Republic Vs East Silverlane

Diunggah oleh

KC BarrasDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Republic Vs East Silverlane

Diunggah oleh

KC BarrasHak Cipta:

Format Tersedia

REPUBLIC vs EAST SILVERLANE

FACTS:

1. Respondent East Silverlane purchased 2 portions of land through Deed of

Absolute Sale from the following: (1) Francisco Oco, and (2) Tan Family.

2. Rspondent filed an application for land registration of the said parcels of

land before the Regional Trial Court.

3. RTC granted the application as the predecessors-in-interest had been in

"open, notorious, continuous, and exclusive possession of the subject

properties", as they claimed, and presented 2 tax declarations covering the

said properties.

4. On appeal, CA affirmed the decision of the trial court.

5. Petitioners assail the foregoing, alleging that the respondent failed to

prove that its predecessors-in-interest possessed the subject property in the

manner and for the length of time required under Section 48 of CA No. 141

(Public Land Act), and Section 14 of the Property Registration Decree.

According to the petitioner, the respondent did not present a credible and

competent witness to testify on the specific acts of owneship performed by

its predecessors-in-interest on the subject property. The respondent's sole

witness, Vicente Oco, can hardly be considered a credible and competent

witness as he is the respondent's liaison officer. And, that thte coconut trees

were planted on the subject property only shows casual/occasional

cultivation and does not qualify as possession under ownership

ISSUE:

WON Respondent East Silverlane proven itself entitled to the benefits of the

Public Land Act and Property Registration Decree on the confirmation of

imperfect/incomplete title

RULING:

Petition granted. RESPONDENT FAILED TO PROVE ENTITLEMENT TO

QUESTIONED BENEFITS. 1. The 12 Tax Declarations covering Area A and

the 11 Tax Declarations covering Area B for a claimed possession of more

than 46 years (1948-1994) do not qualify as competent evidence of actual

possession and occupation.

2. The 19 coconut trees supposedly found on Area A were four years old at

the time a Tax Declaration was filed in 1948 and will not suffice as evidence

that her possession commenced prior to June 12, 1945, in the absence of

evidence that she planted and cultivated them. Alternatively, assuming that

those were planted and maintained, such can only be considered casual

cultivation considering the size of Area A. On the other hand, Tan possessed

Area B in the concept of an owner on or prior to June 12, 1945 cannot be

assumed from his 1948 Tax Declaration.

3. The plants were on the subject property without any evidence that it was

the respondent's predecessors-in-interest who planted them and that actual

cultivation or harvesting was made does not constitute well-nigh

incontrovertible evidence of actual possession and occupation.

4. Vicente Ocos testimony deserves scant consideration and will not

supplement the inherent inadequacy of the tax declarations. 5. The

respondent's application was filed after only four years from the time the

subject property may be considered patrimonial by reason of the DAR's

October 26, 1990 Order shows lack of possession whether for ordinary or

extraordinary prescriptive period

Anda mungkin juga menyukai

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- NarrativeDokumen1 halamanNarrativeKC BarrasBelum ada peringkat

- Reflection PaperDokumen2 halamanReflection PaperKC BarrasBelum ada peringkat

- CRIM REV CodalDokumen100 halamanCRIM REV CodalKC BarrasBelum ada peringkat

- Medical Malpractice JurisprudenceDokumen3 halamanMedical Malpractice JurisprudenceKC BarrasBelum ada peringkat

- Rule 112Dokumen15 halamanRule 112KC BarrasBelum ada peringkat

- Malak Hifni Nasif Who Used The Pseudonym BahithatDokumen1 halamanMalak Hifni Nasif Who Used The Pseudonym BahithatKC BarrasBelum ada peringkat

- Paper in Afro WestDokumen6 halamanPaper in Afro WestKC BarrasBelum ada peringkat

- Reviewer Reyes CRIMDokumen3 halamanReviewer Reyes CRIMKC BarrasBelum ada peringkat

- Reviewer Reyes CRIMDokumen3 halamanReviewer Reyes CRIMKC BarrasBelum ada peringkat

- Egyptian Women and Their RightsDokumen7 halamanEgyptian Women and Their RightsKC BarrasBelum ada peringkat

- A-B CasesDokumen34 halamanA-B CasesKC BarrasBelum ada peringkat

- Rule 112Dokumen15 halamanRule 112KC BarrasBelum ada peringkat

- CharacDokumen2 halamanCharacKC BarrasBelum ada peringkat

- CIVREV Cases Weeks 23Dokumen203 halamanCIVREV Cases Weeks 23KC BarrasBelum ada peringkat

- 11 - Suntay III Vs Cojuangco-SuntayDokumen3 halaman11 - Suntay III Vs Cojuangco-SuntayKC BarrasBelum ada peringkat

- Tranportation Law ReviewerDokumen20 halamanTranportation Law ReviewerKC Barras100% (1)

- Civ Rev Rabuya Reviewer.Dokumen17 halamanCiv Rev Rabuya Reviewer.KC Barras100% (1)

- Section 12. Government Centers. - Provinces, Cities, and Municipalities Shall Endeavor To EstablishDokumen1 halamanSection 12. Government Centers. - Provinces, Cities, and Municipalities Shall Endeavor To EstablishKC BarrasBelum ada peringkat

- RA 9090 Sec 1 and 2Dokumen1 halamanRA 9090 Sec 1 and 2KC BarrasBelum ada peringkat

- Ra 9344Dokumen3 halamanRa 9344KC BarrasBelum ada peringkat

- RA 9165 Defenition of TermsDokumen4 halamanRA 9165 Defenition of TermsKC BarrasBelum ada peringkat

- Chemicals.-.The Penalty of Life Imprisonment To Death and A Ranging From Five Hundred ThousandDokumen1 halamanChemicals.-.The Penalty of Life Imprisonment To Death and A Ranging From Five Hundred ThousandKC BarrasBelum ada peringkat

- SECTION 2. Section 9 of The Same Decree, As Amended, Is Hereby Further Amended To Read AsDokumen1 halamanSECTION 2. Section 9 of The Same Decree, As Amended, Is Hereby Further Amended To Read AsKC BarrasBelum ada peringkat

- Fredco Vs HarvardDokumen3 halamanFredco Vs HarvardKC BarrasBelum ada peringkat

- Belgian Overseas Chartering Vs Philippine First Insurance CoDokumen1 halamanBelgian Overseas Chartering Vs Philippine First Insurance CoKC BarrasBelum ada peringkat

- RA 9344 Definition of TermsDokumen3 halamanRA 9344 Definition of TermsKC BarrasBelum ada peringkat

- Ra 8293Dokumen1 halamanRa 8293KC BarrasBelum ada peringkat

- Crim Rev Cases Full TextDokumen180 halamanCrim Rev Cases Full TextKC BarrasBelum ada peringkat

- Kirtsaeng and Fredco Case DigestDokumen4 halamanKirtsaeng and Fredco Case DigestKC BarrasBelum ada peringkat

- Rule 112Dokumen15 halamanRule 112KC BarrasBelum ada peringkat

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- British Monarchy Lesson PlanDokumen12 halamanBritish Monarchy Lesson PlanPopa NadiaBelum ada peringkat

- CITY OF MANILA vs. COCA-COLA BOTTLERS PHILIPPINES, INCDokumen2 halamanCITY OF MANILA vs. COCA-COLA BOTTLERS PHILIPPINES, INCEmil BautistaBelum ada peringkat

- M E Tool LRP Implementation Annex A Literacy 1Dokumen11 halamanM E Tool LRP Implementation Annex A Literacy 1ISABELO III ALFEREZBelum ada peringkat

- Law On Public Corporation-SyllabusDokumen3 halamanLaw On Public Corporation-SyllabusVictor FernandezBelum ada peringkat

- Sahil Group DDokumen2 halamanSahil Group DAbhishek SardhanaBelum ada peringkat

- Pds Shirley LatestDokumen14 halamanPds Shirley LatestMICHAEL B. GRAGASINBelum ada peringkat

- General Nature and Definition of Human RightsDokumen11 halamanGeneral Nature and Definition of Human RightsDaryl Canillas PagaduanBelum ada peringkat

- CH 31 L1 - Guided ReadingDokumen2 halamanCH 31 L1 - Guided ReadingEdward FosterBelum ada peringkat

- Reiigen Bridgehead Offensive Hasty Assault River CR Leavenw - Orth Ks Comba M Oyloe Et Al 23 May 84Dokumen86 halamanReiigen Bridgehead Offensive Hasty Assault River CR Leavenw - Orth Ks Comba M Oyloe Et Al 23 May 84Luke WangBelum ada peringkat

- DPWH Disaster and Incident Coordination and Management ManualDokumen18 halamanDPWH Disaster and Incident Coordination and Management ManualSharr Danelle SalazarBelum ada peringkat

- Regional Development Fund MoldovaDokumen3 halamanRegional Development Fund MoldovaOleg AndreevBelum ada peringkat

- Full Text of "John Birch Society": See Other FormatsDokumen301 halamanFull Text of "John Birch Society": See Other FormatsIfix AnythingBelum ada peringkat

- The Harpers Ferrian-003Jan2017Dokumen4 halamanThe Harpers Ferrian-003Jan2017Valentine MulangoBelum ada peringkat

- Nelson Mandela 'S Biography Passive FormDokumen4 halamanNelson Mandela 'S Biography Passive FormAngel Angeleri-priftis.Belum ada peringkat

- Ibs Sri Petaling 1 31/03/20Dokumen10 halamanIbs Sri Petaling 1 31/03/20muhammad zulharifBelum ada peringkat

- Natalia Realty, Inc. vs. Department of Agrarian ReformDokumen3 halamanNatalia Realty, Inc. vs. Department of Agrarian ReformaudreyracelaBelum ada peringkat

- Paxton V YelpDokumen28 halamanPaxton V YelpChristopher HuttonBelum ada peringkat

- Compostela Valley ProvinceDokumen2 halamanCompostela Valley ProvinceSunStar Philippine NewsBelum ada peringkat

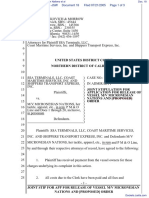

- SSA Terminals, LLC Et Al v. M/V Micronesian Nations Et Al - Document No. 18Dokumen3 halamanSSA Terminals, LLC Et Al v. M/V Micronesian Nations Et Al - Document No. 18Justia.comBelum ada peringkat

- By Senator Rich Alloway: For Immediate ReleaseDokumen2 halamanBy Senator Rich Alloway: For Immediate ReleaseAnonymous CQc8p0WnBelum ada peringkat

- End of Term Assessment Social Studies Fm4 BusinessDokumen2 halamanEnd of Term Assessment Social Studies Fm4 BusinessShelly RamkalawanBelum ada peringkat

- Unit-31 - Advantages Disadvantages Affirmative Action - EgyangoshDokumen15 halamanUnit-31 - Advantages Disadvantages Affirmative Action - EgyangoshIndumathi SBelum ada peringkat

- TEC 08a - Washing State Bunker Procedure List PDFDokumen2 halamanTEC 08a - Washing State Bunker Procedure List PDFnmospanBelum ada peringkat

- The Washington Times - Vol. 41 No. 149 (20 Jul 2023)Dokumen24 halamanThe Washington Times - Vol. 41 No. 149 (20 Jul 2023)mariuscsmBelum ada peringkat

- Bangalisan V Ca G.R. No. 124678 July 31, 1997 Regalado, J.: FactsDokumen1 halamanBangalisan V Ca G.R. No. 124678 July 31, 1997 Regalado, J.: FactsKate GaroBelum ada peringkat

- Religion Comparative EssayDokumen3 halamanReligion Comparative Essayapi-313910257Belum ada peringkat

- SSRN Id1276962Dokumen5 halamanSSRN Id1276962MUHAMMAD ALI RAZABelum ada peringkat

- 100 Performing Ceos and Leaders of PakistanDokumen10 halaman100 Performing Ceos and Leaders of PakistanMujahid HussainBelum ada peringkat

- Certified List of Candidates For Congressional and Local Positions For The May 13, 2013 2013 National, Local and Armm ElectionsDokumen3 halamanCertified List of Candidates For Congressional and Local Positions For The May 13, 2013 2013 National, Local and Armm ElectionsSunStar Philippine NewsBelum ada peringkat

- Harshit Shukla-1 (1) - 1Dokumen1 halamanHarshit Shukla-1 (1) - 1Harish KumarBelum ada peringkat