Public Budget and Budgetary

Diunggah oleh

Samson SeiduJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Public Budget and Budgetary

Diunggah oleh

Samson SeiduHak Cipta:

Format Tersedia

Volume 3, December 2011

Journal of Business and Organizational Development

2011 Cenresin Publications

www.cenresinpub.org

PUBLIC BUDGET AND BUDGETARY CONTROL IN NIGERIA

Yakubu S. Abdullahi

Department of Public Administration

Nasarawa State University, Keffi

Email: yakubushehu66@yahoo.com

INTRODUCTION

In many ways budget documents are the most important manifestation of public they record

the outcome of the political process: winners and losers of the political competition. They

delineate government total service effort. As political documents budget allocate scarce

resources among competing social and economic needs. As managerial documents they

specify the ways and means for providing for government services. By establishing the costs

for various programs they set up the criteria by which government programs are to be

reviewed and evaluated. Budget has become the main instrument by which government

attempts to manage economic growth and development. Budgets become accounting

instruments by which officials are held accountable for what government does and does not

manage to accomplish. In Nigeria the basic requirement for the budgetry process in the

public sector are provided for in the current constitution of the federal republic, financial

regulations and financial memorandum (Abdullahi 2008). The budgeting exercise at the

federal level is strictly governed by the provisions of the 1999 constitution. This involves the

required process through the budget must undergo before it becomes an appropriation act

of parliament which strictly speaking is a form of law binding on and guiding the executive in

terms of the implementation of the budget Provisions and executing the intending projects

and programmes.

At the state level budgeting is also governed to some extent by the constitution (1999) as

well as the financial regulations. Nevertheless it is a different procedure at the local

government level. The local councils in the country are strictly under the regulations of the

state house of assembly which regulates their administrative and financial operations,

besides the financial memorandum. This shows that the budgetry process at the local level is

largely regulated by the executive as well as the state house of assembly.

MEANING OF THE BUDGET

Ndan (2009) defines budget as a detailed financial statement that shows details of

anticipated revenue and prepared expenditure. A budget is also a forecast of expenditures

and revenue for a specific period of time; usually one year. As a planning document a budget

enables business, government, private organizations and households to set the priorities and

monitor progress toward selected goals. To meet the budgetary objections it is imperative to

set aside savings or to borrow from outside sources (Ndan 2009). The personal or family

budget is financial plan that helps individuals to balance income and expenditure. A business

budget is generally used as a tool to formulate intelligent decisions on the management and

growth of a business venture. The most difficult budgetary process involves a government

budget which is a plan for the collection and expenditure of monies needed to carry out the

21

Public Budget and Budgetary Control in Nigeria

Yakubu S. Abdullahi

social, military and economic policies of an administration (Ndan 2009). A government

budget in its entire ramifications is fragile with many definitions base on the views of scholars

and administrators. Ujo etal (2001) asserted that the budget is a control device used by

administrators to guide them in the allocation of resources. Furthermore, (Abdullahi 2008)

seen that the budget as a control device of specific expenditure for projects. In a similar

view, Robins (1980) observes that: budgets are control devices that are designed to guide

the actions of a unit and to provide feedback if the budget is secured. They are the standards

for comparing actual expenditure.

The procedure for preparing budget is called budgetary while the monitoring mechanism is

budgetary control. The practice of government budgeting originates from Britain (Abdullahi

2008) where budget is used in reference to the statements, needs and resources as

presented to the parliament for debate and approval for use in running government

operations and meeting other needs. Therefore the budget statement as defined by dimock

and fox (1983) is used to provide information on finances o f government, including the

resources of revenue, items of expenses and purpose to which those items are put. A

definition by omopariola (2003); shows that government budget is a plan for financing the

activities of the government during a fixed period usually one year prepared and submitted

by the executive to the legislature where approval is absolutely essential before the plan can

be secured.

TYPES OF GOVERNMENT BUDGET

The government budget can be branded in different forms depending on the choice of

political office holders and in line with the policy thrust of a particular government in power.

Some of the budgetary system in Nigeria as observed by (Ndan 2009) includes:

Line Item or Traditional Budgeting: This type of budget requires little data and analysis

and relies heavily on opinion, judgment and historical precedent. Activities which are released

in terms of objectives are budgeted for separately. Under this system, budgets are prepared

without reference to goals. There is little attempt to link the budget with implementation and

subsequent performance review. In a nut shell, traditional budgeting is the budgetary

process which emphasized expenditure rather than performance, emphasized inputs rather

than outputs.

Performance Budgeting: A second type of budget reform is performance budgeting. The

Nigerian federal government in 1981 adopted a version of this system of government

budgeting known as (PPB). Performance budgeting is an attempt to correct the anomalies of

line item or traditional budgeting. Hence Ndan (2009) describe performance budgeting as a

classification that emphasizes the things which government does; rather than the things

which government buys. Elsewhere he defines performance budget as one which represents

the purposes and objectives for which funds are requested, costs of the programmes

proposed for achieving these objectives and quantitative data for measuring the

accomplishments and work performed under each programme. One of the essential features

22

Volume 3, December 2011

Journal of Business and Organizational Development

of this kind of budget is that classification of budget is done in terms of function, programme

and activity.

Planning, Programming Budgeting System

According to Ndan planning programming budgeting system has six major elements, which

include:

i. Identification and examination of goals and objectives in each major area of

government activity.

ii.

Analysis of the output of a given programme in terms of its objectives.

iii.

Measurement of total programme cost not just for one year but for several years

ahead.

iv. Formulation of objectives and programmes extending beyond the single year in the

annual budget.

v. Analysis of alternatives to find the cost effective means of reaching basic programme

objectives.

vi. Establishment of these analytical procedures as a systematic part of budget review.

The idea behind PPBS is that the objectives of government policy must be identified and

stated. Then the activities which contribute to common goal should be identified as a

programme. Within an overall goal, there is a sub-goal and the activities which contribute to

this are entitled sub-programmes.

Zero Base Budgeting (ZBB): Zero based budgeting (ZBB) has been described as the

justification of budgets from base zero to the scratch. This constitutes with routine budgeting

which advocates of ZBB described as being incremented. That is to say the emphasis in

routine short term budgeting is on the change in costs between the current and next years

budget. Zero base budgets is proposed as a means of correcting some anomalies particularly

in non-profit organization like government. It attempts to shift the traditional approach to

budgeting in public sectors towards a new mode of thinking and operation. It subjects

existing or current programmes and activities to the same kind analysis and justification

usually reserved for new programmes. Although the idea of budgeting from zero has been a

long historical one it was only in the 1960, the idea was successfully translated into

technique by peter phyr, when Jimmy carter as governor applied the budget for the state of

Georgia in 1973. In 1977 President Jimmy carter of USA asked each federal agency to

develop its fiscal year on the basis of ZBB.

BUDGETING AT THE FEDERAL STATE AND LOCAL GOVERNMENT LEVEL IN

NIGERIA

The Federal Government Budgetary Process: The constitution of Nigeria succinctly provides

the legal requirement of the budgetary process that should be followed in the making of

federal government budget and indeed any other budget of the state level. There are other

requirements as encapsulated in other laws, the financial regulations and the instructions

from the accountant-general of the federation. According to Abdullah (2008) the frequent

analysis of public finance in annual cycles results from the usual passing annual votes for

23

Public Budget and Budgetary Control in Nigeria

Yakubu S. Abdullahi

expenditure authority by the national assembly. In terms of the annual budget 4 phases can

be identified. These are highlighted as follows:

Budget formulation: this is the first phase of the budget process in good budgeting and

implementation. The phase covers the estimation of government revenue, the determination

of the budgeting priorities as activities within the constantly arising from the available

revenue and borrowing limits and the translation of applied priorities and activities into

expenditure levels.

Budget authorization: this consist the legislative approval which constitutes the second

phase of the budgeting process. The national assembly has the constitutional authority to

review, modify and give the final approval after scrutinizing the appropriation bill. There

exists a special legislative advisory body in the national assembly, the joined finance

committee made up of some members from both clusters which closely scrutinizes the

provisions of the budget before legislative approval.

Budget execution: this is the third phase of the budget process in the government sector.

This phase covers the various operational aspects of budget implementation such as the

establishment obligatory ceiling the evaluation of work and financial plans for individual

operations. The continuing review of government fiscal position, the regulation of funds

release, the implementation of each payment schedules and other related matters. The

national assembly has onerous responsibility in ensuring appropriate implementation of the

budget provision. Hence, the legislature carries out this responsibility called oversight

function through its various committees.

Budget accountability: the effectiveness of this phase is predicated on the operation of

the office of the auditor-general of the federation. Therefore, it stays with an audit of the

accounts produced during the execution phase by both the government auditors and

independent auditors.

BUDGETING AT STATE GOVERNMENT LEVEL

Abdullahi (2008) observed that there are bond adequate provisions in the countrys

constitution meant for the regulation of the budgeting process at the state level. In essence,

the countrys 1999 constitution has some sections which relate to the process a state

government budget shall go through before it becomes an appropriation law for instance

section 12(1) of the constitution provides that: the governors shall cause to be prepared and

laid before the house of assembly any time before the commencement of each financial year,

estimates of the revenue and expenditures of the state for the next following financial year.

The above provision of the constitution clearly portrays the strategic position of the state

house of assembly in respect of budget and budgeting at the state level.

24

Volume 3, December 2011

Journal of Business and Organizational Development

PROCEDURE FOR STATE GOVERNMENT BUDGET PREPARATION

The procedure for the preparation of the state budget is similar to the procedure enhanced

by the constitution for the preparation of the federal government budget. The

commencement of the budget requires any government department makes projection for its

service incorporating the capital and recurrent estimates for the next financial year. The

capital expenditure estimates are for expenditure on capital projects such as construction of

roads, dams etc. the recurrent expenditure estimates are meant for government operational

services personnel emolument, maintenance costs, repairs of machinery etc. Next is the

transfer of budgets of various departments to the ministry of finance for their perusal, where

the department heads have to appear to defend the estimates. The defended estimates

prepared by the departments, titled Appropriation bill are sent to the state house of

assembly. The appropriation bill is then published in the gazette for public comments and

debate. The governor is then expected to go and formally present the budget speech to the

house of assembly after the appropriation bill would have been introduced in the house. The

budget proposal goes through the readings, committee stage and debate in the course of the

normal process of legislative law making before it is pass into law i.e. become appropriation

act.

CONTROL MECHANISM OVER STATE GOVERNMENT BUDGET

The control mechanism over the state government budget is established in the preparation of

the budget to the implementation and approval of the budget estimates. Such area of control

includes;

i.

Approval of departmental budget estimates.

ii.

Publication in the gazette for public scrutiny.

iii.

Budget scrutiny and authorization

iv. Power of legislature on appropriation without governors assent.

v. Legislative oversights function during budget implementation.

vi. Auditing of government expenditure.

BUDGETING AT LOCAL GOVERNMENT LEVEL

Fundamentally budgeting procedure is a different matter entirely at the local government

level in Nigeria (Abdullahi 2008). This is in views of the fact the local government councils

are more or less like appendages to their respective state governments. Hence the whims are

caprices of the state government. Furthermore the local councils are guided in the

preparation of the budgets by the financial memoranda.

According to financial memoranda in chapter two for the budget estimates:

i.

Every department of the local government should in each year prepare a defended

estimate of its revenue and expenditure for the ensuring financial year on behalf of

the executive committee.

ii.

Submit the estimate to the executive committee which shall consider it in order that is

not inconsistent with the general budgeting measures adopted by the local

government and the state for the succeeding financial year.

25

Public Budget and Budgetary Control in Nigeria

iii.

Yakubu S. Abdullahi

The executive committee shall submit the estimate to the local government council

which shall consider and approved.

PROCEDURE FOR PREPARATION AND APPROVAL OF LOCAL GOVERNMENT

BUDGET

The procedure for the preparation of the annual local government (budget) estimate is

exposed in chapter 3 of the financial memoranda. Especially 3.2 provide that the local

government executive committee is to issue a circular calling for the preparation by local

government departments estimates for the coming financial year. The financial memoranda

also states that the call circular for the preparation of budgetary estimates be issued out by

June 1st of every year, so as to reach each local government department in good time for the

commencement of the budgetary process. The treasurer, as provided by section 3.4 of the

financial memoranda, upon the receipt of the executive committees call circular and not less

than 10th of June shall issue an estimate call circular to heads of department. Heads of

department will prepare the estimates of the circular supported by full explanation notes and

shall be forwarded to the treasurer by July 10th. The treasurer will then consolidate

everything and submit to the executive committee through the secretary. The treasurer shall

also prepare a report on general financial applications of the estimates, Proposals and the

effect they have on the financial position of the local government, to accompany the estimate

proposals.

CONTROL MECHANISMS OF LOCAL GOVERNMENT BUDGET

A budget as a policy statement and a financial plan has an in-built mechanism that serves as

a control device to circumscribe the operations officers who are the administrators in charge

of the various departments of the local government. Hence Abdullahi et.al. (2001) observed

that local government estimates can be taken as policy document. This Is in view of the fact

that a policy is a definite course of action selected from among alternatives to guide and

determine present and future decisions. The budget serves as a control mechanism because

the financial plan, as it were clearly indicates the necessary direction to which all the

government operations are tailored. Furthermore local government budget are use in

controlling the operations at the grass roots level.

CONCLUTION

A government budget in Nigeria in its nature is a control device itself which specifies

expenditures for projects and expressed in monetary estimates: Types of government

budgetary system. The government budget can rely on the use of any budgetary systems.

Also the function of government budget clearly shows its control posture of government at all

levels. If properly adhered to government budgets are the most effective tools for curbing

corruption and inculcating discipline in Nigerian society.

26

Volume 3, December 2011

Journal of Business and Organizational Development

RECOMMENDATION

i.

Governments budgets at all levels should be regarded as an effective means of

controlling public sector.

ii.

Implementation of budgets should be strictly observed.

iii.

One of the lingering issues between executive and legislative arms of government is

the non-implementation of government budgets. There is need to burry this issue so

as to create a conducive working environment.

iv. Government budgets should replace peoples needs not elites want.

v. Budgets are the easiest means of portraying government policy thrusts.

vi. Public policies can be easily identified and implemented through public budgets.

vii.

Public budgets and budgetary control should serve as a tool for inter-governmental

relations.

REFERENCES

Abdullahi (2008): public financial management in Nigeria: principles, practices; and issues.

Primer education institute Abuja.

Araga A.S (2006) public financial management in Nigeria. Abuja.

Amaefule E (2007) federal government, states, local government to share N939 billion. The

punch newspaper Lagos September 2007, page 96.

Michael C.L (2006): public Administration, clashing values in the administration of public

policy. California press U.S.A.

Ndan

J.D

(2007):

public

finance

Nigerian

27

perspective.

Faith

printers

Zaria.

Anda mungkin juga menyukai

- IiG OxREP Adam DerconDokumen21 halamanIiG OxREP Adam DerconSamson SeiduBelum ada peringkat

- 1933162Dokumen273 halaman1933162Samson SeiduBelum ada peringkat

- Chapter One Introduction 1Dokumen7 halamanChapter One Introduction 1Samson SeiduBelum ada peringkat

- Peoples and Empires of West Africa in History 1000-1800Dokumen134 halamanPeoples and Empires of West Africa in History 1000-1800Samson SeiduBelum ada peringkat

- Michel LévyColorChartDokumen1 halamanMichel LévyColorChartSamson SeiduBelum ada peringkat

- Land LawDokumen11 halamanLand LawSamson SeiduBelum ada peringkat

- FredDokumen6 halamanFredSamson SeiduBelum ada peringkat

- 9340 36297 1 PBDokumen11 halaman9340 36297 1 PBSamson SeiduBelum ada peringkat

- Doctoral Programme Business 2016-2Dokumen6 halamanDoctoral Programme Business 2016-2Samson SeiduBelum ada peringkat

- References ListDokumen2 halamanReferences ListSamson SeiduBelum ada peringkat

- MaconDokumen1 halamanMaconSamson SeiduBelum ada peringkat

- 02 WholeDokumen405 halaman02 WholeSamson Seidu100% (1)

- Carbon Sequestration in The OceanDokumen32 halamanCarbon Sequestration in The OceanSamson SeiduBelum ada peringkat

- Mercy Chapter TwoDokumen11 halamanMercy Chapter TwoSamson SeiduBelum ada peringkat

- Hutu and TutsiDokumen15 halamanHutu and TutsiSamson SeiduBelum ada peringkat

- Land Law IIDokumen139 halamanLand Law IISamson SeiduBelum ada peringkat

- TEACHER VIEWS ON EXPLANATIONS IN MATHDokumen9 halamanTEACHER VIEWS ON EXPLANATIONS IN MATHSamson SeiduBelum ada peringkat

- Whatsup WordDokumen2 halamanWhatsup WordSamson SeiduBelum ada peringkat

- Guidance and Counselling PracticumDokumen67 halamanGuidance and Counselling PracticumSamson Seidu75% (4)

- Nigeria Basic Science v3Dokumen75 halamanNigeria Basic Science v3Samson SeiduBelum ada peringkat

- Chapter One: 1.1 Background of The StudyDokumen20 halamanChapter One: 1.1 Background of The StudySamson SeiduBelum ada peringkat

- Catholic Young Adult Association (Cyaa) MeetingDokumen2 halamanCatholic Young Adult Association (Cyaa) MeetingSamson SeiduBelum ada peringkat

- PneumoniaDokumen7 halamanPneumoniaseidu86Belum ada peringkat

- Likely Questions For AppointmentDokumen2 halamanLikely Questions For AppointmentSamson SeiduBelum ada peringkat

- Property Law PrecedentDokumen29 halamanProperty Law PrecedentSamson SeiduBelum ada peringkat

- TEACHER VIEWS ON EXPLANATIONS IN MATHDokumen9 halamanTEACHER VIEWS ON EXPLANATIONS IN MATHSamson SeiduBelum ada peringkat

- Taofik's DocsDokumen5 halamanTaofik's DocsSamson SeiduBelum ada peringkat

- Traditional Taboo Practices On Resource Conservation in Uli PDFDokumen14 halamanTraditional Taboo Practices On Resource Conservation in Uli PDFSamson SeiduBelum ada peringkat

- Igbo QuestionDokumen2 halamanIgbo QuestionSamson SeiduBelum ada peringkat

- Innocent's Front PagesDokumen7 halamanInnocent's Front PagesSamson SeiduBelum ada peringkat

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5782)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (72)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- BD 135 y BD136 PNP NPN Transistores de PotenciaDokumen9 halamanBD 135 y BD136 PNP NPN Transistores de PotenciaMario A StBelum ada peringkat

- PCDA-Rev Advisory For Pensioners SPARSHDokumen5 halamanPCDA-Rev Advisory For Pensioners SPARSHSandeep KumarBelum ada peringkat

- Revision 2 - Investment AppraisalDokumen27 halamanRevision 2 - Investment AppraisalVishal PrasadBelum ada peringkat

- CU v. State Department FOIA Lawsuit (George Kent Emails On Biden-Burisma)Dokumen4 halamanCU v. State Department FOIA Lawsuit (George Kent Emails On Biden-Burisma)Citizens UnitedBelum ada peringkat

- Jaeger ChartDokumen1 halamanJaeger ChartTechnical A-Star Testing & Inspection MalaysiaBelum ada peringkat

- Public International Law-Nationality and StatelessnessDokumen6 halamanPublic International Law-Nationality and StatelessnessElias A ApallaBelum ada peringkat

- Profiles of KPK MpasDokumen51 halamanProfiles of KPK Mpasapi-243100634Belum ada peringkat

- Go Lackawanna 05-29-2011Dokumen56 halamanGo Lackawanna 05-29-2011The Times LeaderBelum ada peringkat

- Men Who Buy SexDokumen32 halamanMen Who Buy SexRed Fox100% (1)

- The Mighty Brush Painting Guide Death Korps of Krieg 143rd LegionDokumen20 halamanThe Mighty Brush Painting Guide Death Korps of Krieg 143rd LegionAitor RomeroBelum ada peringkat

- Producers Bank case study: Enhancing reporting & analyticsDokumen3 halamanProducers Bank case study: Enhancing reporting & analyticsvictorious xtremeBelum ada peringkat

- Application Reference No.: 102099: Applied Post DetailsDokumen1 halamanApplication Reference No.: 102099: Applied Post DetailsPRIYANSHI SRIVASTAVABelum ada peringkat

- BoardingCard 208248333 DSA CLJ PDFDokumen1 halamanBoardingCard 208248333 DSA CLJ PDFLechintan MarianaBelum ada peringkat

- Written Assignment: Residential Property Management NSW (CIVREP-NSW3 - AS - v2)Dokumen95 halamanWritten Assignment: Residential Property Management NSW (CIVREP-NSW3 - AS - v2)swati raghuvansiBelum ada peringkat

- The Political System of The European UnionDokumen6 halamanThe Political System of The European UnionLacramioara StoianBelum ada peringkat

- Official Report of Governor Izquierdo On The Cavite Mutiny of 1872Dokumen2 halamanOfficial Report of Governor Izquierdo On The Cavite Mutiny of 1872202280369Belum ada peringkat

- Bilchitz and Landau - The Evolution of The Separation of PowersDokumen146 halamanBilchitz and Landau - The Evolution of The Separation of PowersJose Almanza MacedoBelum ada peringkat

- Boy Proposing To Girl Drawing - Google SearchDokumen1 halamanBoy Proposing To Girl Drawing - Google SearchMaria RobellonBelum ada peringkat

- Fringe Benefit Tax - Nov 06Dokumen27 halamanFringe Benefit Tax - Nov 06Renievave TorculasBelum ada peringkat

- History of Stock BrokingDokumen4 halamanHistory of Stock BrokingDiwakar SinghBelum ada peringkat

- Windows Registry AnalysisDokumen62 halamanWindows Registry AnalysisSyeda Ashifa Ashrafi PapiaBelum ada peringkat

- STLA (Stellantis N.V.) Annual and Transition Report of Foreign Private Issuers (Sections 13 or 15 (D) ) (20-F) 2024-02-22.pdfDokumen335 halamanSTLA (Stellantis N.V.) Annual and Transition Report of Foreign Private Issuers (Sections 13 or 15 (D) ) (20-F) 2024-02-22.pdfMario MaldonadoBelum ada peringkat

- Patchouli Oil MSDS: Section 1: Chemical Product and Company IdentificationDokumen5 halamanPatchouli Oil MSDS: Section 1: Chemical Product and Company IdentificationMutriono OzhoraBelum ada peringkat

- CIS - Alberto Cortés Gonzalez - 2022Dokumen6 halamanCIS - Alberto Cortés Gonzalez - 2022luz marina LopezBelum ada peringkat

- 095 Lee Vs CADokumen2 halaman095 Lee Vs CAjoyce100% (3)

- What is the public cloud? - Under 40 characterDokumen16 halamanWhat is the public cloud? - Under 40 characterSergio Carrillo DiestraBelum ada peringkat

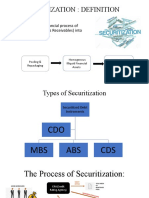

- SECURITIZATIONDokumen5 halamanSECURITIZATIONASHISH KUMARBelum ada peringkat

- Securities and Exchange CommissionDokumen4 halamanSecurities and Exchange CommissionJhoy PuruggananBelum ada peringkat

- Is 3156 2 1992 PDFDokumen8 halamanIs 3156 2 1992 PDFgurdeep singhBelum ada peringkat

- CIPT Onl Mod2Transcript PDFDokumen11 halamanCIPT Onl Mod2Transcript PDFChrist SierraBelum ada peringkat