Platts PVC 29 July 2015

Diunggah oleh

mcontrerjHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Platts PVC 29 July 2015

Diunggah oleh

mcontrerjHak Cipta:

Format Tersedia

This Weeks Highlights:

Asian EDC/VCM: EDC falls $15/mt, VCM flat to $5/mt higher

Asian PVC: Mixed amid flat demand

R

A

S

INDEX:

Platts International Prices

Polymerupdate Indian Domestic Producer Price

Platts Polymer Shipping Costs (USD/MT)

Polymerupdate CIF India Prices

Polymerupdate Indian Open Market Price Table

Polymerupdate Indian Producer Posting Price Comparison

Heard in PVC Market

Platts International Market Commentary & Analysis

Polymerupdate - PVC Market Supply Scenario

Platts Price Analysis Of PVC Chain Processing Margins

Currency Rates

Crisil Research Macroeconomics & Currency Monthly Analysis

Point of Contact

Polymerupdate - About us & Copyright

Platts - About us & Copyright

AS

UD

Week 30 July 29, 2015

POLYMERUPDATE

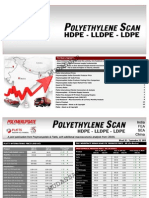

PLATTS INTERNATIONAL PRICES (USD/MT)

Product

India Crude basket:

Naphtha:

(USD/b)

(MOP West India)

July 22

(WK 29)

July 29

(WK 30)

55.70

53.30

- 02.40

459.85

438.35

- 21.50

INDIA DOMESTIC PRODUCER PRICE - RIL (Ex Hazira)

Price Change

on Week

Product

Suspension

344-346

329-331

- 15

CFR South East Asia

359-361

344-346

- 15

CFR Far East Asia

669-671

674-676

+ 05

CFR South East Asia

709-711

709-711

S

A

D

PVC :

MU

- 07

844-846

- 05

899-901

+ 05

PVC Suspension CFR China

856-858

849-851

PVC Suspension CFR SEA

849-851

PVC Suspension CFR India

894-896

Specifications:

Cargoes of 100-500mt delivered 15-30 days forward from date of publication with up to 30 days credit, basis

CFR Far East Asia: China main ports (Shanghai, Shenzhen, Ningbo, Shantou, Hong Kong); CFR South East Asia: Indonesia (Jakarta,

Surabaya), Singapore, Philippines (Manila Bay), Malaysia (Port Kelang), Thailand (Bangkok, Laem Chabang, Map Ta Phut), Vietnam

(Ho Chi Minh). Platts prices reflect spot market values on the day of publication.

India Crude Import Basket Calculation: ( (Dubai + Oman) / 2 * 65.2% ) + (Dated Brent * 34.8%)

MOP West India : Mean of Platts FOB West India naphtha export price

China Domestic

(YUAN/MT EX-WORK)

Ethylene Based

5940-5960

5840-5860

- 100

Carbide Based

5490-5510

5390-5410

- 100

INR/KG

USD/MT

INR/KG

USD/MT

65.50

918

65.50

918

Price Change on Week

INR/KG

*Domestic Indian producer prices are quoted in INR/kg basic (Nett of all taxes) ; equivalent USD/MT price is

calculated at current US/INR rate. *Lot Size:

1 Truck Load (10 to 16 MT)

- Price assessments are based on information gathered from a cross section of the industry that includes resin

producers, processors, traders and distributors.

- Standard repeatable orders (based on confirmed market deals) form the basis of the prices.

R

A

S

VCM :

July 29 (WK 30)

PVC Grade

EDC :

CFR Far East Asia

July 22 (WK 29)

PLATTS Polymer shipping costs (USD/MT)

From:

To:

East China

South China

India

Southeast Asia

NW Europe

Turkey

US Gulf

Latin America

Middle East

25 100 MT

20 25

15 25

45 50

30 35

55 65

50 70

130 140

165 175

Middle East

> 100 MT

10 15

10 15

30 40

25 30

50 60

40 60

120 130

160 165

NOTES:

Polymers refer to polyethylene, polypropylene, polystyrene, ABS, and PVC.

1) Middle East loadings refer to products coming from Jebel Ali (Dubai), Khalifa (Abu Dhabi), Jubail (Saudi Arabia), Shuaiba (Kuwait),

Rabigh (Saudi Arabia), Mesaieed (Qatar), Assaluyeh and Bandar Imam Khomeini (Iran) ports. The assessments are normalized between

these ports.

2) East China deliveries refer to products coming into Zhangjiagang, Shanghai, Jiangyin, Nantong, Ningbo, Nanjing, Zhenjiang ports.

3) South China deliveries refer to products coming into Shenzhen, Shantou, Hong Kong, Xiamen, Zhuhai ports.

4) India deliveries refer to products coming into Kolkata, Mumbai and Chennai ports.

5) South East Asia deliveries refer to products coming into Indonesia (Jakarta, Surabaya), Singapore, Philippines (Manila Bay), Malaysia

(Port Kelang), Thailand (Bangkok), Vietnam (Ho Chi Minh) ports.

6) Northwest Europe deliveries refer to products coming into Antwerp port. Deliveries into Rotterdam and Amsterdam ports will be

normalized to Antwerp.

7) Turkey deliveries refer to products coming into Istanbul and Mersin ports.

8) US Gulf deliveries refer to products coming into Houston port. No deliveries from the Persian Gulf.

9) Latin America deliveries refer to products coming into mainports in Brazil, Chile, Uruguay.

ContactDetails:344,AtoZIndl.Estate,G.K.Marg,LowerParel(w),Mumbai400013,INDIA|Email:info@polymerupdate.com|Tel:+912261772000(25lines)|Fax:+912261772025

Week 30 July 29, 2015

POLYMERUPDATE (CIF INDIA PRICES)

CIF INDIA BY ORIGIN (Nhava Sheva Port)

South Korea

WK 29

WK 30

July 22

July 29

Suspension

Emulsion

900

1060

Thailand

Price Change

on Week

900

1060

Taiwan

WK 29

WK 30

July 22

July 29

900

900

--

--

--

Price Change on Week

--

WK 29

WK 30

July 22

July 29

900

900

1070

1070

Price Change on Week

- All prices are in USD/MT CIF India (Nhava Sheva)

- For South Korea, Singapore, Thailand and Saudi Arabia :

Cargo size of 50-100mt delivered within 30 days.

- Price assessments are based on information gathered from a cross section of the industry that includes resin producers, processors, traders and distributors.

- Standard repeatable orders (based on confirmed market deals) form the basis of the prices.

R

A

S

POLYMERUPDATE - Indian Open Market Price Table

Product

Ethylene Based PVC

Mumbai

Delhi

74.5 - 75

76.50 - 77

S

A

D

Note: All prices are in INR/kg levels.

Kolkata

Bangalore

Indore

76 - 77

73.5 - 74.5

76 - 77

MU

Chennai

77 - 78

(Incl. of VAT)

Ahmedabad

Hyderabad

76 - 77

76 - 77

POLYMERUPDATE - INDIAN PRODUCER POSTING PRICE COMPARISON (GRADE WISE)

PVC SUSPENSION K-67 w.e.f 01 July-2015

Producer

Grade No.

*INR/MT

USD/MT

RIL

67GER01 (Ex-Gandhar)

65500

918

RIL

67.01 (Ex-Hazira)

65500

918

RIL

57GER01 (Ex-Gandhar)

67000

940

RIL

57.11 (Ex-Hazira)

67000

940

*Domestic Indian producer prices are quoted in INR/MT basic (Nett of all taxes) ; equivalent USD/MT price is calculated at current US/INR rate. *Lot Size:

1 Truck Load (10 to 16 MT)

- USD Price calculation: INR/MT Aprox. Clearing and Forwarding Charges / Basic Duty / Exchange Rate = USD/MT (For example: 82330 2500 / 1.075 / 54.24 = 1396)

ContactDetails:344,AtoZIndl.Estate,G.K.Marg,LowerParel(w),Mumbai400013,INDIA|Email:info@polymerupdate.com|Tel:+912261772000(25lines)|Fax:+912261772025

Week 30 July 29, 2015

Currency rates equivalent to 1 US Dollar :

Countries

Currency Rates

Countries

Currency Rates

Indian Rupees (INR)

63.81

Japan Yen (JPY)

Pakistan Rupees (PKR)

101.82

Indonesia Rupiahs (IDR)

13,447.00

China Yuan Renminb (CNY)

6.21

Malaysia Ringgits (MYR)

3.80

Bangladesh Taka (BDT)

77.70

Singapore Dollars (SGD)

1.36

Sri Lanka Rupees (LKR)

133.50

South Korea Won (KRW)

1160.68

Thailand Baht (THB)

34.83

Saudi Arabia Riyals (SAR)

3.74

Taiwan New Dollars (TWD)

31.42

United Arab Emirates Dirhams (AED)

3.67

R

A

S

Heard in PVC MARKET

Platts:

AS

Asian PVC: August loading cargoes heard offered at $850-860/mt CFR Southeast Asia, L/C at sight, 100-500 mt

123.59

Polymerupdate:

N.A.

D

U

M

Asian PVC: Notional August loading deals heard at $850/mt CFR Southeast Asia, L/C at sight, 100-500 mt

Asian PVC: Domestic Chinese Ethylene-based PVC tade levels heard at Yuan 5800mt, L/C at sight, 100-500 mt

Asian PVC: Domestic Chinese Carbide-based PVC tade levels heard at Yuan 5400/mt, L/C at sight, 100-500 mt

Asian PVC: August loading cargoes heard offered at $910/mt CFR India, L/C 90 days, 100-500 mt

Asian PVC: August loading cargoes heard offered at $915/mt CFR India, L/C at sight, 100-500 mt

Asian PVC: August loading deals heard at $900-910/mt CFR India, L/C 90 days, 100-500 mt

Asian PVC: August loading deals heard at $840-850/mt CFR Southeast Asia, L/C at sight, 100-500 mt

Asian PVC: August loading deals heard at $850-860/mt CFR China, L/C at sight, 100-500 mt

Asian PVC: August loading deals heard at $830-850/mt CFR Southeast Asia, L/C at sight, 100-500 mt

ContactDetails:344,AtoZIndl.Estate,G.K.Marg,LowerParel(w),Mumbai400013,INDIA|Email:info@polymerupdate.com|Tel:+912261772000(25lines)|Fax:+912261772025

Week 30 July 29, 2015

PLATTS INTERNATIONAL MARKET COMMENTARY & ANALYSIS

Asian EDC/VCM: EDC falls $15/mt, VCM flat to $5/mt higher

Asian PVC: Mixed amid flat demand

- EDC falls on lower deepsea offers

- Domestic China marker continues to fall

- Turkish demand for Asian cargoes could rise

- VCM firms on release of new PVC offers

EDC: Asian ethylene dichloride was assessed down $15/mt week on week at $330/mt CFR Far

East Asia and $345/mt CFR Southeast Asia Thursday tracking a fall in deepsea offers. No trades

were confirmed this week, with discussion ongoing for September-arrival deepsea cargoes. US

Gulf deepsea cargoes were heard being offered to Far East Asia at around $270/mt FOB, or

$325/mt on a CFR Far East Asia basis. Freight costs were heard at $55/mt, down $20/mt from

last week, and buying ideas heard around $300/mt CFR Far East Asia. Sources said fading

interest in Asia was pushing USG offers lower. The Asian ethylene market remained bearish this

week, with both the Northeast and Southeast Asia markers at four-month lows. The CFR

Northeast Asia ethylene marker was assessed at $1,165/mt Thursday, down $50/mt week on

week, and the CFR Southeast Asia marker at $1,090/mt, down $15/mt. Given an ethylene

conversion factor of 0.29, the breakeven cost for EDC makers is around $338/mt in Northeast

Asia and $316/mt in Southeast Asia.

R

A

S

S

A

D

VCM: Asian vinyl chloride monomer prices were flat to $5/mt higher this week as participants

held back to await new monthly VCM spot offers that are expected to be released next week. The

CFR Far East Asia marker rose $5/mt week on week to be assessed at $675/mt, and the CFR

Southeast Asia marker flat over the same period at $710/mt. In China, a trade was heard for a

3,000 mt end July-loading cargo at $675/mt CFR China, Japan origin. VCM spot negotiations

typically occur after deals have been concluded for new monthly PVC offers. Major Taiwanese

PVC producer Formosa Plastics started offering August-loading cargoes Monday, at $920/mt CFR

India, up $10/mt from last month, and $860/mt CFR China and CFR Southeast Asia, both

unchanged from July. In Southeast Asia, activity remained thin with no trades heard.

MU

RATIONALE:

EDC: Assessed down $15/mt week on week at $330/mt CFR Far East Asia Thursday, tracking a

fall in deepsea offers. No trades were confirmed this week. The CFR Southeast Asia marker was

assessed down $15/mt at $345/mt tracking the Far East Asia market.

VCM: Assessed up $5/mt week on week at $675/mt CFR Far East Asia Thursday. A trade was

heard for a 3,000 mt end-July loading cargo at $675/mt CFR China, Japan origin. The Southeast

Asia marker was assessed flat over the same period at $710/mt. No trades were confirmed this

week.

The CFR India PVC marker rose $5/mt week on week to be assessed at $900/mt Wednesday. Northeast Asia origin

cargoes were heard traded this week at $900-$910/mt CFR India. Few Northeast Asia origin cargoes were offered this

week at around $910-$915/mt CFR India, but most PVC exporters -- including Taiwan's Formosa Plastics -- had already

closed their offers last week after concluding August sales earlier than expected, said sources. The CFR China marker

fell $7/mt from last week to $850/mt Wednesday, amid weak buying interest as the Chinese stock market crashed on

Monday. Traded levels were heard in the range of $850-$860/mt CFR China this week. Domestic China PVC prices

mirrored the fall in imported PVC prices this week, with ethylene-based PVC assessed at Yuan 5,850/mt Wednesday,

and carbide-based PVC at Yuan 5,400/mt, both down Yuan 100/mt from last week. "Carbide PVC prices are unlikely to

fall further as feedstock carbide prices recovered around Yuan 100/mt in the last two weeks," said a participant. The

CFR Southeast Asia marker was down $5/mt this week at $845/mt Wednesday, as buying interest remained weak.

Traded levels were heard to be around $830-$850/mt CFR Southeast Asia this week. "PVC import demand from

Thailand remains bearish for August due to the falling exchange rate for Thai baht against the dollar, pushing effective

import PVC prices higher for local end-users," said a producer. "However, local producers are not aggressively pushing

for sales within Southeast Asia due to a larger volume of cargoes moving into Turkey, where the netback is better

compared to the region," he added. US imports to Turkey have been priced out of the market, trade sources said, due

to a recent hike in antidumping duty on US-origin PVC, from $45/mt to 18.81% of the CIF price. As European prices

remained high, Southeast Asian imports had become competitive in Turkey, with no ADD applicable. SEA origin PVC

prices were heard pegged at around $880/mt CFR Turkey this week. In plant news, South Korea's Hanwha Chemical

restarted one PVC production line at its Ulsan complex last week. Hanwha had declared a force majeure on suspension

PVC supply after a July 3 explosion at a wastewater disposal unit. A second line is expected to remain shut until midAugust. In data out this week, South Korea's PVC exports fell 17.1% month on month to 44,463 mt in June, South

Korean Customs data showed. Meanwhile, Chinese PVC exports fell 10.3% month on month to 52,078 mt in June,

according to the latest General Administration of Customs data. Chinese monthly PVC export volume soared to a yearto-date peak of 125,695 mt in March, boosted by 69,800 mt of exports into India, and had since been steadily falling

as demand from the sub-continent retreated.

RATIONALE:

The CFR India marker rose $5/mt week on week to be assessed at $900/mt Wednesday. Northeast Asia origin cargoes

were heard traded this week at $900-$910/mt CFR India. The CFR China marker fell $7/mt from last week to $850/mt

Wednesday, amid weak buying sentiment as the Chinese stock market crashed on Monday. Traded levels were heard

in the range of $850-$860/mt CFR China this week. The CFR Southeast Asia marker fell $5/mt week on week to be

assessed at $845/mt Wednesday, as buying interests remained weak. Traded levels were heard around $830-850/mt

CFR Southeast Asia this week. Domestic China ethylene-based PVC was assessed at Yuan 5,850/mt Wednesday, while

carbide-based PVC was assessed at Yuan 5,400/mt, both down Yuan 100/mt from last week. Delivered cargoes for

ethylene-based PVC were heard traded mostly at Yuan 5,800-Yuan 5,900/mt, while delivered cargoes for carbide-based

PVC were heard traded at around Yuan 5,400/mt this week.

ContactDetails:344,AtoZIndl.Estate,G.K.Marg,LowerParel(w),Mumbai400013,INDIA|Email:info@polymerupdate.com|Tel:+912261772000(25lines)|Fax:+912261772025

Week 30 July 29, 2015

POLYMERUPDATE - PVC MARKET SUPPLY SCENARIO

VCM plant to be restarted by

Taiwan VCM

Taiwan VCM to resume operations at

vinyl chloride monomer (VCM) plant.

The plant was shut on July 9, 2015 for

annual maintenance turnaround. The

plant is likely to resume production

this week. Located in Lin Yuan,

Taiwan, the VCM plant has a

production

capacity of 420,000

mt/year.

R

A

S

S

A

D

MU

VCM plant operated by SP

Chemicals at lower rates

SP Chemicals is running its vinyl

chloride monomer (VCM) plant at

curtailed levels. The plant is operating

at 40% of production capacity.

Located in Jiangsu, China, the plant

has a production capacity of 300,000

mt/year.

PVC line restarted by Hanwha

Chemical

Hanwha Chemical has restarted

operations at one of the two PVC

lines. The company had enforced FM

on PVC supplies on July 7, 2015 after

an explosion at the plant. The

company has restarted operations at one PVC line recently while the other line will remain shut till mid-August 2015. Located Ulsan in South Korea, the PVC plant comprises of two lines with a combined production

capacity of 210,000 mt/year.

PVC plant likely to be restarted by Yili Nangang

Yili Nangang Chemical is in plans to restart a polyvinyl chloride (PVC) plant following maintenance turnaround. The plant is likely to restart in end-July 2015. It was shut on June 25, 2015. Located in Xinjiang, China,

the plant has a production capacity of 120,000 mt/year.

ContactDetails:344,AtoZIndl.Estate,G.K.Marg,LowerParel(w),Mumbai400013,INDIA|Email:info@polymerupdate.com|Tel:+912261772000(25lines)|Fax:+912261772025

Week 30 July 29, 2015

PLATTS Price Analysis of PVC Chain Processing Margins

Naphtha to Ethylene

Naphtha to PVC

R

A

S

AS

Typical North East Asian $/mt margin for producing ethylene

from naphtha using a conversion cost of $350/mt

Ethylene to PVC

UD

Premium or discount of CFR FE Asia PVC prices compared to ethylene

Premium or discount of CFR FE Asia PVC prices over naphtha

PVC : VCM Ratio

CFR FE Asia PVC prices as a ratio to VCM

ContactDetails:344,AtoZIndl.Estate,G.K.Marg,LowerParel(w),Mumbai400013,INDIA|Email:info@polymerupdate.com|Tel:+912261772000(25lines)|Fax:+912261772025

Week 30 July 29, 2015

CRISIL Research Macroeconomics & Currency Monthly Analysis

Overview: On exports, worry beads forming

After falling by 1.5% in 2014-15, merchandise exports from India plunged 16.8% in the first 3 months ofthis fiscal. What went wrong?

The export destinations are not doing well, prices of many export items have fallen and the rupee, too,has appreciated in real terms

against the basket of 36 countries. Weakgrowth in the US economy in the first quarterwould have contributed to the sharp slide in

India'sexports as well.But our preliminary analysis shows the decline in exports is higher than warranted by these factors. That isto

say, the decline isnt merely cyclical; there could be structural elements at play as well. The cyclicalcomponent of the exports will move

up when cyclical factors (world GDP growth, prices) turn favourable,but structural factors, if not addressed, will continue to act as a

drag on India's export performance.The slowdown in trade is not unique to India. An IMF study (2014) notes that a part of the global

tradeslowdown since the crisis has been driven by structural, not cyclical factors. Theslowdown in trade could reflect deeper, structural

factors, such as a rise in protectionism or a change inglobal production schemes throughout the world.In the case of India, there are

additional worries. Falling competitiveness is another structural factorrestricting export growth. For key export items such as gems &

jewellery and textiles, RevealedComparative Advantage has come down over the years. Recently,the Indian commerce secretary also

expressed concerns on falling competitiveness of Indian exports due toinfrastructure and easing of doing business issues.Another

concern is the threat emanating from treaties such as Trans Pacific Partnership(TPP), which is being forged between 12 countries,

including the US. By not being a part of TPP, India riskslosing out a significant chunk of its export market; TPP countries account for

25% of Indias exports.Indeed, India needs to address export-related issues on a war footing.

R

A

S

S

A

D

MU

IIP indicates industry growth gaining traction

Industrial production growth inched down to 2.7% in May from 3.4% in April. However, despite the volatility, IIP numbers have

averaged at a higher level in 2015 - at 3.5% since January 2015 as compared to 1.4% in the 5 months prior to that. Therefore, IIP

data suggests an improvement in industrial activity this year in comparison to 2014, so far. In May, IIP growth slowed as the

manufacturing sector lost momentum on the back of weak performance of consumer-oriented sectors. Unseasonal rains earlier in the

year, resulting in lower rural demand, are weighing on consumer goods. This is reflected in lower two-wheeler and tractor sales in

April and May. Therefore, favourable distribution of rainfall so far and deficiency at -4% of long term average - much lower than last

year - is a welcome respite.

ContactDetails:344,AtoZIndl.Estate,G.K.Marg,LowerParel(w),Mumbai400013,INDIA|Email:info@polymerupdate.com|Tel:+912261772000(25lines)|Fax:+912261772025

Week 30 July 29, 2015

Inflation crawls up in June

Inflation inched up to 5.4% from 5% in May due to a 70 bps increase in food inflation. Higher protein inflation -9.7% in June compared with

8.2% in May - was behind the food inflation rise. Inflation in pulses crossed 22% in June as production suffered largely a result of a weak

monsoon last year and damage to crops from unseasonal rains this year. So far, the monsoon scenario remains favourable, with rainfall at

4% below the long term average as on July 8, 2015. But, healthy and well-distributed rainfall in July and August will be crucial. We go by

Indian Meteorological Departments forecast of 12% deficient rainfall, but assume distribution remains normal, and the government

undertakes proactive steps to contain food inflation. We, therefore, expect CPI inflation at 5.8% in 2015-16, down from 6% in 2014-15. Core

inflation rose 20 bps to 5.3% in June, a slower climb compared to 40 bps in May. The pick-up came from a sharp jump in personal care and

effects (up 120 bps) and in household services, health, transport and communication and, recreation and amusement (all up 30 bps).

R

A

S

Rupee stays put in June

The rupee averaged 63.9/$, hardly changed from 63.8/$ in May. However, it fell to 71.6 against the euro from71.2 in May. In the first half

of June, the rupee hovered between 64.2/$ and 63.8/$, and rose to 63.5/$ in the second half as weak employment data dragged the US

dollar down. However, as uncertainty on Greece loomed large in the last week of June, the rupee lost some ground, closing at 63.8/$.

There was also no support from FIIs, with net outflows continuing for the second consecutive month.

S

A

D

MU

About CRISIL Research

CRISIL Research is India's largest independent and integrated research house. We provide insights, opinions, and analysis on the Indian economy, industries, capital markets and companies. We are India's most credible

provider of economy and industry research. Our industry research covers 70 sectors and is known for its rich insights and perspectives. Our analysis is supported by inputs from our network of more than 4,500 primary

sources, including industry experts, industry associations, and trade channels. We play a key role in India's fixed income markets. We are India's largest provider of valuations of fixed income securities, serving the mutual

fund, insurance, and banking industries. We are the sole provider of debt and hybrid indices to India's mutual fund and life insurance industries. We pioneered independent equity research in India, and are today India's largest

independent equity research house. Our defining trait is the ability to convert information and data into expert judgements and forecasts with complete objectivity. We leverage our deep understanding of the macroeconomy

and our extensive sector coverage to provide unique insights on micro-macro and cross-sectoral linkages. We deliver our research through an innovative web-based research platform. Our talent pool comprises economists,

sector experts, company analysts, and information management specialists.

ContactDetails:344,AtoZIndl.Estate,G.K.Marg,LowerParel(w),Mumbai400013,INDIA|Email:info@polymerupdate.com|Tel:+912261772000(25lines)|Fax:+912261772025

Week 30 July 29, 2015

POLYMERUPDATE

PLATTS

Editorial Contact:

Global Editorial Director, Petrochemicals: Simon Thorne

Director, Editorial: Jwalant Oza

Managing Editor: Prema Viswanathan

Senior Editors: Harsh Nadkarni, Feroz Khan

Singapore Editors: Gustav Holmvik, Ng Bao Ying, Michelle Kim, Heng Hui, Genevieve Soong,

Maithreyi Ramdas, Pamela Sumayao, Jennifer Lee

Sales Contact:

Marketing Managers: Reshma Jadhav, Tausif Siddiqi, Nilesh Shah

Tokyo Editors: Fumiko Dobashi, Anton Ferkov

About Polymerupdate: Polymerupdate is a destination for global players seeking plastics and petrochemical intelligence. We are a world renowned provider of real time news and price alerts spanning a whole spectrum of

products including Crude oil, Naphtha, Aromatics, Olefins, Polyolefins and Petrochemical Intermediates.

R

A

S

Credible, neutral and regular reporting has attracted over a thousand subscribers who include most of the regions leading resin producers, processors, distributors, traders, consultant firms, investment bankers, credit rating

agencies, as well as front runners in the international information services, news and media companies.

To further facilitate its readers, Polymerupdate recently launched the World's 1st Android & Blackberry Applications for daily polymer news & prices. Polymerupdate through it's daily alerts helps companies worldwide increase

their revenues and their profits, by providing them with real time, quality, valuable and business critical information. With its well appointed stringers and channel partners from across the world, Polymerupdate is rapidly

extending its reach within the industry, as it strives toward its goal of becoming the number one player in its space globally. Additional information available on http://www.polymerupdate.com .

S

A

D

MU

Copyright (C) 2015 Shalimar Infotech Pvt. Ltd. ALL RIGHTS RESERVED: Shalimar Infotech Pvt. Ltd. makes no warranties as to the accuracy of information, or results to be obtained from use. No portion of this

publication may be photocopied, reproduced, retransmitted, put into a computer system or otherwise redistributed without prior written authorization from Polymerupdate.com. Polymerupdate.com is a TRADEMARK of Shalimar

Infotech Pvt. Ltd.

About Platts: Founded in 1909, Platts is a leading global provider of energy, petrochemicals and metals information and a premier source of benchmark prices for the physical and futures markets. Platts' news, pricing,

analytics, commentary and conferences help customers make better-informed trading and business decisions and help the markets operate with greater transparency and efficiency. Customers in more than 150 countries

benefit from Platts coverage of the carbon emissions, coal, electricity, oil, natural gas, metals, nuclear power, petrochemical, and shipping markets. A division of The McGraw-Hill Companies (NYSE: MHP), Platts is

headquartered in New York with approximately 900 employees in more than 15 offices worldwide. Additional information is available at www.platts.com .

Platts content copyright 2015: Copyright 2015 The McGraw-Hill Companies. All rights reserved. No portion of this publication may be photocopied, reproduced, retransmitted, put into a computer system or otherwise

redistributed without prior written authorization from Platts. Platts is a trademark of The McGraw-Hill Companies Inc. Information has been obtained from sources believed reliable. However, because of the possibility of human

or mechanical error by sources, McGraw-Hill or others, McGraw-Hill does not guarantee the accuracy, adequacy or completeness of any such information and is not responsible for any errors or omissions or for results obtained

from use of such information. See back of publication invoice for complete terms and conditions.

About The McGraw-Hill Companies: McGraw-Hill announced on September 12, 2011, its intention to separate into two companies: McGraw-Hill Financial, a leading provider of content and analytics to global financial

markets, and McGraw-Hill Education, a leading education company focused on digital learning and education services worldwide. McGraw-Hill Financials leading brands include Standard & Poors Ratings Services, S&P Capital

IQ, S&P Dow Jones Indices, Platts energy information services and J.D. Power and Associates. With sales of $6.2 billion in 2011, the Corporation has approximately 23,000 employees across more than 280 offices in 40

countries. Additional information is available at http://www.mcgraw-hill.com/ .

ContactDetails:344,AtoZIndl.Estate,G.K.Marg,LowerParel(w),Mumbai400013,INDIA|Email:info@polymerupdate.com|Tel:+912261772000(25lines)|Fax:+912261772025

Anda mungkin juga menyukai

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- Up To 2020-02-18 - HSBC Business Direct Portfolio Summary 02 - StatementDokumen3 halamanUp To 2020-02-18 - HSBC Business Direct Portfolio Summary 02 - StatementLevi dos SantosBelum ada peringkat

- International Macroeconomics 3rd Edition Feenstra Taylor Solution ManualDokumen7 halamanInternational Macroeconomics 3rd Edition Feenstra Taylor Solution Manuallynne100% (25)

- Polymer Additive Reference StandardsDokumen36 halamanPolymer Additive Reference StandardsvasucristalBelum ada peringkat

- Polymerscan: Americas Polymer Spot Price AssessmentsDokumen28 halamanPolymerscan: Americas Polymer Spot Price AssessmentsmcontrerjBelum ada peringkat

- Dynisco Extrusion Handbook C0d23eDokumen293 halamanDynisco Extrusion Handbook C0d23eSimas Servutas50% (2)

- Extruder Screw Desing Basics PDFDokumen54 halamanExtruder Screw Desing Basics PDFAlvaro Fernando Reyes Castañeda100% (6)

- Starbucks Marketing Strategies in ChinaDokumen81 halamanStarbucks Marketing Strategies in ChinaM.Maulana Iskandar Zulkarnain70% (10)

- KFC China Building Competitive Advantages Through DigitizationDokumen16 halamanKFC China Building Competitive Advantages Through Digitizationshamitha123100% (1)

- Po 20140924Dokumen29 halamanPo 20140924mcontrerjBelum ada peringkat

- Po 20140910Dokumen30 halamanPo 20140910mcontrerjBelum ada peringkat

- Platts PP 27 May 2015Dokumen11 halamanPlatts PP 27 May 2015mcontrerjBelum ada peringkat

- Polymerscan: Americas Polymer Spot Price AssessmentsDokumen29 halamanPolymerscan: Americas Polymer Spot Price AssessmentsmcontrerjBelum ada peringkat

- Aditivo AglomeranteDokumen11 halamanAditivo AglomerantemcontrerjBelum ada peringkat

- ScrewDokumen9 halamanScrewmcontrerjBelum ada peringkat

- Belgian Punishment Novel Explores WWII Era SocietyDokumen5 halamanBelgian Punishment Novel Explores WWII Era SocietymcontrerjBelum ada peringkat

- Platts Pe 24 June 2015Dokumen12 halamanPlatts Pe 24 June 2015mcontrerjBelum ada peringkat

- Platts PVC 24 June 2015Dokumen10 halamanPlatts PVC 24 June 2015mcontrerjBelum ada peringkat

- Platts PE 29 July 2015Dokumen14 halamanPlatts PE 29 July 2015mcontrerjBelum ada peringkat

- Platts PP 24 June 2015Dokumen11 halamanPlatts PP 24 June 2015mcontrerjBelum ada peringkat

- Platts PP 29 July 2015Dokumen11 halamanPlatts PP 29 July 2015mcontrerjBelum ada peringkat

- Platts Pe 24 June 2015Dokumen12 halamanPlatts Pe 24 June 2015mcontrerjBelum ada peringkat

- Platts PVC 26 August 2015Dokumen10 halamanPlatts PVC 26 August 2015mcontrerjBelum ada peringkat

- Platts PE 26 August 2015Dokumen13 halamanPlatts PE 26 August 2015mcontrerjBelum ada peringkat

- Platts PP 23 Sept 2015Dokumen11 halamanPlatts PP 23 Sept 2015mcontrerjBelum ada peringkat

- Platts PP 26 August 2015Dokumen11 halamanPlatts PP 26 August 2015mcontrerjBelum ada peringkat

- SAP 120-200 MeshDokumen1 halamanSAP 120-200 MeshmcontrerjBelum ada peringkat

- Platts PVC 23 Sept 2015Dokumen10 halamanPlatts PVC 23 Sept 2015mcontrerjBelum ada peringkat

- Major Application Areas of BentoniteDokumen125 halamanMajor Application Areas of BentoniteApsari Puspita AiniBelum ada peringkat

- NW 15092014 000000 PDFDokumen11 halamanNW 15092014 000000 PDFmcontrerjBelum ada peringkat

- Platts PE 23 Sept 2015Dokumen14 halamanPlatts PE 23 Sept 2015mcontrerjBelum ada peringkat

- Role of Rheology in ExtrusionDokumen25 halamanRole of Rheology in Extrusionmshussein2009Belum ada peringkat

- Role of Rheology in ExtrusionDokumen25 halamanRole of Rheology in Extrusionmshussein2009Belum ada peringkat

- Analysis of South Africa's EconomyDokumen12 halamanAnalysis of South Africa's EconomyKeven NgetiBelum ada peringkat

- Problem 1.9 Americo's Earnings and The Fall of The Dollar: Appreciation CaseDokumen4 halamanProblem 1.9 Americo's Earnings and The Fall of The Dollar: Appreciation CaseSamerBelum ada peringkat

- The Hegemony of The US DollarDokumen4 halamanThe Hegemony of The US DollarJoey MartinBelum ada peringkat

- Contractor - Att. 2A - Mover SOR - ContractDokumen5 halamanContractor - Att. 2A - Mover SOR - ContractMatthew Ho Choon LimBelum ada peringkat

- Case Preliminary BizzitDokumen13 halamanCase Preliminary BizzitAndrew KPBelum ada peringkat

- 人民币 人民币 至印尼盾 汇率 Chinese RMB Yuan to Indonesian Rupiah Exchange RateDokumen3 halaman人民币 人民币 至印尼盾 汇率 Chinese RMB Yuan to Indonesian Rupiah Exchange RateEster EngkaBelum ada peringkat

- Select Technology and Business College Department of Accounting and FinanceDokumen8 halamanSelect Technology and Business College Department of Accounting and FinanceZedo Sis100% (1)

- Materi Remittance Presentasi BNTT - 14 Okt 23Dokumen167 halamanMateri Remittance Presentasi BNTT - 14 Okt 23Selfiana GoethaBelum ada peringkat

- IMF Report On China 2011Dokumen83 halamanIMF Report On China 2011Douglas FunkBelum ada peringkat

- Market EconomyDokumen84 halamanMarket EconomyRazvan OracelBelum ada peringkat

- The US DollarDokumen3 halamanThe US DollarChris Mae Vinson DalumpinesBelum ada peringkat

- 3-A027-National Systems of Innovation Toward A Theory of Innovation and Interactive Learning by Lundvall, Bengt-Åke (Z-LibDokumen18 halaman3-A027-National Systems of Innovation Toward A Theory of Innovation and Interactive Learning by Lundvall, Bengt-Åke (Z-Libwen zhangBelum ada peringkat

- Basics of ImportationDokumen36 halamanBasics of Importationadebisiakinleye14Belum ada peringkat

- Final Exam Sample Questions Attempt Review 2Dokumen9 halamanFinal Exam Sample Questions Attempt Review 2leieparanoicoBelum ada peringkat

- Asian Banks: China Debt: Testing The "Impossible Trinity"Dokumen37 halamanAsian Banks: China Debt: Testing The "Impossible Trinity"Richard WoolhouseBelum ada peringkat

- Shanghai Jiaotong University Long Term Chinese Language Course-Part Time PDFDokumen3 halamanShanghai Jiaotong University Long Term Chinese Language Course-Part Time PDFAnonymous o8LpDTNj100% (1)

- China Minerals 2017–2018 Advance ReleaseDokumen30 halamanChina Minerals 2017–2018 Advance Release崔文政[2B30] TSUI MAN CHINGBelum ada peringkat

- SR03 017918 1571Dokumen2 halamanSR03 017918 1571Genki Anime GirlBelum ada peringkat

- China A Inclusion Consultation - Thierry PollaDokumen16 halamanChina A Inclusion Consultation - Thierry PollaThierry PollaBelum ada peringkat

- BHR 03-11-2019 13th Board Meeting Materials Revised Per Bod DiscussionDokumen41 halamanBHR 03-11-2019 13th Board Meeting Materials Revised Per Bod DiscussionJim HoftBelum ada peringkat

- Forex ProblemsDokumen17 halamanForex ProblemsFoo Chuan Mao100% (1)

- Currency WarDokumen8 halamanCurrency WarrahulBelum ada peringkat

- A Modern History of Chinas Art Market (Kejia Wu) (Z-Library) - CompressedDokumen281 halamanA Modern History of Chinas Art Market (Kejia Wu) (Z-Library) - CompressedTS RFBelum ada peringkat

- Escaping The Middle-Income Trap - Lili Wang and Yi WenDokumen35 halamanEscaping The Middle-Income Trap - Lili Wang and Yi WenSebastian LeonBelum ada peringkat

- Country Analysis (China) .Dokumen35 halamanCountry Analysis (China) .AsadChishtiBelum ada peringkat

- Dickens Breakfast SceneDokumen29 halamanDickens Breakfast SceneHamza WaleedBelum ada peringkat