Change Your Insurance Form Public Sector Division

Diunggah oleh

Will PridmoreHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Change Your Insurance Form Public Sector Division

Diunggah oleh

Will PridmoreHak Cipta:

Format Tersedia

Privacy Collection Statement

Please read this Privacy Collection Statement to see how AustralianSuper uses your personal information.

AustralianSuper Pty Ltd (ABN 94 006 457 987) of 33/50 Lonsdale Street, Melbourne, Victoria, collects

your personal information (PI) to run your super account (including insurance), improve our products

and services and keep you informed. If we cant collect your PI we may not be able to do these tasks.

PI is collected from you but sometimes from third parties like your employer. We will only share your

PI where necessary to perform our activities with our administrator, service providers, as required by

law or court/tribunal order, or with your permission. Your PI may be accessed overseas by some of our

service providers. A list of countries can be found at the URLs below. Our Privacy Policy details how

to access and change your PI, as well as the privacy complaints process. For complete details on the

above go to www.australiansuper.com/CollectionStatement and www.australiansuper.com/privacy or

call us on 1300 300 273.

AustralianSuper, GPO Box 1901, MELBOURNE VIC 3001

Issued by AustralianSuper Pty Ltd ABN 94 006 457 987 AFSL 233788 Trustee of AustralianSuper ABN 65 714 394 898

2045611/14

This page has been left blank intentionally.

Questions? Telephone 1300 300 273 Web www.australiansuper.com

2045611/14

Change your insurance

Use this form to increase, decrease or cancel your cover. AustralianSuper will only make changes to each type of cover

you change in this form. If you do not indicate a change to a type of cover you already have, the amount of your existing

cover will remain the same. Please complete in pen using CAPITAL letters. Print to mark boxes where applicable.

1. PERSONAL DETAILS

Last name

Mr

First name

Date of birth

Mrs Miss Ms Dr

D M M

Gender

Street address

Suburb

Telephone (Preferred)

State

Other

Preferred time of contact

Mobile

Morning (9am12pm)

Afternoon (12pm6pm)

Member number

Email

What is your annual (before-tax) salary, excluding employer super contributions?

(You must provide your salary to apply for extra cover.)

What industry do you work in?

Postcode

What is your job title/occupation?

,

,

. 0 0

What is the average number of hours

each week in your main occupation?

2. DEATH AND TPD COVER This page has been left blank intentionally.

Changing your Death and Total & Permanent Disablement (TPD) cover

Complete this section to increase or decrease your Death or TPD cover. If you want to cancel your cover, complete section 5.

You can apply for units of cover or fixed cover, but not both. If you are switching between units of cover and fixed cover, the type of cover

you choose will apply to all your Death and/or TPD cover.

Units of cover

Complete this section to apply for units of Death or TPD cover. Please write the total number of units of Death or TPD cover

you want (including any cover you may already have).

Death cover (number of units required)

TPD cover (number of units required)

Number of units required

Number of units required

OR

Fixed cover

Complete this section to apply for fixed Death or TPD cover. Please write the total amount of Death or TPD cover you want

(including any cover you may already have).

Amount of Death cover required

Amount of TPD cover required

0 , 0 0 0

,

Cover must be in multiples of $10,000.

0 , 0 0 0

,

Cover must be in multiples of $10,000.

If youre increasing either your Death or TPD cover, please complete sections 69.

Converting existing Death and TPD cover

Complete this section to apply to convert your existing Death or TPD cover:

To fixed cover

I wish to convert my existing Death and/or TPD cover to fixed cover.

You will be provided enough fixed cover, rounded up to the next $10,000, to replace the number of units you have.*

To units of cover

I wish to convert my existing Death and/or TPD cover to units of cover.

You will be provided with the minimum number existing of whole units of cover for your age to replace the fixed cover you have.*

If you are only applying to convert your existing cover, you do not need to complete sections 69. Please read sections

10 and 11, then sign and date the declaration in section 11.

* Any additional cover you receive as a result of the conversion will be limited for at least 12 months. Please refer to this guide for more information on limited cover.

Issued by AustralianSuper Pty Ltd ABN 94 006 457 987 AFSL 233788 Trustee of AustralianSuper ABN 65 714 394 898

PSDInsGd01 11/14 page 1 of 6

3. INCOME PROTECTION COVER

Complete this section to apply for, increase or decrease your Income Protection cover. If you want to cancel your cover,

complete section 5.

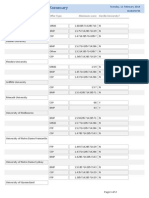

The following table will help you to determine how many units of Income Protection insurance you need. The maximum monthly

benefit you can be paid cannot be higher than 85% of your monthly salary (75% being paid to you and 10% to your super

account)* or $30,000 per month, whichever is lower.

Find your salary in this table to see the maximum cover you can apply for.

Your salary (per year)

Maximum cover per month

$

Up to $7,058

Your salary (per year)

Maximum cover per month

$

Units

Units

$500

$211,765 $218,823

$15,500

31

$7,059 $14,117

$1,000

$218,824 $225,882

$16,000

32

$14,118 $21,176

$1,500

$225,883 $232,941

$16,500

33

$21,177 $28,235

$2,000

$232,942 $240,000

$17,000

34

$28,236 $35,294

$2,500

$240,001 $247,058

$17,500

35

$35,295 $42,352

$3,000

$247,059 $254,117

$18,000

36

$42,353 $49,411

$3,500

$254,118 $261,176

$18,500

37

$49,412 $56,470

$4,000

$261,177 $268,235

$19,000

38

$56,471 $63,529

$4,500

$268,236 $275,294

$19,500

39

40

$63,530 $70,588

$5,000

10

$275,295 $282,352

$20,000

$70,589 $77,647

$5,500

11

$282,353 $289,411

$20,500

41

$77,648 $84,705

$6,000

12

$289,412 $296,470

$21,000

42

$84,706 $91,764

$6,500

13

$296,471 $303,529

$21,500

43

$91,765 $98,823

$7,000

14

$303,530 $310,588

$22,000

44

$98,824 $105,882

$7,500

15

$310,589 $317,647

$22,500

45

$105,883 $112,941

$8,000

16

$317,648 $324,705

$23,000

46

$112,942 $120,000

$8,500

17

$324,706 $331,764

$23,500

47

$120,001 $127,058

$9,000

18

$331,765 $338,823

$24,000

48

$127,059 $134,117

$9,500

19

$338,824 $345,882

$24,500

49

$134,118 $141,176

$10,000

20

$345,883 $352,941

$25,000

50

$25,500

51

$141,177 $148,235

$10,500

21

$352,942 $360,000

$148,236 $155,294

$11,000

22

$360,001 $367,058

$26,000

52

$155,295 $162,352

$11,500

23

$367,059 $374,117

$26,500

53

$162,353 $169,411

$12,000

24

$374,118 $381,176

$27,000

54

$169,412 $176,470

$12,500

25

$381,177 $388,235

$27,500

55

$176,471 $183,529

$13,000

26

$388,236 $395,294

$28,000

56

$183,530 $190,588

$13,500

27

$395,295 $402,352

$28,500

57

$190,589 $197,647

$14,000

28

$402,353 $409,411

$29,000

58

$197,648 $204,705

$14,500

29

$409,412 $416,470

$29,500

59

$204,706 $211,764

$15,000

30

$416,471 $423,529

$30,000

60

*Salary is your annual before-tax salary, excluding employer super contributions. This will be different for self-employed people.

Write the number of units of Income Protection cover you want (every unit will provide cover of $500 per month)

Please choose your preferred waiting period:

30 days

units

60 days

The waiting period is the time you have to wait before youre eligible to make a claim for an Income Protection benefit. If you do

not make a choice and you are applying for income protection cover for the first time, you will be provided with a 60 day waiting

period. If you do not make achoice and you already have income protection cover, your existing waiting period will apply.

If you change your waiting period from 60 days to 30 days and then you claim within 30 days of making the change, you will need to complete a 60 day

waiting period. A 30 day waiting period will cost more.

If you are increasing your Income Protection cover, please complete sections 69.

Please return this completed form to: AustralianSuper, GPO Box 1901, MELBOURNE VIC 3001

Telephone 1300 300 273 Web www.australiansuper.com

PSDInsGd01 11/14 page 2 of 6

4. YOUR INCOME PROTECTION WORK RATING

Complete this section to apply to change your Income Protection work rating.

Your Income Protection insurance cover will be matched to your Income Protection work rating.

The following questions will help us to determine which Income Protection work rating applies to you.

1. Are you:

unemployed

employed and off work because you are ill, injured or have had an accident

unable to do all the duties of your usual occupation (without any limitation) full-time (at least 30 hours

per week), even if you are working full-time, part-time or casually, or

in your usual occupation but your duties have changed or been modified in the last 12 months,

because of an illness, accident or injury?

Yes

No

2. Have you:

in the last 12 months, been away from work for more than four weeks in a row because you were

ill or injured, or

been advised by, or discussed with your medical practitioner that because of an illness or injury youll

need to take at least four weeks in a row off work (regardless if diagnosed) in the next 12 months?

Yes

No

3. Have you been diagnosed with an illness or injury that reduces your life expectancy to less than 12 months?

Yes

No

4. Have you ever been declined Death, TPD or Income Protection cover, or been excluded from insurance

cover for a specific medical condition or injury?

Yes

No

Yes

No

6. Are the usual activities of your job white collar?

This means:

you spend more than 80% of your job doing clerical or administrative (typically office-based)

activities, or

youre a professional using your university qualification in a job that has no unusual work hazards.

(Some examples of unusual work hazards include: working underground, working underwater,

working at heights or working in the air.)

Yes

No

7. Are you earning more than $80,000 a year from your job?

Yes

No

8. Do you have a university qualification?

Yes

No

9. Do you have a management role in your company?

Yes

No

5. Have you ever made or satisfied the requirements to make a claim for an injury or illness either in

Australia or overseas through:

AustralianSuper or another super fund

Workers Compensation

an illness benefit or invalid pension

an insurance Policy that provides Terminal illness, TPD cover, or Income Protection (including

accident or illness cover), or

a common law settlement?

Your answers to the questions above will determine if you are eligible to change your work rating.

5. CANCEL YOUR COVER

Complete this section to cancel part or all of your cover. Please put an () next to each type of cover that you wish to cancel.

If you put an () next to a cover type below, you wont be insured for that cover. So, you (or your beneficiaries) will not be able

to make an insurance claim for that type of cover, in the event of illness, injury or death. If you decide to apply for cover in the

future, you will need to supply detailed health information as part of your application.

I do not want to be covered for:

Income Protection

Death

TPD

If you are cancelling part or all of your cover and not applying to increase any of your cover, please now go to section 11.

6. ABOUT YOUR INSURANCE HISTORY

1. Has an application for life, disability, trauma, accident or illness insurance on your life ever been declined,

deferred or accepted with a loading, exclusion or special terms?

Yes

No

2. Have you ever made a claim for or received sickness, accident or disability benefits, Workers

Compensation, or any other form of compensation due to illness or injury?

Yes

No

Issued by AustralianSuper Pty Ltd ABN 94 006 457 987 AFSL 233788 Trustee of AustralianSuper ABN 65 714 394 898

PSDInsGd01 11/14 page 3 of 6

7. ABOUT YOUR HEALTH

1. What is your height?

Height (cm)

OR

(ft/in)

What is your weight?

Weight (kg)

OR

(st/lb)

2. Are you currently pregnant? (Females only)

Yes

No

3. Have you smoked in the last 12 months?

Yes

No

4. In the last 3 years have you suffered from, been diagnosed with or sought medical advice or treatment for any of the following?

Please mark () to all that apply.

Headache or Migraine (eg. tension or cluster headaches

or migraines)

Trapped Nerves (eg. carpal tunnel syndrome, pinched nerve,

tennis elbow)

Lung or Breathing Conditions (eg. asthma, sleep apnoea)

Infectious Diseases (excl. cold & flu)

Eyesight Conditions (does not incl. contact lenses or

glasses for near or far sightedness)

Gout

Ear or Hearing Conditions (eg. hearing loss, tinnitus

or swimmers ear)

None of the above conditions

If you have selected any of the above conditions in question 4, please give details in the table below.

Condition

Details (incl. dates, symptoms, treatment)

5. In the last 5 years have you suffered from, been diagnosed with or sought medical advice or treatment for any of the following?

Please mark () to all that apply.

High Blood Pressure

High Cholesterol

Chronic Fatigue / Fibromyalgia

None of the above conditions

If you have selected any of the above conditions in question 5, please give details in the table below.

Condition

Details (incl. dates, symptoms, treatment)

6. Have you ever suffered from, been diagnosed with or sought medical advice or treatment for any of the following?

Please mark () to all that apply.

Bone, Joint or Limb Conditions

Back or Neck Pain

Digestive Conditions

Brain or Nerve Conditions (incl. stroke)

Psychological or Emotional Conditions

Cancer, Cyst, Growth, Polyp or Tumour

Thyroid Conditions

Skin Disorder

Genitourinary Conditions

Autoimmune Disease

Heart Related Conditions

Kidney or Liver Conditions

Diabetes

Blood Conditions

None of the above conditions

If you have selected any of the above conditions in question 6, please give details in the table below.

Condition

Details (incl. dates, symptoms, treatment)

7. What is the name of your usual doctor/medical centre?

Address

Contact Number

Please return this completed form to: AustralianSuper, GPO Box 1901, MELBOURNE VIC 3001

Telephone 1300 300 273 Web www.australiansuper.com

PSDInsGd01 11/14 page 4 of 6

8. ABOUT YOUR LIFESTYLE

1. Have you within the last 5 years used any drugs that were not prescribed to you (other than over the

counter drugs) or have you exceed the recommended dosage of any medication?

If Yes, please give details in the table below:

Drug/Medicine

Yes

Reason for use

2. a. On average how many standard alcoholic drinks do you consume each week (a standard drink is

equivalent to either a 125ml glass of wine, a schooner of light beer, a middy/pot of full strength beer

or a 30ml shot of spirits)?

/ week

b. Have you ever been advised by a health professional to reduce your alcohol consumption?

3. a. Do you currently have HIV (Human Immunodeficiency Virus) that causes AIDS (Acquired Immune

Deficiency Syndrome)?

b. If No, are you in a high risk category for contracting HIV?

4. Are you currently awaiting for the results of any medical tests, or has a medical professional recommended

that you undertake a medical test that has not yet been conducted? If yes, please provide details below.

Test

Yes

No

Yes

No

Yes

No

Yes

No

Yes

No

Reason for test

5. Are you currently seeking or contemplating seeking medical advice or treatment?

If yes, please provide details below.

Condition

No

Details

9. EXTRA INFORMATION ABOUT YOU

If you answered Yes to any or listed any conditions of the questions in sections 78, or are applying for Death or TPD cover

above $800,000 or Income Protection cover above $10,000 per month you need to answer these two questions.

1. Has your natural mother, father, any brother or sister been diagnosed under the age of 55 years,

with any of the following conditions: Alzheimers Disease, Cancer, Dementia, Diabetes,

Familial Polyposis, Heart Disease, Huntingtons Disease, Polycystic Kidney Disease,

Multiple Sclerosis, Muscular Dystrophy, Stroke or any inherited or hereditary disease?

Yes

No

Unknown

If yes, please provide details below.

Relationship to proposed insured

Age at diagnosis

Specific condition(s)

2. Do you regularly engage in or intend to engage in any of the following activities?

Please mark () to all that apply.

Water Sports (eg. underwater diving, rock fishing)

Horse Sports (eg. polo, horse riding, rodeo, dressage, jumping)

Aviation (other than as a fare paying passenger on a

commercial airline)

Field Sports (eg. hockey or football including touch

or tag and soccer)

Motor Sports (eg. motorcycle, auto, motor boat)

Hunting (of any kind)

None of the above activities

Sky Sports (eg. skydiving, hang gliding, parachuting, ballooning)

Combat Sports or Martial Arts (eg. martial arts, boxing, fencing)

Any activity not mentioned (eg. base jumping, caving,

outdoor rock climbing)

Please provide details for any activities you have selected above:

Activity

Details

Issued by AustralianSuper Pty Ltd ABN 94 006 457 987 AFSL 233788 Trustee of AustralianSuper ABN 65 714 394 898

PSDInsGd01 11/14 page 5 of 6

10. DUTY OF DISCLOSURE

Your Duty of Disclosure

Before you enter into or become insured under a contract of life

insurance with an insurer, you have a duty under the Insurance

Contracts Act 1984, to disclose to the insurer every matter that

you know, or could reasonably be expected to know, is relevant

to the insurers decision whether to accept the risk of the

insurance and, if so, on what terms.

You have the same duty to disclose those matters to the insurer

before you extend, vary or reinstate your insurance. Your duty,

however, does not require disclosure of a matter:

that diminishes the risk to be undertaken by the insurer

that is of common knowledge

that your insurer knows or, in the ordinary course of its

business, ought to know, or

as to which compliance with your duty is waived by the insurer.

Non-disclosure

If you fail to comply with your Duty of Disclosure and the

insurer would not have covered you on any terms if the

failure had not occurred, the insurer may avoid the cover

within three years of issuing it. If your non-disclosure is

fraudulent, the insurer may avoid your cover at any time.

An insurer who is entitled to avoid your cover may, within

three years of issuing it, elect not to avoid it but to reduce

the sum that you have been insured for in accordance

with a formula that takes into account the premium that

would have been payable if you had disclosed all relevant

matters to the insurer.

11. DECLARATION

This section must be completed in all circumstances.

I have read the Duty of Disclosure (in section 10 of this form)

and I am aware of the consequences of non-disclosure. I

understand that the Duty of Disclosure continues after I have

completed this statement until my application for cover has

been accepted in writing by AustralianSuper and the Insurer

(MetLife Insurance Limited ABN 75 004 274 882 AFSL 238 096).

I understand that information contained in this guide should be

read in conjunction with all reference material.

I authorise:

the Insurer to refer any statements that have been made

in connection with my application for cover and any

medical reports to other entities involved in providing

or administering the insurance (for example reinsurers,

medical consultants, legal advisers)

the Insurer and any person appointed by the Insurer to

obtain information on my medical claims and financial

history from the Insurance Reference Association and any

other body holding information on me, and

any hospital, doctor or other person who has treated or

examined me to give to the Insurer any information on my

illness or injury, medical history, consultation, prescription

or treatment or copies of all hospital or medical reports.

A photocopy of this authorisation is as valid as the original.

I declare that:

the answers to all the questions and the declarations on

this form are true and correct (including those not in my

own handwriting)

I have not withheld any information which may affect any

decision to provide insurance

I agree to provide further medical authorities if requested

I have read and understood the Product Disclosure

Statement

I have read and understood the Insurance in your super

guide to which this application was attached, and

I have read the Privacy Collection Statement and I

agree with how AustralianSuper will use my personal

information.

AustralianSupers Privacy Collection Statement is at the

front of this form booklet. Our Privacy Collection Statement

and Privacy Policy may change from time to time. The latest

versions will be available online at www.australiansuper.com/

CollectionStatement and www.australiansuper.com/privacy

For information on the Insurers privacy and information-handling

practices, read their Privacy Policy Statement at

www.metlife.com.au/privacy

I acknowledge that:

insurance cover will only be provided on the terms and

conditions set out in the contract of insurance with the

Insurer and as agreed between AustralianSuper and the

Insurer from time to time

the answers I have provided, together with any special

conditions, will form the basis of the contract of insurance

if I have chosen to cancel any of my cover, I will no longer

be insured for that cover, and if I decide to apply for

cover in the future, I will need to supply detailed medical

information as part of my application, and

any change in cover will start from the later of the date it is

accepted by the Insurer (as long as my employer is paying

on-time contributions), or for new members, the date I

receive my welcome kit.

Sign here:

Date

D M M

Print full name

As part of your overall assessment process, the Insurer will contact you on your preferred phone number if further information is

needed.

Please return this completed form to: AustralianSuper, GPO Box 1901, MELBOURNE VIC 3001

Telephone 1300 300 273 Web www.australiansuper.com

PSDInsGd01 11/14 page 6 of 6

Anda mungkin juga menyukai

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- That Old Black Magic PDFDokumen2 halamanThat Old Black Magic PDFWill PridmoreBelum ada peringkat

- 9654 EmotionalIntelligenceDokumen238 halaman9654 EmotionalIntelligencejuandva100% (15)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Into The Woods - ScreenplayDokumen123 halamanInto The Woods - ScreenplayWill Pridmore100% (2)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (890)

- Majesty - Prima Official EGuideDokumen287 halamanMajesty - Prima Official EGuideWill Pridmore100% (2)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Nutritional Biochemistry: Vitamins Dr. Bidhan Chandra KonerDokumen50 halamanNutritional Biochemistry: Vitamins Dr. Bidhan Chandra KonerElenanana100% (1)

- Ernest P. Moyer: Our Celestial VisitorsDokumen576 halamanErnest P. Moyer: Our Celestial VisitorsLuis MarcoBelum ada peringkat

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- Enzyme TherapyDokumen34 halamanEnzyme TherapyMohamed AbdelmoneimBelum ada peringkat

- Wonderland Study GuideDokumen22 halamanWonderland Study GuideWill Pridmore67% (6)

- Victorian Recreational Boating Safety HandbookDokumen156 halamanVictorian Recreational Boating Safety HandbookSofia PranaciptaBelum ada peringkat

- Congenital AnomaliesDokumen54 halamanCongenital Anomaliesthiruilayavan83% (6)

- Chemical Pathology MBCHB Student Lecture Notes 2013Dokumen397 halamanChemical Pathology MBCHB Student Lecture Notes 2013Micky Sunnyraj67% (3)

- Science, Technology and EthicsDokumen11 halamanScience, Technology and Ethicsjjamppong09Belum ada peringkat

- The Pathogenic Basis of Malaria: InsightDokumen7 halamanThe Pathogenic Basis of Malaria: InsightRaena SepryanaBelum ada peringkat

- Is Suicide Prevention PossibleDokumen3 halamanIs Suicide Prevention PossibleWill PridmoreBelum ada peringkat

- IJP Suicide Beliefs PDFDokumen2 halamanIJP Suicide Beliefs PDFWill PridmoreBelum ada peringkat

- IPTSDokumen2 halamanIPTSWill PridmoreBelum ada peringkat

- Articles: BackgroundDokumen10 halamanArticles: BackgroundWill Pridmore100% (1)

- Shrek's Diverse Army of Fairytale Creatures Was Also Supported by Solid Costume Design and ADokumen2 halamanShrek's Diverse Army of Fairytale Creatures Was Also Supported by Solid Costume Design and AWill PridmoreBelum ada peringkat

- Suicide EditorialDokumen4 halamanSuicide EditorialWill PridmoreBelum ada peringkat

- Chemotherapy IntroductionDokumen12 halamanChemotherapy IntroductionWill PridmoreBelum ada peringkat

- Template For Public Transport FineDokumen2 halamanTemplate For Public Transport FineWill PridmoreBelum ada peringkat

- Work in Japanese Law FirmsDokumen8 halamanWork in Japanese Law FirmsWill PridmoreBelum ada peringkat

- Dean Recommendation for Medical ElectiveDokumen1 halamanDean Recommendation for Medical ElectiveWill PridmoreBelum ada peringkat

- 2014 Offers MedicineDokumen2 halaman2014 Offers MedicineWill PridmoreBelum ada peringkat

- Tefl GuideDokumen23 halamanTefl GuideWill PridmoreBelum ada peringkat

- Basketball Referees PaperDokumen41 halamanBasketball Referees PaperWill PridmoreBelum ada peringkat

- Authorised Officers ActDokumen671 halamanAuthorised Officers ActWill PridmoreBelum ada peringkat

- Medicine Admissions Guide 2015 2016 v1.1Dokumen80 halamanMedicine Admissions Guide 2015 2016 v1.1Will PridmoreBelum ada peringkat

- Letter of ComplianceDokumen1 halamanLetter of ComplianceWill PridmoreBelum ada peringkat

- Letter of ComplianceDokumen1 halamanLetter of ComplianceWill PridmoreBelum ada peringkat

- Working AbroadDokumen97 halamanWorking AbroadaequricoBelum ada peringkat

- Australia Counter Terrorism White Paper 2010Dokumen83 halamanAustralia Counter Terrorism White Paper 2010DaveBelum ada peringkat

- Payback CallsDokumen14 halamanPayback CallsWill PridmoreBelum ada peringkat

- Code of Conduct For Public Transport Authorised OfficersDokumen9 halamanCode of Conduct For Public Transport Authorised OfficersWill PridmoreBelum ada peringkat

- Diagnostic Approach of Short Stature / Stunted (Jan 2015) - Prof DR Jose BatubaraDokumen49 halamanDiagnostic Approach of Short Stature / Stunted (Jan 2015) - Prof DR Jose BatubaraGerakan Kesehatan Ibu dan AnakBelum ada peringkat

- Demographics of The Aging PeopleDokumen12 halamanDemographics of The Aging Peoplealfandhi100% (1)

- Experiments Enzymes: Science Technology ActionDokumen2 halamanExperiments Enzymes: Science Technology ActionHartini HassanBelum ada peringkat

- UK Prostate Trials For 10th Uro-Onc Meeting 2013Dokumen30 halamanUK Prostate Trials For 10th Uro-Onc Meeting 2013Prof_Nick_JamesBelum ada peringkat

- Who TRS 924 A4Dokumen75 halamanWho TRS 924 A4Andres AbrilBelum ada peringkat

- 9700 s03 QP 6 PDFDokumen28 halaman9700 s03 QP 6 PDFIG UnionBelum ada peringkat

- CCII 8.0 - Clinical EnzymologyDokumen2 halamanCCII 8.0 - Clinical EnzymologyWynlor AbarcaBelum ada peringkat

- Breakdown of Topics - Final Exam GenPath (2016-2017)Dokumen2 halamanBreakdown of Topics - Final Exam GenPath (2016-2017)Alfred ChowBelum ada peringkat

- Nursing Process Guide to Drug Therapy TeachingDokumen7 halamanNursing Process Guide to Drug Therapy TeachingFiona MoffatBelum ada peringkat

- Product Information For Human Medicinal Products HMV4Dokumen61 halamanProduct Information For Human Medicinal Products HMV4CalimeroBelum ada peringkat

- Nervous System Mutliple ChoiceDokumen2 halamanNervous System Mutliple ChoiceSham DeenBelum ada peringkat

- Digestion: Breaking Down Food in the Digestive SystemDokumen25 halamanDigestion: Breaking Down Food in the Digestive SystemJaymee GonzalesBelum ada peringkat

- 2018 Innovation Awards ProgramDokumen16 halaman2018 Innovation Awards ProgramUNeMed CorporationBelum ada peringkat

- ArticlesDokumen955 halamanArticlesMuhammad ChohanBelum ada peringkat

- Road Map - MedicineDokumen1 halamanRoad Map - MedicineEnjie IbrahimBelum ada peringkat

- ScizopheniaDokumen20 halamanScizopheniaGogea GabrielaBelum ada peringkat

- Histochemistry Print PDFDokumen4 halamanHistochemistry Print PDFEka Putra PratamaBelum ada peringkat

- Zwamborn Hanssen1997Dokumen4 halamanZwamborn Hanssen1997JohnnyBelum ada peringkat

- CVD Risk Past, Present & FutureDokumen27 halamanCVD Risk Past, Present & FuturefadlicardioBelum ada peringkat

- Primary Amenorrhea Is Failure of Menses To Occur by One of The FollowingDokumen13 halamanPrimary Amenorrhea Is Failure of Menses To Occur by One of The FollowingMuhammad Ilyas AhmadBelum ada peringkat

- Genome EditingDokumen12 halamanGenome EditingDahlia StudioBelum ada peringkat

- Usp STD CoaDokumen3 halamanUsp STD CoaVinoth KumarBelum ada peringkat