West Bengal Govt College Salary Statement

Diunggah oleh

Probir MondalJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

West Bengal Govt College Salary Statement

Diunggah oleh

Probir MondalHak Cipta:

Format Tersedia

Government of West Bengal

Office of the Principal, P. R. Thakur Government College, Thakurnagar

Salary statement showing pay and recoveries made in the GPF ACCOUNT No EDN / WB /

, & other deductions

from the salary of ..................................................................... , Associate / Assistant Professor of ......................................................

for the period from March 2015 to February 2016

PAY AND ALLOWANCES DRAWN (Rs)

A. G.

D.A./

H.R.A. M.A. GROSS

Pay

A.D.A.

March 2015

15,600

6,000

14,040

3,240

300

39,180

24

150

174

39,006

April 2015

15,600

6,000

14,040

3,240

38,880

24

500

150

674

38,206

May 2015

15,600

6,000

14,040

3,240

38,880

24

500

150

674

38,206

June 2015

15,600

6,000

14,040

3,240

38,880

24

500

150

674

38,206

July 2015

15,600

6,000

14,040

3,240

38,880

24

500

150

674

38,206

August 2015

15,600

6,000

14,040

3,240

38,880

24

500

150

674

38,206

September 2015

15,600

6,000

14,040

3,240

38,880

24

500

150

674

38,206

October 2015

15,600

6,000

14,040

3,240

38,880

24

500

150

674

38,206

November 2015

15,600

6,000

14,040

3,240

38,880

24

500

150

674

38,206

December 2015

15,600

6,000

14,040

3,240

38,880

24

500

150

674

38,206

January 2016

15,600

6,000

16,200

3,240

41,040

24

500

150

674

40,366

February 2016

15,600

6,000

16,200

3,240

41,040

24

500

150

674

40,366

Total

187,200

72,000

172,800

38,880

300

471,180

288

5,500

1,800

7,588

463,592

1,800

7,588

463,592

Total

187,200

72,000

172,800

38,880

300

471,180

288

5,500

P.

TAX

TOTAL

NET

BILL NO. T.V. NO

AMOUNT

WITH

WITH

DRAWN

DATE

DATE

MONTH

Arrear

G.P.F.

Contr.

Recov.

DEDUCTIONS

INCOME

G.I.

TAX

Pay in

Pay-band

Signature of the Employee

Government of West Bengal

Office of the Principal, P. R. Thakur Government College, Thakurnagar

Income Tax Statement for the financial year 2015-2016 (Assessment year 2016-2017)

in respect of Shri/Smt.

Designation :

1. Gross Salary (including arrears) --

Rs.

471,180

2. Less deduction under section 10(13A) --

Rs.

3. Salary Income (1-2)

Rs

471,180

4. Less : Professional Tax U/S 16(iii)

Rs.

1,800

5. Income Chargeable under the head Salaries (3-4)

Rs.

469,380

6. Less: Interest paid on H. B. Loan u/s 24(b) (Maximum Rs 30,000/- if loan ia taken

Rs.

Minimum of

(I)

Actual H.R.A. Received

Rs.

38,880

(ii)

House rent paid in excess of 10% of salary

Rs.

(iii)

40% of Salary

Rs.

(Salary means Basic Pay+DA)

before 31-3-99, otherwise Rs 150,000/-)

7. Add:

Income from other sources:

8. Gross Total Income (5 + 7 - 6)

Rs.

Rs.

469,380

Rs.

5,788

9. Deduction under Chapter VI-A: U/S(a) 80C

(I) G.P.F. Contribution

Rs.

5,500

(ii) LIC Premium paid

Rs.

(iii) ULIP (restricted to 20%) of sum assured)

Rs.

(iv) Group Insurance / PLI

Rs.

288

(v) N.S.C.

Rs.

(vi) Accrued interest on N.S.C.

Rs.

(vii) Principal Amount of H.B. Loan paid (Max Rs. 20,000/-)

Rs.

(viii) Tution fees paid (max Rs 24,000/- for two children)

Rs.

(ix) Other(s)

Rs.

(b) 80CCC

(I) Jeevan Suraksha (Max Rs 10,000/-)

Rs.

(ii) Aggregate amount of deductions u/s 80C, 80CCC, 80CCD are

Rs.

subject to overall limit of Rs. 100,000/Total

Rs

5,788

Rs.

(c) 80D

Mediclaim - Max Rs 10,000/- (Rs 15,000/- for Sr citizens)

(d) 80DD

Medical treatment etc and deposit made for maintenance of

Rs.

handicapped dependents Max Rs 50,000/(e) 80CCF

Rs.

(f) 80G

Rs.

10. Aggregate of deductible amount u/s VI-A

Signature of the Employee

Government of West Bengal

Office of the Principal, P. R. Thakur Government College, Thakurnagar

11. Taxable Income (8 - 10) Rounded off to the nearest multiple of Rs. 10.)

12. Computation of Income Tax

Net Income range

(a)

Upto Rs. 250,000/(b)

From Rs 250,001/- to Rs 500,000/(c )

From Rs 500,001/- to Rs 1000,000/(d)

From Rs 1000,001/- and above

(e)

Total: (a) + (b) + (c )+ (d)

13. Rebate and Relief u/s 89(1)

14. Income Tax payable (12-13)

15. (a)

Income Tax

(b)

Education Cess @ 3%

(c )

Total Tax Payable

Rate

Nil

10%

20%

30%

463,590

Rs.

Rs.

Rs.

21,359

21,359

Rs.

22,000

Rs.

Rs.

5,500

16,500

Tax

Rs.

Rs.

Rs.

Rs.

Rs.

Rs.

21,359

-

21,359

641

16. Income Tax paid through pay bills from March 2014 to February 2015

17. Tax Payable / Refundable

In words (Rupees . .

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Countersigned

Rs.

Signature:

Designation:

Signature of the Employee

Anda mungkin juga menyukai

- FORM 16 TITLEDokumen5 halamanFORM 16 TITLEPunitBeriBelum ada peringkat

- Prestigious Pets Service Contract (With Non-Disparagement Clause)Dokumen2 halamanPrestigious Pets Service Contract (With Non-Disparagement Clause)Defiantly.netBelum ada peringkat

- 100 MONEY MAKING IDEA: WITH & WITHOUT COLLEGE DEGREEDari Everand100 MONEY MAKING IDEA: WITH & WITHOUT COLLEGE DEGREEBelum ada peringkat

- HIGG Social 2.0 - Excel FileDokumen85 halamanHIGG Social 2.0 - Excel FileFINDORABelum ada peringkat

- AznarDokumen2 halamanAznarCharls Vince RosilloBelum ada peringkat

- Memorandum of AgreementDokumen5 halamanMemorandum of AgreementAwe Somontina50% (2)

- Crisostomo v CA Travel Agency Negligence CaseDokumen2 halamanCrisostomo v CA Travel Agency Negligence CaseStella LynBelum ada peringkat

- EPIRA Implementation Status Report Highlights Privatization, Rates, CompetitionDokumen92 halamanEPIRA Implementation Status Report Highlights Privatization, Rates, Competitionkamijou08Belum ada peringkat

- 1 Form 16 16a LatestDokumen25 halaman1 Form 16 16a LatestNishant GhaseBelum ada peringkat

- Income Tax Calculation: Name: S. Ram Mohan ReddyDokumen6 halamanIncome Tax Calculation: Name: S. Ram Mohan ReddyCA Swamyreddy MvBelum ada peringkat

- Memo For Departmental Instructions G.PDokumen2 halamanMemo For Departmental Instructions G.PPraveen BabuBelum ada peringkat

- Aicte Arrears G.O. (MS) 575 2013 H.ednDokumen1 halamanAicte Arrears G.O. (MS) 575 2013 H.ednu19n6735Belum ada peringkat

- Employee salary and tax detailsDokumen13 halamanEmployee salary and tax detailsseeyem2000Belum ada peringkat

- Name of The Scheme Plan/ Non Plan Head of Account B.E.2011 - 12 Procedure of Drawal of Funds Drawing OfficerDokumen2 halamanName of The Scheme Plan/ Non Plan Head of Account B.E.2011 - 12 Procedure of Drawal of Funds Drawing Officernmsusarla999Belum ada peringkat

- Gratuity GO.99Dokumen3 halamanGratuity GO.99Naveen SharmaBelum ada peringkat

- IT Calculator, Mohandas 2013Dokumen36 halamanIT Calculator, Mohandas 2013DEEPTHISAIBelum ada peringkat

- Government of Andhra PradeshDokumen2 halamanGovernment of Andhra PradeshAnonymous hKt1bjMF2Belum ada peringkat

- Income Tax Calculator for TeachersDokumen20 halamanIncome Tax Calculator for Teachersasrahaman9Belum ada peringkat

- GOVT RELEASES FUNDS FOR ST TUITION FEESDokumen2 halamanGOVT RELEASES FUNDS FOR ST TUITION FEESnmsusarla999Belum ada peringkat

- New Gratuity 7,00,000 PRC 2010 G.ODokumen3 halamanNew Gratuity 7,00,000 PRC 2010 G.OSEKHARBelum ada peringkat

- Government of Andhra Pradesh Abstract AllowancesDokumen3 halamanGovernment of Andhra Pradesh Abstract AllowancesgsreddyBelum ada peringkat

- 30042015fin ms47Dokumen2 halaman30042015fin ms47api-215249734Belum ada peringkat

- Statement Showing Pay, Allowances, Deductions and Tax Details for xyzDokumen4 halamanStatement Showing Pay, Allowances, Deductions and Tax Details for xyzreamer27Belum ada peringkat

- EARNINGS AND DEDUCTIONS CALCULATIONDokumen15 halamanEARNINGS AND DEDUCTIONS CALCULATIONasrahaman9Belum ada peringkat

- Leave Salary Calculator of W.b.govt EmployeesDokumen13 halamanLeave Salary Calculator of W.b.govt EmployeesRavi BhairiBelum ada peringkat

- FIN161Dokumen7 halamanFIN161Ranga Nayak PaltyaBelum ada peringkat

- Cps Tax Form Format For 23-24Dokumen11 halamanCps Tax Form Format For 23-24sr91919Belum ada peringkat

- Income Tax Calculator for Govt EmployeesDokumen11 halamanIncome Tax Calculator for Govt Employeeschandu3060Belum ada peringkat

- Government: of Andhra PradeshDokumen1 halamanGovernment: of Andhra Pradeshnmsusarla999Belum ada peringkat

- AP Govt Revises HRA to 30% for Employees in Greater HyderabadDokumen3 halamanAP Govt Revises HRA to 30% for Employees in Greater Hyderabadnmsusarla999Belum ada peringkat

- Mar - 2015 April - 2015 May - 2015 June - 2015: July - 2015 Aug - 2015 DA Arr. Sept - 2015 Oct - 2015 Nov - 2015 Da Arr. Dec - 2015Dokumen6 halamanMar - 2015 April - 2015 May - 2015 June - 2015: July - 2015 Aug - 2015 DA Arr. Sept - 2015 Oct - 2015 Nov - 2015 Da Arr. Dec - 2015akstrmec23Belum ada peringkat

- 2020052336Dokumen4 halaman2020052336Kapil GurunathBelum ada peringkat

- Form 16Dokumen6 halamanForm 16Ravi DesaiBelum ada peringkat

- Income Tax Calculation GuideDokumen17 halamanIncome Tax Calculation Guidesaravanand1983Belum ada peringkat

- Shashank Kantheti Hyd 12 13Dokumen5 halamanShashank Kantheti Hyd 12 13kshashankBelum ada peringkat

- DA RatesDokumen2 halamanDA Ratesदाढ़ीवाला दाढ़ीवालाBelum ada peringkat

- Mar - 2015 April - 2015 May - 2015 June - 2015: July - 2015 Aug - 2015 DA Arr. Sept - 2015 Oct - 2015 Nov - 2015 Da Arr. Dec - 2015Dokumen6 halamanMar - 2015 April - 2015 May - 2015 June - 2015: July - 2015 Aug - 2015 DA Arr. Sept - 2015 Oct - 2015 Nov - 2015 Da Arr. Dec - 2015akstrmec23Belum ada peringkat

- BudgetDokumen81 halamanBudgetGeneral Sanction SectionBelum ada peringkat

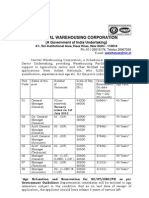

- Notification National Seeds Corporation Limited Non Executive MGT Diploma Trainee PostsDokumen7 halamanNotification National Seeds Corporation Limited Non Executive MGT Diploma Trainee PostsJeshiBelum ada peringkat

- ACp PharmacyDokumen1 halamanACp PharmacyAnshul SharmaBelum ada peringkat

- GVS Doc HHH Doc 8Dokumen1 halamanGVS Doc HHH Doc 8santoshkumarBelum ada peringkat

- Go RT No 740 Dated 28-4-2020 Extenstion of Term PRC PDFDokumen1 halamanGo RT No 740 Dated 28-4-2020 Extenstion of Term PRC PDFG.pradeep ReddyBelum ada peringkat

- Fin e 241 2013Dokumen3 halamanFin e 241 2013raliumBelum ada peringkat

- Go.245 PensionsDokumen4 halamanGo.245 PensionsbharatchhayaBelum ada peringkat

- AP Govt Revises Dearness Relief Rates for Pensioners from Jan 2013Dokumen4 halamanAP Govt Revises Dearness Relief Rates for Pensioners from Jan 2013Billa Naganath0% (1)

- 2013fin ms331Dokumen5 halaman2013fin ms331api-218060126Belum ada peringkat

- Employment Advertisement No. 01/2012: The Maharashtra State Electricity Transmission Co. LTD.Dokumen11 halamanEmployment Advertisement No. 01/2012: The Maharashtra State Electricity Transmission Co. LTD.Jitendra PaliyaBelum ada peringkat

- Fill in The Data Below: 0706764 B. Sankar SinghDokumen24 halamanFill in The Data Below: 0706764 B. Sankar SinghMurali Krishna VBelum ada peringkat

- Microsoft Word - 2019FIN - MS36Dokumen6 halamanMicrosoft Word - 2019FIN - MS36nagalaxmi manchalaBelum ada peringkat

- PRC 2010 D.A. On PensionDokumen3 halamanPRC 2010 D.A. On PensionSEKHARBelum ada peringkat

- Recruitment GrA&B HO Per Div 310112Dokumen6 halamanRecruitment GrA&B HO Per Div 310112vivekn7Belum ada peringkat

- G.O. Ms. No. 108: Government of Andhra PradeshDokumen4 halamanG.O. Ms. No. 108: Government of Andhra PradeshGowri ShankarBelum ada peringkat

- Government of KeralaDokumen5 halamanGovernment of KeralabharathydglBelum ada peringkat

- Institute of Secretariat Training & Management: Êßu Åÿê/ ÷Ê Uã U Ê UDokumen37 halamanInstitute of Secretariat Training & Management: Êßu Åÿê/ ÷Ê Uã U Ê Uvikash SinghBelum ada peringkat

- Telangana Special IncrementDokumen3 halamanTelangana Special Incrementsudheer babu arumbakaBelum ada peringkat

- Income Tax Calculation StatementDokumen106 halamanIncome Tax Calculation Statementnarayanan630% (1)

- Income Tax PerformaDokumen1 halamanIncome Tax PerformaAmandeep Singh0% (1)

- Government of Andhra Pradesh Abstract AllowancesDokumen3 halamanGovernment of Andhra Pradesh Abstract AllowancesgsreddyBelum ada peringkat

- Enhancement of Loan Ceiling On Ewf Fin - Ms 131Dokumen4 halamanEnhancement of Loan Ceiling On Ewf Fin - Ms 131Narasimha Sastry100% (1)

- DSCN - Shree AutomotiveDokumen24 halamanDSCN - Shree AutomotiveNikhilesh BhattacharyyaBelum ada peringkat

- GO Ms No.54 - Dt.11.06.2021 - CCADokumen3 halamanGO Ms No.54 - Dt.11.06.2021 - CCAExecutive Engineer R&BBelum ada peringkat

- A Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionDari EverandA Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionBelum ada peringkat

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesDari EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesBelum ada peringkat

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionDari EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionBelum ada peringkat

- Viet Nam Technical and Vocational Education and Training Sector AssessmentDari EverandViet Nam Technical and Vocational Education and Training Sector AssessmentBelum ada peringkat

- Affiliated College Manual 9aug18 Based On 19jul18 UPDATEDDokumen146 halamanAffiliated College Manual 9aug18 Based On 19jul18 UPDATEDAdarsh KrishnaBelum ada peringkat

- CmsDokumen3 halamanCmsProbir MondalBelum ada peringkat

- Application For Admission To The B.A. / B.Sc. (Hons.) Course 1St Year SESSION: 2017 - 2018Dokumen2 halamanApplication For Admission To The B.A. / B.Sc. (Hons.) Course 1St Year SESSION: 2017 - 2018Probir MondalBelum ada peringkat

- FM-50 Digital Electronics QuestionsDokumen3 halamanFM-50 Digital Electronics QuestionsProbir MondalBelum ada peringkat

- NET Result Dec2011Dokumen38 halamanNET Result Dec2011sengottuvelBelum ada peringkat

- M.SC Syllabus DetailedDokumen6 halamanM.SC Syllabus DetailedProbir MondalBelum ada peringkat

- Guidelines Scheme DetailsDokumen8 halamanGuidelines Scheme Detailspap23Belum ada peringkat

- 1Dokumen5 halaman1Probir MondalBelum ada peringkat

- Sameer V Bajaro (Midterms) PDFDokumen12 halamanSameer V Bajaro (Midterms) PDFLianne Carmeli B. FronterasBelum ada peringkat

- Sample Unsolicited Proposal SubmissionDokumen17 halamanSample Unsolicited Proposal SubmissionKiavash AzizyBelum ada peringkat

- Owner's Right to Recover Pledged MovableDokumen12 halamanOwner's Right to Recover Pledged MovablePaulo San JuanBelum ada peringkat

- Lease Agreement Hyd OfficeDokumen3 halamanLease Agreement Hyd OfficeKiran KumarBelum ada peringkat

- Ps 1Dokumen3 halamanPs 1Jason KristiantoBelum ada peringkat

- Least Contract William CervantesDokumen2 halamanLeast Contract William CervantesLevy LigaoBelum ada peringkat

- Manday Rate REV.03 .JUL.2017 ..TADokumen7 halamanManday Rate REV.03 .JUL.2017 ..TAEngFaisal AlraiBelum ada peringkat

- 394 Supreme Court Reports Annotated: Eviota vs. Court of AppealsDokumen14 halaman394 Supreme Court Reports Annotated: Eviota vs. Court of Appealsmaginoo69Belum ada peringkat

- LABOR 1 - Finals NotesDokumen81 halamanLABOR 1 - Finals NotesSamantha Amielle CanilloBelum ada peringkat

- URR 725 rules for bank reimbursements under letters of creditDokumen3 halamanURR 725 rules for bank reimbursements under letters of creditIntekhab JubrazBelum ada peringkat

- Experience Africa 2011 ITC Paper 3 UnseenDokumen6 halamanExperience Africa 2011 ITC Paper 3 UnseenLemon SherbertBelum ada peringkat

- Service: Paid Overtime Is Cut For Half A Million WorkersDokumen4 halamanService: Paid Overtime Is Cut For Half A Million Workersapi-18815167Belum ada peringkat

- Audit Agreement Format 2Dokumen17 halamanAudit Agreement Format 2sudhier9Belum ada peringkat

- Dance Choreographer AgreementDokumen5 halamanDance Choreographer AgreementDiana wathanjiBelum ada peringkat

- Request Policy Change FormDokumen2 halamanRequest Policy Change FormtmaderazoBelum ada peringkat

- The Expat DilemmaDokumen16 halamanThe Expat Dilemmaajay massBelum ada peringkat

- 74587bos60476 FND p2 Nset cp2 U8Dokumen25 halaman74587bos60476 FND p2 Nset cp2 U8Shivam SinghBelum ada peringkat

- Ifrint Jun 2011 QuDokumen9 halamanIfrint Jun 2011 QuRochak ShresthaBelum ada peringkat

- 16.1 E Commerce AgreementDokumen6 halaman16.1 E Commerce AgreementnimojBelum ada peringkat

- Lecture 6Dokumen16 halamanLecture 6Banjo A. ReyesBelum ada peringkat

- Sri Lanka Immigration RulesDokumen30 halamanSri Lanka Immigration RulesUtpalSahaBelum ada peringkat

- NFSW V OVEJERADokumen8 halamanNFSW V OVEJERAMary Fatima BerongoyBelum ada peringkat

- Alten Sophia Antipolis 2023Dokumen8 halamanAlten Sophia Antipolis 2023Robinson Ferrer PayneBelum ada peringkat

- Mapili Integrated Social Forestry Association (Misfa)Dokumen13 halamanMapili Integrated Social Forestry Association (Misfa)Mayor Stephanie SalvadorBelum ada peringkat