Contract

Diunggah oleh

Gabriela StevensHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Contract

Diunggah oleh

Gabriela StevensHak Cipta:

Format Tersedia

ASSIGNMENT ON

LAW OF

CONTRACT

INDIAN

PARTNERSHIP ACT ,

1932

GUIDED BY:

SUBMITTED BY:

List of Contents

ACKNOWLEDGEMENT.. 1

LIST OF CONTENTS ....... 2

TABLE OF CASES. 3

TABLE OF TREATISE.. 4

TABLE OF ABBREVIATIONS. 4

BACKGROUND...... 5

NATURE OF PARTNERSHIP....... 5

DEFINITION OF PARTNERSHIP... 6

ESSENTIALS OF PARTNERSHIP....... 7

RELATION OF PARTNERS INTER SE. 10

RIGHTS OF PARTNERS.. 12

DUTIES OF PARTNERS... 14

DISSOLOUTION OF FIRM.. 17

TABLE OF CASES

Agarwal Jorwarmall v. Kasam AIR 1937 Nag.

Arunachalam & Co. v. M. Sadasivam AIR 1985 Mad. 345

Blisset v Danial (1853) 68 ER 1022

Burton v. Wookey (1822) 56 ER 1131

Cox v. Hickman(1860) 8 HLC 268 : 125 RR 148

Gobardhan Chakraborty v. Abani Mohan AIR 1991 Cal. 195.

Harsant v. Blaine (1887) 3 TL Rep. 689

Hugh Stevenson & Sons v. Aktiengesellschaft (1918) AC 239

Hukumchand v. Hansraj (1938) @ MLJ 966

Jones v. Llyod (1874) LR 18 Eq. 265.

K. Jaggaiah v. Kokumanu AIR 1984 A.P 149

McLeod v. Dowling (1927) 43 TLR 655.

Mahommed Kamil v. Hafeyatullah AIR 1926 Cal. 380.

Marshal & Co. v. Naginchand (1918) ILR 42

Maung Tha v. Mah Thein (1901) ILR

Maung Tha Hurjum v. Ma Than Yeikh (1900) ILR 28 Cal.

Nawell v. Nawell (1869) 7 Eq. 538.

Pabita Construction Co. v. UCO Bank AIR 2008 Cal. 103.

Peacock v Peacock (1808) 33 ER 902

Ram Singh v. Ram Chand (1923) ILR 5 Lah. 23

Re. Albion Life Assurance Society (1880) 16 CH.D 83

Reghunandan v. Hormasjee (1927) 51 ILR Bom 342.

Rodriguez v. Speyer Bros. (1919) AC 59

Sathappa v. Subrahmanyam 101 IC 17

TABLE OF TREATISE

The law of Contracts & Tenders, Sixth Edition, T.S Venkatesa Iyer

Contract-II, Dr. R.K Bangia

TABLE OF ABBREVIATIONS

A.C. Appeal Cases

All E.R. All England Reports

A.I.R. All India Reports

Del. Delhi High Court

Ex. Court of Exchequer Chamber

K.B. Kings Bench

N.Z.L.R. New Zealand Law Reports

Q.B. Queens Bench

S.C.C. Supreme Court Cases

W.L.R. Weekly Law Report

Background :

The Indian Partnership Act as stated under Section 11 was enacted in 1932

and it came into force on 1st day of October 1932. This act superseded the

earlier law relating to Partnership, which was contained in Chapter XI of

Indian Contract Act, 1872.

The Partnership arises from contract, and therefore, such a

contract not only by the provisions of the Partnership Act, but also by

general law of contract in such provisions. Section 3 of Indian Partnership

Act expressly talks that in so far general law of contract are inconsistent

with the provisions of this Act, shall continue to apply. On the other hand,

regarding the position of minor, since there is a specific provision contained

in Section 30 of Indian Partnership Act, the minors position is governed by

the provisions of Partnership Act.

Nature of Partnership :

Partnership is a form of business organization where two or more persons

join together for jointly carrying on some business. In Partnership, a number

of people could invest their resources and efforts and could start a much

larger business than could be afforded by any of these partners individually.

In case of loss burden also gets divided amongst various partners in a

Partnership.

Section 11 of Companies Act, 1956 imposes a limit as to

the maximum number of persons in a partnership. In a partnership for the

1 Sec. 1. The Act came into force on the 1st day of October 1932, except Section 69, which

came into force on the 1st day of October, 1933.

purpose of carrying on banking business, there can be maximum of 10

persons, whereas there can be maximum of 20 people in carrying on any

other business. If the number of member in any association exceeds the

abovestated limits, that must be registered as a company under the

Companies Act, otherwise that will be considered to be an illegal

association. As against Partnership, there could be possibly much larger

member in a Company.

In certain aspects, a partnership is a more suitable form

of business organization than a Company. For creation of a Partnership just

an agreement between various partners is all what is required, whereas in

case of a Company, there are a lot of procedural formalities which have to

be gone through before a Company is created.

Definition of Partnership:

The word partnership comes from a Latin word meaning to part, i.e, to

share. Though sharing is the central idea of a partnership, yet, as will be

seen later, it is not the sole test of a partnership. Partnership has been

defined in several ways and Lindley collects together as many as nineteen

definition in his book.

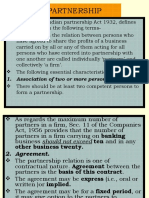

Section 4 of Indian Partnership Act 1932 defines Partnership2:

Partnership is the relation between persons who have agreed to share

the profits of a business carried on by all or any of them acting for all.

Sir Fredrick Pollock defines Partnership as

the relation which subsists between persons carrying on business in

common with a view of profits.

2 The present definition replaces Section 239, Indian Contract Act, which defined

Partnership as under : Partnership is a relation which subsists between persons who

have agreed to combine their property, labor or skill In some business, and to share

the profits thereof between them.

Essentials of Partnership:

1. An Agreement

2. Carrying on of business

3. Sharing profits

1. An Agreement:

Partnership arises from an agreement between two or more persons for the

creation of this relation. The presence of an agreement has to be there,

through the same way be either express or implied. If the basis of the

relationship between certain persons is not an agreement, the association

would not be a partnership. Section 5 expressly provides that the relation of

partnership arises from contract and not from status. Thus, it is the element

of agreement which distinguishes a partnership from various other

relationships like members of a Joint Hindu Family, joint owners or joint

heirs.

The agreement to form partnership has to be between two

or more persons. Since the creation of partnership itself requires a contract

between persons, such persons, therefore, must be competent to contract. A

minor or a person of unsound mind, who are not competent to contract,

cannot become partners. There is nothing which prevents a person

incompetent to contract from accepting any benefit and hence the business

organization permits a minor to be admitted to the benefits of partnership.3

Such minor has a right to share of property and profits as may be agreed

3 See Sec. 30(1). The position of a minor has been discussed in details in Chapter 3.

upon.4 Such minors share is liable for the act of the firm, but the minor is

not personally liable for any such act.5

2. Carrying on of Business:

The object of every Partnership must be carrying on a business and sharing

of profits. It may be any business which is not unlawful. The Act defines

business as including every trade occupation or profession. The definition

is not exhaustive and is capable of including any kind of commercial

activity aimed at earning profits.

Particular Partnership [Section 8]:

According to Section 8, there can be Particular Partnership between

partners whereby they engage in particular adventures or undertaking.

Thus, persons can be partners in the working out of a coal-mine or the

production of a film because although that may be a single adventure

but the same requires a series of transactions and continuous

relationship.

In K. Jaggaiah v. Kokumanu6, the plaintiff and the two

defendants joined together and obtained a contract for the

maintenance of road. There was held to be partnership in the road

building activity. Such activity through arising out of a single contract

was spread over a particular period and the firm had to employ certain

workers, supervise the work, prepare the bills and finally receive the

bills, and all that meant carrying on of business.

3. Sharing of profits:

4 Sec 30(2), Indian Partnership Act.

5 Sec. 30(3).

6 AIR 1984 A.P 149.

The object of every partnership must be to carry on business

for the sake of profits and to share the same. Therefore,

clubs or societies which do not aim at making profits are not

partnerships. The term profits has not been defined in the

Act. It means net gain, i.e., the excess of return over outlay.

Although sharing of profits is one of the

essential elements of every partnership but every person

who shares the profits need not to be a partner. For

example, I may pay a share of profits to the manager of my

business instead of paying him fixed salary so that he takes

more interest in the progress of the business; such person

sharing the profit is simply my servant or agent but not my

partner. In Cox v. Hickman7 it was laid down that the

persons sharing the profits of a business do not always incur

the liability of partners unless the real relation between

them is that of partners. The principle laid down in Cox v.

Hickman forms the basis of the provisions of S.6 of Indian

Partnership Act, which gives a caution that the presence of

only some of the essentials of partnership does not

necessarily result in partnership.

Duration of partnership:

Partners are free to decide as to how long partnership between them shall

continue. It may be partnership for a fixed term, say for 2 years or 5 years,

or it may be until the completion of certain adventures or undertaking, for

instance until the production of a firm. When the partners have not decided

about the duration of partnership, such a partnership is known as partnership

at will

Partnership at will

7 (1860) 8 HLC 268 : 125 RR 148

According to Section 7:

Where no provision is made by contract between the partners

for the duration of their partnership or for the determination of

their partnership, the partnership is partnership at will.

If the duration of partnership has been fixed but the partnership is made to

continue thereafter without specifying any fixed duration for the same, the

subsequently it becomes a partnership at will.8

When the duration of partnership cannot be found either by any express

provision in the partnership agreement or by implication, and the same is

dependent on a totally uncertain event like grant of permanent license for

running cinema business, it would be a partnership at will.9

Since in a partnership at the will duration of partnership is not fixed, nor is

there any provision as regard his determination, the partners are not legally

bound to continue in partnership for any specified period, etc, and the

partnership can be ended at the sweet will of any of the partners. The

following provisions of the Partnership Act in this regard may be noted:

a) Where a partnership is at will, a partner may retire by giving a

notice to all the other partners of his intention to retire.10

b) Where the partnership is at will, the firm may be dissolved by any

partners giving notice in writing to all the other partners of his

intention to dissolve the firm.11 The firm is dissolved as from the date

mentioned in the notice as to the date of dissolution or, if no date is so

8 Arunachalam & Co. v. M. Sadasivam AIR 1985 Mad. 345

9 Gobardhan Chakraborty v. Abani Mohan AIR 1991 Cal. 195.

10 Sec. 32(10)(c)

11 Sec 43(1)

10

mentioned, as from the date of the communication of the notice.12

RELATION OF PARTNERS INTER SE:

Chapter III (Sections 9 to 17) of Indian Partnership Act contains provisions

concerning Relation of partners to one another, i.e. the rights and duties of

the partners as between themselves.

Section 11 of the Act contains the general rule that the mutual rights and

duties of the partners are to be determined by their mutual agreement. The

provision is as under:

11.Determination of rights and duties of partners by contract between

the partners.(1) Subject to the provisions of this Act, the mutual rights and

duties of the partners of a firm may be determined by contract

between the partners, and such contract may be expressed or

may be implied by a course of dealing.

Such contract may be varied by consent of all the

partners, and such consent may be expressed or may be

implied by a course of dealing.

(2) Agreement in restraint of trade- Notwithstanding anything

contained in Section 27 of the Indian Contract Act, 1872, such

contract may provide that a partner shall not carry on any

business other than that of the firm while he is a partner.

As it has been noted as above, this section incorporates the general principle

that the mutual rights and duties of the partners may be determined by the

contract between themselves. They may themselves decide that how much

investment or labour is to be put by whom, or whatever a partner will be

entitled to any remuneration, apart from sharing the profits, or what will be

12 Sec. 43(2)

11

the profit sharing ratio, etc. Such contract may be expressed or may be

implied by a course of dealing. The mutual rights and duties which may

have been agreed upon between the partners may be subsequently varied by

the consent of all the partners. Such variance or change in the mutual rights

and duties may also be made either expressly or by an implied consent

though a course of dealing between the partners.

In Pabita Construction Co. v. UCO Bank13, three partners opened a joint

account with the respondent Bank with special instructions that any of the

two partners would be entitled to operate the bank account. In the course of

business transactions, disputes arose between them and one of them gave

written instructions to the respondent bank, not to clear any cheque unless

all the three partners jointly operate the account in deviation from the earlier

instructions. The Bank, in view of such instructions, refused to clear two

cheques issued by two of the partners. The action taken by the Bank was

held as quite justified by the Court.

RIGHTS OF PARTNERS:

It has been noted above that various rights and duties of the partners

contained in Section 12 to 17 are subject to contract between the partners.

Therefore, unless it has been agreed otherwise, rights are as follows:

1. Right to take part in the conduct of the business [Section 12(a)]

According to Section 12(a), every partner has a right to take part in the

conduct of the business. Since the business of partnership belongs to all the

partners, every partner is entitled to take part in conduct of business. If such

a right is wrongfully denied to a partner, he can seek the enforcement of the

right trough court of law.

13 AIR 2008 Cal. 103.

12

2. Right to express opinion [Section 12(c)]

Section 12(c) contains following provision:

(c) Any difference arising as to ordinary matters connected with

the business may be decided by the majority of the partners, and

every partner shall have the right to express his opinion before

the matter is decided. But no change may be made in the nature

of the business without the consent of all the partners.

When the difference of opinion pertains to an ordinary or routine matter

connected with the business, the same way is resolved by a decision of

majority of the partners. But before the matter is decided every partner must

be provided with an opportunity to express his opinion.

When the matter is not an ordinary or a routine matter but is of

fundamental importance, consent of all the partners is needed.

3. Right to have access to books of firm. [Section 12(d)]

Every partner has a right to have access to and to inspect and copy any

books of the firm. The right is available to both active and dormant partners.

The right is not only in respect of books of the accounts but in respect of any

books of the firm. A partner could exercise the right either personally or by

engaging an agent.

4. Right to share profit [Section 13(b)]

Every partner has a right to share the profit. Usually partners provide in their

agreement as to what will be the proportion in which they will share the

profit.

According to Section 13(b), in absence of such agreement, the

partners are to share the profit equally to the losses sustained by the firm and

not in the proportion the various partners contributed capital.

5. Right to Indemnity [Section 13(e)]

13

A partner acting on the behalf of the firm may make certain payments and

also incur some liabilities. According to Section, he is entitles to claim

indemnity for the same. The indemnity claimed for the acts done by a

partner in ordinary and proper conduct of business and also for doing the

same act in an emergency for the purpose of protecting the firm from the

loss.

DUTIES OF PARTNERS:

Section 9 and 10 incorporate certain duties of the partners which are not

subjected to contract between the partners, whereas certain duties have been

provided from Section 12 to 17, each one of those provisions has been

subject to contract between the partners. Duties are as follows:

1. Duty to carry on the business to the greatest common advantage

Partnership is based upon mutual confidence and trust. It is, therefore,

necessary that no partner should gain any personal advantage at the cost of

others. One of the duties mentioned in Section 9 is that partners must carry

on the business to the greatest common advantage. 14

2. To be just and faithful

Every partner is bound to be just and faithful to the others persons.15 As

already observed, partnership being a fiduciary relationship, it is absolutely

necessary that each partner must be just and faithful to others. It is however

to be noted that such a provisions is not found in the English Partnership Act

and Section 9 of Indian Partnership Act has taken this from Section 257 of

Indian Contract Act Section 10 and 13(f) elaborate the duty of just and

faithful.

14 Peacock v Peacock (1808) 33 ER 902

15 Burton v. Wookey (1822) 56 ER 1131

14

3. To keep and render true and correct accounts

It is the duty of the partners not only to maintain true, proper and correct

accounts of the partnership16 but to allow the other persons to have free

access to such accounts, to inspect them and to take copies of them either by

themselves or by their agent at all reasonable times. If he fails to maintain

proper accounts or mixes up his private affairs with those of partnership he

will have to account for the same.17. Beyond submitting statements of

accounts he will have to hand over the firm which may have come in his

hands.18

4. Duty to indemnify for fraud

Section 10 contains the following provisions :

10. Duty to indemnify for the loss caused by fraud- Every partner shall

indemnify the firm for any loss caused to it his fraud in the conduct of

the business of the firm.

The firm is liable for not only for the contract made by one of them on

behalf of other but also for the wrongful act or omission of the partner

acting in the ordinary course of business of the firm. If a partner commits a

fraud against a third party, the third party can make the firm liable for the

same. Section 10 entitles the firm to recover indemnity from the partner

guilty of fraud because of which the firm had to suffer the loss. It is

therefore, not possible for a partner to negative his liability towards the firm

for loss caused to firm due to his fraud. This section in absolute terms

provides that every partner shall indemnify the firm for any loss caused to

the firm by his fraud in the conduct of business of the firm.

16 Blisset v Danial (1853) 68 ER 1022, Ram Nand v. Nand Kishor

17 Maung Tha v. Mah Thein (1901) ILR

18 Harsant v. Blaine (1887) 3 TL Rep. 689

15

5. To account for the profit of competing business

Ordinarily, through every partner is expected to attend diligently to the

business of the partnership, the partnership agreement may provide weather

a person is expected to give the whole of his time to the affairs of the

partnership, and if he is entitled to carry on any independent business. In the

absence of any such agreement, partners are free to be interested in a private

business of their own, provided the same does not compete with the business

of the partnership.19 It is however, open to the partners by an agreement, to

restrain a partner from carrying to any other business and such restraint, if

reasonable, will be valid and enforceable.

Section 11(2) of Indian Partnership Act provides:

11. (2) Nothwithstanding anything contained in Section 27 of Indian

Contract Act, such contract may provide that a partner shall not carry on any

business other than that of the firm while he is partner.

If the partner fails to obtain consent and carries on a competing business

then, he must account for the profits of such business to the firm and must

also compensate the firm for any loss sustained by carrying on such

competing business.

6. To share losses

Every partner is bound to share the losses equally with others.20 If the

partnership arrangement provides for the proportion in which loses are to be

shared, then it would govern the transaction. In the absence of any such

arrangement, it is presumed that the partners share the losses in the same

proportion they share the profits.21 But if the arrangement does not provide

19 Mahommed Kamil v. Hafeyatullah AIR 1926 Cal. 380.

20 Nawell v. Nawell (1869) 7 Eq. 538

21 Re. Albion Life Assurance Society (1880) 16 CH.D 83

16

even as to the sharing of the profits, then, parties to agree that the profit or

the loss shall be joint22 or that one of the partners shall bear all the losses of

the business.23

7. Section 13(b) provides:The partners are entitled to share equally in the profits

earned, and shall contribute equally to the losses sustained by the firm.

DISSOLOUTION OF FIRM:

Dissolution of partnership means coming to an end of the relationship

known as partnership, between various partners. When one or more partner

ceases to be partners but the others continue the business in partnership,

there is dissolution of partnership between the outgoing partners on the one

hand and remaining partners on the other.

According to Section 39, when the dissolution of partnership

between all the partners of the firm occurs, this is called dissolution of the

firm.

Modes of dissolutions [Section 40-44]

1. By mutual consent:

Whether it is a partnership at will or one for a fixed period, a partnership

would be dissolved , if all the partners agree that it should be dissolved. Just

as a partnership is formed by the consent of all the partners, similarly a

partnership gets dissolved by all the partners agreeing to dissolution.

22 Hukumchand v. Hansraj (1938) @ MLJ 966

23 Reghunandan v. Hormasjee (1927) 51 ILR Bom 342.

17

Section 40 of Indian Partnership Act

A firm may be dissolved with the consent of all the partners or in

accordance with the contract between the partners.

Under this Section all partnership including a partnership including a

partnership at will may be dissolved in the manner provided therein.24

Consent of the partners to dissolve the firm need not necessarily be

expressed but may be implied from the circumstances of the particular

case.25

Notice of dissolution of partnership given by one partner of the firm

accepted by the other partner and not replied to by him amounts to consent

to dissolution.26

2. By the insolvency of all the partners but one

Through the insolvency of one or more partners would only dissolve the

partnership so that it would be open to the remaining partners to enter into a

special agreement for continuing the business of the firm provided there be

at least two solvent partners left, yet if all partners but one have become

insolvent there must necessarily be a dissolution of the firm.

Section 41, Cl (a) of the Indian Partnership Act:

(a) by the adjudication of all the partners or of all the partners but one as

insolvent.

3. By business becoming illegal

Whether it is a partnership at will or for fixed period, if the business of the

partnership is prohibited by law or becomes illegal, then partnership gets

24 Sathappa v. Subrahmanyam 101 IC 17

25 Maung Tha Hurjum v. Ma Than Yeikh (1900) ILR 28 Cal.

26 Agarwal Jorwarmall v. Kasam AIR 1937 Nag.

18

dissolved.27 It is possible that the business may be prohibited or become

illegal if, for example by the declaration of war, the partners become alien

enemies. Where the partners of the firm find that they are nationals of State

which have declared war on each other, all contract entered into before the

declaration of war would be abrogated if they ensure to the benefit of the

enemy or involve dealing with the enemy.28 After one of the partners

becomes an alien enemy if the other partner is now dissolved firm continues

the business making use of the capital of the erstwhile partner of firm, the

enemy partner can claim his share earned after the dissolution payment

being suspended while the war is on.29 Section 41, Clause (b) provides :

(b) by happening of any event which makes it unlawful for the business of

the firm to be carried on or for partners to carry it on in partnership

4. By notice of dissolution

A partnership at will, weather originally so, or subsequently becoming one,

by a partnership for a term being continued beyond the stipulated period,

may be dissolved at any time by any of the partners giving notice of

dissolution to the other partners.30 This right of a partner to dissolve a

partnership at will by giving notice simplicities is a statutory right and is not

affected by his conduct or credentials. The right must however be exercised

in a bona fide and the partner giving notice will not allowed to gain any

particular advantage to himself by giving notice at an unreasonable

moment.31 Notice once given cannot be withdrawn expect with the consent

27 Rodriguez v. Speyer Bros. (1919) AC 59

28 Marshal & Co. v. Naginchand (1918) ILR 42

29 Hugh Stevenson & Sons v. Aktiengesellschaft (1918) AC 239

30 Ram Singh v. Ram Chand (1923) ILR 5 Lah. 23

31 Burdon v. Barkus (1862) 4 De GF

19

of the other partners.32

Section 43 of Indian Partnership Act provides thus:

(1)Where the partnership is at will, the firm may be dissolved by any partner

giving notice in writing to all the other partners of his intention to dissolve

the firm.

(2) The firm is dissolved as from the date mentioned in the notice as the

date of dissolution or, if no date is so mentioned, as from the date of the

notice.

If the partner giving notice dies while it is in course in the post, it has been

held that the dissolution is by death and not by notice.33

32 Jones v. Llyod (1874) LR 18 Eq. 265.

33 McLeod v. Dowling (1927) 43 TLR 655.

Anda mungkin juga menyukai

- Edward Nell Company vs. Pacific Farms Inc.Dokumen4 halamanEdward Nell Company vs. Pacific Farms Inc.Gerald HernandezBelum ada peringkat

- The Law of Partnership Is An Extension of Law of AgencyDokumen23 halamanThe Law of Partnership Is An Extension of Law of AgencyNominee Pareek65% (23)

- Manual For PawnshopsDokumen19 halamanManual For PawnshopsDavid CagahastianBelum ada peringkat

- Ambry Square Mall Floor Plan OverviewDokumen62 halamanAmbry Square Mall Floor Plan OverviewJackBelum ada peringkat

- Income Tax Deduction GuideDokumen33 halamanIncome Tax Deduction GuideJobell CaballeroBelum ada peringkat

- Savigny's Historical JurisprudenceDokumen16 halamanSavigny's Historical JurisprudenceGabriela Stevens100% (1)

- Savigny's Historical JurisprudenceDokumen16 halamanSavigny's Historical JurisprudenceGabriela Stevens100% (1)

- Myanmar Business Law-Chapter 1Dokumen130 halamanMyanmar Business Law-Chapter 1Talento Mup93% (14)

- Religion Under Constitution and Related LawsDokumen29 halamanReligion Under Constitution and Related LawsGabriela StevensBelum ada peringkat

- Religion Under Constitution and Related LawsDokumen29 halamanReligion Under Constitution and Related LawsGabriela StevensBelum ada peringkat

- Indian Partnership ActDokumen18 halamanIndian Partnership ActShrikant RathodBelum ada peringkat

- Rural Bank Stock Transfer Mandamus CaseDokumen1 halamanRural Bank Stock Transfer Mandamus CaseKim Cajucom100% (1)

- Business Law-Chapter 1.... Law of Partnership PDFDokumen98 halamanBusiness Law-Chapter 1.... Law of Partnership PDFmmcities67% (6)

- Partnership Law in Malaysia - Principles and CasesDokumen46 halamanPartnership Law in Malaysia - Principles and CasesHafis ShaharBelum ada peringkat

- Globalization's Complex EffectsDokumen11 halamanGlobalization's Complex EffectsGabriela Stevens100% (1)

- PartnershipDokumen10 halamanPartnershipRaGa JoThiBelum ada peringkat

- Assignment Contract Law 2 INdian Partnership Act 1932Dokumen4 halamanAssignment Contract Law 2 INdian Partnership Act 1932Fairoze AhmedBelum ada peringkat

- Business Law GCT-2Dokumen16 halamanBusiness Law GCT-2Ilma SabeelBelum ada peringkat

- The Law of Partnership Is An Extention of Law of AgencyDokumen22 halamanThe Law of Partnership Is An Extention of Law of AgencyNominee Pareek50% (4)

- Visakhapatnam: Damodaram Sanjivaya National Law UniversityDokumen25 halamanVisakhapatnam: Damodaram Sanjivaya National Law UniversityNikhila KatupalliBelum ada peringkat

- Partnershih Act 1953Dokumen26 halamanPartnershih Act 1953Sajad HussainBelum ada peringkat

- Indian Partnership Act EssentialsDokumen13 halamanIndian Partnership Act EssentialsAnonymous FPYvtlIpBelum ada peringkat

- The Law of Partnership Is An Extention of Law of AgencyDokumen21 halamanThe Law of Partnership Is An Extention of Law of AgencyHaovangDonglien KipgenBelum ada peringkat

- Indian Pertnership Act 1932Dokumen4 halamanIndian Pertnership Act 1932tarachandmaraBelum ada peringkat

- Patnership ActDokumen27 halamanPatnership ActJivaansha SinhaBelum ada peringkat

- Partnership: You Ensure Your Hard Work, We Ensure Your SuccessDokumen53 halamanPartnership: You Ensure Your Hard Work, We Ensure Your SuccessIshan BramhbhattBelum ada peringkat

- He Indian Partnership Act Was Enacted in 1932 and It Came Into Force On 1st Day of OctoberDokumen6 halamanHe Indian Partnership Act Was Enacted in 1932 and It Came Into Force On 1st Day of OctoberPrabhakaran KarthikeyanBelum ada peringkat

- Buss Law AsinmentDokumen27 halamanBuss Law AsinmentAnupam Kumar ChaudharyBelum ada peringkat

- Indian Partnership ActDokumen7 halamanIndian Partnership ActmehakBelum ada peringkat

- Partnership ActDokumen6 halamanPartnership ActranbirsinghnalagarhBelum ada peringkat

- Unit-Iv Indian Partnership Act - Definition - Nature, Mode of Determining The Existence ofDokumen26 halamanUnit-Iv Indian Partnership Act - Definition - Nature, Mode of Determining The Existence ofAnilBelum ada peringkat

- NSB-PGDM - (EM) - BATCH-5-TERM-3-2022-24-BLCG-PPT-3-Elements of Law Relating To Partnership and LLPDokumen35 halamanNSB-PGDM - (EM) - BATCH-5-TERM-3-2022-24-BLCG-PPT-3-Elements of Law Relating To Partnership and LLPVij88888Belum ada peringkat

- Business Law ProjectDokumen14 halamanBusiness Law Projectrvikrant053Belum ada peringkat

- Unit 3Dokumen33 halamanUnit 3Aryaka JainBelum ada peringkat

- Indian Partnership Act 1932 overviewDokumen4 halamanIndian Partnership Act 1932 overviewSwati SinghBelum ada peringkat

- Law of Business OrganizationDokumen21 halamanLaw of Business OrganizationArman KhanBelum ada peringkat

- Dhruti Jain 20 Law AssignmentDokumen6 halamanDhruti Jain 20 Law AssignmentTanvi KodiBelum ada peringkat

- Indian Partnership Act, 1932Dokumen5 halamanIndian Partnership Act, 1932sonalBelum ada peringkat

- Unit 5 - Indian Partnership Act, 1932Dokumen29 halamanUnit 5 - Indian Partnership Act, 1932Prabhnoor KaurBelum ada peringkat

- The Indian Partnership ActDokumen24 halamanThe Indian Partnership Actdee deeBelum ada peringkat

- 1 Legal Lock J84Dokumen11 halaman1 Legal Lock J84Disha MahajanBelum ada peringkat

- Contract ProjectDokumen16 halamanContract ProjectSanat KhandelwalBelum ada peringkat

- Indian Partnership ActDokumen8 halamanIndian Partnership ActShreeKant AwasthiBelum ada peringkat

- Economics and LawsDokumen39 halamanEconomics and Lawshamid khanBelum ada peringkat

- Company LawDokumen6 halamanCompany LawJayagowri SelvakumaranBelum ada peringkat

- Unit - Ii Indian Partnership Act, 1932Dokumen17 halamanUnit - Ii Indian Partnership Act, 1932shobhanaBelum ada peringkat

- The Indian Partnership Act 1932 NotesDokumen12 halamanThe Indian Partnership Act 1932 NotesSiva RatheeshBelum ada peringkat

- Partnership: 1. Association of Two or More PersonsDokumen4 halamanPartnership: 1. Association of Two or More PersonsshekharmvmBelum ada peringkat

- Assignment ON The Indian Partnership Act, 1932 by Neha Sachdeva ROLL NO. - A3256119078 Submitted To: Mr. Annirudh VashishthaDokumen14 halamanAssignment ON The Indian Partnership Act, 1932 by Neha Sachdeva ROLL NO. - A3256119078 Submitted To: Mr. Annirudh VashishthanehaBelum ada peringkat

- PartnershipDokumen44 halamanPartnershipHarsh RawatBelum ada peringkat

- Chapter - 3: © The Institute of Chartered Accountants of IndiaDokumen48 halamanChapter - 3: © The Institute of Chartered Accountants of IndiaVipul DataBelum ada peringkat

- PartDokumen7 halamanPartVanshika GuptaBelum ada peringkat

- The Indian Partnership Act PDFDokumen3 halamanThe Indian Partnership Act PDFsowmyaBelum ada peringkat

- Rights and Duties of Partners in A Parnership Firm & LLP: Report Abuse / FeedbackDokumen14 halamanRights and Duties of Partners in A Parnership Firm & LLP: Report Abuse / FeedbackAditya PrakashBelum ada peringkat

- Partnership ActDokumen42 halamanPartnership ActVaidehi ModaleBelum ada peringkat

- unit 6 special contractDokumen4 halamanunit 6 special contractKanishkaBelum ada peringkat

- The Presentation Is Only Illustrative and Not ExhausitiveDokumen97 halamanThe Presentation Is Only Illustrative and Not ExhausitiveUjjwal AnandBelum ada peringkat

- Legal Aspects of Business Sem 3Dokumen11 halamanLegal Aspects of Business Sem 3molay_rBelum ada peringkat

- Understanding the Key Elements of PartnershipDokumen13 halamanUnderstanding the Key Elements of PartnershipVipin BawejaBelum ada peringkat

- Zainab Contract Sem 2 PDFDokumen15 halamanZainab Contract Sem 2 PDFSaima GousBelum ada peringkat

- Specific ContractsDokumen14 halamanSpecific ContractsKaushik SutharBelum ada peringkat

- Indian Partnership Act, 1932 ExplainedDokumen21 halamanIndian Partnership Act, 1932 ExplainedA. Saeed KhawajaBelum ada peringkat

- Partnership NotesDokumen17 halamanPartnership NotesVanshika GuptaBelum ada peringkat

- L582 PartnershipsDokumen14 halamanL582 PartnershipsMonicaKBelum ada peringkat

- Mock Test Paper 1: Business Laws and CorrespondenceDokumen11 halamanMock Test Paper 1: Business Laws and CorrespondenceVideo uploadingBelum ada peringkat

- Assignment: - 3 of Law of Contract of Nature of Partnership: Submitted By: - Submitted ByDokumen7 halamanAssignment: - 3 of Law of Contract of Nature of Partnership: Submitted By: - Submitted Byroger12 soiBelum ada peringkat

- Essentials of a Valid Partnership FirmDokumen3 halamanEssentials of a Valid Partnership FirmNithiBelum ada peringkat

- Kinds of Partnership Under Indian Partnership ActDokumen14 halamanKinds of Partnership Under Indian Partnership ActRadharani SharmaBelum ada peringkat

- Partnership Act - 230916 - 151446Dokumen13 halamanPartnership Act - 230916 - 151446pravin.vishwakarma.fms22Belum ada peringkat

- Shikwa Jawab-e-ShikwaDokumen16 halamanShikwa Jawab-e-Shikwatariqibnaziz0% (1)

- Anita Yadav ArticleDokumen11 halamanAnita Yadav ArticleGabriela StevensBelum ada peringkat

- Shikwa Jawab-e-ShikwaDokumen16 halamanShikwa Jawab-e-Shikwatariqibnaziz0% (1)

- 12 M.N.HaqueDokumen5 halaman12 M.N.HaquesameenasiddiquiBelum ada peringkat

- Amn LawDokumen6 halamanAmn LawGabriela StevensBelum ada peringkat

- Kumar Prakash 200412 PHDDokumen412 halamanKumar Prakash 200412 PHDGabriela StevensBelum ada peringkat

- Taxation and Growth in EconomyDokumen6 halamanTaxation and Growth in EconomyGabriela StevensBelum ada peringkat

- Principle of Separation of Powers AND Concentration of Authority Tej Bahadur SinghDokumen11 halamanPrinciple of Separation of Powers AND Concentration of Authority Tej Bahadur SinghgowthamBelum ada peringkat

- Mapiilla UprisingDokumen45 halamanMapiilla UprisingGabriela StevensBelum ada peringkat

- 1Dokumen18 halaman1Gabriela StevensBelum ada peringkat

- 10 Chapter 4Dokumen26 halaman10 Chapter 4KartikBelum ada peringkat

- Arbitration in IndiaDokumen17 halamanArbitration in Indiadplpthk1502Belum ada peringkat

- Introduction and Interpretation BDokumen13 halamanIntroduction and Interpretation BGabriela StevensBelum ada peringkat

- Kesavananda Bharati Case Basic Structure OriginsDokumen16 halamanKesavananda Bharati Case Basic Structure OriginsGabriela StevensBelum ada peringkat

- Kesavananda Bharati Case Basic Structure OriginsDokumen16 halamanKesavananda Bharati Case Basic Structure OriginsGabriela StevensBelum ada peringkat

- The Development of Administrative LawDokumen13 halamanThe Development of Administrative LawGabriela StevensBelum ada peringkat

- Imp of Industries in Ind EcoDokumen4 halamanImp of Industries in Ind EcoGabriela StevensBelum ada peringkat

- CollegiumDokumen7 halamanCollegiumGabriela StevensBelum ada peringkat

- Contract ActDokumen21 halamanContract ActGabriela StevensBelum ada peringkat

- Maintenance in GeneralDokumen21 halamanMaintenance in GeneralGabriela StevensBelum ada peringkat

- Maintenance in GeneralDokumen21 halamanMaintenance in GeneralGabriela StevensBelum ada peringkat

- Eports: India's Defiance of Religious Freedom: A Briefing On Anti-Conversion' LawsDokumen16 halamanEports: India's Defiance of Religious Freedom: A Briefing On Anti-Conversion' LawsGabriela StevensBelum ada peringkat

- Criminal Justice SystemDokumen18 halamanCriminal Justice SystemGabriela StevensBelum ada peringkat

- The Constitution and Criminal Justice AdministrationDokumen208 halamanThe Constitution and Criminal Justice AdministrationHammad AliBelum ada peringkat

- Undertaking To File An Income Tax Return by A Non-ResidentDokumen2 halamanUndertaking To File An Income Tax Return by A Non-ResidentjessiechowemailBelum ada peringkat

- Gaming Final Report PDFDokumen250 halamanGaming Final Report PDFbhpliaoBelum ada peringkat

- Financial Accounting and Accounting StandardsDokumen31 halamanFinancial Accounting and Accounting StandardsAlbert Adi NugrohoBelum ada peringkat

- Li & Fung LimitedDokumen3 halamanLi & Fung LimitedIshi Mercado MaresBelum ada peringkat

- BHT 1Dokumen44 halamanBHT 1Onkar ChavanBelum ada peringkat

- Bharti's Easyday Retail Strategy and OperationsDokumen22 halamanBharti's Easyday Retail Strategy and OperationsNishant TyagiBelum ada peringkat

- Email - Id SECL EXECUTIVESDokumen1 halamanEmail - Id SECL EXECUTIVESUmesh Kumar PatelBelum ada peringkat

- AS4: Accounting for Contingencies and Subsequent Events (39Dokumen2 halamanAS4: Accounting for Contingencies and Subsequent Events (39sayedmaruf7866807Belum ada peringkat

- Management Accounting For Financial ServicesDokumen4 halamanManagement Accounting For Financial ServicesMuhammad KashifBelum ada peringkat

- Kardassopoulos v. Georgia - AwardDokumen228 halamanKardassopoulos v. Georgia - AwardAxel SolBelum ada peringkat

- BSU Graduate Students Present Business Research ProjectsDokumen15 halamanBSU Graduate Students Present Business Research Projectsgabrielle doBelum ada peringkat

- About 7 PrinciplesDokumen2 halamanAbout 7 PrinciplesjoylorenzoBelum ada peringkat

- FIN 534 Quiz 5Dokumen13 halamanFIN 534 Quiz 5Justin HunterBelum ada peringkat

- Firm Ownership TypesDokumen10 halamanFirm Ownership TypesdanielBelum ada peringkat

- IMFAHE Quarter Course 2 - Innovation Entrepreneurship LeadershipDokumen4 halamanIMFAHE Quarter Course 2 - Innovation Entrepreneurship LeadershipDaniel NeryBelum ada peringkat

- GALA Valves PDFDokumen14 halamanGALA Valves PDFPrudencio Almonte IIIBelum ada peringkat

- URC Annual Corporate Governance Report 2016 - FinalDokumen74 halamanURC Annual Corporate Governance Report 2016 - FinalDennis DimaanoBelum ada peringkat

- A New Breed of Travel Agent Is Winning Over The Hearts and Wallets of ConsumersDokumen3 halamanA New Breed of Travel Agent Is Winning Over The Hearts and Wallets of ConsumersBrian Ainsley HornBelum ada peringkat

- Flying in Ireland October 2014Dokumen52 halamanFlying in Ireland October 2014Adriano BelucoBelum ada peringkat

- Report of Hon'Ble Lokayukta 280 PagesDokumen315 halamanReport of Hon'Ble Lokayukta 280 PagesMineOwnerBelum ada peringkat

- Effect of Declining Market On TATA MotorsDokumen65 halamanEffect of Declining Market On TATA Motorsarvind3041990Belum ada peringkat

- Final 1Dokumen50 halamanFinal 1saddamitdBelum ada peringkat

- IFRS and US GAAP Revenue Recognition ConvergenceDokumen12 halamanIFRS and US GAAP Revenue Recognition Convergencesusieqnorthrock0% (1)

- Types of Business OrganizationsDokumen12 halamanTypes of Business Organizationsing_civBelum ada peringkat

- Competency Appraisal UM Digos (PARTNERSHIP)Dokumen10 halamanCompetency Appraisal UM Digos (PARTNERSHIP)Diana Faye CaduadaBelum ada peringkat