Skewed Normal Distribution of Return Assets in Call European Option Pricing

Diunggah oleh

hendrikraharjoJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Skewed Normal Distribution of Return Assets in Call European Option Pricing

Diunggah oleh

hendrikraharjoHak Cipta:

Format Tersedia

EvySulistianingsih.

Skewed Normal Distribution

Skewed Normal Distribution Of Return Assets

In Call European Option Pricing

EvySulistianingsih

Department of Mathematics, FMIPA, Tanjungpura University

Abstract

Option is one of security derivates. In financial market, option is a contract that gives a right (not

the obligation) for its owner to buy or sell a particular asset for a certain price at a certain time.

Option can give a guarantee for a risk that can be faced in a market.This paper studies about the

use of Skewed Normal Distribution (SN) in call europeanoption pricing. The SN provides a

flexible framework that captures the skewness of log return. We obtain aclosed form solution for

the european call option pricing when log return follow the SN. Then, we will compare option

prices that is obtained by the SN and the Black-Scholes model with the option prices of market.

Keywords: skewed normaldistribution, log return, options.

calculations of the option price based on

distribution approach. They expect that the

characteristics of data is used can be

modeled well by the approach of the

distribution (other than Normal and

Lognormal

Distribution).One

such

distribution is Skewed Normal Distribution

(SN). Therefore, this paper will discuss the

use of SN for stock return on assets in

determining the price of european call

option.

The remainder of this paper begins with

Itos Lemma, Brownian Motion and BlackScholes Model in section 2, while section 3

derives SN approach pricing model for

europeancall options and the last section

offers the conclusions.

1. INTRODUCTION

Option is a contract that gives the right

(not obligation) to the contract holder

(option buyer) to buy (call option) or sell

(put option) a particular stock at a certain

price within a specified period.

In practice, there are many different

types of option. Based on the form of rights

that occurs, the option can be divided into

two, namely a call option and put option.

Whether buying or selling option, they can

type in europe and america.

In the pricing of stock option, BlackScholes model is the first model used in

option pricing. This model limited the

problem by making an assumption that

stock returns follow a Normal Distribution

while stock prices follow Lognormal

Distribution

In fact, the return data are often not

normally distributed. In addition, the return

data are often found in non zero skewness,

see Hsieh [1], Nelson [3] and Theodossiou

[4]. Thus, the Normal Distribution for the

return and Lognormal Distribution for stock

data which is the assumption in BlackScholes model is less able to explain the

existence of this skewness. This has

encouraged

researchers

to

perform

2. ITOs LEMMA, BROWNIAN

MOTION, ANDBLACK-SCHOLES

MODEL

2.1 Its Lemma

The price of each derivative security is a

function of the security stochastic variables

underlying the derivative and time.

Therefore, it is need an understanding about

the functions of stochastic variables. An

important result in understanding this area

(1)

EvySulistianingsih. Skewed Normal Distribution

Black-Scholes model is the first model

used in option pricing.

Hull [2] states that european call

option with the

corresponding

payoff

was discovered by the mathematician, K.

Ito in 1951, later known as ItsLemma.

Its Lemma.If F(x,t)be a continuous

function, twice differentiable function ofx

andt, or

F F 2 F

,

,

t x x 2

and

{ x ( t ) , t 0}.

Defined a stochastic differential equation

with driftrate a( x, t ) and variance rate

b 2 ( x, t ) ,

dx = a ( x , t ) dt + b ( x, t ) dW ,

x(0) = x 0 , 0 t T

fT = ( ST K , 0 ) , rational price C BS set by

the Black-Scholes formula is

C BS = S0 N ( d1 ) Ke r N ( d 2 ) (2.5)

+

where S0 is stock price at time 0, ST is stock

price at a future time T , K is strike price,

ln ( S0 / K ) + r + 2 / 2

d1 =

, (2.6)

d2 =

(2.1)

(2.7)

and

1

2

is the cumulative

distribution.

N ( x) =

F

b( x, t ) dW.

x

ln ( S0 / K ) + ( r 2 / 2 )

= d1 ,

where dW is Wiener Process, a and b are

function of x and t , then a function F of x

and t follow the process:

F 1 F 2

dF = a( x,t ) + +

b ( x,t ) dt +

2

t 2 x

x

(2.2)

y 2 /2

dy

standard

normal

3. SNAPPROACH FOR

DETERMINING THE PRICE OF

EUROPEAN CALL OPTION

2.2 Brownian Motion of Stock Price

Process

This section describes the calculation of

the european call option price using SN

approach for return assets. However, the

previously disclosed little about the Skewed

Generalized Error Distribution (SGED)

which is a generalization of SN.

Defined a Geometric Brownian Motion

of stock price as follow

dS = Sdt + SdW (2.3)

where and are constants. Equation

(2.3) had been known as a model of stock

price behavior.

Using Its Lemma, the solution of

equation (2.3) is

ST = S0 exp 2 T + WT . (2.4)

2

3.1 Density Function ofSGED andSN

A continuous

random variable Y followsSGEDwith

parameter , , k , , if it

has probability density function which

can be expressed as follows:

2.3 Black-Scholes Model

(2)

EvySulistianingsih. Skewed Normal Distribution

f ( y , , k , ) =

1

k

(3.1)

exp

y

(1 + sign ( y + ) )k k k

In the equation above, the sign states

Signum Function, while (.) stating Gamma

Function. Parameter k with constraints

k > 0 to control the height and the tails of

density function, while which obey the

following constraint

a

1 < < 1 is

skewness parameter, as in Theodossiou [4].

In the case of positive skewness > 0 ,

the density function is skewed to the right,

whereas for the case of negative skewness

< 0 , the density function is skewed to the

left.Theodossiou and Trigeorgis [5]

state that the probabilitydensity function of

SN

is a

special

case of

the probabilitydensity function of

SGED

for parameter values k = 2 .

Through

substitution X = Y + is

obtained that the probability density

function of SN is

where

1

k 1

C=

, (3.2)

2 k

1

1

1 2 3 2

= S ( ) , (3.3)

k k

= 2 AS ( ) , (3.4)

1

S ( ) = 1 + 3 2 4 A2 2 , and(3.5)

2 1 2 3 2

A = . (3.6)

k k

k

Notation of and represent the

expected value and standard deviation of

random variable Y.

x

. (3.7)

f ( x , , ) = exp

[1 + sign(x)]2 2 2

where C =

1

2

1

,

2

1

1

2

1 3

S ( ) = 1 + 3 4 , and

2 2

2

1 2 3 2

A = (1) .

2

2

= S ( ) , = 2 AS ( ) ,

2 2

1

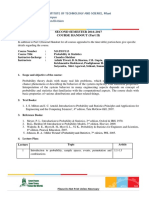

Probability of SN density function

illustrated by this figure

(3)

EvySulistianingsih. Skewed Normal Distribution

Figure 2Probability of SN density function

Based on the definition of sample

moment, it was known that sample

Note that, figure 2 only differ in the value

of , while for value of , and k are the

same.

Can be calculated directly that

moments of SN are m1 =

E ( X ) = , Var( X ) = 2 , 1 = 0,

3 1

2 = 2 (1 + 3 2 ) 2 2 ,

k k

3

3

and 3 = A3 3 .

m2 =

Yt 2

t =1

t =1

=Y ,

, and m3 =

t =1

Furthermore, the calculation shows that

2

estimates of , and respectively are

3.2 Estimation of SN Parameter by

Moment Method

This section derives estimating of SN

parameters by using moment method.

Let the unknown mean and variance of

the SN respectively are and 2

If skewness is also known, it can be

2

2

2

easily calculated that E (Y ) = + and

t =1

(Y Y )

=Y ,

2 =

t =1

.The

= ( 0.626657068656)

details

, and

of

derivation of , 2 and can be found in

appendix 1, below.

3

E (Y 3 ) = SK 2 2 + 3 2 + 3 .

( )

Appendix 1-Estimation of SN Parameter by Moment Method

Using Moment Method, mean and variance of SN respectively are

E (Y ) =

(4)

EvySulistianingsih. Skewed Normal Distribution

Var(Y ) = 2 E[(Y E(Y))2 ] = E(Y 2 ) [E(Y)]2 = E(Y 2 ) 2

Then, letskewness of SN is

E[(Y E (Y ))3 ]

SK =

= A3 3 3

2 32

[ E[(Y E (Y )) ]]

On the other hand, we know

SK ( 2 ) = E (Y 3 ) 3 2 3 ,

3

2

so

E (Y 3 ) = SK ( 2 ) + 3 2 + 3

3

2

Consider that moment population of SN are

1 = E(Y ) = , 2 = E(Y 2 ) = 2 + 2 , 3 = E(Y 3 ) = SK ( 2 ) + 3 2 + 3

3

2

Based on definition of sample moment of moment method, sample moment of SN are

n

m1 =

t =1

= Y , m2 =

, m3 =

t =1

t =1

Furthermore, using moment method we conclude that

n

1 = m1 =

= Y . (A.2.1)

t =1

n

n

2 = m2 + =

2

t =1

. (A.2.2)

n

n

3 = m3 SK ( 2 ) + 3 2 + 3 =

3

2

t =1

. (A.2.3)

Using equation (A.2.3), we get

n

t =1

n 2

Yt

3 t =1

Y 2 Y Y 3

n

=

3

2 2

n

( )

(Y Y )

t =1

2

are

Based on the above results, we get , and

= Y (A.2.4)

(5)

EvySulistianingsih. Skewed Normal Distribution

(

n

2 =

Yt Y

t =1

(Y Y )

n

t =1

(A.2.5)

n

n

Yt Y

1

= t =1 3

. (A.2.6)

Using equation (A.2.4), (A.2.5) and (A.2.6), we will find the parameter estimator for as

follows

1 3

1

1/2

1/2

1

1/2 2

1

1

3

1

3

4(1+2 ) ( 2) 1+32 4 2

2 2

2 2 2

1

1/2

1/2

1

1/2 2

1 3

1 3

3

2

2

SK=A3 3 = 32 1+3 4

,

2 2

2 2

1/2

1/2

1

1/2 2

2 1 3 1+32 4 1 3 2

2 2

2 2

So

3/ 2

2

8 2

2

2

1

3

+

8 (1 + )

1/2

2

8 2

1 + 3

3/2

2

8 3 2 2 1 + 3 2 8

Estimator for can be found by

completing equation (A.2.7) through the

use of Taylor Series approach. Founding

is analog with searching of root from

equation (A.2.7). This process is done by

Scientific Work Place (SWP) with the

following stages:

1. For purposes of simplification, the first

term on the left side of equation (A.2.7)

t =1

3 3 2

( )

2

3

2

= 0. (A.2.7)

simplified by utilizing the simplify

command with the following results

2 2

5 2 + 16 2 )

3 (

( + 3 2 8 2 ) 2

2. Notice the second term on the left side of

equation (A.2.7). Based on previous

results, the term that value is determined

by equation (A.2.7). Thus, equation

(A.2.7) can be written as

(6)

EvySulistianingsih. Skewed Normal Distribution

2 2

( + 3

8 2 )

3

2

( 5

In this case will be chosen real-valued

root.

5. Furthermore, since at the fourth stage is

still obtained real root whose form is still

quite complicated, the roots obtained

were approached by a second-order

Taylor Series.

Through some stages above, we obtained

estimator for parameter as follows

.

= ( 0.626657068656 )

+ 16 2 )

3. Then, the equation obtained in stage 2

above was approached by third-order of

Taylor Series through Power Series

command.

4. By cutting the error term in the Taylor

Series generated in stage 3, then using

Polynomial Roots command, we will

find some roots of it. At this stage will

produced three types of roots that will

determine the value of .

End of Appendix 1.

Call option pricing using SN approach is as

follows:

3.3 SN Approach for Call European

Option Pricing

C 0 = e r S 0

( r 0.5 ) +

2

f ( z ; k = 2, ) dz e r K p

d2

= e0.5 S0 e z f ( z;k = 2, ) dz er K p.(3.8)

2

d2

For purposes of simplification calculation of SN, conducted reparameterization equation

(3.7)becomes

2

1

B exp 2 ( b1 ( z + m ) ) , z m

f ( z; k = 2, ) =

(3.9)

B exp 1 ( b ( z + m ) ) 2 , z > m

2

where B =

S ( )

2

, b1 =

S ( )

S ( )

, b2 =

,,

(1 )

(1 + )

S ( ) = 1 + ( 3 4 D2 ) 2 ,

m = 2 D S ( )

calculation process of the call european

option pricing by SN approach.

D=

This stage considered the two cases as

follows:

1. for d2 m < 0 ,

and

F ( d 2 ) = 1 (1 + ) N b2 ( d 2 m ) so

1 .

p = (1 + ) N b2 ( d 2 m ) .

Calculation of p

2. for d2 m > 0 ,

This section describes about result from

the first stage of

theexplicit formula

F (d2 ) = (1 ) (1 ) N ( b1 ( d2 m) ) so

p = + (1 ) N b1 ( d 2 m ) .

(7)

EvySulistianingsih. Skewed Normal Distribution

2. for d2 m > 0 ,

N b ( d m) + ( b )1

1

2

1

+

q = S0 J ( b1 )

1

N ( b1 )

1

S0 J ( b2 ) N ( b2 )

Calculation of q

This section describes about result from

the second stage of theexplicit formula

calculation process of the call european

option pricing by SN approach.

where

J ( b1 ) = (1 ) e

Analogue with the first stage, this stage

is also looking at two cases as follows:

m 0.5 1( b1 )

J ( b2 ) = (1 + ) e

where J ( b2 ) = (1 + ) e

m 0.5 1( b2 )

) .

2

Appendix 2-Calculation of p and q

Calculation of p

1. For d2 m < 0 ,

m

f ( z ; k = 2; ) dz +

d2

f ( z; k = 2; ) dz

Be

2

1

( b1 ( z + m ) )

2

d2

dz +

Be

1

( b2 ( z + m ))2

2

dz

= 1 (1 + ) N b2 ( d 2 m ) .

So, we can conclude that

p = 1 F ( d 2 ) = 1 1 (1 + ) N b2 ( d 2 m ) = (1 + ) N b2 ( d 2 m ) .

2. For d2 m > 0

F ( d 2 ) =

d2

f ( z; k = 2, ) dz

d2

Be

2

1

( b1 ( z + m ))

2

dz

d2

Be

1

( b1 ( z + m ) )2

2

dz

B

=

b1

m 0.5 1( b2 )

1

q = S0 J ( b2 ) N b2 (d2 m) + ( b2 )

) and

2

) .

2

The details of p and q calculation of

can be found in appendix 2, below.

1. for d2 m < 0 ,

F ( d 2 ) =

b1 ( d 2 m )

1

x2

1

e 2 dx

2

B

2 N ( b1 ( d2 m) )

b1

(8)

EvySulistianingsih. Skewed Normal Distribution

= (1 ) (1 ) N ( b1 ( d2 m) ) .

So, we get

p = 1 F ( d 2 )

= + (1 ) N b1 ( d 2 m ) .

Calculation of q

1. For d2 m < 0 ,

q = S 0 e 0.5

d2

= S0 e

0.5 1b2

) m

2

1

B exp ( b2 ( z + m ) ) dz

2

2

1

1

dz

B

exp

b

z

+

m

(

)

(

)

2

2

2

d2

m 0.5 1b22 2

= S0e

(1+ ) N ( b2 (d2 m) + b21 )

1

= S0 J ( b2 ) N b2 (d2 m) + ( b2 )

m 0.5 1( b2 )

where J ( b2 ) = (1 + ) e

)

2

2. For d2 m > 0

q = S 0 e 0.5

f ( z ; k = 2, ) dz

d2

m

2

= S0 e 0.5 e

d2

Be

2

1

( b1 ( z + m ) )

2

dz +

Be

2

1

( b2 ( z + m ) )

2

{ (

dz

1

1

= S0 J ( b1 ) N b1 ( d 2 m ) + ( b1 ) N ( b1 )

1

+ S0 J ( b2 ) N ( b2 )

where

m 0.5 1( b1 )

J ( b1 ) = (1 ) e

)

2

and J ( b2 ) = (1 + ) e

end of appendix 2

Call Option Price with SN Approach

Based on the result of

p and q

calculation, call option price with SN

approach is

(9)

m 0.5 1( b2 )

) .

2

EvySulistianingsih. Skewed Normal Distribution

S J ( b ) N b (d m) +( b )1 er K (1+) N b ( d m) , d m< 0

2

2 2

2

0 2 2 2

C0 =

1

1

1

S0J ( b1 ) N b1 ( d2 m) +( b1) N ( b1 ) + S0J ( b2 ) N ( b2 )

er K +(1)N b1 ( d2 m) , d2 m> 0

{ (

(3.10)

3.4 Performance of SN Approach of

Return Assets and Black-Scholes on

European Call Option Pricing

This section describes the application of

european call option pricing with SN

approach and Black-Scholes model for

return assets.

Based on the discussion in previous

section,the calculation process of european

call option pricing with SN approachand

Black-Scholes

model

needed

some informations that the

stock

price at the beginning of the contract ( S0 ),

strike price ( K ), risk free interest rates

(3.11)

( r ), maturity time( )and volatility(

).Especially for the SN model is required to

estimate the value of skewness parameter

.

The details of the option price obtained

by using SN approach and Black-Scholes

modelfor log return assets of Dominion

Resources, Inc. (D), Tyco International Ltd.

(TYC), Chesapeake Energy Corporation

(CHK), Home Depot, Inc. (HD), Johnson

& Johnson (JNJ), Loews Corporation (L),

Qwest Communications International Inc.

(Q),

Time

Warner

Inc

(TWX),

Weatherford International, Ltd (WFT), dan

Yahoo! Inc. (YHOO) are compared to

option prices in the marketpresented in

appendix 3, below.

Appendix 3

Table Comparison of 10 call option prices of stocks with r = 0,25% and maturity

timeMarch 19, 2010

No

Stocks

S0

39,11

35

Price of

Market

Option

(X)

4

TYC

37,51

31

HD

31,8

BS Price

(XB)

SN Price

(XSN)

Error of

BS

(X-XB)2

Error of

SN

(X-XSN)2

41,152

41,151

0,013271

0,013248

4,4

65,143

62,138

34

0,02

0,063258

0,048302

37,5

30

5,3

75,042

66,834

4,66

0,03

0,036271

0,034518

3,93E-05

2,04E-05

TWX

30,54

33

0,05

0,082985

0,051699

0,001088

2,89E-06

WFT

17,38

19

0,11

0,14228

0,11163

0,001042

2,66E-06

CHK

26,31

17.5

9,37

8,81E+00 8,90E+00

0,3109178

0,2179956

20,45

12

4,8

8,45E+00 7,91E+00 13,334,913 96,814,323

(10)

44,702,645 32,898,704

0,0018713

0,000801

48,584,976 19,137,956

EvySulistianingsih. Skewed Normal Distribution

No

Stocks

S0

10

JNJ

64,04

65

Price of

Market

Option

(X)

0,22

BS Price

(XB)

SN Price

(XSN)

Error of

BS

(X-XB)2

Error of

SN

(X-XSN)2

0,3206

0,27984

0,0101204

0,0035808

SSE

23

151,207

MSE

23,002

15,121

Notes:

XB= Option price of Black Scholes

XSN = Option price of SN Approach

end of appendix 3

skewness parameter as in the SN which is

able to capture the skewness in the data.

From these results, by taking 10

exercise prices ( K ) for = 1 4 days, it

seems that the price of the option with SN

approach gives results that are relatively

closer to the option price in the market

when compared

to the option price obtained

by the

approach of the Black-Scholes model. In

addition, the SNapproachmodel also gives

the value of mean of square error (MSE) is

relatively lower than the Black-Scholes

model.

Based on the results obtained, SN

approach was better able to explain the

existence of skewness in the logreturn data

than the Black-Scholes model.

As noted previously, the Black-Scholes

model is less able to capture the skewness

of logreturn data. This is caused by the

distribution used in the model does not have

4. CONCLUDING REMARKS

Based on result of writing that has been

stated previously, we can conclude that

Skewed Normal Distribution (SN) is a

special case of Skewed Generalized Error

Distribution for parameter value k =2.

Empirical results show that option

pricing with SN approach results option

price which is closer to the market price

when compared to the option price obtained

by Black-Scholes model.This caused by the

distribution is used in the model does not

have skewness parameter such as in SN

which is able to capture skewness in the

data.

REFERENCES

Hsieh, D.1989.Modeling Heteroskedasticity in Daily Foreign Exchange Rates, Journal of

Business and Economic Statistics,7: 307-317.

Hull, J.1989.Option, Futures, and Other Derivative Securities, Prentice-Hall International,

Inc., Toronto.

Nelson, D.1991.Conditional Heteroskedasticity in Asset Returns: A New Approach,

Econometrica,59:347-370.

Theodossiou, P.1998.Skewed Generalized Error Distribution of Financial Assets and Option

Pricing, Social Science Electronic Publishing, Inc.

(11)

EvySulistianingsih. Skewed Normal Distribution

Theodossiou, P. andTrigeorgis, L. 2003.Option Pricing When Log Returns are Skewed and

Leptokurtic,http://mfs.rutgers.edu/MFC/MFC11/mcfindex/files/MFC223%20Theodossiou

Trigeorgis.pdf, accessed on 2 January 2010.

(12)

Anda mungkin juga menyukai

- Jump Diffusion Models - PrimerDokumen3 halamanJump Diffusion Models - PrimerycchiranjeeviBelum ada peringkat

- Fast Narrow Bounds On The Value of Asian OptionsDokumen12 halamanFast Narrow Bounds On The Value of Asian OptionsLong TranBelum ada peringkat

- A Non-Linear Black-Scholes EquationDokumen8 halamanA Non-Linear Black-Scholes EquationHadiBiesBelum ada peringkat

- The Analysis of Black-Scholes Option Pricing: Wen-Li Tang, Liang-Rong SongDokumen5 halamanThe Analysis of Black-Scholes Option Pricing: Wen-Li Tang, Liang-Rong SongDinesh KumarBelum ada peringkat

- JEDC2001Dokumen18 halamanJEDC2001martin souman moulsiaBelum ada peringkat

- International Journal of Pure and Applied Mathematics No. 4 2013, 547-555Dokumen10 halamanInternational Journal of Pure and Applied Mathematics No. 4 2013, 547-555jawad HussainBelum ada peringkat

- Tree SchemeDokumen26 halamanTree SchemehollowkenshinBelum ada peringkat

- An R Package For Regression Analysis of Proportional Data Using The Simplex DistributionDokumen21 halamanAn R Package For Regression Analysis of Proportional Data Using The Simplex DistributionMaxwell PivessoBelum ada peringkat

- Chi SquareDokumen6 halamanChi Squarehammoudeh13Belum ada peringkat

- Regression 7Dokumen6 halamanRegression 7Benedikta AnnaBelum ada peringkat

- Merton Jump - Diffusion.modelDokumen7 halamanMerton Jump - Diffusion.modelIoannis MilasBelum ada peringkat

- Chapter 02Dokumen10 halamanChapter 02seanwu95Belum ada peringkat

- 5-4 Greek LettersDokumen30 halaman5-4 Greek LettersNainam SeedoyalBelum ada peringkat

- Chapter 05Dokumen13 halamanChapter 05seanwu95Belum ada peringkat

- E (Y) = e, yf (y) dy = exp μ + σ μ − log a σ ,: 8. Equivalent Martingale Measures: The Black-Scholes Formula ThenDokumen3 halamanE (Y) = e, yf (y) dy = exp μ + σ μ − log a σ ,: 8. Equivalent Martingale Measures: The Black-Scholes Formula ThenTu ShirotaBelum ada peringkat

- Econometrics Chapter ThreeDokumen35 halamanEconometrics Chapter Threeyihun0521Belum ada peringkat

- Constant Elasticity of Variance (CEV) Option Pricing Model:Integration and Detailed DerivationDokumen46 halamanConstant Elasticity of Variance (CEV) Option Pricing Model:Integration and Detailed DerivationDny RedoneBelum ada peringkat

- (Springer Texts in Statistics) Jonathan D. Cryer, Kung-Sik Chan - Time Series Analysis - With Applications in R-Springer (2008) - 40-63Dokumen24 halaman(Springer Texts in Statistics) Jonathan D. Cryer, Kung-Sik Chan - Time Series Analysis - With Applications in R-Springer (2008) - 40-63MICHAEL MEDINA FLORESBelum ada peringkat

- Chapter VIII Sampling Distributions and The Central Limit TheoremDokumen9 halamanChapter VIII Sampling Distributions and The Central Limit TheoremYash BhardwajBelum ada peringkat

- Chapter Three Metrics (I)Dokumen35 halamanChapter Three Metrics (I)negussie birieBelum ada peringkat

- Angular Distribution Functions in The Decays of The D State of Charmonium Originating From Unpolarized PP CollisionsDokumen8 halamanAngular Distribution Functions in The Decays of The D State of Charmonium Originating From Unpolarized PP CollisionsEsther SimpsonBelum ada peringkat

- Black Scholes DerivationDokumen19 halamanBlack Scholes DerivationBrandon LockBelum ada peringkat

- Stochastic Calculus and The Nobel Prize Winning Black-Scholes EquationDokumen6 halamanStochastic Calculus and The Nobel Prize Winning Black-Scholes Equationnby949Belum ada peringkat

- Method of MomentsDokumen4 halamanMethod of MomentsladyfairynaBelum ada peringkat

- Kmeans WorksheetDokumen6 halamanKmeans Worksheetsageson_m-1Belum ada peringkat

- Intro To T'hooft SymbolsDokumen5 halamanIntro To T'hooft SymbolsSumanto Chanda100% (1)

- Simple Linear Regression (Chapter 11) : Review of Some Inference and Notation: A Common Population Mean ModelDokumen24 halamanSimple Linear Regression (Chapter 11) : Review of Some Inference and Notation: A Common Population Mean ModelHaizhou ChenBelum ada peringkat

- American Mathematical SocietyDokumen20 halamanAmerican Mathematical SocietyAndrea MaroniBelum ada peringkat

- DVP MotionDokumen42 halamanDVP MotionShabin MuhammedBelum ada peringkat

- Basic Monte Carlo TechniquesDokumen10 halamanBasic Monte Carlo TechniquesMobeen AhmadBelum ada peringkat

- Carbone PendulumDokumen6 halamanCarbone PendulumAdemar Alves TrindadeBelum ada peringkat

- Chap 2Dokumen9 halamanChap 2MingdreamerBelum ada peringkat

- Klaus KirstenDokumen36 halamanKlaus KirstenGaurav DharBelum ada peringkat

- MIT18 S096F13 Pset5Dokumen8 halamanMIT18 S096F13 Pset5Gagik AtabekyanBelum ada peringkat

- Chapter Three MultipleDokumen15 halamanChapter Three MultipleabdihalimBelum ada peringkat

- 5021 Solutions 10Dokumen7 halaman5021 Solutions 10belenhostBelum ada peringkat

- Econometrics Chapter 1 UNAVDokumen38 halamanEconometrics Chapter 1 UNAVRachael VazquezBelum ada peringkat

- Bayes GaussDokumen29 halamanBayes GaussYogesh Nijsure100% (1)

- 1 Crank-Nicholson Algorithm: Übungen Zur Computational Nanoscience Blatt 5Dokumen4 halaman1 Crank-Nicholson Algorithm: Übungen Zur Computational Nanoscience Blatt 5140557Belum ada peringkat

- Homework 9Dokumen7 halamanHomework 9Ale GomezBelum ada peringkat

- (KKKM6043) Matlab Report 1 - Muhamad Zulfitri P106735 - R2Dokumen43 halaman(KKKM6043) Matlab Report 1 - Muhamad Zulfitri P106735 - R2fitri razaliBelum ada peringkat

- Sum of LognormalsDokumen6 halamanSum of LognormalsritolabBelum ada peringkat

- A Comparison Between Skew-Logistic and Skew-Normal DistributionsDokumen10 halamanA Comparison Between Skew-Logistic and Skew-Normal DistributionsSteven SergioBelum ada peringkat

- The Mean and Standard Deviation of The Run Length Distribution of When Control Limits Are EstimatedDokumen10 halamanThe Mean and Standard Deviation of The Run Length Distribution of When Control Limits Are EstimatedFernando GonzalezBelum ada peringkat

- Merton's Jump Diffusion Model: Peter Carr (Based On Lecture Notes by Robert Kohn) Bloomberg LP and Courant Institute, NYUDokumen13 halamanMerton's Jump Diffusion Model: Peter Carr (Based On Lecture Notes by Robert Kohn) Bloomberg LP and Courant Institute, NYUstehbar9570Belum ada peringkat

- Applications and Mathematical Derivation of Options Greeks From First PrincipleDokumen27 halamanApplications and Mathematical Derivation of Options Greeks From First PrincipleKapil AgrawalBelum ada peringkat

- AME 301: Differential Equations, Vibrations and Controls: Notes On Finite-Difference Methods ForDokumen19 halamanAME 301: Differential Equations, Vibrations and Controls: Notes On Finite-Difference Methods ForMukhlizar IsmailBelum ada peringkat

- Numerical Methods: Marisa Villano, Tom Fagan, Dave Fairburn, Chris Savino, David Goldberg, Daniel RaveDokumen44 halamanNumerical Methods: Marisa Villano, Tom Fagan, Dave Fairburn, Chris Savino, David Goldberg, Daniel RaveSanjeev DwivediBelum ada peringkat

- Method of Moments: Topic 13Dokumen9 halamanMethod of Moments: Topic 13Zeeshan AhmedBelum ada peringkat

- Derivations and Applications of Greek LettersDokumen30 halamanDerivations and Applications of Greek Letters段鑫Belum ada peringkat

- Images De-Noising With Mapshrink Estimate and Dual-Threshold in Curvelet DomainDokumen5 halamanImages De-Noising With Mapshrink Estimate and Dual-Threshold in Curvelet DomainjebileeBelum ada peringkat

- Basic Statistical ConceptsDokumen14 halamanBasic Statistical ConceptsVedha ThangavelBelum ada peringkat

- Wavelets: 1. A Brief Summary 2. Vanishing Moments 3. 2d-Wavelets 4. Compression 5. De-NoisingDokumen24 halamanWavelets: 1. A Brief Summary 2. Vanishing Moments 3. 2d-Wavelets 4. Compression 5. De-Noisingac.diogo487Belum ada peringkat

- 7.3.1 Hamilton's Principle: Module 7: Applications of FEM Lecture 3: Dynamic AnalysisDokumen8 halaman7.3.1 Hamilton's Principle: Module 7: Applications of FEM Lecture 3: Dynamic Analysisprince francisBelum ada peringkat

- Improved Exponential Estimator For Population Variance Using Two Auxiliary VariablesDokumen8 halamanImproved Exponential Estimator For Population Variance Using Two Auxiliary VariablesIlieCraciunBelum ada peringkat

- Complex Langevin Method Applied To The 2D SU (2) Yang-Mills TheoryDokumen10 halamanComplex Langevin Method Applied To The 2D SU (2) Yang-Mills TheoryJaime DaltonBelum ada peringkat

- Mathematics 1St First Order Linear Differential Equations 2Nd Second Order Linear Differential Equations Laplace Fourier Bessel MathematicsDari EverandMathematics 1St First Order Linear Differential Equations 2Nd Second Order Linear Differential Equations Laplace Fourier Bessel MathematicsBelum ada peringkat

- Module 4Dokumen29 halamanModule 4ManoharBelum ada peringkat

- Birla Institute of Technology and Science, Pilani Pilani Campus Instruction DivisionDokumen3 halamanBirla Institute of Technology and Science, Pilani Pilani Campus Instruction DivisionSaurabh ChaubeyBelum ada peringkat

- CSC 424 Question and AnswerDokumen4 halamanCSC 424 Question and AnswerIni UwakmfonBelum ada peringkat

- Stochastic Processes and The Mathematics of Finance: Jonathan Block April 1, 2008Dokumen132 halamanStochastic Processes and The Mathematics of Finance: Jonathan Block April 1, 2008.cadeau01Belum ada peringkat

- BZAN6310 - SP19 - Chapter - 4, 5Dokumen30 halamanBZAN6310 - SP19 - Chapter - 4, 5Jack AgronBelum ada peringkat

- Exam P PDFDokumen2 halamanExam P PDFPapercityBelum ada peringkat

- Chapter 3 Part B: Probability DistributionDokumen42 halamanChapter 3 Part B: Probability Distributionalexbell2k12Belum ada peringkat

- Probability For CSC - Tutorials - 2024Dokumen32 halamanProbability For CSC - Tutorials - 2024Gosia BocianBelum ada peringkat

- L3-GEC410-S. O. Edeki - Module-1Dokumen45 halamanL3-GEC410-S. O. Edeki - Module-1PreciousBelum ada peringkat

- Moment Generation FunctionDokumen38 halamanMoment Generation FunctionAzwan MahmudBelum ada peringkat

- PTSP 10 MarksDokumen2 halamanPTSP 10 MarksramanaBelum ada peringkat

- Continuous Probability DistributionsDokumen3 halamanContinuous Probability DistributionsLuke CruzBelum ada peringkat

- Lecture ProbDokumen160 halamanLecture ProbPrarthana ChakrabartiBelum ada peringkat

- Teaching Time-Series Analysis - IIDokumen8 halamanTeaching Time-Series Analysis - IIcbt_71Belum ada peringkat

- Asset-V1 MITx+CTL - SC0x+1T2021+type@asset+block@SC0x W7L2 ManagingUncertainty2 FINAL CLEAN UpdDokumen27 halamanAsset-V1 MITx+CTL - SC0x+1T2021+type@asset+block@SC0x W7L2 ManagingUncertainty2 FINAL CLEAN UpdNguyen DuyBelum ada peringkat

- Introduction To Mean ShiftDokumen13 halamanIntroduction To Mean Shifttiendat_20791Belum ada peringkat

- 18MAB301T - P&S - Unit IDokumen54 halaman18MAB301T - P&S - Unit IjackBelum ada peringkat

- Chebyshevs Inequality - ProblemspdfDokumen6 halamanChebyshevs Inequality - ProblemspdfamreenBelum ada peringkat

- Tutsheet 5Dokumen2 halamanTutsheet 5vishnuBelum ada peringkat

- AP Calculus BC Released Exam 2008 Multiple-Choice Questions (College Board)Dokumen26 halamanAP Calculus BC Released Exam 2008 Multiple-Choice Questions (College Board)vingts100% (1)

- Problem Set 5Dokumen2 halamanProblem Set 5ifireBelum ada peringkat

- VORIS 2 0 1 GuideDokumen40 halamanVORIS 2 0 1 Guideejrobb81Belum ada peringkat

- Random Variable PDFDokumen9 halamanRandom Variable PDFAndrew Tan100% (1)

- Probability Homework SolutionsDokumen10 halamanProbability Homework SolutionsKushagra ChauhanBelum ada peringkat

- Midterm Exam Study Guide ST314-3Dokumen4 halamanMidterm Exam Study Guide ST314-3Isak FoshayBelum ada peringkat

- Discrete Variable Probability Distribution FunctionsDokumen47 halamanDiscrete Variable Probability Distribution FunctionsJanine CayabyabBelum ada peringkat

- Machine Learning Algorithms in Depth (MEAP V09) (Vadim Smolyakov) (Z-Library)Dokumen550 halamanMachine Learning Algorithms in Depth (MEAP V09) (Vadim Smolyakov) (Z-Library)AgalievBelum ada peringkat

- Uniform and Normal Distribution.Dokumen45 halamanUniform and Normal Distribution.aaryadeotaleBelum ada peringkat

- Chapter 1Dokumen13 halamanChapter 1Allen DelaCruz LeonsandaBelum ada peringkat

- Sm2205es1 7Dokumen12 halamanSm2205es1 7JooSie241Belum ada peringkat