Bernardo Morne

Diunggah oleh

CohenHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Bernardo Morne

Diunggah oleh

CohenHak Cipta:

Format Tersedia

Version

2011.11.03.22

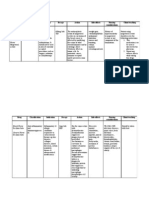

2011 Medical Scheme Quotation

RESOLUTION

Foundation 5501-7500

M Bernardo

2011/07/07

Quote Ref : 496317 Pay 3 children

SCHEME OPTION:

Description of Cover:

Principal Member

Adult Dependant no. 1

Discovery

Keycare Plus

3901-6250

MEDIHELP

Necesse

0 - 7500

Pay 3 Children

Pay 4 Children

TOPMED

Network 3501-7500

Pay 4 children

H1

G2

D1

B1

(Income R5 501 - R7 500)

(Income R3 901 - R6 250)

(Income 0 - 7500)

(Income R3 501 - R7 500)

Capitation

Capitation

Capitation

(Private Network)

Capitation

(CareCross)

Risk Contribution

Risk Contribution

Risk Contribution

Risk Contribution

R 670

R 512

R 533

R 533

R 684

R 540

R 763

R 763

Risk Only

Risk Only

Risk Only

Risk Only

R 45

R 45

R 45

R 45

R 1,227

R 1,111

R 1,269

R 1,571

R 60

R 53

R 62

R 77

R 1,287

R 1,164

R 1,331

R 1,648

Zurreal4Life Platinum - R145 per family

KeyFIT R33/Vitality R145 (Both R158)

N/A

Multiply - R146

Various products available

ranging from R80 - R95

Various products available

ranging from R80 - R95

Various products available

ranging from R80 - R95

Various products available

ranging from R80 - R95

Service Fee: A fee is included in the total for assisting members with: claims /

query resolution, annual personal assistance at option renewal, quartely news

letter etc.

Total Monthly Contribution

(Including R45 Service Fee)

Late Joiner Penalty

(This penalty will be added to your premium every month)

Total Monthly Contribution with Late Joiner Penalty

Optional Loyalty Club

Gap Cover:

Optional Insurance product that provides cover for specialist's fee's whilst

hospitalised, above 100% of Scheme Tariff up to 400% of Scheme Tariff.

Terms will apply.

This summary is for information purposes only and does not supersede the Rules of a Scheme. In the event of any discrepancy between the summary and the Rules of a Scheme, the Rules will prevail.

Underwriting that can be applied to your membership:

3 Month general waiting period

12 month exclusion on pre-existing condition

Late joiner penalty

Advice Provided by:

Optivest - a licensed financial services provider: FSB 13475

Optivest in an Independent healthcare consultancy organisation that strives to present

clients with the highest level of service and does not have shareholding or direct interest

in any medical scheme or medical scheme administrator.

Jackie Verster

Marketing Consultant

OPTIVEST HEALTH SERVICES

Tel: 021 970 6897

Fax: 0866 875 501

Email: jverster@optivest.co.za

FSB license: 13475

Page 1 (of 3)

SCHEME OPTION:

H1

G2

D1

B1

(Income R5 501 - R7 500)

(Income R3 901 - R6 250)

(Income 0 - 7500)

(Income R3 501 - R7 500)

100% of Scheme Tariff

100% of Scheme Tariff

100% of Scheme Tariff

100% of Scheme Tariff

Network Hospitals

Network

Any Hospital

Any Hospital

None

(co-payments apply)

None

IN HOSPITAL BENEFITS:

Rate of Cover for Specialist fees during hospitalisation

Hospitals that may be utilized

(Pre-authorisation is required before treatment starts, or in case of an emergency

within the next two business days)

Overall limits & Deductibles

Listed Procedures: Procedures normally performed in hospital, performed in

Doctor's room/Day Ward e.g.Gastroscopy, etc.

R800 000 Per Family

Unlimited - Subject to pre-authorisation. R1000

In Hospital: Unlimited at Network Hospitals. *CoCovered in Network of Day-Case facilities within

payments apply - see below

co-payment unauthorised non-emercency

50km radius, otherwise Keycare Network hospital

Out of Hospital: Unlimited at Network Provider

admission

None

Colonoscopy, Endoscopy, Gastroscopy in doctor's

rooms/as day case in hospital under concious

sedation, unless clinically appropriate for general

anaestetic - req pre-auth at 100% of Scheme Tariff

In Hospital: Normal delivery: 3 days & 2 nights.

Caesar: 4 days & 3 nights

Out of Hospital: 2 x 2D scans

In Hospital: Unlimited

Out of Hospital: 4 Antenatal visits, 1 Scan and

selected blood test - referred by KeyCare

Network doctor

In Hospital: R16 000 per confinement, subject to

OAL. Out of Hospital: Ltd to 2 Sonars & 2

Specialist consultations per pregnancy, within

Network.

In Hospital: Unlimited (limited to 1 birth per family

per year). Out of Hospital: Pre & postnatal care

provided by Carecross provider,up to 20 weeks,

2 Ultrasound Scans

Covered at Network Provider. Subject to PMB

21 Days per beneficiary

Prescribed Minimum Benefits

Prescribed Mininum Benefits only

Covered at Network Provider. Subject to PMB

In Hospital: Unlimited if related to approved

hospital event (back & neck not covered)

Out of Hospital: Ltd to R2100 per beneficiary

(paid from Specialist benefit)

In and out of Hospital: R10 000 per family per

year

In Hospital: Unlimited - subject to preauthorisation

Out of Hospital: No Benefit

Unlimited through ICON Network. Protocols apply

Cover PMB at cancer specialist in the ICON

network. Register on the Oncology Programme

Subject to ICON Oncology management program Limited to R200 000 pbpa.

protocols - PMB Only

Treatment limited to Tier 1 protocols.

HIV Programme (Network Hospitals). Subject to

Scheme Protocols and PMB. Covered at

provincial facility if not registered

Unlimited if registered on HIVCare Programme R12 000 if not registered

Unlimited, subject to Disease Mangement

Programme and protocols

Subject to registration on the CareWorks

program

ER24

Discovery 911

Netcare 911

ER 24 - Unlimited.

Non-Prefered Provider: Ltd to R1600 per family

7 Days supply

R100 per beneficiary per admission

R240 per beneficiary per admission

No Benefit

Emergency Ward Treatment which does not result in

Hospitalisation

R1 115 per family

Preferred Casualty units in Keycare Network of

hospitals, only pay R110 of consultation. Other

casualty units will pay R250 for consultation

Covered only if indicated as Emergency (PMB)

by treating doctor

No Benefit

International Medical Travel Assistance

No Benefit

No Benefit

No Benefit

No Benefit

No Benefit

No Benefit

R13 500 per family for sub-acute & private

nursing facilities. Subject to pre-authorisation &

case management.

Limited to PMB treatment only

Prescribed Minimum Benefits

Subject to PMB treatment

Prescribed Minimum Benefits

Unlimited to PMB

Prescribed Minimum Benefits

Prescribed Minimum Benefits and 8 additional

conditions covered

Maternity Benefits

(In & Out of Hospital)

Psychiatric & Psychological Treatment

MRI & CAT Scans

(In & Out of Hospital)

Oncology/Cancer (In & Out of Hospital)

(Comprehensive Oncology benefits per scheme available on request)

HIV/Aids - Sub limits on Medicine might apply

Ambulances Services/Administrators used by the Scheme (In case

of an Emergency any service can be used)

Discharge Medicine (Take Home Medicine)

Post Hospitalisation Benefit (Treatment after discharge pertaining to

hospitalisation paid from Risk benefits)

Internally Implanted Prostheses

(Limits apply only on Prostheses)

Dialysis

Joint replacements, including but not limited to

R30 600 per family, subject to Prosthesis specific hips, knees, shoulders and elbows will be

limit

excluded.

No cover for elective hip & knee replacements

Cover for PMB Emergencies only

Covered at Network hospitals and subject to

PMB. Protocols apply

Covered up to maximum of 100% of Scheme

Tariff at a network provider only

Chronic Benefits:

All Schemes provide unlimited Prescribed Minimum Benefits (PMB) for the

Prescribed Minimum Benefits

treatment of Conditions (Chronic Disease List) e.g. Diabetes, Asthma, Cholesterol,

Hypertension, etc. Benefits are Subject to a Scheme treatment plan, formulary, Subject to Network formulary

registration, pre-authorisation and a Designated Service Provider (DSP) to avoid a

co-payment. Benefits will be paid first from stipulated (if any) available Chronic

Designated Service Provider: Network Provider

Benefits, thereafter unlimited at DSP. Non-PMB conditions will be paid from

Acute/Savings benefits if Chronic Benefits are not available/depleted.

Page 2 (of 3)

Prescribed Minimum Benefits

Designated Service Provider: Chosen primary

dispensing GP, Optipharm, DisChem or Clicks

If the designated service provider is not used, a

40% co-payment will apply

Designated Service Provider: Medihelp

Pharmacy Network

Designated Service Provider: CareCross

SCHEME OPTION:

OUT OF HOSPITAL BENEFITS:

*Day-to-Day Benefits, or **Savings, which is included

in the Total Monthly Premium to make provision for

medical expenses that does not require hospitalisation

e.g. GP visits & Dentistry is displayed on this page.

H1

G2

D1

B1

(Income R5 501 - R7 500)

(Income R3 901 - R6 250)

(Income 0 - 7500)

(Income R3 501 - R7 500)

Limited Primary Health Care available through

Network Providers

No Benefit for Wisdom teeth removal

Unlimited Primary Health Care Benefits available

through chosen KeyCare Network Doctor

(No Benefits for Wisdom teeth removal)

Screening Benefit

Guardian Benefit covers certain preventative

screening tests at Network Providers.

Trauma Recovery Extended Benefit

Includes Pharmacist Benefit of R283 per family

for over the counter medication

Mobility Devices Benefit

Unlimited Primary Health Care Benefits available Unlimited Primary Health Care available through

through the Medihelp Preferred Provider Network your chosen CareCross Provider

Dental covered at 100% of Scheme dental tariff - (Impacted Wisdom teeth - no cover, except in

Subject to DENIS limits, protocols & pre-auth

trauma cases)

TOTAL *In-Scheme Day-to-Day Benefits(if applicable) & or **Savings:

Annual Threshold/Safety Net limit to be reached:

N/A

N/A

N/A

N/A

Estimated Self Payment Gap:

N/A

N/A

N/A

N/A

General Practitioner Visits

Unlimited at Network Provider

Unlimited at chosen KeyCare Network doctor

Second GP can be nominated

Unlimited at Medihelp Network provider. Out of

network visits ltd to R700 single member,

R1 400 per family with 20% co-payment

Unlimited-at Primary CareCross GP. Non-Primary

ltd to 3 visits per family to max of R1000 per

family per year

Specialist Visits

4 network visits per family to a max of R1 000.

Subject to pre-authorisation.

R2100 per beneficiary-must be referred by GPonly at doctor working at a network hospital.

Subject to pre-authorisation.

R2000 per beneficiary, to maximum of R2 800

per family. Subject to pre-authorisation.

Limited to R2 100 per family per year. Subject to

referral by Carecross GP and pre-authorisation.

Prescribed/ Acute Medicine

Subject to Network accute formulary.

Pharmacist Benefit R283 per family

Unlimited Subject to the KeyCare Acute Medicine Subject to overall annual limit. Must be

Formulary prescribed by network General

prescribed by network GP and obtained from

Practioner

dispensing GP or network pharmacy

(Consultations, Oral hygiene, Extractions & Fillings)

2 annual check ups per beneficiary covered at

Network Providers

Unlimited at chosen KeyCare Dentist Network

Subject to DENIS protocols, e.g. 1 routine

checkup, 1 oral hygiene visit, 4 fillings pbpa

Unlimited - Subject to CareCross Dentist.

Dentures ltd to 1 set per 24-month cycle per

family. 20% co-pay

Specialised/Advanced Dentistry

No Benefit

No Benefit

No Benefit

No Benefit

No Benefit

No Benefit

Occupational Therapists & Physiotherapy

R1 300 per beneficiary to a maximum of

R2 000 per family

No Benefit

Mental Health

No Benefit

No Benefit

Prescribed Minimum Benefits

Psychiatry limited to PMB

Optical

1 Consultation per beneficiary per 24-month

cycle covered at Network Provider, including

single mono or bifocal prescription.

One eye test, 1 pair of clear single-vision, bifocal

or multi-focal lenses with basic frame or basic set

of contact lenses every 2 years per beneficiary from Keycare Optometry Network

PPN Network. 1 eye test, 1 pair clear single

vision or bifocal glasses per beneficiary in 24month cycle. R150 towards frames. R395

towards contact lenses (PPN only).

Subject to CareCross Optometrist. Benefits per

beneficiary per 24 month cycle: 1 consultation, 1

pair of white single and/or bifocal lenses and

choice of selected frames or contact lenses limit

R350 per beneficiary

Radiology & Pathology

Limited to Network Provider

Pathology: Unlimited - only if required by KeyCare

Network doctor

Radiology: Selected basic x-rays at a radiology

facility in the Network, if required by Network GP

Subject to overall annual limit. Subject to referral

Basic radiology and pathology unlimited - Subject

by network GP, preferred providers Lancet and

to CareCross Doctor/Facility

Pathcare and clinical protocols

Copyright reserved by Optivest Health Services

*Co-payments apply:

*Funeral Benefit: R5 000 benefit to Principal

R1 000 on Circumcision, Colonoscopy, Sigmoidoscopy, member for R1. Maximum age 65 next birthday.

Proctoscopy, Excision nailbed, Myringotomy (grommets);

R1 250 on Gastroscopy, Skin lesions; R2 000 on

Arthroscopy; R2 250 on Hysteroscopy; R2 500 on

Conservative Back treatment, Joint replacements; R3

000 on Functional nasal surgery,

HysterectomyLaparoscopic procedure, Reflux surgery;

R4 000 on Spinal Surgery

Basic Dentistry

Auxiliary Services (Homeopaths, Dieticians, Clinical psychologists, Speech

therapists, Physiotherapy, Chiropractors & Occupational therapists)

*In Scheme Day-to-Day Benefits:

Benefits that are part of Risk Cover, unused benefits will not carry over to next year.

**Savings:

Fixed Rand Amount for Day-to-Day Benefits upfronted annually. Savings that are not used for be

carried over to next year.

All Day-to-Day Benefits and Savings is calculated pro-rata per annum .

Co-payments will not apply for procedures performed out of

hospital or for PMB.

Optional Co-Pay Cover

Page 3 (of 3)

Children regarded as child dependants up to 21st Birthday

Unlimited - Subject to CareCross Formulary

Anda mungkin juga menyukai

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- FacilitiesDokumen19 halamanFacilitiesJeffs9430Belum ada peringkat

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Intraoral RadiographicDokumen62 halamanIntraoral RadiographicEuginiaBelum ada peringkat

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- AssertivenessDokumen4 halamanAssertivenessDamir MujagicBelum ada peringkat

- Grant ProposalDokumen16 halamanGrant Proposalapi-392153225Belum ada peringkat

- WHO-GMP Guidlines For Pharmaceutical IndustriesDokumen148 halamanWHO-GMP Guidlines For Pharmaceutical Industriesmoo78100% (5)

- What Are Coping Mechanisms?Dokumen7 halamanWhat Are Coping Mechanisms?Blaze QuibanBelum ada peringkat

- Aaron Beck On Cognitive Therapy: Instructor's ManualDokumen46 halamanAaron Beck On Cognitive Therapy: Instructor's ManualNarendra100% (3)

- Pulmonary RehabilitationDokumen412 halamanPulmonary Rehabilitationhuxley237860% (5)

- Hendrix PDFDokumen2 halamanHendrix PDFgeorgiana vasileBelum ada peringkat

- CSA11 CholelithiasisDokumen3 halamanCSA11 CholelithiasisBerlon LacsonBelum ada peringkat

- Artificial LiverDokumen1 halamanArtificial LiverPradeep MahalikBelum ada peringkat

- Renal Diseases " Review "Dokumen22 halamanRenal Diseases " Review "api-3827876Belum ada peringkat

- In Vivo Dosimetry in BrachytherapyDokumen17 halamanIn Vivo Dosimetry in BrachytherapySUBHABelum ada peringkat

- Measles (Campak, Rubeola, Gabak, Kerumut)Dokumen20 halamanMeasles (Campak, Rubeola, Gabak, Kerumut)Ami UtamiatiBelum ada peringkat

- Chapter 1. Introduction To PsychiatryDokumen11 halamanChapter 1. Introduction To PsychiatryDiego Francesco MacaliBelum ada peringkat

- Endoscopy and Microendoscopy of The Lacrimal Drainage SystemDokumen60 halamanEndoscopy and Microendoscopy of The Lacrimal Drainage SystemhwalijeeBelum ada peringkat

- Drug Study - CaDokumen3 halamanDrug Study - Casaint_ronald8Belum ada peringkat

- Occular Drug Delivery System - Vinod SijuDokumen120 halamanOccular Drug Delivery System - Vinod Sijuvinsijuvin555Belum ada peringkat

- Folding and Unfolding Manual WheelchairsDokumen9 halamanFolding and Unfolding Manual WheelchairsprkranjithkumarBelum ada peringkat

- DOI Bienestar, Autoeficacia e Independencia en Adultos Mayores Un Ensayo Aleatorizado de Terapia OcupacionalDokumen8 halamanDOI Bienestar, Autoeficacia e Independencia en Adultos Mayores Un Ensayo Aleatorizado de Terapia OcupacionalJhon MillerBelum ada peringkat

- Bourdin, D. (2003) - La Pensée Clinique Clinical Thinking André GreenDokumen4 halamanBourdin, D. (2003) - La Pensée Clinique Clinical Thinking André GreenofanimenochBelum ada peringkat

- Resorption of A Calcium Hydroxide/iodoform Paste (Vitapex) in Root Canal Therapy For Primary Teeth: A Case ReportDokumen4 halamanResorption of A Calcium Hydroxide/iodoform Paste (Vitapex) in Root Canal Therapy For Primary Teeth: A Case ReportHasbi Brilian KumaraBelum ada peringkat

- Grand Case Presentation FormatDokumen7 halamanGrand Case Presentation FormatRENEROSE TORRESBelum ada peringkat

- AtosPharma Intro PDFDokumen33 halamanAtosPharma Intro PDFmohalaaBelum ada peringkat

- Assessment of Development and GrowthDokumen21 halamanAssessment of Development and Growthdrng48Belum ada peringkat

- EMIMAc MSDSDokumen6 halamanEMIMAc MSDSalvaro_cruzBelum ada peringkat

- Application of CTASDokumen32 halamanApplication of CTASsidekick941Belum ada peringkat

- Pathophysiology of Congenital Heart Disease in The Adult: Special ReportDokumen11 halamanPathophysiology of Congenital Heart Disease in The Adult: Special ReportResiden KardiologiBelum ada peringkat

- Document 105Dokumen14 halamanDocument 105Marie JhoanaBelum ada peringkat

- Ashley's TreatmentDokumen3 halamanAshley's TreatmentBrandon M. DennisBelum ada peringkat