Hospitalization Policy

Diunggah oleh

Sudheer ChDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Hospitalization Policy

Diunggah oleh

Sudheer ChHak Cipta:

Format Tersedia

You and IBM: Hospitalization Policy India

You and IBM - India

http://w3-01.ibm.com/hr/web/in/health/hb01-hip0...

Money

Health

Life

Career

Tools

Health benefits

India

[Profiled for India]

Hospitalization Policy

Effective: 01 January 2015 till 31st December 2015

OBJECTIVE

To provide employees and their immediate dependents an opportunity to avail insurance coverage

for hospitalization and Domiciliary hospitalization expenses incurred on account of their medical

needs.

ELIGIBILITY

Employee, Spouse and Children Policy (ESC Policy)

All IBM India regular (full time and part time) employees and their immediate dependents (spouse

and up to 4 children).

The Primary Insureds male and female children aged between 0 days and 24 years irrespective of

gender can be enrolled as long as they are unmarried, still financially dependent on him/her and

have not established their own independent households.

Regular (full time and part time) employees who are covered under the Employee State Insurance

Coverage (ESIC) Act will also be covered under this policy.

If an employee opts out of this policy, none of the benefits in this policy shall apply. However, the

employee shall continue to be eligible for benefits required under law.

Parents Policy

Employees can insure their dependent parents by paying the premium applicable.

The maximum age up to which parents can be insured is 90 years.

SCOPE

The policy coverage is limited to expenses incurred within India.

GENERAL INFORMATION

Insurance Company - Apollo Munich Health Insurance Company Ltd.

Apollo Munich Health Insurance Company Ltd will continue as the insurer for the Group Health

insurance Policy of IBM India for the calendar year 2015.

Apollo Munich Health Insurance (AMHI) is one of the leading insurers in India providing health

insurance. AMHI is a joint venture between Apollo Hospitals group, the leading corporate hospital

group in Asia and Munich Health, an entity of Munich Re, one of the largest re-insurers in the world.

TPA (Third Party Administrator) - Medi Assist India TPA Pvt Ltd

Medi Assist India TPA Pvt Ltd will be the Third Party Administrator (TPA) and will facilitate

administration of Group Hospitalization Policy for IBM India Regular Employees for the calendar

year 2015.

1 of 33

05/06/2015 10:15 PM

You and IBM: Hospitalization Policy India

You and IBM - India

http://w3-01.ibm.com/hr/web/in/health/hb01-hip0...

Money

Health

Life

Career

Tools

All IBM India regular employees may avail coverage.

The base sum insured under this policy is INR 300,000. Employees have the option of increasing

the sum insured by opting for additional cover, the premium for which is payable by the employee.

This is a family floater plan, provided for the nuclear family (nuclear family is defined as employee,

spouse and up to 4 dependent children) i.e. there is no restriction on the amount available for each

member as long as the family does not exceed the limit of INR 300,000 or the enhanced cover in

case additional cover is opted.

All existing employees as of December 31, 2014 may avail coverage from January 1, 2015, by

default.

Spouse & Children insured as of December 31, 2014 may avail coverage from January 1, 2015.

Validation and updation of dependents details (spouse and children) of existing employees will be

possible on or before February 14, 2015.

New employee may avail coverage from their date of joining IBM India.

New employees can enroll their dependents, enhance the family floater cover, enroll parent/s and

opt for parent coverage within 45 days of joining.

New dependents are to be insured within 45 days of eligibility

From date of marriage

From date of birth of a baby

From date of legal adoption of a child

It is the responsibility of the employee to declare correct and accurate information regarding the

name and date of birth as declared in Medi Assist Website. If any information provided by an

employee is found to be incorrect or false this would result in BCG violation.

Claims submitted for dependents whose name has not been enrolled in the website will not be

processed by Medi Assist. Further, the claim will not be paid if such a claim is in any manner

fraudulent or supported by any fraudulent means or devices whether by the insured person or by

any other person acting on his behalf.

Employees share in the Premium (ESC Policy)

The premium for the base sum insured is shared between the employee and IBM.

If an employee avails of the insurance coverage, there would be a deduction of INR 1463 per

annum from the employees salary.

Unless an employee chooses to opt out of the policy, the premium, for this coverage will be

deducted from the employees salary in the month of March 2015 for employees who were on the

rolls of the company on December 31 of the previous year.

For new employees the premium will be deducted in the succeeding month after completing 45

days from enrollment start date.

This premium is eligible for deduction from the taxable income within the defined limits under

Section 80 D of the Income Tax Act.

This premium deduction does not require a declaration in the investment module of You and IBM

tool, as the deduction will happen automatically from the employees salary.

Premium amounts for primary coverage and enhanced coverage for employee and nuclear family

will be deducted from the employee's payroll without any prior intimation. The deduction will be

done within 90 days of the employee having enrolled his/her dependents on the Medi Assist

website.

For onsite employees, the deduction will be done from the onsite payroll.

2 of 33

05/06/2015 10:15 PM

You and IBM: Hospitalization Policy India

You and IBM - India

http://w3-01.ibm.com/hr/web/in/health/hb01-hip0...

Money

Health

Life

Career

Tools

In case, an employee does not wish to be part of the ESC policy, he/she has an option to opt out of

the policy within 45 days of enrollment start date. Once an employee has opted for the ESC policy,

he/she will not be able to opt out of the policy mid -year

The employee can log in to Medi Assist website to opt out.

Once the employee opts out of the scheme, they and their immediate family are not eligible for any

benefits as specified in this policy.

The employee would only be eligible for hospitalization benefits on account of accident during the

course of employment and for treatment of occupational diseases, as required under applicable

law.

Once an employee has opted out of the policy, they may rejoin the policy only next year as midterm

inclusion is not allowed.

In case employee opts out the employee would only be eligible for hospitalization benefits on

account of accident during the course of employment and for treatment of occupational diseases,

as required under applicable law for a sum insured of INR 200,000

DOMICILIARY EXPENSES ON OUTPATIENT CARE

This benefit is extended only to the employee. It is not applicable to the Parents Policy.

Domiciliary expenses on outpatient care for employee is up to a sum insured of INR 10,000 and

with a co-payment of 50% applicable on each & every claim (i.e., actual cost maximum of INR

20,000 at 50% co pay). This INR 10, 000 as a sublimit of the basic in patient sum insured and

balance cannot be carried forward to subsequent year(s). There is no minimum amount for

claim.

This benefit would be available only for specialist consultations and investigations prescribed by

a specialist and not for the treatment taken. Please note that routine health checkups do not fall

under the category of domiciliary benefit and such claims will not be admitted by the insurer.

Charges towards specialist consultation and investigations prescribed by the specialist are

covered.

A specialist is defined as a Physician (M.B.B.S.) whose practice is limited to a particular branch

of medicine or surgery, especially one who is certified by a board of physicians and should hold

an additional degree of MD or MS, DM, MCH, DGO, DNB, FRCS, MRCP, FRCSC and FRCAS.

Some common specialists include

Cardiologist

ENT Specialist

Neurologist

Oncologist

Gastroenterologist

Pediatrician

Gynecologist & obstetrics

Orthopedics

Nephrologists

Urologist

Ophthalmologist

Endocrinologist

Psychiatric/ Behavioral consultation by a Psychiatrist (MD Psychiatry, or similar degree) is

covered. (Psychologist consultation not covered)

3 of 33

05/06/2015 10:15 PM

You and IBM: Hospitalization Policy India

You and IBM - India

http://w3-01.ibm.com/hr/web/in/health/hb01-hip0...

Money

Health

Life

Career

Tools

routine blood work, x ray, ECG, MRI, CT scans etc.

Non Allopathic/Non Specialists consultation; investigation/Medicines & consumables/Routine

Checks ups etc are not covered whether prescribed by an allopathic doctor or not.

Copayment Applicable on Domiciliary Outpatient care

A copayment of 50% on the admissible claim amount shall apply on each and every claim by the

employee and dependents ( Spouse and children)

Special provision under Domiciliary Outpatient care

In event of any incident identified as a workplace incident and if recommended by IBM

The co-payment (50%) applicable under the benefit shall be waived for the claim and

100% of the eligible expenses under consultation, investigation and treatment / medication

would be covered upto the sum insured (INR 10,000) under the benefit

All other terms, conditions under the benefit would remain unchanged

Additional coverage under family floater (ESC Policy)

An employee availing the policy has the option of buying additional coverage for his/her family in

excess of INR 300,000 up to a maximum of INR 700,000 (a total sum insured of maximum of INR

1,000,000 for family).

The incremental premium incurred due to additional coverage will be deducted from the

employees salary. There would be an additional service tax levied on the insurance premium.

Please refer Medi Assist portal for rate chart of premiums applicable

(https://www.mediassistindia.net/IWP).

Employees will need to make a fresh enrollment if they intend to take an additional cover for 2015

for self and dependents (spouse and children).

Please note if the employee had enrolled for an additional cover last year (2014), they would still

need to enroll afresh on or before February 14, 2015.

In case, the employee does not enroll afresh for 2015, the additional coverage would not be carried

forward from 2014 by default.

Any ailment diagnosed / treated during coverage/enrollment window period under the lower sum

insured will continue to have the lower sum insured as the maximum cover (for that ailment and all

related ailments). This is applicable when the sum insured has been increased during enrollment

period.

Coverage at any point for any person under the ESC policy will not exceed INR 10 Lacs even

if both employee and the spouse are employees of IBM. The policy sub-limits for maternity,

domiciliary expenses, etc would apply.

Addition of Dependents (ESC Policy)

Existing employees availing the policy can add dependents at the time of renewal of the insurance

policy once a year and on or before February 14, 2015. They have to log on to the Medi Assist

website and add dependent details. Coverage will be effective from the starting date of the new

policy.

New employees availing the policy can add dependent details within 45 days of joining by logging

on to the Medi Assist website. Coverage will be effective from the date of joining.

Newly married employees availing the policy can add spouse details by logging on to the Medi

Assist website within 45 days of the date of marriage. Coverage will be effective for the spouse

from the date of marriage.

Employees availing the policy who have a new born child can add him/her within 45 days of the

4 of 33

05/06/2015 10:15 PM

You and IBM: Hospitalization Policy India

You and IBM - India

child from the date of birth.

http://w3-01.ibm.com/hr/web/in/health/hb01-hip0...

Money

Health

Life

Career

Tools

Employees availing the policy who have adopted a child can add him/her within 45 days of the date

of legal adoption by logging on to the Medi Assist website. Coverage will be effective from the date

of adoption.

Mid Term Inclusion (ESC Policy)

Mid Term Inclusions will be allowed only as an exception for employees availing the policy who

missed adding the newly married spouse, new born child and adopted child details due to some

valid reasons. Some of the reasons for which midterm inclusion can be allowed are

New addition in family (spouse or child) while employee was on international assignment and

looking for enrollment soon after his/her return to home country (IBM India).

New hire who could not attend the benefits session as part of "New Hire Induction" or "RBA

program" and hence did not have access to IBM India email to refer welcome email from RBA

and action accordingly, as the employee was operating from the client location since date of

joining.

Employee was on LOA or on long leave for the complete allowed window period. (45 days from

the policy start date or marriage/childbirth, whichever is applicable)

Any request for Midterm Inclusions for spouse and children has to have approvals from the HR

Partner/Advisor along with the IST Benefits Lead. The employee would need to submit proof

of marriage or birth certificate whichever is applicable. The coverage date will be effective from

the date the inclusion is endorsed by the insurer.

There is no mid- term enhancement of sum insured with respect to existing members under both

the policies viz., Employee, Spouse & Children and Parents.

Removal of Dependents (ESC Policy)

Dependents cannot be removed during a policy period except under the following circumstances

Divorce

Death of a dependent

Resignation of the employee

The company at its sole discretion can ask for supporting documents for addition or removal of

dependents from the coverage.

Benefits Covered under ESC Policy: For details please refer to the relevant section.

Inpatient Hospitalization

30 days pre hospitalization

60 days post hospitalization

Day care procedures covered specified list

Waiver of Pre-existing disease exclusion

No 30 days and two/one year waiting period

No room rent or type restriction

Copayment 5% for employee and 20% for dependents. In case of death of an employee the

copay would be waived for the claim

Congenital internal diseases are covered.

Congenital external diseases are covered

5 of 33

05/06/2015 10:15 PM

You and IBM: Hospitalization Policy India

You and IBM - India

http://w3-01.ibm.com/hr/web/in/health/hb01-hip0...

Money

Health

Life

Career

Tools

Exclusions under this benefit are

De- addiction program

Admission for primary purpose of confinement

Complications from family planning devices where Hospitalization is required (eg: Impacted IUCD)

Ambulance Limit at INR 1,500 per hospitalization- covers charges from the place of incidence to

the hospital.

Orthopedic appliances up to 5% of the eligible hospitalization expenses or actuals whichever is

lower - Artificial limbs, crutches or any other external appliance and/or device used for diagnosis or

treatment.

Laser treatment for correction of eye due to refractive error greater than or equal to 7.5D is

covered. The procedure would be covered even if the refractive error is less than 7.5D if the

surgery is performed for therapeutic reasons like erosions, non-healing ulcers, recurrent corneal

erosions, nebular opacities, etc.

Domiciliary Hospitalization Benefit

Maternity benefits

Domiciliary expenses on outpatient care

Cancer screening tests

Critical Illness Buffer:

Additional sum insured Benefits (Top-up)

Value Added Services

PARENTS POLICY

The maximum age up to which a member can be enrolled is 90 years.The coverage is on individual

basis i.e. this is not a family floater.

Employees availing the policy can choose to cover their dependent parents each, for a sum insured

of either INR 50,000, INR 100,000, INR 200,000, INR 300,000, INR 400,000 or INR 500,000.

The premium for covering parents will be deducted from the employee's salary. There would be an

additional service tax levied on the insurance premium. This amount will be eligible for deduction

from taxable income within the defined limits under Section 80 D of the Income Tax Act. This

premium deduction doesnt require declaration in the investment module of You and IBM tool as

the deduction will happen automatically from the employees salary.

The Parent Policy also attracts an additional Third Party Administrator (TPA) charge of INR 71 per

parent per year and an additional service tax on the same which will also be deducted from the

employees salary. Please refer Medi Assist portal for rate chart of premiums applicable

(https://www.mediassistindia.net/IWP).

It is the responsibility of the employee to declare correct and accurate information regarding the

name and date of birth in the Medi Assist website. Any information provided by an employee is

found to be incorrect or false would result in BCG Violation.

Employees who intend to enroll their parent/s have to make fresh enrollment of parent/s for 2015

and choose coverage for parent/s. Please note if you had enrolled your parent/s in 2014 and if you

want to enroll them in 2015 as well, you are required to enroll them afresh and opt for the specified

coverage in 2015. In case, you dont enroll afresh for 2015, the enrollment and coverage for

parents would not be carried forward from 2014 by default.

Enrollment and coverage for parents for existing employees can only be done at the time of

renewal of the policy i.e., till February 14, 2015.

Enrollment and coverage for parents for new employees can only be done within 45 days from the

6 of 33

05/06/2015 10:15 PM

You and IBM: Hospitalization Policy India

You and IBM - India

http://w3-01.ibm.com/hr/web/in/health/hb01-hip0...

Money

Health

Life

Career

Tools

Please note that parents declaration made in 2015 is subject to two year lock-in period. The

credentials and sum insured declared in 2015 will be freezed for 2015 & 2016. The employee does

not have an option to opt out of the policy in 2016. However new joiners will need to make the

enrollment decision at the time of joining.

Premium for parents however is payable on annual basis only i.e two years premium is not

payable at one go

No member can be covered twice in the policy even if he/she is a dependent of more than

one employee.

Claims submitted for dependents whose name has not been enrolled in the website will not be

processed by the TPA. Further, the claim will not be paid if such claim be in any manner is

fraudulent or supported by any fraudulent means or devise whether by the insured person or by

any other person acting on his behalf.

Any ailment diagnosed / treated during coverage/enrollment window period under the lower sum

insured will continue to have the lower sum insured as the maximum cover (for that ailment and all

related ailments). This is applicable when the sum insured has been increased during enrollment

window period.

Employees share in the Premium (Parents Policy)

The premium for insuring the parents will be completely borne by the employee.

Premium for parents however is payable on annual basis only i.e two years premium is not

payable at one go

Premium amount for coverage of employee's parents will be deducted from the employee's payroll

without any prior intimation.

The deduction will be done within 90 days of the employee having enrolled his/her dependents on

the Medi Assist website.

For onsite employees, the deduction will be done from the onsite payroll.

Addition of Dependent parents (Parents Policy)

Existing employees availing the policy can opt for parents coverage at the time of renewal of the

insurance policy once a year and on or before February 14, 2015. They have to log on to the Medi

Assist website and add dependent details. Coverage will be effective from the starting date of the

new policy.

New employees availing the policy can opt for parents coverage within 45 days of joining by

logging on to the Medi Assist website. Coverage will be effective from the date of joining.

Mid Term Inclusion (Parents Policy)

There is no mid-term inclusion process for parents.

There is no mid- term enhancement of sum insured in respect of existing members under both the

policies viz., Employee, Spouse & Children and Parents.

Removal of Dependents (Parents Policy)

Dependents cannot be removed during a policy period except under the following circumstances

Divorce

Death of a dependent

Resignation of the employee

The Insurance Company at its sole discretion can ask for supporting documents for addition or

7 of 33

05/06/2015 10:15 PM

You and IBM: Hospitalization Policy India

You and IBM - India

http://w3-01.ibm.com/hr/web/in/health/hb01-hip0...

Money

Health

Life

Career

Tools

Benefits Covered under the Parents Policy: For details please refer to the relevant section.

Hospitalization Expenses

Domiciliary Hospitalization Benefit

Additional Benefits

Value Added Services

HOSPITALISATION EXPENSES

All pre-existing diseases are covered; Hospitalization on account of only investigation, tests and diagnosis is not covered. In case there is

an active treatment of the disease following the investigation, tests and diagnosis, the expenses of

investigation, tests and diagnosis will be covered.

Pre hospitalization expenses incurred 30 days prior to hospitalization and post hospitalization

expenses incurred up to 60 days after hospitalization relating to the illness is covered to the extent

of insurance coverage available; provided that the ailment is covered under the policy. This is

applicable for all eligible treatments other than maternity.

NO CREDIT WILL BE OFFERED FOR THESE EXPENSES. All pre hospitalization claims should

be submitted only with / after the main hospitalization claim is submitted. Reimbursement of these

expenses (both pre and post hospitalization) is possible only on production of complete and

detailed bills and documents relating to the same along with a signed claim form.

Copayment Applicable on Hospitalization Expenses.

A co-payment of 5% on the admissible claim amount shall apply on each and every claim by the

employee.

A co-payment of 20% on the admissible claim amount shall apply on each and every claim by

the dependents (Spouse, children and parents).

The co-payment on admissible claim amount shall not apply in case of death of the employee

during hospitalization.

DOMICILIARY HOSPITALISATION BENEFIT

Domiciliary Hospitalization refers to medical treatment for a period exceeding three days for such

illness/disease/injury which in the normal course would require care and treatment at a

hospital/nursing home but is actually taken whilst confined at home in India under any of the

following circumstances namely:

The condition of the patient is such that he/she cannot be moved to the Hospital/Nursing Home, or

Patient cannot be moved to the Hospital/Nursing Home for lack of accommodation therein.

However, the Domiciliary Hospitalization benefits shall NOT cover:

1. Expenses incurred for pre and post hospitalization treatment.

2. Expenses incurred for the treatment of any of the following diseases:

Asthma

Bronchitis

Chronic Nephritis and Nephritic Syndrome

Diarrhea and all types of Dysenteries including Gastroenteritis

Diabetes Mellitus and Insidious

8 of 33

05/06/2015 10:15 PM

You and IBM: Hospitalization Policy India

You and IBM - India

http://w3-01.ibm.com/hr/web/in/health/hb01-hip0...

Money

Health

Life

Career

Tools

Hypertension

Influenza, Cough, and Cold

All Psychiatric and Psychosomatic disorders

Pyrexia of unknown origins for less than ten days

Tonsillitis and Upper Respiratory Tract infections including Laryngitis

Pharyngitis

Arthritis, Gout, and Rheumatism

Note: When treatment such as Dialysis, Chemotherapy, Radiotherapy, Eye Surgery, Lithotripsy

(Kidney stone removal), D&C and Tonsillectomy are taken in the Hospital/Nursing Home and the

insured is discharged the same day, the treatment will be taken under the Hospitalization Benefit

Section.

This benefit is within the overall inpatient cover i.e. there is no additional sum insured OR sub limit

applicable on this benefit.

Copayment Applicable on Domiciliary Hospitalization Expenses.

A copayment of 5% on the admissible claim amount shall apply on each and every claim by the

employee.

A copayment of 20% on the admissible claim amount shall apply on each and every claim by the

dependents (Spouse, children and parents).

The copayment on admissible claim amount shall not apply in case of death of the employee

during hospitalization.

IN PATIENT TREATMENT FOR PSYCHIATRIC AND BEHAVIORAL CONDITIONS

This benefit is extended only to the employee, spouse, and dependent children. It is not applicable

to the Parents Policy.

This benefit is unique considering that health insurance products in India typically exclude

coverage of psychiatric conditions.

The benefit shall pay for all eligible expenses incurred of inpatient treatment for any psychiatric and

behavioral condition.

This benefit is within the overall inpatient cover i.e. there is no additional sum insured OR sub limit

applicable on this benefit.

Some exclusions for this benefit are:

1. De addiction programs

2. Admission for primary purpose of confinement

Copayment Applicable Inpatient Psychiatric and Behavioral Expenses.

A copayment of 5% on the admissible claim amount shall apply on each and every claim by the

employee.

A copayment of 20% on the admissible claim amount shall apply on each and every claim by the

dependents (Spouse, children).

The copayment on admissible claim amount shall not apply in case of death of the employee

during hospitalization.

9 of 33

05/06/2015 10:15 PM

You and IBM: Hospitalization Policy India

You and IBM - India

http://w3-01.ibm.com/hr/web/in/health/hb01-hip0...

Money

Health

Life

Career

Tools

This benefit is extended only to the employee, spouse, and dependent children. It is not applicable

to the Parents Policy.

Domiciliary expenses on outpatient care for employee, spouse and dependent children is up to a

sum insured of INR 10,000 and with a co-payment of 50% applicable on each & every claim (i.e.,

actual cost maximum of INR 20,000 at 50% co pay). This INR10, 000 is a sublimit of the basic in

patient sum insured and balance cannot be carried forward to subsequent year(s). There is no

minimum amount for claim.

This benefit would be available only for specialist consultations and investigations prescribed by a

specialist and not for the treatment taken. Please note that routine health checkups do not fall

under the category of domiciliary benefit and such claims will not be admitted by the insurer.

Charges towards specialist consultation and investigations prescribed by the specialist are

covered.

A specialist is defined as a Physician (M.B.B.S.) whose practice is limited to a particular branch of

medicine or surgery, especially one who is certified by a board of physicians and should hold an

additional degree of MD or MS, DM, MCH, DGO, DNB, FRCS, MRCP, FRCSC and FRCAS. Some

common specialists include

Cardiologist

ENT Specialist

Neurologist

Oncologist

Gastroenterologist

Pediatrician

Gynecologist & obstetrics

Orthopedics

Nephrologists

Urologist

Ophthalmologist

Endocrinologist

Psychiatric/ Behavioral consultation by a Psychiatrist (MD Psychiatry, or similar degree) is

covered. (Psychologist consultation not covered)

Any investigation prescribed by a specialist would be admissible under the Domiciliary Plan. i.e.

routine blood work, x ray, ECG, MRI, CT scans etc.

Non Allopathic/Non Specialists consultation; investigation/Medicines & consumables/Routine

Checks ups etc are not covered whether prescribed by an allopathic doctor or not.

Copayment Applicable on Domiciliary Outpatient care

A copayment of 50% on the admissible claim amount shall apply on each and every claim by the

employee and dependents ( Spouse and children)

Special provision under Domiciliary Outpatient care

In event of any incident identified as a workplace incident and if recommended by IBM

The co-payment (50%) applicable under the benefit shall be waived for the claim and

100% of the eligible expenses under consultation, investigation and treatment / medication

would be covered upto the sum insured (INR 10,000) under the benefit

10 of 33

05/06/2015 10:15 PM

You and IBM: Hospitalization Policy India

You and IBM - India

http://w3-01.ibm.com/hr/web/in/health/hb01-hip0...

Money

Health

Life

Career

Tools

MATERNITY BENEFIT

This benefit is extended only to the employee, spouse, and dependent children policy. It is not

applicable to the Parents Policy.

The limit for maternity benefit for employees availing the policy is up to a maximum of INR 50,000

within the overall inpatient cover. If both Husband & wife are employees of IBM even then the

maximum of INR 50,000 only be applicable for maternity claim.

Hospitalization for maternity benefit can be availed up to 4 children.

The insurance plan also provides for pre and post natal expenses as a part of the maternity benefit.

The benefit will include consultations, prescribed medications and prescribed investigations up to a

maximum of INR 10,000 per maternity event. This benefit is a sub limit of the maternity benefit of

INR 50,000.

Pre Natal expenses prior to hospitalization and post hospitalization expenses incurred up to 60

days after maternity are covered to the extent of maternity sublimit of INR 10,000.

The pre natal claims should be submitted only with / after the main claim. Reimbursement of these

expenses (both pre and post natal) is possible only on production of complete and detailed bills

and documents relating to the same along with a signed claim form.

In case of any active treatment given to the new born baby, the expenses will be treated as child

expenses (immunization expenses excluded).

Copayment Applicable on Maternity Expenses

A copayment of 5% on the admissible claim amount shall apply on each and every claim by the

employee maternity and related claims up to 4 deliveries. A copayment of 20% on the admissible

claim amount shall apply on each and every claim by the dependents for maternity and related

claims up to 4 deliveries. The copayment on admissible claim amount shall not apply in case of

death of the employee during hospitalization.

HEALTH SCREENING BENEFIT

I.Health screening benefit is available to eligible members on an annual basis unless otherwise

specified

II.Biometric Screening

Combination of Onsite & offsite mode will be used

Onsite here means IBM Campus and Offsite means identified network hospitals / diagnostic

centres

Employees who are not able to participate in the onsite biometric screening camps have a choice

to get the screening done at identified network diagnostic centres/hospitals and file a

reimbursement claim

BMI, BP, Random blood glucose, total cholesterol, Hb%, peak flow test, manual short HRA from

wellness checkpoint will be offered for all employees through onsite biometrics screening camps

III. his benefit is extended only under the employee, spouse, and children (ESC) Policy. This benefit

is not applicable to the Parents Policy. This benefit is applicable to employees only except for

Sections H,I & J where children are eligible.

IV. This benefit is within the overall Sum Insured as a sub limit i.e. there is no additional sum

insured. Any Claim will be paid from main sum insured.

V. The benefit can be claimed as a reimbursement. No cashless is available for this benefit.

11 of 33

05/06/2015 10:15 PM

You and IBM: Hospitalization Policy India

You and IBM - India

http://w3-01.ibm.com/hr/web/in/health/hb01-hip0...

Money

Health

Life

Career

Tools

VII. The benefit would cover tests for specific screening of conditions only and not for

diagnostic purposes, existing medical conditions, treatment or follow-up treatment

VIII. Following screening tests are also covered (in addition to biometric screening): Depending on

the age / gender & risk factor(s), screening may be suggested.

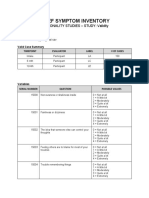

A. Risk factor screening:

Service

Smoking Use Screening

Alcohol Abuse Screening

Depression Screening

Family History of cancer, premature

cardiovascular disease, and other

significant illness

Frequency

Questions and Counselling by Healthcare Professional

on every screening visit starting at age 12 or as clinically

appropriate

Questions and Counselling by Healthcare Professional

on every screening visit starting at age 12 or as clinically

appropriate

Questions and Counselling by Healthcare Professional

on every screening visit starting at age 12 or as clinically

appropriate

On every screening visit

B. Physical Exam:

Service

Height, Weight, Body mass index (BMI),

Waist circumference

Blood pressure measurement

Vision screening

Recommendation

Measurement on every screening visit

Measurement on every screening visit

Measurement on every visit (Snellen chart

recommended) on every visit

C. Blood Tests:

Service

Total-cholesterol and HDL-cholesterol

measurement (Full lipid profile including

fasting Total-cholesterol, LDL-cholesterol,

HDL-cholesterol and Triglyceride

measurement is also acceptable)

Fasting blood glucose measurement

Recommendation

Check in men 35 years old and above and women 45

years old and above. Start earlier for any adult with any

risk factors for cardiovascular disease. Repeat testing

every 5 years if normal or more frequent if elevated.

Measure in adults 40 years old and above or earlier if

tobacco use, obesity, family history of diabetes or large

for gestational age baby, hypertension or dyslipidemia

present. If normal repeat every 5 years; more frequent

screening is appropriate based on risk factors.

D. Other tests

One time HIV

Screening (Rapid HIV

Test by Blood or Saliva)

One time Hepatitis B

Screening

Test individuals at increased risk or upon request by patient. May repeat

based on risk factors.

Test the following individuals:

Persons born in geographic regions with HBsAg prevalence of 2%

Unvaccinated persons whose parents were persons not vaccinated as

infants whose parents were born in geographic regions with HBsAg

prevalence of 8%

Injection-drug users

12 of 33

05/06/2015 10:15 PM

You and IBM: Hospitalization Policy India

You and IBM - India

http://w3-01.ibm.com/hr/web/in/health/hb01-hip0...

Money

Health

Life

Career

Tools

Persons with elevated ALT/AST of unknown etiology

Persons with medical conditions that require immunosuppressive therapy

Infants born to HBsAg-positive mothers

Household contacts and sex partners of HBV-infected persons

Persons who are the source of blood or body fluid exposures that might

warrant post exposure prophylaxis (e.g., needle stick injury to a health

care worker)

Persons infected with HIV

One time Hepatitis C

Screening

HCV-testing is recommended for those who:

Currently inject drugs

Ever injected drugs, including those who injected once or a few times

many years ago

Have certain medical conditions, including persons:

who received clotting factor concentrates produced before 1987

who were ever on long-term hemodialysis

with persistently abnormal alanine aminotransferase levels (ALT)

who have HIV infection

Were prior recipients of transfusions or organ transplants, including

persons who:

were notified that they received blood from a donor who later tested

positive for HCV infection

received a transfusion of blood, blood components or an organ

transplant before July 1992

HCV- testing based on a recognized exposure is recommended for:

Healthcare, emergency medical, and public safety workers after needle

sticks, sharps, or mucosal exposures to HCV-positive blood

Children born to HCV-positive women

Note: For persons who might have been exposed to HCV within the past 6

months, testing for HCV RNA or follow-up testing for HCV antibody is

recommended.

Tuberculosis screening Screening is recommended for:

Household contacts and other close contacts of patients with active TB

People living with HIV

Current and former workers in workplaces with silica exposure

TB should be considered in people with an untreated fibrotic chest X-ray

lesion

In settings where the TB prevalence in the general population is

124/100,000 population or higher

Osteoporosis screening Preferred screening test is dual-energy x-ray absorptiometry (DEXA scan).

Screen women age 65 or older. Screening in men and in women under

age 65 based on risk factors. Repeat testing should be based on risk

factors and findings of previous test.

13 of 33

05/06/2015 10:15 PM

You and IBM: Hospitalization Policy India

You and IBM - India

Service

Cervical cancer

screening

Breast cancer

screening

Colon cancer

screening

http://w3-01.ibm.com/hr/web/in/health/hb01-hip0...

Money

Health

Life

Career

Tools

Recommendation

Preferred screening test is the Papanicolau (Pap) smear. Screen women ages

21 to 65 years, every 3 years.

Preferred screening test is mammography. Screen women ages 50 to 75 years

every two years.

Screen all adults ages 50 to 75 by:

Fecal occult blood testing on 3 consecutive stool samples annually

Flexible Sigmoidoscopy every 5 years, with fecal occult blood testing every 3

years

Or Colonoscopy every 10 years

G. Vaccination

Service

Hepatitis B Vaccine

Recommendation

All doses + booster dose

H. Consultation fee for children

Service

Well child visit for ages 0-3

Recommendation

at the following ages:

3 to 5 days

1 month

2 months

4 months

6 months

9 months

12 months

15 months

18 months

24 months

30 months

Ages 3-18

Every year

I. Risk factor screening for children:

Smoking Use

Screening

Alcohol Abuse

Screening

Depression

Screening

Questions and Counseling by Healthcare Professional) on every screening visit

starting at age 12 or as clinically appropriate

Questions and Counseling by Healthcare Professional on every screening visit

starting at age 12 or as clinically appropriate

Questions and Counseling by Healthcare Professional on every screening visit

starting at age 12 or as clinically appropriate

J. Physical Exam for children

Service

Height, Weight, and Body mass index (BMI),

waist circumference

Blood pressure measurement

Vision screening

Recommendation

Measurement on every screening visit

Measurement on every screening visit

Measurement on every visit (Snellen chart

recommended) on every visit

ADDITIONAL BENEFITS

14 of 33

05/06/2015 10:15 PM

You and IBM: Hospitalization Policy India

You and IBM - India

http://w3-01.ibm.com/hr/web/in/health/hb01-hip0...

Money

Health

Life

Career

Tools

The insurance plan will cover ambulance expenses for all emergency hospitalizations. The limit for

the ambulance charge is INR 1,500. Employees can claim ambulance charges only from the place

of incidence/home of the patient to the hospital and not the return trip. Ambulance usage on the

return trip will be at the cost of the employee.

Expenses towards Appliances:

The insurance plan will cover the cost of appliances as a part of orthopedic treatment. These include

but are not restricted to braces, splints, crutches, wheel chairs, artificial limb etc. These expenses

are a part of the hospitalization benefit and are reimbursable up to a maximum of 5% of the total

eligible claim amount or actual expense of the appliance whichever is lower.

CRITICAL ILLNESS BUFFER

This benefit is extended only to the employee, spouse, and dependent children. This benefit is not

applicable to the Parents Policy.

IBM shall extend support of an additional INR 700,000 per policy year for the treatment of the

following critical illnesses.

The Critical Illness Buffer can only be used once the family floater amount and the additional

coverage if any taken by the employee have been exhausted and only for the following diseases

1. Blindness

2. Cancer

3. Coronary artery surgery

4. Heart valve replacement

5. Kidney failure

6. Major organ transplant

7. Multiple sclerosis

8. Myocardial infarction

9. Paralysis

10. Stroke

11. Surgery of Aorta

12. Treatment of any injury arising out of road accidents to employees

13. Coma of specified severity

14. Motor Neuron Disease

15. Complications for a Preterm Baby

Coverage of HIV / AIDS through Critical Illness Buffer: HIV/AIDS is included in the critical

illness list for critical illness buffer. However unlike other critical illnesses mentioned above, this is

not covered under the family floater cover.

Apart from this list of illnesses, the buffer amount of INR 700,000 can be utilized for the treatment

of any injury arising out of road accidents to employees.

In case of any exception to the policy terms on critical illness, employee would require approval

from IBM Global Health design team and is subject to the availability of funds in the Corporate

Buffer of IBM India.

Copayment Applicable: The critical illness is linked with the additional coverage taken by the

employee. The eligibility for critical illness buffer will be determined as per the table below.

Additional coverage Amount opted for self

and Family

5 lakhs to 7 lakhs

3 lakhs to 4 lakhs

1 lakh to 2 lakhs

15 of 33

Copayment

(%)

0%

10%

20%

Total Sum Insured

(Base+Additional)

8 to10 Lakh

6 to 7 Lakh

4 to 5 Lakh

05/06/2015 10:15 PM

You and IBM: Hospitalization Policy India

You and IBM - India

http://w3-01.ibm.com/hr/web/in/health/hb01-hip0...

Money

Health

Life

Career

Tools

VALUE ADDED SERVICES

Apollo Munich Health Insurance is providing a host of value added services as listed below

exclusive for IBMers

Discounts on Master Health Checkup

You can get discounts up to 20% for a master health checkup for yourself and your immediate

family (enrolled in the IBM medical insurance policy). You can reach out to Apollo Munich on the

toll free number 1800 102 0333 or write to customerservice@apollomunichinsurance.com.

The Apollo team will help you locate the nearest pharmacy / clinic / hospital. Please show your

Medi Assist Health id card (E card) with Apollo Munich logo or IBM Id card to avail these benefits.

Incase you have any concerns, do escalate by calling on the Toll free number and an Apollo team

member will address it on priority.

Discounts on diagnostics, consultation and medicines at Apollo Clinics and Apollo

Pharmacies

You can also avail discounts on diagnostics, consultation and medicines at Apollo Clinics. This

discount will differ from one clinic to another. The Apollo team will help you locate the nearest

pharmacy / clinic / hospital. Please show your Medi Assist Health id card (E card) with Apollo

Munich logo or IBM Id card to avail these benefits. Incase you have any concerns, do escalate by

calling on the Toll free number and an Apollo team member will address it on priority.

There is 11.5% discount offered to IBMers on medicines, 5% discount on purchase of non pharma

(FMCG) item and 15% discount on Apollo private labels products from Apollo Pharmacies. This

discount is not available at pharmacies located in the Apollo Hospitals and Apollo Clinics.

Process of registration

1. Log into apollopharmacy.info/IBM

2. Click on enrollment

3. Provide personal details as requested

4. Click Submit

5. Apollo advantage E card will appear

6. Take a printout of the E card

7. Show this card to Apollo Pharmacy for availing discounts

Healthline

Apollo Munich Health insurance has set up a dedicated health line especially for IBMers. Managed

by qualified doctors, the health line will provide:

Advice on self-care and symptom management

Advice on the prevention of illness

Health information on common illnesses

The employee can avail this service by calling the toll free number 1800 102 0099 between 09.00

18.00 hours, Monday to Friday (except on holidays).

Disclaimer: This service is not a substitute to consultation with physician and employees

need to discuss with their personal Physicians before going ahead with clinical support

services.

Health Tool

Log onto http://www.letsstayhealthy.com/login.aspx to educate yourself on common / chronic

16 of 33

05/06/2015 10:15 PM

You and IBM: Hospitalization Policy India

You and IBM - India

ways of improving your diet and overall wellbeing.

http://w3-01.ibm.com/hr/web/in/health/hb01-hip0...

Money

Health

Life

Career

Tools

EXCLUSIONS UNDER THE POLICY:

The Insurer will not make any payment for any claim in respect of any Insured Person directly or

indirectly for, caused by, arising from or in any way attributable to any of the following unless

expressly stated to the contrary in this Policy:

i. Invasion, act of foreign enemy, civil war, public defense, rebellion, revolution, insurrection,

military or usurped acts, chemical and biological weapons

ii. Any Insured Person committing or attempting to commit a criminal or illegal act, or intentional

self-injury or attempted suicide while sane or insane.

iii. Any Insured Persons participation or involvement in naval, military or air force operation, racing,

diving, aviation, scuba diving, parachuting, hang gliding, rock or mountain climbing.

iv. The abuse or the consequences of the abuse of intoxicants or hallucinogenic substances such

as drugs and alcohol, including smoking cessation programs and the treatment of nicotine addiction

or any other substance abuse treatment or services, or supplies.

v. Obesity or morbid obesity or any weight control program, where obesity means a condition in

which the Body Mass Index (BMI) is above 29 and morbid obesity means a condition where the BMI

is above 37.

vi. Alzheimers disease; general debility or exhaustion (run down condition); genetic disorders;

stem cell implantation or surgery; or growth hormone therapy; sleep apnea

vii. Venereal disease, sexually transmitted disease or illness;

viii. Sterility, treatment whether to effect or to treat infertility, any fertility, sub fertility or assisted

conception procedure, surrogate or vicarious pregnancy, birth control, contraceptive supplies or

services and complications arising therefrom.

ix. Dental treatment and surgery of any kind, unless requiring Hospitalisation.

x. Treatment and supplies for analysis and adjustments of spinal subluxation, diagnosis and

treatment by manipulation of the skeletal structure or for muscle stimulation by any means (except

treatment of fractures and dislocations of the extremities).

xi. Circumcision (not if required as a part of treatment of or for a disease or due to injury).

xii. Laser treatment for correction of eye due to refractive error less than 7.5; if the procedure is

performed only to get rid of spectacles or contact lenses the claim is not payable; if the Lasik

Surgery is performed for therapeutic reasons like erosions, non-healing ulcers, recurrent corneal

erosions, nebular opacities, etc it is payable.

xiii. Aesthetic or change of life treatments of any description such as sex transformation operations,

treatments to do or undo changes in appearance or carried out in childhood or at any other times

driven by cultural habits, fashion or the like or any procedures which improve physical appearance.

xiv. Plastic surgery or cosmetic surgery unless necessary as a part of medically necessary treatment

certified by the attending Medical Practitioner for reconstruction following an Accident or Illness.

xv. Experimental, investigational or unproven treatment, devices and pharmacological regimens, or

measures primarily for diagnostic, X ray or laboratory examinations or other diagnostic studies

which are not consistent with or incidental to the diagnosis and treatment of the positive existence or

presence of any Illness for which confinement is required at a Hospital.

xvi. Convalescence, cure, rest cure, sanatorium treatment, rehabilitation measures, private duty

nursing, respite care, long term nursing care or custodial care.

xvii. Any non-allopathic treatment. Except Ayush Benefit Expenses incurred on treatment taken

under Ayurveda, Unani, Sidha and Homeopathy subject to amounts specified in the Schedule of

Benefits.

xviii. All preventive care, vaccination including inoculation and immunisations, any physical,

psychiatric or psychological examinations or testing during these examinations; enteral feedings

(infusion formulas via a tube into the upper gastrointestinal tract) and other nutritional and electrolyte

supplements, unless certified to be required by the attending Medical Practitioner as a direct

consequence of an otherwise covered claim.

xix. Charges related to a Hospital stay not expressly mentioned as being covered, including but not

limited to charges for admission, discharge, administration, registration, documentation and filing.

xx. Items of personal comfort and convenience including but not limited to television, telephone,

17 of 33

05/06/2015 10:15 PM

You and IBM: Hospitalization Policy India

You and IBM - India

http://w3-01.ibm.com/hr/web/in/health/hb01-hip0...

Money

Health

Life

Career

Tools

services, guest services as well as similar incidental services and supplies, and vitamins and tonics

unless vitamins and tonics are certified to be required by the attending Medical Practitioner as a

direct consequence of an otherwise covered claim.

xxi. Treatment rendered by a Medical Practitioner which is outside his discipline or the discipline for

which he is licensed; referral fees or out station consultations; treatments rendered by a Medical

Practitioner who shares the same residence as an Insured Person or who is a member of an

Insured Person's family, however proven material costs are eligible for reimbursement in

accordance with the applicable cover.

xxii. The provision or fitting of hearing aids, spectacles or contact lenses including optometric

therapy, any treatment and associated expenses for alopecia, baldness, wigs, or toupees, medical

supplies including elastic stockings, diabetic test strips, and similar products.

xxiii. Any treatment or part of a treatment that is not of a reasonable cost, not medically necessary;

nonprescription drugs or treatments.

xxiv. Artificial limbs, crutches or any other external appliance and/or device used for diagnosis or

treatment.

xxv. Vaccination / Immunization.

xxvi. Stem cell Therapy/replacement.

xxvii. Treatment for ARMD Age Related Macular Degeneration with Avastin/ Macugen/ Lucentis

etc. C3R (CORNEAL COLLAGEN CROSSLINKING WITH RIBOFLAVIN) and INTACS are not

payable. Treatment related to ROP (retinopathy of prematurity) and RFL (Retrolental Fibroplasia) is

not payable.

xxviii. Treatment of Seronegative Spondyloarthritis/ Ankylosing Spondylitis, Crohns disease,

Psoriasis etc with biological agents like Remicade, Infliximab, Adalimumab, Rituximab etc.

xxix. Quantum Magnetic Resonance Therapy or RFQMR (Cytotron) treatments are not admissible

under the policy.

NOTE : All types of non-medical expenses (refer the next question for details of the same) incurred

during the course of hospitalization are not covered and have to be paid to the hospital before

discharge

USER GUIDANCE

Medi Assist HELPDESK

The TPA (Medi Assist) will be setting up helpdesks for IBM employees at various locations

supported by Apollo Munich client relationship personnel. Please refer to the communications by

Team Benefits in this regard.

This help desk facility is an attempt to help the employees in putting forward any queries that they

may have regarding the health benefits and the policy provided by IBM.

In case of any queries/suggestions, please feel free to get in touch with or write to

ibmcare@mediassistindia.com or iqueries@in.ibm.com

Frequently Asked Questions (General):

Q. What is a family floater?

A. There is no restriction on the size of the individual claim in a year as long as the family does not

exceed the limit of INR 300,000 or the enhanced cover in case you have opted for the enhanced

cover.

Q. Who is Medi Assist India TPA Private Limited?

A. Medi Assist India TPA Private Limited is your service provider who will facilitate administration of

IBM India Limited Group Health insurance Policy (GHI) on behalf of Apollo Munich health Insurance

company ltd and assist you in accessing quality health care. It is not an insurance company; it acts

18 of 33

05/06/2015 10:15 PM

You and IBM: Hospitalization Policy India

You and IBM - India

http://w3-01.ibm.com/hr/web/in/health/hb01-hip0...

Money

Health

Life

Career

Tools

Q. What are the services available to me through Apollo Munich health Insurance/Medi Assist

India TPA Private Limited?

A. The following services are available to employees

Online Enrollment System: For self and dependents

Electronic id cards: For self and dependents

Network Hospital: The largest network of hospitals in the country

Preferred Network Hospital : Discounted package rates on treatments

Cashless hospitalization facility: For treatment at network hospitals for ailments covered under the

Group Mediclaim Policy

Claims administration services: Registration of each claim

Assessment of each claim for eligibility under the plan

Recovery of missing documents if required

Submission of claim to the TPA and follow up for speedy reimbursement

Dedicated Helpline Both Voice and mail based services

Help desks at designated places

Q. Who can be covered under the policy and for what amount?

A. You and your nominated dependents (spouse and children*) are eligible under a family floater

cover of INR 300,000 unless you have opted out of the policy. If you wish to enhance the coverage

beyond the family floater of INR 300,000 (up to INR 1,000,000 in total), the incremental premium

has to be borne by yourself**.

You have the option of covering your parents under the parents' policy, but the premium, TPA

charges and the service tax would have to be borne by yourself.

NOTE: No other dependents can be insured under this health plan.

* 4 number of children are covered upto to age of 24.

** Premium chart is available on the site https://www.mediassistindia.net/IWP

Q. Do I have an option of opt out of the policy?

A. Yes, you can opt out of the policy by submitting your intent in the Medi Assist website before 14th

February 2015 or 45 days from the date of joining, whichever is earlier. The premium will not be

deducted from your salary. In this case, you and your immediate family will not be covered. You will

be provided only coverage for hospitalization on account of accident during the course of

employment and treatment of occupational diseases, to the extent you are entitled to such benefits

under any statute or law.

Q. How does the coverage take place for a new joiner?

A. Your coverage will begin from the date you have joined IBM, unless you have opted out of the

policy. But for your dependents, you need to visit the website https://www.mediassistindia.net/IWP

and complete your online enrollment procedure by submitting your dependents' details within 45

days from the date of your joining. Please use your employeeID@IBM as the username. An initial

password has been set up for you using a combination of your date of birth and your employee id.

For example, if your employee id is 123456, your username would be 123456@IBM and if your date

of birth is 30-November-2014, your initial password would be 30112014123456. Please change your

password after you log in for the first time.

Claims submitted for dependents whose name has not been enrolled in the website will not be

processed by the TPA.

19 of 33

05/06/2015 10:15 PM

You and IBM: Hospitalization Policy India

You and IBM - India

http://w3-01.ibm.com/hr/web/in/health/hb01-hip0...

Money

Health

Life

Career

Tools

A. Newly married employees can add spouse details within 45 days of the date of marriage.

Coverage will be effective for the spouse from the date of marriage.

Employees who have a new born child can add them within 45 days of the date of birth. Coverage

will be effective for the new born child from the date of birth.

Mid Term Inclusions (after 45 days period) will be allowed only as an exception for employees who

missed adding the spouse details and new born child details due to some valid reasons Any request

for Midterm Inclusions for spouse and children has to have approvals from the HR Partner/Advisor

along with the IST Benefits Lead. The employee would need to submit proof of marriage or birth

certificate whichever is applicable. The coverage date will be effective from the date the inclusion is

endorsed by the TPA on behalf of the insurer.

There is no mid term inclusion process for parents.

There is no mid term enhancement of sum insured in respect of existing members under both the

policies viz., Employee, Spouse & Children and Parents

Claims submitted for dependents whose name has not been enrolled in the website will not be

processed by the TPA.

In case of a divorce/demise in the family, please inform Team Benefits/India/Contr/IBM, as soon as

possible.

Q. 'I am a newly hired employee. My wife has a preexisting health condition. How is this

handled/covered?'

A. Your wife's condition will be covered; there is a 9 month (waiver) period.

Q. How do I complete Online Enrollment procedure?

A. Here are the steps given below for enrolling

Step 1: Click on the link https://www.mediassistindia.net/IWP

Step 2: Enter your User ID and Password

Step 3: Its mandatory to change your password, before you can access any details.

Please call the support team at 1-800-425-5860 if you face any difficulties in logging in or accessing

the portal

i. It is mandatory to review and update Self and dependent details

1. Go to Beneficiary

2. Click on Online Enrollment

3. If any details need to be edited please click the Edit button highlighted against each

member.

4. Click Confirm

ii. Update bank detail to be used for reimbursement

1. Go to Beneficiary

2. Click on Online Enrollment

3. Enter Bank details under the "Bank Details" section

Q. What is an electronic ID card?

A. All employees and the insured members (provided they have not opted out), under this plan, are

entitled for an e ID card. This ID card will identify them for admission into the network hospitals and

to allow access to credit facilities at preferred hospitals around the country. This e ID card is non

transferable.

20 of 33

05/06/2015 10:15 PM

You and IBM: Hospitalization Policy India

You and IBM - India

http://w3-01.ibm.com/hr/web/in/health/hb01-hip0...

Money

Health

Life

Career

Tools

returned upon request or in the event of separation from the Company's services.

Q. How do I get an electronic ID card?

A. You can and need to print the electronic ID card online. Follow the below mentioned steps to print

the ID card:

Complete the online enrollment process by adding self and dependent details by visiting

https://www.mediassistindia.net/IWP (Refer to steps for online enrollment).

It is advisable to take a print of the ID cards after completing the enrollment. These ID cards will be

useful at the time of hospitalization.

Step 1: Log on to https://www.mediassistindia.net/IWP

Step 2: Enter your User ID and Password

Step 3: You can download your e-cards anytime from the "E-cards" section of the portal

Q. What happens if I lose the ID card?

A. If you lose the ID card, you may print another copy of the card online. Follow the above

mentioned steps to print copies of the ID Card.

Frequently Asked Questions (ENROLLMENT):

Q. How do I know my balance Sum Insured?

A. Please mail Medi Assist at ibmcare@mediassistindia.com with details about your complete

name, employee id, Card number.

Q. What do I do when I do not receive any revert on enrollment related queries from Medi

Assist?

A. Please mail your query to ibm@apollomunichinsurance.com, you shall receive revert within 48

working hours.

Q. Can I club my group insurance with my personal insurance?

A. This cannot be done as both are different plans with different coverage.

Q. Can I increase my coverage (sum insured) by paying extra premium?

A. This can be done only during the declaration period.

Q. After quitting IBM, can I continue availing the benefits of this policy by paying extra

premium?

A. Once you leave IBM your coverage under the group policy would cease. You can choose to buy

a retail policy with Apollo Munich but it would be subject underwriting with the portability guidelines.

Q. Can I enroll my brother/sister/uncle/ aunt by paying additional premium?

A. No, this cannot be done as family definition is limited to self, spouse and 4 living children.

Q. If I declare my parents in 2015, can I remove them from insurance coverage next year?

A. Parents declaration made in 2015 is subject to two year lock-in period. The credentials and sum

insured declared in 2015 will be freezed for 2015 & 2016. The employee do not have an option to

opt out of the policy in 2016.

Q.I have opted for 50,000 sum insured in 2015 for my mother. Can I enhance the sum insured

in 2016?

A. Parents declaration made in 2015 is subject to two year lock-in period. The credentials and sum

insured declared in 2015 will be freezed for 2015 & 2016.

21 of 33

05/06/2015 10:15 PM

You and IBM: Hospitalization Policy India

You and IBM - India

http://w3-01.ibm.com/hr/web/in/health/hb01-hip0...

Money

Health

Life

Career

Tools

A. No. The parents coverage should start either at the beginning of policy 2015 for exisiting

employees or along with new employee joining. If employee is covered in ESC or optout policy in

2015 he cannot declare the dependents in 2016 policy.

Q. Will I be insured in the policy even If I have not got my electronic id card?

A. You and your nominated dependents will be insured from the day you join IBM/date of renewal of

policy, whichever is later, provided you complete the online enrollment at

https://www.mediassistindia.net/IWP within the specified timeline.

Q. What do I do if I decide to leave the services of IBM?

A. You need to inform and submit the claim (if any) to Medi Assist before your Last working day.

This is very important because once you are deleted from the policy you will not be eligible to claim

reimbursement for any expenses incurred.

Employees, who have resigned from IBM, are required to respond to Shortfall raised by Medi Assist

within 5 working days failing which the claim will be rejected and prorated premium refund will be

advised in FFS.

In case, there is no claim made (processed & amount settled) by you for self and nuclear family,

prorata premium paid for coverage and/or additional coverage will be refunded back to you for the

period the coverage cease to exist. In case of any claim is made (Processed & amount settled) for

any one/all of the insured person, there will not be any refund of premium.

In case, there is no claim made (Processed & amount settled) for the parent, prorata premium paid

for the concerned parent will be refunded back to you for the period the coverage cease to exist. In

case of any claim is made (Processed & amount settled), there will not be any refund of premium.

Frequently Asked Questions (CLAIMS):

Q. Medi Assist Call Centre not giving correct update on my claim status, what should I do?

A. Please write to ibmcare@mediassistindia.com and seek for your claim status, in case there is no

revert within 48 hrs, please mail ibm@apollomunichinsurance.com.

Q. What do I do in case of a hospitalization in my family?

A. In case of planned hospitalization, call on the helpline numbers of Medi Assist India TPA

Private Limited to inform them when you or your nominated dependent needs hospitalization. This

should be done at least 48 hours prior to the date of admission.

Fill the Pre Authorization form, available with the Network Hospitals upon showing the Medi Assist

ID card or by mentioning your IBM employee id. This can also be obtained from the Medi Assist

helpline or can be downloaded from the Medi Assist website.

Submit/Fax the Pre Authorization Form to our toll free fax numbers at Bangalore 48 hours in

advance.

The advance intimation to Medi Assist will help you to avoid payment of advance amount to some

hospitals.

Sign the relevant documents including discharge summary before leaving the hospital/getting

discharged. If your hospitalization is authorized, then ensure you pay for non-medical expenses and

copayment charges for the dependents and parents, if enrolled.

For a non-network hospital, employee has to arrange to fax the complete pre authorization to Medi

Assist.

22 of 33

05/06/2015 10:15 PM

You and IBM: Hospitalization Policy India

You and IBM - India

http://w3-01.ibm.com/hr/web/in/health/hb01-hip0...

Money

Health

Life

Career

Tools

authorization is complete and eligibility is determined. Medi Assist will then send an authorization

letter to the hospital.

Emergency Cashless Hospitalization:

Pre Auth Emergency Contact Numbers for IBM Employees.

Pre Auth IBM 1: 8880798041

Pre Auth IBM 2: 8088033184

When you have an emergency hospitalization and get admitted into a network hospital, please

inform your family member/relative/friend to contact the billing dept in the hospital with Medi Assist

ID or IBM employee id to send Pre authorization form to Medi Assist. If your hospitalization is

authorized, then ensure you pay for non-medical expenses and copayment charges for the

dependents and parents, if enrolled. Kindly sign the relevant documents before leaving the

hospital/getting discharged.

Cashless claims

Q What is Pre Authorization?

A. Pre authorization is a process that necessarily needs to be completed prior to hospitalization. The

forms for the same can be obtained by calling Medi Assists Telephone Help Lines or downloaded

directly from the Medi Assist web site (Home Page). The form needs to be filled with the help of the

treating doctor. This form contains details like details of treating physician and hospital*, details of

diagnosis*, treatment proposed*, past history, estimate expenses*, signature of the treating

physician*, etc. Medi Assists medical team will then evaluate the same based on medical and policy

grounds. The advance intimation to Medi Assist will help you to avoid payment of advance amount

to some hospitals.

* If complete details are not provided in the form, then credit (in the case of a network hospital) or

claim eligibility (in the case of an out of network hospital) cannot be provided.

Q. What is an Authorization letter?

A. On approval of pre authorization, an authorization letter will be sent to the hospital (only if it is on

Apollo Munich network). The letter authorizes the hospital to extend credit for all medical expenses

during hospitalization. Therefore to use Apollo Munich cashless hospitalization service it is very

important for you to follow the pre authorization process.

Q. My Pre Authorization request has been rejected. What could be the reasons?

A. Pre authorization may be declined under the following circumstances 1) Information provided was

inadequate 2) Disease is not covered by policy 3) Sum insured is exhausted

Q. How to know whether a particular treatment or hospital is covered or not under

insurance?

A. For list of network hospitals, please visit https://www.mediassistindia.net/IWP. In order to know

whether a particular treatment is covered or not please send a pre auth request to Medi Assist.

Q. During my last hospitalization, I was asked for a deposit / advance. Why?

A. Network & non-network hospitals request for deposit, same is adjusted with the final bill.

Q. What do I do incase a network hospital does not accept my Medi Assist Card?

A. In case there is an issue with a network hospital not accepting your card, then please get in touch

with the people mentioned in the escalation matrix (detailed below) or call the toll free number of

Medi Assist 1800 425 5860.

Q. What is a Network Provider and how do I identify them?

A. Based on Apollo Munichs experience and expertise they have tied up with hospitals across the

23 of 33

05/06/2015 10:15 PM

You and IBM: Hospitalization Policy India

You and IBM - India

http://w3-01.ibm.com/hr/web/in/health/hb01-hip0...

Money

Network Hospitals is available on Medi Assist website.

Health

Life

Career

Tools

Q. Does it mean that I cannot get treated in a hospital of my choice?

A. You can get treated in any hospital within the country but the cashless facility will be available

only at the network hospitals. Moreover, the collection of bills and related documents in case of a

network hospital will be done by Medi Assist, whereas in case of a hospital outside of network, you

will have to collect all the documents at the time of discharge and send it to Medi Assist along with a

signed claim form.

Important: Please note that any hospital/nursing home you choose has to be registered and/or

have minimum 15 beds.

Q. Do I need to pay any money at the time of discharge?

A. In case of Non Network Hospitals - You will have to make all payments yourself and then forward

the claim (all the hospital documents and signed claim form in original) to Medi Assist in order to get

claim reimbursed from Insurance Company.

In case of Network Hospitals - Depending upon eligibility, Medi Assist will extend credit for all the

medical expenses billed by the Network hospital for the treatment of your illness only. All

non-medical expenses (described above) and any amount exceeding the credit limit will have to be

paid by you to the hospital at the time of discharge. In case if the patient admitted is a dependent,

80% of the medical expenses will be paid for and you will have to pay the balance 20% along with

all the non-medical expenses (described above) and any amount exceeding the credit limit will have

to be paid by you to the hospital at the time of discharge. The advance intimation to Medi Assist will

help you to avoid payment of advance amount to some hospitals.

Reimbursement claims

Q. How do I get a fresh cheque as my cheque has gone stale?

A. Please handover the stale cheque to the helpdesk executive of Medi Assist, fresh cheque will be

issued within 15 working days.

Q. What is the process of getting rejected cases reviewed?

A. Please mail Medi Assist at ibmcare@mediassistindia.com with details about your rejected claim.

Q. Incase my cashless request is rejected, what should I do?

A. If your cashless is rejected due to some reason, please make the payment and submit the bills

for reimbursement, case will be reviewed as per policy terms & conditions.

Q. How do I submit my claim documents for reimbursement?

A. Please handover your claim documents to the executive conducting Helpdesk in your location or

you can courier the documents to Medi Assist. Address for couriering the claim documents is:

Medi Assist India TPA Pvt Ltd; III Floor, Green Arch, Ist Main Road, J P Nagar,3rd Phase,

Bengaluru, 560078

Please specify Employee Name, Employee ID and Medi Assist Health card number on the

envelope.

Q. As per the doctor, admission was mandatory, then why did Medi Assist reject my claim

stating as Treatment possible on OPD basis?

A. Claim is processed as per policy terms & conditions, after assessing the claim if it is found that

admission was not required then decision will be considered accordingly.

Q. If my claim is rejected, can I ask Medi Assist to return my claim documents?

A. In case your claim is rejected for some reason; you can request Medi Assist for the original claim

24 of 33

05/06/2015 10:15 PM

You and IBM: Hospitalization Policy India

You and IBM - India

http://w3-01.ibm.com/hr/web/in/health/hb01-hip0...

Money

Health

Life

Career

Tools

Q. Hospital says all documents are given, but Medi Assist says documents not provided.

What to do in such case?

A. Please check with Medi Assist what exactly are they asking for, approach the hospital with the

specific requirement.

Q. What is the process of availing corporate buffer?