Monthly Technical Stock Picks: Retail Research

Diunggah oleh

GauriGanJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Monthly Technical Stock Picks: Retail Research

Diunggah oleh

GauriGanHak Cipta:

Format Tersedia

January 31, 2015

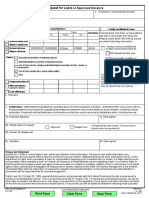

Monthly Technical Stock Picks

RETAIL RESEARCH

Stock

BHEL

Anant Raj Ltd

CMP

Rs.291.75

Rs.50.15

Recommended Action

Buy between CMP & Rs.265

Buy between CMP & Rs.45

Target

Rs.365

Rs.65

Stoploss *

Rs.255

Rs.42.50

Time Horizon

2-3 Months

2-3 Months

* Stoploss as per daily closing basis.

Bharat Heavy Electricals Ltd (BHEL):

BHEL- Monthly timeframe

Observation

The attached larger timeframe chart like monthly timeframe chart of BHEL (Bharat Heavy Electrical Ltd) is indicating

a sustained uptrend over the last few months.

We observe a bullish head & shoulder type pattern (variation type), which is unfolding and the neck line (green up

sloping line) has placed around Rs.297.00. In the last few occasions, the stock price is making attempt to stage

upside breakout of the neck line.

The long term support of 50 month EMA (brown curvy line) is intact and is offering support for the stock price in the

last few months.

The formation of long lower shadow of the last three months is indicating an emergence of buying interest from the

lower levels, which hints at the possibility of upside breakout of the hurdle for near term.

Monthly momentum oscillator like 14 period RSI is repeatedly hitting the upper area of 60 levels and is currently

placed around 60 levels. Monthly RSI moving above 60 could have positive impact on the stock price in future.

The overall positive chart pattern is suggesting a buying opportunity in BHEL Ltd for the next couple of months.

RETAIL RESEARCH

Anant Raj Ltd:

Anant Raj Ltd-Monthly timeframe

Observation

The Anant Raj Ltd as per larger timeframe chart of monthly is indicating that the stock price is in the process of

making a significant bottom reversal pattern, after a decline of the last 5-6 months.

We observe that the stock price is moving with in a converging triangle type pattern (two brown converging trend

lines). Currently the stock price is showing bottom reversal pattern around the lower end of triangle of around

Rs.43-Rs.44 levels.

The last couple of months candlestick pattern is showing another positive indication of spring. The stock prices

were showing false downside break of the lower up sloping triangle line around Rs.45 levels. This is positive for the

stock trend and it signals the possibility of stock price testing the upper triangle around Rs.75-76 levels in the next

few months.

Monthly 14 period RSI is making attempt to turn up from near the key lower levels of 40. From here the monthly RSI

could move up towards the upper 60 levels in medium term.

Positive technical set up is suggesting a buying opportunity for the next few months.

RETAIL RESEARCH

Technical Research Analyst: Nagaraj Shetti (H5101)

RETAIL RESEARCH Tel: (022) 3075 3400 Fax: (022) 2496 5066 Corporate Office

HDFC securities Limited, I Think Techno Campus, Building - B, "Alpha", Office Floor 8, Near Kanjurmarg Station, Opp. Crompton Greaves, Kanjurmarg (East),

Mumbai 400 042 Phone: (022) 3075 3400 Fax: (022) 2496 5066 Website: www.hdfcsec.com Email: hdfcsecretailresearch@hdfcsec.com

Disclaimer: This document has been prepared by HDFC Securities Limited and is meant for sole use by the recipient and not for circulation. This document is not

to be reported or copied or made available to others. It should not be considered to be taken as an offer to sell or a solicitation to buy any security. The information

contained herein is from sources believed reliable. We do not represent that it is accurate or complete and it should not be relied upon as such. We may have from

time to time positions or options on, and buy and sell securities referred to herein. We may from time to time solicit from, or perform investment banking, or other

services for, any company mentioned in this document. This report is intended for non-Institutional Clients

This report has been prepared by the Retail Research team of HDFC Securities Ltd. The views, opinions, estimates, ratings, target price, entry prices and/or other

parameters mentioned in this document may or may not match or may be contrary with those of the other Research teams (Institutional, PCG) of HDFC Securities

Ltd.

Disclosure by Research Analyst: Research Analyst or his relative or HDFC Securities Ltd. does not have any financial interest in the subject company. Also

Research Analyst or his relative or HDFC Securities Ltd. or its Associate does not have beneficial ownership of 1% or more in the subject company at the end of the

month immediately preceding the date of publication of the Research Report. Further Research Analyst or his relative or HDFC Securities Ltd. or its associate does

not have any material conflict of interest. Any holding in stock - No

Disclosure by Research Entity: HDFC Securities Ltd. may have received any compensation/benefits from the subject company, may have managed public

offering of securities for the subject company in the past 12 months. Further, Associates of the Company may have financial interest from the subject company in

the normal course of Business. The subject company may have been our client during twelve months preceding the date of distribution of the Research report.

Research analyst has not served as an officer, director or employee of the subject company. Research entity has not been engaged in market making activity for

the subject company. We have not received any compensation/benefits from the subject company or third party in connection with the Research Report.

RETAIL RESEARCH

Anda mungkin juga menyukai

- Sector Momentum Stock Pick: SKS Microfinance LTDDokumen2 halamanSector Momentum Stock Pick: SKS Microfinance LTDGauriGanBelum ada peringkat

- Technical Stock Idea: Retail ResearchDokumen2 halamanTechnical Stock Idea: Retail ResearchjojoBelum ada peringkat

- Technical Stock Idea: Retail ResearchDokumen2 halamanTechnical Stock Idea: Retail ResearchumaganBelum ada peringkat

- BSPL Pick - 06-12-23 - SHYAMMETLDokumen3 halamanBSPL Pick - 06-12-23 - SHYAMMETLSourav PalBelum ada peringkat

- Technical Stock Idea: Retail ResearchDokumen2 halamanTechnical Stock Idea: Retail ResearchumaganBelum ada peringkat

- Technical Stock Idea: Retail ResearchDokumen3 halamanTechnical Stock Idea: Retail ResearchAnonymous y3hYf50mTBelum ada peringkat

- Technical Switch Trades: Retail ResearchDokumen2 halamanTechnical Switch Trades: Retail ResearchumaganBelum ada peringkat

- Monthly Technical Stock Picks: Retail ResearchDokumen3 halamanMonthly Technical Stock Picks: Retail ResearchGauriGanBelum ada peringkat

- Technical Stock Idea: Retail ResearchDokumen3 halamanTechnical Stock Idea: Retail ResearchumaganBelum ada peringkat

- Technical Stock PickDokumen3 halamanTechnical Stock PickGauriGanBelum ada peringkat

- Sector Momentum Stock Pick: GHCL LTDDokumen2 halamanSector Momentum Stock Pick: GHCL LTDGauriGanBelum ada peringkat

- Retail Research: Technical Stock IdeaDokumen2 halamanRetail Research: Technical Stock IdeakhaniyalalBelum ada peringkat

- Technical Stock Idea: Retail ResearchDokumen2 halamanTechnical Stock Idea: Retail ResearchumaganBelum ada peringkat

- Weekly Momentum Stock Pick: Rs.555 Rs.617 Rs.480/445 1-2 MonthsDokumen2 halamanWeekly Momentum Stock Pick: Rs.555 Rs.617 Rs.480/445 1-2 MonthsGauriGanBelum ada peringkat

- Technical Stock Idea: Retail ResearchDokumen2 halamanTechnical Stock Idea: Retail ResearchumaganBelum ada peringkat

- MTF Stock Pick - 28-04-21-Heritage FoodsDokumen3 halamanMTF Stock Pick - 28-04-21-Heritage FoodsKaran SinghBelum ada peringkat

- NBCC Positional Technical Pick - 05 Nov 2018Dokumen2 halamanNBCC Positional Technical Pick - 05 Nov 2018kashif raja khanBelum ada peringkat

- Diwali Technical Stock Picks: Retail ResearchDokumen2 halamanDiwali Technical Stock Picks: Retail ResearchumaganBelum ada peringkat

- ReRs SoftwareDokumen2 halamanReRs SoftwareDilraj KaurBelum ada peringkat

- MTF (BSPL) Stock Pick - TATASTEEL - 17102023Dokumen3 halamanMTF (BSPL) Stock Pick - TATASTEEL - 17102023riddhi SalviBelum ada peringkat

- Technical Stock PickDokumen3 halamanTechnical Stock PickGauriGanBelum ada peringkat

- Technical Stock PickDokumen2 halamanTechnical Stock PickumaganBelum ada peringkat

- Mentum Stocks: Positional Technical PickDokumen2 halamanMentum Stocks: Positional Technical PickGauriGanBelum ada peringkat

- HSL - Emargin Stock Pick - LA OPALADokumen3 halamanHSL - Emargin Stock Pick - LA OPALAViswanathan SundaresanBelum ada peringkat

- Technical Stock Idea: December 22, 2015Dokumen3 halamanTechnical Stock Idea: December 22, 2015Anonymous y3hYf50mTBelum ada peringkat

- Mentum Stocks: Positional Technical PickDokumen2 halamanMentum Stocks: Positional Technical PickAnonymous y3hYf50mTBelum ada peringkat

- Sector Momentum Stock Pick: Tata Sponge Iron LTDDokumen2 halamanSector Momentum Stock Pick: Tata Sponge Iron LTDGauriGanBelum ada peringkat

- Thematic Reports - PSU-Banks - 23022021Dokumen7 halamanThematic Reports - PSU-Banks - 23022021krishnaheetBelum ada peringkat

- Technical Stock PicksDokumen4 halamanTechnical Stock PicksumaganBelum ada peringkat

- Retail Research: Technical Stock IdeaDokumen2 halamanRetail Research: Technical Stock IdeaumaganBelum ada peringkat

- Indian Currency Market - A Weekly Perspective: 14/08 21/08 % CHG CurrenciesDokumen4 halamanIndian Currency Market - A Weekly Perspective: 14/08 21/08 % CHG CurrenciesGauriGanBelum ada peringkat

- Daily Technical Snapshot: September 03, 2015Dokumen3 halamanDaily Technical Snapshot: September 03, 2015GauriGanBelum ada peringkat

- Mentum Stocks: Positional Technical PickDokumen2 halamanMentum Stocks: Positional Technical PickGauriGanBelum ada peringkat

- Technical Stock Idea: Dishman Pharmaceuticals & Chemicals LTDDokumen3 halamanTechnical Stock Idea: Dishman Pharmaceuticals & Chemicals LTDSankar KumarasamyBelum ada peringkat

- ReportDokumen2 halamanReportAnonymous y3hYf50mTBelum ada peringkat

- MTF Stock Pick - RAIN IND 30082021Dokumen3 halamanMTF Stock Pick - RAIN IND 30082021Keshav KhetanBelum ada peringkat

- Retail Research: Technical Stock IdeaDokumen2 halamanRetail Research: Technical Stock IdeaumaganBelum ada peringkat

- HSL Techno Edge: Retail ResearchDokumen3 halamanHSL Techno Edge: Retail ResearchumaganBelum ada peringkat

- Technical Positional Pick - 13-07-21-SPANDANADokumen3 halamanTechnical Positional Pick - 13-07-21-SPANDANAAjish CJ 2015Belum ada peringkat

- HSL Weekly Insight: Retail ResearchDokumen4 halamanHSL Weekly Insight: Retail ResearchshobhaBelum ada peringkat

- Technical Stock PickDokumen3 halamanTechnical Stock PickGauriGanBelum ada peringkat

- Retail Research: Technical Stock IdeaDokumen2 halamanRetail Research: Technical Stock IdeakhaniyalalBelum ada peringkat

- Technical Stock Idea: Private Client GroupDokumen2 halamanTechnical Stock Idea: Private Client GroupkhaniyalalBelum ada peringkat

- Retail Research: Indian Currency MarketDokumen3 halamanRetail Research: Indian Currency MarketumaganBelum ada peringkat

- VENKYS - E-Margin Positional Pick - HSL - 281221Dokumen3 halamanVENKYS - E-Margin Positional Pick - HSL - 281221destinationsunilBelum ada peringkat

- RBI Policy - Key Challenges For The Banking SectorDokumen4 halamanRBI Policy - Key Challenges For The Banking SectorRekha LohiaBelum ada peringkat

- HSL Techno Edge: Retail ResearchDokumen3 halamanHSL Techno Edge: Retail ResearchDinesh ChoudharyBelum ada peringkat

- Technical Switch Trades: Retail ResearchDokumen2 halamanTechnical Switch Trades: Retail ResearchkhaniyalalBelum ada peringkat

- Special Technical Report - Dollar Index & Usdinr: Retail ResearchDokumen3 halamanSpecial Technical Report - Dollar Index & Usdinr: Retail ResearchumaganBelum ada peringkat

- ICICI Direct - Technical Delivery Call Dredging Corporation of India - Apr 01, 2014Dokumen5 halamanICICI Direct - Technical Delivery Call Dredging Corporation of India - Apr 01, 2014Nandeesh KodimallaiahBelum ada peringkat

- Special Technical Report - GOLD: Retail ResearchDokumen3 halamanSpecial Technical Report - GOLD: Retail ResearchshobhaBelum ada peringkat

- Mid Cap Technical Picks: Retail ResearchDokumen8 halamanMid Cap Technical Picks: Retail ResearchAnonymous y3hYf50mTBelum ada peringkat

- Daily Technical Snapshot: August 19, 2015Dokumen3 halamanDaily Technical Snapshot: August 19, 2015GauriGanBelum ada peringkat

- Weekly Futures Report: Weekly Derivative Futures Roundup For The Week Ended August 25, 2015 August 25, 2015Dokumen4 halamanWeekly Futures Report: Weekly Derivative Futures Roundup For The Week Ended August 25, 2015 August 25, 2015GauriGanBelum ada peringkat

- HSL Weekly Insight: Retail ResearchDokumen4 halamanHSL Weekly Insight: Retail ResearchumaganBelum ada peringkat

- Diwali Technical Stock Pick: Private Client GroupDokumen2 halamanDiwali Technical Stock Pick: Private Client GroupumaganBelum ada peringkat

- Derivative Positional Pick - 24-05-21-Muthootfin June FutureDokumen3 halamanDerivative Positional Pick - 24-05-21-Muthootfin June FutureManjunath JavaregowdaBelum ada peringkat

- HSL Techno Edge: Retail ResearchDokumen3 halamanHSL Techno Edge: Retail ResearchumaganBelum ada peringkat

- Learn Financial Tearms for Stock Selection Criteria and Stock Screening Before TradingDari EverandLearn Financial Tearms for Stock Selection Criteria and Stock Screening Before TradingBelum ada peringkat

- DrekkanasDokumen59 halamanDrekkanasHemlata GuptaBelum ada peringkat

- HSL PCG "Currency Daily": June 22, 2016Dokumen6 halamanHSL PCG "Currency Daily": June 22, 2016GauriGanBelum ada peringkat

- Book 2010 Abd Al-Rehman Al Sufi The Fixed Stars ThesisDokumen405 halamanBook 2010 Abd Al-Rehman Al Sufi The Fixed Stars ThesisGauriGan100% (2)

- IPO Snapshot V-Mart Retail LTD (VMRL) January 31, 2013Dokumen3 halamanIPO Snapshot V-Mart Retail LTD (VMRL) January 31, 2013GauriGanBelum ada peringkat

- Retail Research: Indian Currency MarketDokumen3 halamanRetail Research: Indian Currency MarketGauriGanBelum ada peringkat

- Report PDFDokumen2 halamanReport PDFGauriGanBelum ada peringkat

- Pennar Engineered Building System Limited - IPO Snapshot: Retail ResearchDokumen3 halamanPennar Engineered Building System Limited - IPO Snapshot: Retail ResearchGauriGanBelum ada peringkat

- Wave 59Dokumen5 halamanWave 59GauriGanBelum ada peringkat

- NFO Note: HDFC Retirement Savings FundDokumen7 halamanNFO Note: HDFC Retirement Savings FundGauriGanBelum ada peringkat

- HSL PCG "Currency Daily": June 21, 2016Dokumen6 halamanHSL PCG "Currency Daily": June 21, 2016GauriGanBelum ada peringkat

- S.P. Apparels LTD: Retail ResearchDokumen3 halamanS.P. Apparels LTD: Retail ResearchGauriGanBelum ada peringkat

- Mentum Stocks: Positional Technical PickDokumen2 halamanMentum Stocks: Positional Technical PickGauriGanBelum ada peringkat

- 3013618Dokumen2 halaman3013618GauriGanBelum ada peringkat

- Nifty Technical Levels: September 02, 2015Dokumen1 halamanNifty Technical Levels: September 02, 2015GauriGanBelum ada peringkat

- Daily Technical Snapshot: September 03, 2015Dokumen3 halamanDaily Technical Snapshot: September 03, 2015GauriGanBelum ada peringkat

- Daily Technical Snapshot: October 15, 2015Dokumen3 halamanDaily Technical Snapshot: October 15, 2015GauriGanBelum ada peringkat

- Monthly Strategy Report - September 2015: Month Gone byDokumen10 halamanMonthly Strategy Report - September 2015: Month Gone byGauriGanBelum ada peringkat

- Sector Momentum Stock Pick: GHCL LTDDokumen2 halamanSector Momentum Stock Pick: GHCL LTDGauriGanBelum ada peringkat

- Technical Stock PickDokumen3 halamanTechnical Stock PickGauriGanBelum ada peringkat

- Technical Pick: Weekly ChartDokumen2 halamanTechnical Pick: Weekly ChartGauriGanBelum ada peringkat

- Retail Research Weekly Debt ReportDokumen12 halamanRetail Research Weekly Debt ReportGauriGanBelum ada peringkat

- Retail Research: Weekly Debt ReportDokumen11 halamanRetail Research: Weekly Debt ReportGauriGanBelum ada peringkat

- Retail Research: Weekly Debt ReportDokumen11 halamanRetail Research: Weekly Debt ReportGauriGanBelum ada peringkat

- Indian Currency Market - A Weekly Perspective: Retail ResearchDokumen3 halamanIndian Currency Market - A Weekly Perspective: Retail ResearchGauriGanBelum ada peringkat

- Performance of Pension Funds (NPS Tier - I) : EcemberDokumen2 halamanPerformance of Pension Funds (NPS Tier - I) : EcemberGauriGanBelum ada peringkat

- Mid Week Technicals of Index, Currency and Commodities: NiftyDokumen5 halamanMid Week Technicals of Index, Currency and Commodities: NiftyGauriGanBelum ada peringkat

- 3013734Dokumen2 halaman3013734GauriGanBelum ada peringkat

- Indian Currency Market - A Technical Perspective For Traders and HedgersDokumen6 halamanIndian Currency Market - A Technical Perspective For Traders and HedgersGauriGanBelum ada peringkat

- Beyond VaR OfficialDokumen76 halamanBeyond VaR OfficialmaleckicoaBelum ada peringkat

- Session 13 - NPDIDokumen8 halamanSession 13 - NPDIPRALHAD DASBelum ada peringkat

- 12e.MCQs.C1 For StsDokumen12 halaman12e.MCQs.C1 For StsTrang HoàngBelum ada peringkat

- Sick Leave Form For Rafiullah PDFDokumen1 halamanSick Leave Form For Rafiullah PDFRafiullahBelum ada peringkat

- RIBA Principal Designer PSC 2020 Final PDF Consultation VersionDokumen36 halamanRIBA Principal Designer PSC 2020 Final PDF Consultation Versionalexandra SBBelum ada peringkat

- Stakeholder ProposalDokumen15 halamanStakeholder ProposalEYOB AHMEDBelum ada peringkat

- Student Fees Guide Book Final Year 2022Dokumen98 halamanStudent Fees Guide Book Final Year 2022lindokuhlemashaba877Belum ada peringkat

- 高顿财经ACCA acca.gaodun.cn: Advanced Performance ManagementDokumen13 halaman高顿财经ACCA acca.gaodun.cn: Advanced Performance ManagementIskandar BudionoBelum ada peringkat

- Release PPDokumen27 halamanRelease PPDaut PoloBelum ada peringkat

- Library Books List RIC - FSDDokumen8 halamanLibrary Books List RIC - FSDBook BerryBelum ada peringkat

- 16Dokumen1 halaman16Babu babuBelum ada peringkat

- ACTG 495 Syllabus (Fall 2020) John Eckroth Portland State University Integrated Accounting IssuesDokumen10 halamanACTG 495 Syllabus (Fall 2020) John Eckroth Portland State University Integrated Accounting IssuesHardlyBelum ada peringkat

- Human Factors in Safety - Types, Examples, and SolutionsDokumen7 halamanHuman Factors in Safety - Types, Examples, and SolutionsjhdgdjghdBelum ada peringkat

- Personal Statement - JayabayaDokumen1 halamanPersonal Statement - JayabayaAnang KurniawanBelum ada peringkat

- Grills, Railings, Fence: Profile No.: 220 NIC Code:24109Dokumen10 halamanGrills, Railings, Fence: Profile No.: 220 NIC Code:24109Sanyam BugateBelum ada peringkat

- Presentation On Role of HR Planning in Retention of EmployeesDokumen6 halamanPresentation On Role of HR Planning in Retention of Employeessiddhartha12Belum ada peringkat

- Balaji ResumeDokumen3 halamanBalaji ResumeNaveen KumarBelum ada peringkat

- The Innovation of Grocery StoreDokumen5 halamanThe Innovation of Grocery StoreNguyễn Hồng VũBelum ada peringkat

- Chapter 1Dokumen25 halamanChapter 1Nhi Thanh LêBelum ada peringkat

- Shopping Experiences of Second Hand ClothesDokumen19 halamanShopping Experiences of Second Hand ClothesThu Huyền BùiBelum ada peringkat

- Lindsey 2018Dokumen27 halamanLindsey 2018arin ariniBelum ada peringkat

- Presentation 3Dokumen8 halamanPresentation 3Anindita SinghviBelum ada peringkat

- Adjusting Entries Until Adjusted Trial Balance - EditedDokumen2 halamanAdjusting Entries Until Adjusted Trial Balance - EditedCINDY LIAN CABILLON100% (2)

- UNIT 1 - Planning & Evaluating OperationsDokumen22 halamanUNIT 1 - Planning & Evaluating OperationsGurneet Singh7113Belum ada peringkat

- Week 5 Managing A Service Related BusinessDokumen20 halamanWeek 5 Managing A Service Related Businesskimberly dueroBelum ada peringkat

- PDF Installment Sales Reviewer Problems - CompressDokumen43 halamanPDF Installment Sales Reviewer Problems - CompressMischievous Mae0% (1)

- Sachin Kukreja (FinalDokumen15 halamanSachin Kukreja (FinalSachin KukrejaBelum ada peringkat

- ECONOMICS Chapter - 2 Question BankDokumen1 halamanECONOMICS Chapter - 2 Question BankZee waqarBelum ada peringkat

- NCR - T-245-ND - Aug 40 To Sept 2Dokumen25 halamanNCR - T-245-ND - Aug 40 To Sept 2April Jay BederioBelum ada peringkat

- Homework Chapter 9Dokumen5 halamanHomework Chapter 9Linh TranBelum ada peringkat