55 - Introducing - Holistic - Stress Testing PDF

Diunggah oleh

Senghy MaoDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

55 - Introducing - Holistic - Stress Testing PDF

Diunggah oleh

Senghy MaoHak Cipta:

Format Tersedia

McKinsey Working Papers on Risk, Number 55

Introducing a holistic approach to

stress testing

Christopher Mazingo

Theodore Pepanides

Aleksander Petrov

Gerhard Schrck

June 2014

Copyright 2014 McKinsey & Company

Introducing a holistic approach to stress testing

In the beginning, stress tests were ad hoc initiatives launched by national regulators to assess the current

state of their domestic banking industry in the aftermath of severe external shocks. Increasingly, however, they

are becoming regular features of the ongoing regulatory process. While initial stress-testing exercises mainly

focused on capital adequacy, looking in particular at capital ratios, more recent tests have placed greater

emphasis on qualitative and quantitative modules to evaluate broader risks within banks. Stress testing has

now become one of the regulators main tools for regularly assessing the health of supervised banks. Banks

operating internationally (for example, non-US-owned banks with major US operations) will face multiple and

more comprehensive stress-testing requirements to satisfy both home country and host country requirements.

Stress tests are cost-intensive endeavors. They demand a large number of dedicated employees and the

active involvement across virtually the entire organizationrisk, finance, treasury, business units, audit, senior

management, and the board of directors. Additionally, a failure to comply with a regulators requirements

could result in severe penalties, for example, a mandatory recapitalization, forced sale of operating units and

portfolios, and management changes. It has therefore become a key priority for banks to develop an effective

and cost-efficient approach to stress testing.

For the original round of tests, there was a necessary focus on data collection and mechanisms to allow an

unfiltered transfer of information to relevant evaluators. However, the latest rounds of testing focus much

more significantly on the quality of banks internal risk management and capital planning processesit has

become increasingly important that banks are able to demonstrate to supervisors the quality and robustness

of their internal capabilities in capital planning and stress-testing analysis. Banks can benefit from taking a

more proactive approach, for instance, by developing extensive commentary on their analyses and frequently

communicating with regulators. Like other regulatory requirements, a stress test is essentially a process, and

Impact on evaluation

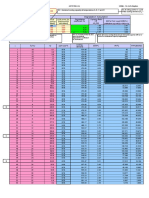

Exhibit Seven steps can help banks develop better stress tests.

Module 1:

Data

preparation

Module 2:

Strategic

PMO1

Single point

of contact

with

evaluator

Standard

and clear

data

structure

First-time-

right

response

to questions

Validated

data integrity

(reconciled

with balance

sheet)

Adequate

Dedicated

data team

senior

leadership

and

attention

Module 3:

Robust

methodologies

Certified

impairment

and EL2

methodology

Thorough

forwardlooking P&L3

and balancesheet

forecasting

Forward-

looking

regulatoryratioprojection

methodology

Module 4:

Superior portfolio analytics

Granular

bottom-up

portfolio

stress-testing

models

Capabilities

to reverseengineer key

assumptions

Deep under-

standing of

(asset)

valuation and

classification

Module 5:

Persuasive

communication

Overarching

story aligned

throughout

organization

Thorough

description of

priority portfolios and LE4

strategies

Confident

executives

with deep

knowledge

of portfolios

and related

strategies

Communication backed

by analysis

and data

Degree of preparedness and sophistication

1 Project-management office.

2 Estimated loss.

3 Profit and loss.

4 Loss estimation.

Module 6:

Macroscenarios and

correlations

Strong in-

house

capabilities

to develop

economic

scenarios

Econometric

models

linking

macroeconomic

parameters

to portfolio

risk factors

and bankperformance

drivers

Superior

ability to

provide

context and

comparison

Module 7:

Stress-testing

model

A stress-

testing

model

aggregating

individual

portfolios

Asset-

liability

modeling

functionality

Advanced

capabilities

to run

reverse

stress tests

Concrete

management action

plan,

coupled with

strong board

governance

it can be made more efficient with regard to time and costs, particularly if banks realize the need for a clearly

articulated and internally aligned story line. This working paper sets out a seven-module process, starting with

thorough data preparation and extending to a clear communication strategy and comprehensive modeling of

macroscenarios (exhibit).

Module 1: Data preparation

The starting point of each stress-testing exercise is the preparation of data tapes. For this step, it is essential

to provide the evaluator with a comprehensive and easy-to-navigate data set augmented by an authoritative

commentary that seeks to explain and interpret the data. Also, it is vital to ensure integrity between reporting

and accounting data sets. For these purposes, banks can benefit from the creation of a dedicated data team

responsible for data aggregation as well as for responding in a timely fashion, often under severe pressure, to

evaluators requests.

Module 2: Strategic project-management office (PMO)

In some banks, stress testing is seen more as an operational than a strategic task, and consequently it receives

relatively littleor even notop-management attention and buy-in. This can be overcome if a bank establishes

a strategic PMO. The PMO serves as single point of contact for the evaluator. It ensures the consistency and

alignment of all data submissions and communication. In addition, it is responsible for the active steering of the

entire stress-testing process and can significantly raise the likelihood of effective internal governance. Ideally,

the PMO consists of top managers from every relevant business function and is headed by a leader one level

below the CEO in the organization. Top-management involvement serves to highlight the importance of the

exercise to both internal and external stakeholders.

Module 3: Robust methodologies

Data models are at the core of each stress test. The creation of viable scenarios and the correct assessment

of their implications for the bank are essential. Often, the applied models neglect second-order effects,

external shocks, and other significant risk factors. In addition, many models are not robust with respect to the

scenarios effect on business volumes, revenues, and costs. Banks therefore need to initiate a forward-looking

projection of financial statements and their underlying drivers. They should also develop comprehensive

stress-testing manuals, including guidelines, standard processes, and best practices.

Module 4: Superior portfolio analytics

Regulators are increasingly focusing their evaluation on selected asset classes and portfolio types. In order to

forecast the behavior of specific portfolios under stress, banks need to establish granular bottom-up stresstesting models on a portfolio level, incorporating all risk types (for instance, credit, market, operational, and

liquidity risk). Only then can they assess the impact of various scenarios on their financial statements and

ratios. To make this convincing and compelling to the evaluators, banks need a deep understanding of their

applied methodologies so that their explanatory materials meet the necessary standard.

Module 5: Persuasive communication

Both internal and external communications are essential for an efficient stress-testing exercise. Banks therefore

need a clear communication strategy. An overarching story line not only helps to set the frame for future analyses

internally but also provides context for the regulators evaluation. Follow-up communication with regulators

should be precise, consistent, and fact based, which can help avoid uncertainties as well as misunderstandings.

It is vital that the bank representatives who present findings to regulators are as well prepared as possible

because an overly conservative assessment of the bank would have serious disadvantages.

Module 6: Macroscenarios and correlations

Banks often apply a black hole approach to developing stress-testing models. Their econometric models

fail to link macroeconomic factors and core banking drivers and usually are not based on historical data. In

Introducing a holistic approach to stress testing

many cases, banks also fail to provide any explanation as to how core drivers of their performance might be

counterintuitively sensitive to macroscenarios. This could raise concerns on the part of the evaluator and

lead to a conservative assessment. It is therefore advisable to build strong in-house capabilities for scenario

development and analysis. Additionally, banks should place high emphasis on developing sophisticated

stress-testing models that consider a wide range of macrotrends.

Module 7: Stress-testing model

It is important that stress tests are not seen as simply necessary and costly elements of a banks compliance with

regulatory requirements. Provided they are of sufficient quality, the data and analyses required to fulfill a test can

serve as a strong base for strategic decisions. Banks should create central risk-aggregator models designed

to combine individual portfolio results from business lines and incorporate forward-planning assumptions.

Banks also need to develop capabilities for reverse stress testing, allowing them to assess the impact of potential

strategic actions on key ratios and financial statements. Finally, they need to ensure that stress tests are followed

by concrete action plans with full account taken of governance, processes, and responsibilities.

Stress testing can be a painful and resource-consuming process for banks. Because the potential penalties

from a poor assessment are so severe, there is little room for inefficiencies or, worse, actual mistakes. Given

the recent announcement of multiple stress-testing initiatives, we can be confident that this will remain the

case for most banks that operate internationally. Due to tight deadlines and increasingly detailed regulatory

requests, the bare submission of unexplained data is no longer feasible. An efficient approach to stress testing

must involve a comprehensive and annotated data tape, outstanding modeling capabilities, stringent process

management, and clear-cut internal and external communications. The seven-step process introduced in this

paper suggests that the real aspiration for senior managers should be to use a mandatory and apparently longlasting regulatory requirement to trigger improvements in how they make strategic decisions.

Christopher Mazingo is a principal in McKinseys New York office, Theodore Pepanides is a principal in

the Athens office, Aleksander Petrov is a principal in the Milan office, and Gerhard Schrck is a principal

in the Frankfurt office.

Contact for distribution: Francine Martin

Phone: +1 (514) 939-6940

E-mail: Francine_Martin@mckinsey.com

McKinsey Working Papers on Risk

1.

The risk revolution

Kevin Buehler, Andrew Freeman, and Ron Hulme

2.

Making risk management a value-added function in the boardroom

Andr Brodeur and Gunnar Pritsch

3.

Incorporating risk and flexibility in manufacturing footprint decisions

Eric Lamarre, Martin Pergler, and Gregory Vainberg

4.

Liquidity: Managing an undervalued resource in banking after the

crisis of 200708

Alberto Alvarez, Claudio Fabiani, Andrew Freeman, Matthias Hauser,

Thomas Poppensieker, and Anthony Santomero

5.

Turning risk management into a true competitive advantage: Lessons from

the recent crisis

Andrew Freeman, Gunnar Pritsch, and Uwe Stegemann

6.

Probabilistic modeling as an exploratory decision-making tool

Andrew Freeman and Martin Pergler

7.

Option games: Filling the hole in the valuation toolkit for strategic investment

Nelson Ferreira, Jayanti Kar, and Lenos Trigeorgis

8.

Shaping strategy in a highly uncertain macroeconomic environment

Natalie Davis, Stephan Grner, and Ezra Greenberg

9.

Upgrading your risk assessment for uncertain times

Eric Lamarre and Martin Pergler

10. Responding to the variable annuity crisis

Dinesh Chopra, Onur Erzan, Guillaume de Gantes, Leo Grepin, and Chad Slawner

11. Best practices for estimating credit economic capital

Tobias Baer, Venkata Krishna Kishore, and Akbar N. Sheriff

12. Bad banks: Finding the right exit from the financial crisis

Gabriel Brennan, Martin Fest, Matthias Heuser, Luca Martini, Thomas Poppensieker,

Sebastian Schneider, Uwe Stegemann, and Eckart Windhagen

13. Developing a postcrisis funding strategy for banks

Arno Gerken, Matthias Heuser, and Thomas Kuhnt

14. The National Credit Bureau: A key enabler of financial infrastructure and

lending in developing economies

Tobias Baer, Massimo Carassinu, Andrea Del Miglio, Claudio Fabiani, and

Edoardo Ginevra

15. Capital ratios and financial distress: Lessons from the crisis

Kevin Buehler, Christopher Mazingo, and Hamid Samandari

16. Taking control of organizational risk culture

Eric Lamarre, Cindy Levy, and James Twining

17. After black swans and red ink: How institutional investors can rethink

risk management

Leo Grepin, Jonathan Ttrault, and Greg Vainberg

18. A board perspective on enterprise risk management

Andr Brodeur, Kevin Buehler, Michael Patsalos-Fox, and Martin Pergler

19. Variable annuities in Europe after the crisis: Blockbuster or niche product?

Lukas Junker and Sirus Ramezani

20. Getting to grips with counterparty risk

Nils Beier, Holger Harreis, Thomas Poppensieker, Dirk Sojka, and Mario Thaten

EDITORIAL BOARD

Rob McNish

Managing Editor

Director

Washington, DC

rob_mcnish@mckinsey.com

Martin Pergler

Senior Expert

Montral

Anthony Santomero

External Adviser

New York

Hans-Helmut Kotz

External Adviser

Frankfurt

Andrew Freeman

External Adviser

London

McKinsey Working Papers on Risk

21. Credit underwriting after the crisis

Daniel Becker, Holger Harreis, Stefano E. Manzonetto,

Marco Piccitto, and Michal Skalsky

22. Top-down ERM: A pragmatic approach to manage risk from

the C-suite

Andr Brodeur and Martin Pergler

Theodore Pepanides, Aleksander Petrov, Konrad Richter, and

Uwe Stegemann

36. Day of reckoning for European retail banking

Dina Chumakova, Miklos Dietz, Tamas Giorgadse, Daniela Gius,

Philipp Hrle, and Erik Lders

23. Getting risk ownership right

Arno Gerken, Nils Hoffmann, Andreas Kremer, Uwe Stegemann,

and Gabriele Vigo

37. First-mover matters: Building credit monitoring for

competitive advantage

Bernhard Babel, Georg Kaltenbrunner, Silja Kinnebrock,

Luca Pancaldi, Konrad Richter, and Sebastian Schneider

24. The use of economic capital in performance management for

banks: A perspective

Tobias Baer, Amit Mehta, and Hamid Samandari

38. Capital management: Bankings new imperative

Bernhard Babel, Daniela Gius, Alexander Grwert, Erik Lders,

Alfonso Natale, Bjrn Nilsson, and Sebastian Schneider

25. Assessing and addressing the implications of new financial

regulations for the US banking industry

Del Anderson, Kevin Buehler, Rob Ceske, Benjamin Ellis,

Hamid Samandari, and Greg Wilson

39. Commodity trading at a strategic crossroad

Jan Ascher, Paul Laszlo, and Guillaume Quiviger

26. Basel III and European banking: Its impact, how banks might

respond, and the challenges of implementation

Philipp Hrle, Erik Lders, Theo Pepanides, Sonja Pfetsch,

Thomas Poppensieker, and Uwe Stegemann

27. Mastering ICAAP: Achieving excellence in the new world of

scarce capital

Sonja Pfetsch, Thomas Poppensieker, Sebastian Schneider, and

Diana Serova

28. Strengthening risk management in the US public sector

Stephan Braig, Biniam Gebre, and Andrew Sellgren

29. Day of reckoning? New regulation and its impact on capital

markets businesses

Markus Bhme, Daniele Chiarella, Philipp Hrle, Max Neukirchen,

Thomas Poppensieker, and Anke Raufuss

30. New credit-risk models for the unbanked

Tobias Baer, Tony Goland, and Robert Schiff

31. Good riddance: Excellence in managing wind-down portfolios

Sameer Aggarwal, Keiichi Aritomo, Gabriel Brenna, Joyce Clark,

Frank Guse, and Philipp Hrle

32. Managing market risk: Today and tomorrow

Amit Mehta, Max Neukirchen, Sonja Pfetsch, and

Thomas Poppensieker

33. Compliance and Control 2.0: Unlocking potential through

compliance and quality-control activities

Stephane Alberth, Bernhard Babel, Daniel Becker,

Georg Kaltenbrunner, Thomas Poppensieker, Sebastian Schneider,

and Uwe Stegemann

34. Driving value from postcrisis operational risk management :

A new model for financial institutions

Benjamin Ellis, Ida Kristensen, Alexis Krivkovich, and

Himanshu P. Singh

35. So many stress tests, so little insight: How to connect the

engine room to the boardroom

Miklos Dietz, Cindy Levy, Ernestos Panayiotou,

40. Enterprise risk management: Whats different in the

corporate world and why

Martin Pergler

41. Between deluge and drought: The divided future of European

bank-funding markets

Arno Gerken, Frank Guse, Matthias Heuser, Davide Monguzzi,

Olivier Plantefeve, and Thomas Poppensieker

42. Risk-based resource allocation: Focusing regulatory and

enforcement efforts where they are needed the most

Diana Farrell, Biniam Gebre, Claudia Hudspeth, and

Andrew Sellgren

43. Getting to ERM: A road map for banks and other financial

institutions

Rob McNish, Andreas Schlosser, Francesco Selandari,

Uwe Stegemann, and Joyce Vorholt

44. Concrete steps for CFOs to improve strategic risk

management

Wilson Liu and Martin Pergler

45. Between deluge and drought: Liquidity and funding for

Asian banks

Alberto Alvarez, Nidhi Bhardwaj, Frank Guse, Andreas Kremer,

Alok Kshirsagar, Erik Lders, Uwe Stegemann, and

Naveen Tahilyani

46. Managing third-party risk in a changing regulatory

environment

Dmitry Krivin, Hamid Samandari, John Walsh, and Emily Yueh

47. Next-generation energy trading: An opportunity to optimize

Sven Heiligtag, Thomas Poppensieker, and Jens Wimschulte

48. Between deluge and drought: The future of US bank liquidity

and funding

Kevin Buehler, Peter Noteboom, and Dan Williams

49. The hypotenuse and corporate risk modeling

Martin Pergler

50. Strategic choices for midstream gas companies: Embracing

Gas Portfolio @ Risk

Cosimo Corsini, Sven Heiligtag, and Dieuwert Inia

McKinsey Working Papers on Risk

51. Strategic commodity and cash-flow-at-risk modeling

for corporates

Martin Pergler and Anders Rasmussen

54. Europes wholesale gas market: Innovate to survive

Cosimo Corsini, Sven Heiligtag, Marco Moretti, and

Johann Raunig

52. A risk-management approach to a successful infrastructure

project: Initiation, financing, and execution

Frank Beckers, Nicola Chiara, Adam Flesch, Jiri Maly, Eber Silva,

and Uwe Stegemann

55. Introducing a holistic approach to stress testing

Christopher Mazingo, Theodore Pepanides, Aleksander Petrov,

and Gerhard Schrck

53. Enterprise-risk-management practices: Wheres the

evidence? A survey across two European industries

Sven Heiligtag, Andreas Schlosser, and Uwe Stegemann

McKinsey Working Papers on Risk

June 2014

Designed by Global Editorial Services

Copyright McKinsey & Company

www.mckinsey.com

Anda mungkin juga menyukai

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (120)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Grade 11 - Life Science - November Paper 2-1 - MemoDokumen8 halamanGrade 11 - Life Science - November Paper 2-1 - MemoJustinCase19910% (1)

- QRG-DC-004 Procedure and Regulation Governing The Requirements For CPWDokumen56 halamanQRG-DC-004 Procedure and Regulation Governing The Requirements For CPWKarthi Keyan100% (2)

- Cervical Changes During Menstrual Cycle (Photos)Dokumen9 halamanCervical Changes During Menstrual Cycle (Photos)divyanshu kumarBelum ada peringkat

- Ashrae - Basic Chiller Plant DesignDokumen59 halamanAshrae - Basic Chiller Plant DesignAmro Metwally El Hendawy100% (3)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Case Study of Flixborough UK DisasterDokumen52 halamanCase Study of Flixborough UK Disasteraman shaikhBelum ada peringkat

- Prepositional Phrase Worksheet ReviewDokumen2 halamanPrepositional Phrase Worksheet ReviewSenghy MaoBelum ada peringkat

- EcodialAdvanceCalculation HelpDokumen64 halamanEcodialAdvanceCalculation HelpMohammed Haseeb O100% (1)

- WS75 9TK (20200223)Dokumen19 halamanWS75 9TK (20200223)Senghy MaoBelum ada peringkat

- Viron P320 XT Variable Speed Pump: DescriptionDokumen1 halamanViron P320 XT Variable Speed Pump: DescriptionSenghy MaoBelum ada peringkat

- Msmaworkshop 10Dokumen4 halamanMsmaworkshop 10Senghy MaoBelum ada peringkat

- Electrical Fire Prevension GuideDokumen34 halamanElectrical Fire Prevension GuideDhanushka RathnasooriyaBelum ada peringkat

- TF 16401636Dokumen2 halamanTF 16401636Senghy MaoBelum ada peringkat

- LPG CalculationDokumen4 halamanLPG CalculationSenghy MaoBelum ada peringkat

- WS75 9TK (20200223)Dokumen19 halamanWS75 9TK (20200223)Senghy MaoBelum ada peringkat

- Uae Fire and Life Safety Code of Practice - Without Links 02Dokumen738 halamanUae Fire and Life Safety Code of Practice - Without Links 02wisamsalu100% (9)

- Uae Fire and Life Safety Code of Practice - Without Links 02Dokumen738 halamanUae Fire and Life Safety Code of Practice - Without Links 02wisamsalu100% (9)

- Gas Cylinder StandardDokumen13 halamanGas Cylinder StandardSenghy MaoBelum ada peringkat

- COPIFGuidelinesDokumen86 halamanCOPIFGuidelinesSenghy MaoBelum ada peringkat

- BSB - Series New PDFDokumen47 halamanBSB - Series New PDFSenghy MaoBelum ada peringkat

- Aqua Designer63 ManualDokumen278 halamanAqua Designer63 ManualJose Alberto Muñoz FloresBelum ada peringkat

- Fs2011 FullDokumen242 halamanFs2011 FullryankckoBelum ada peringkat

- W 17G1+17G2 v1.1 EnglishDokumen66 halamanW 17G1+17G2 v1.1 EnglishSenghy MaoBelum ada peringkat

- Chapter 6 - Fire Fighting SystemsDokumen23 halamanChapter 6 - Fire Fighting SystemsBalgo BalgobinBelum ada peringkat

- American Society of Sanitary EngineeringDokumen16 halamanAmerican Society of Sanitary EngineeringSenghy MaoBelum ada peringkat

- Notebook SWmanual v3.4 FinalDokumen119 halamanNotebook SWmanual v3.4 Finalfu ckBelum ada peringkat

- 35 Cooling and Heating Load CalculationsDokumen21 halaman35 Cooling and Heating Load CalculationsPRASAD326100% (32)

- Handbook On Building Fire CodesDokumen287 halamanHandbook On Building Fire Codesmz1234567100% (1)

- Msi WS75 9TKDokumen5 halamanMsi WS75 9TKSenghy MaoBelum ada peringkat

- SingaporeDokumen550 halamanSingaporeJLim100% (1)

- 07/06/2019 427071582.xls Chiller - Fix CAP+Stepless: Degradation CalculationDokumen7 halaman07/06/2019 427071582.xls Chiller - Fix CAP+Stepless: Degradation CalculationselisenBelum ada peringkat

- Cummins Installation Manual DFAA DFAB DFAC DFBC DFBF DFBD DFBE DFBF DFCB DFCC DFCE DFEB DFEC DFED DFFA DFFB DFGA DFGB DFGC DFJA DFJB DFJC DFJD DFLA DFLB DFLC DFLD DFLE DFMB DQAA DQAB DQBA DQBBDokumen102 halamanCummins Installation Manual DFAA DFAB DFAC DFBC DFBF DFBD DFBE DFBF DFCB DFCC DFCE DFEB DFEC DFED DFFA DFFB DFGA DFGB DFGC DFJA DFJB DFJC DFJD DFLA DFLB DFLC DFLD DFLE DFMB DQAA DQAB DQBA DQBBSenghy MaoBelum ada peringkat

- 1000 KW Cummins Diesel Generator Set - Non EPA TP-C1000-T1-60Dokumen5 halaman1000 KW Cummins Diesel Generator Set - Non EPA TP-C1000-T1-60Senghy MaoBelum ada peringkat

- ASHRAE 62.1 Falcon ChapterDokumen23 halamanASHRAE 62.1 Falcon ChapterSenghy Mao100% (1)

- Certified Graphics Hardware - Autodesk Knowledge NetworkDokumen6 halamanCertified Graphics Hardware - Autodesk Knowledge NetworkSenghy MaoBelum ada peringkat

- 2009 HSC Exam Chemistry PDFDokumen38 halaman2009 HSC Exam Chemistry PDFlillianaBelum ada peringkat

- CGMP Training ToolDokumen21 halamanCGMP Training Toolbabusure99Belum ada peringkat

- Chapter 3.2 Futures HedgingDokumen19 halamanChapter 3.2 Futures HedginglelouchBelum ada peringkat

- Legg Calve Perthes DiseaseDokumen97 halamanLegg Calve Perthes Diseasesivaram siddaBelum ada peringkat

- Msds Aluminium SulfatDokumen5 halamanMsds Aluminium SulfatduckshaBelum ada peringkat

- Government of Tamilnadu Directorate of Legal Studies: Inter-Collegeiate State Level Moot Court Competition-2022Dokumen30 halamanGovernment of Tamilnadu Directorate of Legal Studies: Inter-Collegeiate State Level Moot Court Competition-2022Divya SrinimmiBelum ada peringkat

- Dig Inn Early Summer MenuDokumen2 halamanDig Inn Early Summer MenuJacqueline CainBelum ada peringkat

- A-V300!1!6-L-GP General Purpose Potable Water Commercial Industrial Hi-Flo Series JuDokumen2 halamanA-V300!1!6-L-GP General Purpose Potable Water Commercial Industrial Hi-Flo Series JuwillgendemannBelum ada peringkat

- Physio Essay #4Dokumen2 halamanPhysio Essay #4Maria Margarita Chon100% (1)

- Quiz BowlDokumen36 halamanQuiz BowlSherry GonzagaBelum ada peringkat

- De Thi Chon HSGDokumen10 halamanDe Thi Chon HSGKiều TrangBelum ada peringkat

- ARS122 Engine Spare Part Catalogue PDFDokumen134 halamanARS122 Engine Spare Part Catalogue PDFIrul Umam100% (1)

- Stress Relieving, Normalising and Annealing: Datasheet For Non-Heat-TreatersDokumen2 halamanStress Relieving, Normalising and Annealing: Datasheet For Non-Heat-TreatersGani PateelBelum ada peringkat

- 120-202 Lab Manual Spring 2012Dokumen107 halaman120-202 Lab Manual Spring 2012evacelon100% (1)

- Senior Cohousing - Sherry Cummings, Nancy P. KropfDokumen86 halamanSenior Cohousing - Sherry Cummings, Nancy P. KropfAnastasia JoannaBelum ada peringkat

- Differential Partitioning of Betacyanins and Betaxanthins Employing Aqueous Two Phase ExtractionDokumen8 halamanDifferential Partitioning of Betacyanins and Betaxanthins Employing Aqueous Two Phase ExtractionPaul Jefferson Flores HurtadoBelum ada peringkat

- Labor EstimateDokumen26 halamanLabor EstimateAngelica CabreraBelum ada peringkat

- Gut Health Elimination Diet Meal Plan FINALDokumen9 halamanGut Health Elimination Diet Meal Plan FINALKimmy BathamBelum ada peringkat

- Agriculture and FisheryDokumen5 halamanAgriculture and FisheryJolliven JamiloBelum ada peringkat

- Factors Associated With Early Pregnancies Among Adolescent Girls Attending Selected Health Facilities in Bushenyi District, UgandaDokumen12 halamanFactors Associated With Early Pregnancies Among Adolescent Girls Attending Selected Health Facilities in Bushenyi District, UgandaKIU PUBLICATION AND EXTENSIONBelum ada peringkat

- Ceilcote 222HT Flakeline+ds+engDokumen4 halamanCeilcote 222HT Flakeline+ds+englivefreakBelum ada peringkat

- Schools Division of Roxas CityDokumen4 halamanSchools Division of Roxas CityHuge Propalde EstolanoBelum ada peringkat

- Sasol Polymers PP HNR100Dokumen3 halamanSasol Polymers PP HNR100Albert FortunatoBelum ada peringkat

- App Guide EntelliGuard - G 09 - 2020 AplicacionDokumen100 halamanApp Guide EntelliGuard - G 09 - 2020 AplicacionjeorginagBelum ada peringkat

- 2013 Casel GuideDokumen80 halaman2013 Casel GuideBobe MarinelaBelum ada peringkat

- Helicopter Logging Operations - ThesisDokumen7 halamanHelicopter Logging Operations - ThesisAleš ŠtimecBelum ada peringkat