ifboththefairvalueofareportingunitanditsassociatedimpliedgoodwillfall

belowtheirrespectivecarryingvalues.

D.Ifthefairvalueofareportingunitfallsbelowitsoriginalacquisitionprice.

E.Wheneverthefairvalueoftheentitydeclinessignificantly.

70.Whichofthefollowingwillresultintherecognitionofanimpairmentlossongoodwill?

A.Goodwillamortizationistoberecognizedannuallyonasystematicandrationalbasis.

B.Boththefairvalueofareportingunitanditsassociatedimpliedgoodwillfallbelow

theirrespectivecarryingvalues.

2-70

Chapter 02 - Consolidation of Financial Information

C.Thefairvalueoftheentitydeclinessignificantly.

D.Thefairvalueofareportingunitfallsbelowtheoriginalconsiderationtransferredforthe

acquisition.

E.TheentityisinvestigatedbytheSECanditsreputationhasbeenseverelydamaged.

71.Goehler,Inc.acquiresallofthevotingstockofKenneth,Inc.onJanuary4,2012,atan

amountinexcessofKenneth'sfairvalue.Onthatdate,Kennethhasequipmentwithabook

valueof$90,000andafairvalueof$120,000(10yearremaininglife).Goehlerhas

equipmentwithabookvalueof$800,000andafairvalueof$1,200,000(10yearremaining

life).OnDecember31,2013,Goehlerhasequipmentwithabookvalueof$975,000butafair

valueof$1,350,000andKennethhasequipmentwithabookvalueof$105,000butafair

valueof$125,000.

IfGoehlerappliestheequitymethodinaccountingforKenneth,whatistheconsolidated

balancefortheEquipmentaccountasofDecember31,2013?

A.$1,080,000.

B.$1,104,000.

C.$1,100,000.

D.$1,468,000.

E.$1,475,000.

72.Goehler,Inc.acquiresallofthevotingstockofKenneth,Inc.onJanuary4,2012,atan

amountinexcessofKenneth'sfairvalue.Onthatdate,Kennethhasequipmentwithabook

valueof$90,000andafairvalueof$120,000(10yearremaininglife).Goehlerhas

equipmentwithabookvalueof$800,000andafairvalueof$1,200,000(10yearremaining

life).OnDecember31,2013,Goehlerhasequipmentwithabookvalueof$975,000butafair

valueof$1,350,000andKennethhasequipmentwithabookvalueof$105,000butafair

valueof$125,000.

IfGoehlerappliesthepartialequitymethodinaccountingforKenneth,whatisthe

consolidatedbalancefortheEquipmentaccountasofDecember31,2013?

A.$1,080,000.

B.$1,104,000.

C.$1,100,000.

D.$1,468,000.

E.$1,475,000.

73.Goehler,Inc.acquiresallofthevotingstockofKenneth,Inc.onJanuary4,2012,atan

amountinexcessofKenneth'sfairvalue.Onthatdate,Kennethhasequipmentwithabook

valueof$90,000andafairvalueof$120,000(10yearremaininglife).Goehlerhas

equipmentwithabookvalueof$800,000andafairvalueof$1,200,000(10yearremaining

life).OnDecember31,2013,Goehlerhasequipmentwithabookvalueof$975,000butafair

valueof$1,350,000andKennethhasequipmentwithabookvalueof$105,000butafair

valueof$125,000.

IfGoehlerappliestheinitialvaluemethodinaccountingforKenneth,whatistheconsolidated

balancefortheEquipmentaccountasofDecember31,2013?

2-71

Chapter 02 - Consolidation of Financial Information

A.$1,080,000.

B.$1,104,000.

C.$1,100,000.

D.$1,468,000.

E.$1,475,000.

74.Howisthefairvalueallocationofanintangibleassetallocatedtoexpensewhentheasset

hasnolegal,regulatory,contractual,competitive,economic,orotherfactorsthatlimititslife?

A.Equallyover20years.

B.Equallyover40years.

C.Equallyover20yearswithanannualimpairmentreview.

D.Noamortization,butannuallyreviewedforimpairmentandadjustedaccordingly.

E.Noamortizationoveranindefiniteperiodtime.

75.Harrison,Inc.acquires100%ofthevotingstockofRhineCompanyonJanuary1,2012

for$400,000cash.Acontingentpaymentof$16,500willbepaidonApril15,2013ifRhine

generatescashflowsfromoperationsof$27,000ormoreinthenextyear.Harrisonestimates

thatthereisa20%probabilitythatRhinewillgenerateatleast$27,000nextyear,andusesan

interestrateof5%toincorporatethetimevalueofmoney.Thefairvalueof$16,500at5%,

usingaprobabilityweightedapproach,is$3,142.

WhatwillHarrisonrecordasitsInvestmentinRhineonJanuary1,2012?

A.$400,000.

B.$403,142.

C.$406,000.

D.$409,142.

E.$416,500.

76.Harrison,Inc.acquires100%ofthevotingstockofRhineCompanyonJanuary1,2012

for$400,000cash.Acontingentpaymentof$16,500willbepaidonApril15,2013ifRhine

generatescashflowsfromoperationsof$27,000ormoreinthenextyear.Harrisonestimates

thatthereisa20%probabilitythatRhinewillgenerateatleast$27,000nextyear,andusesan

interestrateof5%toincorporatethetimevalueofmoney.Thefairvalueof$16,500at5%,

usingaprobabilityweightedapproach,is$3,142.

AssumingRhinegeneratescashflowfromoperationsof$27,200in2012,howwillHarrison

recordthe$16,500paymentofcashonApril15,2013insatisfactionofitscontingent

obligation?

A.DebitContingentperformanceobligation$16,500,andCreditCash$16,500.

B.DebitContingentperformanceobligation$3,142,debitLossfromrevaluationof

contingentperformanceobligation$13,358,andCreditCash$16,500.

C.DebitInvestmentinSubsidiaryandCreditCash$16,500.

D.DebitGoodwillandCreditCash$16,500.

E.Noentry.

77.Harrison,Inc.acquires100%ofthevotingstockofRhineCompanyonJanuary1,2012

for$400,000cash.Acontingentpaymentof$16,500willbepaidonApril15,2013ifRhine

generatescashflowsfromoperationsof$27,000ormoreinthenextyear.Harrisonestimates

2-72

Chapter 02 - Consolidation of Financial Information

thatthereisa20%probabilitythatRhinewillgenerateatleast$27,000nextyear,andusesan

interestrateof5%toincorporatethetimevalueofmoney.Thefairvalueof$16,500at5%,

usingaprobabilityweightedapproach,is$3,142.

WhenrecordingconsiderationtransferredfortheacquisitionofRhineonJanuary1,2012,

Harrisonwillrecordacontingentperformanceobligationintheamountof:

A.$628.40

B.$2,671.60

C.$3,142.00

D.$13,358.00

E.$16,500.00

78.Beatty,Inc.acquires100%ofthevotingstockofGatauxCompanyonJanuary1,2012

for$500,000cash.Acontingentpaymentof$12,000willbepaidonApril1,2013ifGataux

generatescashflowsfromoperationsof$26,500ormoreinthenextyear.Beattyestimates

thatthereisa30%probabilitythatGatauxwillgenerateatleast$26,500nextyear,anduses

aninterestrateof4%toincorporatethetimevalueofmoney.Thefairvalueof$12,000at

4%,usingaprobabilityweightedapproach,is$3,461.

WhatwillBeattyrecordasitsInvestmentinGatauxonJanuary1,2012?

A.$500,000.

B.$503,461.

C.$512,000.

D.$515,461.

E.$526,500.

79.Beatty,Inc.acquires100%ofthevotingstockofGatauxCompanyonJanuary1,2012

for$500,000cash.Acontingentpaymentof$12,000willbepaidonApril1,2013ifGataux

generatescashflowsfromoperationsof$26,500ormoreinthenextyear.Beattyestimates

thatthereisa30%probabilitythatGatauxwillgenerateatleast$26,500nextyear,anduses

aninterestrateof4%toincorporatethetimevalueofmoney.Thefairvalueof$12,000at

4%,usingaprobabilityweightedapproach,is$3,461.

AssumingGatauxgeneratescashflowfromoperationsof$27,200in2012,howwillBeatty

recordthe$12,000paymentofcashonApril1,2013insatisfactionofitscontingent

obligation?

A.DebitContingentperformanceobligation$3,461,debitGoodwill$8,539,andCreditCash

$12,000.

B.DebitContingentperformanceobligation$3,461,debitLossfromrevaluationof

contingentperformanceobligation$8,539,andCreditCash$12,000.

C.DebitGoodwillandCreditCash$12,000.

D.DebitGoodwill$27,200,creditContingentperformanceobligation$15,200,andCredit

Cash$12,000.

E.Noentry.

80.Beatty,Inc.acquires100%ofthevotingstockofGatauxCompanyonJanuary1,2012

for$500,000cash.Acontingentpaymentof$12,000willbepaidonApril1,2013ifGataux

generatescashflowsfromoperationsof$26,500ormoreinthenextyear.Beattyestimates

thatthereisa30%probabilitythatGatauxwillgenerateatleast$26,500nextyear,anduses

2-73

Chapter 02 - Consolidation of Financial Information

aninterestrateof4%toincorporatethetimevalueofmoney.Thefairvalueof$12,000at

4%,usingaprobabilityweightedapproach,is$3,461.

WhenrecordingconsiderationtransferredfortheacquisitionofGatauxonJanuary1,2012,

Beattywillrecordacontingentperformanceobligationintheamountof:

A.$692.20

B.$3,040.00

C.$3,461.00

D.$12,000.00

E.$15,200.00

81.PrinceCompanyacquiresDuchess,Inc.onJanuary1,2011.Theconsideration

transferredexceedsthefairvalueofDuchess'netassets.Onthatdate,Princehasabuilding

withabookvalueof$1,200,000andafairvalueof$1,500,000.Duchesshasabuildingwitha

bookvalueof$400,000andfairvalueof$500,000.

Ifpushdownaccountingisused,whatamountsintheBuildingaccountappearinDuchess'