Doing Business in DRC

Diunggah oleh

JoelLadjoHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Doing Business in DRC

Diunggah oleh

JoelLadjoHak Cipta:

Format Tersedia

Doing business in

Democratic Republic of Congo

2012 Africa Oil and Gas Tax

Workshop: Sub-Saharan Africa

Paris, France

2324 February 2012

Contents

Legal issues

Recent and expected legislative changes

Taxation

Subcontractor regime specifics

HR issues

Accounting issues

Page 2

Doing business in Democratic Republic Congo

2012 African Oil and Gas Tax Workshop: Sub-Saharan Africa

The Democratic Republic of Congo (DRC) is

located in central Africa

Page 3

Doing business in Democratic Republic Congo

2012 African Oil and Gas Tax Workshop: Sub-Saharan Africa

Legal issues

DRC Ordinance No.81-013 of 2 April 1981 is obsolete.

In practice investors rely on provisions of oil conventions and

respective production sharing contracts (PSC).

A hydrocarbons code is under development.

Page 4

Doing business in Democratic Republic Congo

2012 African Oil and Gas Tax Workshop: Sub-Saharan Africa

Recent and expected legislative changes

Draft hydrocarbons code

A draft hydrocarbons code is currently under consideration by the

Congolese Parliament and covers the following topics:

Framework of PSC, general regime, risks

State participation in PSC

Introduction of the concept of profit oil

Application of exceptional tax on expatriates salaries (IER) during a

production phase

Petroleum taxes:

Page 5

Additional bonuses

Thresholds for proportional royalty fee

Employment and training of nationals

Subcontracting priority to award subcontractors to companies

incorporated in DRC

Environmental responsibility to repair damage from industrial activities

and gas flaring

Doing business in Democratic Republic Congo

2012 African Oil and Gas Tax Workshop: Sub-Saharan Africa

Recent and expected legislative changes

Value added tax (VAT) replaces the turnover tax (ICA) as of 1

January 2012

DRC is in the process of joining the Organization for the

Harmonization of Corporate Law in Africa (OHADA)

Page 6

Doing business in Democratic Republic Congo

2012 African Oil and Gas Tax Workshop: Sub-Saharan Africa

Taxation

Tax planning structure

Three different tax regimes applicable to oil companies:

For onshore contracts (e.g., with Muanda International Oil Company

(MIOC), ODS International (ODS), and Teikoku Oil), statistical tax,

royalties, income taxes on dividends are collected

For offshore contracts (e.g., with Soreplico, and Japoco Inocal), statistical

tax and taxes on the margin distribution, on participation, and on profits

are collected

In a PSC, taxes on profit oil, royalties, annual surface fees and bonuses

are collected

Page 7

Doing business in Democratic Republic Congo

2012 African Oil and Gas Tax Workshop: Sub-Saharan Africa

Taxation

Tax administration issues

Tax audit by the Ministry of Mines, Petroleum and Hydrocarbons

Various tax administrations have jurisdiction: Directorate of General

Taxes (DGI), Directorate of Administrative, Legal and Domanial

Receipts (DRGAS) and Directorate of Customs and Excise (DGDA)

Page 8

Doing business in Democratic Republic Congo

2012 African Oil and Gas Tax Workshop: Sub-Saharan Africa

Subcontractor regime specifics

Subcontractors are exempt from all taxes that are not

payable by the title holders and their affiliates.

Page 9

Doing business in Democratic Republic Congo

2012 African Oil and Gas Tax Workshop: Sub-Saharan Africa

HR issues

Employment of nationals/foreigners:

The number of expatriates in a company cannot exceed 2% of total

workers by job category.

The draft hydrocarbon code recommends giving preference to equally

qualified Congolese manpower.

Training of nationals:

Page 10

A training budget should be provided, and a vocational training program

and a system for staff promotion should be implemented for all phases of

hydrocarbon operations.

Doing business in Democratic Republic Congo

2012 African Oil and Gas Tax Workshop: Sub-Saharan Africa

HR issues

Immigration labor rules for foreign personnel:

A local contract, work permits, an initial visa and multiple entry/exit visas

are required for any expatriate who works in the DRC.

A specific category work visa (good for six months, renewable once) and

a work permit are required for foreign company personnel.

Work permits are increasingly difficult to obtain due to inefficiency and

administrative delays

Page 11

Doing business in Democratic Republic Congo

2012 African Oil and Gas Tax Workshop: Sub-Saharan Africa

Accounting issues

Petroleum costs:

Under the draft hydrocarbon code:

Conditions of recovery

Ring fencing clearly limited to the permit zone

Bookkeeping:

Bookkeeping of the branch/subsidiary must be performed in the DRC in

French.

Petroleum companies and oil subcontractors must use Congolese

accounting.

Page 12

Doing business in Democratic Republic Congo

2012 African Oil and Gas Tax Workshop: Sub-Saharan Africa

Ernst & Young

Assurance | Tax | Transactions | Advisory

About Ernst & Young

Ernst & Young is a global leader in assurance, tax, transaction and

advisory services. Worldwide, our 152,000 people are united by our

shared values and an unwavering commitment to quality. We make a

difference by helping our people, our clients and our wider

communities achieve their potential.

Ernst & Young refers to the global organization of member firms of

Ernst & Young Global Limited, each of which is a separate legal entity.

Ernst & Young Global Limited, a UK company limited by guarantee,

does not provide services to clients. For more information, please visit

www.ey.com.

How Ernst & Youngs Global Oil & Gas Center can help your

business

The oil and gas industry is constantly changing. Increasingly uncertain

energy policies, geopolitical complexities, cost management and

climate change all present significant challenges. Ernst & Youngs

Global Oil & Gas Center supports a global practice of more than 9,000

oil and gas professionals with technical experience in providing

assurance, tax, transaction and advisory services across the

upstream, midstream, downstream and oil field service sub-sectors.

The Center works to anticipate market trends, execute the mobility of

our global resources and articulate points of view on relevant key

industry issues. With our deep industry focus, we can help your

organization drive down costs and compete more effectively to

achieve its potential.

2012 EYGM Limited.

All Rights Reserved.

EYG no: DW0140

This publication contains information in summary form and is therefore

intended for general guidance only. It is not intended to be a substitute

for detailed research or the exercise of professional judgment. Neither

EYGM Limited nor any other member of the global Ernst & Young

organization can accept any responsibility for loss occasioned to any

person acting or refraining from action as a result of any material in

this publication. On any specific matter, reference should be made to

the appropriate advisor.

Anda mungkin juga menyukai

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5795)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- How To Finally Play The GuitarDokumen16 halamanHow To Finally Play The GuitarJoelLadjo100% (1)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Data Sharing AgreementDokumen12 halamanData Sharing Agreementpinkfloyd1979Belum ada peringkat

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Articles of Incorporation and by Laws Non Stock CorporationDokumen9 halamanArticles of Incorporation and by Laws Non Stock CorporationL A AnchetaSalvia DappananBelum ada peringkat

- Maths Made MagicDokumen76 halamanMaths Made Magicrober_fcBelum ada peringkat

- Strama 2015Dokumen72 halamanStrama 2015Millicent Matienzo100% (5)

- TAMP BriefingDokumen17 halamanTAMP Briefingdragon 999999100% (1)

- The Importance of Corporate Communications During Financial CrisisDokumen12 halamanThe Importance of Corporate Communications During Financial CrisisLang MensilangBelum ada peringkat

- US GAAP Conversion To IFRS: A Case Study of The Balance SheetDokumen8 halamanUS GAAP Conversion To IFRS: A Case Study of The Balance SheetJasonBelum ada peringkat

- APSA Paper Machiavelli and ManagementDokumen21 halamanAPSA Paper Machiavelli and ManagementJoelLadjoBelum ada peringkat

- Fortune of Africa 100 IdeasDokumen17 halamanFortune of Africa 100 IdeasJoelLadjoBelum ada peringkat

- ITC Industry AnalysisDokumen27 halamanITC Industry AnalysisGaurav Verma100% (1)

- Part B - Equitable Treatment of ShareholdersDokumen12 halamanPart B - Equitable Treatment of ShareholdersYogaBelum ada peringkat

- Right Hemisphere Reading Mechanisms in A Global Alexic PatientDokumen18 halamanRight Hemisphere Reading Mechanisms in A Global Alexic PatientJoelLadjoBelum ada peringkat

- Ancient Method-Black GoldDokumen2 halamanAncient Method-Black GoldJoelLadjoBelum ada peringkat

- Beanie Turns Brainwaves Into LightDokumen17 halamanBeanie Turns Brainwaves Into LightJoelLadjoBelum ada peringkat

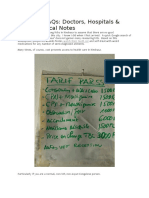

- Kinshasa FAQs - HopitauxDokumen15 halamanKinshasa FAQs - HopitauxJoelLadjoBelum ada peringkat

- Communes Et Districts of KinshasaDokumen4 halamanCommunes Et Districts of KinshasaJoelLadjoBelum ada peringkat

- Belson Outdoors Pig Roast ManualDokumen11 halamanBelson Outdoors Pig Roast ManualJoelLadjoBelum ada peringkat

- Peruvian Localization Oracle EBSDokumen145 halamanPeruvian Localization Oracle EBSlenardilloBelum ada peringkat

- SME Rating AgencyDokumen18 halamanSME Rating Agencyashish_kanojia123341150% (2)

- Auditing and Assurance Standard (AAS) 25 ComparativesDokumen8 halamanAuditing and Assurance Standard (AAS) 25 ComparativesRishabh GuptaBelum ada peringkat

- OB Group13Dokumen7 halamanOB Group13Shreya SharmaBelum ada peringkat

- Thesis On FarmoutDokumen322 halamanThesis On FarmoutPhạm ThaoBelum ada peringkat

- What Matters For Business Success or Failure?: Chamara BandaraDokumen4 halamanWhat Matters For Business Success or Failure?: Chamara Bandarashavindra789Belum ada peringkat

- RIZKA NURUL OKTAVIANI - 120110180007 - TugasFinancialPlanningDokumen4 halamanRIZKA NURUL OKTAVIANI - 120110180007 - TugasFinancialPlanningRizka OktavianiBelum ada peringkat

- A Critical Analysis of Qantas Airways LimitedDokumen19 halamanA Critical Analysis of Qantas Airways Limitedtolubabs50% (2)

- Financial Statement Analysis of "Beximco Pharma": Submitted ToDokumen3 halamanFinancial Statement Analysis of "Beximco Pharma": Submitted TojtopuBelum ada peringkat

- DynaLiners Weekly 49-2015Dokumen12 halamanDynaLiners Weekly 49-2015Somayajula SuryaramBelum ada peringkat

- Theory of Accounts by Valixpdf Ebook and Manual FRDokumen1 halamanTheory of Accounts by Valixpdf Ebook and Manual FRMariane Jean Dela CruzBelum ada peringkat

- James MontierDokumen12 halamanJames Montierapi-26172897Belum ada peringkat

- Chapter 07 IMSMDokumen38 halamanChapter 07 IMSMAbdullah A. Buhamad50% (2)

- CFA Magazine Jan 2013Dokumen60 halamanCFA Magazine Jan 2013Devina DAJBelum ada peringkat

- Insomniac Holdings LLC V Conscious Entertainment Group Wawdce-20-00137 0001.0Dokumen28 halamanInsomniac Holdings LLC V Conscious Entertainment Group Wawdce-20-00137 0001.0MattMeadowBelum ada peringkat

- Jefferies-High Yield Best Picks 2004-Greg ImbruceDokumen3 halamanJefferies-High Yield Best Picks 2004-Greg ImbrucerpupolaBelum ada peringkat

- Money Crossword WordbankDokumen1 halamanMoney Crossword WordbankJoseph JenningsBelum ada peringkat

- Morning Star User GuideDokumen22 halamanMorning Star User Guideee1993Belum ada peringkat

- Exercises For Corporate FinanceDokumen13 halamanExercises For Corporate FinanceVioh NguyenBelum ada peringkat

- Darca Ditch and Reservoir Company HandbookDokumen129 halamanDarca Ditch and Reservoir Company Handbookapi-371772163Belum ada peringkat

- Manajemen Sarana Dan Prasarana Pendidikan Di Sma Institut Indonesia SemarangDokumen24 halamanManajemen Sarana Dan Prasarana Pendidikan Di Sma Institut Indonesia SemarangsakdeBelum ada peringkat

- Oil Trading LicensingDokumen3 halamanOil Trading LicensingSakshi vermaBelum ada peringkat