2014 Sma

Diunggah oleh

Lai Kuan ChanDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

2014 Sma

Diunggah oleh

Lai Kuan ChanHak Cipta:

Format Tersedia

MODULE CODE: 44-6T68-00C

EXAMINATION - SEPTEMBER 2014

MAIN

FACULTY:

Sheffield Business School

DEPARTMENT:

Finance Accounting and Business Systems

MODULE TITLE:

Strategic Management Accounting (TARC)

MODULE LEADER: Lesley Buick

TIME ALLOWED:

3 hours (plus 15 minutes reading time)

___________________________________________________________________

EXAM REGULATIONS:

1.

The University Regulations on academic conduct, including cheating and plagiarism,

apply to all examinations.

2.

The normal examination regulations of the University apply (see script answer book).

INSTRUCTIONS TO CANDIDATES

1.

Please do NOT start writing until told to do so by the Invigilator.

2.

Candidates must NOT use red ink on the script answer book.

3.

The memory of any programmable/graphical calculator used during this examination must

be cleared before the start of the paper.

4.

There are two sections in this paper:

- Section A. Answer ALL questions (40 marks)

- Section B. Answer TWO questions from this section (60 marks)

Total marks available 100.

5.

This is a CLOSED BOOK exam. NO material or notes may be taken into the exam.

6.

When answering questions you should make reference to appropriate academic

literature.

7.

Start each question on a new page.

___________________________________________________________________

STATIONERY REQUIREMENTS PER STUDENT:

1 x 16 Page Answer Booklets

Case study - Supply Chain Restructuring at Sainsburys Supermarkets

Limited (to be collected following the exam)

_____________________________________________________________

SECTION A

THIS PAPER CONTAINS 7 PAGES INCLUDING THIS SHEET

Page 1 of 7

MODULE CODE: 44-6T68-00C

Answer ALL questions in Section A

The questions in Section A are based on the pre-seen case study Supply

Chain Restructuring at Sainsburys Supermarkets Limited" by P. Indu and V.

Gupta

Required:

1. Analyse Sainsbury's internal and external environment during the 2000s, the

period during which both Peter Davis and Justin King served as CEO. You

should use the SWOT model to carry out your analysis.

(10 marks)

2. In 2004, Justin King stated that the availability of products, our quality and

service in store have not been what our customers have come to expect of

Sainsburys. We have become distracted by huge changes ... and these have

made us inward looking rather than focused on serving our customers (p.9).

Assess the key problems with Sainsburys supply and value chain around

2004/2005 and critically discuss how Justin King and Lawrence Christensen

sought to restore customer confidence with Sainsburys.

(20 marks)

3. Evaluate the extent to which adopting total quality management principles

helped to ensure the success of restructuring Sainsbury's value chain and

supply chain and thus improving the company's performance.

(10 marks)

(Total 40 marks)

Page 2 of 7

MODULE CODE: 44-6T68-00C

SECTION B

Answer any TWO questions from Section B

4.

McCoist Ltd specialises in the design and manufacture of a range of quality

sofas and chairs which they sell to customers through a network of specialist

stores. Each piece of furniture comes with a lifetime guarantee against stains

due to the unique stain-resistant fabric used. However it has been noticed

that warranty costs have more than doubled over the last year and the

number of items being returned is increasing sharply.

Sales staff are becoming concerned about their jobs now being much more

difficult as production staff are naming the furniture 'stain magnets' due to the

difficulty in removing any stains from the fabric. This problem has become

relatively well known and the reputation of the furniture is declining.

McCoist Ltd's main rival is Butcher plc, a company that has been in the

market for a longer period and has developed a superior reputation for quality,

on-time delivery and customer service. Butcher plc's (was written as 'Smith

plc' in the printed paper) products only come with a five year warranty and are

generally more expensive that those of McCoist.

McCoist's head office staff have become sufficiently concerned to call a 'crisis'

meeting to discuss how the problems can be solved. Some staff in the

meeting suggested the use of cost of quality reports and introduction of

stricter outsourcing and quality inspection procedures.

Required:

(a)

Discuss actions that the management at McCoist (was written as MTP

in the printed paper) should take in order to identify and quantify the

quality issues and their associated costs.

(6 marks)

(b)

Explain each of the four categories of quality costs, giving two

examples of each that McCoist may have incurred as part of the current

quality problem.

(8 marks)

(c)

Evaluate ways in which McCoist could reduce the four categories of

quality costs discussed in part (b) above. You should ensure you make

suggestions for all four categories.

(8 marks)

(d)

Evaluate how McCoist could learn from the success of Butcher plc and

what changes McCoist could make to improve performance. (8 marks)

(Total 30 marks)

Page 3 of 7

MODULE CODE: 44-6T68-00C

5. Chunky Monkey Ltd manufactures a chocolate bar (Rider) in the shape of a

London bus which it sells to various retailers throughout the UK. Because of

its appeal to the tourist market, the chocolate bar is a popular product with a

high demand.

It currently costs Chunky Monkey 0.75 to manufacture each unit of Rider and

the selling price to the retailers is determined by applying an 80% mark-up on

cost. This price is non-negotiable but individual retailers can negotiate a trade

discount with Chunky Monkey's sales representatives.

The Income Statement for Quarter 3 has given the Finance Director some

cause for concern as profit is lower than expected. It was expected that

operating profit would be at least 10% of sales revenue as reports from the

sales team intimated that sales to all the retailers was above expectations.

Income Statement - Quarter 3

Sales Revenue

Variable Costs

Gross Profit

75,625,000

(41,250,000)

34,375,000

Customer Complaints administration

Telephone Enquiries handling

Meetings with retail customers

Transportation - normal deliveries

Transportation - urgent deliveries

Discounts to retailers

Total Costs

4,500,000

6,600,000

3,199,940

6,216,000

3,353,125

7,562,500

(31,431,565)

Operating Profit

Operating Profit Margin

2,943,435

3.9%

Question 5 continues on the next page

Question 5 continued

As part of the investigation into why operating profit margin is so low, the Finance

Director has asked you, as Senior Management Accountant, to review the four main

retail customers and identify any areas of concern that can be considered at the next

Page 4 of 7

MODULE CODE: 44-6T68-00C

retail customer meeting. Information on each of the four retail customers for Quarter

3 is given below.

Units sold `

Trade discount

Miles travelled per delivery

(same distance for urgent

and normal deliveries)

Number of normal deliveries

Number of urgent deliveries

Telephone enquiries

Complaints received

Customer meetings held

Novelty

Snacks

5,000,000

10%

Little Treats

10,000,000

10%

London

Delights

25,000,000

6%

Visitors'

Village

15,000,000

4%

30

40

35

60

6,000

600

50,000

330

40

5,000

200

100,000

440

120

14,000

300

250,000

660

100

4,000

600

150,000

770

20

Required:

(a) Prepare a customer profitability analysis statement for Chunky Monkey Ltd

for Quarter 3 which shows the following information for each of the retail

chain customers:

i. The total operating profit

ii. The operating profit per Rider chocolate bar

iii. The operating profit margin (in %)

Note: all relevant workings (including the calculation of cost drivers) must be

clearly shown as marks will be allocated to the workings. Marks will also be

awarded for clear presentation of the information.

(15 marks)

(b) Analyse the results of the customer profitability analysis statement completed

in (a) and make recommendations to the Finance Director as to the key

issues that should be raised at the next retail customer meeting.

(8 marks)

(c) Critically evaluate the outputs of an Activity Based Management system and

how these can be used in assessing strategic decisions.

(7 marks)

(Total 30 marks)

6. Commonwealth Ltd has two divisions, each of which operates as a separate

profit centre with individual performance targets against which divisional

managers' performances are measured.

Page 5 of 7

MODULE CODE: 44-6T68-00C

Commonwealth manufactures and constructs children's go-karts. The Push

Division is responsible for manufacturing the go-kart frame and the Pedal

Division assembles purchased components into the finished go-kart. There

are external markets for both the frames and the go-karts.

The Divisional Managers have complete autonomy over their own divisions

and are responsible for all aspects of production, supply and delivery of their

output. Included in their responsibilities is the negotiation of transfer prices

between the divisions.

The divisions are currently involved in the negotiation of a transfer price for

the supply of 100 go-kart frames per month from Push Division to Pedal

Division. The following data relating to the potential deal is available.

Push Division

Go-kart frame (per unit)

50

of 37.50

Current selling price

Variable

costs

production

Variable

costs

of

production

(excluding

cost of frame)

Pedal Division

Go-kart (per unit)

100

55

Currently, the Push Division is producing and selling 225 go-kart frames per

calendar month to external customers. This represents 75% of the division's

total capacity. This demand is likely to stay the same for the foreseeable

future.

Denny Toaster, the divisional manager of the Push Division, is keen to use up

the spare capacity in his division as his bonus is based on performance and

he needs to achieve his profit target. Interest is charged at a rate of 10% per

annum on the division's current debt of 255,000 and the division also has to

cover fixed costs of 8,000 per month. In order to achieve target profit after

covering these costs, the Push division is required to earn a residual income

of 37,500.

Lucy Waster, Push Division's Sales Manager, believes that sales would be

higher if the selling price was reduced to be more in line with that of the

competition. She has suggested that external sales of the go-kart frame could

increase to 300 units per month if the selling price was reduced to 48.75.

Question 6 continues on the following page

Required:

(a) For EACH of the following scenarios, calculate the most appropriate

transfer price(s) for the sale of 100 go-kart frames from Push Division to Pedal

Division and comment on your results.

Page 6 of 7

MODULE CODE: 44-6T68-00C

(i) Current capacity, demand levels and selling price remain unchanged within

the Push Division and the transfer price is based on opportunity costs.

(ii)

Push Division is going to achieve its target residual income of 37,500

and current capacity and demand levels remain unchanged within this

division.

(iii) Denny Toaster accepts the Sales Manager's advice and lowers the selling

price of the frames to 48.75 which means that Push Division's sales

increase to 300 units per month.

(12 marks)

(b) Using your answers to (a) above, critically discuss the purpose and roles

of transfer pricing policies within companies such as Commonwealth Ltd.

(10 marks)

(c) If Commonwealth Ltd decided to transfer Push Division to Africa, evaluate

the additional issues that the company would have to consider when setting

transfer prices between divisions that are geographically located in different

countries.

(8 marks)

(Total 30 marks)

Page 7 of 7

Anda mungkin juga menyukai

- Saa P5Dokumen12 halamanSaa P5smartguy0Belum ada peringkat

- Operations Management in Automotive Industries: From Industrial Strategies to Production Resources Management, Through the Industrialization Process and Supply Chain to Pursue Value CreationDari EverandOperations Management in Automotive Industries: From Industrial Strategies to Production Resources Management, Through the Industrialization Process and Supply Chain to Pursue Value CreationBelum ada peringkat

- CMA SrilankaDokumen7 halamanCMA SrilankaFerry SihalohoBelum ada peringkat

- Problem Solving: The 5-Why’s: Unlocking the Power of Quality Assurance for Success in BusinessDari EverandProblem Solving: The 5-Why’s: Unlocking the Power of Quality Assurance for Success in BusinessBelum ada peringkat

- Seminar 1 Scotia Health BriefDokumen12 halamanSeminar 1 Scotia Health BriefHoàng Bảo Sơn100% (1)

- Vakev Entrepreneurship Examination of The Third Term 2021 For s6Dokumen13 halamanVakev Entrepreneurship Examination of The Third Term 2021 For s6vigiraneza0Belum ada peringkat

- Vakev Entrepreneurship Examination of The Third Term 2021 For s6Dokumen13 halamanVakev Entrepreneurship Examination of The Third Term 2021 For s6vigiraneza0Belum ada peringkat

- Account-Based Marketing: How to Target and Engage the Companies That Will Grow Your RevenueDari EverandAccount-Based Marketing: How to Target and Engage the Companies That Will Grow Your RevenuePenilaian: 1 dari 5 bintang1/5 (1)

- SampleDokumen9 halamanSampleAdznida DaudBelum ada peringkat

- Student Sol10 4eDokumen38 halamanStudent Sol10 4eprasad_kcp50% (2)

- Ce F5 002Dokumen28 halamanCe F5 002សារុន កែវវរលក្ខណ៍Belum ada peringkat

- Module Code: PMC Module Name: Performance Measurement & Control Programme: MSC FinanceDokumen9 halamanModule Code: PMC Module Name: Performance Measurement & Control Programme: MSC FinanceRenato WilsonBelum ada peringkat

- m92 Specimen Coursework AssignmentDokumen38 halamanm92 Specimen Coursework AssignmentNur MieyraBelum ada peringkat

- P17 - Strategic Performance ManagementDokumen13 halamanP17 - Strategic Performance Managementmanojbhatia1220Belum ada peringkat

- Exercise 3Dokumen5 halamanExercise 3Mikhail Aron GorreBelum ada peringkat

- IMT 15 Production and Operation Management M3Dokumen4 halamanIMT 15 Production and Operation Management M3solvedcareBelum ada peringkat

- CMA Srilanka PDFDokumen7 halamanCMA Srilanka PDFFerry SihalohoBelum ada peringkat

- 1) Dec 2002 - QDokumen5 halaman1) Dec 2002 - QNgo Sy VinhBelum ada peringkat

- POA 2008 ZA + ZB CommentariesDokumen28 halamanPOA 2008 ZA + ZB CommentariesEmily TanBelum ada peringkat

- Acct 321 AssignmentDokumen7 halamanAcct 321 AssignmentMuya Kihumba100% (1)

- 2-4 2004 Jun QDokumen11 halaman2-4 2004 Jun QAjay TakiarBelum ada peringkat

- Advanced Financial Management: Tuesday 3 June 2014Dokumen13 halamanAdvanced Financial Management: Tuesday 3 June 2014SajidZiaBelum ada peringkat

- Assignment For First Sem CMDokumen4 halamanAssignment For First Sem CMnishant khadkaBelum ada peringkat

- f5 2013 Jun QDokumen8 halamanf5 2013 Jun Qcatcat1122Belum ada peringkat

- MidtermADM3302M SolutionDokumen5 halamanMidtermADM3302M SolutionAlbur Raheem-Jabar100% (1)

- !cost AnalysisDokumen18 halaman!cost AnalysisAli ArshadBelum ada peringkat

- Advanced Strategic ManagementDokumen110 halamanAdvanced Strategic ManagementDr Rushen SinghBelum ada peringkat

- MBA 290-Strategic AnalysisDokumen110 halamanMBA 290-Strategic AnalysisAbhishek SoniBelum ada peringkat

- Chapter 13Dokumen18 halamanChapter 13محمد الجمريBelum ada peringkat

- Acca A3 F5Dokumen5 halamanAcca A3 F5Nicole TaylorBelum ada peringkat

- 13Dokumen2 halaman13itachi uchihaBelum ada peringkat

- MA2 CGA Sept'12 ExamDokumen19 halamanMA2 CGA Sept'12 Examumgilkin0% (1)

- CPGA QP May 2010 For PrintDokumen20 halamanCPGA QP May 2010 For PrintfaizthemeBelum ada peringkat

- ACCA F5 Tuition MockDokumen8 halamanACCA F5 Tuition MockUmer FarooqBelum ada peringkat

- D15 Hybrid F5 QPDokumen7 halamanD15 Hybrid F5 QPadad9988Belum ada peringkat

- Instructions To CandidatesDokumen23 halamanInstructions To CandidatesCLIVEBelum ada peringkat

- CASE 6 RQL Limited Budgeting and Cost Control Systems PDFDokumen8 halamanCASE 6 RQL Limited Budgeting and Cost Control Systems PDFbhar4tpBelum ada peringkat

- Silo Manufacturing CorporationDokumen22 halamanSilo Manufacturing CorporationCee Phanthira100% (1)

- Milestone 2 BUS-415Dokumen3 halamanMilestone 2 BUS-415mabdullah4830Belum ada peringkat

- LSC Bscfama May 07 QPMGDokumen8 halamanLSC Bscfama May 07 QPMGbrokencyderBelum ada peringkat

- P5 RM March 2016 Questions PDFDokumen12 halamanP5 RM March 2016 Questions PDFavinesh13Belum ada peringkat

- Planning, Control and Performance Management: Time Allowed 3 Hours ALL FOUR Questions Are Compulsory and MUST Be AnsweredDokumen5 halamanPlanning, Control and Performance Management: Time Allowed 3 Hours ALL FOUR Questions Are Compulsory and MUST Be AnsweredSharonTeoh100% (2)

- Management Accounting: Level 3Dokumen18 halamanManagement Accounting: Level 3Hein Linn KyawBelum ada peringkat

- PMC Examination Winter 2011Dokumen5 halamanPMC Examination Winter 2011pinkwine2001Belum ada peringkat

- Tamper DataDokumen191 halamanTamper Dataشايك يوسفBelum ada peringkat

- CMA2 P2 Practice Questions PDFDokumen12 halamanCMA2 P2 Practice Questions PDFMostafa Hassan100% (1)

- Strategic Management (MBA 7002) Exam Feb 2012 - Past PaperDokumen10 halamanStrategic Management (MBA 7002) Exam Feb 2012 - Past Papertg67% (3)

- f5 2009 Dec QDokumen7 halamanf5 2009 Dec QGeorges NdumbeBelum ada peringkat

- 5BUSS001W.Business Decision Making - sem3.finalOTA2020Dokumen10 halaman5BUSS001W.Business Decision Making - sem3.finalOTA2020Raza AliBelum ada peringkat

- MBA 290-Strategic AnalysisDokumen110 halamanMBA 290-Strategic AnalysisAllan YeungBelum ada peringkat

- ASAL Business WB Chapter 26 AnswersDokumen3 halamanASAL Business WB Chapter 26 AnswersElgin LohBelum ada peringkat

- A GCE Accounting 2505 June 2007 Question Paper +ansDokumen17 halamanA GCE Accounting 2505 June 2007 Question Paper +ansNaziya BocusBelum ada peringkat

- OMDokumen7 halamanOMvirajganatra9Belum ada peringkat

- P2 Nov 2013 Question PaperDokumen20 halamanP2 Nov 2013 Question PaperjoelvalentinorBelum ada peringkat

- CUACM 413 Tutorial QuestionsDokumen31 halamanCUACM 413 Tutorial Questionstmash3017Belum ada peringkat

- Tut 10Dokumen5 halamanTut 10Tang TammyBelum ada peringkat

- 2009-06-04 090233 Chapter 5Dokumen7 halaman2009-06-04 090233 Chapter 5nefbeck7Belum ada peringkat

- International Business: Case Analysis - Bharathi Airtel in Africa Group - 7 Section - ADokumen4 halamanInternational Business: Case Analysis - Bharathi Airtel in Africa Group - 7 Section - AVignesh nayakBelum ada peringkat

- CV 10022018 PDFDokumen2 halamanCV 10022018 PDFZia UllahBelum ada peringkat

- Biblioteca en PapelDokumen18 halamanBiblioteca en PapelCristina Garcia Aguilar0% (1)

- Chapter 3 - Combining Factors: Reminder ReminderDokumen5 halamanChapter 3 - Combining Factors: Reminder ReminderLê Thanh TùngBelum ada peringkat

- The Production of Private Ramesside Tombs Within The West Theban FuneraryDokumen37 halamanThe Production of Private Ramesside Tombs Within The West Theban FuneraryCirceSubaraBelum ada peringkat

- SL - No State/UT Active Naef Total Number Foreign Companies RegisteredDokumen4 halamanSL - No State/UT Active Naef Total Number Foreign Companies RegisteredrickysainiBelum ada peringkat

- Michael Porter On How To Marry StrategyDokumen2 halamanMichael Porter On How To Marry StrategySaumya GargBelum ada peringkat

- Characteristics of A Varactor DiodeDokumen2 halamanCharacteristics of A Varactor DiodeRecardo RamsayBelum ada peringkat

- Political Factors of Retail SectorDokumen3 halamanPolitical Factors of Retail SectorSachin Kumar Bassi100% (1)

- TWO (2) Questions in SECTION B in The Answer Booklet Provided. SECTION A: Answer ALL QuestionsDokumen7 halamanTWO (2) Questions in SECTION B in The Answer Booklet Provided. SECTION A: Answer ALL QuestionsnatlyhBelum ada peringkat

- Air BlueDokumen10 halamanAir BlueAli SaimaBelum ada peringkat

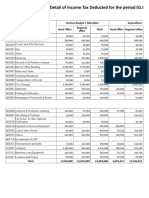

- Diversification of Hindustan Unilever LimitedDokumen21 halamanDiversification of Hindustan Unilever LimitedAtul Nikam50% (2)

- Warm-Up: Lesson A Lesson B Lesson C Lesson DDokumen10 halamanWarm-Up: Lesson A Lesson B Lesson C Lesson DNatalia ZachynskaBelum ada peringkat

- CapgeminiDokumen12 halamanCapgeminitixomBelum ada peringkat

- Ch12 VarianceAnalysis QDokumen11 halamanCh12 VarianceAnalysis QUmairSadiqBelum ada peringkat

- Company Profile - Future GroupDokumen16 halamanCompany Profile - Future GroupHanu InturiBelum ada peringkat

- Cash Register ECR 6100 User GuideDokumen30 halamanCash Register ECR 6100 User GuideJuanManuel Ruiz de ValbuenaBelum ada peringkat

- HiStory of Mozzarella CheeseDokumen2 halamanHiStory of Mozzarella CheesewijayantiBelum ada peringkat

- Complete The Sentences With There Is or There AreDokumen5 halamanComplete The Sentences With There Is or There AreS Leonardo CpdaBelum ada peringkat

- Company Profile (RIL)Dokumen6 halamanCompany Profile (RIL)Viju Hiremath50% (2)

- EconU1exam Jan 2013 Exam PaperDokumen36 halamanEconU1exam Jan 2013 Exam PaperAnonymous RnapGaSIZJBelum ada peringkat

- Indonesia Applying Distributed Generation-SHANGHAIDokumen23 halamanIndonesia Applying Distributed Generation-SHANGHAINyx RubyBelum ada peringkat

- Modern Auditing:: Assurance Services and The Integrity of Financial Reporting, 8 EditionDokumen19 halamanModern Auditing:: Assurance Services and The Integrity of Financial Reporting, 8 Editionsegeri kecBelum ada peringkat

- Calorii LegumeDokumen15 halamanCalorii LegumeAdina Paula GăburoiBelum ada peringkat

- Proforma Income TaxDokumen19 halamanProforma Income TaxRocking SheikhBelum ada peringkat

- Final Accounts of Companies QuestionsDokumen14 halamanFinal Accounts of Companies QuestionsshashankBelum ada peringkat

- Colgate Case StudyDokumen10 halamanColgate Case Studyapi-350427360100% (3)

- Philippine Perspective On HousingDokumen3 halamanPhilippine Perspective On Housingtom macasojot100% (1)

- SSSXXDokumen6 halamanSSSXXNath OruBelum ada peringkat