Public Islamic Sector Select Fund

Diunggah oleh

Armi Faizal AwangDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Public Islamic Sector Select Fund

Diunggah oleh

Armi Faizal AwangHak Cipta:

Format Tersedia

S-13

PUBLIC ISLAMIC SECTOR SELECT FUND

RESPONSIBILITY STATEMENT

This Product Highlights Sheet has been reviewed and approved by the directors of Public Mutual Berhad and

they collectively and individually accept full responsibility for the accuracy of the information. Having made all

reasonable enquiries, they confirm to the best of their knowledge and belief, there are no false or misleading

statements, or omission of other facts which would make any statement in the Product Highlights Sheet false

or misleading.

STATEMENTS OF DISCLAIMER

The Securities Commission Malaysia has authorised the issuance of Public Islamic Sector Select Fund and a copy

of this Product Highlights Sheet has been lodged with the Securities Commission Malaysia.

The authorisation of Public Islamic Sector Select Fund and lodgement of this Product Highlights Sheet, should

not be taken to indicate that the Securities Commission Malaysia recommends the Public Islamic Sector Select

Fund, or assumes responsibility for the correctness of any statement made or opinion or report expressed in this

Product Highlights Sheet.

The Securities Commission Malaysia is not liable for any non-disclosure on the part of Public Mutual Berhad,

responsible for Public Islamic Sector Select Fund, and takes no responsibility for the contents of this Product

Highlights Sheet. The Securities Commission Malaysia makes no representation on the accuracy or completeness

of this Product Highlights Sheet, and expressly disclaims any liability whatsoever arising from, or in reliance upon,

the whole or any part of its contents.

PRODUCT HIGHLIGHTS SHEET

This Product Highlights Sheet (PHS) only highlights the key features and risks of this unit trust fund.

Investors are advised to request, read and understand the funds prospectus before deciding to invest.

Public Islamic Sector Select Fund has been certified as being Shariah-compliant by the Shariah Adviser

appointed for the fund.

BRIEF INFORMATION ON THE PRODUCT

What is this product about?

Type of product

Unit trust fund

Name of fund

Public Islamic Sector Select Fund (PISSF)

Capital protected or

guaranteed

No

Manager of fund

Public Mutual Berhad

Trustee of fund

AmanahRaya Trustees Berhad

Shariah Adviser of fund

ZICOlaw Shariah Advisory Services Sdn. Bhd.

(formerly known as ZI Shariah Advisory Services Sdn. Bhd.)

Distributor of fund

Unit trust consultants of Public Mutual Berhad

KEY FEATURES OF THE PRODUCT

What am I investing in?

Category of fund

Equity (Shariah-compliant)

Type of fund

Capital growth

Fund objective

To seek long-term capital appreciation by investing in a portfolio of securities,

mainly equities, that complies with Shariah requirements from market sectors in

the domestic market.

Note: Long term refers to a period of more than 5 years.

PUBLIC ISLAMIC SECTOR SELECT FUND

What am I investing in? (contd)

Investment strategy

The fund seeks to achieve the long-term goal of capital growth by identifying the

market sectors in the domestic market which offer the most promising investment

returns. The fund will invest in a maximum of 6 of the most promising sectors

determined by the fund manager. To ensure sufficient diversification, the fund will

maintain investments in a minimum of 3 sectors at all times. The fund generally

maintains equity exposures within a range of 75% to 98% against its net asset

value (NAV). The balance of the funds NAV will be invested in sukuk and Islamic

liquid assets which include Islamic money market instruments, Islamic investment

accounts and Islamic deposits.

Asset allocation

Shariah-compliant equities

75% to 98% of NAV

The balance of the funds NAV will be invested in sukuk and Islamic liquid assets

which include Islamic money market instruments, Islamic investment accounts

and Islamic deposits.

PRODUCT SUITABILITY

Who is this fund suitable for?

Investor profile

The fund is suitable for medium to long-term investors who are able to withstand

ups and downs of the stock market in pursuit of capital growth.

Note: Medium to long term refers to a period of 3 years or more.

KEY RISKS

What are the key risks associated with this product?

Market risk

The purchase of equities represents a risk since the prices of stocks fluctuate in

response to various factors. Such movements in the prices of the stocks underlying

the investment portfolio will cause the funds NAV, and consequently the prices

of units, to fall as well as rise.

Specific security risk

Prices of a particular security may fluctuate in response to the circumstances

affecting individual companies as well as general market or economic conditions.

As such, adverse price movements of a particular security invested by the fund

may adversely affect the funds NAV and unit price.

Liquidity risk

Liquidity risk is defined as the risk of the fund manager having to liquidate the funds

holdings of illiquid securities at a discount to market value (for listed securities)

and at a discount to fair value (for unlisted securities) to meet the redemption

requirements. This may adversely impact the funds NAV and unit price.

Industry/sector risk

Industry/sector risk arises when the fund is predominantly invested in specific

industries or sectors. Due to the reduced degree of diversification by industries/

sectors, the fund may be more vulnerable to factors associated with the particular

industries/sectors it is invested in. Any material changes associated with the sectors

that the fund invests in may have an adverse impact on the NAV of the fund.

Risk of non-compliance

with Shariah

requirements

There is the risk that the fund may hold securities which are Shariah non-compliant

due to possibilities that such securities which were determined by the Shariah

Advisory Council of the Securities Commission Malaysia and/or the Shariah

Adviser as Shariah-compliant at the point of purchase, were later re-classified as

Shariah non-compliant securities. If this occurs, the fund manager will take the

necessary steps to dispose off such securities according to Shariah requirements.

You are advised to read the funds prospectus and understand the risks involved and, if necessary,

consult your professional adviser(s) before investing.

FEES & CHARGES

What are the fees and charges involved?

Sales charge

Up to 5.5% of NAV per unit.

The Manager may at its discretion charge a lower sales charge.

PUBLIC ISLAMIC SECTOR SELECT FUND

What are the fees and charges involved? (contd)

Redemption charge

Nil

Switching charge

Switching fee of up to 0.75% of NAV per unit or a minimum of RM50 will be

imposed if units are switched out of the fund within 90 days from the date of

purchase or switching of units into the fund.

Switching fee of up to RM25 will be imposed if units are switched out of the

fund after 90 days from the date of purchase or switching of units into the fund.

Transfer charge

RM25 per transfer.

Management fee

1.50% per annum of the NAV.

Trustee fee

0.06% per annum of NAV, subject to a minimum fee of RM18,000 and a maximum

fee of RM600,000 per annum.

Note: The above fees and charges are exclusive of Goods and Services Tax (GST) or any other similar sales tax or

levy which are payable by you.

There are fees and charges involved and you are advised to consider them before investing in the fund.

ADDITIONAL INFORMATION

Valuation

The NAV of this fund is calculated and the price of units published on each business day at www.publicmutual.com.my.

Purchase and redemption of units

You can purchase and redeem units of the fund on any business day at the funds next determined NAV.

Initial investment

You would need to complete the fund application form that comes with the prospectus and PHS obtainable free

upon request. Your application form, together with the investment amount made out in a cheque can then be

submitted to any of the Public Bank Berhad branches. Please ensure that you obtain the bank-validated copy

of the application form for your record and future reference.

If you are a first time investor of Public Mutual Berhad, you are also required to complete the New Investor Form.

For existing investors who are Public Mutual Online (PMO) subscribers, you may purchase units of the fund online.

Minimum initial investment: RM1,000*.

Note:

* The Manager may reduce the minimum initial investment amount from time to time.

Additional investments

You may invest regularly into your account. This can be easily done through issuing direct debit authorisation

with banks. Alternatively, you may add to your account as and when you feel so inclined by depositing your

cheque into the collection accounts maintained at Public Bank Berhad.

For existing investors who are PMO subscribers, you may purchase additional units of the fund online.

Minimum additional investment: RM100.

How you should write your cheque

Initial investment

: For individual investors, cheque must be made payable to Public Mutual Berhad

followed by new NRIC No. of first holder.

For corporate investors, cheque must be made payable to Public Mutual Berhad

followed by your company registration number.

Additional investment : Cheque issued must be made payable to Public Mutual Berhad followed by

Account No. of targeted fund.

PUBLIC ISLAMIC SECTOR SELECT FUND

Purchase and redemption of units (contd)

How you should write your cheque (contd)

You are advised to write down your name, new NRIC/passport number/company registration number and

telephone number at the back of the cheque.

Cooling-off right

If you are investing with Public Mutual Berhad for the first time, you may exercise your cooling-off right within

6 business days from the date of receipt by Public Mutual Berhad, of the application form and payment. Your

request to exercise your cooling-off right must be submitted either to Public Mutual Berhad Head Office or any

of its branch offices. You will be paid a full refund of your investment within 10 days from the date of exercise

of this cooling-off right. The refund for every unit held will be the sum of the price of a unit on the day the

units were purchased and the sales charge imposed on the day the units were purchased.

Corporates or institutions, staff of the Manager and persons registered to deal in unit trust funds are not entitled

to the cooling-off right.

Redemption

You would need to complete and submit the Repurchase Form to the nearest Public Mutual Berhad branch

office or Public Mutual Berhad Head Office. You can also execute your redemption request using PMO. You will

be paid the redemption proceeds within 10 days from our receipt of your redemption request.

Minimum redemption is 1,000 units. In the case of partial redemption, the Manager may elect to redeem the

entire account if the partial redemption results in less than 1,000 units being held in your account with the fund.

You are advised not to make payment in cash to any of our unit trust consultants or staff when

purchasing units of the fund. If you wish to pay in cash, you are advised to do so personally at any

Public Bank Berhad branch counter, and ensure that a bank-validated copy of the fund application

form is obtained before leaving the bank.

CONTACT INFORMATION

Who should I contact for further information on the fund?

For information pertaining to the fund, you may consult our team of dedicated unit trust consultants who are

registered with the Federation of Investment Managers Malaysia (FIMM), or contact our Customer Service Hotline

at 03-6207 5000 or via email at customer@publicmutual.com.my.

Who should I contact to lodge a complaint?

1. For internal dispute resolution, you may contact our Customer Service Hotline at 03-6207 5000.

2. If you are dissatisfied with the outcome of the internal dispute resolution process, please refer your dispute to

the Securities Industry Dispute Resolution Center (SIDREC):

(a) via phone to

: 03-2282 2280

(b) via fax to

: 03-2282 3855

(c) via email to

: info@sidrec.com.my

(d) via letter to

: Securities Industry Dispute Resolution Center (SIDREC)

Unit A-9-1, Level 9, Tower A

Menara UOA Bangsar

No. 5, Jalan Bangsar Utama 1

59000 Kuala Lumpur

3. You can also direct your complaint to Securities Commission Malaysia (SC) even if you have initiated a dispute

resolution process with SIDREC. To make a complaint, please contact the SCs Investor Affairs & Complaints

Department:

(a) via phone to the Aduan Hotline at : 03-6204 8999

(b) via fax to

: 03-6204 8991

(c) via email to

: aduan@seccom.com.my

(d) via online complaint form available at www.sc.com.my

(e) via letter to

: Investor Affairs & Complaints Department

Securities Commission Malaysia

No. 3, Persiaran Bukit Kiara

Bukit Kiara

50490 Kuala Lumpur

S-13E3

Anda mungkin juga menyukai

- RHB-OSK Malaysia DIVA Fund-PhsDokumen5 halamanRHB-OSK Malaysia DIVA Fund-PhsNur Hidayah JalilBelum ada peringkat

- Sunlife Balanced Fund KFDDokumen4 halamanSunlife Balanced Fund KFDPaolo Antonio EscalonaBelum ada peringkat

- Eastspring Investments Dinasti Equity Fund Product HighlightsDokumen8 halamanEastspring Investments Dinasti Equity Fund Product HighlightsGrab Hakim RazakBelum ada peringkat

- Am-Mateen Asia-Pacific Equity: (The "Fund")Dokumen8 halamanAm-Mateen Asia-Pacific Equity: (The "Fund")Ahmad RafiqBelum ada peringkat

- Product Highlights Sheet Principal Islamic Lifetime Sukuk FundDokumen8 halamanProduct Highlights Sheet Principal Islamic Lifetime Sukuk FundMAKK Business SolutionsBelum ada peringkat

- En Principal Islamic Money Market Fund D PHSDokumen8 halamanEn Principal Islamic Money Market Fund D PHSnirmala sundrarajBelum ada peringkat

- Nism Va Mutual Fund Distributor ExaminationDokumen130 halamanNism Va Mutual Fund Distributor ExaminationKrishna JhaBelum ada peringkat

- Basic Rule For Investing in Mutual FundDokumen22 halamanBasic Rule For Investing in Mutual FundTapan JoshiBelum ada peringkat

- Affin Hwang Flexible Maturity Incvome Fund IV - Prospectus (TMF Trustees)Dokumen82 halamanAffin Hwang Flexible Maturity Incvome Fund IV - Prospectus (TMF Trustees)kairBelum ada peringkat

- Lotus Halal FIF - Abridged ProspectusDokumen21 halamanLotus Halal FIF - Abridged ProspectusReedwan GaniyuBelum ada peringkat

- Ronald A. Mayo AGENCY Shield PHP 03222022184321Dokumen10 halamanRonald A. Mayo AGENCY Shield PHP 03222022184321Ronald MayoBelum ada peringkat

- The Capital Protected Fund Is Classed As A Cautious InvestmentDokumen6 halamanThe Capital Protected Fund Is Classed As A Cautious InvestmentMuhammad Fahad SaleemBelum ada peringkat

- CIMB-Principal KLCI-Linked Fund LeafletDokumen2 halamanCIMB-Principal KLCI-Linked Fund LeafletlilanttBelum ada peringkat

- Schroder International Opportunities Portfolio - Schroder Asian Income (The "Fund'')Dokumen4 halamanSchroder International Opportunities Portfolio - Schroder Asian Income (The "Fund'')Yang Cai De DerekBelum ada peringkat

- Public Mutual Private Retiremenent Scheme ProducthighlightDokumen12 halamanPublic Mutual Private Retiremenent Scheme ProducthighlightBenBelum ada peringkat

- NiSM QuestionzssDokumen709 halamanNiSM Questionzssatingoyal1Belum ada peringkat

- HDFC Children's Gift Fund - Savings Plan - : Nature of Scheme Inception Date Option/PlanDokumen5 halamanHDFC Children's Gift Fund - Savings Plan - : Nature of Scheme Inception Date Option/Plansandeepkumar404Belum ada peringkat

- Role of SebiDokumen6 halamanRole of Sebishobhit_patel19Belum ada peringkat

- BSL Income FundDokumen13 halamanBSL Income FundVineet MishraBelum ada peringkat

- Amanat Prospectus EnglishDokumen104 halamanAmanat Prospectus EnglishAbdoKhaledBelum ada peringkat

- 10 Steps To Invest in Equity - SFLBDokumen3 halaman10 Steps To Invest in Equity - SFLBSudhir AnandBelum ada peringkat

- Axis Hybrid 9Dokumen12 halamanAxis Hybrid 9Arpan PatelBelum ada peringkat

- Thesis Unit Trust Management FundsDokumen7 halamanThesis Unit Trust Management Fundsgjhs6kjaBelum ada peringkat

- Odey Int'l FundDokumen48 halamanOdey Int'l FundcogitatorBelum ada peringkat

- Guide To InvestingDokumen11 halamanGuide To InvestingAnshul KharubBelum ada peringkat

- Igreat IqraDokumen24 halamanIgreat Iqraapi-240706460Belum ada peringkat

- What Is A Risk Profile FormDokumen4 halamanWhat Is A Risk Profile FormMahmood 786Belum ada peringkat

- Marites Estrella-AGENCY-Shield-PHP-02242023073309Dokumen11 halamanMarites Estrella-AGENCY-Shield-PHP-02242023073309jasleh ann villaflorBelum ada peringkat

- Key Information Memorandum Cum Application FormDokumen12 halamanKey Information Memorandum Cum Application FormAbhishek TandonBelum ada peringkat

- Mutual Funds in India: T.Sita Ramaiah Center Head INC - GunturDokumen36 halamanMutual Funds in India: T.Sita Ramaiah Center Head INC - GunturPUTTU GURU PRASAD SENGUNTHA MUDALIAR100% (2)

- Sund Small Sr4Dokumen20 halamanSund Small Sr4Mrityunjay Kumar RaiBelum ada peringkat

- Investment Policy StatementDokumen14 halamanInvestment Policy StatementHamis Rabiam MagundaBelum ada peringkat

- Grea T: Iqra'Dokumen24 halamanGrea T: Iqra'Murnizah MokhtaruddinBelum ada peringkat

- Offer FFFDokumen102 halamanOffer FFFKapil RewarBelum ada peringkat

- Multiple Choice QuestionsDokumen32 halamanMultiple Choice QuestionsTshering Wangdi0% (1)

- Because You Don't Just Build Wealth, You Build Memories.: Wealth Management Solutions From HSBCDokumen12 halamanBecause You Don't Just Build Wealth, You Build Memories.: Wealth Management Solutions From HSBCnarayan.mitBelum ada peringkat

- Mutual Funds DOSDokumen4 halamanMutual Funds DOSAjay SinghBelum ada peringkat

- Merchant Banking Sem4Dokumen7 halamanMerchant Banking Sem4Vinesh RavichandranBelum ada peringkat

- Mam My Sukuk PhsDokumen5 halamanMam My Sukuk PhsMr Ling Tuition CentreBelum ada peringkat

- Investor Protection Guidelines by Sebi NewDokumen17 halamanInvestor Protection Guidelines by Sebi Newnikudi92Belum ada peringkat

- Tax Saving Mutual Funds: Equity Linked Savings Scheme Tax Saving Mutual Funds: Equity Linked Savings SchemeDokumen7 halamanTax Saving Mutual Funds: Equity Linked Savings Scheme Tax Saving Mutual Funds: Equity Linked Savings SchemevarshapadiharBelum ada peringkat

- LC Sageone Select Stock Portfolio: A Long-Only Equity FundDokumen25 halamanLC Sageone Select Stock Portfolio: A Long-Only Equity FundsieausBelum ada peringkat

- FMR Topic 2Dokumen17 halamanFMR Topic 2wenderyBelum ada peringkat

- Key Investor Information: HL Select Global Growth SharesDokumen2 halamanKey Investor Information: HL Select Global Growth SharesMerabharat BharatBelum ada peringkat

- Takafulink Fund Fact SheetDokumen31 halamanTakafulink Fund Fact SheetCikgu AbdullahBelum ada peringkat

- PB China Pacific Equity Fund (Pbcpef)Dokumen5 halamanPB China Pacific Equity Fund (Pbcpef)Nik Hairi OmarBelum ada peringkat

- NCMF Final Prospectus 10122010Dokumen32 halamanNCMF Final Prospectus 10122010mobius50328Belum ada peringkat

- Basics of Unit Trust InvestingDokumen30 halamanBasics of Unit Trust InvestingnanabobomomoBelum ada peringkat

- UFI ProspectusDokumen17 halamanUFI ProspectusAlvin Rejano TanBelum ada peringkat

- Benefits of Investing in Mutual FundsDokumen4 halamanBenefits of Investing in Mutual Fundskumarpoonam2010Belum ada peringkat

- Unit Trusts Are They A Good Investment?Dokumen2 halamanUnit Trusts Are They A Good Investment?Bruce BarclayBelum ada peringkat

- Alternative Investment Funds A Robust Platform For Alternative AssetsDokumen21 halamanAlternative Investment Funds A Robust Platform For Alternative AssetsBhaskar ShanmugamBelum ada peringkat

- Affin Hwang Aiiman Growth Fund - PHS PDFDokumen9 halamanAffin Hwang Aiiman Growth Fund - PHS PDFYeoj NeskireBelum ada peringkat

- ATM Sales ReportDokumen2 halamanATM Sales ReportAnurag SawalBelum ada peringkat

- of SbiDokumen31 halamanof SbiSarbjeet Aujla33% (3)

- Mutual Fund Industry and StructureDokumen7 halamanMutual Fund Industry and Structurehsoni99Belum ada peringkat

- Investor PDFDokumen3 halamanInvestor PDFHAFEZ ALIBelum ada peringkat

- Risk DisclosureDokumen2 halamanRisk DisclosureFahrur RoziBelum ada peringkat

- Home Log in Sign UpDokumen7 halamanHome Log in Sign UpPooja AgarwalBelum ada peringkat

- 6th Central Pay Commission Salary CalculatorDokumen15 halaman6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- FTSE Bursa Malaysia Index Series FAQDokumen18 halamanFTSE Bursa Malaysia Index Series FAQArmi Faizal Awang100% (1)

- JmhurstDokumen42 halamanJmhurstmehmetonb100% (6)

- Options TradingDokumen29 halamanOptions TradingArmi Faizal Awang78% (9)

- Daniel Gramza - Building Your E-Mini Trading StrategyDokumen121 halamanDaniel Gramza - Building Your E-Mini Trading StrategyBig Tex100% (4)

- Monte Carlo Oil and Gas Reserve Estimation 080601Dokumen24 halamanMonte Carlo Oil and Gas Reserve Estimation 080601Ahmed Elsharif75% (4)

- Streamyx Wireless Is A Wireless Broadband Service That Provides Internet Connectivity Via CDMADokumen6 halamanStreamyx Wireless Is A Wireless Broadband Service That Provides Internet Connectivity Via CDMASimon TangBelum ada peringkat

- Ftse FBM KlciDokumen3 halamanFtse FBM KlciArmi Faizal AwangBelum ada peringkat

- Fbmklci 20160429Dokumen3 halamanFbmklci 20160429Armi Faizal AwangBelum ada peringkat

- Ftse FBM Shariah IndexDokumen3 halamanFtse FBM Shariah IndexArmi Faizal AwangBelum ada peringkat

- Public Bank 2013 Annual ReportDokumen312 halamanPublic Bank 2013 Annual ReportArmi Faizal Awang100% (1)

- Al-Banna - Ma'Thurat EnglishDokumen6 halamanAl-Banna - Ma'Thurat EnglishAsiah AminBelum ada peringkat

- Public Bank Annual Report 2009Dokumen197 halamanPublic Bank Annual Report 2009Armi Faizal AwangBelum ada peringkat

- Integrated Living SkillsDokumen13 halamanIntegrated Living Skillsamin_zamanBelum ada peringkat

- 9 Criteria Stock SelectionDokumen18 halaman9 Criteria Stock SelectionArmi Faizal AwangBelum ada peringkat

- Book Name 01Dokumen11 halamanBook Name 01Tanvir AhmedBelum ada peringkat

- 2023 - Tutorial 7 Risk - Return - CAPMDokumen4 halaman2023 - Tutorial 7 Risk - Return - CAPMVanh QuáchBelum ada peringkat

- Solved Webb Company Has Outstanding A 7 Annual 10 Year 100 000 FaceDokumen1 halamanSolved Webb Company Has Outstanding A 7 Annual 10 Year 100 000 FaceAnbu jaromiaBelum ada peringkat

- JWCH 08Dokumen29 halamanJWCH 08007featherBelum ada peringkat

- Scrip SellDokumen2 halamanScrip Sellapi-26549128Belum ada peringkat

- 10 1016@j Iedeen 2020 08 002Dokumen10 halaman10 1016@j Iedeen 2020 08 002HgoglezBelum ada peringkat

- MCQ in Engineering EconomicsDokumen355 halamanMCQ in Engineering EconomicsKen Joshua ManaloBelum ada peringkat

- Coffee Can Investing - The 'Do Nothing' Strategy For Stock Market FortunesDokumen3 halamanCoffee Can Investing - The 'Do Nothing' Strategy For Stock Market FortunesPGM5HBelum ada peringkat

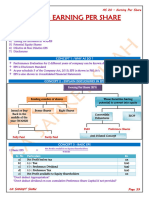

- As 20 - Earning Per Share CH-4Dokumen5 halamanAs 20 - Earning Per Share CH-4lucifersdevil68Belum ada peringkat

- Home Depot - GROUP 2Dokumen10 halamanHome Depot - GROUP 2Karthik KotaBelum ada peringkat

- PWC Fsi What Is Fintech PDFDokumen4 halamanPWC Fsi What Is Fintech PDFTubagus Donny SyafardanBelum ada peringkat

- RBI Commodity Policy DocsDokumen37 halamanRBI Commodity Policy Docsprateek.karaBelum ada peringkat

- Finance For Viva PDFDokumen17 halamanFinance For Viva PDFTusherBelum ada peringkat

- Ca QP ModelDokumen3 halamanCa QP Modelmahabalu123456789Belum ada peringkat

- Case 1Dokumen6 halamanCase 1吳悅寧Belum ada peringkat

- 4052 Xls Eng Prof BLAINE KITCHENWAREDokumen11 halaman4052 Xls Eng Prof BLAINE KITCHENWAREMafernanda GR67% (6)

- Single Stock Futures - Evidence From The Indian Securities MarketDokumen15 halamanSingle Stock Futures - Evidence From The Indian Securities Marketsip_pyBelum ada peringkat

- Abhishek Rai DissertationDokumen120 halamanAbhishek Rai DissertationAnurag MohantyBelum ada peringkat

- Company Law ProjectDokumen16 halamanCompany Law ProjectRishabh NautiyalBelum ada peringkat

- Summer Internship Report: July 2017Dokumen34 halamanSummer Internship Report: July 2017Kunal SharmaBelum ada peringkat

- Chapter 1. Introduction of Venture CapitalDokumen46 halamanChapter 1. Introduction of Venture CapitalPriyanka satamBelum ada peringkat

- A151 Tutorial Topic 6 - QuestionDokumen3 halamanA151 Tutorial Topic 6 - QuestionNadirah Mohamad Sarif100% (1)

- ChemaliteDokumen8 halamanChemaliteamitinfo_mishraBelum ada peringkat

- Intraday Trading With The TickDokumen5 halamanIntraday Trading With The Tickthecrew67100% (1)

- Market Pillars StrategyDokumen7 halamanMarket Pillars Strategyvijayanand kannanBelum ada peringkat

- Question No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerDokumen6 halamanQuestion No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The Answerritz meshBelum ada peringkat

- NP TE L: Corporate FinanceDokumen23 halamanNP TE L: Corporate Financevini2710Belum ada peringkat

- S&P500 Futures AnalysisDokumen7 halamanS&P500 Futures Analysisee1993100% (1)

- DLF Red HerringDokumen487 halamanDLF Red HerringTerrell MonroeBelum ada peringkat

- Banking Sector Yes Bank Under A Moratorium. SBI Investing CapitalDokumen5 halamanBanking Sector Yes Bank Under A Moratorium. SBI Investing CapitalSingh JagdishBelum ada peringkat