Financial Results & Limited Review For March 31, 2015 (Standalone) (Result)

Diunggah oleh

Shyam SunderDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Financial Results & Limited Review For March 31, 2015 (Standalone) (Result)

Diunggah oleh

Shyam SunderHak Cipta:

Format Tersedia

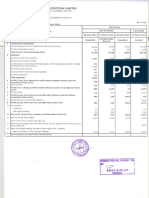

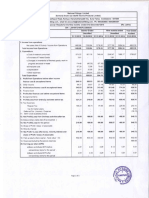

MRUGESH TRADING LIMITED

011\1: L74999MH1984PLC034746

Regd. OffIce: Warden House, 340, J.J. Road, SycuUa, Mumbal400 008.

AUDITED FINANCIAL RESULTS FOR THE QUARTER AND YEAR ENDED 31ST MARCH 2015

(Rupees in Thousands}

Particulars

Sr.

Quarter Ended

31.12.2014

(Audited)

(Unaudited)

I

I

(b)Otht):r Operating Income

Year Ended

31.03.201'

(Audned)

ia}Net Sales}fncome from Operation

Totallocoma

2

3f.03.2.015

31.03.2015

31.03.201'

(Audited)

(Audited)

40

105

140

29

40

lOS

440

57

57

471

471

(1)

48

131)

......~.

48

-

expendIture

(bl Other Expenditure

144

41

(c)) Total

144

41

(Any Item (+xceedlnfl10% of the total

300

29

(aj (lnc(Gase)/pecraaso in StocJi:.in"Trad0

270

270

18.

185 :

f):xpAndltumto hfl fihown seperCltely)

Profit from Operation$ before Other Income.

!nlarost & Excoptionalltoms (1-2)

(115}

other tnc.ome

(115)

-

It<lmSI5-6)

Exoopt!(lflal Items

Profit (+)fLoss H from Ordinary Activities

(115}

before tax {T+a)

10 Tax Expenses

11 Net Profit (+)/Loss (-) from Ordinery Activities

(115}

-------~

(115}

111

....

48

- .

85 :

(31

85

(31)

_ _ _ _

Interest

Profit after Interest but before Exceptional

~

Profit before Interest &. Exceptional Items (3+4}

85

10

(1)

(1)

38

10

(31)

75

28

28

In

(34)

47

2,450

after tax (9-10)

12 Extra Ordlnery Items {Net of Tax Ex.penses)

13 Net Profit (+) I Loss (-) for the period (11-12:)

,.

(115}

Paid-up equity share capital

(1)

10

47

2,450

2,450

(3'

2,450

(0.47}

(0.00)

0.04

(0.14)

0.19

(0.47)

(0.00)

0.04

(0.14)

0.19

2,450

Face Value Rs. 10/ per share)

15

R~erve$

excluding Revaluatlon Reserves

as per aalance Sheet of previous Ale vear

1. E:arnlng Per Share (EPSI

(iii) Basic ~ncl diluted EPS b~fQre Extraordinary

l1.ems for the period ror the year to dille S. for

the previous year (not to be annualized)

(b) Basic and diluted EPg after Extraordinary

items for the period for the year to date & for

the previous year (not to be annualized)

11 Public Sham Hotdlng

~ Number of Shares

~ PercentaQe of Sharnholding

I

1,46,750

1,46,760

1,46,750

1,46,750

1,45,750

59.90

59,90

59.90

59,90

59.90

18 Promoters and promoter group Shareholdlng

a} Picdgtltl/encumbc~d

- Number of shares

- Pere9ntag& of shares (as a '% of tho total

shareholdfng of promoter and promoter

group)

- percentage of shares (as a % of the total

share capital of the company)

b) Non-encumbered

- Number of shares

- percentage of sharn$ fas a % of the total

98.250 i

98,250

98,250

98,25!J

98,250

100

100

100

100

100

40.10

40.10

40.10

40.10

40.10

$hareholdlng or promoter and promoter

group)

- PercentagE! of shares (as a % of the total

share capital of the company)

"r."

;,,.-r~~'b

~'IAUMBAI r

~'(.

'./"

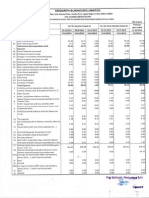

STATEMENT OF ASSETS AND LIABILITIES AS ON 31 ST MARCH, 2015

Rupe"" In Thousands)

AS AT

AS AT

3110312014

3110312014

(Audited)

(Audited)

SR. PARTICULARS

NO.

A

EQUITY AND LIABILITIES

1 Share Holders' Fund

(a) Share Capital

2,450

2,450

(b) Reserves & Surplus

(752)

(785)

Sub Total Share Holder's Fund

1,665

1,698

2,050

2' Current liabilities

(a} Short Term Borrowings

88

80

1,468

1,562

(b) Trade Payable

(b) Other Current liabilities

Sub Total- Current Liabilities

3,8081

TOTAL EQUITY AND LIABILITIES

5,271

ASSETS

1 Non-Current Assets

(a) Non-Curren! Investments

2,518

218

(b) Long Term Loans And Advances

1.111

1,225

Sub Total- NonhCurrent Assets

3,629

1.443

2 Current Assets

(a) Current Investments

(b) InventorIes

(c) Cash and Bank Balance

186

1,514

1,550

119

132

Sub Total - Current Assets

1,642

1,877

TOTAL ASSETS

5,271

3,320

(d) Short Term Loans and Advances

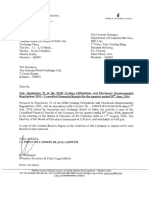

Notes:

1

The above results were taken on record by the Board of Directors of the Company at its meeting held on 26.05.2015

Previous period's figures have been regrouped/rearranged wherever necessary.

AS~17

The company is a single segment company in accordance with

There is no material tax effect of timing difference based on the estimated computation for a reasonable period,

The figures of last quarter are the balancing figures between audited figures in respect of the full financial year

(Segment Reporting) issued by the ICAI.

hence there is no provision for deferred tax in terms of AS -22.

and the published year to date figures upto the third quarter of the current financial year.

S No Investor complaints were received during the quarter ended 31.03.2015.

Place: Mumbal

Dated: 26.05.2015

I. G. Naik & Co.

Chartered Accountants

M.COM. LLB., RCA.

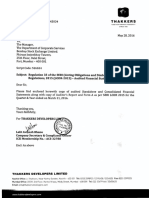

Independent Anditor's Report on Limited Review of the Audited Financial Results or the company

for the Quarter and Year ended 31" Mareh 2015.

To the Board of Directors

Mrugesb Trading limited

Warden House, 340, JJ. Road,

Byculla, Mumbai ~ 400 008

We have reviewed the accompanying statement of Audited financial results ("the Statement") of

Mrugesb Trading Limited for the quarter and year ended 31" March, 2015, except for the disclosures

regarding "Public Shareholding" and "Promoter and Promoter Group shareholding" which have been

traced from disclosures made by the management and have not been audited by us. This Statement is the

responsibility of the Company's Management and has been approved by the Board of

Directors/Committee of the Board of Directors. Our responsibility is to issue a report on these ftnancial

results based on OUr review.

We conducted our review of the Statement in accordance with the Standard on Review Engagements

(SRE) 2410, Review of Interim Financial Information performed by the Independent Auditor of the

Entity, issued by the Institnte of Chartered Accountants of India. This Standard requires that we plan and

perform the review to obtain moderate assurance as to whether the rmancial statements are free of

material misstatement. A review is limited primarily to inquiries of Company persOImel and annlytical

procedures applied to financial data and thus provide less assurance tban an audit. We have not performed

an audit and accordingly we do not express all audit opinion.

Based on our review eonducted as above, nothing has come to our attention that causes us to believe that

the accompanying Statement of audited fmancial results prepared in accordance with the applicable

accounting standards referred to in Section 211 (3C ) of the Companies Act, 1956 and other recognized

accounting practices and policies has not disclosed the information required to be disclosed in terms of

Clause 41 of the Listing Agreements with stock exchanges including the manner in which it is to be

disclosed, or that it contains any material misstatement.

Place: Mumbai

Date: 26.05.2015

For I.G. Naik & Co.

Chartered Accountants

F~l068LOW

IC.Naik

~.

Proprietor

Membersbip No. 034504

Chandrama, 2nd Floor, 21, Kalanagar. Bandra (E) .. Mumbal 400 051.

Tel.: +91 2226591851 Fax: +91 2226408898 Mobile: +91 98201 49972

EmaiJ: ign1953@gmall.com

Anda mungkin juga menyukai

- How to Read a Financial Report: Wringing Vital Signs Out of the NumbersDari EverandHow to Read a Financial Report: Wringing Vital Signs Out of the NumbersPenilaian: 5 dari 5 bintang5/5 (5)

- Government AccountingDokumen131 halamanGovernment AccountingAngelo Andro SuanBelum ada peringkat

- Financial Results & Limited Review For March 31, 2015 (Standalone) (Result)Dokumen3 halamanFinancial Results & Limited Review For March 31, 2015 (Standalone) (Result)Shyam SunderBelum ada peringkat

- Financial Results & Limited Review For March 31, 2014 (Standalone) (Result)Dokumen3 halamanFinancial Results & Limited Review For March 31, 2014 (Standalone) (Result)Shyam SunderBelum ada peringkat

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Dokumen3 halamanFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderBelum ada peringkat

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Dokumen5 halamanFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderBelum ada peringkat

- Financial Results & Auditors Report For March 31, 2015 (Standalone) (Audited) (Result)Dokumen3 halamanFinancial Results & Auditors Report For March 31, 2015 (Standalone) (Audited) (Result)Shyam SunderBelum ada peringkat

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Dokumen3 halamanFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderBelum ada peringkat

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Dokumen3 halamanFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderBelum ada peringkat

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen6 halamanStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Dokumen3 halamanFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Dokumen7 halamanFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Dokumen15 halamanStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Financial Results & Limited Review For Dec 31, 2012 (Result)Dokumen3 halamanFinancial Results & Limited Review For Dec 31, 2012 (Result)Shyam SunderBelum ada peringkat

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Dokumen2 halamanFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderBelum ada peringkat

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Dokumen2 halamanFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen5 halamanStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Dokumen4 halamanFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderBelum ada peringkat

- Standalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Dokumen9 halamanStandalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Dokumen3 halamanFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderBelum ada peringkat

- Standalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Dokumen12 halamanStandalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Financial Results & Auditors Report For March 31, 2015 (Standalone) (Audited) (Result)Dokumen4 halamanFinancial Results & Auditors Report For March 31, 2015 (Standalone) (Audited) (Result)Shyam SunderBelum ada peringkat

- Financial Results, Limited Review Report For December 31, 2015 (Result)Dokumen5 halamanFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderBelum ada peringkat

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Dokumen3 halamanFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Dokumen4 halamanFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderBelum ada peringkat

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Dokumen4 halamanFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderBelum ada peringkat

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Dokumen5 halamanFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen3 halamanStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Dokumen2 halamanFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen5 halamanStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Dokumen6 halamanStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Dokumen5 halamanFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderBelum ada peringkat

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Dokumen5 halamanFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen3 halamanStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Financial Results & Limited Review For Aug 31, 2014 (Standalone) (Result)Dokumen3 halamanFinancial Results & Limited Review For Aug 31, 2014 (Standalone) (Result)Shyam SunderBelum ada peringkat

- Financial Results & Limited Review For Dec 31, 2012 (Result)Dokumen3 halamanFinancial Results & Limited Review For Dec 31, 2012 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Dokumen2 halamanFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderBelum ada peringkat

- Financial Results & Limited Review Report For Dec 31, 2015 (Result)Dokumen2 halamanFinancial Results & Limited Review Report For Dec 31, 2015 (Result)Shyam SunderBelum ada peringkat

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Dokumen3 halamanFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen3 halamanStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Dokumen3 halamanFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderBelum ada peringkat

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen5 halamanStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Financial Results, Limited Review Report, Results Press Release For December 31, 2015 (Result)Dokumen8 halamanFinancial Results, Limited Review Report, Results Press Release For December 31, 2015 (Result)Shyam SunderBelum ada peringkat

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Dokumen3 halamanFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Financial Results, Limited Review Report For December 31, 2015 (Result)Dokumen8 halamanFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Announces Q2 Results, Limited Review Report & Results Press Release For The Quarter Ended September 30, 2015 (Result)Dokumen5 halamanAnnounces Q2 Results, Limited Review Report & Results Press Release For The Quarter Ended September 30, 2015 (Result)Shyam SunderBelum ada peringkat

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Dokumen3 halamanFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderBelum ada peringkat

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Dokumen3 halamanFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderBelum ada peringkat

- Standalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Dokumen10 halamanStandalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Financial Results, Limited Review Report For December 31, 2015 (Result)Dokumen4 halamanFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderBelum ada peringkat

- Codification of Statements on Standards for Accounting and Review Services: Numbers 1 - 23Dari EverandCodification of Statements on Standards for Accounting and Review Services: Numbers 1 - 23Belum ada peringkat

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryDari EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryBelum ada peringkat

- Mutual Fund Holdings in DHFLDokumen7 halamanMutual Fund Holdings in DHFLShyam SunderBelum ada peringkat

- JUSTDIAL Mutual Fund HoldingsDokumen2 halamanJUSTDIAL Mutual Fund HoldingsShyam SunderBelum ada peringkat

- Settlement Order in Respect of R.R. Corporate Securities LimitedDokumen2 halamanSettlement Order in Respect of R.R. Corporate Securities LimitedShyam SunderBelum ada peringkat

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Dokumen4 halamanFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderBelum ada peringkat

- PR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Dokumen1 halamanPR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Shyam SunderBelum ada peringkat

- Financial Results For June 30, 2014 (Audited) (Result)Dokumen3 halamanFinancial Results For June 30, 2014 (Audited) (Result)Shyam SunderBelum ada peringkat

- Settlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedDokumen2 halamanSettlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedShyam SunderBelum ada peringkat

- HINDUNILVR: Hindustan Unilever LimitedDokumen1 halamanHINDUNILVR: Hindustan Unilever LimitedShyam SunderBelum ada peringkat

- Order of Hon'ble Supreme Court in The Matter of The SaharasDokumen6 halamanOrder of Hon'ble Supreme Court in The Matter of The SaharasShyam SunderBelum ada peringkat

- Exit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliDokumen5 halamanExit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliShyam SunderBelum ada peringkat

- Financial Results, Limited Review Report For December 31, 2015 (Result)Dokumen4 halamanFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Dokumen5 halamanStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Financial Results For Mar 31, 2014 (Result)Dokumen2 halamanFinancial Results For Mar 31, 2014 (Result)Shyam SunderBelum ada peringkat

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Dokumen3 halamanFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderBelum ada peringkat

- Financial Results For June 30, 2013 (Audited) (Result)Dokumen2 halamanFinancial Results For June 30, 2013 (Audited) (Result)Shyam SunderBelum ada peringkat

- Financial Results For September 30, 2013 (Result)Dokumen2 halamanFinancial Results For September 30, 2013 (Result)Shyam SunderBelum ada peringkat

- PDF Processed With Cutepdf Evaluation EditionDokumen3 halamanPDF Processed With Cutepdf Evaluation EditionShyam SunderBelum ada peringkat

- Financial Results For Dec 31, 2013 (Result)Dokumen4 halamanFinancial Results For Dec 31, 2013 (Result)Shyam Sunder0% (1)

- Standalone Financial Results For September 30, 2016 (Result)Dokumen3 halamanStandalone Financial Results For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results For June 30, 2016 (Result)Dokumen2 halamanStandalone Financial Results For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen3 halamanStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results For March 31, 2016 (Result)Dokumen11 halamanStandalone Financial Results For March 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokumen5 halamanStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokumen3 halamanStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Transcript of The Investors / Analysts Con Call (Company Update)Dokumen15 halamanTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderBelum ada peringkat

- Investor Presentation For December 31, 2016 (Company Update)Dokumen27 halamanInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderBelum ada peringkat

- 2013 Paper F3 QandA Sample Download v1Dokumen31 halaman2013 Paper F3 QandA Sample Download v1acca_kaplan100% (1)

- Internal Control DocumentationDokumen42 halamanInternal Control DocumentationJhoe Marie Balintag100% (1)

- Understanding Sarbanes OxleyDokumen11 halamanUnderstanding Sarbanes OxleyrangoonroudyBelum ada peringkat

- ARC - Administrative Reforms CommissionDokumen14 halamanARC - Administrative Reforms CommissiongauravBelum ada peringkat

- Travel Expense Report Template 07Dokumen3 halamanTravel Expense Report Template 07Gatot IndiartoBelum ada peringkat

- BPLS ManualDokumen55 halamanBPLS ManualArce FajardoBelum ada peringkat

- AEC6 BudgetingDokumen2 halamanAEC6 BudgetingjolinaBelum ada peringkat

- Flow Chart LGUDokumen1 halamanFlow Chart LGUjohnisflyBelum ada peringkat

- Code Samrec PDFDokumen94 halamanCode Samrec PDFLaurenBetterMedinaBelum ada peringkat

- Chapter 12Dokumen9 halamanChapter 12jennylynBelum ada peringkat

- Fa2 SyllabusDokumen19 halamanFa2 Syllabusazizrehman15951Belum ada peringkat

- AUD 1.2 Client Acceptance and PlanningDokumen10 halamanAUD 1.2 Client Acceptance and PlanningAimee Cute100% (1)

- Expenditure Cycle: Purchasing and Cash DisbursementsDokumen15 halamanExpenditure Cycle: Purchasing and Cash DisbursementsAllisbi HakimBelum ada peringkat

- AA in Specialized Industries - FINALSDokumen10 halamanAA in Specialized Industries - FINALSMiraflor Sanchez BiñasBelum ada peringkat

- Ch01 IT Audit1Dokumen56 halamanCh01 IT Audit1rio casta1Belum ada peringkat

- Standard Audit Programme Guides (SAPGs) for ReviewsDokumen10 halamanStandard Audit Programme Guides (SAPGs) for Reviewslhea Shelmar Cauilan100% (1)

- The Role of Accountants and Accounting InformationDokumen28 halamanThe Role of Accountants and Accounting InformationSamuel KohBelum ada peringkat

- India Entry Strategy BrochureDokumen30 halamanIndia Entry Strategy BrochureRahul BhanBelum ada peringkat

- Chap 21-2Dokumen8 halamanChap 21-2JackBelum ada peringkat

- Sample Blackbook ProjectDokumen98 halamanSample Blackbook Projectprithviraj gosraniBelum ada peringkat

- Self-Certification For Individual: FATCA/CRS Declaration FormDokumen2 halamanSelf-Certification For Individual: FATCA/CRS Declaration FormLeo DennisBelum ada peringkat

- MCS - Cost Volume Analysis ProjectDokumen21 halamanMCS - Cost Volume Analysis ProjectsanjaysinhaBelum ada peringkat

- Chavez v. Philippine Estate AuthorityDokumen6 halamanChavez v. Philippine Estate AuthorityLaura MangantulaoBelum ada peringkat

- 3531 24773 Textbooksolution PDFDokumen42 halaman3531 24773 Textbooksolution PDFADITYA BANSALBelum ada peringkat

- Reading ArticleDokumen1 halamanReading ArticleMuy KongBelum ada peringkat

- Public Administration SyllabusDokumen3 halamanPublic Administration SyllabusAmitanshu VishalBelum ada peringkat

- Chhattisgarh Minor Mineral Receipts 2012Dokumen57 halamanChhattisgarh Minor Mineral Receipts 2012CMD Technical CellBelum ada peringkat

- Acc Unit-5-AnswersDokumen5 halamanAcc Unit-5-AnswersGeorgeBelum ada peringkat

- Bank Reconciliation and Adjusting Entries for Borderlands CompanyDokumen1 halamanBank Reconciliation and Adjusting Entries for Borderlands CompanyKevin James Sedurifa OledanBelum ada peringkat