Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)

Diunggah oleh

Shyam SunderDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)

Diunggah oleh

Shyam SunderHak Cipta:

Format Tersedia

Chartered Accountants

C-9, ~,anjay Apartnl('nt, S V.P. Ftoad

Near Gokul Hotel, Boriv'ali (West)

IV1umbai400092.

+912228916494/95

Emal! ID:-dmkhco@gmaiLconl

. - -......The Board of Directors,

---....------....- . - ...- - - - -

..

N2N TECHNOLOGIES LIMITED,

Sun lounge -ground floor (right wing), One earth

Opposite Magarpatta city, Hadapsar

Pune-411028

Re: Limited Review of the Financial Result for the quarter ended 30th June, 2015.

We have reviewed the accompanying statement of unaudited financial results of N2N TECHNOLOGIES

LIMITED for the period ended 30 th June, 2015except for the disclosures regarding 'Public Shareholding'

and 'Promoter and Promoter Group Shareholding' which have been traced from disclosures made by

the management but have neither been reviewed nor been audited by us. The statement has been

prepared by the company pursuant to clau.se 41 oftheUsting Agreement with the stock exchange in

India, Which has been initialed by us for identification purpose. This statement is the responsibility of

the Company's Management and has been approved;by the Board of Director. Our responsibility is to

issue a report on these financial statements based on our review.

;~

We conducted our review in accordance with the Standard on Review Engagement (SRE) 2410,

"Review of Interim Review Financial information performed by the Independent Auditor of the Entity"

issued by the Institute of Chartered Accountants of India.

This standard. requires that we plan a'nd

perform the review to obtain niOderate <!ssurance as to whether the financial statements are free of

material misstatement. A review is limited primarily to inquiries of company personnel and analytical

procedures applied to financial data and thus provide less assurance than an audit.

We have not

performed an audit and accordingly, we do not express an audit opinion.

Based on our review conducted as above, nothing has come to our attention that causes us to believe

that the accompanying statement of unaudited financial results prepared in accordance with applicable

accounting standards specified under section 133 of companies Act, 2013, Read with Rule 7 of the

companies (Accounts) Rules,2014 and other accounting principles generally accepted in India, has not

disclosed the information required to be disclosed in terms of Clause 41 of the Listing Agreement

including the manner in which it is to be disclosed, or that it contains any material misstatement.

For DMKH & Co.

Place: Mumbai

Date: 03-09-2015

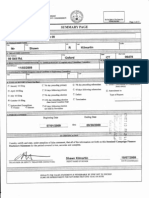

N2N Technologies Limited

(CIN: L72900PN1985PLC145004)

Regd. Office: Office no. 101, P1 Pentagon, Magarpatta City, Hadapsar, Pune - 411013

Unaudited Standalone financial results for the Quarter ended on 30/06/2015

(Figs in Lacs)

Results for the Quarter Ended

Audited Results

for the Year

Ended

Audited

31.03.2015

Audited

31.03.2015

Particulars

Unaudited

30.06.2015

1. Net Sales /Income from Operations

0.00

0.00

0.00

0.00

0.00

2. Total Expenditure:

a) Purchase

Less: (Increase) / Decrease in Stock

b) Changes in inventories of finished goods, work-in-progress and stock-intrade

c) Staff cost

d) Depreciation & amortisation

e) Other expenditure

f) Legal & Professional Fees

g) Directors Sitting Fees

h) Amalgamation/Merger Exp

I) Interest

j) Non recurring expense - Bad Debts/Exp written off

k) Advertising Expenses

l) Filing Fees

Unaudited

30.06.2014

0.00

0.30

0.28

0.00

0.15

0.97

6.46

0.00

0.52

0.09

0.19

3.63

0.87

0.52

1.65

0.45

0.90

3.68

8.02

0.71

1.91

2.50

0.15

0.88

0.18

0.00

0.68

0.34

9.23

4.58

0.18

0.00

0.68

0.34

21.64

(0.88)

(9.23)

(4.58)

(21.64)

4. Other Income

4.09

14.19

5. Profit From Operations before Interest and

Exceptional Item (3+4)

3.21

4.95

3. Profit From Operations before other Income,

Interest and Exceptional Item (1-2)

6. Interest Expense

7. Profit From Operations before Exceptional Item

(5-6)

8. Exceptional Items

9. Profit(+)/Loss (-) from Ordinary Activities

before Tax (7+8)

10. Tax Expenses

3.21

4.95

14.19

(4.58)

(7.45)

(4.58)

(7.45)

(4.58)

(7.45)

3.21

4.95

-0.30

-0.30

0

11. Net Profit (+)/Loss (-) from Ordinary

Activities After Tax (9-10)

12. Extraordinary Items (Net of tax expenses Rs. Nil)

13. Net Profit (+)/Loss(-) for the period (11-12)

14. Paid-up equity share capital

(Face value of Rs.10/- each)

15. Reserves excluding revaluation reserves

16. Earning per Share before & after Exceptional Item

- Basic

- Diluted

17. Public Shareholding

- Number of shares

- Percentage of Shareholding

18. Promoters and Promoter Group

Shareholding

a) Pledged/Encumbered

- Number of Share

- % of Shares (as a % of the total shareholding of promoter and

promoter group)

- % of shares (as a % of the total share capital of the Company)

b) Non-encumbered

- Number of Share

- % of Shares (as a % of the total shareholding of promoter and

promoter group)

- % of shares (as a % of the total share capital of the Company)

3.21

5.26

(4.58)

(7.76)

(4.58)

(7.76)

3.21

5.26

440.81

440.81

440.81

440.81

1,426.24

1,426.24

1,434.14

1,426.24

0.07

0.07

0.12

0.12

(0.10)

(0.10)

(0.18)

(0.18)

2,782,086

63.11%

2,782,086

63.11%

2,782,086

63.11%

2,782,086

63.11%

1,152,340

1,152,340

752,340

1,152,340

70.87%

26.14%

473,640

29.13%

10.74%

70.87%

26.14%

473,640

29.13%

10.74%

46.27%

17.07%

873,640

53.73%

19.82%

70.87%

26.14%

473,640

29.13%

10.74%

Notes :

1. The above Financial Results unaudited Standalone Financial Results wer reviewed by Audit committee & approved by the Board of Directors at their

meeting held on Sept 3rd, 2015 along with LRR of Auditor

2. Figures are rounded off to the nearest thousands.

3. The figures for previous year/periods have been regrouped/reclassified/restated, wherever necessary.

4. Segment reporting is not applicable as the company activity falls within a single business segment.

5. No investor complaints were received during the quarter & no investor complaints are pending at the beginning and at the

end of the quarter ended June 2015

Anda mungkin juga menyukai

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- Funds Flow Statement Analysis of Mind Links IT R&D Labs Pvt LtdDokumen61 halamanFunds Flow Statement Analysis of Mind Links IT R&D Labs Pvt LtdNagireddy Kalluri81% (32)

- Withdraw PayPal Money in Malaysia SolutionDokumen16 halamanWithdraw PayPal Money in Malaysia Solutionafarz2604Belum ada peringkat

- Business Finance Week 1 & 2Dokumen38 halamanBusiness Finance Week 1 & 2Myka Zoldyck100% (6)

- Mutual Fund Holdings in DHFLDokumen7 halamanMutual Fund Holdings in DHFLShyam SunderBelum ada peringkat

- JUSTDIAL Mutual Fund HoldingsDokumen2 halamanJUSTDIAL Mutual Fund HoldingsShyam SunderBelum ada peringkat

- Settlement Order in Respect of R.R. Corporate Securities LimitedDokumen2 halamanSettlement Order in Respect of R.R. Corporate Securities LimitedShyam SunderBelum ada peringkat

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Dokumen4 halamanFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderBelum ada peringkat

- PR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Dokumen1 halamanPR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Shyam SunderBelum ada peringkat

- Financial Results For June 30, 2014 (Audited) (Result)Dokumen3 halamanFinancial Results For June 30, 2014 (Audited) (Result)Shyam SunderBelum ada peringkat

- Settlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedDokumen2 halamanSettlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedShyam SunderBelum ada peringkat

- HINDUNILVR: Hindustan Unilever LimitedDokumen1 halamanHINDUNILVR: Hindustan Unilever LimitedShyam SunderBelum ada peringkat

- Order of Hon'ble Supreme Court in The Matter of The SaharasDokumen6 halamanOrder of Hon'ble Supreme Court in The Matter of The SaharasShyam SunderBelum ada peringkat

- Exit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliDokumen5 halamanExit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliShyam SunderBelum ada peringkat

- Financial Results, Limited Review Report For December 31, 2015 (Result)Dokumen4 halamanFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Dokumen5 halamanStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Financial Results For Mar 31, 2014 (Result)Dokumen2 halamanFinancial Results For Mar 31, 2014 (Result)Shyam SunderBelum ada peringkat

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Dokumen3 halamanFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderBelum ada peringkat

- Financial Results For June 30, 2013 (Audited) (Result)Dokumen2 halamanFinancial Results For June 30, 2013 (Audited) (Result)Shyam SunderBelum ada peringkat

- Financial Results For September 30, 2013 (Result)Dokumen2 halamanFinancial Results For September 30, 2013 (Result)Shyam SunderBelum ada peringkat

- PDF Processed With Cutepdf Evaluation EditionDokumen3 halamanPDF Processed With Cutepdf Evaluation EditionShyam SunderBelum ada peringkat

- Financial Results For Dec 31, 2013 (Result)Dokumen4 halamanFinancial Results For Dec 31, 2013 (Result)Shyam Sunder0% (1)

- Standalone Financial Results For September 30, 2016 (Result)Dokumen3 halamanStandalone Financial Results For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results For June 30, 2016 (Result)Dokumen2 halamanStandalone Financial Results For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen3 halamanStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results For March 31, 2016 (Result)Dokumen11 halamanStandalone Financial Results For March 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokumen5 halamanStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokumen3 halamanStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Transcript of The Investors / Analysts Con Call (Company Update)Dokumen15 halamanTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderBelum ada peringkat

- Investor Presentation For December 31, 2016 (Company Update)Dokumen27 halamanInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderBelum ada peringkat

- Discussion Problems and Solutions On Module 3, Part 1Dokumen28 halamanDiscussion Problems and Solutions On Module 3, Part 1AJ Biagan MoraBelum ada peringkat

- TM BseDokumen4 halamanTM BseVansh GoelBelum ada peringkat

- Rau's FEBRUARY Magazine - 2023 Final PDFDokumen132 halamanRau's FEBRUARY Magazine - 2023 Final PDFshaik abdullaBelum ada peringkat

- ACCT212 WorkingPapers E2-16ADokumen2 halamanACCT212 WorkingPapers E2-16AlowluderBelum ada peringkat

- Sabeetha Final ProjectDokumen52 halamanSabeetha Final ProjectPriyesh KumarBelum ada peringkat

- Form BDokumen4 halamanForm BWangchen RigzinBelum ada peringkat

- ITM - Capstone Project ReportDokumen53 halamanITM - Capstone Project ReportArchana Singh33% (3)

- US Internal Revenue Service: f6198 - 1999Dokumen1 halamanUS Internal Revenue Service: f6198 - 1999IRSBelum ada peringkat

- Updated AP ListDokumen12 halamanUpdated AP ListSusan KunkleBelum ada peringkat

- Financial Accounting and Reporting Fundamentals ReviewDokumen1 halamanFinancial Accounting and Reporting Fundamentals ReviewRyan PelitoBelum ada peringkat

- Sample Paper 1 MCQ AccDokumen2 halamanSample Paper 1 MCQ AccDRBelum ada peringkat

- Presentation On Inflation: Presented By: Darwin Balabbo ManaguelodDokumen13 halamanPresentation On Inflation: Presented By: Darwin Balabbo ManaguelodJulius MacaballugBelum ada peringkat

- Chap 21 - Leasing (PSAK 73) - E12-12Dokumen27 halamanChap 21 - Leasing (PSAK 73) - E12-12Happy MichaelBelum ada peringkat

- Prefered Stok and Common StockDokumen23 halamanPrefered Stok and Common StockRiska StephanieBelum ada peringkat

- XXXXXXXXXX1191 20230728113715988340..Dokumen6 halamanXXXXXXXXXX1191 20230728113715988340..MOHAMMAD IQLASHBelum ada peringkat

- Advanced Accounting 7e Hoyle - Chapter 1Dokumen47 halamanAdvanced Accounting 7e Hoyle - Chapter 1Leni Rosiyani100% (8)

- Applicability of IND AS: Phases of adoptionDokumen2 halamanApplicability of IND AS: Phases of adoptionSamyu MemoriesBelum ada peringkat

- Money Market's InstrumentsDokumen20 halamanMoney Market's InstrumentsManmohan Prasad RauniyarBelum ada peringkat

- M.Nor Abdul Razak - EditDokumen8 halamanM.Nor Abdul Razak - EditWredha KusumaBelum ada peringkat

- Seec F'orm 20Dokumen23 halamanSeec F'orm 20The Valley IndyBelum ada peringkat

- Financial Forecast For Conference Income Statement ExampleDokumen6 halamanFinancial Forecast For Conference Income Statement ExampleMohamed SururrBelum ada peringkat

- Stoic Lesson On FinanceDokumen8 halamanStoic Lesson On Financefrank menshaBelum ada peringkat

- Capital GainsDokumen25 halamanCapital GainsanonymousBelum ada peringkat

- R22 Capital Structue IFT NotesDokumen11 halamanR22 Capital Structue IFT NotesAdnan MasoodBelum ada peringkat

- Gold LoanDokumen22 halamanGold LoanJinal Vasa0% (1)

- I Am Sharing 'TCWD-ASSIGNMENT1' With YouDokumen4 halamanI Am Sharing 'TCWD-ASSIGNMENT1' With YouQUENIE SAGUNBelum ada peringkat

- Employment Vs Independent Contractor AnalysisDokumen4 halamanEmployment Vs Independent Contractor AnalysisLarry HaberBelum ada peringkat