NAhiD - Ns Overview Macroeconomics1

Diunggah oleh

Al Arafat RummanJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

NAhiD - Ns Overview Macroeconomics1

Diunggah oleh

Al Arafat RummanHak Cipta:

Format Tersedia

Macroeconomics Lecture Series

Lecture 1. (Overview of Macroeconomics)

Overview of Macroeconomics

We economists don't know much, but we do know how to create a shortage. If you want

to create a shortage of tomatoes, for example, just pass a law that retailers can't sell

tomatoes for more than two cents per pound. Instantly you'll have a tomato shortage. It's

the same with oil or gas.

Milton Friedman, Chicago

Macroeconomics is part of our everyday lives. If the macroeconomy is doing well, jobs

easy to find, incomes are generally rising, and profits of corporations are high. On

other hand, if the macroeconomy is in a slump, new jobs are scarce, incomes are

growing well, and profits are low. Students who entered the job market in the boom of

late 1990s in the United States, on average, had an easier time finding a job than

those who entered in the recession of 20082009. Given the large effect that

macroeconomy can have on our lives, it is important that we understand how it works.

are

the

not

the

did

the

Differences and similarities between Microeconomics and Macroeconomics:

Microeconomics examines the functioning of individual industries and the behavior of

individual decision-making units, typically firms and households. With a few assumptions

about how these units behave (firms maximize profits; households maximize utility), we

can derive useful conclusions about how markets work and how resources are allocated.

Instead of focusing on the factors that influence the production of particular products and

the behavior of individual industries, macroeconomics focuses on the determinants of

total national output. Macroeconomics studies not household income but national income,

not individual prices but the overall price level. It does not analyze the demand for labor in

the automobile industry but instead total employment in the economy.

Both microeconomics and macroeconomics are concerned with the decisions of

households and firms. Microeconomics deals with individual decisions; macroeconomics

deals with the sum of these individual decisions. Aggregate is used in macroeconomics to

refer to sums. When we speak of aggregate behavior, we mean the behavior of all

households and firms together. We also speak of aggregate consumption and aggregate

investment, which refer to total consumption and total investment in the economy,

respectively.

Because microeconomists and macroeconomists look at the economy from different

perspectives, you might expect that they would reach somewhat different conclusions

about the way the economy behaves. This is true to some extent. Microeconomists

generally conclude that markets work well. They see prices as flexible, adjusting to

Page 1 of 10

Mohammad Amzad Hossain

Professor, Dept. of Economics, JU.

Macroeconomics Lecture Series

Lecture 1. (Overview of Macroeconomics)

maintain equality between quantity supplied and quantity demanded. Macroeconomists,

however, observe that important prices in the economy for example, the wage rate (or

price of labor)often seem sticky. Sticky prices are prices that do not always adjust

rapidly to maintain equality between quantity supplied and quantity demanded.

Microeconomists do not expect to see the quantity of apples supplied exceeding the

quantity of apples demanded because the price of apples is not sticky. On the other hand,

macroeconomists who analyze aggregate behaviorexamine periods of high

unemployment, where the quantity of labor supplied appears to exceed the quantity of

labor demanded. At such times, it appears that wage rates do not adjust fast enough to

equate the quantity of labor supplied and the quantity of labor demanded.

Macroeconomic Concerns:

Three of the major concerns of macroeconomics are

Output growth

Unemployment

Inflation and deflation

Government policy makers would like to have high output growth, low unemployment, and

low inflation. We will see that these goals may conflict with one another and that an

important point in understanding macroeconomics is understanding these conflicts.

Output Growth

Instead of growing at an even rate at all times, economies tend to experience short-term

ups and downs in their performance. The technical name for these ups and downs is the

business cycle. The main measure of how an economy is doing is aggregate real output.

When aggregate output declines, there are fewer goods and services to consume and

average standard of living declines. When firms curtail production, they also lay off

workers, increasing the rate of unemployment.

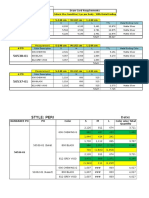

Recessions are periods during which aggregate output

declines. It has become conventional to classify an

economic downturn as a recession when aggregate

output declines for two consecutive quarters. A prolonged

and deep recession is called a depression, although

economists do not agree on when a recession becomes a

depression. Right after the liberation war back in 1971,

Bangladesh experienced a deep recession. United States of

Figure 1.1:The

business cycle

Page 2 of 10

Mohammad Amzad Hossain

Professor, Dept. of Economics, JU.

Macroeconomics Lecture Series

Lecture 1. (Overview of Macroeconomics)

America and many European nations experienced a prolonged and severe recession back

in 1930s also known as the Great Depression.

During recessions, not only are more people unemployed, but those who are employed

have shorter workweeks, as more workers have to accept part-time jobs and fewer

workers have the opportunity to work overtime. When recessions end and the economy

enters a boom, these effects work in reverse: incomes rise, unemployment falls, and

workweeks expand. Economists call these short-run fluctuations in output and

employment the business cycle. A typical business cycle is illustrated in Figure 1.1. Since

most economies, on average, grow over time, the business cycle in Figure 1.1 shows a

positive trendthe peak (the highest point) of a new business cycle is higher than the

peak of the previous cycle. The period from a trough,or bottom of the cycle, to a peak is

called an expansion or a boom. During an expansion, output and employment grow. The

period from a peak to a trough is called a contraction, recession,or slump, when output

and employment fall.

In judging whether an economy is expanding or contracting, note the difference between

the level of economic activity and its rate of change. If the economy has just left a trough

(point A in Figure 1.1), it will be growing (rate of change is positive), but its level of output

will still be low. If the economy has just started to decline from a peak (point B), it will be

contracting (rate of change is negative), but its level of output will still be high. In 2010

the U.S. economy was expandingit had left the trough of the 20082009 recessionbut

the level of output was still low and many people were still out of work. Many European

nations underwent severe recession in 2007-08, and some are still struggling to

overcome.One the other hand, over the last decade aggregate output of Bangladesh has

been expanding at about 5.5-6% annually!!!

Unemployment

The unemployment ratethe percentage of the labor force that is unemployedis a key

indicator of the economys health. If more people are employed we expect grater amount

of real output or services will be produced. Because the unemployment rate is usually

closely related to the economys aggregate output, announcements of each months new

figure are followed with great interest by economists, politicians, and policy makers.

Although macroeconomists are interested in learning why the unemployment rate has

risen or fallen in a given period, they also try to answer a more basic question: Why is

there any unemployment at all? We do not expect to see zero unemployment. At any time,

some firms may go bankrupt due to competition from rivals, bad management, or bad

luck. Employees of such firms typically are not able to find new jobs immediately, and

while they are looking for work, they will be unemployed. Also, workers entering the labor

market for the first time may require a few weeks or months to find a job.

Page 3 of 10

Mohammad Amzad Hossain

Professor, Dept. of Economics, JU.

Macroeconomics Lecture Series

Lecture 1. (Overview of Macroeconomics)

If we base our analysis on supply and demand, we would expect conditions to change in

response to the existence of unemployed workers. Specifically, when there is

unemployment beyond some minimum amount, there is an excess supply of workersat

the going wage rates, there are people who want to work who cannot find work. In

microeconomic theory, the response to excess supply is a decrease in the price of the

commodity in question and therefore an increase in the quantity demanded, a reduction in

the quantity supplied, and the restoration of equilibrium. With the quantity supplied equal

to the quantity demanded, the market clears.

The existence of unemployment seems to imply that the aggregate labor market is not in

equilibriumthat something prevents the quantity supplied and the quantity demanded

from equating. Why do labor markets not clear when other markets do, or is it that labor

markets are clearing and the unemployment data are reflecting something different? This

is another main concern of macroeconomists.

Inflation and Deflation

Inflation is an increase in the overall price level. Keeping inflation low has long been a goal

of government policy. Especially problematic are hyperinflations, or periods of very rapid

increases in the overall price level.

Most Americans are unaware of what life is like under very high inflation. In some

countries at some times, people were accustomed to prices rising by the day, by the hour,

or even by the minute. Some examples might be helpful: Bolivia and most recently

Zimbabwe have experienced hyperinflation. Box 1. and box 2. Summarize some key facts

of these experiences.

Box 1. Hyperinflation in Bolivia

During the hyperinflation in Bolivia in 1984 and 1985, the price of one egg rose from 3,000

pesos to 10,000 pesos in 1 week. In 1985, three bottles of aspirin sold for the same price

as a luxury car had sold for in 1982. At the same time, the problem of handling money

became a burden. Banks stopped counting depositsa $500 deposit was equivalent to

about 32 million pesos, and it just did not make sense to count a huge sack full of bills.

Bolivias currency, printed in West Germany and England, was the countrys third biggest

import in 1984, surpassed only by wheat and mining equipment.

Page 4 of 10

Mohammad Amzad Hossain

Professor, Dept. of Economics, JU.

Macroeconomics Lecture Series

Lecture 1. (Overview of Macroeconomics)

Box 2. Hyperinflation in Zimbabwe

On April 18, 1980, the Republic of Zimbabwe was born from the former British colony of

Rhodesia. The Rhodesian Dollar was replaced by the Zimbabwe dollar at par value/ face

value. When Zimbabwe gained independence, the Zimbabwean dollar was more valuable

than the US dollar. In its early years, Zimbabwe experienced strong growth and

development. Wheat production for non-drought years was proportionally higher than in

the past. The tobacco industry was thriving as well (which earned almost one-third of

foreign currencies). Economic indicators for the country were strong.

In the 1990s, the Zimbabwean president Robert Mugabe instituted land reforms intended

to redistribute land from white landowners to black farmers to correct the injustices of

colonialism. However, many of these farmers had no experience or training in farming.

From 1999 to 2009, the country experienced a sharp drop in food production and in all

other sectors. Food output capacity fell 45%, manufacturing output 29% in 2005, 26% in

2006 and 28% in 2007, and unemployment rose to 80%.

In addition to that President Mugabe printed more money to finance second Congo War,

giving its army and other officials higher salaries. Another reason to print money is selfdealing or financing corruption. This certainly resulted in the lack of faith in the currency

and the value of currency collapsed.

In June 2008 the annual rate of price growth was 11.2 million percent. The worst of the

inflation occurred in 2008, leading to the abandonment of the currency. The peak month of

hyperinflation occurred in mid-November 2008 with a rate estimated at 79,600,000% per

month.

Adaptations:

Use of Foreign Currencies and Black Markets:

In 2007, the government declared inflation illegal. Anyone who raised the prices for goods

and services was subject to arrest. This amounted to a price freeze, which is usually

ineffective in halting inflation. Officials arrested numerous corporate executives for

changing their prices.

In December 2008, the Central Bank of Zimbabwe licensed around 1,000 shops to deal in

foreign currency. Citizens had increasingly been using foreign currency in daily exchanges,

as local shops stated fewer prices in Zimbabwe dollars because they needed foreign

currency to import foreign goods. Many businesses and street vendors continued to do so

without getting the license.In January 2009, acting Finance Minister Patrick Chinamasa

lifted the restriction to use only Zimbabwean dollars. This too acknowledged what many

were already doing.

Page 5 of 10

Mohammad Amzad Hossain

Professor, Dept. of Economics, JU.

Macroeconomics Lecture Series

Lecture 1. (Overview of Macroeconomics)

Skyrocketing prices in Bolivia and Zimbabwe are a small part of the story. When inflation

approaches rates of 2,000 percent per year, the economy and the whole organization of a

country begin to break down. Workers may go on strike to demand wage increases in line

with the high inflation rate, and firms may find it hard to secure credit.

Hyperinflations are rare. Nonetheless, economists have devoted much effort to identifying

the costs and consequences of even moderate inflation.

Does anyone gain from inflation?

Who loses?

What costs does inflation impose on society?

How severe are they?

What causes inflation?

What is the best way to stop it?

These are some of the main concerns of macroeconomists.

A decrease in the overall price level is called deflation. In some periods in U.S. history and

recently in Japan, deflation has occurred over an extended period of time. The goal of

policy makers is to avoid prolonged periods of deflation as well as inflation in order to

pursue the macroeconomic goal of stability.

The Components of the Macroeconomy

Understanding how the macroeconomy works can be challenging because a great deal is

going on at one time. Everything seems to affect everything else. To see the big picture, it

is helpful to divide the participants in the economy into four broad groups: (1) households,

(2) firms, (3) the government, and (4) the rest of the world. Households and firms make up

the private sector, the government is the public sector, and the rest of the world is the

foreign sector. These four groups interact in the economy in a variety of ways, many

involving either receiving or paying income.

The Circular Flow Diagram

A useful way of seeing the economic

interactions among the four groups in the

economy is a circular flow diagram, which

shows the income received and payments

made by each group. A simple circular flow

diagram is pictured in Figure 20.3. Let us walk

through the circular flow step by step.

Page 6 of 10

Mohammad Amzad Hossain

Professor, Dept. of Economics, JU.

Macroeconomics Lecture Series

Lecture 1. (Overview of Macroeconomics)

Households work for firms and the government, and they receive wages for their work. Our

diagram shows a flow of wages intohouse-holds as payment for those services.

Households also receive interest on corporate and government bonds and dividends from

firms. Many households receive other payments from the government, such as Social

Security benefits, veterans benefits, and welfare payments. Economists call these kinds of

payments from the government (for which the recipients do not supply goods, services, or

labor) transfer payments. Together, these receipts make up the total income received by

the households.

Households spend by buying goods and services from firms and by paying taxes to the

government. These items make up the total amount paid out by the households. The

difference between the total receipts and the total payments of the households is the

amount that the house-holds save or dissave. If households receive more than they spend,

they saveduring the period. If they receive less

Figure 2. Circular Flow Diagram

than they spend, they dissave. A household can

dissave by using up some of its previous savings or by borrowing. In the circular flow

diagram, household spending is shown as a flow out of households. Saving by households

is sometimes termed a leakage from the circular flow because it withdraws income, or

current purchasing power, from the system.

Firms sell goods and services to households and the government. These sales earn

revenue,which shows up in the circular flow diagram as a flow intothe firm sector. Firms

pay wages, interest, and dividends to households, and firms pay taxes to the government.

These payments areshown flowing outof firmsthe government collects taxes from

households and firms. The government also makes payments. It buys goods and services

from firms, pays wages and interest to households, and makes transfer payments to

households. If the governments revenue is less than its payments, the government is

dissaving.

Finally, households spend some of their income on importsgoods and services produced

in the rest of the world. Similarly, people in foreign countries purchase exportsgoods and

services produced by domestic firms and sold to other countries. One lesson of the circular

flow diagram is that everyones expenditure is someone elses receipt. If you buy a

personal computer from Dell, you make a payment to Dell and Dell receives revenue. If

Dell pays taxes to the government, it has made a payment and the government has

received revenue. Everyones expenditures go somewhere. It is impossible to sell

something with-out there being a buyer, and it is impossible to make a payment without

there being a recipient. Every transaction must have two sides.

The Three Market Arenas

Page 7 of 10

Mohammad Amzad Hossain

Professor, Dept. of Economics, JU.

Macroeconomics Lecture Series

Lecture 1. (Overview of Macroeconomics)

Another way of looking at the ways households, firms, the government, and the rest of the

world relate to one another is to consider the markets in which they interact. We divide the

markets into three broad arenas:

The goods-and-services market,

The labor market, and

The money (financial) market.

Goods and Services Market

Households and the government purchase goods and services from firms in the goodsand-services market. In this market, firms also purchase goods and services from each

other. For example, a local shoe maker buys lace from other companies/ firms. In addition,

firms buy capital goods from other firms. If General Motors needs new robots on its

assembly lines, it may buy them from another firm instead of making them.

Firms supply to the goods-and-services market. Households, the government, and firms

demand from this market. Finally, the rest of the world buys from and sells to the goodsand-services market. Bangladesh imports hundreds of millions of dollars worth of

automobiles, oil, aircrafts and other goods. Bangladesh exports RMG, leather products,

jute, tea and others to many countries.

Labor Market

Interaction in the labor market takes place when firms and the government purchase labor

from households. In this market, households supply labor and firms and the government

demand labor. In any market-based economy, firms are the largest demanders of labor,

although the government is also a substantial employer. The total supply of labor in the

economy depends on the sum of decisions made by households. Individuals must decide

whether to enter the labor force (whether to look for a job at all) and how many hours to

work. Labor is also supplied to and demanded from the rest of the world. In recent years,

the labor market has become an international market. For example, vegetable and fruit

farmers in California would find it very difficult to bring their product to market if it were

not for the labor of migrant farm workers from Mexico. For years, Turkey has provided

Germany with guest workers who are willing to take low-paying jobs that more

prosperous German workers avoid. Call centers run by major U.S. corporations are

sometimes staffed by labor in India and other developing countries.

Money Market

In the money marketsometimes called the financial markethouseholds purchase stocks

and bonds from firms. Households supply funds to this market in the expectation of

earning income in the form of dividends on stocks and interest on bonds. Households also

demand (borrow) funds from this market to finance various purchases. Firms borrow to

Page 8 of 10

Mohammad Amzad Hossain

Professor, Dept. of Economics, JU.

Macroeconomics Lecture Series

Lecture 1. (Overview of Macroeconomics)

build new facilities in the hope of earning more in the future. The government borrows by

issuingbonds. The rest of the world borrows from and lends to the money market. Every

morning thereare reports on TV and radio about the Japanese and British stock markets.

Much of the borrowing and lending of households, firms, the government, and the rest of

the world are coordinatedby financial institutionscommercial banks, savings and loan

associations, insurance companies, and the like. These institutions take deposits from one

group and lend them to others.

When a firm, a household, or the government borrows to finance a purchase, it has an

obligation to pay that loan back, usually at some specified time in the future. Most loans

also involvepayment of interest as a fee for the use of the borrowed funds. When a loan is

made, the borrowerusually signs a promise to repay, or promissory note, and gives itto

the lender. When the federalgovernment borrows, it issues promises called

Treasurybonds,notes,or billsin exchange formoney. Firms can borrow by issuing corporate

bonds.Instead of issuing bonds to raise funds, firms can also issue shares of stock. A share

of stockis a financial instrument that gives the holder a share in the firms ownership and

therefore theright to share in the firms profits. If the firm does well, the value of the stock

increases and thestockholder receives a capital gainon the initial purchase. In addition, the

stock may paydividendsthat is, the firm may return some of its profits directly to its

stockholders instead ofretaining the profits to buy capital. If the firm does poorly, so does

the stockholder. The capitalvalue of the stock may fall, and dividends may not be paid.

Stocks and bonds are simply contracts, or agreements, between parties. I agree to loan

you a certain amount, and you agree to repay me this amount plus something extra at

some future date, or Iagree to buy part ownership in your firm, and you agree to give me a

share of the firms future profits.

A critical variable in the money market is the interest rate. Although we sometimes talkas

if there is only one interest rate, there is never just one interest rate at any time.

Instead,the interest rate on a given loan reflects the length of the loan and the perceived

risk to thelender. A business that is just getting started must pay a higher rate than

General Motorspays. A 30-year mortgage has a different interest rate than a 90-day loan.

Nevertheless, interest rates tend to move up and down together, and their movement

reflects general conditionsin the financial market.

The Role of the Government in the Macroeconomy:

The government plays a major role in the macroeconomy, so a useful way of learning how

themacroeconomy works is to consider how the government uses policy to affect the

economy. Thetwo main policies are (1) fiscal policy and (2) monetary policy. Much of the

study of macroeconomics is learning how fiscal and monetary policies work.

Fiscal Policy:

Page 9 of 10

Mohammad Amzad Hossain

Professor, Dept. of Economics, JU.

Macroeconomics Lecture Series

Lecture 1. (Overview of Macroeconomics)

Fiscal policyrefers to the governments decisions about how much to tax and spend; taxes

and spending are two powerful tools of fiscal policy. The government collects taxes from

households and firms and spends those funds on goods and services ranging from missiles

to parks to Social Security payments to building highways.Taxes take the form of personal

income taxes, Social Security taxes, and corporate profits taxes,among others. An

expansionary fiscal policy is a policy in which taxes are cut and/or government spending

increases. A contractionary fiscal policy is the reverse.

Monetary policy:

Monetary policyin Bangladesh is controlled by Bangladesh Bank,the central bank. The

central bank, as it is usually called, determines the quantity of money in the

economy,which in turn affects interest rates. Central Bankss decisions have important

effects on the economy. The tool of monetary policy is money supply. Monetary policy can,

like fiscal policy, expansionary or contractionary. When Bangladesh bank raises supply of

money then the policy is expansionary and policy of this sort reduces average lending

rate, of the so called interest rate. Lower interest rates then stimulate output and

employment, ceteris paribus. A contractioinary policy has exactly opposite impact as that

of expansionary policy.

References:

G. Mankiew, Macroeconomics, sixth edition

Case and Fair, Principles of Economics, 10th edition

Page 10 of 10

Mohammad Amzad Hossain

Professor, Dept. of Economics, JU.

Anda mungkin juga menyukai

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (894)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Eco 2009 Het Final Exam QuestionsDokumen4 halamanEco 2009 Het Final Exam QuestionsAslı Yaren K.Belum ada peringkat

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Microeconomics PGP - I: Problem Set-IIIDokumen4 halamanMicroeconomics PGP - I: Problem Set-IIIdheerajm88Belum ada peringkat

- Managerial Economics Assignment AnalysisDokumen8 halamanManagerial Economics Assignment AnalysisHammad Aqdas100% (1)

- (Karl Brunner (Ed.) ) Economics and Social InstitutionsDokumen288 halaman(Karl Brunner (Ed.) ) Economics and Social InstitutionsSalvador SaballosBelum ada peringkat

- Wealth and Poverty in NT and Its World - Bruce MalinaDokumen15 halamanWealth and Poverty in NT and Its World - Bruce Malina31songofjoyBelum ada peringkat

- Pride Group yarn test report summaryDokumen1 halamanPride Group yarn test report summaryHunter KingBelum ada peringkat

- CommercialDokumen1 halamanCommercialAl Arafat RummanBelum ada peringkat

- Daily Routine at Corona LifeDokumen9 halamanDaily Routine at Corona LifeAl Arafat RummanBelum ada peringkat

- New Microsoft Excel WorksheetDokumen4 halamanNew Microsoft Excel WorksheetAl Arafat RummanBelum ada peringkat

- Calculation Formula Marker 1Dokumen6 halamanCalculation Formula Marker 1Al Arafat RummanBelum ada peringkat

- Step-1: Yarn Test: Quality Management System Pride GroupDokumen2 halamanStep-1: Yarn Test: Quality Management System Pride GroupAl Arafat RummanBelum ada peringkat

- TodayDokumen8 halamanTodayAl Arafat RummanBelum ada peringkat

- New Microsoft Excel WorksheetDokumen4 halamanNew Microsoft Excel WorksheetAl Arafat RummanBelum ada peringkat

- HRDokumen34 halamanHRAl Arafat RummanBelum ada peringkat

- Bengal Record Manual 1943 2Dokumen10 halamanBengal Record Manual 1943 2Al Arafat RummanBelum ada peringkat

- CV FinalDokumen2 halamanCV FinalAl Arafat RummanBelum ada peringkat

- nAhiD - ns19.03.2015 BrandDokumen16 halamannAhiD - ns19.03.2015 BrandAl Arafat RummanBelum ada peringkat

- FFQCDokumen64 halamanFFQCAl Arafat RummanBelum ada peringkat

- Quality Assurance Department (QAD) ProcessesDokumen9 halamanQuality Assurance Department (QAD) ProcessesAl Arafat RummanBelum ada peringkat

- Draw Cord Requirements and Production QuantitiesDokumen4 halamanDraw Cord Requirements and Production QuantitiesAl Arafat RummanBelum ada peringkat

- Buyer Style Po No Order Qty Knitt - Issu Knitt - Receive LinkingDokumen4 halamanBuyer Style Po No Order Qty Knitt - Issu Knitt - Receive LinkingAl Arafat RummanBelum ada peringkat

- nAhiD - ns19.03.2015 BrandDokumen16 halamannAhiD - ns19.03.2015 BrandAl Arafat RummanBelum ada peringkat

- HR Texile Ltd. (Pride group) Color Sample ApprovalDokumen3 halamanHR Texile Ltd. (Pride group) Color Sample ApprovalAl Arafat RummanBelum ada peringkat

- Customer Relationship ManagementDokumen7 halamanCustomer Relationship ManagementAl Arafat RummanBelum ada peringkat

- NAhiD - Ns - C3the Marketing ProcessDokumen58 halamanNAhiD - Ns - C3the Marketing ProcessAl Arafat RummanBelum ada peringkat

- NAhiD - Ns C5 Kotler01Dokumen30 halamanNAhiD - Ns C5 Kotler01Al Arafat RummanBelum ada peringkat

- NAhiD - Ns - C4how Business and Marketing Are ChangingDokumen1 halamanNAhiD - Ns - C4how Business and Marketing Are ChangingAl Arafat RummanBelum ada peringkat

- nAhiD - Ns 09.04.2015 CH20Dokumen40 halamannAhiD - Ns 09.04.2015 CH20Al Arafat RummanBelum ada peringkat

- How Business and Marketing Are ChangingDokumen5 halamanHow Business and Marketing Are ChangingAl Arafat RummanBelum ada peringkat

- nAhiD - ns19.03.2015 BrandDokumen16 halamannAhiD - ns19.03.2015 BrandAl Arafat RummanBelum ada peringkat

- nAhiD - Ns 09.04.2015 CH20Dokumen40 halamannAhiD - Ns 09.04.2015 CH20Al Arafat RummanBelum ada peringkat

- NAhiD - Ns C5 Kotler02Dokumen24 halamanNAhiD - Ns C5 Kotler02Al Arafat RummanBelum ada peringkat

- NAhiD - Ns - C3marketing Management OrientationDokumen20 halamanNAhiD - Ns - C3marketing Management OrientationAl Arafat RummanBelum ada peringkat

- nAhiD - Ns 09.04.2015 CH20Dokumen40 halamannAhiD - Ns 09.04.2015 CH20Al Arafat RummanBelum ada peringkat

- NAhiD - Ns 26.03.2015 Chapter EightDokumen17 halamanNAhiD - Ns 26.03.2015 Chapter EightAl Arafat RummanBelum ada peringkat

- Critique Paper 1Dokumen3 halamanCritique Paper 1airaa2Belum ada peringkat

- 8.capital BudgetingDokumen82 halaman8.capital BudgetingOblivion OblivionBelum ada peringkat

- J.C. Laugee, DanoneDokumen10 halamanJ.C. Laugee, DanoneHynek BuresBelum ada peringkat

- Managerial Economics Compilation ReviewDokumen121 halamanManagerial Economics Compilation ReviewMilette CaliwanBelum ada peringkat

- Dominion MotorsDokumen9 halamanDominion MotorsAnimesh BanerjeeBelum ada peringkat

- Sample ExamsDokumen11 halamanSample ExamsCai04Belum ada peringkat

- Purchasing Power ParityDokumen2 halamanPurchasing Power ParitynirmalamanjunathBelum ada peringkat

- Inflation AccountingDokumen9 halamanInflation AccountingyasheshgaglaniBelum ada peringkat

- VII. Politics As A Science in Japan: Retrospect and ProspectsDokumen20 halamanVII. Politics As A Science in Japan: Retrospect and ProspectsSantiago MirettiBelum ada peringkat

- Cap 2 RoadmapDokumen1 halamanCap 2 RoadmapAihra Nicole DiestroBelum ada peringkat

- Micro & Macro EconomicsDokumen8 halamanMicro & Macro Economicsadnantariq_2004100% (1)

- Market Efficiency, Time-Varying Volatility and Equity Returns in Bangladesh Stock MarketDokumen26 halamanMarket Efficiency, Time-Varying Volatility and Equity Returns in Bangladesh Stock MarketShihabHasanBelum ada peringkat

- Basic Microeconomics (Reviewer)Dokumen3 halamanBasic Microeconomics (Reviewer)Patricia QuiloBelum ada peringkat

- 898 Ch15ARQDokumen2 halaman898 Ch15ARQNga BuiBelum ada peringkat

- Document 1Dokumen3 halamanDocument 1api-251976905Belum ada peringkat

- Hood Emerging 1995Dokumen19 halamanHood Emerging 1995oktayBelum ada peringkat

- Chapter 29Dokumen26 halamanChapter 29ENG ZI QINGBelum ada peringkat

- URBN218 Analysis 9Dokumen4 halamanURBN218 Analysis 9Liwro NacotnaBelum ada peringkat

- US Airlines Industry: by Group 10 Bhaumik Trivedi Dhivakaran Tamilchelvan Mayukh Chaudhuri Pranjal Kumar Shakun TakkarDokumen9 halamanUS Airlines Industry: by Group 10 Bhaumik Trivedi Dhivakaran Tamilchelvan Mayukh Chaudhuri Pranjal Kumar Shakun TakkarMayukh ChaudhuriBelum ada peringkat

- Set One Principle of Economics - CH 1, 3 and 4Dokumen14 halamanSet One Principle of Economics - CH 1, 3 and 4MaggiehoushaimiBelum ada peringkat

- 13 Costs ProductionDokumen54 halaman13 Costs ProductionAtif RaoBelum ada peringkat

- Money and Its FunctionsDokumen20 halamanMoney and Its FunctionssuganyababumbaBelum ada peringkat

- WEF DibiDokumen130 halamanWEF DibimanuelBelum ada peringkat

- Markets in Action Essay QsDokumen12 halamanMarkets in Action Essay Qsmkc306Belum ada peringkat

- LibroDokumen212 halamanLibromiguelchp02Belum ada peringkat