Accountant

Diunggah oleh

saburi25Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Accountant

Diunggah oleh

saburi25Hak Cipta:

Format Tersedia

Eximius Management Pvt.Ltd.

Policies and Procedures

Issued by:HR

Subject:Job Description for Accounts

department

Approved by:

Date:08/08/2015

Department: Accounts

Report to: Senior Accountant

1) Receipt of Bills

The following procedures shall be followed at the time of receipt of bills.

a) Entry shall be made giving details of the bills received such as date of receipt of

invoice, name of vendor, date of invoice, description in the invoice, amount etc in

the Manual Register maintained by Accounts Department.

b) A unique serial number code on the top of the bill would be mentioned which

would be same as the serial number on which the bill was entered in the manual

register.

d) It should be ensured that the entry of the bills in the register will be made on the

same day of receipt of bills from vendor and hand over the details to the senior

accountant.

2) Entry of Bill in the Books of Accounts

a) After review of bill by the Executive Accountant, the bill would be checked by

Senior with the Purchase Order/Agreement/Approval of the bill. He would ensure

that necessary supporting documents are attached with the bill.

b) The Director would check the TDS implication and Service Tax implications on the

bill and provide for the same in the books of accounts accordingly.

c) In case of purchase of any Housekeeping and security material or other, relevant

entry would be made in the stock register for the quantity and value and serial

number given in the stock register would be mentioned in the Purchase Invoice

before the purchase bill is is entered in the books of accounts.

d) After the purchase bill is approved by the Senior Accountant, entry would be

made in the books of accounts.

e) It would be ensured that the entry of the bills will be made within 24 hours of

receipt of bills from the accounts Department.

f) Also it would be ensured that the Serial numbers are correct for posting the entry

in books of accounts.

Eximius Management Pvt.Ltd.

Policies and Procedures

Issued by:HR

Subject:Job Description for Accounts

department

Approved by:

Date:08/08/2015

3) Preparation of Approval note for payment

a) After the above steps, approval note for release of payment of the bill shall be

prepared by the Senior Accountant along with the relevant supporting documents

such as Original Invoice, Journal Voucher passed by the Executive Accountant,

agreement (wherever applicable).

b) After preparing the approval note, Senior Accountant would ensure that the

approval note is signed by the relevant authorities.

c) On approval of payment note by Senior Accountant the note along with

supporting document should be sent to Director for approval along with all the

supporting documentation.

4) Issue of Cheques

a) On receipt of approval of CEO, the Finance Manager would prepare the cheque on

the basis of approval note signed by the relevant authorities.

b) After the cheque is prepared, the same would be sent for President / Secretary

General and Treasurer (mandatory) approval / signature along with the payment

note and supporting documentation. Unless otherwise mentioned, the cheques

should will be processed on the following dates :

For regular Payment

For Salary and TDS

For Service Tax

10th and 25th of the each month

5th of the next month

3rd of the next month.

c) Once the cheques are signed, payment entry would be made in the books of

accounts by Accounts Department on the same day.

4 Dispatch of Cheques

a) The cheques should be dispatched on the same day through courier unless they

are hand delivered.

b) A control register would be maintained by Accountant for all the courier sent

giving details of courier number, cheque no, name of party, amount and follow up

should be done by Accounts Officer twice a week with the courier company on the

delivery of the cheque so that the control register can be updated accordingly.

Eximius Management Pvt.Ltd.

Policies and Procedures

Issued by:HR

Subject:Job Description for Accounts

department

Approved by:

Date:08/08/2015

5 Cash payments:

a) Cash payments would be avoided as far as possible. Only petty bills can be paid

in cash for the following petty expenses:

i. Expenditure for refreshments during official meetings.

ii. Staff Conveyance

. iii. Office Maintenance of petty nature

iv. Printing & Stationary of petty nature

v. Any Other Petty Expense.

b) No cash payments above Rs 20,000 should be made against a single bill.

c) Cash payments would be released only after approval of Director on receipt of

the bill for payment.

d) It is also ensured that the complete approval note along with the bill is prepared

by the Senior Accountant before handing over it to the Executive Director.

6. Payroll

a) The Accounts Department will prepare monthly salary sheet by the 4th of every

month on the basis of attendance and leave records of the employees.

b) TDS deduction would be checked with the computation of taxable income

prepared for each employee and tax deducted so far before the current month.

c) Any adjustments for any advances or loans taken by the employee would be

made before the approval of salary.

d) In case of new employees, appointment letters would be checked along with

other relevant documents such as last employers, relieving certificate, and

experience certificate. While preparing the TDS calculations, last employers Form 16

should be considered.

e) The salary sheet would then be checked and approved by the Senior Accountant.

f) In case of any employees leaving the company, the full and final settlement

account would be prepared by the Executive Accountant and will be approved by

Senior Accountant and Director.

Eximius Management Pvt.Ltd.

Policies and Procedures

Issued by:HR

Subject:Job Description for Accounts

department

Approved by:

Date:08/08/2015

The Senior Accountant would check the following documents before making the full

and final payment: Letter of resignation,

1.

2.

3.

4.

5.

6.

7.

8.

Acceptance of resignation by adjustment, any loans/ staff advance

Any TDS short deducted on basis of declarations not received,

Copy of tax savings investments such as payment of LIC premiums,

PPF,

Home loans certificates for which credit has been taken etc;

Any office equipment such as laptop,

Mobile,

Blackberry handed over etc.

g) Accounts Department will prepare the final cheques for disbursement and send it

for approval to Director for their approval along with the relevant supporting.

7. Staff Advances and Loans

a) Staff advances and loans can only be given to employees after the approval

Director as per the companys HR policy.

b) Accounts Department will ensure the advance is being adjusted on a monthly

basis before disbursement of salaries as per terms of sanction.

Eximius Management Pvt.Ltd.

Policies and Procedures

Issued by:HR

Subject:Job Description for Accounts

department

Approved by:

Date:08/08/2015

APPENDIX I: PROCESS MAPS

1. Accounting for Income:

Responsibility

Action

Eximius Management Pvt.Ltd.

Policies and Procedures

Issued by:HR

Subject:Job Description for Accounts

department

Approved by:

Date:08/08/2015

Start

Executive Accountant

Receive Income

Prepare and Issue

Receipts

Balance and Verify Daily

Collections

Correct

NO

YE

Update Cash Book

Prepare Bank

Reconciliation

Post to General Ledger

Senior Accountant

Stop

ii. Procedure for processing of Payments

Eximius Management Pvt.Ltd.

Policies and Procedures

Issued by:HR

Subject:Job Description for Accounts

department

Responsibility

Approved by:

Date:08/08/2015

Action

Eximius Management Pvt.Ltd.

Policies and Procedures

Issued by:HR

Subject:Job Description for Accounts

department

Approved by:

Date:08/08/2015

Start

Executive Accountant

Receive & Record

Documents

Verify Documents &

Approvals

Balance and Verify Daily

Collections

Valid

NO

YE

Prepare Payment

Voucher and cheque

Examine the Payment

Senior Accountant

Forward to Internal

Audit and signatories

Stop

Return

to

Source

Anda mungkin juga menyukai

- Fin Pol and ProceduresDokumen48 halamanFin Pol and Proceduressaburi25Belum ada peringkat

- Accounting Policies and Procedures ManualDokumen33 halamanAccounting Policies and Procedures ManualKingston Nkansah Kwadwo Emmanuel100% (1)

- 11 Core Managerial CompetenciesDokumen28 halaman11 Core Managerial Competenciessaburi25Belum ada peringkat

- SOP FinanceDokumen13 halamanSOP Financesaburi25100% (1)

- Industrial DisputesDokumen8 halamanIndustrial Disputessaburi25Belum ada peringkat

- Assessment CentresDokumen20 halamanAssessment Centressaburi25Belum ada peringkat

- Organizational Behavior Course Model: OB Outcomes: Attitudes and Behaviors Influenced by Managers UsingDokumen37 halamanOrganizational Behavior Course Model: OB Outcomes: Attitudes and Behaviors Influenced by Managers UsingKuntal GhoshBelum ada peringkat

- Strategichumanaresourcemanagementtolapresentation 120715225007 Phpapp02Dokumen35 halamanStrategichumanaresourcemanagementtolapresentation 120715225007 Phpapp02saburi25Belum ada peringkat

- Talent Management - Talent Leadership Interventions (Appendix 1)Dokumen2 halamanTalent Management - Talent Leadership Interventions (Appendix 1)saburi25Belum ada peringkat

- 4B.Industrial Relations PDFDokumen6 halaman4B.Industrial Relations PDFsaburi25Belum ada peringkat

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Payment Voucher - SAADUNDokumen5 halamanPayment Voucher - SAADUNMahani Anie100% (1)

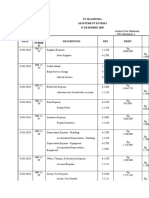

- PT SejahteraDokumen2 halamanPT Sejahtera202010415109 ADITYA FIRNANDOBelum ada peringkat

- Quotation List E D C: Series No. Model No. Unit Price (Usd) Unit Price (Usd) Unit Price (Usd)Dokumen4 halamanQuotation List E D C: Series No. Model No. Unit Price (Usd) Unit Price (Usd) Unit Price (Usd)Lucian StroeBelum ada peringkat

- Module 10: Mathematics of Finance Lesson 1: Activity 1: FV PV (1+r)Dokumen6 halamanModule 10: Mathematics of Finance Lesson 1: Activity 1: FV PV (1+r)Pia LatojaBelum ada peringkat

- Chinese Soft Power Rise and Implications For A Small State by CharuniDokumen3 halamanChinese Soft Power Rise and Implications For A Small State by CharuniRaphael Sitor NdourBelum ada peringkat

- Class 12 Project EcoDokumen18 halamanClass 12 Project EcoKunal GuptaBelum ada peringkat

- Service Management: SMG 301 Spring 2015Dokumen10 halamanService Management: SMG 301 Spring 2015Aboubakr SoultanBelum ada peringkat

- The Struggling Spanish Economy: Guide Words Possible Source Main IdeaDokumen4 halamanThe Struggling Spanish Economy: Guide Words Possible Source Main IdeaMayeBelum ada peringkat

- New U LI Cable Support System Catalogue 2019Dokumen185 halamanNew U LI Cable Support System Catalogue 2019muhamad faizBelum ada peringkat

- Overview of Energy Systems in Northern CyprusDokumen6 halamanOverview of Energy Systems in Northern CyprushaspyBelum ada peringkat

- Macroeconomic Theory and Policy: Pcpadhan@xlri - Ac.inDokumen7 halamanMacroeconomic Theory and Policy: Pcpadhan@xlri - Ac.inManoranjan DashBelum ada peringkat

- Distributors and Their Bio Cide S 2017Dokumen9 halamanDistributors and Their Bio Cide S 2017Sérgio - ATC do BrasilBelum ada peringkat

- 945-Jeevan Umang: Prepared byDokumen7 halaman945-Jeevan Umang: Prepared byVishal GuptaBelum ada peringkat

- Transport and LocationDokumen16 halamanTransport and LocationAjay BhasiBelum ada peringkat

- Smurfit Kappa Sustainable Development Report 2013Dokumen104 halamanSmurfit Kappa Sustainable Development Report 2013edienewsBelum ada peringkat

- Bos 63146Dokumen40 halamanBos 63146Piyush GoyalBelum ada peringkat

- PWC To Acquire PRTMDokumen2 halamanPWC To Acquire PRTMBRR_DAGBelum ada peringkat

- RVU Distribution - New ChangesDokumen5 halamanRVU Distribution - New Changesmy indiaBelum ada peringkat

- FactoringDokumen36 halamanFactoringmaninder1419699Belum ada peringkat

- Latest Scheme BrochureDokumen46 halamanLatest Scheme Brochurerohit klshaanBelum ada peringkat

- BudgetingDokumen5 halamanBudgetingKevin James Sedurifa Oledan100% (1)

- State 0wned BankDokumen7 halamanState 0wned BankFarzana Akter 28Belum ada peringkat

- Initial Project Screening Method - Payback Period: Lecture No.15 Contemporary Engineering EconomicsDokumen32 halamanInitial Project Screening Method - Payback Period: Lecture No.15 Contemporary Engineering EconomicsAfiq de WinnerBelum ada peringkat

- The Guidebook For R and D ProcurementDokumen41 halamanThe Guidebook For R and D Procurementcharlsandroid01Belum ada peringkat

- A Research Report ON "Perception of Consumer Towards Online Food Delivery App"Dokumen43 halamanA Research Report ON "Perception of Consumer Towards Online Food Delivery App"DEEPAKBelum ada peringkat

- Business History of Latin AmericaDokumen257 halamanBusiness History of Latin AmericaDaniel Alejandro Alzate100% (2)

- Contemporay Economic Issues 2nd EditionDokumen176 halamanContemporay Economic Issues 2nd Edition;krvn;kjzdnjvi;Belum ada peringkat

- An Introduction To The World Trade Organization (WTO)Dokumen9 halamanAn Introduction To The World Trade Organization (WTO)naeemkhan1976Belum ada peringkat

- Project Profile On Bakery Products: Mixing of Ingredients Except Flour in Required Proportion in Paste FormDokumen4 halamanProject Profile On Bakery Products: Mixing of Ingredients Except Flour in Required Proportion in Paste FormKomma RameshBelum ada peringkat