Foreign Institutional Investors A Study of Indian Firms & Investors

Diunggah oleh

Rashmi Ranjan Panigrahi0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

31 tayangan1 halamanFOREIGN INSTITUTIONAL INVESTORS A STUDY OF INDIAN FIRMS & INVESTORS

Judul Asli

Foreign Institutional Investors a Study of Indian Firms & Investors

Hak Cipta

© © All Rights Reserved

Format Tersedia

DOCX, PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniFOREIGN INSTITUTIONAL INVESTORS A STUDY OF INDIAN FIRMS & INVESTORS

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai DOCX, PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

31 tayangan1 halamanForeign Institutional Investors A Study of Indian Firms & Investors

Diunggah oleh

Rashmi Ranjan PanigrahiFOREIGN INSTITUTIONAL INVESTORS A STUDY OF INDIAN FIRMS & INVESTORS

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai DOCX, PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 1

FOREIGN INSTITUTIONAL INVESTORS: A STUDY OF INDIAN FIRMS & INVESTORS

Rashmi Ranjan Panigrahi 1

January, 2016

Paper type: Empirical Paper

ABSTRACT

This conceptual paper indicates and emphasizes on analysis of investor & Indian firms on foreign institutional

investors. The Indian government gives an open enticement to individuals, companies and other institutions to

invest directly or indirectly in India by adopted New Economic Policy in 1991 and they started investing in

various financial instruments of money market, capital market, forex market and capital assets of real estates

and production activities directly. The investment made in the financial securities directly or indirectly by

investors is termed as foreign institutional investors and investment in capital securities by investors known as

foreign direct investment. The study analyses the inter-firm differences in the foreign institutional investors

portfolio investment with respect to the Indian firms. These two types of foreign investment play an important

role in attracting the foreign capital with in the country. The purpose of this paper is to analyze the role of

foreign institutional investors in the development of economy. The net investments made by investors in the

proportionate share of gross purchases and gross sales is collected for the period of 1992 to 2014 to check the

compound annual growth rate of FIIs. To check the significant level of calculated CGR, the method of t-value is

used. It founds that the calculated values are significant and reliable to use. The other attempt made to check the

future predictions of net investment in their proportionate share that depicts the positive attitude of foreigners

toward India. This paper also revealed that SEBI & RBI are the major institutes to regulate & control the FIIs.

The Indian government always tries to attract more foreign capital by providing more safety & transparency to

investors with the measures suggested by these apex institutes. The percent increase to previous year method is

used to check the proportion and flows of Gross Investments, Direct Investments, and Net foreign Direct

Investment & Net Portfolio Investment in FIIs investment. The suggestion has given to the government to work

hard on this concept and make it more attractive by providing various opportunities and cutting investment

limits to pump more foreign capital in India. The firm specific characteristics studied are promoters

shareholding, firm size, systematic risk, price to book ratio, return on equity, dividend yield and export sales.

Measuring foreign institutional investors shareholding as a percentage of the total outstanding shares or as a

percentage of the total outstanding shares available for investment by the non-promoters category does not alter

the results.

Research design and Methodology: This is a concept paper and the researcher has adopted the method of

reviewing different research articles, research journals, and case studies, to collect data about foreign

institutional investors which is consequently incorporated as a concept paper drafted by the researcher.

Key Words: Foreign Institutional Investors, Foreign Capital, Financial Securities, Gross Purchases, Gross

Sales, Index & Stock Market.

Mr. Rashmi Ranjan Panigrahi, Lecturer in Finance, Finance, Dept- MBA/ MFC (Master of Finance and

Control)/ MCOM -Education, ARYA SCHOOL OF MANAGEMENT & IT, Bhubaneswar-751019, Contact

Details: 9778789570, panigrahirashmi176@gmail.com

Anda mungkin juga menyukai

- GST Towards A Rational and Simple Indirect Tax Structure - IJREAMV04I023802Dokumen8 halamanGST Towards A Rational and Simple Indirect Tax Structure - IJREAMV04I023802Rashmi Ranjan PanigrahiBelum ada peringkat

- Question of Environmental StudiesDokumen3 halamanQuestion of Environmental StudiesRashmi Ranjan PanigrahiBelum ada peringkat

- DEMONETIZATION at Innovations Cashless PDFDokumen8 halamanDEMONETIZATION at Innovations Cashless PDFRashmi Ranjan PanigrahiBelum ada peringkat

- Rules For Melodi On (Antakshari)Dokumen3 halamanRules For Melodi On (Antakshari)Rashmi Ranjan Panigrahi100% (1)

- MCQ Questions For MFCDokumen4 halamanMCQ Questions For MFCRashmi Ranjan PanigrahiBelum ada peringkat

- Foreign Institutional Investors - A STUDY OF Indian Firms & Investors PDFDokumen10 halamanForeign Institutional Investors - A STUDY OF Indian Firms & Investors PDFRashmi Ranjan PanigrahiBelum ada peringkat

- Basel Iii PDFDokumen141 halamanBasel Iii PDFprashant1kumar1malviBelum ada peringkat

- Gouranga Final Project 3Dokumen108 halamanGouranga Final Project 3Rashmi Ranjan PanigrahiBelum ada peringkat

- Rashmi1 3498Dokumen1.545 halamanRashmi1 3498Rashmi Ranjan Panigrahi50% (2)

- ArabunisaDokumen11 halamanArabunisaRashmi Ranjan PanigrahiBelum ada peringkat

- Shalu 1Dokumen10 halamanShalu 1Rashmi Ranjan PanigrahiBelum ada peringkat

- Principle of Business Management (4 Year Question)Dokumen2 halamanPrinciple of Business Management (4 Year Question)Rashmi Ranjan Panigrahi100% (1)

- Business EthicsDokumen10 halamanBusiness EthicsRashmi Ranjan Panigrahi100% (1)

- MCQ Questions For MFCDokumen4 halamanMCQ Questions For MFCRashmi Ranjan PanigrahiBelum ada peringkat

- B S M, Docx Unit-3Dokumen15 halamanB S M, Docx Unit-3Rashmi Ranjan PanigrahiBelum ada peringkat

- Rules For Melodi On (Antakshari)Dokumen3 halamanRules For Melodi On (Antakshari)Rashmi Ranjan Panigrahi100% (1)

- Lecture Notes On Environmental Studies: Institute of Aeronautical EngineeringDokumen72 halamanLecture Notes On Environmental Studies: Institute of Aeronautical EngineeringRashmi Ranjan PanigrahiBelum ada peringkat

- Project Report On Performance Appraisal of BSNLDokumen71 halamanProject Report On Performance Appraisal of BSNLRashmi Ranjan Panigrahi100% (1)

- Seminar Presentation On MAKE in INDIADokumen7 halamanSeminar Presentation On MAKE in INDIARashmi Ranjan PanigrahiBelum ada peringkat

- My Projet EditedDokumen57 halamanMy Projet EditedRashmi Ranjan PanigrahiBelum ada peringkat

- BS 02Dokumen32 halamanBS 02Rashmi Ranjan PanigrahiBelum ada peringkat

- Shalu 1Dokumen10 halamanShalu 1Rashmi Ranjan PanigrahiBelum ada peringkat

- Business Ethics: Course ObjectivesDokumen2 halamanBusiness Ethics: Course ObjectivesRashmi Ranjan PanigrahiBelum ada peringkat

- Arya School of Management & It: Event-: B Quiz (Final Round)Dokumen4 halamanArya School of Management & It: Event-: B Quiz (Final Round)Rashmi Ranjan PanigrahiBelum ada peringkat

- BCC 602-Principles and Practice of AuditingDokumen3 halamanBCC 602-Principles and Practice of AuditingRashmi Ranjan PanigrahiBelum ada peringkat

- Melodi On - (Antakshari)Dokumen19 halamanMelodi On - (Antakshari)Rashmi Ranjan PanigrahiBelum ada peringkat

- MB0048-Q2. A. Linear Programming Is A Mathematical Technique of Optimizing A LinearDokumen3 halamanMB0048-Q2. A. Linear Programming Is A Mathematical Technique of Optimizing A LinearRashmi Ranjan Panigrahi100% (1)

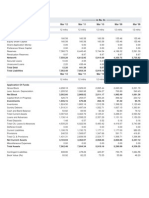

- Project Synopsis Of"financial Performance AnalysisDokumen5 halamanProject Synopsis Of"financial Performance AnalysisRashmi Ranjan Panigrahi100% (3)

- Principle of Business Management (4 Year Question)Dokumen2 halamanPrinciple of Business Management (4 Year Question)Rashmi Ranjan PanigrahiBelum ada peringkat

- How banks create credit through lending and expanding depositsDokumen9 halamanHow banks create credit through lending and expanding depositsRashmi Ranjan PanigrahiBelum ada peringkat

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Case: Financing Alibaba'S Buyout - Syndicated Loan in AsiaDokumen6 halamanCase: Financing Alibaba'S Buyout - Syndicated Loan in AsiaMohit KeshriBelum ada peringkat

- FMI Practice Questions (Final Exam)Dokumen53 halamanFMI Practice Questions (Final Exam)MirzaMuhammadBelum ada peringkat

- The Financial Environment:: Markets, Institutions, and Interest RatesDokumen30 halamanThe Financial Environment:: Markets, Institutions, and Interest Ratestopeq100% (1)

- Im CH-5Dokumen21 halamanIm CH-5Biruk Chuchu NigusuBelum ada peringkat

- Accounting 34 Module 8 AssignmentDokumen2 halamanAccounting 34 Module 8 AssignmentCzarina SalazarBelum ada peringkat

- Harshad MehtaDokumen32 halamanHarshad MehtaRoshankumar S PimpalkarBelum ada peringkat

- Largest Risks Facing The International Banking SystemDokumen24 halamanLargest Risks Facing The International Banking SystemflichuchaBelum ada peringkat

- Chapter-Four Financial InstrumentsDokumen15 halamanChapter-Four Financial InstrumentsAbdiBelum ada peringkat

- Geogit BNP Paribas ProjectDokumen54 halamanGeogit BNP Paribas ProjectAbdul Kadir ArsiwalaBelum ada peringkat

- Mutual Fund 100Q Set-2Dokumen69 halamanMutual Fund 100Q Set-2royal62034Belum ada peringkat

- Antique Daily - FMCGDokumen15 halamanAntique Daily - FMCGjaikamdar.finBelum ada peringkat

- FIN301-Financial Report-Aamra Technologies Limited.Dokumen9 halamanFIN301-Financial Report-Aamra Technologies Limited.Neong GhalleyBelum ada peringkat

- Fundamental Analysis of Bosch Ltd. CAGR Growth and Financial RatiosDokumen6 halamanFundamental Analysis of Bosch Ltd. CAGR Growth and Financial RatiosJeffry MahiBelum ada peringkat

- DT Mnemonics: Sucessforsure (SFS) Direct Taxation NotesDokumen4 halamanDT Mnemonics: Sucessforsure (SFS) Direct Taxation NoteschandreshBelum ada peringkat

- "Investment Analysis of J.P. Morgan Chase & Co": Final Project ReportDokumen51 halaman"Investment Analysis of J.P. Morgan Chase & Co": Final Project ReportindhuBelum ada peringkat

- Foundations of Digital Marketing and E-CommerceDokumen55 halamanFoundations of Digital Marketing and E-CommerceDương Hải DuyênBelum ada peringkat

- Dba 302 Financial Management Test 4TH March 2020 Part TimeDokumen6 halamanDba 302 Financial Management Test 4TH March 2020 Part Timemulenga lubembaBelum ada peringkat

- MessagingDokumen9 halamanMessagingHEMANT SARVANKARBelum ada peringkat

- 49304752.xls / Sheet1 1Dokumen3 halaman49304752.xls / Sheet1 1LaSassyMeliBelum ada peringkat

- Balance Sheet and P&L of CiplaDokumen2 halamanBalance Sheet and P&L of CiplaPratik AhluwaliaBelum ada peringkat

- Galanida, Lagumbay & Mendez - 09 TP 1 - GovernanceDokumen3 halamanGalanida, Lagumbay & Mendez - 09 TP 1 - GovernanceKate GalanidaBelum ada peringkat

- Valuation MultiplesDokumen4 halamanValuation MultiplesKamaBelum ada peringkat

- Financial Institutions Management A Risk Management Approach Saunders 7th Edition Test BankDokumen18 halamanFinancial Institutions Management A Risk Management Approach Saunders 7th Edition Test BankLeeSmithmjni100% (34)

- Credit RiskDokumen15 halamanCredit RiskjoshdreamzBelum ada peringkat

- Development of local currency bond markets in India: key reforms and experiencesDokumen33 halamanDevelopment of local currency bond markets in India: key reforms and experiencesRohit BhardwajBelum ada peringkat

- Tano Jay, Case Study Roma Bakery Financcial HealthDokumen3 halamanTano Jay, Case Study Roma Bakery Financcial HealthJAY MARK TANO100% (1)

- Sunway Holdings Berhad: 1QFY12/10 Net Profit More Than Doubles From A Year Ago - 26/05/2010Dokumen4 halamanSunway Holdings Berhad: 1QFY12/10 Net Profit More Than Doubles From A Year Ago - 26/05/2010Rhb InvestBelum ada peringkat

- Gitman IM Ch06Dokumen12 halamanGitman IM Ch06tarekffBelum ada peringkat

- Securities and Exchange Board of India: Master CircularDokumen236 halamanSecurities and Exchange Board of India: Master CircularViral_v2inBelum ada peringkat

- Gold AmanDokumen9 halamanGold AmanRishi DhallBelum ada peringkat