Agri Snap Shot 2013 222 Questions

Diunggah oleh

arpannathHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Agri Snap Shot 2013 222 Questions

Diunggah oleh

arpannathHak Cipta:

Format Tersedia

Canara Bank RSTC Gurgaon

Agriculture Snap Test -222

Snap Test - 222

1. New farmer is the one who is availing of bank credit for the first time. Each Rural / SemiUrban branch has to finance at least _______________ each year. For the purpose of

identification of new farmers ________________ is to be obtained. Answer:

2. Piggery Farm without bacon processing shall be classified as (a) Manufacturing (b)

Service enterprise (c) Direct Agriculture-Farming activity (d) Indirect Agriculture (e)

Micro Finance Answer:

3. Bank has now proposed to have a focus on financial inclusion/ financial deepening by

bringing the existing credit products like GCCS, DIR, TFG Financing, etc. apart from

micro insurance & concessional transfer facilities under an Umbrella scheme called

_____________________ (a) Janashree Bima Yojana (b) Each one Reach one (c) Canara

Nayee-Disha (d) Micro credit Group (MCG). Answer:

4. In respect of Crop loans and other Agricultural related loans to whom Income Tax

provisions are not applicable, submission of Audited B/S need not be insisted for loans

amounts upto ________________ Answer:

5. Discretion has been given to the sanctioning authority to waive insurance cover for

assets charged to the Bank for agricultural loans/advances upto ___________ on the

merits of each case. Answer:

6. What is mixed farming: a) cultivating 2 crops simultaneously b) Cultivating in 2 types of

soils c) Cultivating crops and Allied Activities d) cultivating 2 crops in a year Ans:

7. Now, RBI has allowed the Authorized Dealers to grant rupee loans to NRIs except for the

following purposes: (a) Business of chit fund & Nidhi company (b) Construction of Farm

Houses (c) Agricultural or Plantation activities (d) Real Estate Business (e) All the

above.: Answer:

8. Manufacture of Bio fertilizer is to be classified as :_________________ (a) Direct

Agriculture (b) Indirect Agriculture (c) MSME - (Mfg /Industry) (d) MSME - (Services)

Answer:

9. Which of the following activities considered as MSME - Service? (a) Agri-Clinic and

Agri-Business (b) Renting of agricultural Machinery (Harvesting) (c) Training-cumincubator Centre (d) Seed Grading Services (e) All the above. Answer:

10. All loans under schematic lending (under agriculture, government sponsored schemes,

finance to SMEs etc) are coming under which of the following business lines? (a) Private

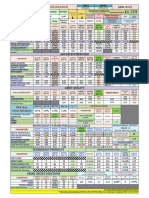

Banking (b) Commercial Banking (c) Retail banking (d) None of the above.. Answer:

11. It is an informal group of progressive and prompt paying borrowers. They disseminate the

information to the rural fraternity, about the various financial products and the principle

of development through credit; inculcate the habit of savings, better repayment ethics.

They also give information about the problems faced by the farmers, to the

Bank/NABARD/Government. They act as financial literacy centers in the villages. They

act as a bridge between the rural people and the Bank/NABARD/Government. RBI has

1

AUG2013

Canara Bank RSTC Gurgaon

Agriculture Snap Test -222

also permitted the Banks to engage them as Business Correspondents / Business

Facilitators. The description pertains to ________________. Answer:

12. Composite unit of Bacon Processing and Piggery Farm is to be classified as : (a) MSME

- (Mfg /Industry) (b) MSME - (Services) (c) Direct Agriculture (d) Indirect Agriculture

Answer:

13. The coverage under the RKBY Scheme in respect of loans granted for notified crops in

notified areas (as decided by the participating State Government/Union Territories) is

mandatory. RKBY is a risk mitigation product of _____________ (GIC/LIC/AIC/UIA)

Answer:

14. Additional interest subvention of ___% will be available in case of farmers who repay

loans promptly, thus rate of Interest for such farmers would come down to 4% p.a. for the

crop loans upto Rs.3 lakhs. Answer:

15. The scheme provides credit to persons belonging to economically disadvantaged

sections of the society. The loans can be sanctioned for smaller groups with 3-5

members in urban areas and 5-10 members in Rural and Semi urban areas. The finance

can be granted for starting/improving/expanding any type of income generating activity.

The group mentioned here refers to: (a) Joint Liability group (b) Tenant farmer group (c)

Self Help Group (d) Micro credit group. Answer :

16. Which of the following is NOT true regarding MCGs? (a) Limit permitted per member is

Rs.50000/- and a maximum of Rs.500000/- per group. (b) Debt swapping facility to

group members is also permitted up to a maximum of Rs.25000/- within the overall

limit of Rs.50000/- per member. (c) For availing the Debt swap loan facility, the loan

taken from the money lender should be at least one year old. (d) No Margin need to be

brought in by the members in a group. (e) None of the above is incorrect. Answer:

17. Which of the following is NOT true regarding MCGs? (a) The loans given to the groups

are to be treated as clean loans. (b) Should be repaid in monthly/quarterly/half yearly

installments, with repayment holiday of three months in the beginning. (c) The maximum

repayment period that can be generally permitted is 48 months. (d) The terms of

repayment can be extended up to 60 months depending upon the income generation. (e)

None of the above is incorrect Answer:

18. Which of the following is NOT true regarding Janashree Bima Yojana Scheme ? (a)

Janashree Bima Yojana is a Death cum Disability insurance scheme by LIC of India. (b)

All the Credit Linked Women Self help Group members are eligible to be covered under

the scheme. (c) The premium payable is Rs.200/- per member per year. Members have to

pay a premium of Rs.100/- per year and the balance would be met by Govt. of India (d)

The policy is valid only for one year and hence requires renewal every year by paying the

premium. (e) None of the above is incorrect. Answer:

19. Under Janashree Bima Yojana compensation is available for Natural death upto

________________; & for Death due to accident ______________; Permanent

disability due to accident ___________ Answer:

2

AUG2013

Canara Bank RSTC Gurgaon

Agriculture Snap Test -222

20. The add-on benefit available in Janashree Bima Yojana Scheme is a scholarship of

Rs._____________ per annum, for two children of the JBY members, who are studying

in _________ to ________ standard. Answer:

21. Loans upto _____________ for purchase & distribution of inputs to allied activities such

as Cattle feed, poultry feed etc & Drip and Sprinkler irrigation dealers upto

_____________ per dealer can be classified as Indirect Agriculture. Answer:

22. The farmers having land holdings of __________ and less of dry land, tenant cultivators,

share croppers are only classified as small farmers. In respect of borrowers who do not

possess land (owned or leased) but are engaged in non land based activities allied to

agriculture such as dairy, poultry, piggery, etc and having income from all sources,

farmers with annual income of _________ or other farmers. Answer:

23. Adjusted Net Bank Credit denotes Gross Bank Credit plus Investments made by banks in

Non-SLR Bonds held in _____________ category. Answer:

24. For borrowers with 2 years satisfactory track record & where Charge is created under the

State Act as per Talwar Committee recommendations, branches can extend agricultural

loans without insisting on mortgage of landed property upto ______________ as Subceiling for any one loan segment-Crop loans/development/investment loan and

Rs._____________ as the overall ceiling. Answer:

25. Branch managers and AEOs are empowered to value the landed properties offered as

security for agriculture loans as mentioned below: Branch Managers- Agriculture loans

upto a limit _____________. AEOs / AEO promotee managers Agriculture loans upto

_____________ Answer.

26. Display of Hypothecation board need not be insisted for all agriculture loans upto a limit

of ________________ and all crop loans, KCCS, Kisan Suvidha, Canara Kisan OD,

irrespective of amount. Answer:

27. Agriculture extension activity: A budget of ___________ in respect of rural and semi

urban branches is permitted for a minimum of ________ activities in a year. Answer:

28. It has been decided that branches can finance upto _________ in their command area for

all Priority Sector Advances. For financing beyond, the branches have to obtain the

permission of Circle Office for branch sanctions. Answer

29. For Development Loans upto ________ obtention of bills / vouchers / receipts can be

waived, subject to obtention of a declaration from the borrower for having incurred the

expenditure + conducting post sanction visit within 15 days from the date of

disbursement for ensuring and confirming end use. Answer:

30. Expenses towards storing, processing of produce and expenditure incurred in holding like

godown charges, treatment of food grains to prevent pest/rodent attack of the agricultural

produce till marketing can be covered under the __________________ scheme. Answer:

31. Reimbursement as a mode of disbursement is to be permitted only in respect of

development loans under Agriculture. The reimbursement is to be permitted for expenses

incurred within __________. Maximum reimbursement of ______________ can be

permitted. Sanctioning authorities can permit reimbursement upto and inclusive of

3

AUG2013

Canara Bank RSTC Gurgaon

Agriculture Snap Test -222

_______________ out of the total sanctioned limit in case of agriculture development

loans where immovable assets are created / developed. Answer:

32. A loan granted for short duration crops will be treated as NPA, if the installment of

principal or interest thereon remains overdue for __________ seasons. A loan granted for

long duration crops will be treated as NPA, if the installment of principal or interest

thereon remains overdue for __________ season. Answer:

33. Which of the following is NOT true regarding KCCS? (a) Opening of SB A/c need not be

made a pre condition to grant KCC. (b) Time norms modified - within 15 days from

receipt of application. (c) Loan limit should not exceed 50% of value of the produce. (d)

No drawal in the account should remain outstanding for more than 12 months, except for

long duration crops. (For long duration crops it is 18 months.) (e) None of the above is

incorrect. Answer:

34. Sub-limit II of Kisan Credit Card Scheme shall be ___________ the annual net income

of the farmer subject to a maximum of _________. Answer:

35. Validity of Kisan Credit Card Scheme is _______________ subject to annual review.

Answer:

36. Agriculturists with ________ satisfactory dealings are eligible for Canara Kisan OD.

Answer:

37. Canara Kisan OD Limit: Maximum 3 times _________ (Gross / Net) annual income with

minimum Rs.100,000/- and Maximum of Rs._____________. Answer:

38. Canara Kisan OD Ceiling per acre mortgaged: _________ subject to 50% of value of

mortgaged landed property. Answer:

39. Under the Canara Kisan OD scheme, with in overall limit, upto __________ can be

permitted for repayment of outside debts by farmer. Answer:

40. RBI has given a mandate to ensure that at least __________ of agriculture credit flows to

tenant farmers / Oral lessees. Answer:

41. Finance To Tenant Farmers & Oral Lessees through JLGs: Total quantum of loan to the

group for raising of crops should be limited to @ _____________ per member. Exposure

per group for the purpose of raising of crops shall not exceed ____________ Answer:

42. A need was felt for an exclusive Credit Card Scheme for individual tenant farmers and

farmers without proper land records to bring in a larger number of disadvantaged sections

within the ambit of Financial Inclusion. The ____________________ has been

formulated with this objective. (a) KMCCS (b) Kisan Tatkal (c) TFG Credit Card (d)

Swarojgar Credit Card. Answer:

43. Agriculture Gold Loans: the ceiling on rate of advance now stands enhanced to

___________ per Gram of Net weight of the gold jewelleries pledged or ___________ of

the appraised value, whichever is lower. The above rate will be valid till ____________

or till advised otherwise earlier. Answer:

44. Security deposit from jewel appraisers to be insisted is _____________ Answer: .

4

AUG2013

Canara Bank RSTC Gurgaon

Agriculture Snap Test -222

45. Normal Provision on Standard Assets in case of Agriculture and MSE:

46. Which of the following is NOT true regarding Kisan Tatkal? (a) Minimum limit:

Rs.1000/- Maximum limit: Rs. 50000/- (b) The total amount of finance extended not to

exceed 50 % of the KCCS limit. (c) KT limit shall not exceed 25% of the estimated

annual income of the agriculturist within the above ceilings. (d) To be repaid within a

period of 3-5 years in half yearly/annual installments. (e) None of the above is incorrect.

Answer:

47. Sanctioning Authority may waive Insurance cover on fish crops and bund structures in

respect of Working Capital limits for Inland Fisheries Projects subject to the following:

(a) Obtention of a corpus Fund as collateral at the rate of 3% of the limit (b) If the

limit/loan is secured by way of Immovable Properties for minimum of 100% of the

exposure (c) Experience of the borrower in the line of Inland fisheries for 3 years and

above (d) Satisfactory past dealings of the borrower for more than 3 years (e) All the

above. Answer:

48. Loans granted for construction of own storage facilities like godowns, silos etc for storing

own produce should be classified under (a) farm development loans (b) Farm House (c)

Rural Godowns (d) Canara Kisan OD. Answer:

49. State as to whether the following is True or false? Loans to farmers for construction of

farm houses exclusively used for residential purposes should not be classified under

agriculture. Answer:

50. The maximum amount of Loan to farmers for construction of farm houses (which are

structures that apart from being dwelling houses for farmers shall necessarily include

storage room / sheds for livestock & located on or adjacent to the Farm) is

Rs.______________ at Housing Loan, Rate of Interest. Answer:

51. Obtention of ________ (A // B // D // H // R) Register extraction (original) issued by RTO

along with the application from the prospective buyer borrowers is made mandatory for

all types of loans against the security (Primary/collateral) of used vehicles viz. LHV (both

priority and non priority including staff), Canara Mobile etc. Answer: .

52. AL DIR Branch target: _______ loans per year per branch. Answer:

53. ___________ of DIR loans should be routed through Rural & Semi Urban branches. Not

less than ___________ of the total DRI advances should go to SC / ST borrowers.

Answer :

54. State as to whether the following is True or false regarding the eligibility sanctioning of

AL DIR loans? The borrower need not own any land or the size of the land holding

should not exceed one acre of irrigated land or 2.5 acres of unirrigated land. Answer: .

55. Eligibility for sanctioning AL DIR loans: Annual family income should be less than

___________ in rural; _____________ in semi-urban & _______________ in Urban

areas. . Answer:

56. Eligibility for loans for purchase of Tractor alone or Tractor + Trailer: The applicant

should have at least __________ of perennially irrigated land or __________ of dry land

5

AUG2013

Canara Bank RSTC Gurgaon

Agriculture Snap Test -222

so as to ensure sufficient work of at least 1000 to 1200 hours per year including a

minimum of 500 hours of work on the farmers own land. Answer:

57. Disbursement of Tractor / Power Tiller loans: Branches to retain _______ % of the value

of the quotation (wherever registration with RTO authorities is required) payable to the

dealers till the RC Book is received duly noting our lien. Answer :

58. Pumpset / Minor Irrigation Loans: Disbursement for electrical pump sets, _________%

of the cost of pump sets + accessories including the margin should be disbursed directly

to the dealer. The balance __________ % is to be paid only after the installation of the

complete pumping system and obtaining the certificate from the dealer as per

Annexure-13 of the MoI + letter guaranteeing the satisfactory performance of the pump

set after energization. Answer:

59. Pump set / Minor Irrigation Loans: Disbursement for oil engines ___________ %

payments to the dealer towards pump sets and accessories should be made after

ensuring that the same have been supplied to the borrower and obtaining the certificate

guaranteeing the satisfactory performance of the pump from the dealer. Answer:

60. Tractor / Power Tiller loans: Our lien should be noted in the RC Book within ________

of disbursement & RC book copy should be obtained. Answer:

61. A cap of ______ farm machinery loans per branch per year is fixed for branches where

the outstanding Farm Machinery portfolio is less than 50. After reaching the cap of 50

farm machinery loans, the branches to seek prior clearance from CO. Answer:

62. The branches with outstanding farm machinery portfolio of more than 50 loans or

recovery is less than ________ under the relative portfolio, have to obtain prior clearance

from CO for every block of 5 farm machinery loans proposed. Answer:

63. Which of the following statements are true regarding financing of pre-owned tractors? (a)

Tractor should not be more than 3 years old. (b) Loan Quantum: Not more than 60% of

the value of the tractor as per valuation report or sale consideration whichever is less. (c)

Repayment: Maximum 5 years in half yearly / yearly instalments. (d) All the above are

true. Answer:

64. Scoring matrix should be used to assess the eligibility & is applicable for both new and

second hand tractors. If a farmer scores __________ and below, such cases are to be

rejected. Answer:

65. High yielding milch cattle is one which is yielding not less than _________ litres per day.

Answer:

66. Under dairy loans bank can finance initial feed cost for a period of _________ at the rate

of ___________ Kgs per animal for the first batch of animals. Answer:

67. The normal economic life of a milch buffalo is __________ lactations and that of a cow is

__________ lactations. Milch animals should be bought at the __________ or

__________ lactation stage. Answer:

68. Which of the following is / are NOT true regarding the Scheme of Debt swapping for

farmers? (a) Farmers who have raised loans from non-institutional sources are eligible.

6

AUG2013

Canara Bank RSTC Gurgaon

Agriculture Snap Test -222

(b) Farm should be situated within 16 Kms radius of the Branch. (c) Loan upto the extent

of indebtedness, provided it is within 150% of the Gross annual income subject to a

maximum Limit of Rs. 50,000/-. (d) The amount should have been borrowed for some

productive purpose. Answer:.

69. Loan scheme for Purchase of Agricultural Lands: Total Land Holdings after Purchase of

Land, should not exceed ___________ acres irrigated or ________ acres of non-irrigated

land. Answer:

70. State as to whether the following is True or false regarding the purpose of the loan

scheme for Purchase of Agricultural Lands: Purchase of land can be considered for

Purchase, develop & cultivation of agriculture / waste / fallow lands // diversifying into

allied activities. Answer:

71. The maximum quantum of Sericulture loan for cultivation of mulberry, rearing of silk

worms, construction of rearing house and purchase of rearing equipment/wire

mesh/disease free layings (DFL) is Rs. _________ lacs. Answer:

72. Since GCCS is an important financial inclusion tool, it has been decided to levy only

_____________ % of Processing Charges, Folio charges, Notice Charges, and Inspection

charges. Answer:

73. Under GCCS scheme the maximum loan quantum is __________ % of net annual income

of entire household with maximum _____________Answer:

74. Farmers' clubs are to be rated for graduation of farmers' clubs to federation/producers'

groups/companies. To rate the farmers club as GOOD it should score above:

__________ Answer:

75. Term loan benchmark parameters in respect of Direct and Indirect Agriculture like Cold

storage / Rural godowns / Yards / Warehouses / Agro processing units/ Agri Clinics/

Agriculture Business/ Customer service units: Internal Rate of Return is ___________and

above from estimated weighted average cost of funds in case of cold storage/ rural

godown/ yards/ warehouses. Answer:

76. Term loan benchmark parameters in respect of Direct and Indirect Agriculture like Cold

storage / Rural godowns / Yards / Warehouses / Agro processing units/ Agri Clinics/

Agriculture Business/ Customer service units: D/E ratio 3:1 upto _____________

{Beyond 3 :1 only for TL _________ (above / upto) Rs. 10 Lacs}. Promoters

Contribution Minimum of 15 % of project cost. Answer:

77. The __________ scheme envisages finance for construction of new cold storages,

expansion of existing units and modernization /rehabilitation of existing cold storage

units with the element of subsidy. Answer:

78. Revised Guidelines - Capital Investment Subsidy Scheme (For Construction / Renovation

/ Expansion Of Rural Godown - Grameena Bhandara Yojana .

Subsidy

Farmers

Non farmers

Women farmers

As a % of capital cost

25%

15%

33.33%

Max subsidy

Rs 46.87 lacs Rs 28.12 lacs

??

7

AUG2013

Canara Bank RSTC Gurgaon

Agriculture Snap Test -222

Answer:

79. Subsidy Grant available for eligible food processing industries undertaking Technology

upgradation / expansion / modernization / establishment etc. from Ministry of Food

Processing Industries, Government of India @ 25% (Max. _____________) of the cost of

Plant & Machinery and Technical Civil Works (TCW) in General areas and 33%

(Max.___________ ) in difficult areas will be available as subsidy Answer:

80. Under the Scheme for financing Commission Agents functioning in rural / semi-urban

areas against book debts / receivables towards supply of agricultural inputs to farmers,

maximum quantum of loan is ____________Answer:

81. _________________ are envisaged to provide expert advice and services to farmers on

technology, cropping practices, protection from pests and diseases, market trends, prices

of various crops in the markets and also clinical services for animal health, etc., which

would enhance productivity of crops/ animals and increased income to farmers. Answer:

82. Ceiling on AC & ABC Project: __________ per graduate with max.____________ per

group of 5 graduates. Answer:

83. There is no restriction on number of farmers clubs to be formed per branch. But, all the

Semi urban / Rural branches to ensure formation of at least _______________ where

there are no existing farmers' club. Answer:

84. Farmers club: The sharing of these expenses at 50:50 has been discontinued &

NABARD would be giving a uniform assistance of Rs.______________ per year per

club, for three years for the minimum and mandatory expenses. Answer:

85. Our Bank will pay ___________ per club per year, for the fourth and fifth years & would

be permitted by DM/AGM of the COs. Answer:

86. ______________ has set up a fund called FTTF. (Farmers Technology Transfer funds)

The fund will extend the support in the form of grant, soft loan, equity like support or a

blend of the same, as may be decided on the merits of each case. Answer:

87. Restructuring of Agriculture Gold Loans: Deferment of outstanding liability upto a

maximum period of __________, linked to expected cash flow from activity for which

the loan was permitted. The interest shall be serviced during the deferment period.

Answer:

88. Evaluation of restructuring proposals for agricultural loans exceeding Rs. 25 Lakhs: The

projected DSCR should not be less than ___________. IRR should be atleast 2% above

the rate of interest applicable to restructured loan accounts. The Current Ratio should not

be less than ___________ wherever applicable. Answer:

89. As per our Advances Restructuring Policy for restructuring agriculture Investment

Loans like Pump set loan, Farm Machinery Loan etc. which of the following is permitted?

(a) Rescheduling without changing the existing tenor with one year moratorium +

Ballooning (graded) repayment (b) Rescheduling the repayment period by one to 3 years

with a holiday of one year (c) Option (a) or (b) subject to recovering the loan within the

economic life period of the asset. Answer:

8

AUG2013

Canara Bank RSTC Gurgaon

Agriculture Snap Test -222

90. All agriculture term loans above _______________ are to be appraised by Agriculture

Consultancy Services as to the technical feasibility and economic viability. Answer: .

91. Which of the following is/are the conditions for granting of fresh credit facilities (upto Rs.50000/- (by

respective sanctioning authorities) to OTS beneficiaries who are non-wilful defaulters? (a) Purpose can

only be to agricultural and allied activities or to weaker section for undertaking all gainful activities (b)

Party should have repaid at least 10% of the principal amount of the previous loan before permitting

concession / compromise (c) Only after 3 months from the date of clearance of the dues under OTS. (d)

Fresh loans may be considered as far as possible in joint names viz., along with the spouse or along with

the eldest members in the family (in the absence of spouse) to ensure family responsibility (e) All the

above. Answer:

92. Bank can take action under SARFAESI Act in respect of all NPA accounts except in the

following cases: (a) Claim / liability below Rs.1.00 lac (b) Security interest (mortgage) created in

agricultural land* (c) Pledge of movables within the meaning of Section 172 of Indian Contract

Act (d) In case where the amount due is less than twenty percent of the principal amount

and

interest thereon. (e) All the above. (*) High Court of AP held that, if a land is ordinarily used for

the purposes of agriculture, it would be agricultural land and if it is not so used, it would not be

agricultural land for the purpose of taking action under SARFAESI Act irrespective of whether

revenue / municipal records mentions it as agriculture land or not. Answer:

93. 7 crore loan to corporate. amount to be classified under indirect agriculture. Answer94. Rural area under SGSY means:

95. Subsidy available to SHG under SGSY is restricted to 50% of the project cost with

maximum of Rs. ____ within per member entitlement of Rs ____.

96. To arrive figures in rural areas for Consumer Price Index, whose assistance is decided to

take:

97. The max distance criteria for the operation of the Banking correspondent for rural , urban

, semi urban areas is _____ Ans

98. In Sugar cane loans, wherever tie up arrangement with Sugarmills, loan upto Rs._______

can be given without insisting mortgage under KCCS/Investment/Development Loans:

Ans:

99. Time norm for sanction of KCC loan branch sanctions : Ans

100. The insurance premium for providing Life Insurance cover(PAIS) to KCC holders is

Rs.-------. Of this, the bank and borrower contribute in the ratio of -------Ans101. ______________ (Moriculture / Mariculture) is a specialized branch of aquaculture

involving the cultivation of marine organisms for food and other products in the open

ocean, an enclosed section of the ocean, or in tanks, ponds or raceways which are filled

with seawater. Answer:

102.

Debt Swapping Farmers Target:

***

9

AUG2013

Anda mungkin juga menyukai

- Help Manual For IOs Doing Inspection of Computerized Branches Updated Till 30th September 2008-1 PDFDokumen194 halamanHelp Manual For IOs Doing Inspection of Computerized Branches Updated Till 30th September 2008-1 PDFarpannathBelum ada peringkat

- HSBC Technology Manifesto Vision for Healthy CultureDokumen15 halamanHSBC Technology Manifesto Vision for Healthy CulturearpannathBelum ada peringkat

- Amazon Copywriting Secrets How Everyone Can Use The Power of Words To Get More Clicks Sales and P20200309 62415 1he8taq PDFDokumen4 halamanAmazon Copywriting Secrets How Everyone Can Use The Power of Words To Get More Clicks Sales and P20200309 62415 1he8taq PDFarpannath0% (3)

- Reasoning TricksDokumen1 halamanReasoning TricksarpannathBelum ada peringkat

- Math TricksDokumen1 halamanMath TricksarpannathBelum ada peringkat

- 5197 PDFDokumen1 halaman5197 PDFarpannathBelum ada peringkat

- NibDokumen1 halamanNibarpannathBelum ada peringkat

- Performance of The Branch: Advances PortfolioDokumen1 halamanPerformance of The Branch: Advances PortfolioarpannathBelum ada peringkat

- Art and Culture: Visual Arts and Architecture in Ancient IndiaDokumen103 halamanArt and Culture: Visual Arts and Architecture in Ancient IndiaarpannathBelum ada peringkat

- 5197-Car Hire 04 Dates-Ltr 157 DT 23.04.19Dokumen1 halaman5197-Car Hire 04 Dates-Ltr 157 DT 23.04.19arpannathBelum ada peringkat

- MySQL database settings for WordPressDokumen1 halamanMySQL database settings for WordPressarpannathBelum ada peringkat

- Canara Bank officer permission to operate from third placeDokumen1 halamanCanara Bank officer permission to operate from third placearpannathBelum ada peringkat

- 1st Round Training 2011Dokumen91 halaman1st Round Training 2011arpannathBelum ada peringkat

- 1971 PDFDokumen339 halaman1971 PDFarpannathBelum ada peringkat

- SLBCDokumen10 halamanSLBCarpannathBelum ada peringkat

- 1 Retail LendingDokumen7 halaman1 Retail LendingarpannathBelum ada peringkat

- SBI Recruitment of Specialist Cadre OfficersDokumen2 halamanSBI Recruitment of Specialist Cadre OfficersSekar MariappanBelum ada peringkat

- Vision Ias - Material July August 2018Dokumen120 halamanVision Ias - Material July August 2018Anonymous DD1ICVZfoBelum ada peringkat

- Subject (01) ECONOMICS: Ugc - Net Exam June 2013 DATE OF EXAM:30/06/2013 Keys - Paper 2Dokumen1 halamanSubject (01) ECONOMICS: Ugc - Net Exam June 2013 DATE OF EXAM:30/06/2013 Keys - Paper 2arpannathBelum ada peringkat

- E-Lock Installation GuideDokumen9 halamanE-Lock Installation GuidearpannathBelum ada peringkat

- Cboa Descriptive MsmeDokumen32 halamanCboa Descriptive MsmearpannathBelum ada peringkat

- Jaiib BreakthroughDokumen3 halamanJaiib BreakthrougharpannathBelum ada peringkat

- Siva MantraDokumen5 halamanSiva MantraarpannathBelum ada peringkat

- Architecture of Aadhaar Payment SystemDokumen1 halamanArchitecture of Aadhaar Payment SystemarpannathBelum ada peringkat

- IT FormsDokumen2 halamanIT FormsarpannathBelum ada peringkat

- IIESTDokumen4 halamanIIESTarpannathBelum ada peringkat

- S 01 13 III EconomicsDokumen24 halamanS 01 13 III EconomicsshreeshlkoBelum ada peringkat

- CrazycommandDokumen2 halamanCrazycommandarpannathBelum ada peringkat

- LLP Master Data3Dokumen1 halamanLLP Master Data3arpannathBelum ada peringkat

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Financial System, Market & ManagementDokumen62 halamanFinancial System, Market & ManagementVer Dnad JacobeBelum ada peringkat

- Thorogood Publishing Manager's Guide To Competitive Marketing Strategies 3rdDokumen414 halamanThorogood Publishing Manager's Guide To Competitive Marketing Strategies 3rdCristina MariaBelum ada peringkat

- Economics Midterm ReviewDokumen5 halamanEconomics Midterm ReviewAmyBelum ada peringkat

- Banking Course OutlineDokumen7 halamanBanking Course Outlinemohammed BayuBelum ada peringkat

- "A Study On Financial Institutions Offering Home Loans" Study Conducted atDokumen64 halaman"A Study On Financial Institutions Offering Home Loans" Study Conducted atSumit BansalBelum ada peringkat

- Corporate Law Project NewDokumen10 halamanCorporate Law Project NewAyushi VermaBelum ada peringkat

- Banking AwarenessDokumen412 halamanBanking AwarenessSai PraveenBelum ada peringkat

- 3.1 Money and Finance New Book: Money and Banking: Igcse /O Level EconomicsDokumen17 halaman3.1 Money and Finance New Book: Money and Banking: Igcse /O Level EconomicsJoe Amirtham100% (1)

- Sun Life ProspectusDokumen39 halamanSun Life ProspectusAiza CabolesBelum ada peringkat

- SecuritizationDokumen19 halamanSecuritizationSunny TomarBelum ada peringkat

- SBA Loan SecretsDokumen3 halamanSBA Loan SecretsPNWBizBrokerBelum ada peringkat

- Industry EnviDokumen21 halamanIndustry Envijohn louie superalisBelum ada peringkat

- LLM 411: Indian Constitutional Law: Schedule-A Ll.M. Course of Study Ll.M. First Semester Core PaperDokumen50 halamanLLM 411: Indian Constitutional Law: Schedule-A Ll.M. Course of Study Ll.M. First Semester Core Paperbhavishyat kumawatBelum ada peringkat

- Indian Bank Case StudyDokumen20 halamanIndian Bank Case StudyRadha syam100% (1)

- Latest StatmentDokumen3 halamanLatest Statmentgovt job postgyyBelum ada peringkat

- 11th Edition Eugene F. Brigham University of Florida Joel F. Houston University of FloridaDokumen18 halaman11th Edition Eugene F. Brigham University of Florida Joel F. Houston University of FloridaHoàng Anh NguyễnBelum ada peringkat

- Debts Recovery Tribunal Rules SummaryDokumen18 halamanDebts Recovery Tribunal Rules Summaryfwd2dattaBelum ada peringkat

- Mobile BankingDokumen23 halamanMobile Bankingdm_ngos100% (1)

- Büchi - Economic Transformation of Chile - R. LeivaDokumen223 halamanBüchi - Economic Transformation of Chile - R. LeivaMaría MuzzachiodiBelum ada peringkat

- A. First Metro Investment CorporationDokumen2 halamanA. First Metro Investment CorporationJeth Vigilla NangcaBelum ada peringkat

- Business Pp2Dokumen3 halamanBusiness Pp2martinBelum ada peringkat

- Treasury ManagementDokumen9 halamanTreasury ManagementAkash BdBelum ada peringkat

- Pub 1011 KBMDokumen24 halamanPub 1011 KBMtiffany_wilken2978Belum ada peringkat

- Useful Sample ResolutionsDokumen29 halamanUseful Sample ResolutionsSoumitra Chawathe87% (15)

- President CEO Revenue Sales in Nashville TN Resume Walter WasyliwDokumen3 halamanPresident CEO Revenue Sales in Nashville TN Resume Walter WasyliwWalterWasyliw2Belum ada peringkat

- Security Market Operations BookDokumen282 halamanSecurity Market Operations BookAbhishek AnandBelum ada peringkat

- Analysis of Laxmi Bank's financial performanceDokumen22 halamanAnalysis of Laxmi Bank's financial performanceBijaya Dhakal0% (1)

- Syllabus Bcom Taxation and Finance PDFDokumen31 halamanSyllabus Bcom Taxation and Finance PDFThe Alchemist100% (1)

- Shark Note BarclaysDokumen6 halamanShark Note BarclayschefofrBelum ada peringkat

- Equitable PCI Bank Vs NG Sheung NgorDokumen2 halamanEquitable PCI Bank Vs NG Sheung NgorRobert QuiambaoBelum ada peringkat