IREDA Bond Application Form

Diunggah oleh

Sarah DeanJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

IREDA Bond Application Form

Diunggah oleh

Sarah DeanHak Cipta:

Format Tersedia

TEAR HERE

M K

INDIAN RENEWABLE ENERGY DEVELOPMENT AGENCY LIMITED COMMON APPLICATION FORM

APPLICATION FORM

(A GOVERNMENT OF INDIA ENTERPRISE)

FOR ASBA / NON ASBA

(FOR RESIDENT APPLICANTS) Credit Rating : [ICRA] AA+ [pronounced ICRA Double A Plus] (Outlook: Stable) by ICRA Limited and IND AA+ by India Ratings & Research Private Limited

Application

Form No.

To, The Board of Directors,

INDIAN RENEWABLE ENERGY DEVELOPMENT AGENCY LIMITED

ISSUE OPENS ON : JANUARY 8, 2016

ISSUE CLOSES ON* : JANUARY 22, 2016

*For early closure or extension of the issue, refer overleaf

55009267

PUBLIC ISSUE OF TAX FREE, SECURED, REDEEMABLE, NON-CONVERTIBLE BONDS IN THE NATURE OF DEBENTURES VIDE SHELF PROSPECTUS & PROSPECTUS TRANCHE-I DATED DECEMBER 31, 2015

I/we hereby confirm that I/we have read and understood the terms and conditions of this Application Form and the attached Abridged Prospectus and agree to the Applicants Undertaking as given overleaf. I/we hereby confirm

that I/we have read the instructions for filling up the Application Form given overleaf.

ESCROW BANK / SCSB BRANCH

BANK BRANCH

REGISTRARS / SCSB

DATE OF

SUB- CONSORTIUM MEMBER /BROKERS

SUB BROKER/AGENT

LEAD MANAGER/ CONSORTIUM MEMBER/TRADING MEMBER STAMP & CODE

SERIAL NO.

RECEIPT

CODE

STAMP & CODE

STAMP & CODE

SERIAL NO.

155929

23/13116-31

Edelweiss Securities Ltd. 01/121

1. APPLICANTS DETAILS - PLEASE FILL IN BLOCK LETTERS (Please refer to point no. 28 of the attached Abridged Prospectus)

First Applicant (Mr./ Ms./M/s.)

Date of Birth D D M M Y Y Y Y

Address

Name of Guardian (if applicant is minor) Mr./Ms.

Pin Code (Compulsory)

Tel No. (with STD Code) / Mobile

Second Applicant (Mr./ Ms./M/s.)

Third Applicant (Mr./ Ms./M/s.)

2. Investor Category (Please refer overleaf) Category I

Category II

Category III

Category IV

Sub Category Code (Please refer overleaf)

3. PLEASE PROVIDE APPLICANTS DEPOSITORY DETAILS

(Please Refer To Point No. 28 Of The Attached Abridged Prospectus) For NSDL Enter 8 Digit DP Id Followed By 8 Digit Client Id / For CDSL Enter 16 Digit Client ID

NSDL /

CDSL

4. IN CASE OF APPLICATION TO HOLD THE BONDS IN PHYSICAL FORM, PLEASE PROVIDE FOLLOWING DETAILS

(Please enclose self attested copies of the KYC Documents along with the Application Form. For list of KYC documents, please refer overleaf)

Bank Details for payment of Refund / Interest / Maturity Amount (Mandatory)

NOMINATION (Please see Page 25 of this Abridged Prospectus)

Name of the Nominee : _____________________________________________________ Bank Name : _____________________________________ Branch : ____________________

If Nominee is Minor, Guardians Name : ____________________________________________ Account No.: __________________ IFSC Code : _____________ MICR Code: ____________

PLEASE FILL IN BLOCK LETTERS

5. INVESTMENT DETAILS (For details, please refer Issue Structure overleaf)

Options / Series of Bonds

Series 1A

Coupon rate / Annualised yield (%) per annum for Category I, II, III

7.28%

Options/ Series of Bonds

Series 1B

Coupon rate / Annualised yield (%) per annum For Category IV

7.53%

Series 2A

Series 3A

7.49%

7.43%

Series 2B

Series 3B

7.74%

7.68%

For Category I, II, III & IV

10 years

15 years

20 years

10 years from the Deemed Date of Allotment.

15 years from the Deemed Date of Allotment.

20 years from the Deemed Date of Allotment.

Repayment of the face value amount of Bonds plus any interest at the applicable coupon/ interest rate that may have accrued on the Maturity Date/Redemption Date

` 1,000 per Bond

` 1,000 per Bond

` 1,000 per Bond

Annual

None.

5 Bonds (` 5,000) (individually or collectively, across all Series of Bonds) and in the multiple of One Bond (` 1,000) thereafter

Tenor

Redemption Date

Redemption Amount (`/ Bond)

Face Value/Issue Price

Frequency of Coupon / Interest Payment

Put and call option

Minimum Application and in the multiple of thereafter

No. of Bonds applied

Amount Payable (`)

Grand Total (`)

6. PAYMENT DETAILS (Please tick () any one of payment option A or B below)

Please write a Sole/First Applicants Name, Phone No. and Application No. on the reverse of Cheque/DD.

Amount Paid (` in figures)

(` in words)

A. CHEQUE/ DEMAND DRAFT (DD) to be drawn in favour of Escrow Account IREDA Public Issue II

Dated D D M M Y Y

Cheque/DD No.

Drawn on (Bank Name & Branch)

(B) ASBA

Bank A/c No.

ASBA A/c. Holder Name ________________________________________________

(in case Applicant is different from ASBA A/c. Holder)

Bank Name & Branch ___________________________________________________

____________________________________________________________________________________________________

6A. PAN & SIGNATURE OF

SOLE/ FIRST APPLICANT

6B. PAN & SIGNATURE OF

SECOND APPLICANT

6C. PAN & SIGNATURE OF

THIRD APPLICANT

PAN

PAN

PAN

6D. Signature of ASBA Bank Account Holder(s)

(as per Bank Records)(for ASBA Option only)

I/We authorize the SCSB to do all acts as are necessary to

make the Application in the Issue

1)

2)

Furnishing PAN of the Applicant is mandatory including minors PAN in case of

Application by minor. Please refer point no. 28 of the attached Abridged Prospectus

Date : ___________________, 2016

INDIAN RENEWABLE ENERGY

DEVELOPMENT AGENCY LIMITED

(A Government of India Enterprise)

3)

TEAR HERE

Application

Form No.

Acknowledgement Slip for Lead Managers/

Consortium Member/Sub-Consortium Member/

Brokers/Sub-Brokers/Trading Members / SCSBs

DPID/

CLID

LEAD MANAGERS / CONSORTIUM /

SUBCONSORTIUM MEMBERS /BROKER S/

SUBBROKERS/ TRADING MEMBERS /SCSB

BRANCHS STAMP

(ACKNOWLEDGING UPLOAD OF APPLICATION IN

STOCK EXCHANGE SYSTEM) (MANDATORY)

55009267

PAN

Amount Paid (` in figures)

Date, Stamp & Signature of Escrow

Bank (Mandatory)

Bank & Branch

Cheque / DD/ASBA Bank A/c No.

Dated___________,2016

Received from Mr./Ms. /M/s.

Telephone / Mobile

(A Government of India Enterprise)

INDIAN RENEWABLE ENERGY

DEVELOPMENT AGENCY LIMITED

TEAR HERE

TEAR HERE

PUBLIC ISSUE OF TAX FREE, SECURED, REDEEMABLE, NON-CONVERTIBLE BONDS IN THE NATURE OF DEBENTURES VIDE SHELF PROSPECTUS & PROSPECTUS TRANCHE-I DATED DECEMBER 31, 2015

Options/Series of Bonds

Issue Price (`/Bond)

No. of Bonds applied for

Amount Payable (`)

Grand Total (`)

Series 1A / 1B

` 1,000

Cheque / DD/ASBA Bank A/c No.

Drawn on (Name of Bank & Branch)

Series 2A / 2B

` 1,000

Series 3A / 3B

` 1,000

Date Stamp & Signature of Lead Manager/ Name of Sole / First Applicant

Consortium Members/Sub-Consortium

___________________________________________

Members/Trading Members/SCSB

___________________________________________

Applications submitted without being uploaded on the terminals of the Stock Exchanges

will be rejected.

Acknowledgement Slip for Applicant

Dated

,2016

All future communication in connection with this application

should be addressed to the Registrar to the Issue. For

details, pleaser refer overleaf. Acknowledgement is subject

to realization of Cheque / Demand Draft.

Application

Form No.

55009267

While submitting the Application Form, the Applicant should ensure that the date stamp being put on the Application Form by the Lead Manager/Consortium /Sub-Consortium Member/Broker/Sub Broker/Trading Member/SCSB matches with the date stamp on the Acknowledgement Slip

155929

M K

APPLICANTS UNDERTAKING

I/We hereby agree and confirm that:

1. I/We have read, understood and agreed to the contents and terms and conditions of INDIAN RENEWABLE ENERGY DEVELOPMENT AGENCY LIMITED Shelf Prospectus & Prospectus Tranche -I dated December 31, 2015 (Prospectus)

2. I/We hereby apply for allotment of the Bonds to me/us and the amount payable on application is remitted herewith.

3. I/We hereby agree to accept the Bonds applied for or such lesser number as may be allotted to me/us in accordance with the contents of the Prospectus subject to applicable statutory and/or regulatory requirements.

4. I/We irrevocably give my/our authority and consent to IL&FS TRUST COMPANY LIMITED to act as my/our trustees and for doing such acts as are necessary to carry out their duties in such capacity.

5. I am/We are Indian National(s) resident in India and I am/ we are not applying for the said Bonds as nominee(s) of any person resident outside India and/or Foreign National(s).

6. The application made by me/us do not exceed the investment limit on the maximum number of Bonds which may be held by me/us under applicable statutory and/or regulatory requirements.

7. In making my/our investment decision I/We have relied on my/our own examination of the company and the terms of the issue, including the merits and risks involved and my/our decision to make this application is solely based on

disclosures contained in the Prospectus.

8. I/We have obtained the necessary statutory and/or regulatory permissions/approvals for applying for, subscribing to, and seeking allotment of the Bonds applied for.

9. Additional Undertaking, in case of ASBA Applicants:

1) I/We hereby undertake that I/We am/are an ASBA Applicant(s) as per applicable provisions of the SEBI Regulations; 2) In accordance with ASBA process provided in the SEBI Regulations and disclosed in the Prospectus, I/We authorize

(a) the Lead Manager/Consortium Members/Sub-Consortium Members and Trading Members (in Specified cities only) or the SCSBs, as the case may be, to do all acts as are necessary to make the Application in the Issue, including

uploading my/our application, blocking or unblocking of funds in the bank account maintained with the SCSB as specified in the Application Form, transfer of funds to the Public Issue Account on receipt of instruction from the Lead Manager,

Registrar to the Issue, after finalization of Basis of Allotment; and (b) the Registrar to the Issue to issue instruction to the SCSBs to unblock the funds in the specified bank account upon finalization of the Basis of Allotment. 3) In case

the amount available in the specified Bank Account is insufficient as per the Application, the SCSB shall reject the Application.

10. Additional Undertaking in case the Applicant wishes to hold the Bonds in physical form:

1) In terms of Section (8)(1) of the Depositories Act, 1996, I/we wish to hold the Bonds in physical form. 2) I/We confirm that the Information provided in this form is true and correct and I/We enclose herewith self attested copies of the

KYC Documents. 3) I/We confirm that we do not hold any Demat Account.

ISSUE RELATED INFORMATION FOR FILLING THE APPLICATION FORM

KYC Documents: (To be submitted only for holding Bonds in Physical Form): Please provide the following documents along with the Application Form: (a) Self-attested copy of the PAN card (in case of

a minor, the guardian shall also submit the self-attested copy of his/her PAN card); (b) Self-attested copy of your proof of residence. Any of the following documents shall be considered as a verifiable proof of residence: ration

card issued by the GoI; or valid driving license issued by any transport authority of the Republic of India; or electricity bill (not older than three months); or landline telephone bill (not older than three months); or valid passport

issued by the GoI; or voters identity card issued by the GoI; or passbook or latest bank statement issued by a bank operating in India; or registered leave and license agreement or agreement for sale or rent agreement or fl at

maintenance bill; or AADHAR letter; or life insurance policy. Self-attested copy of a cancelled cheque of the bank account to which the amounts pertaining to payment of refunds, interest and redemption, as applicable, should

be credited. (c) In absence of the cancelled cheque, our Company may reject the Application or it may consider the bank details as given on the Application Form at its sole discretion. In such case the Company, Lead Managers

and Registrar shall not be liable for any delays/ errors in payment of refund and/ or interest. For information pertaining to KYC Documents, please refer on page 15 of this Abridged Prospectus

INVESTOR CATEGORIES:

Category I (Qualified Institutional Buyers)/(QIBs)#

Sub Category Code Category II (Corporates)# (contnd ........)

Sub Category Code

Public Financial Institutions

11

Statutory bodies/corporations

24

Alternative Investment Funds, subject to investment conditions applicable to them under the

12

Public/Private Charitable/Religious Trusts settled and/or registered in India

25

Securities and Exchange Board of India (Alternative Investment Funds) Regulations, 2012

Scheduled commercial banks

13

Partnership firms formed under applicable laws of India in the name of partners

26

Mutual Funds registered with SEBI

14

Association of Persons

27

State industrial development corporations

15

Co-operative banks incorporated in India

28

Insurance companies registered with the IRDA

16

Regional Rural Banks incorporated in India

29

17

Any other domestic legal entities/ persons as may be permissible under the CBDT

30

Provident funds with a minimum corpus of ` 25 crore

Notification and authorised to invest in the Bonds in terms of applicable laws.

Category III (High Networth Individuals)/(HNIs)

18

Pension funds with a minimum corpus of ` 25 crore

The National Investment Fund set up by resolution F. No. 2/3/2005-DD-II dated November

19

The following Investors applying for an amount aggregating to more than `10 lakhs

23, 2005 of the GoI, published in the Gazette of India

across all Series of Bonds in this Issue:

Insurance funds set up and managed by the army, navy, or air force of the Union of India

20

Resident Indian Individuals

31

Insurance funds set up and managed by the Department of Posts, India

55

Hindu Undivided Families through the Karta

32

Category IV (Retail Individual Investors) /(RIIs)

Indian Multilateral and bilateral development financial institutions

56

Category II (Corporates)#

The following Investors applying for an amount aggregating upto and including

Companies within the meaning of section 2 (20) of the Companies Act 2013

21

` 10 lakhs across all Series of Bonds in this Issue:

Limited Liability Partnerships registered under the provisions of the LLP Act

22

Resident Indian Individuals

41

Societies registered under the applicable laws in India

23

Hindu Undivided Families through the Karta

42

# See general circular (No. 6/2015), dated April 9, 2015 issued by the MCA clarifying that in cases where the effective yield (effective rate of return) on tax free bonds is greater than the prevailing yield of one year, three year, five year

or ten year government security closest to the tenor of the loan, there is no violation of Section 186(7) of the Companies Act, 2013.

Options / Series of Bonds*

Series 1A

Series 2A

Series 3A

Coupon rate (%) per annum for Category I, II, III#

7.28%

7.49%

7.43%

#

Annualised yield (%) per annum for Category I, II, III

7.28%

7.49%

7.43%

Options/ Series of Bonds*

Series 1B

Series 2B

Series 3B

Coupon rate (%) per annum for Category IV#

7.53%

7.74%

7.68%

Annualised yield (%) per annum For Category IV#

7.53%

7.74%

7.68%

For Category I, II, III & IV

Tenor

10 years

15 years

20 years

Redemption Date

10 years from the Deemed Date of Allotment.

15 years from the Deemed Date of Allotment.

20 years from the Deemed Date of Allotment.

Repayment of the face value amount of Bonds plus any interest at the applicable coupon/ interest rate that may have accrued on the Maturity Date/Redemption Date

Redemption Amount (`/ Bond)

Frequency of interest payment

Annual

Coupon Payment Dates

The date, which is the day falling one year from the Deemed Date of Allotment, in case of the first coupon/ interest payment and the same day every year, until the Redemption Date

for subsequent coupon/ interest payment.

Coupon / Interest Type

Fixed coupon rate

Minimum Application and in multiple thereafter

5 Bonds (` 5,000) (individually or collectively, across all Series of Bonds) and in the multiple of One Bond (` 1,000) thereafter

Face Value / Issue Price

` 1,000 per Bond

Modes of interest payment

See Terms of the Issue on page 19 of the attached Abridged Prospectus

Issuance mode of the Instrument

In dematerialised form or in physical form as specified by the Applicant in the Application Form.

Trading mode of the Instrument

In dematerialized form only

Put and call option

None.

Seniority

The claims of the Bondholders shall be superior to the claims of any unsecured creditors of our Company and subject to applicable statutory and/or regulatory

requirements, rank pari passu inter se to the claims of other secured creditors of our Company having the same security.

Security

The Bonds proposed to be issued will be secured by a first pari passu charge on present and future receivables of the Issuer to the extent of the amount mobilized under

the Issue and interest thereon. The Issuer reserves the right to deal with the receivables, both present and future in the ordinary course of business, including without

limitation to create a first/ second charge on pari-passu basis thereon for its present and future financial requirements, without requiring the consent of, or intimation to,

the Bondholders or the Debenture Trustee in this connection, provided that a minimum security cover of 1 (one) time is maintained on the outstanding principal amount

and interest due thereon.

* Our Company shall Allot Bonds of Tranche- I Series 1A/ Tranche- I Series 1B (depending upon the category of Applicants) for all valid Applications, wherein the Applicants have not indicated their choice of the relevant Series of Bonds.

# In pursuance of the CBDT Notification, and for avoidance of doubt, it is clarified that: (i) The coupon rates indicated under the Tranche -I Series 1B, the Tranche -I Series 2B and the Tranche -I Series 3B Bonds shall be payable only on the Bonds allotted to Category IV investors in the Issue. Such coupon is payable only if on the

Record Date for payment of interest, the Bonds are held by investors falling under Category IV. (ii) In case the Bonds allotted under Tranche -I Series 1B, the Tranche -I Series 2B and the Tranche -I Series 3B are transferred by Category IV investors to investors falling under Categories I, Category II or Category III, the coupon rate

on such Bonds shall stand at par with coupon rate applicable for Tranche -I Series 1A, the Tranche -I Series 2A and the Tranche -I Series 3A, respectively. (iii) If the Bonds allotted under Tranche -I Series 1B, the Tranche -I Series 2B and the Tranche -I Series 3B are sold/ transferred by Category IV investors to other investors falling

under Category IV as on the Record Date, the coupon rates on such Bonds shall remain unchanged. (iv) The Bonds allotted under Tranche -I Series 1B, Tranche -I Series 2B and the Tranche -I Series 3B shall continue to carry the specified interest rate if on the Record Date, such Bonds are held by Category IV Investors; (v) If on any

Record Date, the original Category IV Allottees/ transferee(s) hold the Bonds allotted under Tranche -I Series 1B, Tranche -I Series 2B,Tranche -I Series 3B,Tranche -I Series 1A, the Tranche -I Series 2A and the Tranche -I Series 3A for an aggregate face value amount of over ` 10 lakh, then the coupon rate applicable to such Category

IV Allottees/transferee(s) on Bonds under Tranche -I Series 1B, Tranche -I Series 2B and Tranche -I Series 3B shall stand at par with coupon rates applicable for Tranche -I Series 1A, the Tranche -I Series 2A and the Tranche -I Series 3A, respectively; (vi) Bonds allotted under Tranche -I Series 1A, Tranche -I Series 2A and Tranche -I

Series 3A shall carry coupon rates indicated above until the maturity of the respective Series of Bonds irrespective of Category of holder(s) of such Bonds; (vii) For the purpose of classification and verification of status of Category IV Bondholders, the aggregate face value of Bonds held by the Bondholders in all the Series of Bonds,

allotted under the relevant Tranche Issue shall be clubbed and taken together on the basis of PAN.

Early closure or Extension of the issue: The Issue shall remain open for subscription from 10 A.M. to 5 P.M (Indian Standard Time) during the period indicated above with an option for early closure/extension as may be decided by the board of directors of our Company or a duly constituted Bond committee. In the event of such

early closure or extension of the subscription list of the Issue, our Company shall ensure that public notice of such early closure/extension is published on or before such early date of closure or the Issue Closing Date, as applicable, through advertisement(s) in at least one leading national daily newspaper with wide circulation.

Basis of Allotment: For Basis of Allotment details, please refer point no. 41 of the attached Abridged Prospectus. For Grounds for Technical Rejection: Please refer to point no. 37 of the attached Abridged Prospectus.

For further information, please refer to section titled Terms of the Issue on page 19 of the attached Abridged Prospectus and on page 62 of the Prospectus Tranche-I.

TEAR HERE

In case of queries related to Allotment/ credit of Allotted Bonds/Refund, the Applicants should contact Registrar

to the Issue.

In case of ASBA Application submitted to the SCSBs, the Applicants should contact the relevant SCSB.

In case of queries related to upload of Applications submitted to the Lead Managers/ Consortium/SubConsortium Members/Brokers/Sub Brokers/Trading Member should contact the relevant Lead Managers/

Consortium /Sub-Consortium Members/Brokers/Sub Brokers/ Trading Member.

Acknowledgement is subject to realisation of Cheque/DD/Availability of Funds in the ASBA account

The grievances arising out of Applications for the Bonds made through Trading Members may be addressed

directly to BSE Ltd.

COMPANY CONTACT DETAILS

INDIAN RENEWABLE ENERGY DEVELOPMENT AGENCY LIMITED

(A Government of India Enterprise)

Registered Office: India Habitat Centre, East Court, Core 4 A,

1st Floor, Lodhi Road, New Delhi - 110003;

Tel No: +91 (11) 24682214; Facsimile: +91 (11) 24682202

Corporate Office: 3rd Floor, August Kranti Bhawan, Bhikaiji

Cama Place, New Delhi 110066; Tel No: +91 (11) 26717400-12;

Facsimile: +91 (11) 26717416; Website: www.ireda.gov.in

INDIAN RENEWABLE ENERGY DEVELOPMENT AGENCY LIMITED

REGISTRAR CONTACT DETAILS

KARVY COMPUTERSHARE PRIVATE LIMITED

Karvy Selenium Tower B, Plot No. 31-32, Gachibowli,

Financial District, Nanakramguda, Hyderabad 500032, India

Tel No.: +91 (40) 6716 2222; Facsimile: +91 (40) 2343 1551; Email:

einward.ris@karvy.com; Investor Grievance Email: ireda.bonds@

karvy.com Website: http://karisma.karvy.com Contact Person:

Mr. M Murali Krishna; SEBI Registration No.: INR000000221

Anda mungkin juga menyukai

- IRFC Tax Free Bond Dec15Dokumen48 halamanIRFC Tax Free Bond Dec15Robin FlyerBelum ada peringkat

- Muthoot Finance Limited: D D M M Y Y Y YDokumen2 halamanMuthoot Finance Limited: D D M M Y Y Y YShaji MathewBelum ada peringkat

- Shriram City Union Finance Non Convertible Debentures Application Form Call Wealth Advisor Anandaraman at 9843146519Dokumen48 halamanShriram City Union Finance Non Convertible Debentures Application Form Call Wealth Advisor Anandaraman at 9843146519Mutual Funds Advisor ANANDARAMAN 944-529-6519Belum ada peringkat

- IBHFL IPO Abridged ProspectusDokumen48 halamanIBHFL IPO Abridged Prospectusratan203Belum ada peringkat

- HUDCO Tax Free Bond Application FormDokumen8 halamanHUDCO Tax Free Bond Application FormPrajna CapitalBelum ada peringkat

- Apply for Muthoot Finance NCDsDokumen1 halamanApply for Muthoot Finance NCDsRajesh ManogaranBelum ada peringkat

- Muthoot Finance NCD Application Form Dec 2011 - Jan 2012Dokumen8 halamanMuthoot Finance NCD Application Form Dec 2011 - Jan 2012Prajna CapitalBelum ada peringkat

- Text CorretorDokumen4 halamanText CorretorARUNAVA SAMANTABelum ada peringkat

- Application Form: Green Delta Mutual FundDokumen4 halamanApplication Form: Green Delta Mutual Fundsumon1982Belum ada peringkat

- Zero Balance Form - SFLBDokumen3 halamanZero Balance Form - SFLBroshcrazyBelum ada peringkat

- Manappuram Finance NCD Application FormDokumen47 halamanManappuram Finance NCD Application FormTejas Pradyuman JoshiBelum ada peringkat

- (Debit Mandate Form NACH/ ECS/ Direct Debit) : Request ForDokumen2 halaman(Debit Mandate Form NACH/ ECS/ Direct Debit) : Request Forssgentis100% (1)

- 30592478Dokumen48 halaman30592478Siddharth KumarBelum ada peringkat

- 12345Dokumen8 halaman12345induchellamBelum ada peringkat

- DSP BlackRock Tax Saver Fund Application FormDokumen4 halamanDSP BlackRock Tax Saver Fund Application FormPrajna CapitalBelum ada peringkat

- REC Infra Bond Application FormDokumen2 halamanREC Infra Bond Application FormPrajna CapitalBelum ada peringkat

- Green Delta Mutual Fund: Application FormDokumen5 halamanGreen Delta Mutual Fund: Application Formkabir_bg82Belum ada peringkat

- New Application For Surrender of Policy 151212 (CTFN)Dokumen2 halamanNew Application For Surrender of Policy 151212 (CTFN)Ramkumar KumarBelum ada peringkat

- REC TAx Free Bond Application FormDokumen8 halamanREC TAx Free Bond Application FormPrajna CapitalBelum ada peringkat

- PFC Tax Free Bonds Application FormDokumen8 halamanPFC Tax Free Bonds Application FormPrajna CapitalBelum ada peringkat

- Birla SL MF SipDokumen1 halamanBirla SL MF SipShar MathewBelum ada peringkat

- Systematic Investment Plan S I P: SIP Enrolment FormDokumen4 halamanSystematic Investment Plan S I P: SIP Enrolment FormRahul SinghBelum ada peringkat

- Enrolment Form For SIP/ Micro SIPDokumen4 halamanEnrolment Form For SIP/ Micro SIPmeatulBelum ada peringkat

- IDFC Infra Bond Tranche 1 Application DetailsDokumen8 halamanIDFC Infra Bond Tranche 1 Application DetailsAjay KamatBelum ada peringkat

- Ishan 800001258 PDFDokumen2 halamanIshan 800001258 PDFSaahil ShahBelum ada peringkat

- Sip & Micro Sip PDC Form - 29.04.2013Dokumen4 halamanSip & Micro Sip PDC Form - 29.04.2013Aayush ShahBelum ada peringkat

- IRFC Tax Free Bond Application FormDokumen8 halamanIRFC Tax Free Bond Application FormPrajna CapitalBelum ada peringkat

- HDFC InstaInvest Form 7-03-12Dokumen2 halamanHDFC InstaInvest Form 7-03-12lakshmi_narayana412Belum ada peringkat

- Muthoot Finance NCD Application Form Mar 2012Dokumen8 halamanMuthoot Finance NCD Application Form Mar 2012Prajna CapitalBelum ada peringkat

- L&T Long Term Infrastructure Bond Tranche 2 Application Form 2012Dokumen8 halamanL&T Long Term Infrastructure Bond Tranche 2 Application Form 2012Prajna CapitalBelum ada peringkat

- RamgyanDokumen8 halamanRamgyanRamgyan PrajapatiBelum ada peringkat

- LN TBond FormDokumen90 halamanLN TBond FormboargzcrBelum ada peringkat

- Application Form: Access Engineering Limited - Initial Public OfferingDokumen2 halamanApplication Form: Access Engineering Limited - Initial Public Offeringprasad_iron2924Belum ada peringkat

- Common Application Form for Equity Oriented SchemesDokumen2 halamanCommon Application Form for Equity Oriented SchemesARVINDBelum ada peringkat

- L&T Long Term Infrastructure Bond Tranche 1 Application FormDokumen8 halamanL&T Long Term Infrastructure Bond Tranche 1 Application FormPrajna CapitalBelum ada peringkat

- Common Application FormDokumen2 halamanCommon Application FormJeta SharmaBelum ada peringkat

- LNT Bond FormDokumen8 halamanLNT Bond FormsunajbaniBelum ada peringkat

- 107 ExtraDokumen47 halaman107 ExtraDhawan SandeepBelum ada peringkat

- STFC NCD ProspectusOCT 13 NCDDokumen47 halamanSTFC NCD ProspectusOCT 13 NCDPrakash JoshiBelum ada peringkat

- IFCI Infra Bond 2012 Application FormDokumen2 halamanIFCI Infra Bond 2012 Application FormPrajna CapitalBelum ada peringkat

- IDFC Long Term Infrastructure Bond Tranche 2 Application Form 2012Dokumen8 halamanIDFC Long Term Infrastructure Bond Tranche 2 Application Form 2012Prajna CapitalBelum ada peringkat

- Reliance Mutual Funds Compelete Application FormDokumen10 halamanReliance Mutual Funds Compelete Application FormARVINDBelum ada peringkat

- Baroda Pioneer Transaction FormDokumen2 halamanBaroda Pioneer Transaction FormAjith MosesBelum ada peringkat

- IFCI Long Term Infra Bonds Application FormDokumen2 halamanIFCI Long Term Infra Bonds Application FormPrajna CapitalBelum ada peringkat

- DSKNCDAUG14Dokumen1 halamanDSKNCDAUG14Amitava GhoshBelum ada peringkat

- Axis Bank Fixed Deposit FormDokumen4 halamanAxis Bank Fixed Deposit Formramu2011Belum ada peringkat

- Investment Form DetailsDokumen2 halamanInvestment Form DetailsRandhir RanaBelum ada peringkat

- IDFC Infrastructure Bond Tranche 3 Application Form 2012Dokumen8 halamanIDFC Infrastructure Bond Tranche 3 Application Form 2012Prajna CapitalBelum ada peringkat

- EMP5464 Fillable May 15 13 V3Dokumen4 halamanEMP5464 Fillable May 15 13 V3PrekelBelum ada peringkat

- Systematic Investment Plan (Sip)Dokumen2 halamanSystematic Investment Plan (Sip)GujuBelum ada peringkat

- Mid PioneerDokumen1 halamanMid PioneerVishnu VBelum ada peringkat

- SIP Registration RenewalForm Dec15Dokumen2 halamanSIP Registration RenewalForm Dec15singenaadamBelum ada peringkat

- Home Loan Application FormDokumen4 halamanHome Loan Application FormSudeep ChatterjeeBelum ada peringkat

- Application Format of RGGLV SelectionDokumen16 halamanApplication Format of RGGLV Selectioninderpalsingh22Belum ada peringkat

- Financing Handbook for Companies: A Practical Guide by A Banking Executive for Companies Seeking Loans & Financings from BanksDari EverandFinancing Handbook for Companies: A Practical Guide by A Banking Executive for Companies Seeking Loans & Financings from BanksPenilaian: 5 dari 5 bintang5/5 (1)

- The Long Road Ahead: Status Report on the Implementation of the ASEAN Mutual Recognition Arrangements on Professional ServicesDari EverandThe Long Road Ahead: Status Report on the Implementation of the ASEAN Mutual Recognition Arrangements on Professional ServicesBelum ada peringkat

- Green Bond Market Survey for Cambodia: Insights on the Perspectives of Institutional Investors and UnderwritersDari EverandGreen Bond Market Survey for Cambodia: Insights on the Perspectives of Institutional Investors and UnderwritersBelum ada peringkat

- Asme B31.3 2004Dokumen366 halamanAsme B31.3 2004Anonymous 8jRsci982% (11)

- Price ScheduleDokumen6 halamanPrice ScheduleSarah DeanBelum ada peringkat

- IpoDokumen3 halamanIpoSarah DeanBelum ada peringkat

- Uttara KannadaDokumen88 halamanUttara KannadaSarah DeanBelum ada peringkat

- Gas Line Sizing GuideDokumen3 halamanGas Line Sizing Guideputrude100% (1)

- Odorising SystemDokumen36 halamanOdorising SystemSarah DeanBelum ada peringkat

- Municipal Corporation of Greater MumbaiDokumen1 halamanMunicipal Corporation of Greater MumbaiSarah DeanBelum ada peringkat

- Elastic Bending Radius Calculation of PIPELINESDokumen9 halamanElastic Bending Radius Calculation of PIPELINESSarah DeanBelum ada peringkat

- History of National FlagDokumen3 halamanHistory of National FlagSarah DeanBelum ada peringkat

- Odorising SystemDokumen97 halamanOdorising SystemSarah DeanBelum ada peringkat

- Sukanya Samriddhi CalculatorDokumen34 halamanSukanya Samriddhi CalculatorSarah DeanBelum ada peringkat

- WPS PDFDokumen1 halamanWPS PDFSarah DeanBelum ada peringkat

- Odorising SystemDokumen36 halamanOdorising SystemSarah DeanBelum ada peringkat

- Elastic Bending Radius Calculation of PIPELINESDokumen1 halamanElastic Bending Radius Calculation of PIPELINESmailmaverick816777% (13)

- India All-In-One Map 09072015Dokumen1 halamanIndia All-In-One Map 09072015Sarah DeanBelum ada peringkat

- MP Status - All DRS THaneDokumen23 halamanMP Status - All DRS THaneSarah DeanBelum ada peringkat

- North Goa Geooraphical AreaDokumen1 halamanNorth Goa Geooraphical AreaSarah DeanBelum ada peringkat

- Composition and Properties of Natural GasDokumen2 halamanComposition and Properties of Natural GasSarah DeanBelum ada peringkat

- SRDokumen4 halamanSRSarah DeanBelum ada peringkat

- C141 Calculation Sheet - Train 2 29th Nov 06 0700Dokumen32 halamanC141 Calculation Sheet - Train 2 29th Nov 06 0700Sarah DeanBelum ada peringkat

- Teco - Dates Zone VIDokumen6 halamanTeco - Dates Zone VISarah DeanBelum ada peringkat

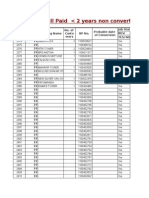

- Details of Gasified (Fullpaid) Less Than 2 YearsDokumen62 halamanDetails of Gasified (Fullpaid) Less Than 2 YearsSarah DeanBelum ada peringkat

- LPDokumen4 halamanLPSarah DeanBelum ada peringkat

- NAvi MumbaiDokumen23 halamanNAvi MumbaiSarah DeanBelum ada peringkat

- LP Status - All DRS THaneDokumen45 halamanLP Status - All DRS THaneSarah DeanBelum ada peringkat

- LP Status - All DRS THaneDokumen45 halamanLP Status - All DRS THaneSarah DeanBelum ada peringkat

- MPDokumen1 halamanMPSarah DeanBelum ada peringkat

- Pending Morethan 15monthsDokumen36 halamanPending Morethan 15monthsSarah DeanBelum ada peringkat

- LPDokumen4 halamanLPSarah DeanBelum ada peringkat

- Pathophysiology of Uremic EncephalopathyDokumen5 halamanPathophysiology of Uremic EncephalopathyKristen Leigh Mariano100% (1)

- Lease of Residential HouseDokumen4 halamanLease of Residential HousedenvergamlosenBelum ada peringkat

- 1 FrameworkDokumen26 halaman1 FrameworkIrenataBelum ada peringkat

- Pneapple Waste To Bioethanol Casabar - Et - Al-2019-Biomass - Conversion - and - BiorefineryDokumen6 halamanPneapple Waste To Bioethanol Casabar - Et - Al-2019-Biomass - Conversion - and - Biorefineryflorian willfortBelum ada peringkat

- V Ships Appln FormDokumen6 halamanV Ships Appln Formkaushikbasu2010Belum ada peringkat

- CSIR AnalysisDokumen1 halamanCSIR Analysisசெபா செல்வாBelum ada peringkat

- The Unseelie Prince Maze of Shadows Book 1 by Kathryn AnnDokumen267 halamanThe Unseelie Prince Maze of Shadows Book 1 by Kathryn Annanissa Hri50% (2)

- Blink CodesDokumen3 halamanBlink CodesNightin VargheseBelum ada peringkat

- Declarative and Procedural Knowledge (Lêda's Final Paper) 2010 01Dokumen13 halamanDeclarative and Procedural Knowledge (Lêda's Final Paper) 2010 01Jair Luiz S. FilhoBelum ada peringkat

- FILM STUDIES CORE COURSE GUIDEDokumen230 halamanFILM STUDIES CORE COURSE GUIDEAmaldevvsBelum ada peringkat

- Gr.10 Music History ModuleDokumen45 halamanGr.10 Music History ModuleKyle du PreezBelum ada peringkat

- A Short Example Presentation On Molecules Slash Molecular Chemistry in LatexDokumen8 halamanA Short Example Presentation On Molecules Slash Molecular Chemistry in LatexintangibilidadeBelum ada peringkat

- New Pacific Timber v. Señeris, 101 SCRA 686Dokumen5 halamanNew Pacific Timber v. Señeris, 101 SCRA 686Ishmael AbrahamBelum ada peringkat

- UNIT- 5 IRSDokumen78 halamanUNIT- 5 IRSganeshjaggineni1927Belum ada peringkat

- De Thi Thu Tuyen Sinh Lop 10 Mon Anh Ha Noi Nam 2022 So 2Dokumen6 halamanDe Thi Thu Tuyen Sinh Lop 10 Mon Anh Ha Noi Nam 2022 So 2Ngọc LinhBelum ada peringkat

- UEME 1143 - Dynamics: AssignmentDokumen4 halamanUEME 1143 - Dynamics: Assignmentshikai towBelum ada peringkat

- Course Code: Hrm353 L1Dokumen26 halamanCourse Code: Hrm353 L1Jaskiran KaurBelum ada peringkat

- The NicotinaDokumen8 halamanThe Nicotinab0beiiiBelum ada peringkat

- Personality, Movie Preferences, and RecommendationsDokumen2 halamanPersonality, Movie Preferences, and RecommendationsAA0809Belum ada peringkat

- Ted Hughes's Crow - An Alternative Theological ParadigmDokumen16 halamanTed Hughes's Crow - An Alternative Theological Paradigmsa46851Belum ada peringkat

- Fundamental of Computer MCQ: 1. A. 2. A. 3. A. 4. A. 5. A. 6. ADokumen17 halamanFundamental of Computer MCQ: 1. A. 2. A. 3. A. 4. A. 5. A. 6. AacercBelum ada peringkat

- Abinitio Interview QuesDokumen30 halamanAbinitio Interview QuesVasu ManchikalapudiBelum ada peringkat

- KEC115/6/7x: Ac Generator Short Circuit and Over Current GuardDokumen4 halamanKEC115/6/7x: Ac Generator Short Circuit and Over Current GuardRN NBelum ada peringkat

- Lecture-3 Sources of Bioelectric PotentialDokumen13 halamanLecture-3 Sources of Bioelectric PotentialMurali krishnan.MBelum ada peringkat

- Iso 16399-2014-05Dokumen52 halamanIso 16399-2014-05nadim100% (1)

- Bond Strength of Normal-to-Lightweight Concrete InterfacesDokumen9 halamanBond Strength of Normal-to-Lightweight Concrete InterfacesStefania RinaldiBelum ada peringkat

- Mechanical Function of The HeartDokumen28 halamanMechanical Function of The HeartKarmilahNBelum ada peringkat

- LEONI Dacar® 110 enDokumen1 halamanLEONI Dacar® 110 engshock65Belum ada peringkat

- 01 Lab ManualDokumen5 halaman01 Lab ManualM Waqar ZahidBelum ada peringkat

- Remembering Manoj ShuklaDokumen2 halamanRemembering Manoj ShuklamadhukarshuklaBelum ada peringkat