Automobile Mileage

Diunggah oleh

martingo08Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Automobile Mileage

Diunggah oleh

martingo08Hak Cipta:

Format Tersedia

Automobile Mileage Log

This is an example of a vehicle log that contains the information required to support a claim for input

tax credits of the use of a vehicle. This vehicle log has been provided for your convenience. It does

not replace the need to retain all records that pertain to the operation of the vehicle.

This is how to complete the log: (refer to the attached example)

1.

2.

3.

4.

Record the name and address of the vehicle owner and the GST registration number.

Record the make and year of the vehicle.

Begin a new page for each month of the log.

For each trip during the month, record:

a. The date of the trip and the odometer reading at the beginning of the trip.

b. The point of origin (place trip began), a description of the trip, and the nature of the

goods/services involved.

c. The odometer reading at the end of the trip and how many kilometres were driven.

d. Allocate on a reasonable basis the amount of kilo metres driven for business use and

the amount for non-business use. Combined trips for personal and business use

require an allocation be made since it is not entirely business use.

5. At the end of the month complete the Summary Section as follows:

a. Record the vehicle odometer reading at the end of the month in space 'A'.

b. Subtract 'B' from' A' to get the total kilometres driven and record this amount in

space 'C'.

c. Add total distance traveled for business from column 'Bus. KM' and enter in

space'D'.

d. Multiply space 'D' by 100 and divide this total by the total in space 'c' to get the

percentage of business use for the vehicle. Record this amount in space 'E'.

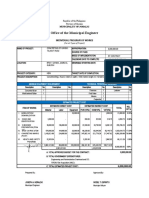

EXAMPLE OF A VEHICLE LOG

\liE:

John Doe

GST#:

R123456789

DRESS:

Anyplace, Alberta

VEHICLE:

Ford F150

Date

month/day)

110

1 11

1 11

111

1 11

113

113

114

116

116

119

120

121

121

122

123

125

128

Description

of Trip

Auction to check for Truck

Auction to buy combine header

Zeller - purchase clothing

Buy twine

Take farm hands to field

Bank

Check cattle

Dentist

Bank and pick up parts

Dinner

Move cattle

Bank and mail

Sell feeders

Fishin!l trip

Tractor parts

mail and tractor parts

Coffee shop

Purchase cultivator

Goods/Services

Passenger Carried

None

Combine header

Purchases

Twine

3 INOrkers

Deposit book

None

Wife

Parts

Wife

Cattle and trailer

Deposit book and mail

Cattle and Trailer

Son

Parts

Mail and tractor parts

None

Cultivator

Point of

Origin

Home

Home

Edmonton

Edmonton

Morrinville

Home

Home

Home

Home

Home

Home

Home

Home

Home

Home

Home

Home

Home

Destination

Westlock

Edmonton

Edmonton

Morrinville

Westlock

Westlock

Field 1

Edmonton

Westlock

Westlock

Rosington

Westlock

Edmonton

Muskeg Lake

Westlock

Westlock

Clyde

Red Deer

Odometer Readina

Start (km)

End (km)

12,500

12,530

12,530

12,580

12,580

12,596

12,596

12,629

12,629

12,680

12,680

12,710

12,710

12,742

12,742

12,792

12,792

12,822

12,822

12,852

12,852

12,932

12,932

12,962

12,962

13,012

13,012

13,160

13,160

13,190

13,190

13,220

13,220

13,248

13,248

13,748

Total Distance

A. Odometer Close:

B; Odometer Start C:

Total Km Driven 0:

Business Km:

E: Business Use D/C x 100

Distance

Driven (km)

30

50

16

33

51

30

32

50

30

30

80

30

50

148

30

30

28

500

1,248

Business

Use (km)

30

50

Non Business

Use (km)

16

33

51

15

32

15

15

50

15

30

80

15

50

15

148

30

15

500

916

13,748

12,500

1.248

916

73%

15

28

332

Automobile Mileage Log

Name:

GST#:

Address:

Vehicle:

Odometer

Date

Decription of Trip

Goods/Services

Passengers Carried

Point of Orgin

Destination

Start (km) End (km)

Total Distance:

Distance

Travelled (KM)

Business

(km)

Non

Business

(km)

Automobile Mileage Log Summary Sheet

GST#:

Name:

Vehicle:

Address:

Summary

for

Month of

A

Odometer Reading

End of Month

B

Odometer Reading

Beginning of Month

C

Total Kilometers

Driven in Month

(B-C)

January

February

March

April

May

June

July

August

September

October

..

November

December

D

Total Business

Kilometer Travelled

(From Automobile Log)

E

Percentage

Usage

(D x 100 I C)

Anda mungkin juga menyukai

- GoalsDokumen1 halamanGoalsmartingo08Belum ada peringkat

- Afirmaciones SheetDokumen2 halamanAfirmaciones Sheetmartingo08Belum ada peringkat

- Inspiration Vs MotivationDokumen2 halamanInspiration Vs MotivationDivij KishalBelum ada peringkat

- 1 S6Dokumen22 halaman1 S6martingo08Belum ada peringkat

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5782)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (72)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Surat DataDokumen23 halamanSurat Datatushar_fight3056Belum ada peringkat

- Ere Ijesa ReportDokumen52 halamanEre Ijesa ReportolaBelum ada peringkat

- Japan's Major Ports and Their Strategic ImportanceDokumen20 halamanJapan's Major Ports and Their Strategic ImportanceMisama NedianBelum ada peringkat

- Transportation: I. GeographyDokumen2 halamanTransportation: I. GeographyHuynhXuanKhanhBelum ada peringkat

- 03 Subgrade PDFDokumen9 halaman03 Subgrade PDFTsegawbeztoBelum ada peringkat

- ZazaDesign & Construction Suarez PresentationDokumen48 halamanZazaDesign & Construction Suarez PresentationNayar GutierrezBelum ada peringkat

- Braking SystemDokumen50 halamanBraking SystemDeepakBelum ada peringkat

- Salitex Expansion Joint Filler BoardDokumen2 halamanSalitex Expansion Joint Filler BoardSandipBelum ada peringkat

- 6M - Brgy Road Projects - GANGODokumen13 halaman6M - Brgy Road Projects - GANGOJoseph HeraldoBelum ada peringkat

- Aluminium loading ramps for heavy equipmentDokumen36 halamanAluminium loading ramps for heavy equipmentŞerban RaduBelum ada peringkat

- Diwali 2023 - Performer Pre-Festival Workshop PresentationDokumen43 halamanDiwali 2023 - Performer Pre-Festival Workshop Presentationpalivela1990Belum ada peringkat

- Installation and safety guide for BeSafe iZi Twist i-SizeDokumen115 halamanInstallation and safety guide for BeSafe iZi Twist i-SizeMadalina TarnauceanuBelum ada peringkat

- Introduction To HighwaysDokumen4 halamanIntroduction To HighwaysAakash GuptaBelum ada peringkat

- UntitledDokumen339 halamanUntitledBart SimpsonBelum ada peringkat

- Skybus Vs Metro: Mumbai Deserves The Best: Jaya GoyalDokumen8 halamanSkybus Vs Metro: Mumbai Deserves The Best: Jaya GoyaldhokalerajBelum ada peringkat

- MTO-Highway Planning and Design Process Guideline-2016Dokumen190 halamanMTO-Highway Planning and Design Process Guideline-2016Ashton MartynBelum ada peringkat

- Bridge EngineeringDokumen134 halamanBridge EngineeringdineshBelum ada peringkat

- Steel Product GuideDokumen32 halamanSteel Product Guideabdulkerim aBelum ada peringkat

- Curtin Campus Map PDFDokumen1 halamanCurtin Campus Map PDFthetsoeBelum ada peringkat

- NC Travel GuideDokumen194 halamanNC Travel GuidebytahnyaBelum ada peringkat

- Driving With An Automatic Driving LessonsDokumen5 halamanDriving With An Automatic Driving LessonsRachel SkinnerBelum ada peringkat

- De Thi Hoc Ki 2Dokumen29 halamanDe Thi Hoc Ki 2Đào Nhật HiểnBelum ada peringkat

- Regulatory SignsDokumen10 halamanRegulatory SignsAngel QuingaluisaBelum ada peringkat

- Aramco Journey Management PlanDokumen18 halamanAramco Journey Management PlanSyed Baseer100% (1)

- Jimena Jaimes; Instructora Ingles - Heavy Machinery Vocabulary 2020Dokumen1 halamanJimena Jaimes; Instructora Ingles - Heavy Machinery Vocabulary 2020Karen Dayana OCAMPO AYABelum ada peringkat

- Travel To Dhamma DipaDokumen6 halamanTravel To Dhamma Dipaalin_titocBelum ada peringkat

- Nineteenth CenturyDokumen8 halamanNineteenth Centuryapi-254602354Belum ada peringkat

- 2 and 3 Wheelers in IndiaDokumen93 halaman2 and 3 Wheelers in IndiaSreejith_Naray_5140Belum ada peringkat

- Paceville Integrated Development FrameworkDokumen234 halamanPaceville Integrated Development FrameworkMartin ParkerBelum ada peringkat

- TIA TorontoDokumen29 halamanTIA TorontoTahmidSaanidBelum ada peringkat