Mih Presentation 0915

Diunggah oleh

Queens Post0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

3K tayangan12 halamanMIH

Hak Cipta

© © All Rights Reserved

Format Tersedia

PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniMIH

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

3K tayangan12 halamanMih Presentation 0915

Diunggah oleh

Queens PostMIH

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 12

Housing New York

Mandatory Inclusionary Housing

September 2015

Housing New York

A Five-Borough, Ten-Year Plan

Housing New York is a comprehensive plan to build and

preserve 200,000 units of high-quality affordable housing

over the next decade. The Plan will create opportunities for

New Yorkers with a range of incomes, from the very lowest

to those in the middle class, and will foster vibrant and

diverse neighborhoods.

Key Facets of

The Affordable Housing Crisis

Gap Between Rents and Incomes

Over the past decade, average rents rose by more than 10% while wages stagnated

High Rent Burden

55% of renter households are rent-burdened and 30% are extremely rent burdened

Insufficient Housing Production

The marketplace is not meeting the needs of existing residents, let alone new ones

Limited Supply of Affordable Units

Despite significant public investment, only a fraction of eligible New Yorkers served

Population Growth

230,000 new residents arrived since 2010 and 600,000 more are expected by 2040

3

Housing New York:

Implementation

Create More

Affordable Housing

Create 80,000 new affordable units

Reform 421-a tax exemption program

Improve zoning to promote affordability

Preserve Existing

Housing and

Prevent

Displacement

Preserve affordability of 120,000

existing units

Strengthen rent regulations

Protect tenants facing harassment

Plan for and Invest

in Strong

Neighborhoods

Collaboratively plan with communities

Create Neighborhood Development

Fund

Align planning with strategic

investments

4

What is Mandatory Inclusionary Housing?

A new proposal to use zoning to

require permanently affordable housing

when future City Planning Commission actions

encourage substantial new housing

Goals of Mandatory Inclusionary Housing

Promote vibrant, diverse neighborhoods

Ensure affordable housing in areas in which we are

planning for growth

Meet the needs of a range of low-and moderateincome New Yorkers

Ensure that program meets legal standards

Apply program consistently

Support financial feasibility of housing creation

Financial Feasibility Assessment: Conclusions

BAE Urban Economics, an experienced affordable housing

consultant, conducted an analysis for the City, and found that:

There is a tradeoff between the percentage of affordable

housing and reaching lower income levels

Strongest housing markets can generally support a

requirement for 20-30% affordable housing

Mid-markets do not support this without direct subsidy,

unless moderate incomes are targeted

In weakest markets, direct subsidy is needed (with or

without MIH)

A 50% requirement is not financially feasible

7

Proposed Requirements Would Be

The Most Rigorous of Any Major U.S. City

For each rezoning, the City

Planning Commission and City

Council can apply:

Option 1: 25 percent of housing

at an average of 60% AMI

Option 2: 30 percent of housing

at an average of 80% AMI

Plus, in limited emerging or midmarket areas, an additional option

may be added:

Workforce option: 30 percent at

an average of 120% AMI (without

direct subsidy)

Not available in Manhattan CDs 1-8

Affordable

Monthly Rent

for 2BR*

AMI

Income*

Sample

Occupation

40%

$31,080

Security Guard

$775

60%

$46,620

Paramedic

$1,150

80%

$62,150

School bus

driver + home

health aide

$1,550

100%

$77,700

Teacher + retail

salesperson

$1,950

120%

$93,240

Firefighter +

server

$2,350

* For a household of three people

8

Key Features of Proposed Program

Other requirements

Required units would be new, permanently affordable units

Applies to developments, enlargements, or conversions > 10 units

Locations of affordable units

On-site, same building as market-rate units, spread on at least half of the

buildings stories, with a common street entrance and lobby

On-site, separate building, completely independent from the ground to the

sky; would not stigmatize residents of affordable units

Off-site, different zoning lot located within the same Community District or

within mile

Other considerations

Payment-in-lieu option for buildings of between 11 and 25 units

Requirements could be reduced or waived through BSA where they would

make development infeasible (legal requirement for hardship relief)

9

MIH Is One of Many Tools That Work Together

Strategic use of subsidy programs can

reach incomes as low as 30% AMI

Reform of State 421-a tax

exemption program will require

affordable housing in every rental

building receiving benefits

More affordable housing

Broader range of incomes

No benefits for luxury condos

421-a

Reform

City Housing Subsidies

Zoning for Quality Mandatory

and Affordability Inclusionary

Housing

Zoning for Quality and Affordability

will promote senior and affordable

housing, aid efficient use of housing

subsidies and promote better buildings

10

Process for Establishing and Applying MIH

Community Board

Borough President

Borough Board review

60 days

City Planning

Commission review

City Council review

approx. 60 days

50 days

Public land use review process (approx. 6 months)

Zoning Text Amendments to Establish the MIH Program

Public review concurrent with Zoning for Quality and Affordability proposal

Application of Mandatory Affordable Housing in Neighborhoods

For public and private applications to the City Planning Commission that

encourage substantial new housing each with its own full public review

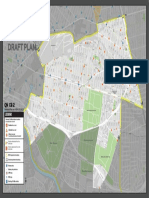

City-initiated rezonings e.g., East New York

Private applications for zoning map changes

Private applications for special permits that create substantial new

residential density

11

For complete information,

visit DCPs website:

nyc.gov/planning

12

Anda mungkin juga menyukai

- Class Action LawsuitDokumen43 halamanClass Action LawsuitQueens PostBelum ada peringkat

- Innovation QNS Large Scale General Development - CD1-SignedDokumen5 halamanInnovation QNS Large Scale General Development - CD1-SignedQueens PostBelum ada peringkat

- SettlementDokumen37 halamanSettlementQueens PostBelum ada peringkat

- Won - Brooks-Powers - Caban - Safety Improvements - Study Newtown Road and 45th ST - Queens - FINAL DOT-582698-B9P4Dokumen2 halamanWon - Brooks-Powers - Caban - Safety Improvements - Study Newtown Road and 45th ST - Queens - FINAL DOT-582698-B9P4Queens PostBelum ada peringkat

- Flushing Food Tour 2022Dokumen2 halamanFlushing Food Tour 2022Queens PostBelum ada peringkat

- Joint CM Letter To Alvin Bragg Re Jose Alba July 7 2022Dokumen2 halamanJoint CM Letter To Alvin Bragg Re Jose Alba July 7 2022Queens PostBelum ada peringkat

- Letter To MayorDokumen2 halamanLetter To MayorQueens PostBelum ada peringkat

- Renderings of High School On Northern Boulevard 09.20.2021Dokumen17 halamanRenderings of High School On Northern Boulevard 09.20.2021Queens PostBelum ada peringkat

- 2022 CB1Q Letter CPC 2501 Queens Plaza N MTA Easement 6 - 24Dokumen2 halaman2022 CB1Q Letter CPC 2501 Queens Plaza N MTA Easement 6 - 24Queens PostBelum ada peringkat

- JPCA Proposal and DOT ResponseDokumen6 halamanJPCA Proposal and DOT ResponseQueens PostBelum ada peringkat

- Citi Bike Locations in Sunnyside/WoodsideDokumen1 halamanCiti Bike Locations in Sunnyside/WoodsideQueens PostBelum ada peringkat

- Nichols V Governor Kathy Hochul (2022-02301)Dokumen3 halamanNichols V Governor Kathy Hochul (2022-02301)Luke ParsnowBelum ada peringkat

- Joshua Bowen Respondent V James G. Van Bramer - 2nd Dept DecisionDokumen3 halamanJoshua Bowen Respondent V James G. Van Bramer - 2nd Dept DecisionQueens PostBelum ada peringkat

- Bob Holden LetterDokumen1 halamanBob Holden LetterQueens PostBelum ada peringkat

- 29th Street Shoreline CollapseDokumen7 halaman29th Street Shoreline CollapseQueens PostBelum ada peringkat

- LIRR Burns ST Alliance LetterDokumen2 halamanLIRR Burns ST Alliance LetterQueens PostBelum ada peringkat

- CB2 Calls For More Testing SitesDokumen2 halamanCB2 Calls For More Testing SitesQueens PostBelum ada peringkat

- JF Motors Notice and PetitionDokumen74 halamanJF Motors Notice and PetitionQueens PostBelum ada peringkat

- QBP Rec ULURP 200070 ZMQ 62 04 Roosevelt Avenue Rezon CD 2 v720Dokumen2 halamanQBP Rec ULURP 200070 ZMQ 62 04 Roosevelt Avenue Rezon CD 2 v720Queens PostBelum ada peringkat

- Brooklyn Mitsubishi Petition Notice To Respondents Schedules A-GDokumen98 halamanBrooklyn Mitsubishi Petition Notice To Respondents Schedules A-GQueens PostBelum ada peringkat

- Interview Questionnaire: Personal InformationDokumen4 halamanInterview Questionnaire: Personal InformationQueens PostBelum ada peringkat

- COVID-19 Vaccination Sites in NE QueensDokumen2 halamanCOVID-19 Vaccination Sites in NE QueensMaya KaufmanBelum ada peringkat

- Michael Davidson Playground - June 2021Dokumen6 halamanMichael Davidson Playground - June 2021Queens PostBelum ada peringkat

- QBP Rec ULURP 210200 ZMQ 31 Street and Hoyt Avenue Rezone CD1Dokumen2 halamanQBP Rec ULURP 210200 ZMQ 31 Street and Hoyt Avenue Rezone CD1Queens PostBelum ada peringkat

- QBP Donovan Richards Chancellor Porter LetterDokumen1 halamanQBP Donovan Richards Chancellor Porter LetterQueens PostBelum ada peringkat

- Julia L FormanDokumen4 halamanJulia L FormanQueens PostBelum ada peringkat

- 50-01 Queens Boulevard SetupDokumen4 halaman50-01 Queens Boulevard SetupQueens PostBelum ada peringkat

- Donna Kent V Jamill Jones Et Al COMPLAINT 2Dokumen18 halamanDonna Kent V Jamill Jones Et Al COMPLAINT 2Queens PostBelum ada peringkat

- Lt. Michael Davidson PlaygroundDokumen31 halamanLt. Michael Davidson PlaygroundQueens PostBelum ada peringkat

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5795)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- What Is Zoning?Dokumen6 halamanWhat Is Zoning?M-NCPPCBelum ada peringkat

- Healthpro Vs MedbuyDokumen3 halamanHealthpro Vs MedbuyTim RosenbergBelum ada peringkat

- Factors Affecting SME'sDokumen63 halamanFactors Affecting SME'sMubeen Shaikh50% (2)

- Cfa - Technical Analysis ExplainedDokumen32 halamanCfa - Technical Analysis Explainedshare757592% (13)

- Feasibilities - Updated - BTS DropsDokumen4 halamanFeasibilities - Updated - BTS DropsSunny SonkarBelum ada peringkat

- Levacic, Rebmann - Macroeconomics. An I... o Keynesian-Neoclassical ControversiesDokumen14 halamanLevacic, Rebmann - Macroeconomics. An I... o Keynesian-Neoclassical ControversiesAlvaro MedinaBelum ada peringkat

- Packing List PDFDokumen1 halamanPacking List PDFKatherine SalamancaBelum ada peringkat

- Percentage and Its ApplicationsDokumen6 halamanPercentage and Its ApplicationsSahil KalaBelum ada peringkat

- Introduction - IEC Standards and Their Application V1 PDFDokumen11 halamanIntroduction - IEC Standards and Their Application V1 PDFdavidjovisBelum ada peringkat

- De Mgginimis Benefit in The PhilippinesDokumen3 halamanDe Mgginimis Benefit in The PhilippinesSlardarRadralsBelum ada peringkat

- Working Capital Appraisal by Banks For SSI PDFDokumen85 halamanWorking Capital Appraisal by Banks For SSI PDFBrijesh MaraviyaBelum ada peringkat

- Strategic Planning For The Oil and Gas IDokumen17 halamanStrategic Planning For The Oil and Gas ISR Rao50% (2)

- Bill CertificateDokumen3 halamanBill CertificateRohith ReddyBelum ada peringkat

- S03 - Chapter 5 Job Order Costing Without AnswersDokumen2 halamanS03 - Chapter 5 Job Order Costing Without AnswersRigel Kent MansuetoBelum ada peringkat

- TIPS As An Asset Class: Final ApprovalDokumen9 halamanTIPS As An Asset Class: Final ApprovalMJTerrienBelum ada peringkat

- Democratic Developmental StateDokumen4 halamanDemocratic Developmental StateAndres OlayaBelum ada peringkat

- 4 P'sDokumen49 halaman4 P'sankitpnani50% (2)

- A View About The Determinants of Change in Share Prices A Case From Karachi Stock Exchange (Banking)Dokumen17 halamanA View About The Determinants of Change in Share Prices A Case From Karachi Stock Exchange (Banking)(FPTU HCM) Phạm Anh Thiện TùngBelum ada peringkat

- Manufactures Near byDokumen28 halamanManufactures Near bykomal LPS0% (1)

- 11980-Article Text-37874-1-10-20200713Dokumen14 halaman11980-Article Text-37874-1-10-20200713hardiprasetiawanBelum ada peringkat

- Benetton (A) CaseDokumen15 halamanBenetton (A) CaseRaminder NagpalBelum ada peringkat

- Use CaseDokumen4 halamanUse CasemeriiBelum ada peringkat

- Patent Trolling in IndiaDokumen3 halamanPatent Trolling in IndiaM VridhiBelum ada peringkat

- Is Enron OverpricedDokumen3 halamanIs Enron Overpricedgarimag2kBelum ada peringkat

- Metropolitan Transport Corporation Guindy Estate JJ Nagar WestDokumen5 halamanMetropolitan Transport Corporation Guindy Estate JJ Nagar WestbiindduuBelum ada peringkat

- Revenue Procedure 2014-11Dokumen10 halamanRevenue Procedure 2014-11Leonard E Sienko JrBelum ada peringkat

- MHO ProposalDokumen4 halamanMHO ProposalLGU PadadaBelum ada peringkat

- Report of The Committee On Regulatory Regime For Trees Grown On Private Land Nov 2012Dokumen42 halamanReport of The Committee On Regulatory Regime For Trees Grown On Private Land Nov 2012Ravi Shankar KolluruBelum ada peringkat

- What Is InflationDokumen222 halamanWhat Is InflationAhim Raj JoshiBelum ada peringkat

- Ekspedisi Central - Google SearchDokumen1 halamanEkspedisi Central - Google SearchSketch DevBelum ada peringkat