Notice: Agency Information Collection Activities Proposals, Submissions, and Approvals

Diunggah oleh

Justia.comJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Notice: Agency Information Collection Activities Proposals, Submissions, and Approvals

Diunggah oleh

Justia.comHak Cipta:

Format Tersedia

Federal Register / Vol. 70, No.

78 / Monday, April 25, 2005 / Notices 21271

maintenance, and purchase of services of a dual consolidated loss or payment DEPARTMENT OF THE TREASURY

to provide information. of the associated interest charge. The

Approved: April 15, 2005. regulations provide for the filing of Internal Revenue Service

Glenn P. Kirkland,

certain agreements in such cases. This

document also makes clarifying and Proposed Collection; Comment

IRS Reports Clearance Officer. Request for Revenue Procedure 2002–

conforming changes to the current

[FR Doc. E5–1952 Filed 4–22–05; 8:45 am] regulations. 32

BILLING CODE 4830–01–P

Current Actions: There are no changes AGENCY: Internal Revenue Service (IRS),

being made to this existing regulation. Treasury.

DEPARTMENT OF THE TREASURY Type of Review: Extension of ACTION: Notice and request for

currently approved collection. comments.

Internal Revenue Service

Affected Public: Business or other for- SUMMARY: The Department of the

[REG–106879–00] profit organizations. Treasury, as part of its continuing effort

Estimated Number of Respondents: to reduce paperwork and respondent

Proposed Collection; Comment burden, invites the general public and

Request for Regulation Project 30.

other Federal agencies to take this

Estimated Time Per Respondent: 2 opportunity to comment on proposed

AGENCY: Internal Revenue Service (IRS), hours.

Treasury. and/or continuing information

Estimated Total Annual Burden collections, as required by the

ACTION: Notice and request for

Hours: 60. Paperwork Reduction Act of 1995,

comments.

The following paragraph applies to all Public Law 104–13 (44 U.S.C.

SUMMARY: The Department of the of the collections of information covered 3506(c)(2)(A)). Currently, the IRS is

Treasury, as part of its continuing effort by this notice: soliciting comments concerning

to reduce paperwork and respondent Revenue Procedure 2002–32, Waiver of

An agency may not conduct or 60-month Bar on Reconsolidation after

burden, invites the general public and sponsor, and a person is not required to

other Federal agencies to take this Disaffiliation.

respond to, a collection of information

opportunity to comment on proposed unless the collection of information DATES: Written comments should be

and/or continuing information displays a valid OMB control number. received on or before June 24, 2005 to

collections, as required by the Books or records relating to a collection be assured of consideration.

Paperwork Reduction Act of 1995, of information must be retained as long ADDRESSES: Direct all written comments

Public Law 104–13 (44 U.S.C. as their contents may become material to Glenn P. Kirkland, Internal Revenue

3506(c)(2)(A)). Currently, the IRS is in the administration of any internal Service, Room 6516, 1111 Constitution

soliciting comments concerning existing revenue law. Generally, tax returns and Avenue, NW., Washington, DC 20224.

final regulation, REG–106879–00, Dual tax return information are confidential, FOR FURTHER INFORMATION CONTACT:

Consolidated Loss Recapture Events. as required by 26 U.S.C. 6103. Requests for additional information or

DATES: Written comments should be copies of revenue procedure should be

Request for Comments: Comments

received on or before June 24, 2005 to directed to Allan Hopkins, at (202) 622–

submitted in response to this notice will

be assured of consideration. 6665, or at Internal Revenue Service,

be summarized and/or included in the

ADDRESSES: Direct all written comments request for OMB approval. All Room 6516, 1111 Constitution Avenue,

to Glenn P. Kirkland, Internal Revenue comments will become a matter of NW., Washington, DC 20224, or through

Service, Room 6516, 1111 Constitution public record. the Internet, at

Avenue NW., Washington, DC 20224. Allan.M.Hopkins@irs.gov.

Comments are invited on: (a) Whether

FOR FURTHER INFORMATION CONTACT: SUPPLEMENTARY INFORMATION:

the collection of information is

Requests for additional information or necessary for the proper performance of Title: Waiver of 60-moth Bar on

copies of the regulations should be the functions of the agency, including Reconsolidation after Disaffiliation.

directed to R. Joseph Durbala at Internal OMB Number: 1545–1784.

whether the information shall have Revenue Procedure Number: Revenue

Revenue Service, Room 6516, 1111 practical utility; (b) the accuracy of the

Constitution Avenue NW., Washington, Procedure 2002–32.

agency’s estimate of the burden of the Abstract: Revenue Procedure 2002–32

DC 20224, or at (202) 622–3634, or collection of information; (c) ways to

through the Internet at provides qualifying taxpayers with a

enhance the quality, utility, and clarity waiver of the general rule of

RJoseph.Durbala@irs.gov. of the information to be collected; (d) § 1504(a)(3)(A) of the Internal Revenue

SUPPLEMENTARY INFORMATION: ways to minimize the burden of the Code barring corporations from filing

Title: Dual Consolidated Loss collection of information on consolidated returns as a member of a

Recapture Events. respondents, including through the use group of which it had been a member

OMB Number: 1545–1796. Regulation of automated collection techniques or for 60 months following the year of

Project Number: REG–106879–00 other forms of information technology; disaffiliation.

(Final). and (e) estimates of capital or start-up Current Actions: There are no changes

Abstract: This document contains costs and costs of operation, being made to the revenue procedure at

final regulations under section 1503(d) maintenance, and purchase of services this time.

regarding the events that require the to provide information. Type of Review: Extension of a

recapture of dual consolidated losses. Approved: April 20, 2005. currently approved collection.

These regulations are issued to facilitate Affected Public: Business or other for-

Glenn P. Kirkland,

compliance by taxpayers with the dual profit organizations.

consolidated loss provisions. The IRS Reports Clearance Officer. Estimated number of respondents: 20.

regulations generally provide that [FR Doc. E5–1953 Filed 4–22–05; 8:45 am] The estimated annual burden per

certain events will not trigger recapture BILLING CODE 4830–01–P respondent varies from 2 hours to 8

VerDate jul<14>2003 15:40 Apr 22, 2005 Jkt 205001 PO 00000 Frm 00099 Fmt 4703 Sfmt 4703 E:\FR\FM\25APN1.SGM 25APN1

Anda mungkin juga menyukai

- Federal Income Tax: a QuickStudy Digital Law ReferenceDari EverandFederal Income Tax: a QuickStudy Digital Law ReferenceBelum ada peringkat

- Topic: Tax Refunds Commissioner of Internal Revenue V. Univation Motor Philippines, Inc. (Formerly Nissan Motor Philippines)Dokumen2 halamanTopic: Tax Refunds Commissioner of Internal Revenue V. Univation Motor Philippines, Inc. (Formerly Nissan Motor Philippines)Joshua Erik MadriaBelum ada peringkat

- Bank Robbery Suspects Allegedly Bragged On FacebookDokumen16 halamanBank Robbery Suspects Allegedly Bragged On FacebookJustia.comBelum ada peringkat

- 49 Insights June 2022V2Dokumen24 halaman49 Insights June 2022V2Rheneir MoraBelum ada peringkat

- Philippine Declaration of IndependenceDokumen2 halamanPhilippine Declaration of Independenceelyse yumul100% (1)

- Barbri Notes Personal JurisdictionDokumen28 halamanBarbri Notes Personal Jurisdictionaconklin20100% (1)

- Tax Alert (December 2020)Dokumen10 halamanTax Alert (December 2020)Rheneir MoraBelum ada peringkat

- Aichi Forging Company of Asia Inc Vs Cta Enbanc and CirDokumen2 halamanAichi Forging Company of Asia Inc Vs Cta Enbanc and CirJessica Nubla100% (1)

- DIGEST - Sitel Philippines Corp. v. CIRDokumen3 halamanDIGEST - Sitel Philippines Corp. v. CIRAgatha ApolinarioBelum ada peringkat

- CIR V Deutsche Knowledge ServicesDokumen3 halamanCIR V Deutsche Knowledge ServicesWilbert ChongBelum ada peringkat

- Critical RegionalismDokumen8 halamanCritical RegionalismHarsh BhatiBelum ada peringkat

- Cir V. Team Sual Corporation: Doctrine/SDokumen3 halamanCir V. Team Sual Corporation: Doctrine/SDaLe AparejadoBelum ada peringkat

- CIR V Deutsche Knowledge ServicesDokumen3 halamanCIR V Deutsche Knowledge ServicesRobert Manto100% (1)

- DIGEST - Sitel Philippines Corp. v. CIRDokumen3 halamanDIGEST - Sitel Philippines Corp. v. CIRAgatha ApolinarioBelum ada peringkat

- Deutsche Bank AG Manila Branch v. Commissioner of Internal Revenue, G.R. No. 18850, August 19, 2013Dokumen2 halamanDeutsche Bank AG Manila Branch v. Commissioner of Internal Revenue, G.R. No. 18850, August 19, 2013Dominique VasalloBelum ada peringkat

- ROHM Apollo Semiconductor Philippines vs. CIRDokumen8 halamanROHM Apollo Semiconductor Philippines vs. CIRred gynBelum ada peringkat

- US Internal Revenue Service: 12256402Dokumen6 halamanUS Internal Revenue Service: 12256402IRSBelum ada peringkat

- US Internal Revenue Service: 10274002Dokumen7 halamanUS Internal Revenue Service: 10274002IRSBelum ada peringkat

- Federal Register-02-28062Dokumen2 halamanFederal Register-02-28062POTUSBelum ada peringkat

- Description: Tags: 120302eDokumen2 halamanDescription: Tags: 120302eanon-247808Belum ada peringkat

- Federal Register-02-28477Dokumen1 halamanFederal Register-02-28477POTUSBelum ada peringkat

- Federal Register-02-28262Dokumen2 halamanFederal Register-02-28262POTUSBelum ada peringkat

- Federal Register-02-28261Dokumen1 halamanFederal Register-02-28261POTUSBelum ada peringkat

- Federal Register-02-28361Dokumen2 halamanFederal Register-02-28361POTUSBelum ada peringkat

- Federal Register-02-28295Dokumen1 halamanFederal Register-02-28295POTUSBelum ada peringkat

- US Internal Revenue Service: 11943601Dokumen7 halamanUS Internal Revenue Service: 11943601IRSBelum ada peringkat

- US Internal Revenue Service: I1120icd - 1994Dokumen16 halamanUS Internal Revenue Service: I1120icd - 1994IRSBelum ada peringkat

- Federal Register-02-28545Dokumen2 halamanFederal Register-02-28545POTUSBelum ada peringkat

- Federal Register-02-28464Dokumen1 halamanFederal Register-02-28464POTUSBelum ada peringkat

- Description: Tags: 120701bDokumen2 halamanDescription: Tags: 120701banon-814387Belum ada peringkat

- 258791Dokumen26 halaman258791jemybanez81Belum ada peringkat

- LANDCASTERDokumen36 halamanLANDCASTERKathleneGabrielAzasHaoBelum ada peringkat

- Treasury RFI SOFR FRN3Dokumen3 halamanTreasury RFI SOFR FRN3LaLa BanksBelum ada peringkat

- 2020-09801 2 PDFDokumen6 halaman2020-09801 2 PDFchristianBelum ada peringkat

- UDokumen53 halamanUvmanalo16Belum ada peringkat

- Two-year prescriptive period and 120+30 day rule for filing administrative and judicial claims for tax refunds or creditsDokumen3 halamanTwo-year prescriptive period and 120+30 day rule for filing administrative and judicial claims for tax refunds or creditsBeryl Joyce BarbaBelum ada peringkat

- CIR vs. AICHI PDFDokumen20 halamanCIR vs. AICHI PDFpa0l0sBelum ada peringkat

- Instructions For Form 1120S: U.S. Income Tax Return For An S CorporationDokumen19 halamanInstructions For Form 1120S: U.S. Income Tax Return For An S CorporationIRSBelum ada peringkat

- Excess Input Tax or Creditable Input: - Second DivisionDokumen29 halamanExcess Input Tax or Creditable Input: - Second DivisionAsHervea AbanteBelum ada peringkat

- 12) Commr. v. Aichi Forging, G.R. No. 184823 PDFDokumen25 halaman12) Commr. v. Aichi Forging, G.R. No. 184823 PDFJosemariaBelum ada peringkat

- Preweek Taxation Law 2017 PDFDokumen48 halamanPreweek Taxation Law 2017 PDFAnonymous kiom0L1FqsBelum ada peringkat

- ESCRA - CIR vs. Aichi Forging Co.Dokumen24 halamanESCRA - CIR vs. Aichi Forging Co.Guiller MagsumbolBelum ada peringkat

- Western Mindanao Power Corp. vs. CIR Dispute Over VAT RefundDokumen7 halamanWestern Mindanao Power Corp. vs. CIR Dispute Over VAT RefundJonjon BeeBelum ada peringkat

- Q & A 2018 Mock BarDokumen6 halamanQ & A 2018 Mock BarAbhor TyrannyBelum ada peringkat

- 1 Sitel Vs CIR Input VATDokumen25 halaman1 Sitel Vs CIR Input VATKris OrenseBelum ada peringkat

- 14 CIR v. Aichi Forging Company of Asia Inc.Dokumen24 halaman14 CIR v. Aichi Forging Company of Asia Inc.Anonymous 8liWSgmIBelum ada peringkat

- CBK Power Company Limited, Petitioner, vs. Commissioner of Internal Revenue, RespondentDokumen10 halamanCBK Power Company Limited, Petitioner, vs. Commissioner of Internal Revenue, RespondentJay CezarBelum ada peringkat

- Search Result: Case TitleDokumen28 halamanSearch Result: Case Titleic corBelum ada peringkat

- Master Circular Service TaxDokumen8 halamanMaster Circular Service Taxpadmanabha14Belum ada peringkat

- So Ordered.: Velasco, JR., Peralta, Mendoza and Sereno, JJ.Dokumen25 halamanSo Ordered.: Velasco, JR., Peralta, Mendoza and Sereno, JJ.RomBelum ada peringkat

- CIR Vs Achi 2010Dokumen24 halamanCIR Vs Achi 2010Christelle Ayn BaldosBelum ada peringkat

- Sitel Philippines Corporation vs. Commissioner of Internal Revenue, 817 SCRA 193, February 08, 2017Dokumen21 halamanSitel Philippines Corporation vs. Commissioner of Internal Revenue, 817 SCRA 193, February 08, 2017Vida MarieBelum ada peringkat

- CIR Vs AichiDokumen24 halamanCIR Vs AichiElaine GuayBelum ada peringkat

- US Internal Revenue Service: 10534401Dokumen9 halamanUS Internal Revenue Service: 10534401IRSBelum ada peringkat

- RMO 47-2020 - Consolidated VAT RefundDokumen36 halamanRMO 47-2020 - Consolidated VAT Refunduno_01Belum ada peringkat

- Commissioner of Internal Revenue vs. Univation Motor Philippines, Inc. (Formerly Nissan Motor Philippines, Inc.), 901 SCRA 512, April 10, 2019Dokumen18 halamanCommissioner of Internal Revenue vs. Univation Motor Philippines, Inc. (Formerly Nissan Motor Philippines, Inc.), 901 SCRA 512, April 10, 2019j0d3Belum ada peringkat

- Description: Tags: 060600eDokumen2 halamanDescription: Tags: 060600eanon-237556Belum ada peringkat

- Federal Register-02-28273Dokumen1 halamanFederal Register-02-28273POTUSBelum ada peringkat

- US Internal Revenue Service: A-02-96Dokumen4 halamanUS Internal Revenue Service: A-02-96IRSBelum ada peringkat

- 10.-Commissioner of Internal Revenue v. Philex20210508-12-154gc7kDokumen16 halaman10.-Commissioner of Internal Revenue v. Philex20210508-12-154gc7kMarj BaquialBelum ada peringkat

- Federal Register 02 28061Dokumen2 halamanFederal Register 02 28061POTUSBelum ada peringkat

- J.R.a. Philippines, Inc. vs. Commissioner of Internal RevenueDokumen5 halamanJ.R.a. Philippines, Inc. vs. Commissioner of Internal Revenuevince005Belum ada peringkat

- Revenue Memo Authorizes TVN for Additional Refund ClaimsDokumen2 halamanRevenue Memo Authorizes TVN for Additional Refund ClaimsPAMELA KALAWBelum ada peringkat

- Tax Batch 3Dokumen18 halamanTax Batch 3Alyssa CornejoBelum ada peringkat

- Statutory Construction CasesDokumen83 halamanStatutory Construction CasesSherlock YookieBelum ada peringkat

- Arbabsiar ComplaintDokumen21 halamanArbabsiar ComplaintUSA TODAYBelum ada peringkat

- Brandon Marshall Stabbing by Wife: Domestic Violence Arrest ReportDokumen1 halamanBrandon Marshall Stabbing by Wife: Domestic Violence Arrest ReportJustia.comBelum ada peringkat

- Divorced Husband's $48,000 Lawsuit Over Wedding Pics, VideoDokumen12 halamanDivorced Husband's $48,000 Lawsuit Over Wedding Pics, VideoJustia.comBelum ada peringkat

- U.S. v. Rajat K. GuptaDokumen22 halamanU.S. v. Rajat K. GuptaDealBook100% (1)

- Clergy Abuse Lawsuit Claims Philadelphia Archdiocese Knew About, Covered Up Sex CrimesDokumen22 halamanClergy Abuse Lawsuit Claims Philadelphia Archdiocese Knew About, Covered Up Sex CrimesJustia.comBelum ada peringkat

- Signed Order On State's Motion For Investigative CostsDokumen8 halamanSigned Order On State's Motion For Investigative CostsKevin ConnollyBelum ada peringkat

- USPTO Rejection of Casey Anthony Trademark ApplicationDokumen29 halamanUSPTO Rejection of Casey Anthony Trademark ApplicationJustia.comBelum ada peringkat

- Amended Poker Civil ComplaintDokumen103 halamanAmended Poker Civil ComplaintpokernewsBelum ada peringkat

- Guilty Verdict: Rabbi Convicted of Sexual AssaultDokumen1 halamanGuilty Verdict: Rabbi Convicted of Sexual AssaultJustia.comBelum ada peringkat

- U.S. v. TomorrowNow, Inc. - Criminal Copyright Charges Against SAP Subsidiary Over Oracle Software TheftDokumen5 halamanU.S. v. TomorrowNow, Inc. - Criminal Copyright Charges Against SAP Subsidiary Over Oracle Software TheftJustia.comBelum ada peringkat

- Van Hollen Complaint For FilingDokumen14 halamanVan Hollen Complaint For FilingHouseBudgetDemsBelum ada peringkat

- Stipulation: SAP Subsidiary TomorrowNow Pleading Guilty To 12 Criminal Counts Re: Theft of Oracle SoftwareDokumen7 halamanStipulation: SAP Subsidiary TomorrowNow Pleading Guilty To 12 Criminal Counts Re: Theft of Oracle SoftwareJustia.comBelum ada peringkat

- Emmanuel Ekhator - Nigerian Law Firm Scam IndictmentDokumen22 halamanEmmanuel Ekhator - Nigerian Law Firm Scam IndictmentJustia.comBelum ada peringkat

- Rabbi Gavriel Bidany's Sexual Assault and Groping ChargesDokumen4 halamanRabbi Gavriel Bidany's Sexual Assault and Groping ChargesJustia.comBelum ada peringkat

- Rabbi Gavriel Bidany's Federal Criminal Misdemeanor Sexual Assault ChargesDokumen3 halamanRabbi Gavriel Bidany's Federal Criminal Misdemeanor Sexual Assault ChargesJustia.comBelum ada peringkat

- Wisconsin Union Busting LawsuitDokumen48 halamanWisconsin Union Busting LawsuitJustia.comBelum ada peringkat

- Deutsche Bank and MortgageIT Unit Sued For Mortgage FraudDokumen48 halamanDeutsche Bank and MortgageIT Unit Sued For Mortgage FraudJustia.com100% (1)

- Defamation Lawsuit Against Jerry Seinfeld Dismissed by N.Y. Judge - Court OpinionDokumen25 halamanDefamation Lawsuit Against Jerry Seinfeld Dismissed by N.Y. Judge - Court OpinionJustia.comBelum ada peringkat

- Court's TRO Preventing Wisconsin From Enforcing Union Busting LawDokumen1 halamanCourt's TRO Preventing Wisconsin From Enforcing Union Busting LawJustia.comBelum ada peringkat

- FBI Records: Col. Sanders (KFC - Kentucky Fried Chicken Founder) 1974 Death ThreatDokumen15 halamanFBI Records: Col. Sanders (KFC - Kentucky Fried Chicken Founder) 1974 Death ThreatJustia.comBelum ada peringkat

- Online Poker Indictment - Largest U.S. Internet Poker Cite Operators ChargedDokumen52 halamanOnline Poker Indictment - Largest U.S. Internet Poker Cite Operators ChargedJustia.comBelum ada peringkat

- Supreme Court Order Staying TX Death Row Inmate Cleve Foster's ExecutionDokumen1 halamanSupreme Court Order Staying TX Death Row Inmate Cleve Foster's ExecutionJustia.comBelum ada peringkat

- Sweden V Assange JudgmentDokumen28 halamanSweden V Assange Judgmentpadraig2389Belum ada peringkat

- NY Judge: Tricycle Riding 4 Year-Old Can Be Sued For Allegedly Hitting, Killing 87 Year-OldDokumen6 halamanNY Judge: Tricycle Riding 4 Year-Old Can Be Sued For Allegedly Hitting, Killing 87 Year-OldJustia.comBelum ada peringkat

- Federal Charges Against Ariz. Shooting Suspect Jared Lee LoughnerDokumen6 halamanFederal Charges Against Ariz. Shooting Suspect Jared Lee LoughnerWBURBelum ada peringkat

- OJ Simpson - Nevada Supreme Court Affirms His ConvictionDokumen24 halamanOJ Simpson - Nevada Supreme Court Affirms His ConvictionJustia.comBelum ada peringkat

- Lee v. Holinka Et Al - Document No. 4Dokumen2 halamanLee v. Holinka Et Al - Document No. 4Justia.com100% (4)

- 60 Gadgets in 60 Seconds SLA 2008 June16Dokumen69 halaman60 Gadgets in 60 Seconds SLA 2008 June16Justia.com100% (10)

- City of Seattle v. Professional Basketball Club LLC - Document No. 36Dokumen2 halamanCity of Seattle v. Professional Basketball Club LLC - Document No. 36Justia.comBelum ada peringkat

- Capital PunishmentDokumen3 halamanCapital PunishmentAnony MuseBelum ada peringkat

- BPS95 07Dokumen93 halamanBPS95 07AUNGPSBelum ada peringkat

- Transfer of PropertyDokumen18 halamanTransfer of Propertynitin0010Belum ada peringkat

- International and Regional Legal Framework for Protecting Displaced Women and GirlsDokumen32 halamanInternational and Regional Legal Framework for Protecting Displaced Women and Girlschanlwin2007Belum ada peringkat

- Walder - The Remaking of The Chinese Working ClassDokumen47 halamanWalder - The Remaking of The Chinese Working ClassWukurdBelum ada peringkat

- (G.R. No. 115245, July 11, 1995)Dokumen3 halaman(G.R. No. 115245, July 11, 1995)rommel alimagnoBelum ada peringkat

- Constitutional Law Study Guide 4Dokumen4 halamanConstitutional Law Study Guide 4Javis OtienoBelum ada peringkat

- AITC Candidates For WB AE 2021Dokumen13 halamanAITC Candidates For WB AE 2021NDTV80% (5)

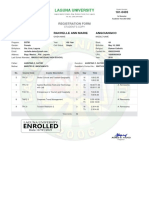

- Laguna University: Registration FormDokumen1 halamanLaguna University: Registration FormMonica EspinosaBelum ada peringkat

- Thesun 2009-10-22 Page04 Wanted Duo Caught After Robbery SpreeDokumen1 halamanThesun 2009-10-22 Page04 Wanted Duo Caught After Robbery SpreeImpulsive collectorBelum ada peringkat

- Justice and FairnessDokumen35 halamanJustice and FairnessRichard Dan Ilao ReyesBelum ada peringkat

- Difference Between Home and School Language-1Dokumen20 halamanDifference Between Home and School Language-1Reshma R S100% (1)

- People Vs YauDokumen7 halamanPeople Vs YauMark DungoBelum ada peringkat

- Referencias DynaSand ETAP.01.06Dokumen19 halamanReferencias DynaSand ETAP.01.06ana luciaBelum ada peringkat

- Page2Dokumen1 halamanPage2The Myanmar TimesBelum ada peringkat

- Hadith of Husbands Calling Their Wives To Bed, Does It Apply To Men & WomenDokumen2 halamanHadith of Husbands Calling Their Wives To Bed, Does It Apply To Men & Womenapi-3701716Belum ada peringkat

- Poe On Women Recent PerspectivesDokumen7 halamanPoe On Women Recent PerspectivesЈана ПашовскаBelum ada peringkat

- It ACT IndiaDokumen3 halamanIt ACT IndiarajunairBelum ada peringkat

- Marxism and NationalismDokumen22 halamanMarxism and NationalismKenan Koçak100% (1)

- Rte JoshDokumen149 halamanRte JoshJulian GrayBelum ada peringkat

- Eng PDFDokumen256 halamanEng PDFCarmen RodriguezBelum ada peringkat

- Inversion (Theory & Exercises)Dokumen8 halamanInversion (Theory & Exercises)Phạm Trâm100% (1)

- We Should All be Feminists: The need for grassroots changeDokumen9 halamanWe Should All be Feminists: The need for grassroots changeDaniel BatlaBelum ada peringkat

- A Fresh Start? The Orientation and Induction of New Mps at Westminster Following The Parliamentary Expenses ScandalDokumen15 halamanA Fresh Start? The Orientation and Induction of New Mps at Westminster Following The Parliamentary Expenses ScandalSafaa SaddamBelum ada peringkat

- Singapore Court of Appeals' Decision Awarding Marcos' Ill-Gotten Wealth To PNBDokumen72 halamanSingapore Court of Appeals' Decision Awarding Marcos' Ill-Gotten Wealth To PNBBlogWatchBelum ada peringkat

- BRICS Summit 2017 highlights growing economic cooperationDokumen84 halamanBRICS Summit 2017 highlights growing economic cooperationMallikarjuna SharmaBelum ada peringkat