Accounting Exam C

Diunggah oleh

faithbuiHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Accounting Exam C

Diunggah oleh

faithbuiHak Cipta:

Format Tersedia

C

Free Exam

for 2013-17 VCE study design

Engage

Education

Foundation

VCE Revision Seminars

As a not for profit, this free exam

was made possible by our VCE

Exam Revision Seminars.

Sept 19 - Oct 18 2015.

24 different subjects

VCAA Assessors

Huge set of notes, teacher

slides and an exam

6.5hrs all located at the

University of Melbourne

Visit http://ee.org.au/enrol to enrol now!

Units 3 and 4 Accounting

Practice Exam Question Booklet

Duration: 15 minutes reading time, 2 hours writing time

Structure of book:

Number of questions

6

Number of questions to

be answered

6

Number of marks

100

Students are permitted to bring into the examination room: pens, pencils, highlighters, erasers,

rulers and a scientific calculator.

Students are not permitted to bring into the examination room: blank sheets of paper and/or white

out liquid/tape.

Materials supplied:

This question booklet of 9 pages.

An answer booklet.

Instructions:

You must complete all questions of the examination.

Write all your answers in the spaces provided in this booklet.

Units 3 and 4 Accounting: Free Exam C

The Engage Education Foundation

Questions

Question 1

Harold Jones runs a small business called Stationery Heaven which sells stationery products. The

business has been previously using single entry accounting but has decided to commence using a

double entry accounting system based on the accrual accounting method. In addition, the business will

introduce control accounts and subsidiary records for Creditors, Debtors and Stock. In order to record

stock, the perpetual method of stock recording and the FIFO cost assignment method will be used. The

business will prepare reports every 6 months on 30 June and 31 December.

Stationery Heaven had the following balances as at 1 July 2014:

Bank

GST Clearing

Debtors

Creditors

Stock

Equipment

Capital Jones

Loan ABC Finance

$

2 000 Dr

3 400 Cr

15 000

7 900

57 620

5 700

?

3 500

The loan from ABC Finance must be repaid by 15 September 2014.

a.

Prepare the relevant general journal entry to record the move to a double-entry accounting system.

(A narration is not required).

3 marks

b.

Identify two benefits of using both a control account and subsidiary ledgers for Debtors.

2 marks

c.

Explain, with reference to an accounting element, how the ABC Finance Loan should be classified in

the Balance Sheet in July 2014.

2 marks

d.

Explain what is meant by the term double entry accounting.

2 marks

Total: 9 marks

Page 1

6.5 hour revision seminars for just $56 visit www.ee.org.au for more info.

The Engage Education Foundation

Units 3 and 4 Accounting: Free Exam C

Question 2

At 31 March 2014, the following journals were provided by the owner of Basic Books:

Sales Journal

Date

2014

Debtor

Mar 31

Totals

Inv.

No.

Cost of

Sales

Sales

GST

Debtors

Control

5 600

11 000

1 100

12 100

Stock

Control

GST

Creditors

Control

8 900

890

9 790

Purchases Journal

Date

2014

Creditor

Mar 31

Totals

Inv.

No.

Cash Receipts Journal

Date

2014

Details

Mar 31

Totals

Rec.

No.

Bank

Disc.

Exp.

Debtors

Control

Cost of

Sales

Sales

GST

33 780

60

5 240

12 000

26 000

2 600

Cash Payments Journal

Date

2014

Details

Mar 31

Totals

Chq.

No.

Bank

Disc.

Rev.

Creditors

Control

Stock

Control

Wages

Sundries

GST

27 480

40

4 350

7 500

6 800

7 520

1 350

When the owner was searching through his files, he discovered the following documents which had not

yet been recorded.

Basic Books

Tax Invoice No. 78

30 March 2014

Charge to: Georges Primary School

For: Student Diaries

Quantity: 25 Diaries at $8 each

Amount:

$200

GST:

$20

Total:

$220

Basic Books

Memo No. 56

15 March 2014

Withdrew 2 Calendars, with cost

price $5 each, for personal use.

The cost price of the student diaries was $5 each.

www.engageeducation.org.au

Page 2

Units 3 and 4 Accounting: Free Exam C

a.

The Engage Education Foundation

Record the above transactions in the appropriate journals (Narrations are not required).

3 marks

b.

Explain the effect on the Balance Sheet if the transaction documented by Memo No. 56 was not

recorded.

2 marks

c.

Complete the Stock Control ledger account as at 31 March 2014.

(You are required to balance the account.)

5 marks

d.

Identify one advantage and one disadvantage of offering debtors a discount for early payment.

2 marks

Total: 12 marks

Page 3

6.5 hour revision seminars for just $56 visit www.ee.org.au for more info.

The Engage Education Foundation

Units 3 and 4 Accounting: Free Exam C

Question 3

As at 31 January 2014 the following pre-adjustment Trial Balance was provided (the business reports

monthly):

Baxter Boats

Pre-adjustment Trial Balance as at 31 January 2014

Account

Debit $

Accumulated Depreciation Vehicle

Advertising

890

Bank

5 900

Building

200 000

Capital

Cost of Sales

23 000

Creditors Control

Debtors Control

17 800

Discount Expense

200

Discount Revenue

Drawings

510

Freight In

700

Freight Out

1 150

GST Clearing

Interest Expense

250

Loan WXY Finance

Prepaid Rent Expense

3 000

Sales

Stock Control

4 580

Vehicle

30 000

Wages Expense

3 380

291 360

Credit $

6 000

112 290

36 450

170

2 450

88 000

46 000

291 360

The following items require adjustments to be made for the month ending 31 January 2014:

a.

A payment for a six-month contract for $3 600 for rent beginning 1 December 2013 has been

made.

At 31 January 2014, $340 wages are still owed.

A Debtor (P. Heck) has been declared bankrupt and advised they are unable to pay their $500

account.

The Vehicle is depreciated using the straight-line method at 10% pa.

$90 in Drawings was accidentally recorded as Wages Expense.

Prepare the General Journal entries necessary to record the information above on 31 January 2014.

(Narrations are not required.)

10 marks

b.

Explain, with reference to an accounting principle, the purpose of preparing balance day

adjustments.

1 + 2 = 3 marks

c.

Show how the Wages general ledger account would appear at 31 January 2014 after relevant

entries had been posted. (You are required to close the account.)

4 marks

d.

Prepare an extract of the Balance Sheet at 31 January 2014 to show Non-Current Assets.

2 marks

www.engageeducation.org.au

Page 4

Units 3 and 4 Accounting: Free Exam C

The Engage Education Foundation

The owner has been depreciating the vehicle using the straight-line method but believes the reducing

balance method would be more appropriate.

e.

Discuss, with reference to appropriate accounting principles and qualitative characteristics, whether

the owner should change depreciation methods.

4 marks

Total: 23 marks

Question 4

Hammonds Electrics sells three different types of steam mops. Details of type Floor Wiz are shown

below.

a.

Balance (1 December 2013) - 6 units at cost price of $90 each.

7 December: Credit purchase of 15 units from Wiz Ltd at a cost of $100 plus $10 GST each (Inv.

S77).

17 December: Credit sale of 9 units for $180 plus $18 GST each to Bagget Motels (Inv. A4).

20 December: Bagget Motels returned 3 units due to damage (Credit Note No. 7).

22 December: The damaged stock was returned to Wiz Ltd for a full credit (Credit Note No.

M21).

On 31 December a physical stocktake showed 11 units on hand (Memo No. 6).

Record all relevant information into the Stock Card.

5 marks

b.

Record the transactions on 20 December and 22 December into the General Journal.

(Narrations are not required.)

5 + 3 = 8 marks

c.

Explain how the use of Stock Cards can assist in the management of stock.

3 marks

Total: 16 marks

Page 5

6.5 hour revision seminars for just $56 visit www.ee.org.au for more info.

The Engage Education Foundation

Units 3 and 4 Accounting: Free Exam C

Question 5

Mark Mitchell operates a small business, Mitchs Music, selling a range of musical instruments and

accessories.

The business prepares financial reports quarterly on 31 March, 30 June, 30 September and 31

December each year.

At 31 December 2013 an examination of stock records (see table below) indicated a stock loss and the

need to write down the value of one item.

Quantity on

Stock Card

Quantity from

Stocktake

Unit Cost

Price

Normal Unit

Selling Price

Net Realisable

Value

Martin Electric

Guitar

20

20

$300

$620

$620

Stendway Electric

Piano

15

14

$500

$1,200

$1,200

Les Pete Bass

Guitar

12

12

$180

$400

$150

Morrison Trumpet

15

14

$90

$150

$150

Model

a.

Using the information contained in the above table, calculate

value of the stock loss.

value of the stock write down.

total value of stock on hand at 31 December 2013.

1 + 1 + 2 = 4 marks

b.

Explain what is meant by the term Net Realisable Value.

2 marks

c.

Prepare the General Journal entry required to record the stock write-down.

(Narration is not required.)

2 marks

In January 2013 Mark agreed to rent out part of the store to a piano teacher who provides music lessons

for students. The rental agreement comprises two components:

$100 per month (plus 10% GST) payable 3 months in advance.

Commission of 10% on revenue earned on piano lessons. This commission is calculated at the

end of each reporting period and paid to Mark in the following month.

The agreement commenced on 1 February 2013 with receipt of the first 3 months rent (Rec. 76). At 31

March, the piano teacher had provided 40 piano lessons @ $35 each plus GST.

d.

Record the

Receipt of Rent Revenue on 1 February 2013.

Adjusting entries required on 31 March 2013.

Receipt of Commission Revenue (including GST) on 9th April 2013 (Rec. 142).

In the appropriate journals (Note: Narrations are not required in the General Journal).

1 + 2 + 2 + 2 = 7 marks

www.engageeducation.org.au

Page 6

Units 3 and 4 Accounting: Free Exam C

e.

The Engage Education Foundation

Explain why a balance day adjustment was required on 31 March 2013. State an accounting

principle to support your answer.

2 + 1 = 3 marks

f.

Explain the effect on the Assets and Equities of the business if the adjustment for Accrued Revenue

was not made.

2 marks

Total: 20 marks

Page 7

6.5 hour revision seminars for just $56 visit www.ee.org.au for more info.

The Engage Education Foundation

Units 3 and 4 Accounting: Free Exam C

Question 6

Peter Collier requested his accountant prepare budgets for his business Petes Parklands. He

provided the accountant with the following information:

Estimates for year ending 31 December 2013:

Credit Sales

Bad Debts

Discount Expense

Rent Revenue

Wages Expense

Stock Write Down

Cost of Sales

Office expenses

Depreciation Equipment

$710 000 plus GST

1% of credit sales plus GST

2% of credit sales plus GST

$2 500 per month

$182 000

$10 000

$370 000

$50 000 plus $5 000 GST

$12 000

Relevant account balances:

Accrued Rent Revenue

Creditors Control

Debtors Control

Stock Control

GST Clearing

1 January 2013

(Actual)

31 December 2013

(Estimated)

Nil

$47 000

$70 000

$82 000

$3 700 Cr

$2 500

$52 000

$62 000

$95 000

$4 200 Cr

The bank balance at 31 December 2013 was estimated to be $28 500 Cr.

a.

Reconstruct the necessary ledger accounts to determine the estimated

Cash collected from debtors

Cash paid to creditors

Rent Revenue received.

4 + 5 + 3 = 12 marks

b.

Prepare the Budgeted Income Statement for the year ended 31 December 2013.

5 marks

www.engageeducation.org.au

Page 8

Units 3 and 4 Accounting: Free Exam C

The Engage Education Foundation

After preparation of financial reports on 31 December 2013 the accountant provided the following

information:

c.

Budgeted

Actual

Stock Loss

(none)

$5 000

Sales Returns

(none)

$6 500

Explain what is shown by this information and suggest strategies the business could employ to

minimise it occurring in future reporting periods.

3 marks

Total: 20 marks

End of Booklet

Looking for solutions? Visit www.engageeducation.org.au/practice-exams

To enrol in one of our Accounting seminars head to: http://engageeducation.org.au/seminars/

Page 9

6.5 hour revision seminars for just $56 visit www.ee.org.au for more info.

Anda mungkin juga menyukai

- Illustration of Loneliness-B ClarinetDokumen1 halamanIllustration of Loneliness-B ClarinetfaithbuiBelum ada peringkat

- Accounting Exam BDokumen7 halamanAccounting Exam BfaithbuiBelum ada peringkat

- Piano Concerto No. 20Dokumen4 halamanPiano Concerto No. 20faithbuiBelum ada peringkat

- Piano Concerto No. 20Dokumen4 halamanPiano Concerto No. 20faithbuiBelum ada peringkat

- Piano Concerto No. 20 - Horn IIDokumen4 halamanPiano Concerto No. 20 - Horn IIfaithbuiBelum ada peringkat

- Piano Concerto No. 20 - Horn IIDokumen4 halamanPiano Concerto No. 20 - Horn IIfaithbuiBelum ada peringkat

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5782)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (72)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- LG Oled65g6p T-Con Board Layout Voltages 2017Dokumen10 halamanLG Oled65g6p T-Con Board Layout Voltages 2017Fernando AguiarBelum ada peringkat

- Assassin Teens-Ryan, AvengerDokumen10 halamanAssassin Teens-Ryan, AvengerSunay BhagatBelum ada peringkat

- KENYA - Tourism Sector Perfomance Report - 2019Dokumen30 halamanKENYA - Tourism Sector Perfomance Report - 2019Paul UdotoBelum ada peringkat

- Puerto - Rico - Codes - 2018 Live LoadsDokumen2 halamanPuerto - Rico - Codes - 2018 Live LoadsAlex SanchezBelum ada peringkat

- Morbid Curiosities: The Art of Montague Rhodes JamesDokumen7 halamanMorbid Curiosities: The Art of Montague Rhodes JamesMatthew BanksBelum ada peringkat

- Codex 1Dokumen4 halamanCodex 1Juan Diego MartínezBelum ada peringkat

- Singular Subjects Verbs ExamplesDokumen2 halamanSingular Subjects Verbs Exampleseliza ismailBelum ada peringkat

- How To Make A Ship in A BottleDokumen3 halamanHow To Make A Ship in A BottlePranjal SoodBelum ada peringkat

- Viisan VK18 Book Scanner - BrochureDokumen16 halamanViisan VK18 Book Scanner - BrochureChristian Robert NalicaBelum ada peringkat

- Final PortfolioDokumen12 halamanFinal Portfolioapi-529179424Belum ada peringkat

- Blue DVD ListDokumen379 halamanBlue DVD ListMiranda FranklinBelum ada peringkat

- Mercantilism GameDokumen20 halamanMercantilism Gameapi-341406434Belum ada peringkat

- Top NotchersDokumen17 halamanTop NotchersKierk Robin RetBelum ada peringkat

- Lumi by Akira Back MenuDokumen3 halamanLumi by Akira Back MenuEaterSDBelum ada peringkat

- The Monkey and The CrocodileDokumen3 halamanThe Monkey and The Crocodileapi-3821467100% (3)

- Hip-Hop PPT DemoDokumen9 halamanHip-Hop PPT Demoapi-292940790100% (1)

- Goodtime Maintenance ManualDokumen24 halamanGoodtime Maintenance ManualRami TannousBelum ada peringkat

- A Friend Like Filby by Mark Wakely PDFDokumen302 halamanA Friend Like Filby by Mark Wakely PDFMark Wakely0% (1)

- Report LagDokumen312 halamanReport LagBulentDoganBelum ada peringkat

- Extra Credit Essay - AnthroDokumen4 halamanExtra Credit Essay - AnthroMeghan NanneyBelum ada peringkat

- #1 Sample EssaysDokumen4 halaman#1 Sample Essaysbersam05Belum ada peringkat

- What did you do last weekend sentencesDokumen3 halamanWhat did you do last weekend sentencesRONALDCONBelum ada peringkat

- Sports and Activities VocabularyDokumen1 halamanSports and Activities VocabularyMerida KimBelum ada peringkat

- Airblue TicketDokumen2 halamanAirblue TicketJawad Bashir67% (6)

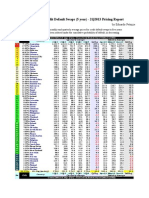

- Sovereign Credit Default Swaps (5 Year) - 2Q2013 Pricing ReportDokumen1 halamanSovereign Credit Default Swaps (5 Year) - 2Q2013 Pricing ReportEduardo PetazzeBelum ada peringkat

- Announcer: Welcome To The Essential Tennis Podcast. If You Lave Tennis and Wants ToDokumen9 halamanAnnouncer: Welcome To The Essential Tennis Podcast. If You Lave Tennis and Wants ToVicente SouzaBelum ada peringkat

- 7 - The Biliary TractDokumen48 halaman7 - The Biliary TractKim RamosBelum ada peringkat

- Boys Scout of The Philippines: Patrol Leaders Training CourseDokumen3 halamanBoys Scout of The Philippines: Patrol Leaders Training CourseHelen AlensonorinBelum ada peringkat

- 00 - Whatever People Say I Am, That's What I'm Not PDFDokumen151 halaman00 - Whatever People Say I Am, That's What I'm Not PDFbirajr78Belum ada peringkat

- Each) : Grammar 1 Write The Question For Each Following Answer. Example: She Played Basketball YesterdayDokumen17 halamanEach) : Grammar 1 Write The Question For Each Following Answer. Example: She Played Basketball YesterdayProduction PeachyBelum ada peringkat