Religare Morning Digest-3rd September 2015

Diunggah oleh

PrashantKumarHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Religare Morning Digest-3rd September 2015

Diunggah oleh

PrashantKumarHak Cipta:

Format Tersedia

Religare Morning Digest

September 3, 2015

Nifty Outlook

After Tuesdays sharp decline, equity markets made a positive start on Wednesday but failed to

uphold for long and concluded the day in red. Initially, mood was positive in response to news that

the government has accepted the recommendations of A P Shah-led panel on minimum alternate

tax (MAT) that it is not applicable to foreign institutional investors (FIIs). Some recovery in rupee in

early trades was also supporting the bounce. However, underperformance from the rate sensitive

pack was hurting the sentiments from the early trade which later intensified and pulled the index in

negative territory.

Undoubtedly, its tough phase for traders due to the excessive volatility and we are not

expecting any major respite in near future. Hence, its important for them to maintain pro-active

approach in trade management and that can be done only in highly liquid fundamentally strong

counters. Needless to say, we have reached near to the major support zone of 7600 mark again and

its sustainability holds the key ahead.

Nifty

VWAP

Max Call

Max Put

7920

8500

7800

News

Religare Super Ideas

DLF jumped 3.6% on BSE after the Singapore government's sovereign wealth fund GIC

announced its decision to invest about Rs 1990 crore in two upcoming real estate development

projects of a wholly-owned subsidiary of DLF.

Bajaj Auto has posted 2% rise in its total sales during August with the company selling 3.42 lakh

units versus 3.37 lakh units in the same month of last year. Motorcycle sales rose by 2% to 2.9

lakh units against 2.84 lakh units. Commercial vehicles sales were down by 2% to 51,529 units.

Scrip

Buy/Sell

CMP

Initiation

Range

SL

Target

DABUR

Buy

280.15

278 - 280

270

300

CAIRN

Sell Fut.

141.5

143 - 145

150

128

SAIL will spend Rs 7,500 crore on modernisation and expansion programme in the current fiscal

ending March 2016.

Instrument

B/S

Lot

INITIATION

PRICE

NIFTY 7300PE

25

NIFTY

2*7200PE

50

TOTAL

FII & DII activity (Rs. in Cr.)

Sectors to watch

Derivative Ideas :

Trade Stats

Sector Name

Outlook

Category

Amt

MTD

YTD

68

TELECOMM

STABLE

FII

-675

17209

46189

52

BANKS

POSITIVE

DII

682

10533

65672

PHARMA

STABLE

36

SL

50

TARGET

10

Disclaimer: http://www.religareonline.com/research/Disclaimer/Disclaimer_RSL.html

*FII & DII data of 1st September 2015

NO OF CONTRACTS

TURNOVER

IN CR

IDXFUTS

929147

22694

IDXOPT

6406634

137769

STKFUTS

825396

21075

Religare Morning Digest

September 3, 2015

Religare Super Ideas

Derivative Ideas

Cairn India Limited (CAIRN)

Dabur India Limited (DABUR)

Vix is likely to settle to 20% in the short term, some

put writing seen at 7200 strike. We expect the

premium of 7200 strikes to drop.

Strategy:- Buy nifty 7300pe @ 68 and sell 2* 7200 pe

@ 52, each spread at 36, sloss 50, target 10.

Dabur outperformed broader markets today, rallied

over 5%. This up move over shadowed past three

sessions decline. This rise was backed by better than

average volume. All this suggest move up side move

in near term.

It is in down trend and has been trading in lower low

lower high formation from a long time.

Recently, buying was witnessed and it retraced

almost 61.8% as per the Fibonacci theory. This is

generally observed that stock price resume its broader

trend after retracing to these levels. Considering all, we

believe down side move in near term.

Investment PickKOTAKBANK

Scrip

CMP

Recommendation Price

Target

Duration

KOTAKBANK

608.70

705.10

900

9-12 month

KOTAKBANK

Kotak Mahindra Bank acquired ING Vysya Bank in an all-stock deal. This amalgamation has created the fourth largest private sector bank in the country. Through this

move the bank is able to increase its branch network, fee income and asset profile which would improve profitability for the merged entity going forward.

The banks Q1 June 2015 results were hit adversely by significant provisions on merger of ING Vysya Bank. However, it believes that the merger benefits will flow in due

course from both, revenue synergies as well as cost efficiencies, resulting from significant geographical and product complementarities, fuller customer segment coverage,

economies of scale and improved productivity and efficiency.

We expect the bank to deliver much higher growth than the industry in FY16-FY17, driven by market share gains in the retail and SME loan segments post-merger.

Disclaimer: http://www.religareonline.com/research/Disclaimer/Disclaimer_RSL.html

Religare Morning Digest

September 3, 2015

Market Snapshot

Top Gainers - Nifty

Sectoral Indices Performance

Index

Closing

% Change

% MTD

% YTD

CNX Auto

7,639

-1.38%

-3.9%

-7.8%

CNX Bank

16,253

-1.68%

-5.2%

-13.3%

CNX Energy

7,442

-0.93%

-2.7%

-13.9%

CNX Finance

6,653

-1.92%

-4.9%

-10.9%

CNX FMCG

19,856

0.47%

-1.3%

-1.3%

CNX IT

11,605

1.12%

0.0%

3.5%

CNX Media

2,244

-0.76%

-3.6%

-6.0%

CNX Metal

1,746

-1.43%

-4.8%

-34.4%

12,840

-1.28%

-2.8%

17.3%

2,962

-3.16%

-7.5%

-30.6%

157

0.71%

-2.6%

-22.6%

CNX Pharma

CNX PSU Bank

CNX Realty

Stock

Tech Mahindra

Idea Cellular

CMP (INR)

536

TCS

UltraTech Cem.

ACC

154.5

% Chg

4.6%

3.4%

% MTD

4.1%

-0.9%

% YTD

-17.3%

0.5%

2591.8

2.1%

1.1%

1.3%

2886.1

1356.35

1.8%

1.8%

-0.1%

1.6%

10.1%

-3.1%

Top Losers - Nifty

Stock

BHEL

Punjab Natl.Bank

ONGC

M&M

St Bk of India

CMP (INR)

% Chg

% MTD

% YTD

206.5

129.55

225.2

1134.55

230.55

-5.2%

-3.9%

-3.8%

-3.6%

-3.6%

-8.8%

-10.6%

-5.9%

-7.1%

-6.8%

-22.1%

-40.9%

-34.0%

-8.1%

-26.1%

Delivery Spurt stocks

Bulk Deals - NSE

Security Name

Client Name Buy/Sell

Quantity

Price Value (in Cr.)

Stock Name

Day's del. Vol. Del. Vol. spike Price change

Mercator Limited

ALBULLA INVESTMENT FUND LTD

BUY

8293585

22.48

18.64

Mercator

9081192

2801%

-5.7%

Mercator Limited

LOTUS GLOBAL INVESTMENTS LIMITED

SELL

8293585

22.48

18.64

D B Corp

362547.00

1157%

-1.3%

Housing Development and SHAASTRA SECURITIES TRADING PRIVATE SELL

2299657

58.8

13.52

Shrenuj & Co.

89414.00

863%

-4.9%

Housing Development and SHAASTRA SECURITIES TRADING PRIVATE BUY

2299657

58.77

13.52

GE Shipping Co

705307.00

782%

-1.6%

Jagran Prakashan

1183219.00

603%

-1.9%

Mandhana Indus

131188.00

558%

-1.9%

32777.00

473%

-5.2%

Vakrangee

1876856.00

380%

-6.7%

Indiabulls Hous.

2840880.00

346%

-3.6%

Kansai Nerolac

223660.00

340%

-4.8%

Dishman Pharma &Chem N.K. SECURITIES

SELL

460945 251.59

11.60

Dishman Pharma &Chem N.K. SECURITIES

BUY

460945 251.49

11.59

Plastiblends India Limite

KOLSITE CORPORATION LLP

BUY

204500 326.25

6.67

Plastiblends India Limite

KABRA EXTRUSIONTECHNIK LTD

SELL

204500 326.24

6.67

Disclaimer: http://www.religareonline.com/research/Disclaimer/Disclaimer_RSL.html

Visagar Polytex

Religare Morning Digest

September 3, 2015

Current Portfolio and Performance Summary as on 2nd September15

Sector

Entry Date

Weight

Construction

3/2/2015

9.6%

1,818

1,528

Consumer Goods

4/10/2015

11.2%

849

806

Pharma

6/26/2015

7.6%

719

729

Financial Services

7/21/2015

5.6%

683

702

IT

7/21/2015

5.0%

983

949

PI Industries

Fertilisers & Pesticides

7/23/2015

5.7%

659

713

Dabur India

Consumer Goods

8/5/2015

7.5%

296

280

Auto

8/13/2015

6.9%

2,660

2,329

MCX

Financial Services

8/21/2015

4.7%

1,067

965

Cash

Cash

Stock

Larsen & Toubro

Asian Paints

Aurobindo Pharma

Repco Home Finance LimHCL Technologies

Hero MotoCorp

Total Total

Disclaimer: http://www.religareonline.com/research/Disclaimer/Disclaimer_RSL.html

Reco price (`)

CMP (`)

36.1%

100%

Religare Morning Digest

September 3, 2015

Historical Performance as on 2nd September15

Performance Matrix

1-Month

3-Month

6-Month

1-Year

Since Inception

Religare Alpha

-5.49%

1.96%

-4.16%

0.00%

14.67%

Nifty

-9.56%

-6.31%

-13.66%

0.00%

-2.12%

Outperformance

4.07%

8.27%

9.50%

0.00%

16.79%

Disclaimer: http://www.religareonline.com/research/Disclaimer/Disclaimer_RSL.html

Religare Morning Digest

September 3, 2015

Research Product Basket

For every client, the advisor must allocate a specific proportion of funds for trading and investing depending on the risk taking ability and willingness of the client and

their investment goals.

The below mentioned product basket tries to address the way to deal with the trading portfolio (cash/derivative) for optimum effectiveness of research calls.

It is recommended to divide your trading funds for various types of calls and not invest the entire amount for 1 or 2 calls only.

For 1L margin*

For cash market trading

Call / Product

Call Frequency

No. of calls

Avg open call duration

% funds allocated

Total

Per Call

Intraday Calls

Intraday

2-3

< 1 day

25%

25,000

8,000

Live / RMD Calls

Master Pick

Religare Alpha

Cash

Intraday Calls

Live / RMD Calls

Master Pick

Daily

3-4

3 - 4 days

30%

30,000

4,000

Weekly

1 month

15%

15,000

5,000

Opportunity

NA

2 - 3 months

20%

20,000

As per weightage

NA

10%

10,000

These calls are flashed live on Ms Lync and ODIN with the purpose of squaring off positions on the same day. As a policy, we restrict our intraday cash

market calls to less than 4 calls a day. Hence, funds should be allocated accordingly to have provision to trade in all calls.

2 super ideas are flashed in RMD daily with a view of 3-4 days. Additionally as per market opportunity, we flash live calls during the day (including

BTST calls). 3-4 such calls are made on a daily basis which might be open for 3-4 days. Funds should be allocated keeping in mind that there will be 7

-8 such open calls daily.

This is our weekly recommendation shortlisted on the basis of techno-funda analysis. 15% of funds is recommended to be allocated for Master Pick

considering that there will be 3 open calls. The average open duration for this call will be 1 month.

Religare Alpha

This is a portfolio of 8-10 stocks which are held with a view of 2-3 months. It is recommended to allocate 20% of funds for building this portfolio which

will provide stability to the overall trading portfolio.

Cash

10% surplus cash in the portfolio should be kept for the purposes of allocating it to opportunities as and when they arrive .

For 1L margin*

For derivative market trading

Call / Product

Derivative Ideas

Live calls

Cash

Derivative Ideas

Live Calls

Cash

Call Frequency

No. of calls

Avg open call duration

% funds allocated

Total

Per Call

Daily

1-2

1 - 3 days

40%

40,000

40,000

Intraday / Daily

1-2

3 - 4 days

50%

50,000

50,000

10%

10,000

NA

1 derivative idea is shared in RMD daily. It can be a plain vanilla F&O buy/sell call or an option strategy. Funds should be allocated assuming 2 such

calls will be open at any time. These calls are open for 3-4 days on an average.

These calls are flashed on MS Lync and ODIN during live market hours. These calls can be intraday or with a view of 2-3 days. Funds should be

allocated considering 2 such calls will be open at any time. 3/4 times, these calls will be on Nifty / Bank Nifty only.

It is recommended to hold 10% cash to capitalize on any opportunity that may arise in markets.

Disclaimer: http://www.religareonline.com/research/Disclaimer/Disclaimer_RSL.html

Religare Morning Digest

September 3, 2015

Team Members

Ajay Kumar Srivastava ajaykumar.s@religare.com

Ajit Mishra

ajit.mishra@religare.com

Ashish Bansal

ashish.bansal@religare.com

Gaurav Sharma

gaurav.sh@religare.com

Swati Saxena

swati.saxena@religare.com

Manoj M Vayalar

manoj.vayalar@religare.com

Munjal Mehta

munjal.mehta@religare.com

Disclaimer: http://www.religareonline.com/research/Disclaimer/Disclaimer_RSL.html

Religare Morning Digest

September 3, 2015

Before you use this research report , please ensure to go through the disclosure inter-alia as required under Securities and Exchange Board of India (Research Analysts) Regulations,

2014 and Research Disclaimer at the following link : http://old.religareonline.com/research/Disclaimer/Disclaimer_RSL.html

Specific analyst(s) specific disclosure(s) inter-alia as required under Securities and Exchange Board of India (Research Analysts) Regulations, 2014 is/are as under:

Statements on ownership and material conflicts of interest , compensation Research Analyst (RA)

[Please note that only in case of multiple RAs, if in the event answers differ inter-se between the RAs, then RA specific answer with respect to questions under F (a) to F(j) below , are

given separately]

S. No.

Statement

Answer

Yes

I/we or any of my/our relative has any financial interest in the subject company? [If answer is yes, nature of Interest is given below this table]

I/we or any of my/our relatives, have actual/beneficial ownership of one per cent. or more securities of the subject company, at the end of the month

immediately preceding the date of publication of the research report or date of the public appearance?

No

No

No

I/we or any of my/our relative, has any other material conflict of interest at the time of publication of the research report or at the time of public

appearance?

I/we have received any compensation from the subject company in the past twelve months?

No

I/we have managed or co-managed public offering of securities for the subject company in the past twelve months?

No

I/we have received any compensation for brokerage services from the subject company in the past twelve months?

No

I/we have received any compensation for products or services other than brokerage services from the subject company in the past twelve months?

No

I/we have received any compensation or other benefits from the subject company or third party in connection with the research report?

No

I/we have served as an officer, director or employee of the subject company?

I/we have been engaged in market making activity for the subject company?

No

No

No

Nature of Interest ( if answer to F (a) above is Yes :

Name(s) with Signature(s) of RA(s).

[Please note that only in case of multiple RAs and if the answers differ inter-se between the RAs, then RA specific answer with respect to questions under F (a) to F(j) above , are given

below]

SS..No.

Name(s) of RA.

Signtures of

RA

Serial Question of question which the signing RA

needs to make a separate declaration / answer

Yes

No.

Copyright in this document vests exclusively with RSL. This information should not be reproduced or redistributed or passed on directly or indirectly in any form to any other

person or published, copied, in whole or in part, for any purpose, without prior written permission from RSL. We do not guarantee the integrity of any emails or attached files

and are not responsible for any changes made to them by any other person.

Disclaimer: http://www.religareonline.com/research/Disclaimer/Disclaimer_RSL.html

Anda mungkin juga menyukai

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5795)

- 9th, December 2015: Nifty Outlook Sectoral OutlookDokumen5 halaman9th, December 2015: Nifty Outlook Sectoral OutlookPrashantKumarBelum ada peringkat

- Evaluating The Efficiency of Emerging Options Markets: Evidence From GreeceDokumen34 halamanEvaluating The Efficiency of Emerging Options Markets: Evidence From GreecePrashantKumarBelum ada peringkat

- Analysis of Automatic Strangle Trade On Expansive Symbols of Korean Option MarketDokumen3 halamanAnalysis of Automatic Strangle Trade On Expansive Symbols of Korean Option MarketPrashantKumarBelum ada peringkat

- 220v DC CHP Battery Bank and Charger Sizing CalculationDokumen6 halaman220v DC CHP Battery Bank and Charger Sizing CalculationPrashantKumar100% (1)

- KRX+Indices FinalDokumen26 halamanKRX+Indices FinalPrashantKumarBelum ada peringkat

- Beating The Market Withcharles KirkpatrickDokumen9 halamanBeating The Market Withcharles KirkpatrickPrashantKumarBelum ada peringkat

- NCFM Update 1Dokumen2 halamanNCFM Update 1PrashantKumarBelum ada peringkat

- Market - Outlook - 09 - 09 - 2015 1Dokumen14 halamanMarket - Outlook - 09 - 09 - 2015 1PrashantKumarBelum ada peringkat

- AngelBrokingResearch WonderlaHolidays IC 310815Dokumen18 halamanAngelBrokingResearch WonderlaHolidays IC 310815PrashantKumarBelum ada peringkat

- 9th, September 2015: Nifty Outlook Sectoral OutlookDokumen5 halaman9th, September 2015: Nifty Outlook Sectoral OutlookPrashantKumarBelum ada peringkat

- Daily Technical Report: Sensex (25318) / Nifty (7688)Dokumen4 halamanDaily Technical Report: Sensex (25318) / Nifty (7688)PrashantKumarBelum ada peringkat

- Derivative Stock PickDokumen2 halamanDerivative Stock PickPrashantKumarBelum ada peringkat

- Some Relief For Bulls: Punter's CallDokumen3 halamanSome Relief For Bulls: Punter's CallPrashantKumarBelum ada peringkat

- General Installation Commissioning Guidelines For VRLA Batteries - 0Dokumen3 halamanGeneral Installation Commissioning Guidelines For VRLA Batteries - 0PrashantKumar100% (1)

- PR-1158 12V65AH BatteryDokumen11 halamanPR-1158 12V65AH BatteryPrashantKumarBelum ada peringkat

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Billing Summary Customer Details: Total Amount Due (PKR) : 2,831Dokumen1 halamanBilling Summary Customer Details: Total Amount Due (PKR) : 2,831Shazil ShahBelum ada peringkat

- Correlations in Forex Pairs SHEET by - YouthFXRisingDokumen2 halamanCorrelations in Forex Pairs SHEET by - YouthFXRisingprathamgamer147Belum ada peringkat

- A View About The Determinants of Change in Share Prices A Case From Karachi Stock Exchange (Banking)Dokumen17 halamanA View About The Determinants of Change in Share Prices A Case From Karachi Stock Exchange (Banking)(FPTU HCM) Phạm Anh Thiện TùngBelum ada peringkat

- Quijano ST., San Juan, San Ildefonso, BulacanDokumen2 halamanQuijano ST., San Juan, San Ildefonso, BulacanJoice Dela CruzBelum ada peringkat

- DuPont Analysis On JNJDokumen7 halamanDuPont Analysis On JNJviettuan91Belum ada peringkat

- Aptdc Tirupati Tour PDFDokumen1 halamanAptdc Tirupati Tour PDFAfrid Afrid ShaikBelum ada peringkat

- Why The Strengths Are Interesting?: FormulationDokumen5 halamanWhy The Strengths Are Interesting?: FormulationTang Zhen HaoBelum ada peringkat

- Chap014 Solution Manual Financial Institutions Management A Risk Management ApproachDokumen19 halamanChap014 Solution Manual Financial Institutions Management A Risk Management ApproachFami FamzBelum ada peringkat

- Production Planning & Control: The Management of OperationsDokumen8 halamanProduction Planning & Control: The Management of OperationsMarco Antonio CuetoBelum ada peringkat

- GST Rate-: Type of Vehicle GST Rate Compensation Cess Total Tax PayableDokumen3 halamanGST Rate-: Type of Vehicle GST Rate Compensation Cess Total Tax PayableAryanBelum ada peringkat

- Community Development Fund in ThailandDokumen41 halamanCommunity Development Fund in ThailandUnited Nations Human Settlements Programme (UN-HABITAT)100% (1)

- Healthpro Vs MedbuyDokumen3 halamanHealthpro Vs MedbuyTim RosenbergBelum ada peringkat

- The Global Interstate System Pt. 3Dokumen4 halamanThe Global Interstate System Pt. 3Mia AstilloBelum ada peringkat

- Manual Goldfinger EA MT4Dokumen6 halamanManual Goldfinger EA MT4Mr. ZaiBelum ada peringkat

- Year 2016Dokumen15 halamanYear 2016fahadullahBelum ada peringkat

- Sponsorship Prospectus - FINALDokumen20 halamanSponsorship Prospectus - FINALAndrea SchermerhornBelum ada peringkat

- 2017 Metrobank - Mtap Deped Math Challenge Elimination Round Grade 2 Time Allotment: 60 MinDokumen2 halaman2017 Metrobank - Mtap Deped Math Challenge Elimination Round Grade 2 Time Allotment: 60 MinElla David100% (1)

- Delivering The Goods: Victorian Freight PlanDokumen56 halamanDelivering The Goods: Victorian Freight PlanVictor BowmanBelum ada peringkat

- Readymade Plant Nursery in Maharashtra - Goa - KarnatakaDokumen12 halamanReadymade Plant Nursery in Maharashtra - Goa - KarnatakaShailesh NurseryBelum ada peringkat

- Hard Work and Black Swans - Economists Are Turning To Culture To Explain Wealth and Poverty - Schools Brief - The EconomistDokumen9 halamanHard Work and Black Swans - Economists Are Turning To Culture To Explain Wealth and Poverty - Schools Brief - The EconomistMaría Paula ToscanoBelum ada peringkat

- StatementsDokumen2 halamanStatementsFIRST FIRSBelum ada peringkat

- Ifland Engineers, Inc.-Civil Engineers - RedactedDokumen18 halamanIfland Engineers, Inc.-Civil Engineers - RedactedL. A. PatersonBelum ada peringkat

- Monsoon 2023 Registration NoticeDokumen2 halamanMonsoon 2023 Registration NoticeAbhinav AbhiBelum ada peringkat

- Ram Kumar Mishra, Geeta Potaraju, and Shulagna Sarkar - Corporate Social Responsibility in Public Policy - A Case of IndiaDokumen12 halamanRam Kumar Mishra, Geeta Potaraju, and Shulagna Sarkar - Corporate Social Responsibility in Public Policy - A Case of IndiaShamy Aminath100% (1)

- HQ01 - General Principles of TaxationDokumen14 halamanHQ01 - General Principles of TaxationJimmyChao100% (1)

- Designing For Adaptation: Mia Lehrer + AssociatesDokumen55 halamanDesigning For Adaptation: Mia Lehrer + Associatesapi-145663568Belum ada peringkat

- What Is InflationDokumen222 halamanWhat Is InflationAhim Raj JoshiBelum ada peringkat

- Module 2Dokumen7 halamanModule 2Joris YapBelum ada peringkat

- CBN Rule Book Volume 5Dokumen687 halamanCBN Rule Book Volume 5Justus OhakanuBelum ada peringkat

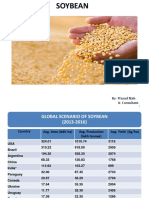

- Soybean Scenario - LaturDokumen18 halamanSoybean Scenario - LaturPrasad NaleBelum ada peringkat