Value Investors Club - Post Holdings Inc (Post)

Diunggah oleh

giorgiogarrido6Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Value Investors Club - Post Holdings Inc (Post)

Diunggah oleh

giorgiogarrido6Hak Cipta:

Format Tersedia

11/16/2015

ValueInvestorsClub/POSTHOLDINGSINC(POST)

Signed in as gg4t@virginia.edu. Logout (/logout)

Search the site

POST HOLDINGS INC POST

October 01, 2015 by smash432 (/member/smash432/52655)

2015 2016

Price:

59.00 EPS

0

0

Shares Out. (in M):

73 P/E

0

0

Market Cap (in M): 4,307 P/FCF

0

0

Net Debt (in M):

3,962 EBIT

0

0

TEV:

8,269 TEV/EBIT

0

0

Description

SituationOverview:SinceitsspinofffromRalcorpin2012,POSThasbeenonanM&Atear,

completingovertenacquisitionsandleveringitsbalancesheetto~6.0xEBITDA.Whilethepace

andstrategicrationaleforsomeoftheseacquisitionshavegiveninvestorspause,theongoing

diversificationofitsbusinesshastransformeditfromapureplaycerealcompanytoahigher

growthpackagedfoodcompanywithamorediversifiedbreakfastportfolioandestimated60%

ofsalesinhighergrowthcategories.Despitetransitoryissuesfromoperationalmisstepsand

headlineriskfromAvianFlu,POSTsstrongFCFgeneration,whichyields6%+,highlightsthe

30%+leveredreturnofthispublicLBO.Pricetargetof$90.

WhySituationPresentsItself:Giventhepaceandbreadthofrecentacquisitions,andthe

resultingopacityintheearningspoweroftheproformabusiness,thereisconcernthatPOSThas

not"boughtright"andthatrecenttransactionsdonotjustifytheirmultiplesandassociated

leverage.POSTchunkedQ314earningsattributabletotheperformanceoftheseacquisitions

(Dymatize,Premier),significantlyreducedFYEguidance(again),andraisedconcernsaboutthe

companysintegrationability.Thestocksoldoffsharplynearly25%inthemonthsafterQ3

earnings.Althoughthestockhasperformedwellsincethenonimprovedquarterlyearnings,

FYQ2earningsweredampenedfromtheAIoverhangstocksoldofffrom$51/shareto

$42/share.Finally,theacquisitionofMOMsbrandswhichatfirstwasreceivedwitha

lukewarmresponseasitdoubleddownonthesecularlychallengedcerealcategorywilllikely

provideforsignificantbottomlinecontributionfromrationalizedtradespendandadditional

upsidetothe$50Msynergyguidance(yettobeappreciated).At10xEBITDA,amaterialdiscount

toalowergrowthcompetitorset,webelievethatvaluationtodayreflectslowexpectationsinthe

turnaroundinbusinessfundamentals(cereal,ActiveNutrition),conservativeassumptionsover

thecostsavingsopportunitiesatMOMs,norgivecredittotherapiddeleveragingpowerof

POSTsbusinessmodel.

http://www.valueinvestorsclub.com/idea/POST_HOLDINGS_INC/137369

1/11

11/16/2015

ValueInvestorsClub/POSTHOLDINGSINC(POST)

NotableEvents:

oOn1/25/2015,POSTannouncedtheacquisitionofMOMsBrandsfor$1.15bn.

oOn4/28/15,POSTreportedthat~10%ofitsMichaelFoodseggsupplywasaffectedbythe

currenthighpathogenicavianinfluenza(AI)outbreak,withtheexpectedimpactraisedto

~14%ofitssupplyasofitsF2Q15reporton5/7/15,andthenagainto~20%on5/12/15.By

August,POSTannouncedthatthroughitscostcontrolsandforcemajeurepricinginitiatives,

theAIheadwindhadeffectivelybeenmitigated.

oOn8/12/15,POSTraised~$300MinamixedshelfofferingforincrementalM&A

oOn9/2015,POSTclosesDymatizesmanufacturingplantandpermanentlytransferedtoco

packers.POSTalsopurchasedWilliametteEggfarms,whichshouldadd$15MinEBITDAto

FYearnings.

CatalystPath&Timing:

oWebelievethatPOSTsentimenthastroughedandisalreadyontherise,andthepathto

gettingpaidwillbefromthefollowing:

MOMs/POSTintegrationupdates,whichwillmostlikelystartinQ315;wewouldexpect

either1)anaccelerationinthetimingofsynergies/costsavingsrealizedand/or2)

increasedsynergytargets(increasedfrom$50Mguided).

OngoingIRIdataonPOST/MOMcerealtrends,whichsofarhavedemonstratedstrong

momentum.ThelatestscannerdatashowsPOSTgrowingsalesinthelatest12weekby

3.8%vs.K(4.1%)andGIS(4.8%)andgaining1ptsofmarketshare.

ActiveNutritionearningshavetroughed,andweexpectthissegmenttocontributebythe

endoftheyeartoearly2016.Althoughthisislikelya$40$60MEBITDAbusiness(less

than10%ofoverallPOSTprofitability),weexpecttradingmultipleexpansionvs.bottom

linecontributiontobeadriverofshareappreciationfromthisbusiness.

WeareinaholdingpatterninMichaelFoodsasthefalloutfromAIhasbeenongoingand

whoemergesasawinner/loserremainstobeseen.However,themostrecentfinancial

updateshasshownPOSTtobeadeptatmitigatingtheepidemicandbelieveMichael

Foodsisinthebestpositiontogainmarketsharefromcompetitors(Cargill/Rembrandt)

astheycullcustomers.Sofar,AIhasnotnegativelyaffectedPOST'sprofitability.

i)AvianFluwillmostlikelypersistasanoverhangfortheforeseeablefuturewiththe

possibilityofaresurgenceinthefallastheweathercools.

WithcareerChairman/CEOBillStiritzastheChairmanofPOST,potentialgrowththrough

M&Aisalwaysinthecards.POSTcurrentlysitsonabout$1billionindrypowder

(includingaccordionfacility),andgivenStiritzsreputation,wewouldexpectcontinued

http://www.valueinvestorsclub.com/idea/POST_HOLDINGS_INC/137369

2/11

11/16/2015

ValueInvestorsClub/POSTHOLDINGSINC(POST)

M&Abothboltonandlargeracquisitions(CAGrumorsofbuyingbackRalcorporthe

ConsumerFoodsGroupareubiquitousalthoughthemostrecentnewsisthatPOSThas

notsubmittedabid).

Conditions/Miscellaneous:ConvertiblePreferreds

oHolderscanconvertthe2.4Msharesat2.1192sharesofcommonstockpershareof

convertiblepreferred($47.19conversionprice;5.09sharedilutionimpact)

oHolderscanconvertthe3mn+.2overallotmentsharesat1.8477sharesofcommonstock

($54.12conversionprice;5.54sharedilutionimpact).

Overthepasttwoyears,POSThastransformedfromaonecategorycompany(challenged

RTEcerealcategory)toprovidingadiversifiedproductofferinginhighergrowth

segments.

oPOSThasacquiredover12companiesintheareasofsportsnutrition,eggproducts,

pasta,cheese,refrigeratedpotatoes,andprivatelabelpeanutbutter/granola.

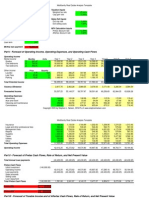

oThechartbelowillustrateswhatthesalesandEBITDAattributionisperacquisitionin

additiontotheimpliedmultiple.Assuming$250MinEBITDAcontributionfromthePOST

cerealbasebusinessonanormalizedbasisandassumingNOorganicgrowth,POSTisa

$800M+EBITDAcompany(yearoveryearbridgeincludedlateron).

oProformafortheseacquisitions,nearly60%ofPOSTsbusinessisinmoderate/high

growthproductofferingsoutsidethecerealcategory(althoughwebelievecerealwill

actuallybeaflatgrowingcategoryintheST).

http://www.valueinvestorsclub.com/idea/POST_HOLDINGS_INC/137369

3/11

11/16/2015

ValueInvestorsClub/POSTHOLDINGSINC(POST)

UpsidetoMOMsBrandsSynergiesismeaningful.

Background/MarketShare:POST,whichisthethirdlargestU.S.brandedreadytoeat

cerealmanufacturer,regainednearly1.4marketsharepointssinceits2012lowto

nearly20%(includingMOMs)despitethecategorysmultiyearweakness(8%declinein

retailvolumessince2011).Interestingly,POST(notincludingprivatelabel)wastheonly

largecerealcompanytoincreaseretailvolumein2014despitethecategorydeclining

3%.Thecompanyexpectsthecategorytodeclineanadditional4%inFY2015,although

POSThasbeenabletobuckthistrendgiventheacquisitionofMOM.POSThasgained

nearly70basispointsofsharein2014thehighestgainamongthetopbrandedand

privatelabelplayersovertheyearagoperiod,as9ofitstop12corebrandshaveeither

stabilizedshareorgainedmarketshare.

TheacquisitionofMOMsBrands,whichplaysinthevalueendofRTEcereals,provides

forsignificantupsidetothe$50Mofsynergiesmanagementhascurrentlyoutlined.

i)Distribution:MOMdrivesthemajorityofitssales(morethan60%)inmorerural

regionsoftheU.S.(e.g.,Texas,Oklahoma,Washington,Idaho,Montana,Oregon,

Iowa,Nebraska,Florida,Mississipii,Alabama,Georgia,etc)whilePoststoptwo

regionsarethemorepopulatedNortheastandGreatLakesregions(inline

exposurewithGISandK).

ii)ThebestinclassMOMsfacilitiesandPOSTfacilitiesaresignificantlyunder

utilized;IRhasindicatedthatclosingoneofthefacilitiesisdefinitelyonthetable.

Forreference,POSTcloseditsModestoplant(madeGrapeNutsandRaisinBran)

whichwasa$14Mcostsavingsoffthebat.

Toputthisinperspective,seearepresentativelistofmergersinthefoodspaceandthe

announcedcostsavingguidanceasa%ofthetargetedsales.MOMsoutlined$50Mof

costsavingsimplies~6.6%oftargetedsales.Giventhe100%overlapinproduct

category,wewouldassumecostsavingsnear910%ofsalesor$75M.Tablebelowthat

thefloorinpotentialcostsavingsisinthemid6%.

http://www.valueinvestorsclub.com/idea/POST_HOLDINGS_INC/137369

4/11

11/16/2015

ValueInvestorsClub/POSTHOLDINGSINC(POST)

AvianFluisatransientheadlineissue;MichaelFoodswillmostlikelybethewinnerat

theend.

BriefSituationOverview

On4/28/15,POSTreportedthat~10%ofitsMichaelFoodseggsupplywasaffected

bytheAIoutbreak,withtheexpectedimpactraisedto~14%ofitssupplyasofitsF2Q15

reporton5/7/15,andthenagainto~20%fivedayslateron5/12/15.Asofits5/7/15

update(when~14%ofthesupplywasaffected),POSThadpreliminarilyexpectedthe

impactfromAItorepresenta$20mmEBITDAheadwindoverthebalanceofFY15(5

months),basedonacombinationoftheexpectedimpactfromthelostvolumeassociated

withlimitedsupply,aswellasthehighercostofanysupplyPOSTisabletoprocureon

theopenmarket(asof5/8/15,averageeggcostshadincreased+40%from4/22/15,for

example)

TherewasafalsepositiveforAIon5/27accordingtotheNebraskaDept.of

AgricultureataMFIlayinghenflockofthreemillionheadinBloomfield.Thiscoincided

withanincreasedest.byPostofitseggsupplyimpactedbyAIto35%from25%.On6/3,

NorfolkDailyNewsreportedthatfollowuptestinghasfailedtoconfirmthepositivetest.

***POSThasenactedforcemajeureeffectiveimmediatelyoncustomers;asifthe

latestearnings,POSThasdeclaredthatAIheadwindtoprofitablilityhasbeeneffectively

mitigated.

Whatarethelongtermimplications?AbsentAI,therewillbeclearwinnersandlosersinthe

nexttwoyears.Qualitatively,wefindthatMichaelFoods,whichhashadtheleastexposureto

AIandamorediversifiedcustomerbase,willbeaclearwinnerwhileitscompetitorsare

http://www.valueinvestorsclub.com/idea/POST_HOLDINGS_INC/137369

5/11

11/16/2015

ValueInvestorsClub/POSTHOLDINGSINC(POST)

eitherunderfinancialduressorhavekeycustomerconcentration.Furthermore,wewould

expectMFItoactuallyimplementinsurancesurchargestotheirgrainspluscontracts,which

willserveasamechanismforfurtherpricinggains.

-TherearecurrentlythreeplayersintheeggprocessingspaceMichaelFoods,Cargill

(hasexclusivityonMcDonalds),andRembrandt(privatelabel).

Anecdotallywearehearingthefollowingfromourchannelchecks:

i)Cargilliscullinghighprofitbusinessinordertoserveitslargestcustomer,

McDonalds.Currently,approximately45%ofCargillssupplyhasbeeninfectedwith

AI.MCDisalsonowrollingoutanalldaybreakfastmenu,furtheringcontraining

Cargilltofocusonitslargestcustomers.WebelievePOSTwillbethebeneficiaryof

furthercustomerattritionandpotentiallywinningsomeofMCDsbusiness.

ii)Rembrandtisfinanciallyconstrainedandispotentiallyonalifeline.Outof700

employees,theyhavealreadylaidoff270employeesduetoAIoutbreaks.According

topublicsources,Rembrandthasabout14.5Mhens,ofwhich50%havebeen

exposedanddestroyed.

(1)5/1:Rembrandt,Iowa,announcedthatitwilllayoff231.Onebarnhousing

about250,000henswasinfected,but5.5millionbirdswerekilledasaresult.

(2)5/21:Renville,Minn.,announceditwillhavetolayoff39workersinaddition

tokilling2millionchickensaftersufferingMinnesotassinglelargest

contamination.

oAdditionally,thecurrentbackdropinthecommoditycomplex(cornandsoy),whichare

atmultiyearlows,willprovidesometailwindtoMFIseggEBITasfeedcostsfallon

delayedpassthrough.Chartforillustrativepurposesonly.

http://www.valueinvestorsclub.com/idea/POST_HOLDINGS_INC/137369

6/11

11/16/2015

ValueInvestorsClub/POSTHOLDINGSINC(POST)

ThecomplexionofPOSTsearningsinrecentquartershasbeenobfuscatedbythemyriad

ofacquisitionsinadditiontointegrationmisexecution.Normalizingforwhatwe

believeareonlymomentaryissues,webelievePOSThastheabilitytogenerateover

$800M+in2016andcloseto$900MinEBITDAby2017

POSTraisedtheirFYguidancefrom$585M$615Mto$635M$650MoninAugust,even

admisttheAIheadwind.

Thebelow2016EEBITDAbridgeattemptstoreconcilethenoiseoftheaforementioned

integrationissues.

Note:thatassumingnoorganicgrowth,2016EEBITDAwouldbe$800M+purelyonFY

contributionfromtheMOMsacquisitionandfromrealizedcostsavingsfromtheMOMs

acquisitionvs.afullybaked$780Mconsensus2016EBITDAnumber.Includingorganic

toplinegrowthof3%orsowouldcontribute~$25MinincrementalEBITDAor

~$830Min2016EEBITDA.

http://www.valueinvestorsclub.com/idea/POST_HOLDINGS_INC/137369

7/11

11/16/2015

ValueInvestorsClub/POSTHOLDINGSINC(POST)

AttheheartofPOSTsbusinessmodelisapublicLBOlevered~6.0x+withsignificantFCF

generationthatwillbetheultimatetransferofwealthfromdebttoequityholders.Thetable

belowillustratesthisdeleveragingscenario.

oHistorically,POSThastradedbetween8.5xEBITDAand11.5xEBITDA.Thiswasduringa

timeinwhichthecompanywaseitherasecularlychallengedonecategoryfoodcompanyorin

themidstofintegratingmultipleacquisitions.Althoughthecompanyiscurrentlytrading~10.2x

EBITDAoffPF2016EEBITDA,wewouldexpectthebusinesstoholdthismultiple(inlinewith

maturebusinessesGIS,CPB,CAG)asthecompaniesintegrationstrategybearsfruitintheformof

FCFgeneration/deleveraging.

oReviewingthecomps,notethatthespacetradesfairlytightlyinthe10x15xEBITDArange.

ThenameswecompPOSTtoareGIS,CPB,andCAG(whichtradetightlyinthe12x13x

range).

Incomparison,POSThasavastlysuperiortoplinegrowthalgorithmdrivenbyabove

averagegrowthinMichaelFoodsandActiveNutrition,whichisoffsetbythemore

challengedcerealbusiness,althoughweseevastlysuperiorbottomlinecontributionfrom

thisbusiness.

i)Fromcompstable,CPB,CAG,andGIShaveeithercontractedtoplinegrowthin

forecasted1415andwhichisflatin1516.Bycomparison,weforecastPOSTto

growintheMSDtoHSDforthenexttwoyears,builtonaconstructiveindustry

backdropforMichaelFoodsandturnaroundinActiveNutrition(albeit,still

conservativelymodeled).Notethatwedonotmodelaturnaroundinthecereal/MOMs

segmentbutconservativelygivecreditforbottomlinecontributionfromcostsavings.

AlthoughcomparingthemarginstructuresofPOSTvs.thecompsetislessfavorableand

somewhatdifficult,wenotethatthegrowthrateinEBITDAfrom2014to2017forthe

vastmajorityofthespaceisintheLSD.Inparticular,CPB,CAG,andGISareforecastedto

growthfrom201417at1%to3%CAGR.LayingoverthesynergiesfromtheMOMs

acquisitionaloneyieldsclosetoaDDgrowth.POSTsEBITDAmarginsof13%14%is

inlinewithCAGvs.CPBandGISwhichareinthe18%19%range.

WebelieveinvestorsareoverpenalizingPOSTforexecutionandaleveredbalancesheet.

However,astheanalysisshowsperbelow,POSTsuperiorFCFgenerationwilldelever

rapidlytoamanageable~4.04.5xEBITDArange,whichissimilartoCAGsleverage,and

shouldyieldareratetoamoreappropriate12xEBITDAmultiple.

http://www.valueinvestorsclub.com/idea/POST_HOLDINGS_INC/137369

8/11

11/16/2015

ValueInvestorsClub/POSTHOLDINGSINC(POST)

I do not hold a position with the issuer such as employment, directorship, or consultancy.

I and/or others I advise hold a material investment in the issuer's securities.

Catalyst

oOngoingM&A:mgmtisfocusedonacquiringboltonplatformsanddivestingnonstrategic

businesses(wouldnotbesurprisedtoseecheeseportfolio,adragtoMichaelFoodsprofitability,

beingdivested).

oWeeklyRTECerealNielsenData,whichshouldshowcontinuedpricing/marketshare

improvementfromthecombinedMOMs/POSTportfolio.

oMOMstargetedcostsavingsQ415:MgmtannouncingcostsavingsupdatefromMOMs

acquisition;FY2016shouldhighlightupsideto$50Mcostsavingstarget.

http://www.valueinvestorsclub.com/idea/POST_HOLDINGS_INC/137369

9/11

11/16/2015

ValueInvestorsClub/POSTHOLDINGSINC(POST)

oAIFall2015:headlineshaveplayedoutwouldexpecttoseesomematerialimprovement

onmarginsidefromforcemajeurandPOSTgainingnewcustomersfromcompetitorfallout.

Messages

http://www.valueinvestorsclub.com/idea/POST_HOLDINGS_INC/137369

10/11

11/16/2015

ValueInvestorsClub/POSTHOLDINGSINC(POST)

Messages

No messages

http://www.valueinvestorsclub.com/idea/POST_HOLDINGS_INC/137369

11/11

Anda mungkin juga menyukai

- CorpFinance Cheat Sheet v2.2Dokumen2 halamanCorpFinance Cheat Sheet v2.2subtle69100% (4)

- Critical Financial Review: Understanding Corporate Financial InformationDari EverandCritical Financial Review: Understanding Corporate Financial InformationBelum ada peringkat

- Valuation Wha You Need To KnowDokumen3 halamanValuation Wha You Need To KnowVarenka RodriguezBelum ada peringkat

- Private Placement Memorandum (Series A Round)Dokumen15 halamanPrivate Placement Memorandum (Series A Round)api-3764496100% (6)

- 50 13 Pasting in Excel Full Model After HHDokumen64 halaman50 13 Pasting in Excel Full Model After HHcfang_2005Belum ada peringkat

- The Mechanics of Economic Model-Of-DFC - ROIC - CAPDokumen29 halamanThe Mechanics of Economic Model-Of-DFC - ROIC - CAPLouis C. MartinBelum ada peringkat

- Audit Committee Quality of EarningsDokumen3 halamanAudit Committee Quality of EarningsJilesh PabariBelum ada peringkat

- Real Estate ModelDokumen13 halamanReal Estate Modelgiorgiogarrido667% (3)

- Lazard Secondary Market Report 2022Dokumen23 halamanLazard Secondary Market Report 2022Marcel LimBelum ada peringkat

- Competitive Advantage PeriodDokumen6 halamanCompetitive Advantage PeriodAndrija BabićBelum ada peringkat

- How To Model Reversion To The Mean - Determining How Fast, and To What Mean, Results RevertDokumen26 halamanHow To Model Reversion To The Mean - Determining How Fast, and To What Mean, Results Revertpjs15Belum ada peringkat

- Apollo Global Management, LLC August Investor PresentationDokumen33 halamanApollo Global Management, LLC August Investor PresentationOkkishoreBelum ada peringkat

- Valuation Q&A McKinseyDokumen4 halamanValuation Q&A McKinseyZi Sheng NeohBelum ada peringkat

- CS MarketNeutral HOLT Notes PDFDokumen3 halamanCS MarketNeutral HOLT Notes PDFMichael GuanBelum ada peringkat

- Capital Structure, The Determinants and FeaturesDokumen5 halamanCapital Structure, The Determinants and FeaturesRianto StgBelum ada peringkat

- IDT Corp. (NYSE: IDT) : Unlocking Value With One of The World's Best Capital AllocatorsDokumen55 halamanIDT Corp. (NYSE: IDT) : Unlocking Value With One of The World's Best Capital Allocatorsatgy1996Belum ada peringkat

- Formulas #1: Future Value of A Single Cash FlowDokumen4 halamanFormulas #1: Future Value of A Single Cash FlowVikram Sathish AsokanBelum ada peringkat

- Strategic Analysis For More Profitable AcquisitionsDokumen26 halamanStrategic Analysis For More Profitable Acquisitionsankur khudaniaBelum ada peringkat

- Navigating Planet Ad Tech: A Guide For MarketersDokumen10 halamanNavigating Planet Ad Tech: A Guide For Marketersgiorgiogarrido6Belum ada peringkat

- A Guide To Venture Capital Term SheetsDokumen22 halamanA Guide To Venture Capital Term Sheetsmlieberman0% (10)

- Understanding Bank Capital - A Primer - Money, Banking and Financial MarketsDokumen6 halamanUnderstanding Bank Capital - A Primer - Money, Banking and Financial Marketssm1205Belum ada peringkat

- Wisdom From Seth Klarman - Part 1Dokumen3 halamanWisdom From Seth Klarman - Part 1suresh420Belum ada peringkat

- 2013 06 Greenwald Earnings Power Value EPV Lecture SlidesDokumen43 halaman2013 06 Greenwald Earnings Power Value EPV Lecture Slidesgiorgiogarrido6Belum ada peringkat

- Behind the Curve: An Analysis of the Investment Behavior of Private Equity FundsDari EverandBehind the Curve: An Analysis of the Investment Behavior of Private Equity FundsBelum ada peringkat

- IBIG 06 01 Three Statements 30 Minutes BlankDokumen5 halamanIBIG 06 01 Three Statements 30 Minutes BlankSiddesh NaikBelum ada peringkat

- Brigham Test Bank Stocks PDFDokumen82 halamanBrigham Test Bank Stocks PDFBryant Lee Yurag100% (1)

- Corporate Strategy and Shareholder Value: Howard E. JohnsonDokumen24 halamanCorporate Strategy and Shareholder Value: Howard E. Johnsonprabhat127Belum ada peringkat

- Cashflow.comDokumen40 halamanCashflow.comad9292Belum ada peringkat

- Convertible Preferred StockDokumen3 halamanConvertible Preferred StockManojit Ghatak100% (1)

- Sequoia Fund Investor Day 2014Dokumen24 halamanSequoia Fund Investor Day 2014CanadianValueBelum ada peringkat

- Tollymore Letters To Partners Dec 2021Dokumen193 halamanTollymore Letters To Partners Dec 2021TBoone0Belum ada peringkat

- Chapter7DistressedDebtInvestments Rev2a HKBComments 08-02-14 SGMReplyDokumen40 halamanChapter7DistressedDebtInvestments Rev2a HKBComments 08-02-14 SGMReplyJamesThoBelum ada peringkat

- UNIT 5 Working Capital FinancingDokumen24 halamanUNIT 5 Working Capital FinancingParul varshneyBelum ada peringkat

- Sample Financial Analysis ReportDokumen19 halamanSample Financial Analysis Reportdk1020100% (2)

- Arlington Value 2014 Annual Letter PDFDokumen8 halamanArlington Value 2014 Annual Letter PDFChrisBelum ada peringkat

- For InterviewsDokumen6 halamanFor InterviewsBill LeeBelum ada peringkat

- MRO 2017 Aeroturbine and AJW PG 52Dokumen170 halamanMRO 2017 Aeroturbine and AJW PG 52giorgiogarrido6Belum ada peringkat

- Profiles in Investing - Marty Whitman (Bottom Line 2004)Dokumen1 halamanProfiles in Investing - Marty Whitman (Bottom Line 2004)tatsrus1Belum ada peringkat

- Financial Statement Analysis - Concept Questions and Solutions - Chapter 8Dokumen30 halamanFinancial Statement Analysis - Concept Questions and Solutions - Chapter 8Arshdeep Singh50% (2)

- Platform EconomicsDokumen459 halamanPlatform Economicsgiorgiogarrido6100% (1)

- If I Would Like To Protect My Downside, How Would I Structure The Investment?Dokumen6 halamanIf I Would Like To Protect My Downside, How Would I Structure The Investment?helloBelum ada peringkat

- CFROIDokumen15 halamanCFROImakrantjiBelum ada peringkat

- CFA Equity Research Challenge 2011 - Team 9Dokumen15 halamanCFA Equity Research Challenge 2011 - Team 9Rohit KadamBelum ada peringkat

- Reformulation - Analysis of SCFDokumen17 halamanReformulation - Analysis of SCFAkib Mahbub KhanBelum ada peringkat

- Value Investors Club - ATHENE HOLDING LTD (ATH) PDFDokumen12 halamanValue Investors Club - ATHENE HOLDING LTD (ATH) PDFgilforbesBelum ada peringkat

- 23 LboDokumen15 halaman23 LboBhagaban DasBelum ada peringkat

- ACCT421 Detailed Course Outline, Term 2 2019-20 (Prof Andrew Lee) PDFDokumen7 halamanACCT421 Detailed Course Outline, Term 2 2019-20 (Prof Andrew Lee) PDFnixn135Belum ada peringkat

- Arlington Value 2006 Annual Shareholder LetterDokumen5 halamanArlington Value 2006 Annual Shareholder LetterSmitty WBelum ada peringkat

- Mick McGuire Value Investing Congress Presentation Marcato Capital ManagementDokumen70 halamanMick McGuire Value Investing Congress Presentation Marcato Capital ManagementscottleeyBelum ada peringkat

- Becton Dickinson BDX Thesis East Coast Asset MGMTDokumen12 halamanBecton Dickinson BDX Thesis East Coast Asset MGMTWinstonBelum ada peringkat

- Valuation Errors - HBSDokumen13 halamanValuation Errors - HBSlaliaisondangereuseBelum ada peringkat

- MGM Stock PitchDokumen1 halamanMGM Stock Pitchapi-545367999Belum ada peringkat

- Private Debt Investor Special ReportDokumen7 halamanPrivate Debt Investor Special ReportB.C. MoonBelum ada peringkat

- Graham & Doddsville - Issue 20 - Winter 2014 - FinalDokumen68 halamanGraham & Doddsville - Issue 20 - Winter 2014 - Finalbpd3kBelum ada peringkat

- Tiburon Systemic Risk PresentationDokumen12 halamanTiburon Systemic Risk PresentationDistressedDebtInvestBelum ada peringkat

- Leverage Buyout - LBO Analysis: Investment Banking TutorialsDokumen26 halamanLeverage Buyout - LBO Analysis: Investment Banking Tutorialskarthik sBelum ada peringkat

- WSO ResumeDokumen1 halamanWSO ResumeJohn MathiasBelum ada peringkat

- A Ray of Hope For The Asset Market: Energy - Oil & Gas Exploration & ProductionDokumen50 halamanA Ray of Hope For The Asset Market: Energy - Oil & Gas Exploration & ProductionAshokBelum ada peringkat

- Starboard Value LP LetterDokumen4 halamanStarboard Value LP Lettersumit.bitsBelum ada peringkat

- Applied Corporate Finance: Journal ofDokumen15 halamanApplied Corporate Finance: Journal ofFilouBelum ada peringkat

- Kenya Medical Comprehensive Report (Draft)Dokumen207 halamanKenya Medical Comprehensive Report (Draft)KhusokoBelum ada peringkat

- Goldman Sachs Presentation To Credit Suisse Financial Services ConferenceDokumen20 halamanGoldman Sachs Presentation To Credit Suisse Financial Services ConferenceEveline WangBelum ada peringkat

- Elevator Pitch DraftDokumen2 halamanElevator Pitch DraftJack JacintoBelum ada peringkat

- Alta Fox JYNT Long - Final Version PDFDokumen38 halamanAlta Fox JYNT Long - Final Version PDFJerry HsiangBelum ada peringkat

- Summary New Venture ManagementDokumen57 halamanSummary New Venture Managementbetter.bambooBelum ada peringkat

- A Note On Venture Capital IndustryDokumen9 halamanA Note On Venture Capital Industryneha singhBelum ada peringkat

- Capital StructureDokumen11 halamanCapital StructureSathya Bharathi100% (1)

- 2012 q3 Letter DdicDokumen5 halaman2012 q3 Letter DdicDistressedDebtInvestBelum ada peringkat

- RV Capital June 2015 LetterDokumen8 halamanRV Capital June 2015 LetterCanadianValueBelum ada peringkat

- Cadbury Trian LetterDokumen14 halamanCadbury Trian Letterbillroberts981Belum ada peringkat

- Yacktman PresentationDokumen34 halamanYacktman PresentationVijay MalikBelum ada peringkat

- Private Equity Unchained: Strategy Insights for the Institutional InvestorDari EverandPrivate Equity Unchained: Strategy Insights for the Institutional InvestorBelum ada peringkat

- Capital Structure and Profitability: S&P 500 Enterprises in the Light of the 2008 Financial CrisisDari EverandCapital Structure and Profitability: S&P 500 Enterprises in the Light of the 2008 Financial CrisisBelum ada peringkat

- Survival Rates of Service Business - StudyDokumen14 halamanSurvival Rates of Service Business - Studygiorgiogarrido6Belum ada peringkat

- Arisaig Quarterly: The Great Disconnect I: Stocks and Economic ActivityDokumen13 halamanArisaig Quarterly: The Great Disconnect I: Stocks and Economic Activitygiorgiogarrido6Belum ada peringkat

- Wp-Content Uploads Sites 3 2014 12 Reading List For Life and Investment Fundamentals 101Dokumen2 halamanWp-Content Uploads Sites 3 2014 12 Reading List For Life and Investment Fundamentals 101giorgiogarrido6Belum ada peringkat

- Rail RenaissanceDokumen27 halamanRail RenaissanceEvan TindellBelum ada peringkat

- LBS - Massimo Fuggeta Investment Theory Vs PractuceDokumen26 halamanLBS - Massimo Fuggeta Investment Theory Vs Practucegiorgiogarrido6Belum ada peringkat

- A Valuation of ABB Comparison of Organic and M A Growth StrategiesDokumen113 halamanA Valuation of ABB Comparison of Organic and M A Growth Strategiesgiorgiogarrido6Belum ada peringkat

- The State of The LandscapeDokumen5 halamanThe State of The Landscapegiorgiogarrido6Belum ada peringkat

- Theory of Accounts-ReviewerDokumen27 halamanTheory of Accounts-ReviewerJeane BongalanBelum ada peringkat

- 08 Handout 1 PDFDokumen3 halaman08 Handout 1 PDFJeffer Jay GubalaneBelum ada peringkat

- Edison Investment Research PolyMet ReportDokumen16 halamanEdison Investment Research PolyMet ReportSteve TimmerBelum ada peringkat

- Week 4 - ch16Dokumen52 halamanWeek 4 - ch16bafsvideo4Belum ada peringkat

- Document 5Dokumen17 halamanDocument 5Mika MolinaBelum ada peringkat

- Company Equity Enterprise Value Sales Gross Profit: Market Valuation LTM Financial StatisticsDokumen34 halamanCompany Equity Enterprise Value Sales Gross Profit: Market Valuation LTM Financial StatisticsRafał StaniszewskiBelum ada peringkat

- CH 17Dokumen39 halamanCH 17IreneBelum ada peringkat

- Financial Statement Analysis and Value Investing: Xinjie MaDokumen89 halamanFinancial Statement Analysis and Value Investing: Xinjie MaXinjie MaBelum ada peringkat

- Chapter 17 EPS 13th EdDokumen67 halamanChapter 17 EPS 13th EdAryan ShahBelum ada peringkat

- What3words2 w3w Investment Explainer Ordinary Shares EngDokumen5 halamanWhat3words2 w3w Investment Explainer Ordinary Shares Engpokerbrot88Belum ada peringkat

- Income Based ValuationDokumen25 halamanIncome Based ValuationApril Joy ObedozaBelum ada peringkat

- Chapter 10 Subsidiary Preferred StockDokumen28 halamanChapter 10 Subsidiary Preferred StockNicolas ErnestoBelum ada peringkat

- Curefoods Board CTC Allotment of CCPS PDFDokumen18 halamanCurefoods Board CTC Allotment of CCPS PDFAbhishekShubhamGabrielBelum ada peringkat

- Flexionmobile Company DescriptionDokumen61 halamanFlexionmobile Company DescriptionBob GoodBelum ada peringkat

- U.S. Century Bank Stock Conversion LawsuitDokumen26 halamanU.S. Century Bank Stock Conversion LawsuitDave MinskyBelum ada peringkat

- Glaucus Research - ItochuDokumen42 halamanGlaucus Research - ItochuChen JinghanBelum ada peringkat

- ANSWERS Second Term Sheet Mar2022Dokumen2 halamanANSWERS Second Term Sheet Mar2022AvinashSinghBelum ada peringkat

- MFRS133-LECTURE NOTES 1-FAR570 For StudentsDokumen20 halamanMFRS133-LECTURE NOTES 1-FAR570 For StudentsJICBelum ada peringkat

- Some New Evidence On Why Companies Use Convertible BondsDokumen12 halamanSome New Evidence On Why Companies Use Convertible BondsferinadBelum ada peringkat

- FARAP-4517Dokumen4 halamanFARAP-4517Accounting StuffBelum ada peringkat

- MetaCarta CaseDokumen7 halamanMetaCarta Casejack stauberBelum ada peringkat

- 2011 - ZÄHRES - Contingent Convertibles - Bank Bonds Take On A New LookDokumen20 halaman2011 - ZÄHRES - Contingent Convertibles - Bank Bonds Take On A New LookarchonVBelum ada peringkat