Notice: Meetings: Federal Prevailing Rate Advisory Committee

Diunggah oleh

Justia.comHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Notice: Meetings: Federal Prevailing Rate Advisory Committee

Diunggah oleh

Justia.comHak Cipta:

Format Tersedia

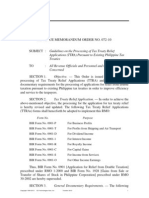

Federal Register / Vol. 70, No.

30 / Tuesday, February 15, 2005 / Notices 7779

PENSION BENEFIT GUARANTY beginning in February 2005 is 4.66 The meetings will start at 10 a.m. and

CORPORATION percent (i.e., 85 percent of the 5.48 will be held in Room 5A06A, Office of

percent composite corporate bond rate Personnel Management Building, 1900 E

Required Interest Rate Assumption for for January 2005 as determined by the Street, NW., Washington, DC.

Determining Variable-Rate Premium; Treasury). The Federal Prevailing Rate Advisory

Interest Assumptions for The following table lists the required Committee is composed of a Chair, five

Multiemployer Plan Valuations interest rates to be used in determining representatives from labor unions

Following Mass Withdrawal variable-rate premiums for premium holding exclusive bargaining rights for

AGENCY: Pension Benefit Guaranty payment years beginning between Federal blue-collar employees, and five

Corporation. March 2004 and February 2005. representatives from Federal agencies.

ACTION: Notice of interest rates and Entitlement to membership on the

The re- Committee is provided for in 5 U.S.C.

assumptions. For premium payment years quired inter-

beginning in: est rate is: 5347.

SUMMARY: This notice informs the public The Committee’s primary

of the interest rates and assumptions to March 2004 ............................... 4.79 responsibility is to review the Prevailing

be used under certain Pension Benefit April 2004 ................................. 4.62 Rate System and other matters pertinent

Guaranty Corporation regulations. These May 2004 .................................. 4.98 to establishing prevailing rates under

rates and assumptions are published June 2004 ................................. 5.26 subchapter IV, chapter 53, 5 U.S.C., as

elsewhere (or can be derived from rates July 2004 .................................. 5.25

amended, and from time to time advise

published elsewhere), but are collected August 2004 ............................. 5.10

September 2004 ....................... 4.95 the Office of Personnel Management.

and published in this notice for the These scheduled meetings will start

October 2004 ............................ 4.79

convenience of the public. Interest rates November 2004 ........................ 4.73 in open session with both labor and

are also published on the PBGC’s Web December 2004 ........................ 4.75 management representatives attending.

site (http://www.pbgc.gov). January 2005 ............................ 4.73 During the meetings either the labor

DATES: The required interest rate for February 2005 .......................... 4.66 members or the management members

determining the variable-rate premium may caucus separately with the Chair to

under part 4006 applies to premium Multiemployer Plan Valuations devise strategy and formulate positions.

payment years beginning in February Following Mass Withdrawal Premature disclosure of the matters

2005. The interest assumptions for The PBGC’s regulation on Duties of discussed in these caucuses would

performing multiemployer plan Plan Sponsor Following Mass unacceptably impair the ability of the

valuations following mass withdrawal Withdrawal (29 CFR part 4281) Committee to reach a consensus on the

under part 4281 apply to valuation dates prescribes the use of interest matters being considered and would

occurring in March 2005. assumptions under the PBGC’s disrupt substantially the disposition of

FOR FURTHER INFORMATION CONTACT: regulation on Allocation of Assets in its business. Therefore, these caucuses

Catherine B. Klion, Attorney, Legislative Single-Employer Plans (29 CFR part will be closed to the public because of

and Regulatory Department, Pension 4044). The interest assumptions a determination made by the Director of

Benefit Guaranty Corporation, 1200 K applicable to valuation dates in March the Office of Personnel Management

Street, NW., Washington, DC 20005, 2005 under part 4044 are contained in under the provisions of section 10(d) of

202–326–4024. (TTY/TDD users may an amendment to part 4044 published the Federal Advisory Committee Act

call the Federal relay service toll-free at elsewhere in today’s Federal Register. (Pub. L. 92–463) and 5 U.S.C.

1–800–877–8339 and ask to be Tables showing the assumptions 552b(c)(9)(B). These caucuses may,

connected to 202–326–4024.) applicable to prior periods are codified depending on the issues involved,

SUPPLEMENTARY INFORMATION: in appendix B to 29 CFR part 4044. constitute a substantial portion of a

meeting.

Variable-Rate Premiums Issued in Washington, DC, on this 9th day

of February 2005. Annually, the Chair compiles a report

Section 4006(a)(3)(E)(iii)(II) of the of pay issues discussed and concluded

Employee Retirement Income Security Vincent K. Snowbarger,

recommendations. These reports are

Act of 1974 (ERISA) and § 4006.4(b)(1) Deputy Executive Director, Pension Benefit

Guaranty Corporation.

available to the public, upon written

of the PBGC’s regulation on Premium request to the Committee’s Secretary.

Rates (29 CFR part 4006) prescribe use [FR Doc. 05–2857 Filed 2–14–05; 8:45 am]

The public is invited to submit

of an assumed interest rate (the BILLING CODE 7708–01–P

material in writing to the Chair on

‘‘required interest rate’’) in determining Federal Wage System pay matters felt to

a single-employer plan’s variable-rate be deserving of the Committee’s

premium. Pursuant to the Pension attention. Additional information on

Funding Equity Act of 2004, for OFFICE OF PERSONNEL

MANAGEMENT these meetings may be obtained by

premium payment years beginning in contacting the Committee’s Secretary,

2004 or 2005, the required interest rate Federal Prevailing Rate Advisory Office of Personnel Management,

is the ‘‘applicable percentage’’ Committee; Open Committee Meetings Federal Prevailing Rate Advisory

(currently 85 percent) of the annual rate Committee, Room 5538, 1900 E Street,

of interest determined by the Secretary According to the provisions of section NW., Washington, DC 20415 (202) 606–

of the Treasury on amounts invested 10 of the Federal Advisory Committee 1500.

conservatively in long-term investment Act (Pub. L. 92–463), notice is hereby

grade corporate bonds for the month given that meetings of the Federal Dated: February 8, 2005.

preceding the beginning of the plan year Prevailing Rate Advisory Committee Mary M. Rose,

for which premiums are being paid. will be held on—Thursday, March 10, Chairperson, Federal Prevailing Rate

Thus, the required interest rate to be 2005, Thursday, March 17, 2005, Advisory Committee.

used in determining variable-rate Thursday, April 7, 2005, Thursday, [FR Doc. 05–2811 Filed 2–14–05; 8:45 am]

premiums for premium payment years April 21, 2005. BILLING CODE 6325–49–P

VerDate jul<14>2003 17:50 Feb 14, 2005 Jkt 205001 PO 00000 Frm 00069 Fmt 4703 Sfmt 4703 E:\FR\FM\15FEN1.SGM 15FEN1

Anda mungkin juga menyukai

- Arbabsiar ComplaintDokumen21 halamanArbabsiar ComplaintUSA TODAYBelum ada peringkat

- U.S. v. Rajat K. GuptaDokumen22 halamanU.S. v. Rajat K. GuptaDealBook100% (1)

- Divorced Husband's $48,000 Lawsuit Over Wedding Pics, VideoDokumen12 halamanDivorced Husband's $48,000 Lawsuit Over Wedding Pics, VideoJustia.comBelum ada peringkat

- U.S. v. TomorrowNow, Inc. - Criminal Copyright Charges Against SAP Subsidiary Over Oracle Software TheftDokumen5 halamanU.S. v. TomorrowNow, Inc. - Criminal Copyright Charges Against SAP Subsidiary Over Oracle Software TheftJustia.comBelum ada peringkat

- Emmanuel Ekhator - Nigerian Law Firm Scam IndictmentDokumen22 halamanEmmanuel Ekhator - Nigerian Law Firm Scam IndictmentJustia.comBelum ada peringkat

- Amended Poker Civil ComplaintDokumen103 halamanAmended Poker Civil ComplaintpokernewsBelum ada peringkat

- USPTO Rejection of Casey Anthony Trademark ApplicationDokumen29 halamanUSPTO Rejection of Casey Anthony Trademark ApplicationJustia.comBelum ada peringkat

- Deutsche Bank and MortgageIT Unit Sued For Mortgage FraudDokumen48 halamanDeutsche Bank and MortgageIT Unit Sued For Mortgage FraudJustia.com100% (1)

- Signed Order On State's Motion For Investigative CostsDokumen8 halamanSigned Order On State's Motion For Investigative CostsKevin ConnollyBelum ada peringkat

- Rabbi Gavriel Bidany's Sexual Assault and Groping ChargesDokumen4 halamanRabbi Gavriel Bidany's Sexual Assault and Groping ChargesJustia.comBelum ada peringkat

- Brandon Marshall Stabbing by Wife: Domestic Violence Arrest ReportDokumen1 halamanBrandon Marshall Stabbing by Wife: Domestic Violence Arrest ReportJustia.comBelum ada peringkat

- Guilty Verdict: Rabbi Convicted of Sexual AssaultDokumen1 halamanGuilty Verdict: Rabbi Convicted of Sexual AssaultJustia.comBelum ada peringkat

- Clergy Abuse Lawsuit Claims Philadelphia Archdiocese Knew About, Covered Up Sex CrimesDokumen22 halamanClergy Abuse Lawsuit Claims Philadelphia Archdiocese Knew About, Covered Up Sex CrimesJustia.comBelum ada peringkat

- Van Hollen Complaint For FilingDokumen14 halamanVan Hollen Complaint For FilingHouseBudgetDemsBelum ada peringkat

- Sweden V Assange JudgmentDokumen28 halamanSweden V Assange Judgmentpadraig2389Belum ada peringkat

- Defamation Lawsuit Against Jerry Seinfeld Dismissed by N.Y. Judge - Court OpinionDokumen25 halamanDefamation Lawsuit Against Jerry Seinfeld Dismissed by N.Y. Judge - Court OpinionJustia.comBelum ada peringkat

- FBI Records: Col. Sanders (KFC - Kentucky Fried Chicken Founder) 1974 Death ThreatDokumen15 halamanFBI Records: Col. Sanders (KFC - Kentucky Fried Chicken Founder) 1974 Death ThreatJustia.comBelum ada peringkat

- Online Poker Indictment - Largest U.S. Internet Poker Cite Operators ChargedDokumen52 halamanOnline Poker Indictment - Largest U.S. Internet Poker Cite Operators ChargedJustia.comBelum ada peringkat

- City of Seattle v. Professional Basketball Club LLC - Document No. 36Dokumen2 halamanCity of Seattle v. Professional Basketball Club LLC - Document No. 36Justia.comBelum ada peringkat

- NY Judge: Tricycle Riding 4 Year-Old Can Be Sued For Allegedly Hitting, Killing 87 Year-OldDokumen6 halamanNY Judge: Tricycle Riding 4 Year-Old Can Be Sued For Allegedly Hitting, Killing 87 Year-OldJustia.comBelum ada peringkat

- City of Seattle v. Professional Basketball Club LLC - Document No. 36Dokumen2 halamanCity of Seattle v. Professional Basketball Club LLC - Document No. 36Justia.comBelum ada peringkat

- Federal Charges Against Ariz. Shooting Suspect Jared Lee LoughnerDokumen6 halamanFederal Charges Against Ariz. Shooting Suspect Jared Lee LoughnerWBURBelum ada peringkat

- Function Media, L.L.C. v. Google, Inc. Et Al - Document No. 56Dokumen4 halamanFunction Media, L.L.C. v. Google, Inc. Et Al - Document No. 56Justia.com100% (4)

- OJ Simpson - Nevada Supreme Court Affirms His ConvictionDokumen24 halamanOJ Simpson - Nevada Supreme Court Affirms His ConvictionJustia.comBelum ada peringkat

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Sample ProblemsDokumen5 halamanSample ProblemsfenBelum ada peringkat

- Business Tax Activity 1Dokumen10 halamanBusiness Tax Activity 1Michael AquinoBelum ada peringkat

- Materi PPT Bing SharesDokumen3 halamanMateri PPT Bing SharesSyifa UrrohmahBelum ada peringkat

- Research ProjectDokumen64 halamanResearch ProjectSaurabh RautBelum ada peringkat

- Right of Lien by BankersDokumen13 halamanRight of Lien by Bankersgeegostral chhabraBelum ada peringkat

- ASSIGNMENT 2 Group 9Dokumen6 halamanASSIGNMENT 2 Group 9Haroon Z. ChoudhryBelum ada peringkat

- Mahindra & Mahindra Annual Report 2015Dokumen271 halamanMahindra & Mahindra Annual Report 2015Madhav KapurBelum ada peringkat

- Statement of Assests 2012Dokumen3 halamanStatement of Assests 2012Mark Anthony S. MoralesBelum ada peringkat

- Chapter 01 SolutionsDokumen2 halamanChapter 01 SolutionsShakuli YesrBelum ada peringkat

- Regime InvestingDokumen8 halamanRegime InvestingDirk FOoBelum ada peringkat

- Bhanu Bains PDFDokumen11 halamanBhanu Bains PDFbhanubainsBelum ada peringkat

- Daftar Saham - 20240120Dokumen38 halamanDaftar Saham - 202401202xtf448275Belum ada peringkat

- FormulaDokumen13 halamanFormulaMichBadilloCalanogBelum ada peringkat

- FIN AL: Form GSTR-3BDokumen3 halamanFIN AL: Form GSTR-3BameygandhiBelum ada peringkat

- RMO 072-2010 - Application of Tax Treaty ReliefDokumen18 halamanRMO 072-2010 - Application of Tax Treaty ReliefEmil A. MolinaBelum ada peringkat

- MCQ Fin 502Dokumen50 halamanMCQ Fin 502Tareque Rubel90% (10)

- Bharat ParekhDokumen3 halamanBharat ParekhAashish Singh100% (1)

- Exercises of IAS 39Dokumen2 halamanExercises of IAS 39Gustavo AlmeidaBelum ada peringkat

- Depreciation QuestionsDokumen1 halamanDepreciation Questionsjahangir tanveer100% (1)

- Question Final ExamDokumen2 halamanQuestion Final ExamCaroline WijayaBelum ada peringkat

- Accounts - Redemption of Preference ShareDokumen23 halamanAccounts - Redemption of Preference ShareArunima Jain100% (1)

- Simple Mortgage DeedDokumen3 halamanSimple Mortgage DeedkjapashaBelum ada peringkat

- Franchise PDFDokumen1 halamanFranchise PDFJonathan VidarBelum ada peringkat

- UtangDokumen10 halamanUtangrex tanongBelum ada peringkat

- Hospitalization Accident Claim FormDokumen8 halamanHospitalization Accident Claim FormWYBelum ada peringkat

- Credit Card NCC BANKDokumen1 halamanCredit Card NCC BANKKazi Foyez AhmedBelum ada peringkat

- Consumer Decision MakingDokumen7 halamanConsumer Decision MakingUtkarsh GurjarBelum ada peringkat

- Kriz T. Elmido Bsa Ii-A Date: Aec 216 Regulatory Framework and Legal Issues in BusinessDokumen11 halamanKriz T. Elmido Bsa Ii-A Date: Aec 216 Regulatory Framework and Legal Issues in BusinessHazel Seguerra BicadaBelum ada peringkat

- Credit Reference Bureau-426Dokumen8 halamanCredit Reference Bureau-426Albert CofieBelum ada peringkat

- Co Operative BankDokumen52 halamanCo Operative BankDevendra SawantBelum ada peringkat