Business Organization Case Digests

Diunggah oleh

jaseHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Business Organization Case Digests

Diunggah oleh

jaseHak Cipta:

Format Tersedia

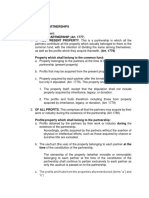

[BUSORG CASE DIGESTS]

Benjamin Yu vs. NLRC

Facts:

Benjamin Yu was formerly the Assistant General Manager of

the marble quarrying and export business operated by a

registered partnership with the firm name of "Jade Mountain

Products Company Limited". The partnership was originally

organized with Lea and Rhodora Bendal as general partners

and Chin Shian Jeng, Chen Ho-Fu and Yu Chang, all

Taiwanese, as limited partners.

Benjamin Yu was hired by virtue of a Partnership Resolution,

as Assistant General Manager with a monthly salary of

P4,000.00. According to Yu, however, he actually received only

half of his stipulated monthly salary, as promised by partners

that the balance would be paid when the firm shall have

secured additional operating funds from abroad.

Sometime in 1988, without the knowledge of Benjamin Yu, the

general partners Lea and Rhodora Benda and Mr. Yu Chang, a

limited partner, sold and transferred their interests in the

partnership to private respondent Willy Co and to one

Emmanuel Zapanta. The partnership now constituted solely by

Willy Co and Emmanuel Zapanta continued to use the old firm

name of Jade Mountain, though they moved the firm's main

office from Makati to Mandaluyong.

Having learned of the transfer of the firm's main office,

petitioner Benjamin Yu reported to the Mandaluyong office for

work and there he was informed by Willy Co that it was for him

to decide whether or not he was responsible for the obligations

of the old partnership, including petitioner's unpaid salaries.

Petitioner was in fact not allowed to work anymore in the Jade

Mountain business enterprise. His unpaid salaries remained

unpaid.

Benjamin Yu filed a complaint for illegal dismissal and recovery

of unpaid salaries, moral and exemplary damages and

attorney's fees, against Jade Mountain, Mr. Willy Co and the

other private respondents. The partnership and Willy Co

contended that Benjamin Yu was never hired as an employee

by the present or new partnership.

Labor Arbiter: Yu had been illegally dismissed. The Labor

Arbiter decreed his reinstatement and awarded him his claim

for unpaid salaries, backwages and attorney's fees.

NLRC (on appeal): Reversed the decision of the Labor Arbiter

and dismissed petitioner's complaint. It held that a new

partnership consisting of Mr. Willy Co and Mr. Emmanuel

Zapanta had bought the Jade Mountain business, that the new

partnership had not retained petitioner Yu in his original

position as Assistant General Manager, and that there was no

law requiring the new partnership to absorb the employees of

the old partnership.

Benjamin Yu had not been illegally dismissed by the new

partnership which had simply declined to retain him in his

former managerial position or any other position. Finally, the

NLRC held that Benjamin Yu's claim for unpaid wages should

be asserted against the original members of the preceding

partnership.

Issues:

(1) Whether the partnership which had hired petitioner Yu as

Assistant General Manager had been extinguished and

replaced by a new partnerships composed of Willy Co and

Emmanuel Zapanta; and

(2) If indeed a new partnership had come into existence,

whether petitioner Yu could nonetheless assert his rights under

his employment contract as against the new partnership.

Held:

(1) SC agreed with the NLRC. The legal effect of the changes

in the membership of the partnership was the dissolution of the

old partnership which had hired petitioner in 1984 and the

emergence of a new firm composed of Willy Co and Emmanuel

Zapanta in 1987.

The applicable law in this connection is Article 1828 of the Civil

Code which provides as follows:

Art. 1828. The dissolution of a partnership is the change

in the relation of the partners caused by any partner

ceasing to be associated in the carrying on as

distinguished from the winding up of the business.

(Emphasis supplied)

Article 1830 of the same Code must also be noted:

Art. 1830. Dissolution is caused:

(1) without violation of the agreement between the

partners; XXX

(b) by the express will of any partner, who

must act in good faith, when no definite term

or particular undertaking is specified; XXX

(2) in contravention of the agreement between the

partners, where the circumstances do not permit a

dissolution under any other provision of this article, by

the express will of any partner at any time;

[BUSORG CASE DIGESTS]

In the case at bar, just about all of the partners had sold their

partnership interests, amounting to 82% of the total partnership

interest, to Mr. Willy Co and Emmanuel Zapanta. The

acquisition of 82% of the partnership interest by new partners,

coupled with the retirement or withdrawal of the old partners,

was enough to constitute a new partnership.

The occurrences of events which precipitate the legal

consequence of dissolution of a partnership do not, however,

automatically result in the termination of the legal personality of

the old partnership. Article 1829 of the Civil Code states that:

[o]n dissolution the partnership is not terminated, but

continues until the winding up of partnership affairs is

completed.

The legal personality of the expiring partnership persists for the

limited purpose of winding up and closing of the affairs of the

partnership. In the case at bar, the business of the old

partnership

was

simply

continued

by

the

new

partners, without the

old

partnership

undergoing

the

procedures relating to dissolution and winding up of its

business affairs.

In other words, the new partnership simply took over the

business enterprise owned by the preceding partnership, and

continued using the old name of Jade Mountain Products

Company Limited, without winding up the business affairs of

the old partnership, paying off its debts, liquidating and

distributing its net assets, and then re-assembling the said

assets or most of them and opening a new business

enterprise.

(2) SC did not agree with NLRC. Under Article 1840 above,

creditors of the old Jade Mountain are also creditors of the new

Jade Mountain which continued the business of the old one

without liquidation of the partnership affairs. Indeed, a creditor

of the old Jade Mountain, like petitioner Benjamin Yu in respect

of his claim for unpaid wages, is entitled to priority vis--vis any

claim of any retired or previous partner insofar as such retired

partner's interest in the dissolved partnership is concerned. It is

clear to the Court that under Article 1840 above, Benjamin Yu

is entitled to enforce his claim for unpaid salaries, as well as

other claims relating to his employment with the previous

partnership, against the new Jade Mountain.

It is at the same time also evident to the Court that the new

partnership was entitled to appoint and hire a new general or

assistant general manager. The non-retention of Benjamin Yu

as Assistant General Manager did not therefore constitute

unlawful termination, or termination without just or authorized

cause. We think that the precise authorized cause for

termination in the case at bar was redundancy. The new

partnership had its own new General Manager, apparently Mr.

Willy Co, the principal new owner himself. It follows that

petitioner Benjamin Yu is entitled to separation pay at the rate

of one month's pay for each year of service that he had

rendered to the old partnership, a fraction of at least six (6)

months being considered as a whole year.

Plus Moral Damages of Php 20,000 for Yus shabby treatment,

legal interest of 6% per annum for unpaid wages and

separation pay, and attorneys fees of 10% of to the total

amount due from Jade Mountain.

G.R. No. 413

February 2, 1903

Jose Fernandez vs. Francisco de la Rosa

Facts:

Fernandez and Dela Rosa entered into a verbal agreement to

form a partnership for the purchase of cascoes and hiring the

same in Manila. In their arrangement, each partner will furnish

such amount of money for the purchase of the cascoes with

the profits divided proportionally. Dela Rosa was designated to

buy the cascoes. Thus, Fernandez furnished Dela Rosa 300

pesos for the purchase of casco no. 1515, 300 pesos for its

repairs, and 825 for the purchase of casco no. 2089.

Subsequently, the parties undertook to draw up articles of

partnership but no written agreement was executed because

Dela Rosa allegedly presented a different draft of such articles,

deliberately excluding casco no. 2089 in the partnership. This

prompted Fernandez to demand for an accounting upon him.

Fernandez presented in evidence the following receipt: "I have

this day received from D. Jose Fernandez eight hundred and

twenty-five pesos for the cost of a casco which we are to

purchase in company. Manila, March 5, 1900. Francisco de la

Rosa." The casco being referred to be purchased in company

according to the Supreme Court pertains to casco no. 2089,

contrary to the claim of Dela Rosa that the same was for casco

no. 1515.

Dela Rosa admitted receiving 300 pesos as a loan from the

bakery firm co-owned by Fernandez, and 825 pesos from

Fernandez for the purchase of casco no. 1515 (not casco no.

[BUSORG CASE DIGESTS]

2089) but maintained not receiving anything for the purchase

of casco no. 2089. Verily, Dela Rosa, at some point, returned

the sum of 1,125 pesos to Fernandez.

believe that he intended to relinquish them. On the contrary he

notified the defendant that he waived none of his rights in the

partnership.

The lower court ruled in favor of Dela Rosa .

Issue:

WON a partnership exists between Fernandez and Dela Rosa.

Collective partnership or en comandita

A contract of partnership subject to a suspensive condition,

postponing its operation until an agreement was reached as to

the respective participation of the partners in the profits

Held:

Yes, a partnership exists between the parties.

Council Red Men vs. Veterans Army

Partnership is a contract by which two or more persons bind

themselves to contribute money, property, or industry to a

common fund, with the intention of dividing the profits among

themselves. (Civil Code, art. 1665). The essential points upon

which the minds of the parties must meet in a contract of

partnership are, therefore, (1) mutual contribution to a common

stock, and (2) a joint interest in the profits (Civil Code, secs.

1689, 1695.)

As regards the first element, the Supreme Court found that

money was indeed furnished by Fernandez and received by

Dela Rosa with the understanding that it was to be used for the

purchase of the cascoes in question. As regards the second

element, namely, the intention to share profits, appears to be

an unavoidable deduction from the fact of the purchase of the

cascoes in common, in the absence of any other explanation of

the object of the parties in making the purchase in that form,

and, it may be added, in view of the admitted fact that prior to

the purchase of the first casco the formation of a partnership

had been a subject of negotiation between them.

Facts:

This case involves the Veteran Army of the Philippines.

Their Constitution provides for the organization of posts.

Among the posts thus organized is the General Henry W.

Lawton Post, No. 1.

March 1, 1903: a contract of lease of parts of a certain

buildings in the city of Manila was signed by Lewis, Stovall,

and Hayes (as trustees of the Apache Tribe, No. 1, Improved

Order of Red Men) as lessors, and McCabe (citing for and on

behalf of Lawton Post, Veteran Army of the Philippines) as

lessee.

The lease was for the term of two years commencing February

1, 903, and ending February 28, 1905.

The Lawton Post occupied the premises in controversy for

thirteen months, and paid the rent for that time. Thereafter, it

abandoned the premises.

While the Supreme Court was unable to find that there was

any specific verbal agreement of partnership, the same may be

implied from the fact as to the purchase of the casco. It is thus

apparent that a complete and perfect contract of partnership

was entered into by the parties.

Council Red Men then filed an action to recover the rent for the

unexpired term of the lease.

As to the absence of a written instrument

The execution of a written agreement was not necessary in

order to give efficacy to the verbal contract of partnership as a

civil contract, the contributions of the partners not having been

in the form of immovables or rights in immovables. (Civil Code,

art. 1667.)

Judgment was rendered also against the Veteran Army of the

Philippines for P1,738.50, and the costs.

As to the return of Fernandezs money contribution

The amount returned fell short of that which the plaintiff had

contributed to the capital of the partnership, since it did not

include the sum which he had furnished for the repairs of

casco No. 1515. Moreover, it is quite possible that a profit may

have been realized from the business during the period in

which the defendant have been administering it prior to the

return of the money, and if so he still retained that sum in his

hands. For these reasons the acceptance of the money by the

plaintiff did not have the effect of terminating the legal

existence of the partnership by converting it into a societas

leonine.

It is also claimed that the action cannot be maintained against

the Veteran Army of the Philippines because it never

contradicted, either with the Council Red Men or with Apach

Tribe, No. 1, and never authorized anyone to so contract in its

name.

There was no intention on the part of the plaintiff in accepting

the money to relinquish his rights as a partner, nor is there any

evidence that by anything that he said or by anything that he

omitted to say he gave the defendant any ground whatever to

Judgment was rendered in the court below on favor of the

defendant McCabe, acquitting him of the complaint.

It is claimed by the Veterans Army that the action cannot be

maintained by the Council Red Men as this organization did

not make the contract of lease.

Issue:

Whether or not Article 1695 of the Civil Code is applicable to

the Veteran Army of the Philippines. NO

Held:

Council Red Men must show that the contract of lease was

authorized by the Veterans Army

The view most favorable to the appellee (Council Red Men) is

the one that makes the appellant (Veterans Army) a civil

partnership. Assuming that is such, and is covered by the

[BUSORG CASE DIGESTS]

provisions of title 8, book 4 of the Civil Code, it is necessary for

the appellee (Council Red Men) to prove that the contract in

question was executed by some authorized to so by the

Veteran Army of the Philippines.

NOTE: Whether a fraternal society, such as the Veteran Army

of the Philippines, is a civil partnership is not decided.

Article 1695 of the Civil Code is not applicable in this case

Article 1695 of the Civil Code provides as follows:

Mariano P. Pascual vs. CIR and Court of Tax Appeals

"Should no agreement have been made with regard to the

form of management, the following rules shall be observed:

1 All the partners shall be considered as agents, and

whatever any one of them may do by himself shall bind

the partnership; but each one may oppose the act of the

others before they may have produced any legal effect."

One partner, therefore, is empowered to contract in the name

of the partnership only when the articles of partnership make

no provision for the management of the partnership business.

The constitution of the Veteran Army of the Philippines makes

provision for the management of its affairs, so that article 1695

of the Civil Code, making each member an agent of the

partnership in the absence of such provision, is not applicable

to that organization.

In the case at bar we think that the articles of the Veteran Army

of the Philippines do so provide. It is true that an express

disposition to that effect is not found therein, but we think one

may be fairly deduced from the contents of those articles. They

declare what the duties of the several officers are. In these

various provisions there is nothing said about the power of

making contracts, and that faculty is not expressly given to any

officer. We think that it was, therefore, reserved to the

department as a whole; that is, that in any case not covered

expressly by the rules prescribing the duties of the officers, the

department were present. It is hardly conceivable that the

members who formed this organization should have had the

intention of giving to any one of the sixteen or more persons

who composed the department the power to make any contract

relating to the society which that particular officer saw fit to

make, or that a contract when so made without consultation

with, or knowledge of the other members of the department

should bind it.

The contract of lease is not binding on the Veterans Army

absent showing that it was authorized in a meeting of the

department

We therefore, hold, that no contract, such as the one in

question, is binding on the Veteran Army of the Philippines

unless it was authorized at a meeting of the department. No

evidence was offered to show that the department had never

taken any such action.

In fact, the proof shows that the transaction in question was

entirely between Apache Tribe, No. 1, and the Lawton Post,

and there is nothing to show that any member of the

department ever knew anything about it, or had anything to do

with it.

Judgment against the appellant is reversed, and the Veteran

Army of the Philippines is acquitted of the complaint. No costs

will be allowed to either party in this court.

The distinction between co-ownership and an unregistered

partnership or joint venture for income tax purposes is the

issue in this petition.

Facts:

On June 22, 1965, petitioners bought two (2) parcels of land

from Santiago Bernardino, et al. and on May 28, 1966, they

bought another three (3) parcels of land from Juan Roque. The

first two parcels of land were sold by petitioners in 1968

toMarenir Development Corporation, while the three parcels of

land were sold by petitioners to Erlinda Reyes and Maria

Samson on March 19,1970. Petitioners realized a net profit in

the sale made in 1968 in the amount of P165,224.70, while

they realized a net profit of P60,000.00 in the sale made in

1970. The corresponding capital gains taxes were paid by

petitioners in 1973 and 1974 by availing of the tax amnesties

granted in the said years.

However, in a letter of then Acting BIR Commissioner Efren I.

Plana, petitioners were assessed and required to pay a total

amount of P107,101.70 as alleged deficiency corporate income

taxes for the years 1968 and 1970.

Respondent Commissioner informed petitioners that in the

years 1968 and 1970, petitioners as co-owners in the real

estate transactions formed an unregistered partnership or joint

venture taxable as a corporation under Section 20(b) and its

income was subject to the taxes prescribed under Section 24,

both of the National Internal Revenue Code that the

unregistered partnership was subject to corporate income tax

as distinguished from profits derived from the partnership by

them which is subject to individual income tax; and that the

availment of tax amnesty under P.D. No. 23, as amended, by

petitioners relieved petitioners of their individual income tax

liabilities but did not relieve them from the tax liability of the

unregistered partnership. Hence, the petitioners were required

to pay the deficiency income tax assessed.

Issue:

Whether or not petitioners formed an unregistered partnership

subject to corporate income tax. NO!

Held:

Article 1767 of the Civil Code of the Philippines provides:

By the contract of partnership two or more persons bind

themselves to contribute money, property, or industry to a

common fund, with the intention of dividing the profits among

themselves.

Pursuant to this article, the essential elements of a partnership

are two, namely: (a) an agreement to contribute money,

property or industry to a common fund; and (b) intent to divide

the profits among the contracting parties.

In the present case, there is no evidence that petitioners

entered into an agreement to contribute money, property or

[BUSORG CASE DIGESTS]

industry to a common fund, and that they intended to divide the

profits among themselves. Respondent commissioner and/ or

his representative just assumed these conditions to be present

on the basis of the fact that petitioners purchased certain

parcels of land and became co-owners thereof.

then being leased to the Shell Company. They agreed to

operate a gas station thereat with an initial investment of P

15,000.00 to be taken from the advance rentals due to them

from SHELL for the occupancy of the said lots owned by them

in common.

In the instant case, petitioners bought two (2) parcels of land in

1965. They did not sell the same nor make any improvements

thereon. In 1966, they bought another three (3) parcels of land

from one seller. It was only 1968 when they sold the two (2)

parcels of land after which they did not make any additional or

new purchase. The remaining three (3) parcels were sold by

them in 1970. The transactions were isolated. The character of

habituality peculiar to business transactions for the purpose of

gain was not present.

They executed a joint affidavit where they agreed to help their

brother, petitioner herein, by allowing him to operate and

manage the gasoline service station of the family. And in order

not to run counter to the policy of Shell of appointing only one

dealer, it was agreed that petitioner would apply for the

dealership.

Article 1769 of the new Civil Code lays down the rule for

determining when a transaction should be deemed a

partnership or a co-ownership. Said article paragraphs 2 and

3, provides;

(2) Co-ownership or co-possession does not itself establish a

partnership, whether such co-owners or co-possessors do or

do not share any profits made by the use of the property;

(3) The sharing of gross returns does not of itself establish a

partnership, whether or not the persons sharing them have a

joint or common right or interest in any property from which the

returns are derived; xxxx

The sharing of returns does not in itself establish a partnership

whether or not the persons sharing therein have a joint or

common right or interest in the property. There must be a clear

intent to form a partnership, the existence of a juridical

personality different from the individual partners, and the

freedom of each party to transfer or assign the whole property.

In the present case, there is clear evidence of co-ownership

between the petitioners. There is no adequate basis to support

the proposition that they thereby formed an unregistered

partnership. The two isolated transactions whereby they

purchased properties and sold the same a few years thereafter

did not thereby make them partners. They shared in the gross

profits as co- owners and paid their capital gains taxes on their

net profits and availed of the tax amnesty thereby. Under the

circumstances, they cannot be considered to have formed an

unregistered partnership which is thereby liable for corporate

income tax, as the respondent commissioner proposes.

And even assuming for the sake of argument that such

unregistered partnership appears to have been formed, since

there is no such existing unregistered partnership with a

distinct personality nor with assets that can be held liable for

said deficiency corporate income tax, then petitioners can be

held individually liable as partners for this unpaid obligation of

the partnership. However, as petitioners have availed of the

benefits of tax amnesty as individual taxpayers in these

transactions, they are thereby relieved of any further tax

liability arising therefrom.

Estanislao vs. CA, Estanislao and Santiago

Facts:

Petitioner and private respondents are brothers and sisters

who are co-owners of certain lots at Quezon City which were

Thereafter, the parties entered into an Additional Cash Pledge

Agreement which canceled and superseded the Joint Affidavit

previously executed by the co-owners.

For sometime, petitioner submitted financial statements

regarding the operation of the business to private respondents,

but thereafter petitioner failed to render subsequent

accounting. Hence, a demand was made on petitioner to

render an accounting of the profits.

The financial report shows that the business was able to make

a profit of P 87,293.79 for 1968 and P150, 000.00 for 1969 was

realized.

Private respondents filed a complaint in the CFI of Rizal

against petitioner:

1)

to execute a public document embodying all the

provisions of the partnership agreement

2) to render a formal accounting

3) to pay the plaintiffs their lawful shares and participation in

the net profits of the business

CFI ruled in favor of private respondents. CA affirmed.

Issue:

Whether a partnership exists between members of the same

family arising from their joint ownership of certain

properties; YES

Held:

Petitioner relies heavily on the provisions of the Joint Affidavit

and the Additional Cash Pledge Agreement (See Full Text for

contents).

Petitioner contends that because of the stipulation in the Cash

Pledge Agreement cancelling and superseding the previous

Joint Affidavit, whatever partnership agreement there was in

said previous agreement had thereby been abrogated.

We find no merit in this argument. Said cancelling provision

was necessary for the Joint Affidavit speaks of P15,000.00

advance rentals starting May 25, 1966 while the latter

agreement also refers to advance rentals of the same amount

starting May 24, 1966.

Further, evidence in the record shows that there was in fact

such partnership agreement between the parties:

1.

This is attested by the testimonies of private

respondent Remedios Estanislao and Atty. Angeles.

[BUSORG CASE DIGESTS]

2.

3.

4.

Petitioner submitted to private respondents periodic

accounting of the business.

Petitioner gave a written authority to private

respondent Remedies Estanislao, his sister, to

examine and audit the books of their "common

business'.

Respondent Remedios assisted in the running of the

business.

There is no doubt that the parties hereto formed a partnership

when they bound themselves to contribute money to a

common fund with the intention of dividing the profits among

themselves.

The sole dealership by the petitioner and the issuance of all

government permits and licenses in the name of petitioner was

in compliance with the afore-stated policy of SHELL and the

understanding of the parties of having only one dealer of the

SHELL products.

To argue that because the original articles of partnership

provided that the partners could extend the term of the

partnership, the provisions of Republic RA cannot be adversely

affect appellants herein, is to erroneously assume that the

aforesaid provision constitute a property right of which the

partners can not be deprived without due process or without

their consent. The agreement contained therein must be

deemed subject to the law existing at the time when the

partners came to agree regarding the extension.

In the present case, as already stated, when the partners

amended the articles of partnership, the provisions of Republic

Act 1180 were already in force, and there can be not the

slightest doubt that the right claimed by appellants to extend

the original term of their partnership to another five years

would be in violation of the clear intent and purpose of the law

aforesaid.

Obillos vs. CIR & Court of Tax Appeals

Ang Pue vs. Sec of Commerce and Industry

Facts:

On May 1, 1953, Ang Pue and Tan Siong, both Chinese

citizens, organized the partnership Ang Pue & Company for a

term of five years from May 1, 1953, extendible by their mutual

consent.

On June 19, 1954 Republic Act No. 1180 was enacted which

provided that a partnership not wholly formed by Filipinos could

continue to engage in the retail business until the expiration of

its term.

Prior to the expiration of the five-year term of the partnership

but after the enactment of the RA 1180, the partners amended

the original articles of part ownership so as to extend the term

of life of the partnership to another five years. When the

amended articles were presented for registration in the Office

of the Securities & Exchange Commission, registration was

refused upon the ground that the extension was in violation of

the aforesaid Act.

Ang Pue & Company filed an action for declaratory relief to

secure judgment "declaring that plaintiffs could extend for five

years the term of the partnership pursuant to the provisions of

plaintiffs' Amendment to the Article of Co-partnership." TC

dismissed the same.

Issue:

Whether the terms of partnership may still be extended for 5

more years; NO

Held:

To organize a corporation or a partnership that could claim a

juridical personality of its own and transact business as such,

is not a matter of absolute right but a privilege which may be

enjoyed only under such terms as the State may deem

necessary to impose.

RA No. 1180 was clearly intended to apply to partnership

already existing at the time of the enactment of the law.

Facts:

Jose Obillos, Sr. transferred his rights to his four children, the

petitioners, to enable them to build their residences.

Presumably, the Torrens titles issued to them would show that

they were co-owners of the two lots.

After having held the two lots for more than a year, the

petitioners resold them from which they derived a total profit

of P134,341.88 or P33,584 for each of them. They treated the

profit as a capital gain and paid an income tax of P16,792.

One day before the expiration of the five-year prescriptive

period, the Commissioner of Internal Revenue required the

petitioners to pay corporate income tax in addition to individual

income tax. Further, he considered the share of the profits of

each petitioner as taxable in full and not a mere capital gain of

which is taxable. Petitioners are being held liable for

deficiency income taxes and penalties totaling to P127,781.76.

Commissioner acted on the theory that the four petitioners had

formed an unregistered partnership or joint venture within the

meaning of sections 24(a) and 84(b) of the Tax Code.

Issue:

Whether petitioners formed an unregistered partnership; NO

It is error to consider the petitioners as having formed a

partnership under article 1767 of the Civil Code simply

because they allegedly contributed P178,708.12 to buy the two

lots, resold the same and divided the profit among themselves.

As testified by Jose Obillos, Jr., they had no such intention.

They were co-owners pure and simple. Their original purpose

was to divide the lots for residential purposes. The division of

the profit was merely incidental to the dissolution of the coownership.

Article 1769(3) of the Civil Code provides that "the sharing of

gross returns does not of itself establish a partnership, whether

or not the persons sharing them have a joint or common right

or interest in any property from which the returns are

derived". There must be an unmistakable intention to form a

partnership or joint venture.

[BUSORG CASE DIGESTS]

All co-ownerships are not deemed unregistered partnership.

Co-Ownership who own properties which produce income

should not automatically be considered partners of an

unregistered partnership, or a corporation, within the purview

of the income tax law. To hold otherwise, would be to subject

the income of all co-ownerships of inherited properties to the

tax on corporations, inasmuch as if a property does not

produce an income at all, it is not subject to any kind of income

tax, whether the income tax on individuals or the income tax on

corporation.

In the instant case, what the Commissioner should have

investigated was whether the father donated the two lots to the

petitioners and whether he paid the donor's tax.

Lim Tong Lim vs. Philippine Fishing

Defense: Lim disclaims any direct participation in the purchase

of the nets, alleging that the negotiations were conducted by

Chua and Yao only, and that he has not even met the

representatives of the respondent company. Petitioner further

argues that he was a lessor, not a partner, of Chua and Yao,

for the "Contract of Lease.

We are not convinced by petitioner's argument that he was

merely the lessor of the boats to Chua and Yao, not a partner

in the fishing venture.

He would like this Court to believe that he consented to the

sale of his own boats to pay a debt of Chua and Yao, with the

excess of the proceeds to be divided among the three of them.

No lessor would do what petitioner did. Indeed, his consent to

the sale proved that there was a preexisting partnership among

all three.

Facts:

On behalf of "Ocean Quest Fishing Corporation," Antonio Chua

and Peter Yao entered into a Contract for the purchase of

fishing nets from the Philippine Fishing Gear Industries, Inc..

Chua and Yao claimed that they were engaged in a business

venture with Lim Tong Lim, who however was not a signatory

to the agreement.

The sale of the boats, as well as the division among the three

of the balance remaining after the payment of their loans,

proves beyond cavil that F/B Lourdes, though registered in his

name, was not his own property but an asset of the

partnership. It is not uncommon to register the properties

acquired from a loan in the name of the person the lender

trusts, who in this case is the petitioner himself. After all, he is

the brother of the creditor, Jesus Lim.

Buyers, however, failed to pay for the fishing nets and the

floats. Private respondents filed a collection suit against Chua,

Yao and Lim Tong Lim. The suit was brought against the three

in their capacities as general partners, on the allegation that

"Ocean Quest Fishing Corporation" was a nonexistent

corporation as shown by a Certification from the Securities and

Exchange Commission.

Being partner, they are all liable for debts incurred by or on

behalf of the partnership. The liability for a contract entered

into on behalf of an unincorporated association or ostensible

corporation may lie in a person who may not have directly

transacted on its behalf, but reaped benefits from that contract.

RTC ruled that defendants are jointly liable to plaintiff, that their

joint liability could be presumed from the equal distribution of

the profit and loss. CA affirmed.

Issue:

Whether by their acts, Lim, Chua and Yao could be deemed to

have entered into a partnership; YES

From the factual findings of both lower courts, it is clear that

Chua, Yao and Lim had decided to engage in a fishing

business, which they started by buying boats worth P3.35

million, financed by a loan secured from Jesus Lim who was

petitioner's brother. In their Compromise Agreement, they

subsequently revealed their intention to pay the loan with the

proceeds of the sale of the boats, and to divide equally among

them the excess or loss. These boats, the purchase and the

repair of which were financed with borrowed money, fell under

the term "common fund" under Article 1767. The contribution to

such fund need not be cash or fixed assets; it could be an

intangible like credit or industry. That the parties agreed that

any loss or profit from the sale and operation of the boats

would be divided equally among them also shows that they

had indeed formed a partnership.

Partnership extended not only to the purchase of the boat, but

also to that of the nets and the floats. The fishing nets and the

floats, both essential to fishing, were obviously acquired in

furtherance of their business.

Aguila vs. CA & Vda. De Abrogar

Facts:

Petitioner is the manager of A.C. Aguila & Sons, Co., a

partnership engaged in lending activities. Private respondent,

with the consent of her late husband, and A.C. Aguila & Sons,

Co., represented by petitioner, entered into a Memorandum of

Agreement (See full text for details).

A.C Aguila bought the property of private respondent and her

late husband for P200,000. On the same day, parties executed

the deed of absolute sale.

Private respondent failed to redeem the property within the 90day period. Hence, petitioner caused the cancellation of TCT

No. 195101 and the issuance of a new certificate of title in the

name of A.C. Aguila and Sons, Co.

Thereafter, private respondent was demanded to vacate the

premises within 15 days after receipt of the letter and

surrender its possession peacefully to A.C. Aguila & Sons.

Upon the refusal of private respondent to vacate the subject

premises, A.C. Aguila & Sons, Co. filed an ejectment case.

MTC ruled in favor of A.C. Aguila & Sons, Co. RTC and CA

affirmed.

Private respondent then filed a petition for declaration of nullity

of a deed of sale with the Regional Trial Court signature of her

[BUSORG CASE DIGESTS]

husband on the deed of sale was a forgery because he was

already dead when the deed was supposed to have been

executed on June 11, 1991.

partnership subject to tax under Sections 24 and 84(b) of the

National

Internal

Revenue

Code;UNREGISTERED

PARTNERSHIP

RTC ruled in favor of petitioner. CA reversed ruling that

transaction is an equitable mortgage.

Petitioner now contends that he is not the real party in interest

but A.C. Aguila & Co., against which this case should have

been brought.

Held:

Petitioners did not merely limit themselves to holding the

properties inherited by them. Some of the said properties were

sold at considerable profit, and from the said profit were the

purchase and sale of corporate securities. All the profits from

these ventures were divided among petitioners proportionately

in accordance with their respective shares in the inheritance.

From the moment petitioners allowed not only the incomes

from their respective shares of the inheritance but even the

inherited properties themselves to be used by Lorenzo T. Oa

as a common fund in undertaking several transactions or in

business, with the intention of deriving profit to be shared by

them proportionally, such act was tantamount to actually

contributing such incomes to a common fund and, in effect,

they thereby formed an unregistered partnership within the

purview of the provisions of the Tax Code.

Issue:

Whether petitioner is a real party in interest; NO

Held:

Under Art.1768 of the Civil Code, a partnership "has a juridical

personality separate and distinct from that of each of the

partners." The partners cannot be held liable for the obligations

of the partnership unless it is shown that the legal fiction of a

different juridical personality is being used for fraudulent,

unfair, or illegal purposes.

In this case, private respondent has not shown that A.C. Aguila

& Sons, Co., as a separate juridical entity, is being used for

fraudulent, unfair, or illegal purposes. Moreover, the title to the

subject property is in the name of A.C. Aguila & Sons, Co. and

the Memorandum of Agreement was executed between private

respondent, with the consent of her late husband, and A.C.

Aguila & Sons, Co., represented by petitioner. Hence, it is the

partnership, not its officers or agents, which should be

impleaded in any litigation involving property registered in its

name.

Ona & Heirs of Bunales vs. CIR

Facts:

Julia Buales died leaving as heirs her surviving spouse and

her five children. The surviving spouse as administrator of the

estate submitted the project of partition which was approved by

the Court.

Although the project of partition was approved by the Court, no

attempt was made to divide the properties therein listed.

Instead, the properties remained under the management of

Lorenzo T. Oa who used said properties in business by

leasing or selling them and investing the income derived

therefrom and the proceeds from the sales thereof in real

properties and securities. From said investments and

properties petitioners derived such incomes as profits from

installment sales of subdivided lots, profits from sales of

stocks, dividends, rentals and interests.

Commissioner of Internal Revenue decided that petitioners

formed an unregistered partnership subject to the corporate

income tax, pursuant to Section 24, in relation to Section 84(b),

of the Tax Code. Petitioners were assessed for P8,092.00 and

P13,899.00 as corporate income taxes for 1955 and 1956.

Petitioners protested but CIR denied the same.

Issue:

WON petitioners are co-owners of the properties inherited by

them from the deceased Julia Buales and the profits derived

from transactions involving the same or an unregistered

In cases of inheritance, there should be a period when the

heirs can be considered as co-owners rather than unregistered

co-partners within the contemplation of our corporate tax laws.

Before the partition and distribution of the estate of the

deceased, all the income thereof does belong commonly to all

the heirs, without them becoming thereby unregistered copartners, but it does not necessarily follow that such status as

co-owners continues until the inheritance is actually and

physically distributed among the heirs. After knowing their

respective shares in the partition, they might decide to continue

holding said shares under the common management of the

administrator or executor or of anyone chosen by them and

engage in business on that basis.

Co-ownership of inherited properties is automatically converted

into an unregistered partnership the moment the said common

properties and/or the incomes derived therefrom are used as a

common fund with intent to produce profits for the heirs in

proportion to their respective shares in the inheritance as

determined in a project partition either duly executed in an

extrajudicial settlement or approved by the court in the

corresponding testate or intestate proceeding.

Partnerships under the civil code are different from that of

unregistered partnerships which are considered as

"corporations" under sections 24 and 84(b) of the NIRC.

When NIRC includes "partnerships" among the entities subject

to the tax on "corporations", said Code must allude, therefore,

to organizations which are not necessarily "partnerships", in

the technical sense of the term. Section 24 of said Code

exempts from the aforementioned tax "duly registered general

partnerships,"

In section 84(b) of said Code, "the term corporation includes

partnerships, no matter how created or organized." The term

"corporation" includes, among others, "joint accounts" and

"associations", none of which has a legal personality of its own,

independent of that of its members.

Kiel vs. Estate of P.S. Sabert

[BUSORG CASE DIGESTS]

Facts:

In 1907, Albert F. Kiel along with William Milfeil commenced to

work on certain public lands situated in the municipality

of Parang, Province of Cotabato, known as Parang Plantation

Company. Kiel subsequently took over the interest of Milfeil.

In 1910, Kiel and P. S. Sabert entered into an agreement to

develop the Parang Plantation Company. Sabert was to furnish

the capital to run the plantation and Kiel was to manage it.

They were to share and share alike in the property. It seems

that this partnership was formed so that the land could be

acquired in the name of Sabert, Kiel being a German citizen

and not deemed eligible to acquire public lands in the

Philippines.

By virtue of the agreement, from 1910 to 1917, Kiel worked

upon and developed the plantation. During the World War, he

was deported from the Philippines.

On August 16, 1919, five persons, including P. S. Sabert,

organized the Nituan Plantation Company, with a subscribed

capital of P40,000. On April 10, 1922, P. S. Sabert transferred

all of his rights in two parcels of land situated in the

municipality of Parang, Province of Cotabato, embraced within

his homestead application No. 21045 and his purchase

application No. 1048, in consideration of the sum of P1, to

the Nituan Plantation Company.

In this same period, Kiel appears to have tried to secure a

settlement from Sabert. At least in a letter dated June 6,

1918, Sabert wrote Kiel that he had offered "to sell all property

that I have for P40,000 or take in a partner who is willing to

develop the plantation, to take up the K. & S. debt no matter

which way I will straiten out with you."

But Sabert's death came before any amicable arrangement

could be reached and before an action by Kiel against

Sabert could be decided. So these proceedings against the

estate of Sabert.

Issues:

(1) Whether a trust in the land had been established by the

evidence in the case. NO

(2) Whether a co-partnership between Kiel and the deceased

Sabertexisted. YES

Held:

It is conceivable, that the facts in this case could have been so

presented to the court by means of allegations in the

complaint, as to disclose characteristics of a resulting trust. But

the complaint as framed asks for a straight money judgment

against an estate. In no part of the complaint did plaintiff

(Kiel) allege any interest in land, claim any interest in land, or

pretend to establish a resulting trust in land. That Kiel did not

care to press such an action is demonstrated by the relation of

the fact of alienage with the rule, that a trust will not be created

when, for the purpose of evading the law prohibiting one from

taking or holding real property, he takes a conveyance thereof

in the name of a third person.

No partnership agreement in writing was entered into by Kiel

and Sabert. The question consequently is whether or not the

alleged verbal copartnership formed by Kiel and Sabert has

been proved, if we eliminate the testimony of Kiel and only

consider the relevant testimony of other witnesses. In

performing this task, we are not unaware of the rule of

partnership that the declarations of one partner, not made in

the presence of his copartner, are not competent to prove the

existence of a partnership between them as against such other

partner, and that the existence of a partnership cannot be

established by general reputation, rumor, or hearsay.

The testimony of the plaintiff's witnesses, together with the

documentary evidence, leaves the firm impression with us

that Kiel and Sabert did enter into a partnership, and that they

were to share equally.

Applying the tests as to the existence of partnership, we feel

that competent evidence exists establishing the partnership.

Even more primary than any of the rules of partnership above

announced, is the injunction to seek out the intention of the

parties, as gathered from the facts and as ascertained from

their language and conduct, and then to give this intention

effect.

(The court remanded the case to the TC to determine how

much Kiel is entitled to as for his share.)

Alicbusan vs. CA

Facts:

Cesar Cordero and Leopoldo Alicbusan were partners in the

operation of Babys Canteen located in the Philtranco terminal

in Pasay City. Pursuant to their agreement, Cordero assumed

the position of Managing partner while Alicbusan took care of

accounting, records keeping and other comptrollership

functions.

The partnership was to exist for a fixed term, between July

1981 up to July 1984. Upon expiration of the said period, both

of them continued their relationship under the original term.

On May 11, 1990, Cordero filed a complaint for collection for

various sums totaling P209, 497. 36 which he later on

amended to P309, 681. 51. This represented the collectibles

he had from Philtranco, by virtue of an arrangement whereby

Philtranco employees were allowed to buy goods and items

from Babys Canteen on credit, which payments were

subsequently deducted by Philtranco from the employees

salaries. Philtranco would remit the amount to them 15 days

later.

According to Cordero, the remittances of salary deductions for

the months of February up to May 1990 were withheld by

Philtranco due to Alicbusans instigation. He averred that

Alicbusan had done this in bad faith because of business

differences which arose between him and Alicbusan in another

partnership operation in Quezon.

Alicbusans defense is to aver that he transferred all his rights

and interests over Babys Canteen for the sum of P250,000 as

evidenced by a Deed of Sale and Transfer of Right between

the parties on April 5, 1989. Under the said deed Cordero

allegedly bound himself to pay the downpayment of P50,000,

[BUSORG CASE DIGESTS]

while the balance would be payable in 20 monthly installments

at P10,000 per month.

RTC ruled in favor of Cordero and Babys Canteen, upholding

the existence of a partnership between Cordero and Alicbusan.

CA affirmed the ruling of the RTC.

Issue:

Whether a partnership still exists between Cordero and

Alicbusan.YES

Held:

Cordero argues that the court should not have disregarded the

legal presumptions in favor of the validity of the deed of sale os

his partnership rights, namely:

1. that the private transactions have been fair and regular

2. that the ordinary course of business has been followed

3. there is sufficient consideration for a contract

However, these presumptions are disputable and can be

rebutted by the evidence to the contrary. The calibration of this

evidence and the relative weight accorded to them are within

the exclusive domain of both the trial and appellate courts

which cannot be set aside by the Supreme Court absent any

showing that there is no evidence to support the conclusion

already established.

Contrary to Alicbusans assertion, the record is replete with

evidence establishing the fact that the deed of sale was

fictitious and simulated.

First, payments were never madethe downpayment or the

subsequent installments of P10,000. What were presented as

payment were a series of checks with varying amounts.

Second, Alicbusan continued to perform his functions of

comptrollership after the deed was signed. Alicbusan continued

to oversee and check daily sales and report vouches. He was

the approving authority as far as check vouchers were

concerned. Furthermore, the evidence shows that he

subsequently delegated this function to his wife. The balance

sheet lists the Partners capital for each of them. During this

time, Alicbusan did not object to his inclusion in the report as

partner of Babys Canteen, which he would have if the sale

were not terminated.

Hence Alicbusan is liable to pay Cordero P30,000 as moral

damages.

Yulo vs. Yang Chiao Seng

Facts:

Yang Chiao Seng proposed to form a partnership with Rosario

Yulo to run and operate a theatre on the premises occupied by

Cine Oro, PlazaSta. Cruz, Manila, the principal conditions of

the offer being:

(1) Yang guarantees Yulo a monthly participation of P3,000;

(2) partnership shall be for a period of 2 years and 6 months

with the condition that if the land is expropriated, rendered

impracticable for business, owner constructs a permanent

building, then Yulos right to lease and partnership even if

period agreed upon has not yet expired;

(3) Yulo is authorized to personally conduct business in the

lobby of the building; and

(4) after Dec 31, 1947, all improvements placed by partnership

shall belong to Yulo but if partnership is terminated before

lapse of 1 and years, Yang shall have right to

remove improvements.

Parties established, Yang and Co. Ltd., to exist from July

1,1945 Dec 31, 1947.

The land on which the theater was constructed was leased by

Yulo from owners, Emilia Carrion and Maria Carrion Santa

Marina for an indefinite period but that after 1 year, such lease

may be cancelled by either party upon 90-day notice.

In Apr 1949, the owners notified Yulo of their desire to cancel

the lease contract come July. Yulo and husband brought a civil

action to declare the lease for a indefinite period. Owners

brought their own civil action for ejectment upon Yulo and

Yang.

CFI: Two cases were heard jointly; Complaint of Yulo and Yang

dismissed declaring contract of lease terminated.

CA: Affirmed the judgment.In 1950, Yulo demanded from Yang

her share in the profits of the business. Yang answered saying

he had to suspend payment because of pending ejectment

suit. Yulo filed present action in 1954, alleging the existence of

a partnership between them and that Yang has refused to

pay her shares

Defendants Position: The real agreement between plaintiff

and defendant was one of lease and not of partnership; that

the partnership was adopted as a subterfuge to get around the

prohibition contained in the contract of lease between the

owners and the plaintiff against the sublease of the property.

Trial Court: Dismissal. It is not true that a partnership was

created between them because defendant has not actually

contributed the sum mentioned in the Articles of Partnership

or any other amount. The agreement is a lease because

plaintiff didnt share either in the profits or in the losses of the

business as required by Art 1769 (CC) and because plaintiff

was granted a guaranteed participation in the profits belies

the supposed existence of a partnership.

Issue:

Was the agreement a contract a lease or a partnership?

SUBLEASE

Held:

The agreement was a sublease not a partnership.

The following are the requisites of partnership:

1

two or more persons who bind themselves to

contribute money,property or industry to a common

fund;

10

[BUSORG CASE DIGESTS]

2

The intention on the part of the partners to divide the

profits among themselves (Article 1761, CC)

Plaintiff did not furnish the supposed P20,000 capital nor did

she furnish any help or intervention in the management of the

theatre. Neither has she demanded from defendant any

accounting of the expenses and earnings of the business. She

was absolutely silent with respect to any of the acts that a

partner should have done; all she did was to receive her share

of P3,000 a month which cannot be interpreted in any manner

than a payment for the use of premises which she had leased

from the owners.

Gatchalian vs. Collector of Internal Revenue

Policy: A partnership is formed when two or more persons

contributed money to buy a sweepstakes ticket with the

intention to divide the prize which they may win.

Facts:

Plaintiffs purchased, in the ordinary course of business, from

one of the duly authorized agents of the National Charity

Sweepstakes Office one ticket for the sum of two pesos (P2),

said ticket was registered in the name of Jose Gatchalian and

Company. The ticket won one of the third-prizes in the amount

of P50,000.

Jose Gatchalian was required to file the corresponding income

tax return covering the prize won. Defendant-Collector made

an assessment against Jose Gatchalian and Co. requesting

the payment of the sum of P1,499.94 to the deputy provincial

treasurer of Pulilan, Bulacan. Plaintiffs, however through

counsel made a request for exemption. It was denied

If a partnership had been formed by A, B, etc. then it was liable

for income tax pursuant to law then in force; if merely a

community of property, then such co-ownership was not liable,

not having a legal personality of its own.

Issue:

Did the plaintiff form a partnership or merely a communityof

property?Partnership

Held:

The plaintiff formed a partnership. Hence, they are liable to pay

the income tax.

According to the stipulation facts the plaintiffs organized a

partnership of a civil nature because each of them put up

money to buy a sweepstakes ticket for the sole purpose of

dividing equally the prize which they may win, as they did in

fact in the amount of P50,000.

The partnership was not only formed, but upon the

organization thereof and the winning of the prize, Jose

Gatchalian personally appeared in the office of the Philippines

Charity Sweepstakes, in his capacity as co-partner, as such

collection the prize, the office issued the check for P50,000 in

favor of Jose Gatchalian and company, and the said partner, in

the same capacity, collected the said check. All these

circumstances repel the idea that the plaintiffs organized and

formed a community of property only.

Having organized and constituted a partnership, the entity is

bound to pay the income tax Act No. 2833. Being the

partnership liable to the income tax, the tax must be paid

collectively by the partnership and not by the plaintiffs

individually.

EUFEMIA EVANGELISTA, MANUELA EVANGELISTA, and

FRANCISCA EVANGELISTA, petitioners,

vs. THE

COLLECTOR OF INTERNAL REVENUE and THE COURT

OF TAX APPEALS, respondents.

Facts:

Eufemia, Manuela and Fransisca Evangelista were siblings

who bought several (4) real estate properties from 1943-1944.

The money to buy these properties came from a 59k loan from

their father and from their own money.

1945 they appointed their brother Simeon to manage their

properties with full power to lease, to collect and receive rents;

to bring suits against defaulting tenants, to sign all letters,

contract, etc.

The Evangelista sisters leased the properties they bought to

tenants, earning net profits:

1945 5.8k

1946 7.4k

1947 12.6k

In 1954, the CIR demanded the payment of the following taxes:

Income taxes (1945-1949) 6.1k

Real estate dealers fixed tax (1946-9) 527 pesos

Residence taxes of corporation (1945-9) 6.8k

The sisters filed a case with the CTA, claiming that they were

not subject to the aforementioned taxes since the said taxes

were imposed upon corporations provided for in Section 24 of

Commonwealth Act 84.

Commonwealth Act 84:

SEC. 24.Rate of tax on corporations.There shall be levied,

assessed, collected, and paid annually upon the total net

income received in the preceding taxable year from all sources

by every corporation organized in, or existing under the laws of

the Philippines, no matter how created or organized but not

including duly registered general co-partnerships (compaias

colectivas), a tax upon such income equal to the sum of the

following:

SEC. 84 (b). The term 'corporation' includes partnerships, no

matter how created or organized, joint-stock companies, joint

accounts (cuentas en participacion), associations or insurance

companies, but does not include duly registered general

copartnerships.

The sisters claim they are mere co-owners and not copartners.

Issue:

Whether the Evangelistas were properly subject to the taxes

assessed by the CIR. YES

11

[BUSORG CASE DIGESTS]

HELD:

Ruling summary:The SC upheld the ruling of the CTA against

the Evangelistas because the two elements of a partnership

were present:

1 there was an agreement to contribute money,

property or industy to a common fund

2 they had the intent to divide the profits among the

contracting parties

First element: agreement to contribute MPI

This element is undisputed because the sister pooled their own

money and even borrowed money from their father. The funds

they used to buy the properties were not something they found

already in existence. They created it purposely.

Second element intent to gain

1 they invested the money in numerous properties

and entered into numerous transactions - strongly

indicative of a pattern or common design that was not

limited to the conservation and preservation of the

aforementioned common fund or even of the property

acquired; instead, the Court was convinced of the

habitual character peculiar to business transactions

engaged in the purpose of gain

2 lots they purchased were not residential, but were

leased to tenants

3 appointment of Simeon as manager Simeons

appointment and his functions indicate that the affairs

relative to said properties have been handled as if the

same belonged to a corporation or business and

enterprise operated for profit.

4 ^ the aforementioned conditions have existed for

over 10 years

5 The Evangelistas did not present nor explain their

purpose in creating the set up or the causes for

its continued existence.

The arrangement created by the sisters are covered by the

tax

The tax in question is one imposed upon "corporations", which,

strictly speaking, are distinct and different from "partnerships".

When our Internal Revenue Code includes "partnerships"

among the entities subject to the tax on "corporations", said

Code must allude, therefore, to organizations which are not

necessarily "partnerships", in the technical sense of the term.

Thus, for instance, section 24 of said Code exempts from the

aforementioned tax "duly registered general partnerships

which constitute precisely one of the most typical forms of

partnerships in this jurisdiction. . Likewise, as defined in

section 84(b) of said Code, "the term corporation includes

partnerships, no matter how created or organized."

Again, pursuant to said section 84(b), the term "corporation"

includes, among other, joint accounts, and "associations,"

none of which has a legal personality of its own,

independent of that of its members.

For purposes of tax on corporations, the NIRC includes

partnerships

Partnerships included: syndicate, group, pool, joint venture or

other unincorporated organization, through or by means of

which any business, financial operation, or venture is carried

on

Partnerships excluded: duly registered general copartnerships

Evangelista sisters also subject to real estate dealer tax

Real estate dealer' includes any person engaged in the

business of buying, selling, exchanging, leasing, or renting

property or his own account as principal and holding himself

out as a full or part time dealer in real estate or as an owner of

rental property or properties rented or offered to rent for an

aggregate amount of three thousand pesos or more a year.

Reyes vs. CIR

Facts:

Petitioners Florencio and Angel Reyes, father and son,

purchased a lot and building for P 835,000.00. The initial

payment of P 375,000.00 was shared equally by them. The

balance of P 460,000.00 was left, which represents the

mortgage obligation of the vendors with a bank, which

mortgage obligations were assumed by the vendees. At the

time of the purchase, the building was leased to various

tenants, whose rights under the lease contracts with the

original owners, the purchaser, petitioners herein, agreed to

respect. Petitioners divided equally the income of operation

and maintenance. An assessment as to the income tax due

was made against petitioners by the CIR. This assessment

was appealed to the Court of Tax Appeals. The CTA ruled that

petitioners are liable for the income tax due from the

partnership formed by petitioners.

The CTA applied the provisions of the NIRC on corporations.

The first cited provision imposes an income tax on corporations

"organized in, or existing under the laws of the Philippines, no

matter how created or organized but not including duly

registered general co-partnerships" a term, which according to

the second provision cited, includes partnerships "no matter

how created or organized, ...," and applying the leading case of

Evangelista v. Collector of Internal Revenue.

Issue:

Whether or not petitioners form a partnership as to make them

liable to the income tax assessed by the CTA - YES

Held:

Petitioners are subject to the tax on corporations as provided

for in the NIRC. Applying the leading case of Evangelista v.

Collector of Internal Revenue, and section 84(b) of the NIRC,

which explicitly provides that the term corporation "includes

partnerships" and to Article 1767 of the Civil Code of the

Philippines, defining what a contract of partnership is, "the

essential elements of a partnership are two, namely:

(a) an agreement to contribute money, property or industry to a

common fund; and

(b) intent to divide the profits among the contracting parties.

The first element is undoubtedly present in the case at bar, for,

admittedly, petitioners have agreed to and did, contribute

money and property to a common fund. Hence, the issue

12

[BUSORG CASE DIGESTS]

narrows down to their intent in acting as they did. Upon

consideration of all the facts and circumstances surrounding

the case, we are fully satisfied that their purpose was to

engage in real estate transactions for monetary gain and then

divide the same among themselves.

Also, the SC said that for purposes of the tax on corporations,

our National Internal Revenue Code, include partnerships

with the exception only of duly registered general copartnerships within the purview of the term "corporation." It is,

therefore, clear to our mind that petitioners herein constitute a

partnership, insofar as said Code is concerned, and are

subject to the income tax for corporations.

the evidence on record. (Which petition was outrightly

dismissed by the CA due to absence of extrinsic or collateral

fraud, observing further that an appeal was the proper

remedy.)

Sps Navarro claim:

Navarro vs. CA

CASE: Petition for annulment of judgment: by Sps Navarro;

dismissed by the CA:

Facts:

On July 23, 1976, Olivia V. Yanson filed a complaint against

Lourdes Navarro for "Delivery of Personal Properties With

Damages". The complaint incorporated an application for a writ

of replevin.(*was subsequently amended to include private

respondent's husband, Ricardo B. Yanson, as co-plaintiff, and

petitioner's husband, as co-defendant.)

On July 27, 1976, then Executive Judge Oscar R. Victoriano

approved Yansons application for a writ of replevin. By virtue

of the same, Yanson has recovered the subject chattels.

Subsequently, the Presiding judge rendered a decision

disposing that

1

all chattels already recovered by [Yanson] by

virtue of the Writ of Replevin and as listed in the

complaint are sustained to belong to [Yanson]

being the owner of these properties;

the motor vehicle (Ford Fiera Jeep) registered in

and which had remain in the possession of the

[Navarro] was likewise declared to belong to

Yanson, however, [Navarro] is ordered to

reimburse [Yanson] the sum of P6,500.00

representing the amount advanced to pay part of

the price for the Jeep.

[Navarro] was likewise ordered to return to

[Yanson] such other equipment[s] as were

brought by the latter to and during the operation

of their business as were listed in the complaint

and not recovered as yet by virtue of the previous

Writ of Replevin.

This decision was subsequently declared final and executory.

The trial court issued a writ of execution. The Sheriff's Return

of Service declared that the writ was "duly served and

satisfied". A receipt for the amount of P6,500.00 issued by Mrs.

Lourdes Yanson, co-petitioner in this case, was likewise

submitted by the Sheriff

Sps Navarro filed with the CA a petition for annulment of the

trial court's decision, claiming that the trial judge erred in

declaring the non-existence of a partnership, contrary to

that the trial judge ignored evidence that would

show that the parties "clearly intended to

form, and (in fact) actually formed a verbal

partnership engaged in the business of Air

Freight Service Agency in Bacolod"; and

that the decision sustaining the writ of replevin is

void since the properties belonging to the

partnership do not actually belong to any of

the parties until the final disposition and

winding up of the partnership"

Sps Navarro keep on pressing that the idea of a partnership

exists on account of the so-called admissions in judicio.

Issue:

Whether a partnership existed between the parties in the

present case.NO.

Held:

As a premise, Article 1767 of the New Civil Code defines

the contract of partnership:

Art. 1767. By the contract of partnership two or more persons

bind themselves to contribute money, property, or

industry to a common fund, with the intention of dividing

the proceeds among themselves.

xxx xxx xxx

Corollary to this definition is the provision in determining

whether a partnership exist as so provided under Article 1769,

to wit:

xxx xxx xxx

Furthermore, the Code provides under Article 1771 and 1772

that

1 while a partnership may be constituted in any

form, a public instrument is necessary where

immovables or any rights is constituted.

2 Likewise, if the partnership involves a capitalization of

P3,000.00or more in money or property, the same

must appear in a public instrument which must be

recorded in the Office of the Securities and Exchange

Commission.

Failure to comply with these requirements shall only affect

liability of the partners to third persons.

In consideration of the above, it is undeniable that both the

plaintiff (Yanson) and the defendant-wife (Navarro) made

admission to have entered into an agreement of operating

this Allied Air Freight Agency of which the Yanson

personally constituted with the Manila Office in a sense that the

Yanson did supply the necessary equipments and money while

her brother Atty. Rodolfo Villaflores was the Manager and the

defendant the Cashier.

13

[BUSORG CASE DIGESTS]

It was also admitted that part of this agreement was an equal

sharing of whatever proceeds realized.

Consequently, Yanson brought into this transaction certain

chattels in compliance with her obligation. The same has been

done by the herein brother and Navarro who started to work in

the business.

A cursory examination of the evidences presented no

proof that a partnership, whether oral or written had been

constituted at the inception of this transaction.

True it is that even up to the filing of this complaint those

movables brought by Yanson for the use in the operation of the

business remain registered in her name.

While there may have been co-ownership or copossessionof some items and/or any sharing of proceeds

by way of advances received by both Yanson and Navarro,

these are not indicative and supportive of the existence of

any partnership between them. Article 1769 of the New Civil

Code is explicit.

In view of the above factual findings of the Court it follows

inevitably therefore that there being no partnership that

existed, any dissolution, liquidation or winding up is

beside the point.

Biglangawa and Espiritu vs. Pastor Constantino

Facts:

January 1950: Biglangawa and Espiritu appointed Constantino

as their exclusive agent to develop the area they owned into a

subdivision and sell them. As compensation they promised

commission (of 30% on the gross sales) and a fee (of 10% on

the collections made by him). He advanced all expenses in the

development, administration and advertisement of such area

October 1951: Constantino was able to dispose more than

half of the area

Later in October 1951: Owners terminated the contract but

acknowledged that they will pay the unpaid commission in

monthly installments (they had a practice of paying

Constantino lesser than what was expressed on the January

1950 contract, such that, when liquidation was made, there

was still a balance on Constantinos commission)

July 1955: Lower court decided in favor of the owners and

ordered the cancellation of the LP stating that Constantinos

civil action was purely and clearly a claim for money

judgment which does not affect the title or the right of

possession of real property annotated with LP and it being a

settled rule in this jurisdiction that a notice of lis pendens may

be invoked as a remedy in cases where the very lis mota of the

pending litigation concerns directly the possession of, or title to

a specific real property

Constantinos theory: Such holding that his was purely a

money judgement claim is wrong. Instead he is contending that

the agreement whereby he is to be paid commission and fee

actually converted him into a partner and gave him 1/5