Travel Insurance - Out of Province Details

Diunggah oleh

Man DanaHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Travel Insurance - Out of Province Details

Diunggah oleh

Man DanaHak Cipta:

Format Tersedia

Snapshot: Manulife Travel Insurance for Canadians

Revised December 2014

Plan Comparison

Single-Trip**

Core Benefits

Emergency Medical $5,000,000 CDN*

Includes Emergency Medical

and Terrorism coverage

Flight & Travel Accident $100,000 & $50,000/trip respectively, for double

dismemberment, $50,000 & $25,000 respectively, for single dismemberment

$2,500,000 maximum aggregate for Trip Cancellation/Interruption

Trip Cancellation

& Interruption

Includes all benefits

Trip Lengths of:

4, 10, 18 or 30 days

Top-ups for longer durations

Includes Trip Cancellation,

Trip Interruption and

Terrorism Coverage

No maximum duration

Includes all benefits

Trip Cancellation/Interruption As a free-standing plan, up to sum insured

to a maximum of $20,000/trip. For Single-Trip All-Inclusive, up to $5,000/trip.

For Multi-Trip All-Inclusive, up to $5,000/trip and $8,000/policy.

Baggage Loss/Damage/Delay $1,000/trip & $3,000/policy for Loss/Damage

$500/trip & $1,500/policy for Delay

Terrorism Coverage $35,000,000 maximum aggregate for Emergency Medical;

Multi-Trip

All-Inclusive

Single-Trip**

All-Inclusive

Multi-Trip

Includes Emergency Medical

and Terrorism coverage

Trip Lengths of:

4, 10, 18 or 30 days

Top-ups for longer durations

Other Features or Requirements

Eligible Age***

Guaranteed Issue

Medical Questionnaire To determine eligibility and rate category in order

to purchase Emergency Medical

Four Rate Categories: A+, A, B, or C.

Emergency Medical Pre-existing Condition & Stability

A pre-existing medical condition is covered if stable (per policy definition) in the

time frame prior to departure.

BounceBack Benefit $2,000 for round trip from destination to home.

No Limit

No Limit

No Limit

No Limit

No Limit

Under 60 years of age

Rate Category A

Under 60 years of age

Rate Category A

Under 60 years of age

Rate Category A

Under 60 years of age

Rate Category A

Not Applicable

Applicable if 60 or over

Applicable if 60 or over

Applicable if 60 or over

Applicable if 60 or over

Not Applicable

Rate Categories A+ & A:

All Ages: 3 months

Rate Category B:

60+: 6 months

Rate Category C:

60+: 12 months

Rate Categories A+ & A:

All Ages: 3 months

Rate Category B:

60+: 6 months

Rate Category C:

60+: 12 months

Rate Categories A+ & A:

All Ages: 3 months

Rate Category B:

60+: 6 months

Rate Category C:

60+: 12 months

Rate Categories A+ & A:

All Ages: 3 months

Rate Category B:

60+: 6 months

Rate Category C:

60+: 12 months

Not Applicable

Applicable

Applicable

Not Applicable

Not Applicable

Not Applicable

Not Applicable

Applicable

Not Applicable

Applicable

Applicable

Applicable

Applicable

Applicable

Applicable

Not Applicable

Voluntary. Available up to

maximum duration if done

prior to expiry & no claims

Voluntary. Available up to

maximum duration if done

prior to expiry & no claims

Voluntary. Available up to

maximum duration if done

prior to departure

Voluntary. Available up to

maximum duration if done

prior to departure

Not Applicable

Applicable

Applicable

Applicable

Applicable

Applicable 25%

co-payment does not apply

Trip Cancellation & Interruption Pre-existing Condition & Stability

No coverage if cancellation is due to insureds or spouses medical condition that

was not stable during 3 months prior to purchase.

Automatic Extensions 72 hours if your carrier is delayed; 5 days if you or

a travelling companion have a medical condition that prevents travel and are not

hospitalized if hospitalized, will extend for full period of hospitalization and 5 days

after discharge, to maximum of 12 months.

Top-ups and Extensions

Notification of Assistance Centre Mandatory for medical emergency

at destination insured responsible for 25% of claim cost if Assistance Centre

not notified

* For the complete list of benefits and maximum sums, refer to policy.

** Maximum of 183 days for Ontario/212 days for Nfld residents; can be issued for longer durations with special request.

Plans underwritten by The Manufacturers Life Insurance Company.

Manulife, the Block Design, the Four Cubes Design, and Strong Reliable Trustworthy Forward-thinking are trademarks of The Manufacturers Life Insurance Company and are used by it, and by its affiliates under license.

2014 The Manufacturers Life Insurance Company. All rights reserved.

AT0193E-12/14

*** Minimum age for any program is 30 days.

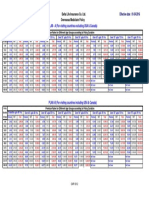

Premium Rates 60+ (Rate Category A+)

Single Trip

Single-Trip

All Inclusive

60 64

65 69

70 74

75 79

80 84

85+

$3.60 $4.76/day

$4.25 $5.88/day

$5.90 $8.09/day

$10.00 $15.16/day

$16.89 $24.00/day

$24.62 $28.94/day

$175

$195

$215

$245

$275

$295

Premium Rates 0-59 (Rate Category A)

Based on # of days(1)

Add to Single Trip

0 25

26 39

40 54

55 59

$2.62 $2.96/day

$2.83 $3.24/day

$3.15 $3.63/day

$3.70 $4.90/day

$125

$135

$145

$165

Based on # of days(1)

Add to Single Trip

$4.16 $5.90/day

$5.38 $8.09/day

$6.70 $9.41/day

$12.26 $18.26/day

$20.59 $29.61/day

$26.62 $33.44/day

$175

$195

$215

$245

$275

$295

Based on # of days(1)

Add to Single Trip

$6.00 $8.63/day

$7.50 $11.63/day

$9.50 $15.06/day

$17.26 $25.58/day

$29.50 $38.08/day

$39.75 $52.03/day

$175

$195

$215

$245

$275

$295

Based on # of days(1)

Add to Single Trip

$8.53 $10.65/day

$11.50 $16.36/day

$14.55 $21.85/day

$25.00 $30.67/day

$39.38 $56.47/day

$56.62 $78.62/day

$175

$195

$215

$245

$275

$295

Available

Not Available

Available

Not Available

Not Available

Available

Not Available

Available

Not Available

Not Available

Available

Available

Available

Available

Available

Available

Not Available

Not Available

Not Available

Not Available

Available up to departure;

partial refund available

for early return

Available only for

Emergency Medical

up to departure

Available up to first travel date;

non-refundable after first travel date

Non-refundable

Non-refundable

Use to top up a Manulife

or other insurers plan

Not used for

top-up purposes

Use Single Trip Plan for top-up

Use Single Trip Plan for top-up

Not Applicable

Not Applicable;

if Bounceback added:

8% Ont., 9% Que.

8% Ont., 9% Que. on

All-inclusive premium only

and Bounceback if added,

8% MB on All-inclusive

premium only

Not Applicable

8% Ont., 2.3% Que., 8% MB

on entire premium amount

8% Ont., 9% Que., 8% MB on entire premium amount

Premium Rates 60+ (Rate Category A)

60 64

65 69

70 74

75 79

80 84

85+

Premium Rates 60+ (Rate Category B)

60 64

65 69

70 74

75 79

80 84

85+

Premium Rates 60+ (Rate Category C)

60 64

65 69

70 74

75 79

80 84

85+

Optional Medical Deductibles USD

$500 (15%); $1,000 (20%); $5,000 (35%); $10,000 (50%)

Multi-Trip

All Inclusive

Multi-Trip

$73

$82

$109

$129

$189

$246

$92

$112

$153

$267

$491

$741

$121

$130

$170

$305

$715

$802

$170

$205

$280

$580

$881

$1,020

$139

$156

$207

$245

$359

$467

4 days 10 days 18 days 30 days 4 days

$39

$44

$52

$66

$54

$59

$60

$91

$84

$86

$95

$115

$109

$121

$130

$170

$81

$86

$107

$130

4 days 10 days 18 days 30 days 4 days

$78

$91

$119

$133

$202

$273

$110

$130

$180

$320

$590

$795

$150

$155

$210

$375

$800

$850

$210

$230

$320

$611

$1,550

$1,690

$148

$173

$226

$253

$384

$519

4 days 10 days 18 days 30 days 4 days

$119

$136

$178

$214

$271

$324

$180

$210

$277

$482

$750

$950

$220

$313

$300

$426

$415

$565

$710 $1,012

$1,155 $2,200

$1,300 $2,580

$226

$258

$338

$407

$515

$616

4 days 10 days 18 days 30 days 4 days

$135

$175

$212

$376

$465

$611

$209

$242

$350

$265

$339

$498

$330

$415

$646

$595

$711 $1,139

$1,038 $1,279 $2,311

$1,196 $1,688 $2,887

$257

$333

$403

$715

$884

$1,161

Trip Cancellation

& Interruption

Prior to

$203

$286

$335

departure* 0-54 55-59 60-64 65-69 70-74 75-79 80-84 85+

$230

$295

$390

0

$

$53 $60 $71 $79

$87 $103 $114 $128

$291

$370

$532

$74 $75 $76 $91

$97 $117 $134 $150

$507

$580 $1,102 $ 500

$93 $97 $105 $113 $118 $158 $192 $216

$933 $1,359 $1,674 $ 1,000

$1,408 $1,524 $1,938 $ 1,500 $114 $119 $131 $138 $145 $203 $249 $281

10 days 18 days 30 days $ 2,000 $136 $142 $156 $164 $174 $255 $312 $353

$ 2,500 $161 $168 $185 $200 $214 $293 $358 $399

$156

$205

$243

$ 3,000 $174 $180 $204 $222 $237 $332 $404 $445

$162

$222

$263

$ 3,500 $197 $206 $235 $260 $280 $372 $450 $490

$179

$244

$296

$ 4,000 $217 $226 $260 $290 $315 $412 $495 $535

$230

$290

$340

$ 4,500 $237 $246 $285 $320 $350 $452 $540 $580

10 days 18 days 30 days

$ 5,000 $257 $266 $310 $350 $385 $492 $585 $625

$221

$289

$399

$ 5,500 $277 $286 $335 $380 $420 $532 $630 $670

$261

$304

$437

$ 6,000 $297 $306 $360 $410 $455 $572 $675 $715

$342

$399

$608

$ 6,500 $317 $326 $385 $440 $490 $612 $720 $760

$608

$713 $1,161

$ 7,000 $337 $346 $410 $470 $525 $652 $765 $805

$1,121 $1,520 $2,945

$1,511 $1,615 $3,211 $ 7,500 $357 $366 $435 $500 $560 $692 $810 $850

$ 8,000 $377 $386 $460 $530 $595 $732 $855 $895

10 days 18 days 30 days

$ 8,500 $397 $406 $485 $560 $630 $772 $900 $940

$342

$418

$595

$ 9,000 $417 $426 $510 $590 $665 $812 $945 $985

$437

$570

$809

$ 9,500 $437 $446 $535 $620 $700 $852 $990 $1,030

$526

$789 $1,074 $10,000 $457 $466 $560 $650 $735 $892 $1,035 $1,075

$916 $1,349 $1,923 $10,500 $477 $486 $585 $680 $770 $932 $1,080 $1,120

$1,425 $2,195 $4,180

$11,000 $497 $506 $610 $710 $805 $972 $1,125 $1,165

$1,805 $2,470 $4,902

$11,500 $517 $526 $635 $740 $840 $1,012 $1,170 $1,210

10 days 18 days 30 days $12,000 $537 $546 $660 $770 $875 $1,052 $1,215 $1,255

$12,500 $557 $566 $685 $800 $910 $1,092 $1,260 $1,300

$397

$437

$635

$504

$614

$904

$13,000 $577 $586 $710 $830 $945 $1,132 $1,305 $1,345

$640

$751 $1,170 $13,500 $597 $606 $735 $860 $980 $1,172 $1,350 $1,390

$1,131 $1,286 $2,062 $14,000 $617 $626 $760 $890 $1,015 $1,212 $1,395 $1,435

$1,972 $2,316 $4,182 * www.manulifetravelinsurance.com displays more Trip Cancellation/

Interruption premium rates.

$2,272 $3,055 $5,225

Savings and Features Offered

Family Rate

(up to and including age 59) 2x oldest/only adult

Travel Companion 5% savings

Travel Canada 50% off

(cannot be combined with a deductible)

Refunds

Top-ups

Provincial Sales Tax

(1) up to 212 days

Anda mungkin juga menyukai

- VRC-2301 (V10 Rate Card)Dokumen2 halamanVRC-2301 (V10 Rate Card)lead sulphideBelum ada peringkat

- Your Financial Travel Guide to Life: 30 Years On the Road With Rowling & AssociatesDari EverandYour Financial Travel Guide to Life: 30 Years On the Road With Rowling & AssociatesBelum ada peringkat

- Condiciones de FaroDokumen3 halamanCondiciones de FaroNorma VillegaBelum ada peringkat

- Explore (Travel Insurance Product) - BrochureDokumen8 halamanExplore (Travel Insurance Product) - BrochureDinesh GoelBelum ada peringkat

- EQ Employee Benefits Plan Brochure (January 2023)Dokumen8 halamanEQ Employee Benefits Plan Brochure (January 2023)Darren ChenBelum ada peringkat

- Explore (Travel Insurance Product) - BrochureDokumen8 halamanExplore (Travel Insurance Product) - Brochurecoolsesh2Belum ada peringkat

- Jeevan Utsav LeafletDokumen2 halamanJeevan Utsav LeafletphotonxcomBelum ada peringkat

- A4+Health+ (EIS) 1Dokumen7 halamanA4+Health+ (EIS) 1Eugene XuBelum ada peringkat

- Plans Titanium Platinum Gold Silver BronzeDokumen6 halamanPlans Titanium Platinum Gold Silver Bronzekrishnamira2001311Belum ada peringkat

- Income Hospital CareDokumen8 halamanIncome Hospital CareHihiBelum ada peringkat

- Ch1 Solutions 1Dokumen59 halamanCh1 Solutions 1YoungCheon JungBelum ada peringkat

- IU Bike Rental Program Business PlanDokumen7 halamanIU Bike Rental Program Business Planiustudents100% (1)

- New Hire Benefits Summary: Medical Plan OptionsDokumen3 halamanNew Hire Benefits Summary: Medical Plan OptionsRavi Prakash MayreddyBelum ada peringkat

- ExcelDokumen2 halamanExcelapi-300241947Belum ada peringkat

- 2015 Brackets & Planning Limits (Janney)Dokumen5 halaman2015 Brackets & Planning Limits (Janney)John CortapassoBelum ada peringkat

- SmartTraveller Brochure Aug 2012Dokumen7 halamanSmartTraveller Brochure Aug 2012prasanna_pipingBelum ada peringkat

- 2017-2018 PD Salary Scale v2 PDFDokumen2 halaman2017-2018 PD Salary Scale v2 PDFLuis Fernando Mulcue NietoBelum ada peringkat

- Financial Literacy-Middle School 13-PresenationDokumen31 halamanFinancial Literacy-Middle School 13-PresenationRodel floresBelum ada peringkat

- Brochure PDF MANHATTHAN LIFEDokumen2 halamanBrochure PDF MANHATTHAN LIFEEmanuel ChirinosBelum ada peringkat

- ICan Brochure DigitalDokumen16 halamanICan Brochure DigitalAnkush JainBelum ada peringkat

- Wcsu Camp Sliding ScaleDokumen1 halamanWcsu Camp Sliding Scaleapi-98197056Belum ada peringkat

- Plan DetailDokumen4 halamanPlan DetailB GANAPATHYBelum ada peringkat

- Travel Guard NewDokumen6 halamanTravel Guard NewMark TangBelum ada peringkat

- HPA00001134392 Mansfield PAC 3557 HP 1625 Coverage Selection FormDokumen7 halamanHPA00001134392 Mansfield PAC 3557 HP 1625 Coverage Selection FormLinda MansfieldBelum ada peringkat

- Practice Time Value of MoneyDokumen7 halamanPractice Time Value of Moneymohamed00007Belum ada peringkat

- AmSure Health Protector PresentationDokumen42 halamanAmSure Health Protector Presentationkaccnu29Belum ada peringkat

- 2016 Health Benefits TableDokumen1 halaman2016 Health Benefits TableRyan YK ChiangBelum ada peringkat

- Vision Care Plan The Choice ProgramDokumen2 halamanVision Care Plan The Choice Programapi-296522671Belum ada peringkat

- Gas Tankers ListDokumen1 halamanGas Tankers ListDebashish Priyanka SinhaBelum ada peringkat

- Life Insurance Programming From The Consumer's View PointDokumen5 halamanLife Insurance Programming From The Consumer's View PointimranBelum ada peringkat

- Historical Rate Sheet Jul-12Dokumen2 halamanHistorical Rate Sheet Jul-12AyeshaJangdaBelum ada peringkat

- Plan 869 - DHAN VRIDDHIDokumen43 halamanPlan 869 - DHAN VRIDDHIgirishBelum ada peringkat

- Med Sup Rates July 2021Dokumen23 halamanMed Sup Rates July 2021eliBelum ada peringkat

- In Economica Steban MurciaDokumen2 halamanIn Economica Steban MurciaANONYMUS HACKERBelum ada peringkat

- Living Care Plus Product SummaryDokumen6 halamanLiving Care Plus Product SummaryAng KhengBelum ada peringkat

- Test 1Dokumen2 halamanTest 1Christian DeKnockBelum ada peringkat

- Medi Classic PresentationDokumen24 halamanMedi Classic PresentationS S Biradar LicBelum ada peringkat

- Travel Elite BRDokumen2 halamanTravel Elite BRSrikanth MuthukrishnanBelum ada peringkat

- JACAM Benefit OverviewDokumen7 halamanJACAM Benefit OverviewStephenDohertyBelum ada peringkat

- SAF GTL BrochureDokumen12 halamanSAF GTL BrochureJoelBelum ada peringkat

- Sept 9 Vvta Contract 2018-2021 CleanDokumen71 halamanSept 9 Vvta Contract 2018-2021 Cleanapi-232952686100% (1)

- Amsure - Basic - As On 01 Sept 2010Dokumen44 halamanAmsure - Basic - As On 01 Sept 2010Bhunesh SriramojuBelum ada peringkat

- Mindef Mha Product SummaryDokumen40 halamanMindef Mha Product SummaryJedrek TeoBelum ada peringkat

- Alumni Health InsuranceDokumen10 halamanAlumni Health Insuranceblogs414Belum ada peringkat

- Bupa GoldExtras NSW ACT 0415Dokumen3 halamanBupa GoldExtras NSW ACT 0415Laura Leander WildeBelum ada peringkat

- Sun Life Hospital IncomeDokumen4 halamanSun Life Hospital IncomeHihiBelum ada peringkat

- Salary Guide Legal 2021-2022 FinalDokumen3 halamanSalary Guide Legal 2021-2022 FinalBen SetoBelum ada peringkat

- AISAUCES2Dokumen8 halamanAISAUCES2jlehartBelum ada peringkat

- Manulife ESP PDFDokumen31 halamanManulife ESP PDFTim YapBelum ada peringkat

- Delta Life Insurance Co. Ltd. Overeseas Mediclaim Policy: PLAN - A (For Visiting Countries Excluding USA & Canada)Dokumen1 halamanDelta Life Insurance Co. Ltd. Overeseas Mediclaim Policy: PLAN - A (For Visiting Countries Excluding USA & Canada)i sumonBelum ada peringkat

- JkkjjijDokumen2 halamanJkkjjijmarketbus12Belum ada peringkat

- Product Summary - ECIDokumen7 halamanProduct Summary - ECIEugene LimBelum ada peringkat

- American Eagle Outfitters TemplateDokumen16 halamanAmerican Eagle Outfitters TemplateVitor Minoru OkadaBelum ada peringkat

- Recovery Hospital Cash FactsheetDokumen4 halamanRecovery Hospital Cash FactsheetMuhammad ArifinBelum ada peringkat

- CignaTTK ProHealth Vs Max Bupa HeartBeatDokumen9 halamanCignaTTK ProHealth Vs Max Bupa HeartBeatmaakabhawan26Belum ada peringkat

- Super Top Up Health Plan IIMKAADokumen3 halamanSuper Top Up Health Plan IIMKAAcharankviBelum ada peringkat

- Energy Brochure OnlineDokumen8 halamanEnergy Brochure Onlinenirajthacker93620Belum ada peringkat

- Financial Algebra Budget ProjectDokumen15 halamanFinancial Algebra Budget Projectapi-502440235Belum ada peringkat

- Tabla 1 Documento Base Forecast 2023Dokumen1 halamanTabla 1 Documento Base Forecast 2023marioralvarezBelum ada peringkat

- Derivative+Market - Recent Trends ND Development, Future .Dokumen25 halamanDerivative+Market - Recent Trends ND Development, Future .KARISHMAAT86% (7)

- Period End ClosingDokumen4 halamanPeriod End ClosingJose Luis Becerril BurgosBelum ada peringkat

- Adamodar MkttimingDokumen56 halamanAdamodar MkttimingMardiko NumbraBelum ada peringkat

- Field of EconomicsDokumen5 halamanField of EconomicsVinod JoshiBelum ada peringkat

- Chapter Two: Strategy, Organization Design, and EffectivenessDokumen9 halamanChapter Two: Strategy, Organization Design, and EffectivenessberitahrBelum ada peringkat

- Zahra Et Al. (2003)Dokumen18 halamanZahra Et Al. (2003)Guilherme MarksBelum ada peringkat

- Cash Flow Statement: (Cheat Sheet)Dokumen5 halamanCash Flow Statement: (Cheat Sheet)LinyVatBelum ada peringkat

- PIS and COFINS ContributionsDokumen2 halamanPIS and COFINS ContributionsRod Don PerinaBelum ada peringkat

- BBF612S - Understanding Financial PerfomanceDokumen5 halamanBBF612S - Understanding Financial PerfomanceReana GeminaBelum ada peringkat

- Recognition and MeasurementDokumen16 halamanRecognition and MeasurementajishBelum ada peringkat

- JKH - WPL Rights Issue Update - 20131021Dokumen10 halamanJKH - WPL Rights Issue Update - 20131021Randora LkBelum ada peringkat

- Building A Better Partnership Between Finance and StrategyDokumen4 halamanBuilding A Better Partnership Between Finance and StrategyRaghvendra ToliaBelum ada peringkat

- 22 31MR53Dokumen10 halaman22 31MR53overqualifiedBelum ada peringkat

- Business ValuationDokumen5 halamanBusiness ValuationAppraiser PhilippinesBelum ada peringkat

- Singapore Case StudyDokumen4 halamanSingapore Case StudyMogana RawanBelum ada peringkat

- Confluence Technique Be A Trader Road TourDokumen163 halamanConfluence Technique Be A Trader Road Toursani_ilpkuantan100% (2)

- TcoDokumen18 halamanTcoshashankgowda100% (1)

- 2009-SEC Form ExA-001-Initia External AuditorlDokumen3 halaman2009-SEC Form ExA-001-Initia External Auditorlalfx216Belum ada peringkat

- Chapter 5 - Statement of Cash FlowsDokumen4 halamanChapter 5 - Statement of Cash FlowsArman100% (1)

- Crs Report For Congress: Worldcom: The Accounting ScandalDokumen6 halamanCrs Report For Congress: Worldcom: The Accounting ScandalMarc Eric RedondoBelum ada peringkat

- Presented By: Sujeeth Joishy K SumalathaDokumen15 halamanPresented By: Sujeeth Joishy K SumalathaKiran NayakBelum ada peringkat

- Following Steps Are Taken in This ProcedureDokumen3 halamanFollowing Steps Are Taken in This ProcedureMita MandalBelum ada peringkat

- Building An Investment ThesisDokumen11 halamanBuilding An Investment ThesisJack Jacinto100% (2)

- Cadbury ReportDokumen22 halamanCadbury ReportVania MalikBelum ada peringkat

- Suplemen, Vitamin, Obat PenenangDokumen6 halamanSuplemen, Vitamin, Obat PenenangKeuangan primamedikaBelum ada peringkat

- Group 3 - Master Budget-Earrings UnlimitedDokumen8 halamanGroup 3 - Master Budget-Earrings UnlimitedLorena Mae LasquiteBelum ada peringkat

- S.I and C.IDokumen16 halamanS.I and C.IMumtazAhmad100% (1)

- Title: Determinants of Capital Structure of Oromia International BankDokumen2 halamanTitle: Determinants of Capital Structure of Oromia International BankHabtamu Hailemariam AsfawBelum ada peringkat

- MonmouthDokumen25 halamanMonmouthPerci LunarejoBelum ada peringkat

- Risk Return and Dividend ProblemsDokumen13 halamanRisk Return and Dividend ProblemsBISMA RAFIQBelum ada peringkat